The global bakery enzymes market is set to register USD 1.21 billion in 2025. The industry is poised to depict 5.04% CAGR from 2025 to 2035, reaching USD 2 billion by 2035.

The growing consumer trend for natural and label-friendly bakery foods is one of the prime factors driving the market's growth. Likewise, as synthetic additives fall out of favor, manufacturers are developing enzyme-based alternatives that improve dough stability and texture and extend shelf life without compromising clean-label status.

Major companies like Novozymes, DSM-Firmenich, and DuPont have invested in research and advanced development to create sophisticated enzyme solutions that follow consumer trends for healthier or more natural baked products.

The leading players enter strategic partnerships and acquisitions to drive their market position. For example, AB Enzymes and Kerry Group have expanded their production capacity. They focus on innovative enzyme products that allow for longer shelf life and improved softness by creating dough. Such developments are sorely needed in the growing industrial bakery market in North America, Europe, and Asia-Pacific, where mass bakeries require consistent and efficient enzyme solutions.

Rising competition is stimulating innovation, too, with Amano Enzyme and BASF expanding production to meet demand for soaring specialized baked goods. The growing demand for gluten-free and fiber-rich baked goods in recent years has stimulated the desirability for customized enzyme formulations, particularly those of plant-based enzymes that can work in the place of synthetic emulsifiers. As consumer trends shift towards plant-based bakeries, enzyme suppliers meet these demands.

Moreover, technological advancements such as precision fermentation also play a crucial role in the growth of bakery enzymes. Leverage cutting-edge biotechnology to develop high-performance yet cost-effective enzyme solutions that optimize every baking process step.

With sustainability quickly becoming a hot-point/big issue in society, bio-based enzymes are becoming more popularly used, traipsing through the food waste and decomposition processes in the products and improving the overall product quality. Such developments, planned expansions, and joint ventures will drive the global market in the upcoming future.

Explore FMI!

Book a free demo

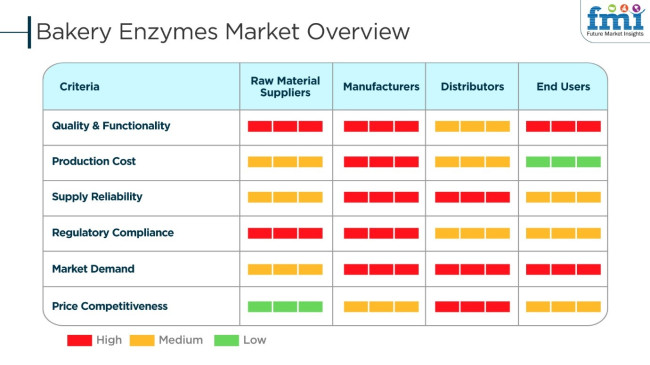

The bakery enzymes business is compelled by increasing customer requirements for clean-label, additive-free, and better-quality bread products. The suppliers of raw materials concentrate on eco-friendly and non-GMO source enzyme purchases for consistent quality and efficiency. Product manufacturers specialize in enzyme function within dough conditioning, texture development, and shelf-life extension in fulfilling industrial and craft baker needs.

Distributors are careful to ensure supply chain optimization, value-priced products, and product development according to industry specifications. Commercial bakeries and foodservice operators require high-performance enzymes that enhance product consistency while reducing reliance on chemical additives.

The trend toward gluten-free, organic, and fortified baked foods is fueling demand for specialty enzymes such as amylases, proteases, and lipases. In addition, sustainability challenges and regulatory requirements are impacting enzyme formulations, driving the market towards natural and bioengineered alternatives for better baking performance.

