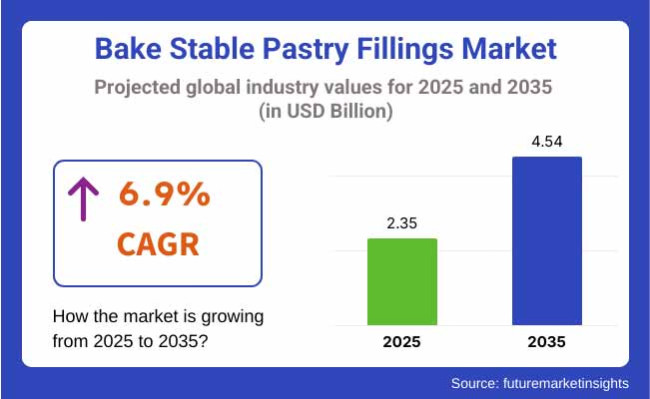

The global bake stable pastry fillings market is estimated to be worth USD 2.35 billion in 2025. It is projected to reach a value of USD 4.54 billion by 2035, expanding at a CAGR of 6.9% over the assessment period of 2025 to 2035. The bake-stable pastry fillings sector is on an upward trajectory due to strong backing from the food industry, which is shifting to high-quality and convenient baking ingredients.

In fact, bake-stable fillings can withstand extreme temperatures and remain unchanged in texture and flavor; thus, they are a must-have for bakeries, food service providers, and industrial-scale manufacturers. The introduction of premium and artisanal baked goods has majorly impacted growth.

The growth is mainly pushed by the increasing demand for filled pastries, croissants, tarts, and pies in both retail and food service sectors. Shoppers want to explore new culinary experiences beyond the norm with packed pastries and unique ingredients. In return, patisseries are going for the bake-stable fillings that embrace characteristics of the personification of the water of life, consistency, moisture, and shelf stability.

The rising trend for natural and clean labeling ingredients is also a determinant of development. Firms are designing bake-stable fillings without the addition of artificial additives, preservatives, or high-fructose corn syrup, which is the mark of the consumer's shift to healthier eating habits. Furthermore, the trend for plant-based and allergen-free pastry fillings is expanding the industry for innovations in dairy-free, gluten-free, and nut-free formulations.

Innovation results in better product stability and versatility in the food processing and formulation techniques sector. The addition of fruit concentrates, chocolate ganache, and nut pastes to make fillings has widened the palette of flavors. Besides, steps taken towards sugar reduction and other functional ingredients are the selling point for compliance with health-conscious clients for the producers.

Despite oscillating raw materials prices, supply chain disruptions are the main issues that can lead to increased production expenses and decreased availability of goods. Also, the competition caused by ready-to-use and frozen bakery products to replace traditional bake-stable pastry fillings is another hurdle. Nevertheless, the industry has scope for expansion.

The fast-moving demand for premium and gourmet baked goods, alongside the launch of innovative health fillings with functional effects, is the right time to proceed with that growth. Moreover, the latent adoption of bake-stable fillings in hybrid bakery products such as filled cookies has resulted in product diversification. As the bakery business accepts innovations, the bake-stable pastry fillings sector is ready for continuous growth in the forthcoming period.

It is expected that there will be steady growth between 2020 and 2024 due to the growing demand for convenience baking products in commercial and home baking. Plant-based and allergen-free products will take center stage as consuming patterns further evolve. AI-quality control and robotic production lines will emerge to increase efficiency and consistency.

There will be increased sustainable sourcing, biodegradable packaging, and lower sugar content to further delineate the next generation of bake-stable pastry fillings in keeping with global trends toward health and sustainability. Increasing frozen and pre-baked bakery products also required heat-stable and long-duration fillings with consistency when baking.

The future until 2025 to 2035 is promising for robust innovation, where the limelight is on ingredient technology development and sustainability. The incorporation of functional ingredients, such as protein-fortified and fiber-enriched fillings, will appeal to health-oriented consumers. Plant-based and allergen-free products will take center stage as consuming patterns further evolve.

