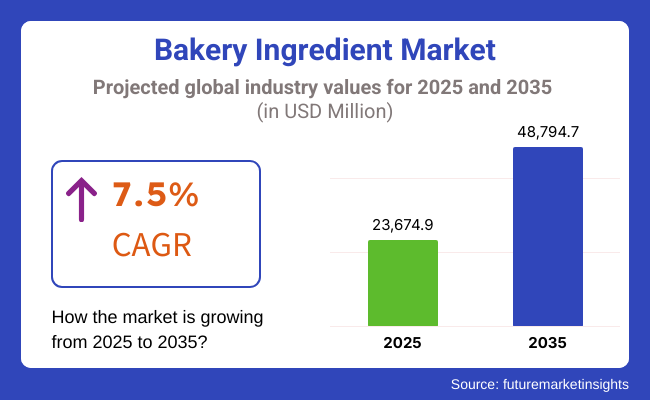

The global Bakery Ingredients sales will reach approximately USD 23,674.9 million by the end of 2025. Forecasts suggest the market will achieve a 7.5% compound annual growth rate (CAGR) and exceed USD 48,794.7 million in value by 2035

The green bakery ingredients market is set for a great rise with the fast development of new technologies, the changing consumer market, and the increasing demand for healthier, functional, and premium bakery products. The rise of climate-friendly, gluten-free, and high-protein formulations is the shift mark to be, having a direct effect on ingredient producers to come up with novelties or go for more environmentally friendly options.

The search of consumers for wholesome and nutrient-rich products has directly resulted in the increasing rate of using specialty flour blends, natural sweeteners, and functional enzymes which promote the quality of the final product without adverse effects on the taste.

The major propeller for the market is, as a matter of fact, the fast-developing commercial baking industry which is not just a market but a running train due to its mass-scale production of high-quality baked goods in the most efficient way.

With the substantial cultural shift that came with urbanization and a new trend toward baked goods that could be eaten on-the-go, there are manufacturers who are setting on the new path of upgrading the baking systems, providing long-lasting solutions for the products and the usage of frozen dough.

Moreover, the demand for premium bakery products such as artisan bread, gourmet pastries, or even hybrid desserts is scaling up because of the rise in disposable income in developing areas.

The market is also growing with the jumps in health-conscious consumption; it drives the new ideas for fortified, high-in-fiber, and protein-enriched bakery products. The request for the sugar reduced and alternative sweeteners is on the rise too; thus, the companies are producing the new formulations based on monk fruit, allulose, and inulin that keep the same texture and sweetness of the traditional baked products throughout the process.

The factories of North America and Europe continue to thrive by creating clean-label and functional bakery products by focusing on gluten-free, organic, and keto-friendly baked goods. The enterprises in these areas are channelling resources into high-performance emulsifiers and fermentation-based ingredients to deliver healthful products with typical textures and flavors.

The Asia-Pacific region is seeing a strong growth of bakery products due to the proliferation of Western-style bakery items. China and India have emerged as leading consumption hubs, growing demand with increasing urbanization and improving dietary habits for premium and convenience bakery foods.

In Latin America and the Middle East, the commercial baking industry is making strong waves with the number of openings of bakery chain stores, cafés, and quick-service restaurants (QSRs) all going up. Ingredient suppliers are directing their efforts toward the introduction of the mix-flour technology plus enzyme dough improvers to increase the production capacity.

On the other hand, the major bakery element producers today are through various productive schemes such as mergers and acquisitions and product innovations beginning to broaden their portfolio. Some companies, for instance, Cargill, ADM, and Puratos are into inventing new generations of emulsifiers, specialty enzymes, and sweeteners that comply with demanding market trends.

Green ingredient procurement as well as a clean-label promise would be the primary priorities in the years to come. With the unrelenting breakthroughs in ingredient technologies and the product relaunches initiated by the consumers, the bakery ingredients business is certain to see a continued good performance in the international sales for the forthcoming decade.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 7.1% (2024 to 2034) |

| H2 2024 | 7.8% (2024 to 2034) |

| H1 2025 | 7.3% (2025 to 2035) |

| H2 2025 | 8% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 7.1% in the first half (H1) of 2024 and then slightly faster at 7.8% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 7.3% in the first half of 2025 and continues to grow at 8% in the second half. The industry saw a decline of 35 basis points in the first half (H1 2025) and an increase of 46 basis points in the second half (H2 2025).