The following table presents a comparative analysis of the semi-annual growth variations in the global industry for the base year (2024) and the current year (2025). This assessment provides insights into revenue realization patterns and shifts in industry performance over the forecast period.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 4.5% |

| 2024 to 2034 (H2) | 5.1% |

| 2025 to 2035 (H1) | 4.7% |

| 2025 to 2035 (H2) | 5.2% |

The industry is projected to witness steady expansion, with noticeable variations in growth rates over different six-month periods. The first half of the decade from 2025 to 2035 is expected to register a CAGR of 4.5%, followed by an increase to 5.1% in the second half. Moving further, the projected growth rate is expected to reach 4.7% in H1 2025 to 2035, maintaining a strong momentum of 5.2% in H2 2025 to 2035.

During the first half (H1), the sector experienced a rise of 40 BPS, while in the second half (H2), the business remained stable, reflecting steady demand for natural and functional bakery enzymes.

Competitive Pricing Strategies to Boost Industry Expansion

The global industry is witnessing a shift in pricing strategies, with manufacturers adopting competitive pricing to enhance accessibility. With growing demand for enzyme-based solutions in both artisanal and industrial baking, companies are focusing on offering cost-effective formulations. Enzyme suppliers are leveraging economies of scale to lower production costs and provide affordable enzyme solutions without compromising quality.

Additionally, bulk purchasing and long-term contracts with bakeries are helping to stabilize pricing fluctuations. This trend is crucial in regions with price-sensitive consumers, where affordability plays a key role in product adoption. Furthermore, businesses are introducing tiered pricing models, ensuring that small and medium-sized bakeries can access enzyme technologies at reasonable rates.

As bakery manufacturers seek alternatives to synthetic additives, enzyme companies are offering cost-efficient solutions tailored to different product categories, ensuring widespread adoption. The emphasis on competitive pricing is expected to drive industry penetration and increase enzyme utilization across diverse bakery applications.

Pricing Variations Based on Product Quality

The bakery enzymes industry is increasingly adopting a tiered pricing structure based on product quality and performance. High-performance enzymes designed for premium and specialty baked goods are priced at a premium due to their superior functionality, extended shelf life benefits, and clean-label attributes.

Conversely, standard bakery enzyme formulations targeting mass-market baked goods are positioned at lower price points to cater to budget-conscious manufacturers. With the rising consumer preference for high-quality, preservative-free bakery products, enzyme manufacturers are investing in advanced research to develop premium enzyme solutions with enhanced dough stability and improved texture.

Additionally, tailored enzyme formulations for gluten-free, organic, and artisanal bakery products are commanding higher prices due to their specialized applications. This differentiation in pricing based on quality ensures that businesses can cater to various consumer segments, from large-scale industrial bakeries to niche artisanal brands, thereby expanding the market’s reach and accessibility.

Distinct Pricing Dynamics in Organized vs. Conventional Markets

Pricing structures for bakery enzymes differ significantly between organized and conventional bakery markets. In the organized sector, which includes large-scale bakery chains and industrial producers, enzyme suppliers focus on bulk contracts and long-term agreements, ensuring cost-efficient procurement and stable pricing. This segment benefits from economies of scale, enabling businesses to negotiate favorable pricing with enzyme manufacturers.

On the other hand, conventional and small-scale bakeries often face higher costs due to limited purchasing power and fragmented supply chains. These businesses rely on retail distributors for enzyme procurement, resulting in price markups and increased cost pressures.

To bridge this gap, enzyme manufacturers are exploring direct supply models and localized production facilities, ensuring affordability for smaller bakeries. Additionally, regulatory compliance and sustainability initiatives are impacting pricing structures, with companies offering eco-friendly enzyme solutions at premium rates in organized markets while maintaining cost-effective options for conventional bakeries.

Demand for clean-label and natural ingredients in food has been a salient factor in enzyme usage in baking. As consumer demand for additive-free and healthier products grows stronger, bakery enzymes have gained acceptance, for they offer improvement to dough quality, texture, and shelf life without resorting to synthetic additives.

The shift toward sustainable plant-based ingredients is creating an industry that can expand. Enzymes serve as natural substitutes for chemical emulsifiers, reducing the employment of artificial ingredients in bakery products.