AI-quality control and robotic production lines will emerge to increase efficiency and consistency. Increased sustainable sourcing, biodegradable packaging, and lower sugar content will further delineate the next generation of bake-stable pastry fillings in keeping with global trends toward health and sustainability.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased need for heat-resistant fillings for commercial bakeries. | Development of protein-fortified and fiber-enriched pastry fillings. |

| Clean-label and preservative-free product movement. | Growth in plant-based and allergen-free products. |

| Increased popularity of fruit, nut, and chocolate-flavored fillings. | AI-based manufacturing for consistency and quality control. |

| Increased use in frozen and pre-baked pastry products. | Sustainable ingredients and biodegradable packaging. |

| Focus on texture and shelf stability improvement. | Reduced sugar and functional ingredient innovations. |

There is a surge in sales and increased interest from customers in bakery products. There is a strong demand for premium baked goods and filled pastries because of the convenience of these food solutions. Industry players satisfy the needs of commercial bakers, food service providers, retail brands, and artisanal bakers, who have distinct purchasing criteria.

Commercial bakeries buy high-quality, temperature-stable fillings in bulk, mainly for mass production. In this case, the focus is on consistency and cost-effectiveness. Foodservice, especially small cafes and quick-service restaurants, find it convenient to use ready-to-eat fillings with a long shelf life and different flavours.

In the retail and packaged goods segment, there is a movement toward the use of clean-label organic and fruit fillings because of the demand from health-conscious consumers. Artisanal bakers also want their unique textures and flavors, such as specialty and gourmet fillings, even though they are smaller in size.

The industry is shaped by sustainability and a clean label, and producers work directly with customers' requirements. So, they enter the industry by using natural ingredients, less sugar, and eco-friendly packaging.

Globally, the industry is on the rise due to increasing interest in easy-to-use and long-lasting baking supplies. Nevertheless, strict food safety rules, such as the prohibition of preservatives, the addition of artificial additives, and the need for correct labeling, make the situation harder for companies that face compliance issues. Companies are obliged to ensure observance of local and international food standards to win consumers' trust and gain credibility.

The supply chain disruptions, which are caused by the rise and fall of raw material prices, raw materials containing high-quality fruits and dairy products, and transport service delays, have a negative influence on production. The reliance on seasonal ingredients gives more chance to the risk of one-sidedness, which is why acquiring multiple supplies weeds out risk and secures product consistently through sustainable procurement and effective logistics management.

The price competition of homemade and fresh bakery goods alongside the trend of clean labels is one more obstacle that hinders the industry from flourishing. People are more attracted to products such as natural, organic, and non-sugary ones. Thus, to retain their share, producers must put primary emphasis on product advancement, introducing healthy alternatives, using plant-based recipes, and adding functional items with no loss on general taste and structure.

Customers are not happy about allergens, artificial flavoring, and high sugar content, and that has a direct effect on their buying habits. Assurance in the sourcing of ingredients, clarity in nutritional labels, and advice from third parties will be the essential tools for regaining consumer confidence and letting the industry grow even more in an increasingly health-conscious society.

| Segment | Value Share (2025) |

|---|---|

| Chocolate (By Flavour) | 38% |

By flavor, the chocolate flavor is expected to hold 38.0% of the share in 2025, followed by fruit-based fillings with a 22.0% share.

Chocolate fillings dominate the industry owing to their versatility, rich taste profile , and widespread appeal among different baked goods consumers. These fillings are commonly used in croissants, tarts, doughnuts, and filled pastries, and both artisanal bakeries and high-volume commercial producers fuel the demand.

Their bake-stable chocolate filling ranges, which are hazelnut-chocolate and dark chocolate ganache products that maintain their texture and flavor even when subjected to extended heating, are being adopted by companies including Barry Callebaut and Puratos.

Fruit fillings, share at 22.0%, is low but continue to play a significant part due to a shift toward natural, clean-label, healthier products. Popular fruit flavors consist of fruit that have been used in pies, turnovers, and Danish pastries, such as apple, cherry, raspberry, and apricot.

