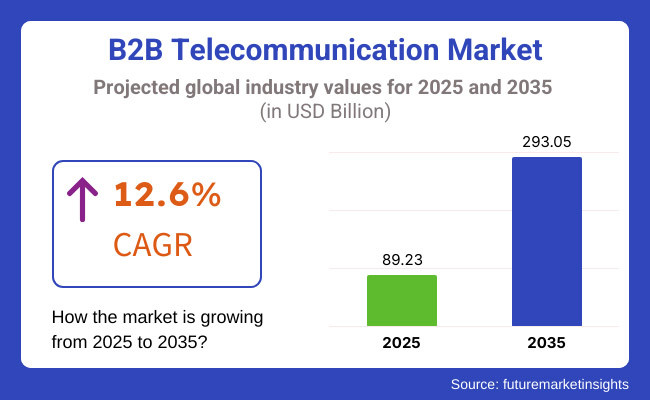

The B2B telecommunication market has high growth potential and is projected to grow between 2025 and 2035, fueled by the embracement of cloud-based communication solutions, 5G network deployments, and industrial digitization. From USD89.23 billion in 2025, the industry is projected to reach USD 293.05 billion by 2035, exhibiting a 12.6% CAGR in the forecast period.

With businesses becoming more and more reliant on remote workforces, IoT connectivity, and AI-driven communication tools, the demand forfast, secure, and scalable telephony services is massive.

This industry refers to a wide range of voice, text, data, and video communication services, from beginning to end, easily reaching its end target and facilitating communication business to business. As this business complexity accelerates, enterprises are increasingly using software-defined wide-area networks (SD-WAN), UCaaS, and AI-driven networkautomation to enhance operational efficiency.

It is also driving the transformation of business communication infrastructure to create frictionless data exchange and business continuity powered by hybrid cloud networking,edge computing, and security solutions.

As an organization fills the B2B telco appetite, a few big trends are driving the industry. This is causing a mass transition of businesses tocloud-powered communications and collaboration solutions that enable higher responsiveness at lower operational costs. It allows industries to adopt IoT solutions, perform real-time data reporting, and automate withultra-high levels of connectivity.

In addition, companies are utilizing AI-enabled chatbots, virtual assistants, and contact centers thatautomate customer interaction to reduce the complexity of customer experience and improve service delivery. In addition, with industries like finance, healthcare, and government where data is critical, there is a highly increasing demand for secure and encrypted communication channels.

The industry continues its course of healthy growth but is still filling its role. On telecom operators, the 5G rolloutcost of the investment in infrastructure and capacity of a industry can be a significant burden.

Furthermore, regulatory constraintsand data privacy issues might become an additional hurdle, especially with much stricter compliance requirements in some industries. In addition, malicious attacks, along with more advanced cyber threats such as data breaches and network vulnerabilities, require continuous innovations in encryption and threat protection technologiesto secure the communications domain.

Future innovations within Telecom B2B are paving the way todefine future trends that are laying the foundations of what the future of telecom looks like. Mandatory remote working and the expansion of hybrid working are driving the need for user-friendly,cloud-based, distributed communication solutions that are easily accessible from all devices and locations.

In terms of business applications, edge computing is also supporting faster processing ofdata and reduction in latency. Cooperationbetween telecommunications and technology firms is further accelerating the transformation of industry-specific solutions into real-life solutions. With the progress of the digital revolution across the world, B2B telecommunication market will achieve an uninterrupted growth synched upwith the needs of technology and the enterprise connectivity requirements.

Explore FMI!