As the bakery industry strives to keep pace with changing consumer preferences, enzyme-based formulations are increasingly being viewed as the way forward. Advances in enzyme technology are also enabling the development of highly tailored solutions for specific bakery applications and improving the performance of the end product.

The industry for bakery enzymes will obtain gradual growth on the basis of increasing health consciousness and sustainability. Further investment in enzyme development, promotion, and organizing a methodical marketing plan to educate consumers about the advantages of enzyme-triggered products will provide extra impetus to the market growth in the next decade.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in demand for bakery enzymes to give better texture, shelf life, and dough handling | Clean-label trends and consumer demand for natural ingredients drive increased adoption |

| Enzymes used mainly for volume improvement and dough conditioning | Growing applications in gluten-free, high-fiber, and protein-enriched bakery products |

| Synthetic and chemically modified enzymes commonly utilized | Increased demand for non-GMO and plant-based enzyme substitutes |

| North America and Europe dominance in enzyme take-up | Double-digit growth from the Asia Pacific and Latin American regions because of expanding processed foods consumption |

| Consumer education and attention towards enzyme-driven benefits in baked foods | High-level consumer learning and promotion driving focus on quality and health boosts |

| Raw material shortages and impact on enzyme capacity by supply disruptions | Supply chain resilience through local purchase and new fermenting technologies fortified |

| Regulatory compliance on food safety and enzyme approvals | Tighter regulations and increasing focus on sustainability and transparency in ingredient sourcing |

Threats associated with the bakery enzymes market are regulatory issues, raw material price fluctuations, supply chain crises, technological restrictions, and consumer views on it.

Regulatory compliance is one of the primary risks as bakery enzymes must pass through very strict protocols like safety and labeling ones established by organizations like the FDA, EFSA, and FSSAI. Moreover, alterations in the food safety laws and worries concerning GMOS (Genetically Modified Organisms) regarding the use of enzymes can affect the industry permissions and formulations of goods.

The volatility of raw material prices, such as plant extracts and microbial fermentation are the main bacterial sources of production costs. It is very crucial for companies to come up with supplier partnerships as well as product diversification strategies to stabilize the price.

Supply chain troubles, due to geopolitical conflicts, pandemics, or climate-related obstacles, can lead to the delays of enzyme production and dispatch, thereby, causing operational failure for the bakery manufacturers. The creation of regional production facilities along with proper stock management resources can be the answer for the marginal risks left.

Technological limitations regarding enzyme stability and shelf life also can be the hindrances. The innovations in encapsulation of the enzyme, and its formulation are a must to reach better performances in different baking conditions.

Carbohydrates are used in baking to increase fermentation efficiency, which improves dough stability and increases loaf volume. For industrial bakeries with high production quantities, where uniformity and shelf life are essential, this is extremely beneficial. The increasing consumer inclination toward gluten-free and high-fiber bakery products is driving the carbohydrase enzymes industry, as they are used to enhance the quality of various alternative flour formulations.

Bread remains the leading application segment for bakery enzymes. Because pan food like bread is a staple food item in a variety of regions, there is an increasing need for enzyme-based solutions that help in enhancing the quality, texture, and shelf life of pan food. Soft and fresh bakery goods without any type and action of synthetic additives are in high demand among consumers, thus the first choice of manufacturers for the preparation of enzyme formulations.

Also propelling the rise of enzymes is the popularity of artisanal and specialty bread, such as whole grain, gluten-free and sourdough. With a natural ingredients focus and supporting regulatory policies around the use of it, enzymes are also replacing chemical dough conditioners and emulsifiers to a natural ingredient system, which is in line with the clean-label trend.

Liquid enzymes, including amylases and proteases, are commonly applied in the bakery industry due to their ease of use and even distribution in dough mixes. Liquid amylases are especially favored because they assist in the hydrolysis of starches into simple sugars, enhancing dough fermentation and texture.

