The market for baby personal care products is expected recovery steady as both the sales channel and end user in the market advance between 2025 and 2035, owing to enhanced parental awareness and increasing demand for natural and organic baby care products and rising disposable income. Some of those products include baby skincare, haircare, toiletries, diapers, and wipes, and parents are looking for gentle, chemical-free formulations.

A global shift toward premium and environmentally conscious baby care products is driving market growth, as brands innovate with plant-based ingredients, sustainable packaging, and dermatologically tested formulations. Moreover, the growing number of e-commerce platforms providing baby personal care products has made it easier for them to do comparison shopping for baby products that meet their specific needs. Additionally, consumer purchasing behaviour is driven by influencer marketing and product endorsement by paediatricians.

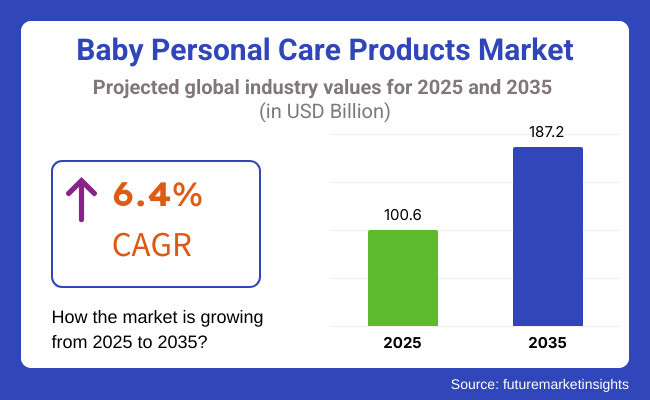

With a projected CAGR of 6.4% from 2025 to 2035, the market is increasingly being driven by the consumer shift toward high-quality, safe, and effective baby personal care formulations.

Explore FMI!

Book a free demo

North America baby personal care products market is driven by the robust demand for organic and hypoallergenic formulations among the consumers. Parents in the United States and Canada are opting for chemical-free skincare, plant-based baby wipes and fragrance-free lotions to prevent allergic reactions and skin irritations. Also, consistent, subscription-based delivery of baby care product is increasing in the region, with sustainable consumption pattern to ensure the parents always have the product they need.

Europe is relatively mature as a market with a strong inclination towards natural and eco-friendly baby care products. Manufacturers have developed clean-label and certified organic products due to stringent regulations in countries such as Germany, France, and the UK regarding baby cosmetics and toiletries. Sustainable packaging and cruelty-free testing are strong selling points, and European shoppers are highly aware of their environmental footprints and the transparency of the ingredients in their products.

Region-wise, Asia-Pacific is expected to grow at a higher CAGR during the forecast period on account of increasing birth rates, urbanization and a growing middle-class population with higher spending capacity. In urman, npw hooses of China, lndit, nd Jpan are experiencing growing interest in higher coiling And imported baby personable life Goods, gryckl, and bby629.Moreover, considering the safety and naturalness of baby skincare and hygiene products, various herbal and Ayurveda formulations are gaining popularity which is shaping up new product innovations in the global baby care market.

Ensuring Product Safety and Avoiding Harmful Ingredients

The market for baby personal care products is highly scrutinized due to the concern over product safety, ingredient transparency, and regulatory compliance. Moms and dads are becoming more mindful about potential health hazards posed by chemicals such as parabens, phthalates, sulphates and artificial fragrances in baby shampoo, lotion and wipes. Studies connecting these ingredients to skin irritation, hormonal disruptions, and long-term health issues have resulted in increasing consumer demand for organic and hypoallergenic alternatives.

Globally, regulators are clamping down on safety standards, but different regulations around the globe pose headaches for manufacturers with more than one geographical market. For consumers, the presence of counterfeit and mischaracterized “natural” products only contributes to the confusion and makes it difficult for parents to trust those options that genuinely are safe. Brands need to focus on clear ingredient lists, certifications from reputable entities, and educate the consumer on their formulations to combat this. R&D efforts on developing baby care products that are gentle yet effective, will be essential in gaining credibility and expanding in the market.