Book a free demo

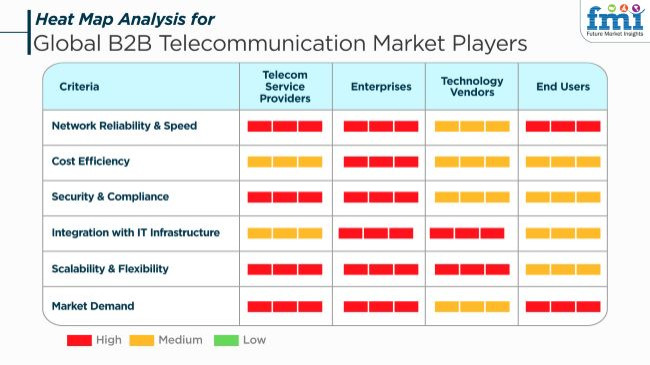

The B2B telecommunications sector is experiencing a fast-paced change brought about by the transition to 5G, cloud-based solutions, and digital transformation initiatives in various sectors. Companies are concerned about ultra-fast, reliable connectivity with stronger privacy privileges to support remote work, IoT integration, and real-time data processing.

Telecommunication service providers are during the expansion of fiber-optic networks, private 5G & deployment, and better maintenance service to fulfill the needs of businesses. Tech suppliers are the silent support in equipping SDN (software-defined networking), AI analytics, and cybersecurity tools for the smooth operation of the communication facility.

Clients show their causal effect on the industry through remote work, learning their connectivity issues with different devices, and, most importantly, the demand they create for them. Scalability, cost, and legislative issues like data protection are the determinants of the choice of the network.Solutions based on hybrid cloud infrastructure and automation propelled by AI and edge computing are growing to differentiate companies, which makes B2B telecom a crucial partner in the digital-first business movement.

Contract & Deals Analysis – B2B Telecommunication Market

| Company | Contract/Development Details |

|---|---|

| AT&T Business | AT&T secured a multi-year contract with a global financial services firm to provide secure, high-speed connectivity and managed network services, enhancing operational efficiency. |

| Verizon Business | Verizon entered into an agreement with a multinational healthcare provider to deploy 5G-enabled B2B telecommunication solutions for real-time data transmission and telemedicine services. |

| BT Group | BT Group expanded its enterprise telecommunication offerings through a strategic partnership with a leading manufacturing company, focusing on cloud-based unified communications and IoT connectivity. |

| Orange Business Services | Orange announced a collaboration with a top-tier government agency to implement secure, AI-driven telecommunication infrastructure for mission-critical operations. |

From 2020 to 2024, the industry grew at a fast pace, fueled by the growth in remote work, cloud, and rising demand for high-speed connectivity. Businesses focused on secure and scalable communication solutions, driving investments in SD-WAN, unified communications, and IoT-enabled networks.

The 5G infrastructure also revolutionized business operations, supporting quicker data transmission and low-latency applications. Yet, cybersecurity risks, regulatory requirements, and supply chain disruptions made it challenging, compelling telecom providers to improve network robustness and build stronger security architectures.

Between 2025 and 2035, the industry will transform with AI-powered network management, edge computing, and universal use of private 5G networks. Companies will increasingly turn to telecom providers for AI-fueled analytics, customer support through automation, and ultra-secure, zero-trust network architecture.

As hybrid work paradigms continue, there will be demand for high-performance, seamless connectivity that will fuel innovations in satellite communications, quantum cryptography, and decentralized network infrastructure. Telecommunications companies will transition to the provision of end-to-end integrated digital ecosystems that will allow companies to streamline operations, improve collaboration, and future-proof their connectivity strategies.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter telecom regulations (GDPR, CCPA, FCC guidelines) required telecom providers to enhance data privacy, security, and compliance frameworks for enterprises. | AI-driven, quantum-secure telecom platforms ensure real-time compliance, automated regulatory adherence, and blockchain-backed communication security across global enterprise networks. |

| Enterprises adopted 5G-enabled B2B telecom solutions for faster data transmission, lower latency, and better network efficiency. | AI-powered 6G enterprise networks offer ultra-low latency, self-optimizing bandwidth allocation, and real-time adaptive communication solutions tailored to business workloads. |

| AI-enhanced network monitoring optimized bandwidth allocation, reduced downtime, and improved predictive maintenance for enterprise connectivity. | AI-native telecom infrastructure autonomously detects network issues, self-heals connectivity problems, and optimizes enterprise communication workflows for maximum efficiency. |

| Businesses integrated unified communication solutions (VoIP, video conferencing, messaging) to support hybrid workforces and global teams. | AI-powered, immersive enterprise communication platforms enable real-time, voice-to-text AI transcription, holographic conferencing, and predictive collaboration enhancements. |