Even dispersion throughout the dough is achieved through the liquid form, producing consistent product quality. Liquid proteases are also employed to alter gluten structure, enhancing extensibility of dough and improving the texture of baked products such as bread and pizza dough. The ease with which liquid enzymes can be incorporated into the dough process makes them a favorite among bakeries seeking consistency and control in production.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| China | 7.0% |

| India | 7.6% |

| Germany | 4.5% |

| UK | 4.3% |

The USA has a significant industry share in the global industry for bakery enzymes, which is expected to witness a CAGR of 4.8% during 2025 to 2035, cites FMI. Consumers are becoming more inclined toward natural and clean-label bakery products, and therefore, manufacturers are using enzyme-based solutions to improve product quality and shelf life. Due to growing health awareness, demand for additive-free baked foods is increasing.

The bakery industry is shifting toward enzyme technologies, emphasizing dough stability, texture improvement, and extended freshness. The influence of large industry players and ongoing research and development activities also supports industry value.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Increasing Demand for Clean-Label Products | Consumers prefer natural ingredients, which encourages the use of enzyme-based solutions. |

| Advancements in Enzyme Technologies | Innovations improve dough stability, texture, and shelf life. |

| Presence of Leading Industry Players | Major baking companies and enzyme producers invest in research and development. |

| Health-Conscious Consumer Preferences | Growing awareness leads to reduced consumption of synthetic additives. |

As per FMI, the Chinese industry for bakery enzymes is anticipated to grow at a CAGR of 7.0% during 2025 to 2035. Urbanization and growing disposable incomes lead to increased demand for good-quality bakery products; therefore, manufacturers resort to using enzymes to improve texture, flavor, and shelf life. Increased demand for Western-style baked, and convenience food drives the industry.

Clean-label trends are more and more demanded by consumers, which propel the use of natural enzymes in baking. Government support for the food industry regarding retail chain development and innovation fosters industry expansion.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Rising Urbanization and Disposable Income | Consumers seek high-quality and convenient bakery products. |

| Growing Interest in Western-Style Baked Goods | Increased preference for breads, pastries, and other Western-style products. |

| Demand for Clean-Label Ingredients | Consumers prioritize natural and enzyme-based baking solutions. |

| Government Support for Food Innovation | Policies encourage advancements in food technology and retail sector growth. |

Bakery product consumption is driven by urbanization and growth in the middle-class population. Urban lifestyles and changing eating patterns prompt consumers to ready-to-eat baked food. Hence, companies embrace enzymes for better quality, extended shelf life, and freshness. Natural ingredients are gaining greater consumer popularity, encouraging the adoption of enzyme-based over chemicals.

The fast growth of the retail industry and bakery chains nationwide also aids industry growth. FMI estimates that the Indian bakery enzymes market will achieve a 7.6% CAGR over the forecast period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Growing Middle-Class Population | Rising disposable incomes increase demand for bakery products. |

| Urbanization and Changing Lifestyles | Consumers seek convenient, ready-to-eat baked goods. |

| Preference for Natural Ingredients | Enzyme-based solutions replace chemical additives. |

| Expansion of the Retail and Bakery Chains | Large-scale bakery chains and supermarkets boost product availability. |

As per FMI, the German bakery enzymes market is expected to record a CAGR of 4.5% during the period 2025 to 2035. The nation has a strong bakery sector with a strong demand for quality bread, rolls, and pastries. Conventional baking methods are changing with enzyme-based products enhancing production efficiency and consistency.

Organic and clean-label product demand ensures the acceptability of natural baking enzymes. Advances in enzyme technology also increase gluten strength, dough conditioning, and texture in industrial and artisanal baking.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong Demand for High-Quality Baked Goods | Traditional and premium bakery products remain highly popular. |

| Advancements in Dough Processing | Enzyme solutions improve gluten strength and dough handling. |

| Preference for Organic and Clean-Label Ingredients | Consumers favor natural enzyme-based formulations. |

| Well-Established Baking Industry | Large-scale bakeries invest in technology to maintain product quality. |

FMI cites that the UK bakery enzyme market is expected to grow with a CAGR of 4.3% during 2025 to 2035. Consumers favorably look for clean-label and organic products in bakeries, thereby implementing the use of natural enzymes in bakery products. Manufacturers are focusing on using enzyme-based formulations to improve dough texture, shelf life, and customer demand for high-quality bread and pastry.