Rising Demand for Organic and Sustainable Baby Care Products

The growing inclination toward the organic and sustainable lifestyle has been a major contributing factor in the baby personal care products market growth. As such, parents are in the pursuit of plant-based, non-toxic and cruelty-free product options that serve their child’s well-being while being aware of their footprint on the planet. There has been a surge in demand for biodegradable baby wipes, refillable skincare products, and eco-friendly packaging, leading manufacturers to innovate formulation and design.

Additionally, e-commerce has increased market availability, enabling small and independent businesses to prevail against established brands by providing premium, niche, and personalized baby care Subscription-based models of fulfilment for things like diapers, lotions, and bath products are becoming all the rage, delivering convenience for parents and steady earnings for brands. Businesses that prioritize sustainability, ethical sourcing, and transparency within their production process stand to gain great dividends as this market shift matures.

The baby personal care market underwent a faster progression towards organic and chemical-free formulations from 2020 to 2024. Longstanding brands and upstarts have broadened their lines to include plant-based skincare, fragrance-free wipes and gentle cleansing solutions to keep pace with increasing demand for non-toxic baby products. Sustainability, too, proved a key focus, with brands launching biodegradable diapers, refillable baby lotions and recycled packaging materials.

As we look into the future of 2025 to 2035, we will see the market further heavy down towards sustainability and ingredient transparency. Also, the increase in natural preservatives and biotechnology will pave the way for more efficient plant-based baby care solutions. Brands will also invest in digital education platforms to establish trust with parents by educating them about the sourcing of the ingredients, efficacy and safety standards. New baby care offerings that are customized for individual skin sensitivities and climate conditions will emerge, helping redefine the industry dynamic around innovation.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter safety standards for baby skincare products |

| Technological Advancements | Introduction of plant-based preservatives and natural emulsifiers |

| Industry Adoption | Growth of organic-certified baby care brands |

| Supply Chain and Sourcing | Increase in ethically sourced natural ingredients |

| Market Competition | Entry of indie and eco-conscious baby care brands |

| Market Growth Drivers | Demand for chemical-free, hypoallergenic baby products |

| Sustainability and Energy Efficiency | Emergence of biodegradable baby wipes and reusable packaging |

| Consumer Preferences | Preference for fragrance-free and dermatologist-tested products |

| Retail and E-Commerce Growth | Surge in online sales and direct-to-consumer brands |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Global harmonization of ingredient safety regulations and mandatory transparency laws |

| Technological Advancements | Advances in bioengineered natural ingredients for improved safety and efficacy |

| Industry Adoption | Widespread adoption of clean-label and personalized baby care solutions |

| Supply Chain and Sourcing | Shift toward fully biodegradable and sustainable packaging solutions |

| Market Competition | Expansion of large brands into the premium organic baby care segment |

| Market Growth Drivers | Personalization, sustainable packaging, and eco-friendly formulations |

| Sustainability and Energy Efficiency | Full transition to carbon-neutral production and refillable baby care systems |

| Consumer Preferences | Increased demand for personalized, region-specific baby skincare solutions |

| Retail and E-Commerce Growth | Expansion of subscription-based baby care product services |

Growth in the USA baby personal care products market is being driven by the rising awareness of parents towards the hygiene and skincare of babies. Parents are increasingly looking for chemical-free alternatives, allowing organic and hypoallergenic products to go mainstream. As consumer preferences evolve, major brands are targeting sustainable packaging and plant-based formulations. E-commerce growth has also brought premium international brands closer to the consumers, significantly boosting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