Hybridization of Traditional and Modern Bakery Flavors

As the bakery ingredients market undergoes a radical transformation, the craving for uncommon and nostalgic flavors is the trigger, as customers favour a blend of both conventional and modern tastes. Bakeries have started adding local flavors (e.g., Japanese matcha, Indian cardamom, or Middle Eastern za’atar) into traditional items like croissants, muffins, and cookies.

This development is compelling the suppliers of seasonings to come up with desired spice blends and unique cultural spice infusions. The premiumization factor out of which clients are directly benefiting is present. People are ready to pay a premium for artisanal, gourmet efforts.

Investments in research and development are a part of the strategy to extend shelf-life (good flavor stability), which means the production and storage conditions for these unique items will be the same throughout their life. Restaurants are also working with ingredient companies and food technologists in order to create new unique flavors and secularism.

Rise of Enzymes and Natural Emulsifiers in Baking

The bakery sector is revolutionizing the use of enzymes and natural emulsifiers as they substitute the synthetic additives successfully without compromising on dough stability, texture, and shelf-life. The clean label initiative has driven food processors to peel off from chemical dough improvers which in turn has made functional enzymes yielding better freshness and more volume enlisted.

The application of such enzymes as amylase, protease, and lipase on the fermentation process, has become part of the norm, while using natural emulsifiers such as lecithin from sunflower and soy, synthetic emulsifiers, and DATEM, and SSL are being replaced.

Ingredient suppliers are pivoting to a multi-functional enzyme portfolio that solves for a variety of flour types and processing conditions. This transition is also addressing the challenges of environmentally-efficient strategies pursued by big bakeries through increased production rates, minimized waste, and adherence to regulations regarding clean formulations and reduced E-numbers.

Functional Indulgence: Bakery Products with Added Health Benefits

Consumers are after rich-in-nutrient baked products with health-promoting functions over and above basic nutrition. The result of this trend is that manufacturers are adding ingredients that are high in protein, enriched with fiber, and are gut-friendly (probiotic/prebiotic), and immune boosters into the bread formulations.

Utilization of superfoods like chia, flaxseeds, oats, and turmeric into mind bread, muffins, and cookies reflects the health-conscious approach that their target market has. Moreover, the necessity for a low-GI and high-fiber diet is mirrored in the progressive use of resistant starch and whole grain blends.

Manufacturers are sending out bakery products that are fortified with vitamins, minerals, and omega-3s to meet the desires of clients who want them to have quality nutrients along with the remaining pleasure. Key suppliers of ingredients have come up with the breakthrough of heat-stable probiotics and functional protein blends so that these advantages can be kept even after the baking process.

Fermentation-Driven Innovations in Baking

Fermentation is back in the light since the consumers are looking for not only artisan but also healthy bakery products. Bread that has undergone a wild fermentation process, supported by wild yeasts, sourdough cultures, and lactobacillus strains, is now consumed more as it has better texture, longer shelf-life, and is easier to digest.

This transformation is the one that push bakery suppliers to produce their own sourdough cultures, yeast strains, and pre-ferments that are slower in action which are going to let the commercial bakeries increase their production while still being true to the art. Also, with the increase of flavours, such as tartness, umami, and the earthy flavor, the manufacture of bread with more complex taste is likely.

The manufacturers have chosen to put money into fermentation technologies that are strict-controlled in order to satisfy abrupt consumer trends for natural processes while still achieving the same level of production. Ingredient suppliers also work on postbiotic products that ensure better health of the gut, on fermented bakery products.

Influence of Hyperlocal Grains and Ancient Cereals

The bakery ingredients market is seeing a hyper-local and ancient grain movement in which customers lay emphasis on more nutrition and local authenticity. Goods like spelt, einkorn, sorghum, teff, and amaranth are having been outstripping the competition with their special micronutrient contents as well as better digestibility.

Manufacturers take advantage of this situation to bring out fiber-rich; gluten-free and high-protein bakery items that especially attract health-conscious people and those with food intolerance problems. Ingredient suppliers are working on state-of-the-art custom milling techniques that preserve the bran and germ thus offering the benefits of greater nutrient retention.