Food safety regulations supporting food innovation also enable it to become more prevalent when embracing advanced enzyme solutions. FMI projects the bakery enzymes market in the UK to grow at 4.3% CAGR over the forecast period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Rising Consumer Interest in Clean-Label Products | Demand for natural and enzyme-based bakery products continues to grow. |

| Regulatory Support for Food Innovation | Policies encourage the development of high-quality, enzyme-enhanced baked goods. |

| Advancements in Dough Texture and Freshness | Enzymes improve baking consistency and product longevity. |

| Expanding Industry for Specialty Baked Goods | Growth in artisanal and premium baked goods fuels enzyme use. |

The major players, including Novozymes, DSM-Firmenich, IFF, Kerry Group, and AB Enzymes, are increasingly putting their stakes in biotechnology innovations, making strategic acquisitions, and expanding production capacities to bolster their stronghold in the industry. Those companies have created specialized enzyme blends for gluten-free, low-sugar, and high-fiber baked goods, meeting diverse dietary needs.

In addition, startups and niche providers are emerging with sustainable and non-GMO enzyme solutions that address the clean-label trend. Regulations and sustainability propel the industry with varied technologies such as eco-friendly enzyme production methods, enzyme recycling, advanced formulation techniques, etc. While demand continues to escalate for high-performance and health-oriented baking solutions, superior competitive advantage will lay with business models grounded in innovation, agility in regulations, and greens.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Novozymes A/S | 25-30% |

| DuPont de Nemours, Inc. | 20-25% |

| AB Enzymes | 10-15% |

| Koninklijke DSM N.V. | 10-12% |

| Other Players | 18-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novozymes A/S | Global leader in industrial enzymes, offering innovative solutions for dough conditioning, freshness, and texture improvement. |

| DuPont de Nemours, Inc. | Develops multifunctional enzyme blends for improved baking performance, focusing on sustainability and clean-label solutions. |

| AB Enzymes | Provides customized baking enzymes for optimizing texture, volume, and extended shelf life in bakery applications. |

| Koninklijke DSM N.V. | Specializes in enzyme-based solutions that enhance the nutritional value and quality of bakery products. |

Key Company Insights

Novozymes A/S (25-30%)

A baking enzymes industry leader focused on sustainable and high-performance enzyme innovations.

DuPont de Nemours Inc. (20-25%)

A strong R&D in enzyme technology that emphasizes eco-friendly and clean-label formulations

AB Enzymes (10-15%)

Specializes in tailor-made enzyme solutions for large-scale and artisanal bakeries.

Koninklijke DSM N.V. (10-12%)

Its focus is on the nutritional and functional improvement of bakery products.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 1.21 billion in 2025.

The industry is predicted to reach USD 2 billion by 2035.

Which country is slated to observe the fastest growth in the global bakery enzymes industry?

Key companies include Kerry Group Plc, Corbion N.V., DSM N.V., BASF SE, Advanced Enzymes Technologies Ltd., Puratos Group N.V., Lallemand Inc., BDF Ingredients, Caldic B.V., Leveling, VEMO 99 Ltd., Mirpain, Jiangsu Boli Bioproducts Co. Ltd., Amano Enzymes Inc, AB Enzymes, Danisco A/S, and Novozymes A/S.

Carbohydrase are being widely used.

By product type, the industry is segmented into carbohydrase, protease, lipase, and others.

By application, the industry is segmented into bread, cakes & pastries, and cookies & biscuits.

By form, the industry is segmented into powder and liquid.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.