| B2B telecom services expanded edge capabilities to process IoT data in real-time, supporting smart manufacturing, healthcare, and logistics. | AI-driven, edge-native telecom networks autonomously manage IoT connectivity, while real-time decentralized processing caters to autonomous systems and ultra-low latency enterprise applications. |

| Enterprises deployed SDN/NFV to create a scalable software-defined telecom infrastructure with reduced hardware dependency. | AI-enabled intent-based networking automatically configures enterprise telecom environments in response to real-time traffic and security demands. |

| Telecom operators built stronger security systems for enterprises using AI insights for threat detection, end-to-end encryption, and zero-trust network access (ZTNA). | AI-native, self-learning security systems autonomously neutralize cyber threats while implementing decentralized identity verification and quantum-resistant encryption protocols. |

| API-driven telecom services allowed businesses to integrate custom corporate communication solutions smoothly. | AI-enabled intent-based TaaS platforms provide real-time programmable networking, dynamic API integration, and self-optimizing enterprise connectivity solutions. |

| Enterprises utilized AI-driven contact centers to enhance customer experiences, automate workflows, and personalize user interactions. | AI integration enables real-time sentiment analysis and voice recognition, offering hyper-personalized, predictive, and intent-aware autonomous B2B customer engagement. |

| Telecom service providers prioritized energy efficiency while optimizing power consumption in data centers. | AI-driven green telecom networks use predictive energy optimization, carbon-neutral connectivity, and dynamic power scaling for sustainable enterprise communication solutions. |

The B2B telecom sector carries inherent risks such as network security vulnerabilities, regulatory compliance, infrastructure investments, competitive pressures, and technological disruptions.

The reliance on cloud computing services, Internet of Things (IoT), and 5G networks by businesses makes network security vulnerabilities the most critical issue. Cyber threats, such as data breaches and service downtimes can cause huge financial losses and image tarnishing for both telecom providers and their clients. The implementation of the latest hardware and software controls is fundamental in managing the risk.

Regulatory compliance has become a focus area with the government enforcing data protection laws such as GDPR, CCPA, and telecom licensing and net neutrality requirements. Noncompliance might lead to enormous fines, restrictions in operations, and legal issues.

Infrastructure investments are another issue which have their attendant risks, as for instance deploying 5G, fiber optics, and cloud-based solutions comes with high capital costs. Regional telecom players might find it difficult to cope with the large-scale network deployment and this consequently would impair their competitiveness in potentially lucrative industry sections.

Pressure in competition from telecom behemoths and newly formed consciousness, who are offering affordable products say VoIP, cloud communication, and AI, thereby giving challenge to traditional business models. On the other hand, the clinching of the key is through service attesting, customer support, and enterprise innovations.

Technological disruptions, which are things like the move to edge computing, AI-backed automation, and SDN, could render the traditional telecom infrastructures unproductive. A firm that does not recognize the change in B2B communication requirements could suffer loss in industry share.

The evolution of enterprise communication with Unified Communication and Collaboration (UCC) solutions enables the merger of many tools and resources, includingmessaging, video conferencing, and cloud-based collaboration. Businesses cancontinue operating efficiently at different sites thanks to these solutions, and communication becomes easier. The demand for these platforms continues to grow as hybrid and remote work models become the standard amongmany organizations.

Prominent playersin this space are Microsoft, Cisco, and Zoom Video Communications. Currently, the strongestsuccess story for business cloud apps is Microsoft Teams. Development to bring all the apps together on Teams has paid off, Teams is deep into the Office 365 ecosystem and well-integrated with Office 365.

On the other hand, Cisco Webex is still a great choice for enterprises that value security,scale, and enterprise-level communication capabilities. Anyone who has had the chance to use Zoom will appreciate its user-friendly design and its ability to serve enterprises of all sizes. UCC Solutions and Tomorrow's Digital Workspaces with the growth of companies doubling down on improving collaboration as one of the keys to success in the future, those UCCsolutions have quickly become one of the cornerstones of any sort of digital workplace.