Furthermore, this trend is behind the reconfiguration of the flour blends which allows for the use of alternative grains in the production of goods that have the same quality and volume. Some highlights are consumer education, sustainable sourcing, and zero waste through the development of non-conventional grain-based bakery layouts.

Sugar Reduction Strategies and Alternative Sweeteners in Baking

In the context of soaring health worries associated with sugar consumption and obesity, bakery manufacturers have adopted a pro-active strategy to cut back on the addition of refined sugar while keeping the taste and texture intact.

The low-sugar and no-added sugar trend is now replaced by the use of natural sweeteners such as monk fruit extract, allulose, tagatose, and erythritol, which give sweetness without calories. Manufacturers are including fiber-based sweeteners, such as inulin which will help with the texture and mouthfeel.

Additionally, ingredient suppliers are making adjustments due to sugar's loss of functional properties including browning, moisture retention, and fermentation support. The key focal points are labelled sugar substitutes, a balanced perception of sweetness, and stability during high-temperature baking.

Between 2020 and 2024, the bakery ingredients market grew steadily owing to rising consumer demand for convenience foods, artisanal bakery products, and health-promoting product lines. The pandemic-driven rise in home baking had a brief effect on the demand-equipment market for flour, yeast, and pre-mixes while the commercial baking sector was affected on the side of the clean-label and functional ingredients.

Starting from 2025 to 2035 market fluctuation is to be expected due to the factors like the growing need for gluten-free, high-protein, and low-sugar bakery formulations. Manufacturers are following the customer's choices and switching to sustainable sources, plant-based products, and fermentation-boosted ingredients.

Future developments will include better automation, ingredient fortification, and the introduction of hybrid flavors solidifying the position of bakery ingredients as a necessary part of the global food industry. The long-lasting growth will be supplemented by the strategic investments in new product development and supply chain efficiency.

The world bakery ingredients market refers to the coexistence of both large multinational companies and specialized players. The market displays the concentration of average maturity where the major players account for a significant share of the overall market.

The leading bakery ingredients market is characterized by the MNC giants such as Associated British Foods (ABF), Cargill, Inc., ADM (Archer Daniels Midland Company), and Kerry Group. These corporations have vast international operations, different product portfolios, and they have built strong distribution networks, which facilitates their prevalence in the market.

In the rank of the second tier are the likes of IFF (International Flavors & Fragrances), Corbion N.V., Puratos Group, and Lesaffre. These firms have a concentration on specific product categories or unique solutions that are more in line with the bakery market, and they are well known for their creativity and technological advancements in the industry.

The third tier of the market is more fragmented and consists of both local and regional players along with specialized companies like Tate & Lyle and DSM-Firmenich. These players are usually those addressing small niche markets or are those that seek to offset costs through competitive solutions against the larger MNCs.

In the overall scene, the global bakery ingredients market is noted as moderately mature at the concentration level, where the main impact is created by the top-tier MNCs. The provision of the second and third layers of the market with product diversification and healthy competition, where the focus is on the specialized product portfolio or targeted regional solutions, thus comply with the bakery industry's needs.

The following table shows the estimated growth rates of the top three countries. USA, China and India are set to exhibit high consumption, and CAGRs of 4.8%, 7.3% and 8.5% respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 4.8% |

| China | 7.3% |

| India | 8.5% |

Bakeries in China are breaking the tradition of innovation by bringing together unique local flavors and Western-baked goods in a bid to satisfy changing consumer preferences. This combination includes adding such ingredients as red bean paste, black sesame, and matcha to croissants, cakes, and pastries. Some companies are selling special ready-to-use flavor infusions for the bakeries to follow these successful product blends.

This trend also indicates the preference for nostalgic but trendy goods and is thus also important for both, the young people who are drawn to these new designs and for the older ones who prefer a higher-end bakery with an Asian twist. The suppliers of ingredients also try to implement the flavor stabilization technologies to ensure that these special tastes survive the industrial-scale baking.

In the USA, we are witnessing a significant rise in the artisanal segment of traditional Latinx breads that especially includes conchas, pan dulce, and tres leches cakes.