In the UK, the demand for baby personal care products is booming, as people are gravitating towards dermatological tested products, hypoallergenic, and eco-friendly products. Government regulations on baby skincare ingredients and rising consumer trust in certified organic brands are aiding the market growth. Other factors driving sector growth include increased disposable income and the growing popularity of online shopping for baby products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

Germany, France, and Italy are the largest markets for baby personal care products in the EU, as natural and sustainable baby care solutions gain momentum. Stringent European Union regulations have made adding chemicals to baby cosmetics a very costly affair, thus driving innovation in formulations that are chemical free. Increasing awareness of skincare requirements for infants and the power of social media in promoting premium infant food brands are driving sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The baby personal care market is expected to grow in Japan, driven by the demand for high-quality, technologically advanced skincare products. Japanese parents spent their time looking for soft, moisture-locked items with traditional components like rice bran and camellia oil. Fewer children means more spending per child and greater sales of premium baby care products. Retailers are also broadening their online offerings to accommodate the needs of digital-savvy customers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

The baby personal care market in South Korea is evolving quickly, highlighting innovation in baby skincare and haircare. Strong beauty and cosmetics industries in the country are inspiring cutting-edge baby skincare formulations such as probiotic-infused creams, herbal-based washes and ingredients ranging from white lotus to pearl powder to glycerine and water sodium. Growing disposable income and consumer’s preference of luxury brands are further driving high-end baby care products market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

Hair Care & Skin Care Steer Market Growth with Parents Placing Emphasis on Mild and Safe Products

Due to the increasing demand for gentle, non-toxic, and dermatologically tested products among parents for their babies, the skin and hair care segments collectively dominate the baby personal care products market. As a daily necessity, these products maximize the well-being of an infant’s skin and hair by providing hydration, nourishment, and protection from external aggressors.

Skin care products hold the fastest-growing share of the baby personal care segment as these products are gentle and non-allergenic in nature specifically designed for babies' sensitive skin. Baby-specific products, in contrast to traditional skin care solutions, assure safety by limiting irritants and harsh chemicals.

The growing market adoption can be attributed to the increasing use of baby lotions, creams, and moisturizers containing natural ingredients like shea butter, aloe vera, and coconut oil, which parents prefer when choosing a clean-label product for their baby, with a focus on chemical-free skin care. According to studies, 65% of parents use organic-certified or dermatologist-approved baby skin care products, thus causing this segment to be in high demand.

The market has been further propelled by the rise of dedicated baby skin care lines, boasting eczema-friendly formulas, sun coverage with SPF and barrier-repair creams to provide optimal protection against dryness, allergens and skin irritants.

Developments in this direction, including the use of plant-based and cruelty-free ingredients, along with the inclusion of paraben-free, sulphate- free and fragrance-free ingredients in baby skin care formulations, have further propelled the adoption of baby skin care products, as it reflects sustainability, in addition to appealing to the consumer’s socio-economic priorities.

Probiotics-infused baby skincare solutions containing microbiome-balancing agents are helping build skin resilience and immunity and this drives the baby dermatology market growth, paving the way for innovation in baby dermatology.

Although skin care segment has some edge like hydration, protection, skin health enhancement but it faces challenges such as stringent regulatory approvals, high production cost for organic formulations and competition from generic baby care brands. Emerging innovations like AI driven personalized baby skin care recommendations, biodegradable packaging and sustainable ingredient sourcing are enhancing accessibility along with efficacy and sustainability in baby skin care products, thereby ensuring the global market grows.

Hair care products continue to be a strong category, driving sales for baby shampoos, conditioners and detanglers. Baby-specific products are designed to be tear-free, non-irritating, and mild surfactant-based compared to traditional hair care products.

The adoption of sulphate-free and hypoallergenic hair care products for babies such as 2-in-1 shampoo-conditioners, leave-in detanglers, and scalp-soothing oils are necessary for safe and effective hair nourishment, which has driven the demand. According to studies, more than 55% of parents look for paediatrician-recommended baby hair care products or dermatologically tested baby hair care products, which indicates that this segment will continue having customers.

The demand is further proved with the growing variety of specialized baby hair care products such as pH-based formula, scalp hydration treatments, whole strands relief that are highly effectual which is further enhancing the market demand that leads to ensuring sound scalp and hair growth.

Moreover, the inclusion of natural and plant-based extracts such as chamomile, almond oil, and coconut water in baby hair care formulations has also propelled the adoption, ensuring a chemical-free regime for grooming infants.

The launch of waterless and foaming baby shampoos, with improved rinse-off ability and eco-friendly formulations, led to the optimal growth of the market, providing enhanced convenience and sustainability in the baby personal care habits of consumers.

While the land of lather and rinse has reap benefits from the better scalp health, gentler cleansing and nourishment that are inherent to the category fewer of its brands are managing to keep affordability, threats from private label and constant bar–raising on tear-free technology. But the product differentiation, consumer penetration and confidence in the market for baby hair care products will still go on due to innovative developments in biodegradable baby shampoo packages, personalized hair care solutions based on baby's scalp conditions and these formulas endorsed by paediatricians.

The baby personal care products industry is poised to flourish with rising parental awareness towards baby hygiene, increasing demand for organic and chemical-free products along with increasing disposable income across developing economies. Bolds transform in the field of sustainable packaging, hypoallergenic formulation and use of plant based ingredients. Therefore, companies are focusing on health-conscious consumer’s niche by providing dermatologically tested, non-toxic & eco-friendly baby care products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Johnson & Johnson | 18-22% |

| Procter & Gamble (P&G) | 15-20% |

| Unilever | 12-16% |

| Kimberly-Clark Corporation | 8-12% |

| The Himalaya Drug Company | 5-9% |

| Other Companies (combined) | 35-45% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson | Top brand for baby shampoo, body lotion and powder, and hypoallergenic skincare products. |

| Procter & Gamble (P&G) | Includes Pampers baby wipes, mild cleansers and diaper rash creams. |

| Unilever | Manufactures Dove Baby skin-care line, including tear-free shampoos and moisturizing lotions. |

| Kimberly-Clark Corporation | Huggies wipes, and baby skincare for hygiene and comfort. |

| The Himalaya Drug Company | Offering herbal and organic baby care products such as lotions, powders, and oils. |

Johnson & Johnson (18-22%)

An internationally renowned player in baby personal care with gentle and clinically tested formulations, such as tear-free shampoos and moisturizing lotions.

Procter & Gamble (15-20%)

P&G leads the baby wipes and hygiene market, with an emphasis on dermatologically tested, hypoallergenic baby care products.

Unilever (12-16%)

The Dove Baby by Unilever range features gentle, pH-balanced skincare, addressing sensitive skin needs.

Kimberly-Clark Corporation (8–12%)

Huggies baby wipes and gentle skincare solutions provide warmth, comfort and safety for new-borns and toddlers.

The Himalaya Drug Company (5-9%)

A leader in the herbal baby care category, offering toxin-free, Ayurveda inspired personal care products.

Other Major Competitors (35-45% Combined)

The baby personal care market features brands that are natural, organic, and premium in its category. These include:

The Baby Personal Care Products Market was valued at approximately USD 100.6 billion in 2025.

The market is projected to reach USD 188.6 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2035.

The demand for Baby Personal Care Products Market is expected to be driven by increasing parental awareness of baby hygiene, rising demand for organic and natural ingredients, expanding product innovations in mild and hypoallergenic formulations, and growing disposable income in emerging markets.

The top 5 countries contributing to the Baby Personal Care Products Market are the United States, China, India, Germany, and Brazil.

The Skin and Hair Care segment is expected to lead the Baby Personal Care Products market, driven by the increasing preference for chemical-free baby lotions, shampoos, and oils, along with innovations in dermatologically tested and paediatrician-approved products.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.