VoIP technology, the ability to have voice and video calls over the Internet,has made its quantum leap as well. This solution provides a cheaper and insurable alternative to traditional telephony services, which is while itis being widely adopted. The ability of VoIP to integrate with UCC platforms is beneficial for organizations as it allows seamless communication between employees, clients,and partners.

The VoIP industryhas several prominent vendors, such as RingCentral, Vonage, 8x8 Inc., and Nextiva. 8x8 Inc. and RingCentral are proven players with alarge footprint of cloud-based VoIP and contact center solutions that will serve organizations of all sizes. The growing trend of cloud-based telecommunication infrastructure has made VoIP essential to enterprisecommunication. Businesses use VoIP solutions to reduce costs,improve connectivity, and streamline operations.

Small and medium enterprises (SMEs) are being proactive in adopting advanced telecommunication solutions to enhance productivityand streamline operations. Due to budget constraints, SMEs are increasingly adopting cloud-based UCC and VoIP services, which deliver enterprise-level communication functionalitywithout the high capital expenditure required to invest in large-scale telecoms infrastructure. SMEs have highly adopted Zoom, RingCentral, and Google Meet.

These upper-hand features make it an even moreattractive product to deploy in small picky-b's, either setting up their account, its such affordable pricing models, ease of use, and flexibility. So, with thedigital transformation gaining momentum among SMEs, the need for cloud communication solutions is going to increase multi-fold. Large enterprises typically must implement sophisticatedtelecommunication infrastructures that help handle international operations, customer interactions, and internal communication networks. Such enterprises must also havenext-generation UCC, VoIP, and IoT-based telecom solutions to augment their digital transformation plans.

This transition to cloud-basedand AI-powered communication technologies facilitates enterprises to enhance their efficiency, security, and scalability. Cisco, Microsoft, AT&T, and Verizon are leaders in the enterprisesegment. Ciscoand Microsoft still rule the UCC space, providing complex chat and collaboration tools intended for big companies. On the other hand, AT&T and Verizon top theindustry for integrated cloud-based VoIP and 5G-enabled business communication solutions. And these telecommunication giants are making strides in the telco space as businessesprioritize greater, seamless connectivity with the future of enterprise communication.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

| China | 11.0% |

| Germany | 9.8% |

| Japan | 9.9% |

| India | 11.3% |

| Australia | 9.6% |

The USA industry is expanding at a higher growth rate with increasing demands for faster connectivity, cloud communication, and digitalization in the enterprise sector. Organizations leverage B2B telecommunication solutions for optimized operations, enhanced remote collaboration, and improved data sharing.

Through ongoing investment in 5G network infrastructure, network automation through AI, and secure enterprise networking, B2B telecommunication demand is still on the steep upsurge. In 2024, the USA telecommunication industry used over USD 20 billion for fifth-generation network solutions. According to FMI, the USA industry is expected to expand at 10.2% CAGR during the forecast period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Rise in 5G Rollout and High-Speed Network Demand | More demand for cloud-based and fiber-optic telecommunication services for corporate communication. |

| Advancements in AI-Based Network Management and IoT Connectivity | Artificial intelligence-powered B2B telecommunication platforms enhance network automation, scalability, and security. |

| Rising Applications across BFSI, Healthcare, and IT Services | B2B telecommunication solutions automate communication, cloud integration, and remote worker connectivity. |

China's industry is witnessing unparalleled growth with mounting innovation in 5G and fiber-optic cable installation, enhanced use of cloud-based telecommunication solutions, and state-promoted initiatives advancing digital connectivity. One of the largest telecommunication industries in the world, China also experiences a growing demand for B2B telecom solutions in the manufacturing, logistics, and finance service industries.