They are such bakeries are indeed Latin-owned and they are proud to use high-quality, locally sourced as well as innovative ingredients example being the dulce de leche-filled croissants and the chili-infusion chocolate pastries. The mass-producing companies are seizing this moment by providing frozen or pre-mixed dough that is going to allow the bakeries to save time and at the same time keep the dignity of the recipe.

Consumers are getting more and more directed to these products as they hold the cultural identity and bring back the feel of being handcrafted, therefore demanding the high-standard of bakery ingredients. The ingredient companies are making the changes to their fermentation technology and they are also creating unique flour blends that are going to help the masses keep the original taste and texture.

The journey of Indian bakeries is increasingly being marked by experimenting with fusion desserts that marry traditional Indian sweets with Western bakery items. This includes things like gulab jamun cupcakes, ras malai cheesecakes, and saffron-infused tarts which are traditional tastes blended with a different, modern, form. The baking industry ingredient manufacturers are mainly concerned about the texture of the final product; so, they are working on using stabilizers and fat replacers to get the required levels.

The trend of the café culture and the boom in the sweets market has resulted in the need for such innovations, which are realized through the trend of selling mixes and specialized and new bakery flavor extracts. The suppliers of ingredients are also making moves with the introduction of spice-infused baking enhancers that will simplify the process of including flavors like cardamom, saffron, and rose in big production.

| Segment | Value Share (2025) |

|---|---|

| Flour (Product Type) | 45% |

Flour is a key part of the bakery ingredients market with its demand raising due to its essential role in bread, cakes, pastries, and biscuits among others. As the primary building block in most baked goods, its versatility and low cost make it something that cannot be replaced.

The interest in specialty flours, like whole wheat, gluten-free, and those made of ancient grains, has grown due to health-oriented consumers, who are more and more demanding such products. The flour manufacturers are working to improve the well-known flour mixes by adding the features that the customers crave, such as high fiber, high protein, and resistant starch.

Also, with the concrete shift into organic and clean-label baking, the flour producers are being forced to look at less manipulated, and non-GMO options. With the flourish of the global bakery sector, flour continues to be the central force in the industry, with the result that its market hold remains unshaken.

| Segment | Value Share (2025) |

|---|---|

| Commercial Baking (Application) | 40% |

The commercial baking sector stays the leading power in the global bakery ingredients market because of the increasing demand for mass-produced, high-quality baked goods. Big bakeries and industrial producers depend on constant ingredient supplies, use of sophisticated baking equipment, and shelf-life extending solutions to cope with the rising demand for bread, cakes, and pastries.

The demand for pre-mixes, emulsifiers, and functional enzymes is on the rise with the commercial bakers' need to improve texture, full-bodied, and freshness, all while optimizing production. With urbanization and changing lifestyles convenience becomes the new form as consumers go for ready-to-eat products, hence, the commercial baking industry's growth as a result.

On top of that, the manufacturers are utilizing fully automated production lines, quick-freeze dough, and clean-label formulations to address developing market requirements. As artisanal and hybrid bread products become the new fashion, commercial bakeries, in response, are adjusting to fresher ingredient formulations in their efforts to outcompete their rivals.

The bakery ingredients market is extremely competitive with the likes of Associated British Foods, Cargill, and Archer Daniels Midland Company being on the top and driving the industry. They adopt strategies such as product innovation, collaborations, and expansion into emerging markets to increase their market share.

They have been showing to the consumers that they are following the trends by producing healthier, clean-label, and specialty ingredients. For instance, Cargill has launched a new product, SimPure 92260, which is a soluble rice flour that serves as a maltodextrin alternative thus, catering to the demand for natural and label-friendly components.

In addition, companies are focusing on gluten-free and organic products to meet the concerns of health among the consumers that are escalating. Strategic acquisitions and partnerships are well-established where companies widen their product ranges and bolster their distribution networks. All these move together to ensure their position in constantly developing the bakery ingredients sector.

Within the Forecast Period, the market is expected to grow at a CAGR of 7.5%.

By 2035, the sales value of the industry is expected to reach USD 48,794.7 million.

Flours, Sweeteners, Leavening Agents, Fats and Oils, Others

Commercial Baking, Home Baking, Industrial Baking

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.