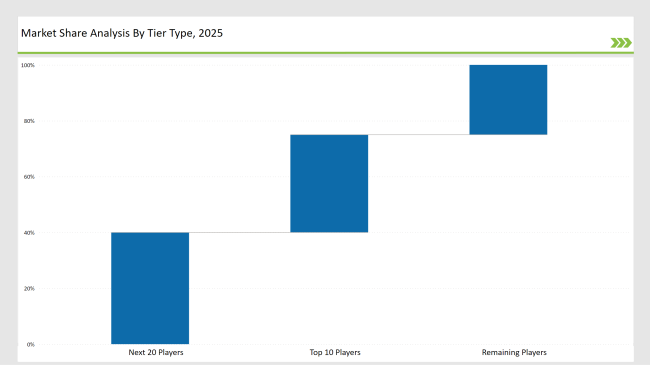

The global market for bagging machines is highly competitive and segmented. Companies have been divided into Tier 1, Tier 2, and Tier 3 as per market presence and strategic positioning. Tier 1 brands such as Barry-Wehmiller, FUJI Machinery, and Viking Masek make up for about 35% of the market share.

It gains a stronghold with high-speed packaging solutions, automation, and distribution networks worldwide. Their focus on sustainable packaging, modular machine designs, and high-performance materials allows them to serve the food, pharmaceutical, and industrial markets.

The Tier 2 players, like Concetti, Paxiom Group, and Hayssen Flexible Systems, constitute about 40% of the market. These players offer mid-sized enterprises economical and customized bagging solutions, improving operational efficiency and expanding automation capabilities to better establish their positions in the market.

Tier 3 players, mainly regional manufacturers and niche startups, hold 25% of the market. Here, companies play on specialized bagging systems, which are of localized industries in low-cost machines with high precision. Agility would help them go after industry-specific needs while holding on to competition in pricing.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Barry-Wehmiller, FUJI Machinery, Viking Masek) | 17% |

| Rest of Top 5 (Concetti, Paxiom Group) | 11% |

| Next 5 of Top 10 (Hayssen Flexible Systems, IMA Group, Mondial Pack, Rovema, ULMA Packaging) | 7% |

The bagging machine market serves industries such as:

Vendors offer specialized products to meet evolving industry needs:

Manufacturers integrate AI-driven monitoring and automation to enhance production efficiency, while sustainability remains a priority in packaging innovations.

This section highlights the key players that drove innovation and growth in the bagging machine market in 2025. Companies launched high-performance bagging solutions with increased speed and automation. Manufacturers invested in AI-driven defect detection to enhance packaging precision. Firms expanded production capacity to meet the demand for eco-friendly bagging solutions. Businesses introduced smart packaging features to optimize logistics and reduce waste.

Year on Year Leaders:

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Barry-Wehmiller, FUJI Machinery, Viking Masek |

| Tier 2 | Concetti, Paxiom Group, Hayssen Flexible Systems |

| Tier 3 | IMA Group, Mondial Pack, niche startups |

| Manufacturer | Latest Developments |

|---|---|

| Barry-Wehmiller | In January 2024, introduced AI-powered monitoring systems for bagging machines. |

| FUJI Machinery | In March 2024, launched ultra-fast automated bagging solutions for the food industry. |

| Viking Masek | In June 2024, expanded global distribution networks for flexible packaging solutions. |

| Concetti | In February 2024, invested in robotics-driven precision bagging for industrial use. |

| Paxiom Group | In July 2024, developed cloud-integrated monitoring systems for bagging machines. |

| Hayssen Flexible Systems | In April 2024, introduced eco-friendly biodegradable bagging options. |

| IMA Group | In August 2024, strengthened pharmaceutical bagging capabilities with sterile automation. |

The industry is moving forward with AI-driven automation, sustainable packaging, and cloud-integrated monitoring. Manufacturers are optimizing bagging efficiency to minimize waste and costs. Companies are investing in biodegradable materials to meet the global sustainability agenda.

Engineers are developing smart packaging solutions to track logistics. Firms are integrating IoT-enabled predictive maintenance to reduce downtime. Further investments in next-generation bagging technologies will be driven by emerging innovations.

Barry-Wehmiller, FUJI Machinery, Viking Masek, Concetti, and Paxiom Group lead the market.

The top 10 players collectively hold about 35% of the global market.

AI-based defect detection, IoT integration, and sustainable packaging solutions drive innovation.

Explore Packaging Machinery Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.