This is where products like bake-stable fruit fillings from manufacturers like Dawn Foods and Zeelandia come in, allowing bakers to keep their food fresh, bright, and in a season without needing to be made while fresh-catering to both industrial and artisanal bakers with seasonal or traditional offerings.

As consumers increasingly target both indulgence and variety, the industry is anticipated to experience growth. Chocolate will remain at the forefront due to global demand, while fruit fillings will gain traction as part of the health and premium product segments.

| Segment | Value Share (2025) |

|---|---|

| Supermarkets (By Distribution Channel) | 48% |

Hypermarkets and supermarkets are expected to hold a share of 48.0% in the industry, continuing to be a leading retail segment in terms of share in 2025. They will be followed by online retail, which will have a share of 20.0%.

Hypermarkets and supermarkets dominate industry share as they cover a vast range of products, reach a broader consumer base, and make goods available instantly for consumers. Large retailers such as Walmart, Carrefour, and Tesco have many baking filling assortments for casual home baking as well as small business industrial users.

The excellent promotions and discounts offered by these outlets, along with impulse buying behavior, lead to larger amounts of sales for them. In addition, in-store bakeries increase the demand for bulk delivery of bake-stable fillings for professional use.

However, online retail, accounting for 20.0% of the revenue share, is steadily increasing, benefiting from convenience, a wider range of options, and home delivery. Mainstream and niche brands alike, from organic to clean-label to gourmet fillings, are available for consumers through e-commerce platforms such as Amazon, Instacart, and specialty baking supply sites.

However, for artisan bakers, small businesses, and hobbyists who previously lived outside the reach of physical retail stores, online channels are increasingly the way to go. The trend is also driven by the surge in baking at home, especially after the pandemic, and the convenience of comparing prices and reading reviews online.

Although hypermarkets/supermarkets are the most important sales channel, online retail is forecasted to gain a good share in the next years, owing to changing consumer purchasing behaviour and expanding manufacturers' direct-to-consumer strategies.

| Countries | CAGR (%) |

|---|---|

| The USA | 6.8% |

| UK | 6.2% |

| France | 6.4% |

| Germany | 6.5% |

| Italy | 6.1% |

| South Korea | 6.3% |

| Japan | 5.9% |

| China | 7.2% |

| Australia | 6.0% |

| New Zealand | 5.8% |

Bakery companies in the United States combine tradition and innovation. Premiumization is a trend with great momentum that has contributed to an increased demand for premium-quality, natural, and clean-label fillings. Industrial bakeries are still diversifying their portfolios by introducing unique flavors to attract traditional consumers as well as young consumers looking for exotic or fusion-based offerings.

In that regard, increasing specialty bakeries providing dietary food options such as gluten-free and vegan has pushed manufacturers to become creative with plant-based and low-sugar fillings. The increased demands for convenience store-baked foods further solidify their position in the competitive scenario.

A mix of traditional baking customs and new fad diets fuels the UK. Consumer demand for healthier indulgence has prompted manufacturers to introduce low-sugar and fortified fillings directly targeted at addressing regulatory pressures to reduce sugar.

Artisan bakeries and patisseries dealing with hand-made high-end ingredients have encouraged consumers to ask for organic and locally sourced fruits-based fillings. Seasonal and limited-use fillings have intensified, especially during festive times. Robust café society and increasing on-the-go consumption drive sales, with convenience-driven product forms at the forefront.

France supports robust demand for bake-stable pastry fillings because of its deep culinary culture. There is a quest for rich, authentic flavors such as praline, chocolate, and fruit flavors derived from superior ingredients. Frozen pastry creation, driven by high-end retailers and domestic baking style, has created an opportunity for bake-stable, long-shelf-life options.

Increased demand for hybrid pastries with traditional French methods married with global influences also creates opportunities for new fillings. Increased availability of foreign bakery chains also spurred product diversification, underpinning ongoing industry growth.

Demand for German-bake stable pastry fillings is driven by a strong culture of confectionery and bread consumption with a focus on natural ingredients and high-quality content. There is a growing demand for functional and nutritionally enriched fillings, such as those containing added fiber or protein content, to meet the healthy eating consumer trend.