The government's emphasis on domestic technology innovation and data security has also driven industry growth. China invested in enterprise telecommunication infrastructure and network solutions based on AI for USD 22 billion in 2024. FMI is of the opinion that the Chinese industry will grow at 11.0% CAGR during the forecast period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government Support for Countrywide 5G and Cloud Connectivity | Domestic telecom growth favoring policies drive adoption. |

| Increasing Application of AI and IoT in Business Telephony | Increasing application of smart telecom networks to industrial automation and real-time communications. |

| Increasing Demand for Scalable and Secure B2B Telephony Solutions | Telecom services enhance business connectivity in smart manufacturing, e-commerce, and finance. |

Germany's industry is growing with its strong industrial economy, increased adoption of enterprise connectivity in the cloud, and growing focus on cybersecurity and GDPR compliance. Germany, one of Europe's premier tech hubs, invests in enterprise IT B2B telecom solutions, financial services, and smart manufacturing.

The nation's vision for safe AI-based communication networks has also fueled adoption in business and government institutions. FMI estimates 9.8% CAGR growth in the German industry during the forecast period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong Enterprise Appetite for Secure and High-Speed Connectivity | German businesses use B2B telecom for digital transformation and cloud collaboration. |

| More Adoption of Edge Computing and Industrial IoT using 5G | More investment in AI-based B2B telecom solutions for optimizing processes in real time. |

| More Cybersecurity and Encrypted Communications Services | More adoption of enterprise telecom solutions with AI-based security solutions. |

Japan's industry is expanding due to innovations in high-speed broadband technology, increasing adoption of AI-based telecommunication analytics, and enterprise cloud connectivity technology innovations. Japan's technology sector exploits B2B telecommunication platforms to offer real-time communications, secure business networking, and remote work. Japan's leadership in high-performance network infrastructure and AI-powered telecom solutions has spurred adoption across various industries.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Integration of AI in Network Optimization and Secure Communication | Japan leads the world in applying AI-driven network traffic management and telecommunication security. |

| More Usage of Cloud-Based Enterprise Communication and Collaboration | Greater usage of B2B telecom by IT, banking, and e-commerce sectors. |

| Reinventing 5G and Edge Computing for Business Applications | More usage of real-time data exchange and ultra-low-latency business connectivity. |

India's industry is witnessing record growth, driven by increasing fiber-optic investments, growing demands for secure corporate communication, and government-supported digital empowerment initiatives. With initiatives like 'Digital India' and the spread of AI-driven corporate connectivity, there is massive demand for B2B telecom services in the banking, IT, and manufacturing. Enhanced domestic telecom operators and government-supported smart connectivity initiatives drive industry growth.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Initiatives for Digital Connectivity and Telecom Infrastructure | Government policies favoring countrywide fiber-optic rollout drive B2B take-up of telecom. |

| Scaling of AI-Powered Enterprise Telecom Solutions in BFSI and IT Services | Application of cloud-hosted telecom networks for secure and scalable business communication. |

| Scaling of Low-Cost, High-Speed Telecom Services Demand | Absorption by small and medium businesses and large businesses of AI-driven network automation. |

Australia's industry is growing consistently with more investment in broadband, cloud enterprise networking, and AI-powered telecom security solutions. Banks, healthcare, and government agencies are adopting B2B telecom solutions for improved network management, security, and real-time data exchange. Cloud-first and digital transformation strategies are gaining traction nationwide and driving the demand for innovative B2B telecom solutions.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Government policies to fund high-speed network infrastructure and secure business communications | 5G and fiber-optic expansion policy drives industry growth. |

| AI-Powered Telecom Network Analysis and Automation Growth | Increased deployment of AI-powered network security to prevent fraud and encrypt data. |

| Demand growth for Cloud-Based, Scalable Enterprise Telecom Services | Firms deploy B2B telecom for hybrid cloud infrastructure and remote worker management. |

The global B2B telecom industry is becoming increasingly competitive as demand for high-speed connectivity, cloud-based communications services, and secure networking solutions accelerates. Businesses are moving rapidly toward digital transformation, and telecom providers are focusing on AI-driven network optimization, 5G infrastructure, and cloud-based unified communications to drive efficiency and scale.

AT&T, Verizon Communications, China Mobile, BT Group, and Deutsche Telekom are the leading players, all investing in next-generation technologies, managed services, and cybersecurity enhancements to strengthen their positions in the industry. Key offerings cover SD-WAN, IoT connectivity, unified communications as a service (UCaaS), 5G enterprise networking, and cybersecurity services aimed at corporate clients and government entities.

Industry evolution will be based on the increasing shift toward cloud-native communication platforms, AI-based network analytics, and edge computing solutions to enhance real-time data processing. The increased demand for hybrid work environments and remote collaboration tools is another major influence that is affecting industry dynamics.

Strategic Factors include aggressive investments in 5G rollouts, partnerships with cloud service providers, and M&A to expand service capability. Moreover, with enterprises now giving priority to network security and data privacy, providers are also focusing on regulatory compliance and encryption-based communication solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AT&T Inc. | 20-25% |

| Verizon Communications | 15-20% |

| China Mobile | 10-15% |

| BT Group | 8-12% |

| Orange Business Services | 5-10% |

| Deutsche Telekom | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| AT&T Inc. | Enterprise connectivity solutions, SD-WAN services, and 5G-enabled business networking. |

| Verizon Communications | Cloud-based unified communications, security solutions, and high-speed B2B networking. |

| China Mobile | Global telecom infrastructure, IoT connectivity, and enterprise cloud services. |

| BT Group | Secure managed network services, VoIP, and enterprise-grade telecommunication solutions. |

| Orange Business Services | Cloud networking, cybersecurity, and IoT solutions for enterprises. |

| Deutsche Telekom | 5G business solutions, AI-driven network management, and enterprise cloud connectivity. |

Key Market Insights

AT&T Inc. (20-25%)

AT&T lends credibility to enterprise network connectivity solutions, SD-WAN services, and 5G business networking, obliquely quick-fixing related issues of business transformation.

Verizon Communications (15-20%)

Verizon specializes in solutions such as unified communication in the cloud, business security, and high-speed network services that enable world-class business management tools for myriad businesses across the globe.

China Mobile (10-15%)

China Mobile connects businesses through the IoT and offers a worldwide infrastructural upgrade in telecommunications with its global offerings in Cloud services.

BT Group (8-12%)

Among other services, BT provides managed network services, gearless VoIP, and a bestowing tete at telecommunication solutions.

Orange Business Services (5-10%)

Orange Business Services is aced in this way by providing cloud networking cybersecurity and telecommunication services based on IoT for enterprises.

Deutsche Telekom (4-8%)

Deutsche Telekom strives to deliver 5G-enabled cloud-native connectivity, AI-dependent network management tools, and telecom solutions operating above cloud limits for enterprises.

Other Key Players (30-38% Combined)

These companies contribute to ongoing advancements in B2B telecommunications by integrating AI-driven analytics, cloud-based communication platforms, and next-generation 5G networking. The increasing adoption of enterprise digital transformation, secure network solutions, and scalable telecom services continues to shape the competitive landscape of the b2b telecommunication market.

The global B2B telecommunications industry is projected to reach USD 89.23 billion in 2025.

The industry is anticipated to grow to USD 293.05 billion by 2035.

India is forecasted to grow at a CAGR of 11.3% from 2025 to 2035, making it the fastest-growing industry.

The key players in the telecommunications and IT services industry include Amdocs, AT&T, Inc., Cisco Systems, Inc., Comarch S.A., Deutsche Telekom AG, NTT Communication, Orange S.A., Telefonica, S.A., Vodafone Group PLC, and Verizon.

AI-powered B2B telecommunication solutions are being widely used.

By solution, the industry is segmented into unified communication and collaboration, VoIP, WAN, cloud services, and M2M communication.

By end user, the industry is segmented into small & medium enterprises and large enterprises.

By vertical, the industry is segmented into BFSI, healthcare, media and entertainment, government, energy and utility, retail, transportation and logistics, and others.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Card-Based Electronic Access Control Systems Market Growth - Forecast 2025 to 2035

Memory Integrated Circuits (IC) Market Growth - Trends & Forecast 2025 to 2035

Semiconductor Substrate Market Insights - Trends & Forecast 2025 to 2035

Hyperscale Cloud Market Trends - Growth & Forecast 2025 to 2035

Endpoint Detection and Response Market Growth - 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.