The global baby diaper market is growing at a rapid pace, mainly due to increasing birth rates, growing awareness about baby hygiene, and the demand for sustainable and skin-friendly diapering solutions. Parents are now focusing on quality and comfort due to absorbent material technological advancements, eco-friendly alternatives, and smart diaper monitoring systems.

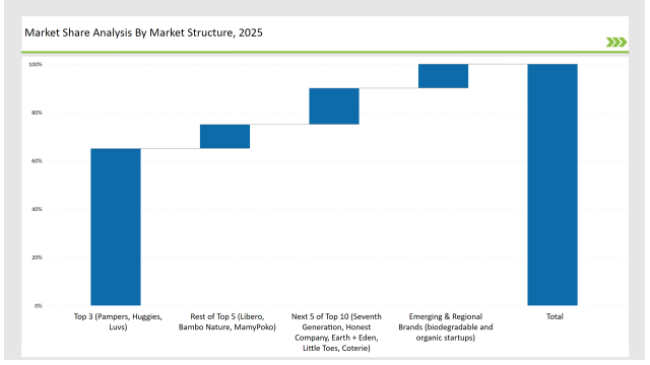

The market leaders are Pampers, Huggies, and MamyPoko, which continue to lead the market through innovative diaper technologies and brand loyalty, capturing 55% of the market share. 30% is comprised of regional players and private labels, emphasizing affordability and customization. 15% is comprised of the emerging sustainable brands. These are supportive of a focus on organic materials and biodegradable diapers.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Pampers, Huggies, Luvs) | 65% |

| Rest of Top 5 (Libero, Bambo Nature, MamyPoko) | 10% |

| Next 5 of Top 10 (Seventh Generation, Honest Company, Earth + Eden, Little Toes, Coterie) | 15% |

| Emerging & Regional Brands (biodegradable and organic startups) | 10% |

The baby diaper market in 2025 is moderately concentrated, with the top 10 players holding 40% to 60% of the total market share. Leading brands like Procter & Gamble, Kimberly-Clark, and Unicharm maintain a strong presence, while regional players and private labels intensify competition.

Supermarkets and retail stores remain the leading sales channel for baby diapers, accounting for 50% of sales as parents prefer immediate accessibility and bulk purchasing options. E-commerce accounts for 30% of the market share, owing to the ease, subscription diaper delivery, and digital discounts. Pharmacies and healthcare providers comprise 15%, which offer medically recommended diaper brands for premature or sensitive-skinned babies. DTC brands and specialty baby stores make up 5% since parents opt for organic, premium, or custom-fit diapering solutions.

Baby Diaper Market Categories Disposable diapers take the lead by 65%. This is based on the advantages of being quite easy to apply, strong absorption, and simply available. 25% accounts for cloth diapers, which, being sustainable and cost-effective besides being hypoallergenic. Hybrid diapers accounted for 10% as this brings together both the benefits from disposables to reusable inserts by appealing to environmentally conscious parents.

Baby diaper sales turn over in 2024 mainly due to the factors of sustainability, innovation, and consumer preferences for gentle, chemical-free products. Some leaders are:

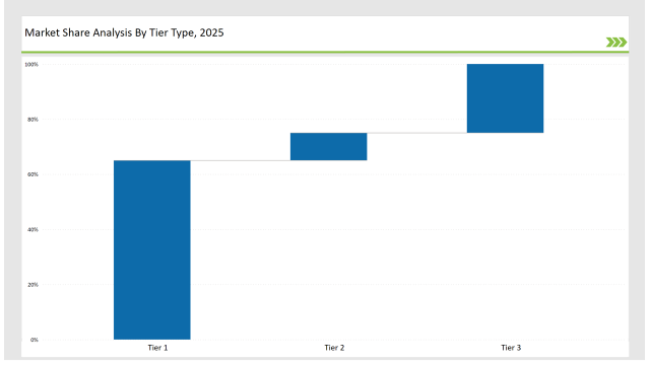

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Pampers, Huggies, Luvs |

| Market share % | 65% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Libero, Bambo Nature, MamyPoko |

| Market share % | 10% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, organic startups |

| Market share % | 25% |

| Brand | Key Focus Areas |

|---|---|

| Pampers | Plant-based, hypoallergenic diapering solutions |

| Huggies | Smart diapers with wetness tracking technology |

| MamyPoko | Ultra-thin, overnight absorbency diapers |

| Libero | Biodegradable, compostable diapers |

| Seventh Generation | Non-toxic, plant-based diaper alternatives |

| Emerging Brands | Bamboo-based, organic diapers for sensitive skin |

The baby diaper market is on the threshold of further growth with sustainability, innovation, and smart technology. Improving absorbency, reducing environmental impact, and comfort will be the areas where brands improve as parents seek eco-friendlier, safe, and convenient diapering options. Digital advancements, such as AI-driven diaper sizing recommendations and mobile-connected diaper monitoring, will change the face of parental convenience.

Further partnerships with pediatricians, hospitals, and maternity centers will increase the credibility of the product. Regulatory Incentives and Biodegradable Diapers-Sustainable Production Methods As governments of the world push for greener consumer products, more regulatory incentives to biodegradable diapers and sustainable production methods can be anticipated in the near future. Personalization, sustainability, and technology-led solutions, designed around changing expectations of modern parents, represent the future of the baby diapers market.

Major brands such as Pampers (Procter & Gamble), Huggies (Kimberly-Clark), and Luvs collectively hold around 65% of the market.

Regional brands, including MamyPoko (Asia) and Bambo Nature (Europe), contribute approximately 20% of the market by focusing on local preferences and eco-friendly options.

Startups and sustainable diaper brands focusing on biodegradable and cloth alternatives hold about 10% of the market

Private labels from retailers such as Walmart’s Parent’s Choice and Costco’s Kirkland account for approximately 5% of the market.

High for companies controlling 65%+, medium for 40-65%, and low for those under 30%.

Korea Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Men’s Skincare Market Analysis - Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis by Base Material, End Use, Product Type, Sales Channel, and Region through 2025 to 2035

Korea Photo Printing and Merchandise Market Analysis - Size, Share & Trends 2025 to 2035

Japan Photo Printing & Merchandise Market Analysis - Size, Share & Trends 2025 to 2035

Korea Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.