The country's established bakery industry, big industrial plants, and small family-run artisan bakeries require a steady demand for classic tastes such as dairy-based, fruit, and nut-based fillings. Sugar-free and allergen-free alternative innovations gained momentum, keeping pace with the evolving dietary needs. Sustainability and clean-label thinking also steer the industry with consumers seeking authenticity in food provenance.

Italy’s demand for baked foods is dominated significantly by its rich history of pastry and significant faith in heritage ingredients such as ricotta, hazelnut, and citrus-based. Introducing new techniques into old recipes has helped the demand for stable, consistent fillings remain faithful to heritage.

The move towards grab-and-go bakery items has driven demand for long-stable fillings for packaged bakeries. Premiumization has also stimulated the growth of gourmet fillings, which are infused with local ingredients. Clean-label and low-sugar demand continues to compel makers to go out of the box when considering ingredients.

South Korea is growing at a rapid rate due to increased demand for Western-style bakeries and intense café culture. Korean consumers opt for premium, novel, and aesthetic bakery foods, hence the strong demand for specialty and artisanal fillings.

The increasing popularity of fusion pastries combining Korean and Western tastes has been equated to novel filling formulations, including the application of red bean, matcha, and yuzu ingredients. Increasing concern with health has resulted in a growing demand for low-calorie, functional, and vegetable-based fillings. Convenience remains a driving force, as does the growth of frozen and packaged bakery products.

The attention to detail, creativity, and a balance of tradition and modernity characterize Japanese bakeries. Bake-stable pastry filling is influenced by consumers' demand for good appearance, quality, and novelty textures. Azuki bean, chestnut, and sweet potato rank among the most popular filling flavors utilized, generally synonymous with both Western and Japanese pastries.

The aging demographics have generated demands for lower sugar and nutrient-upgraded products, and high-end indulgence is one of the principal drivers among young consumers. Industry expansion is still being driven by café culture and bakery sales in convenience stores, with ongoing demand for every type of product.

The Chinese industry for bake stable pastry fillings is expanding exponentially due to urbanization, the developing middle class, and increased consumer demand for Western-style baked products. New product development has been fueled by traditional Chinese pastry fusion with modern fillings.

Domestic and overseas bakery chains continue to grow, generating demand for variety and quality fillings. Increasing demand for healthy and functional bakery items has also prompted the growth of fortified fillings with added vitamins and minerals. Growing e-commerce is also driving bakery sales online.

Multicultural eating patterns and a strong café culture define Australia's bake-stable pastry filling market. Consumers are increasingly more disposed towards natural and organic fillings, particularly those without added preservatives and artificial flavorings.

Gourmet and artisan bakeries have driven demand for high-quality fruit, nut, and dairy fillings. Increased health consciousness has encouraged innovation in reduced-sugar, gluten-free, and plant-based fillings. Demand for frozen and ready-to-bake pastry fillings is also growing, catering to the retail and food service industries.

New Zealand's market for bake-stable pastry fillings, although smaller in size, is fuelled by robust consumer interest in natural and local ingredients. Clean-label obsession has fueled demand for minimally processed, organic fillings within the country.

Traditional standbys such as berry, honey, and dairy fillings are still top sellers, with international influences constantly adding to flavor profiles. Café and bakery cultures, particularly within urban centers, have continued to underpin industry expansion. The increase in convenience-driven product formats and frozen bakery foods continues to create fresh premiumization and innovation opportunities.

The industry is growing due to the rising demand for highly superior pastry ingredients that are convenient to use and versatile in their application. Baking trends toward artisanal and naturally gourmet, with consumer perceptions now inclined toward clean-label and non-GMO natural ingredients, have altered the competitive playing field. Key players are now oriented toward product innovation, expansion of distribution channels, and investments in sustainability sourcing and production to rank better in the industry.

Within the industry outlook, Puratos Group, Dawn Foods, Zeelandia, AGRANA Beteiligungs-AG, Barry Callebaut, etc., dominate the bake-stable fillings segment by providing various fillings, namely fruit-based, chocolate-based, and nut-based fillings. These emergent players are bringing in organic, non-GMO, and plant-based fillings as an answer to consumers' changing preferences.

Growing demand from the industrial and artisanal bakery segments, coupled with technological advances in food preservation, sugar reduction, and allergen-free alternatives, are triggering increasing competition. Strategic drivers for growth in this industry include an orientation to product diversification, collaboration with bakery chains, and investment in eco-friendly packaging systems and production methods.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Puratos Group | 18-22% |

| Dawn Foods | 15-19% |

| Zeelandia | 12-16% |

| AGRANA Beteiligungs-AG | 10-14% |

| Barry Callebaut | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Puratos Group | It offers a wide range of fruit, chocolate, and nut-based bake-stable fillings with a strong focus on clean-label and sustainable ingredients. |

| Dawn Foods | Specializes in high-quality pastry fillings, including fruit-based and custard varieties, catering to industrial and artisanal bakeries. |

| Zeelandia | Provides innovative bakery solutions with a focus on extended shelf life, clean-label formulations, and premium-quality fillings. |

| AGRANA Beteiligungs-AG | A major supplier of fruit-based bake stable fillings, known for its sustainable sourcing and customized product development. |

| Barry Callebaut | Leading in chocolate-based bake stable fillings, with an emphasis on premium ingredients and reduced-sugar alternatives. |

Key Company Insights

Puratos Group (18-22%)

Puratos is a leading player in the bakery industry, offering an extensive range of bake-stable pastry fillings. The company has made significant investments in sustainable sourcing and clean-label solutions to meet the rising demand for natural and premium products.

Dawn Foods (15-19%)

Dawn Foods is a major provider of bakery ingredients, including bake-safe fillings for industrial-scale bakeries. The company is expanding its product portfolio to include allergen-free and reduced-sugar options.

Zeelandia (12-16%)

Zeelandia focuses on technological advancements in bake-stable pastry fillings, offering extended shelf-life solutions and customized formulations for large-scale bakery manufacturers.

AGRANA Beteiligungs-AG (10-14%)

AGRANA is a global leader in fruit-based fillings, leveraging its expertise in sustainable agriculture and natural ingredient processing to develop high-quality pastry fillings.

Barry Callebaut (8-12%)

Barry Callebaut dominates the chocolate-based pastry filling segment, continuously innovating with sugar-reduced and functional ingredient solutions to meet evolving consumer demands.

Other Key Players (30-40% Combined)

The segmentation is into powder, RTD shakes, and bars, with varied demand across applications in the bakery, confectionery, and food service sectors.

The segmentation is into supermarkets, convenience stores, and online stores, with supermarkets leading due to extensive product availability and in-store promotions.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East and Africa.

The industry is slated to reach USD 2.35 billion in 2025.

The industry is predicted to reach a size of USD 4.54 billion by 2035.

Key companies include Puratos Group, Dawn Foods, Zeelandia, AGRANA Beteiligungs-AG, Barry Callebaut, AAK AB, Fruit Filling Inc., CSK Food Enrichment, and Herbstreith & Fox.

China, slated to grow at 7.2% CAGR during the forecast period, is poised for the fastest growth.

Chocolate-based bake stable pastry fillings are among the most widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Flavour, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Flavour, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Flavour, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness by Flavour, 2023 to 2033

Figure 71: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Flavour, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: MEA Market Attractiveness by Flavour, 2023 to 2033

Figure 107: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bakery Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bakery Mixes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bakery Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bakery Cases Market Analysis – Trends, Growth & Forecast 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Competitive Breakdown of Bakery Mixes Suppliers

Bakery Meal Market – Growth, Demand & Nutritional Applications

Bakery Fat Market – Demand, Innovations & Market Expansion

Bakery Flexible Packaging Market

Bakery Improvers Market

Bakery Conditioner Market

Bakeable Trays Market

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United States Bakery Ingredients Market Outlook – Demand, Size & Forecast 2025–2035

Par-Baked Bread Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA