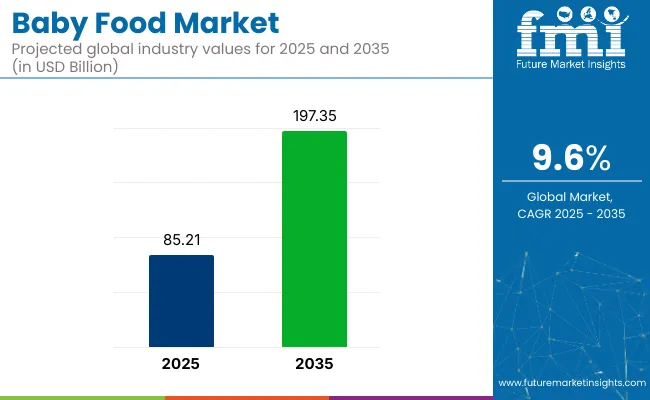

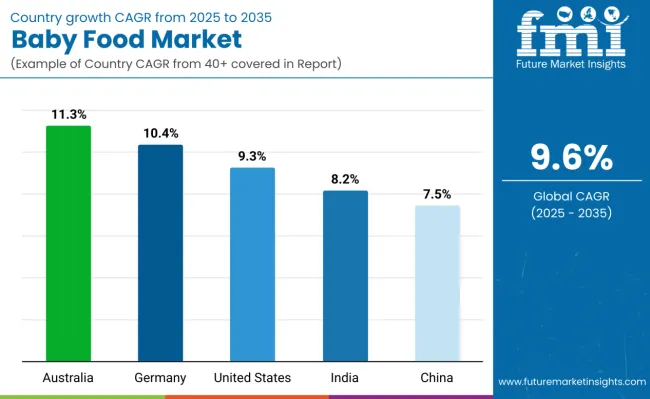

The baby food market is forecast to reach USD 213.21 billion by 2035, rising from USD 85.25 billion in 2025, at a CAGR of 9.6%. Product diversification has moved beyond basic nutrition to clinical-grade formulations, prompted by paediatric guidelines tightening across Asia-Pacific and the EU.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 85.25 billion |

| Market Value (2035) | USD 213.21 billion |

| CAGR (2025 to 2035) | 9.6% |

Multinationals are focusing on enzymatic hydrolysis of cow milk proteins to target preterm infants and allergy-prone newborns, pushing specialised formulations such as DHA-enhanced or prebiotic variants. The increasing demand for controlled nutrient-release systems has led to investments in wet-blending and high-shear mixing equipment.

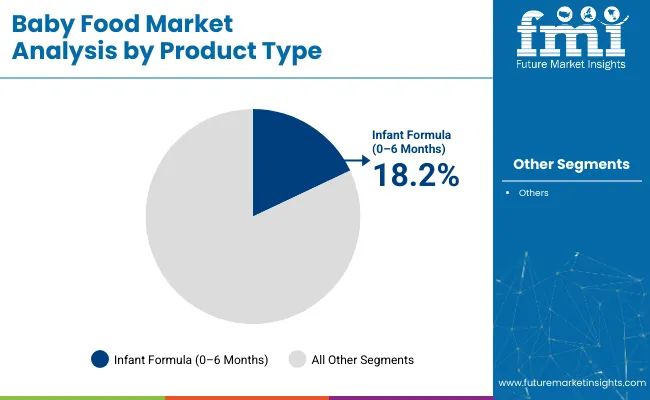

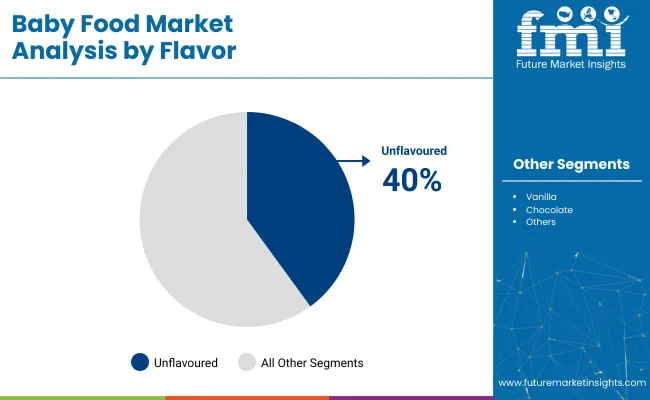

Flavour-neutral blends dominate, with unflavoured holding 40.0% share, aligning with regulatory discouragement of added sugars for infants under two. Special milk formulas have gained traction in clinical nutrition settings, though they account for just 18.2% of 2025 sales. Growth is being driven by neonatal intensive care units favouring protein-hydrolysed mixes to address early malabsorption risks.

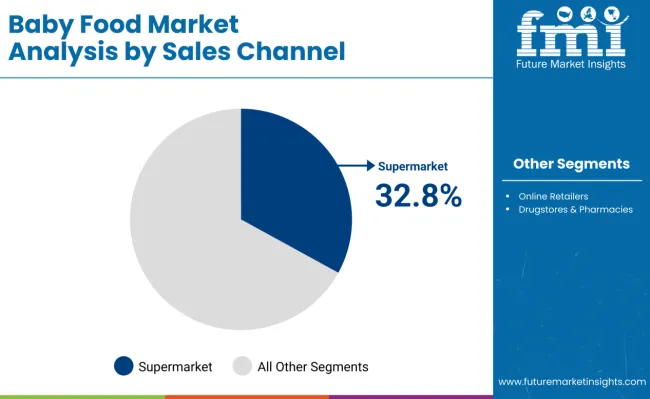

Supermarkets retain 32.8% share through shelf-stable stage-one products, leveraging bundled promotions. Australia’s 11.3% CAGR stems from stringent local standards-such as FSANZ nutrient caps and DHA requirements-which have enabled local processors to meet high-barrier export approvals in East Asia.

Collaborations and partnerships keep the industry active and competitive. Pristine Pearl Pharma and Dutch Medical Food BV formed a strategic collaboration to introduce personalized medical nutrition products in India, addressing disease-related malnutrition.

The industry holds a smaller share in its parent markets. Within the food and beverage market, it accounts for around 3-5%, as baby food is a niche segment within the broader food sector. In the infant nutrition market, the share is higher at approximately 20-25%, driven by the growing demand for specialized nutrition for infants.

The packaged food market sees a contribution of about 4-6%, reflecting the popularity of convenient baby food products. The organic food market holds around 2-4%, due to rising demand for organic baby food options. In the retail market, the baby food market makes up about 3-5%, influenced by the growth of both physical and online retail channels for infant food products.

Per capita spending on baby food varies widely between developed and developing countries due to differences in income levels, lifestyle patterns, and access to commercial nutrition products. In developed nations, higher spending is driven by busy urban lifestyles, strong brand trust, and greater focus on convenience and quality, with parents often choosing fortified and organic baby food options. In contrast, developing countries tend to show lower spending, primarily due to economic limitations and a continued reliance on homemade food.

Government regulations and certifications in the baby food market are designed to ensure product safety, nutritional adequacy, and consumer trust. These measures vary by region but share the common goal of protecting infant health and guiding manufacturers to meet strict quality standards.

In 2025, growth within the industry has concentrated in special milk formulas, supermarket retailing, unflavoured variants, and bag-in-box packaging. Each segment is shaped by formulation regulations, distribution efficiency, ingredient policies, and packaging performance under controlled environments.

A 18.2% share has been accounted by 0-24 month special milk formula in 2025. This segment benefits from prescription-linked usage, regulatory approvals, and strong positioning in clinical feeding protocols where breastfeeding is not feasible.

A 32.8% share has been held by supermarkets in 2025, supported by format coverage, inventory rotation systems, and cross-category bundling strategies focused on new parents.

A 40% share has been accounted for by unflavoured food in 2025, owing to ingredient simplicity, pediatric recommendations, and reduced labeling complexities tied to regulatory disclosure rules. Sweeteners and salt are excluded to conform with WHO dietary thresholds for infants under 2 years.

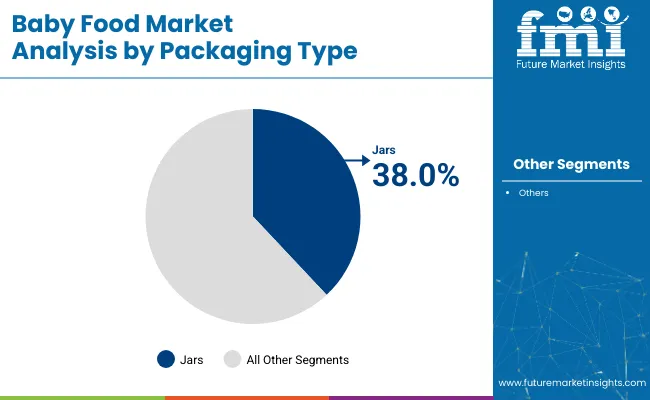

A 35% share has been held by bags in boxes in 2025, attributed to their structural protection, dosing precision, and resilience across transport and retail channels.

Product formulation shifts and regulatory enforcement are giving a direction to the industry. Innovations are being driven by compositional scrutiny and traceability requirements across regions with strong infant food regulation, particularly the EU, USA, and select ASEAN countries.

Brands are being pushed to reformulate based on flagged additives, processing residues, and micronutrient inconsistencies. Parental concerns over maltodextrin, excess sugar, and palm oil content have led to product recalls and delistings in France and Germany. DSM and Arla are introducing custom infant-grade ingredients to align with stricter guidelines from EFSA and Codex Alimentarius. Multinational retailers have begun conducting independent lab checks before listing new SKUs. Clean compositions with region-specific fortification are crucial for shelf access in pharmacies and premium retail chains.

Global traceability enforcement has increased sharply after contamination incidents in powdered formulas. Regulations in China and the EU now require source tracing for every input in the supply chain. Platforms like TraceOne and iFoodDS have been implemented by processors and distributors to log ingredient origin, process flow, and batch validation. Local brands in India and Indonesia are facing rejection from modern trade due to unverifiable sourcing. Companies without traceable vendor ecosystems are struggling to maintain buyer confidence or meet export clearance norms.

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 11.3% |

| Germany | 10.4% |

| United States | 9.3% |

| India | 8.2% |

| China | 7.5% |

Global baby food industry growth is being led by Australia at a 11.3% CAGR, followed by Germany at 10.4%, and the United States at 9.3%. India stands at 8.2%, while China follows with a 7.5% CAGR. All five countries outperform the estimated global average, reflecting distinct regulatory, demographic, and supply chain catalysts across regions.

Growth premiums range from +1.2 to +5.3 percentage points over baseline CAGR, with Australia’s export-led growth delivering the highest margin. Australia outpaces global CAGR by +5.3 points, driven by regulatory rigor and export focus. Germany posts a +4.4 point premium due to rising demand for premium, non-GMO formulations.

United States exceeds by +3.3 points, backed by USDA and FDA-backed safety initiatives. India maintains a +2.2 point lead, supported by targeted rural nutrition programs and infrastructure incentives. China achieves a +1.2 point premium, sustained by traceability mandates and domestic innovation support. These countries are shaping global dynamics in the baby food segment, balancing domestic demand with cross-border distribution strengths. The report covers detailed analysis across 40+ countries.

The baby food market in the United States is expected to grow at a CAGR of 9.3% from 2025 to 2035. The FDA’s Closer to Zero initiative redefined heavy metal thresholds, prompting recipe reformulations across mainstream and specialty brands. USDA’s fast-tracked organic approvals have increased the shelf presence of certified infant products.

Momentum is also coming from pediatric nutrition startups leveraging DTC models with clinical endorsements. Some states have introduced grants to incentivize local ingredient sourcing for infant purées. Clinical trials supported by the NIH are increasing confidence in hypoallergenic formulas.

The baby food market in Germany is projected to grow at a CAGR of 10.4% from 2025 to 2035. Federal regulations on lactose, sweeteners, and pesticide residues have raised the compliance bar above EU norms. Non-GMO and biodynamic farming alliances have integrated directly into infant food supply chains.

The Federal Ministry of Food and Agriculture includes quality in its nutrition policy roadmap. Regional procurement for hospitals and daycare centers favors certified local producers. Retail expansion is being led by niche companies specializing in ultra-clean formulations for newborns and toddlers.

The baby food market in China is forecast to expand at a CAGR of 7.5% from 2025 to 2035. Regulations by SAMR now require end-to-end traceability, including QR-coded batch histories for all infant nutrition products. Import-dependent categories like infant formula have been included in Free Trade Zone (FTZ) fast lanes to reduce bottlenecks.

Government innovation grants are supporting domestic R&D to replace key imported micronutrients. Regional governments have launched pilot initiatives linking maternal health clinics with certified providers. Tier-1 cities are the core demand centers for high-end food imports.

The baby food market in Australia is anticipated to grow at a CAGR of 11.3% from 2025 to 2035. FSANZ imposes among the world’s strictest safety requirements for infant nutrition, creating a quality benchmark for local and export products. The Infant Nutrition Council oversees a dual-certification program to support ASEAN-bound product approvals.

State governments have extended infrastructure incentives to manufacturers using locally sourced produce. Export-focused production has accelerated across Victoria and New South Wales, positioning Australian brands in high-value regional industries. Clinical partnerships are being formed with pediatric hospitals to trial new allergen-free blends.

Baby Food Market Sales Analysis in India

The baby food market in India is expected to grow at a CAGR of 8.2% between 2025 and 2035. The Ministry of Women and Child Development has expanded POSHAN Abhiyaan to include private-sector fortified food in government programs. FSSAI has revised licensing to allow greater flexibility for regional producers. Growth is shifting from metros to tier 2 and tier 3 cities due to rising institutional demand. Government-aided ICDS centers are increasingly procuring blended infant meals from certified suppliers. New labelling rules now require declaration of every nutrient added to infant formulations above minimal levels.

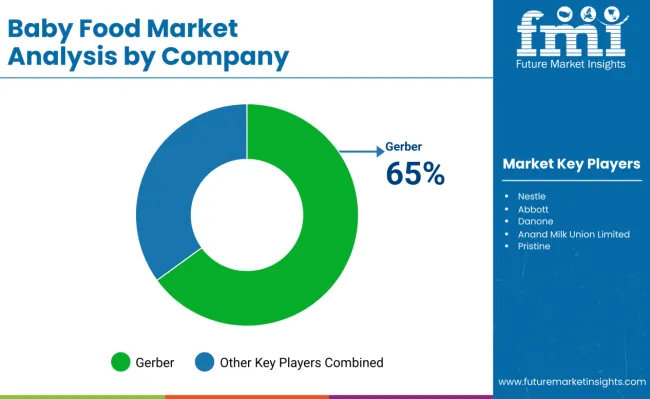

The baby food market is highly competitive, with leaders like Nestlé, Abbott, Danone, and Reckitt Benckiser (Mead Johnson) holding large shares. These companies leverage strong brand recognition, vast distribution networks, and heavy investments in marketing. Nestlé dominates with products like Gerber and Cerelac, while Abbott and Danone cater to premium segments with brands like Similac and Aptamil. Reckitt Benckiser bolsters its position through Enfamil. Emerging players such as Manna Foods, Pristine, and Tiny Spoons target niche markets, offering organic and locally sourced options. The market is moderately fragmented, driven by innovation from both large and small companies. As demand for diverse and high-quality food grows, the competitive landscape is constantly changing.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 85.25 billion |

| Projected Market Value (2035) | USD 213.21 billion |

| CAGR (2025 to 2035) | 9.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Product Type | Infant Formula, Complementary Food |

| Flavor | Unflavoured, Vanilla, Chocolate, Berries, Mango, Apple, Banana, Mixed Fruits, Others |

| Packaging Type | Bags in Boxes, Pouches, Jars, Can/Tins, Others |

| Sales Channel | Store-based (Hypermarkets, Supermarkets, Drugstores & Pharmacies, Convenience Stores, Grocery Stores, Baby Specialty Stores), Online Retailers |

| Region | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Nestle, Abbott, Danone, Anand Milk Union Limited, Mead Johnson Nutrition India /Reckitt Benckiser, Manna Foods, Pristine, Mightly Steps Private Limited, The Great Banyan, Tiny Spoons, Gerber - Nestlé Sub, Nurture, Inc., Heinz, Hain Celestial Group, Ella’s Kitchen, Sprout, Plum Organics, Hero Group, HiPP, Others |

| Additional Attributes | Dollar sales, CAGR trends, product type distribution, flavor preferences, packaging preferences, competitor dollar sales & market share, regional growth patterns, sales channel trends, end-user segmentation |

The segmentation is into Infant Formula (0 to 6 Months - Starting Infant Formula, 6 to 12 Months - Follow-on Milk Formula, 12 to 24 Months - Toddlers Milk Formula, and 0 to 24 Months - Special Milk Formula), and Complementary Food (6 to 24 Months) (Fruit and Vegetable Puree, Baby Cereals, and Baby Porridge).

The segmentation is into Unflavoured, Vanilla, Chocolate, Berries, Mango, Apple, Banana, Mixed Fruits, and Others (nuts, honey).

The segmentation is into Bags in Boxes, Pouches, Jars, Can/Tins, and Others (Small Tubs).

The segmentation is into store-based (Hypermarkets, Supermarkets, Drugstores & Pharmacies, Convenience Stores, Grocery Stores, and Baby Specialty Stores), and Online Retailers.

The segmentation is into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The projected valuation of the baby food market in 2025 is 85.25 billion USD.

The forecast valuation of the baby food market by 2035 is 213.21 billion USD.

The expected CAGR for the baby food market from 2025 to 2035 is 9.6%.

The 0-24 months, special milk formula segment will lead in 2035, with a 18.2% share in 2025.

Australia is expected to be the leading country in the baby food market, with a 11.3% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dried Baby Food Market Size and Share Forecast Outlook 2025 to 2035

Prepared Baby Food Market Size and Share Forecast Outlook 2025 to 2035

BRIC Organic Baby Food Market Size, Growth, and Forecast for 2025 to 2035

Hypo Anti-Allergic Baby Food Market Analysis by Product Form, Product Origin, Distribution Channel and others Through 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA