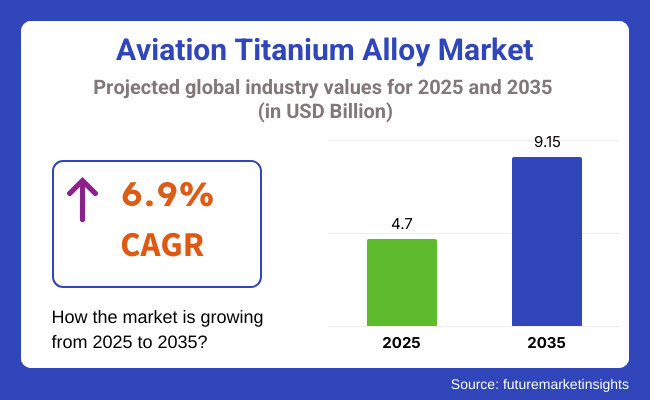

The aviation titanium alloy industry is poised to surge at a steady CAGR of 6.9% between the forecast period between 2025 and 2035. The market is anticipated to hold a market share of USD 4.7 billion in 2025 and is likely to reach a value of USD 9.15 billion.

In 2024, the industry for aviation titanium alloys saw consistent growth due to rising aircraft production, growing demand for lightweight and fuel-efficient materials, and development in additive manufacturing.

Major aerospace producers, such as Boeing and Airbus, stepped up their purchase of titanium alloys, especially for new-generation aircraft models. Supply chain disruptions continued, especially due to geopolitical tensions and volatility in raw material supply, which resulted in periodic price fluctuations. However, the demand was still strong as airlines concentrated on fleet renewal and sustainability.

The industry is set to keep growing in 2025. It is expected to experience increased utilization of sophisticated manufacturing methods like 3D printing, which maximizes the use of titanium alloys and minimizes waste. Research and development spending will fuel innovation, resulting in the development of high-performance alloys with enhanced strength-to-weight ratios.

Moreover, as defense budgets are on the rise in several nations, demand for titanium alloys used in military aircraft and unmanned aerial vehicles (UAVs) will increase.

Future Market Insights carried out a comprehensive survey with major stakeholders in the aviation titanium alloy industry, such as aerospace manufacturers, suppliers, and industry experts. The results show a high level of agreement on the increasing role of titanium alloys in future aircraft.

A high 78% of the respondents stated that lightweight materials are now a top priority because of their direct influence on fuel efficiency and carbon emissions reduction. Further, 65% of companies witnessed an increase in their procurement budget for buying titanium, which points clearly to the move toward high-performance materials for satisfying both commercial and defense industries.

The most immediate issue raised by stakeholders was the volatility of the supply chain. More than 70% of respondents cited raw material scarcity and price volatility as significant issues that impinge on their production timetables.

The survey further pointed out that geopolitical volatility and trade barriers are central drivers of this uncertainty. Yet, despite these challenges, over 60% of industry leaders indicated optimism regarding long-term industry stability, which they attributed to continued investment in recycling technologies and alternative sources of titanium.

Technology adoption was another dominant theme, with more than 55% of the participants asserting that additive manufacturing (3D printing) will have a revolutionary impact on titanium alloy usage.

The technique is regarded as a game-changer for reducing material loss and optimizing component design. Additionally, nearly 50% of survey participants expect an increase in collaborations between aerospace firms and material science researchers to develop titanium alloys with enhanced properties, such as greater corrosion resistance and higher temperature tolerance.

The survey results highlight a transitioning industry - one that is managing near-term supply chain issues while positioning for long-term expansion through innovation and sustainability initiatives.

As manufacturers continue to invest in next-generation materials, stakeholders see the importance of strategic alliances and policy structures that provide stable supply and cost-effectiveness.

| Countries | Government Regulations and Mandatory Certifications |

|---|---|

| United States | The Defense Federal Acquisition Regulation Supplement (DFARS) mandates that specialty metals, including titanium alloys used in defense applications, must be melted or produced in the USA or designated qualifying countries. This ensures the integrity and reliability of materials used in defense aerospace components. Additionally, aerospace parts must comply with Federal Aviation Administration (FAA) certifications to meet stringent safety and performance standards. |

| European Union | The European Union Aviation Safety Agency (EASA) sets comprehensive regulations for aerospace manufacturing, including the use of materials like titanium alloys. These regulations ensure that all aerospace components meet rigorous safety and quality standards. Despite efforts to diversify sources, Europe's aerospace sector remains heavily dependent on Russian titanium supplied by VSMPO-AVISMA. |

| Canada | Transport Canada oversees aerospace regulations, requiring adherence to national standards for materials used in aircraft manufacturing. Compliance with these standards is mandatory for certification and operational approval within Canada. |

| Australia | The Civil Aviation Safety Authority (CASA) regulates the use of materials in aerospace applications, including titanium alloys, to ensure they meet national safety and performance criteria. Certification by CASA is required for all aerospace components and materials used in Australian aircraft. |

From 2025 to 2035, the USA aviation titanium alloy industry is anticipated to grow at a 7.4% CAGR. The aerospace and defense sector is also a positive factor for the industry, with companies such as Boeing, Lockheed Martin, and Northrop Grumman using more titanium in next-generation aircraft.

These requirements for DFARS compliance mean domestic titanium production stays first on the list for aerospace manufacturers, minimizing dependence on overseas suppliers. Additive manufacturing and higher government spending on military aircraft such as UAVs and fighter jets to bolster demand with high-performance titanium alloys.

FMI opines that the United States aviation titanium alloy sales will grow at nearly 7.4% CAGR through 2025 to 2035.

The UK is anticipated to grow at a 6.5% CAGR through the forecast period, which is slightly slower than the global average. The country’s aerospace sector, which includes the defense contractors BAE Systems and Rolls-Royce, is a key factor in titanium alloy demand, especially in aircraft engines and structural parts.

Trade uncertainties due to Brexit have disrupted supply chains, but partnerships with USA and European aerospace companies offer stability. Pioneering research into advanced titanium alloys with improved efficiency and recyclability are fostered and driven by the UK government’s push for sustainable aviation, including hybrid-electric aircraft.

FMI opines that the United Kingdom aviation titanium alloy sales will grow at nearly 6.5% CAGR through 2025 to 2035.

France is set to post a 6.8% CAGR between 2025 and 2035, owing to its strong civil and military aerospace industries. The French airline industry is one of the biggest consumers of titanium alloys used in aircraft, including the A350 and next-generation hydrogen-powered aircraft, as per the report.

The French defense sector further fuels demand, as fighter jets require titanium, which Dassault Aviation is increasingly reliant on. Positive government incentives for aerospace R&D and growing investments in sustainable aviation technologies will propel the industry's expansion, but dependency on Russian titanium continues to be a threat.

FMI opines that French aviation titanium alloy sales will grow at nearly 6.8% CAGR through 2025 to 2035.

Germany's aviation titanium alloy industry will grow at 6.7% CAGR, lower than the global average. The country’s aerospace industry, underpinned by Airbus activities and important suppliers, needs titanium for high-performance aircraft parts.

Titanium alloy demand is bolstered by the government's emphasis on technology innovation, particularly lightweight materials. Germany is also investing heavily in hydrogen aviation as well as electric propulsion systems, which is providing new ways for titanium to be used in new aircraft designs. But its growth in the industry may be at risk due to global supply chain challenges.

FMI opines that German aviation titanium alloy sales will grow at nearly 6.7% CAGR through 2025 to 2035.

Italy will expand at 6.3% CAGR, among the slowest growing industries across Europe. Demand for titanium alloys is largely driven by Leonardo S.p.A., Italy's largest aerospace company, for both commercial and defense purposes.

The dependence on imported raw materials complicates the issue, even as the country reaps the benefits of collaborations with European aircraft manufacturers. Government initiatives to modernize Italy’s aerospace sector and increase domestic production capabilities will sustain demand, but geopolitical tensions and economic uncertainties could stifle more rapid growth.

FMI opines that Italian aviation titanium alloy sales will grow at nearly 6.3% CAGR through 2025 to 2035.

The South Korean aviation titanium industry is expected to grow at 7.1% CAGR, leading most of Europe. Korean aerospace firms such as Korea Aerospace Industries (KAI) are also ramping up their titanium consumption on fighter jets, helicopters, and space applications.

The South Korean government has made a major financial commitment to indigenous aircraft programs like the KF-21 fighter jet, which needs sophisticated titanium components and parts. Joint ventures with international aerospace firms, together with a significant drive towards indigenous production of aerospace materials, will provide additional impetus to industry growth.

FMI opines that South Korea aviation titanium alloy sales will grow at nearly 7.1% CAGR through 2025 to 2035.

Japan’s aviation titanium alloy industry will maintain the global average growth of 6.6%. Japan has a long history of aerospace development, with both Mitsubishi Heavy Industries and Kawasaki Heavy Industries involved in aircraft manufacturing.

Japan is a top producer and exporter of titanium and has a steady supply for its domestic aerospace industry. The government is pouring money into new materials for next-generation aircraft, including supersonic and hydrogen-powered planes. Demand for titanium alloys is further bolstered by robust defense spending and alliances with the USA

FMI opines that the Japan aviation titanium alloy sales will grow at nearly 6.6% CAGR through 2025 to 2035.

China is estimated to have a CAGR of around 7.8%, making it one of the fastest-growing aviation titanium alloy industries. The country’s fast growth in commercial and military aviation also fuels demand, with COMAC creating new aircraft like the C919 and CR929.

China’s titanium sector is one of the largest in the world, ensuring efficient supply of availability for domestic manufacturers. Growth will also be further driven by government initiatives aimed at reducing dependence on Western aerospace suppliers and increasing domestic aircraft production.

Furthermore, the Tianwen-1 Mars Rover has the potential to expand the industry through specific customer preferences in titanium alloys, as China’s space industry is becoming an ever-growing demand customer.

FMI opines that the China aviation titanium alloy sales will grow at nearly 7.8% CAGR through 2025 to 2035.

The jet titanium alloy industry in Australia and New Zealand is estimated to grow at a CAGR of 6.2%, which is slightly less than the global average. Best-selling aircraft such as fighter jets, helicopters, and UAVs, are being actively acquired under defense procurement programs, driving the industry in Australia.

RAAF and cooperation with USA aerospace companies also keep the demand for titanium parts alive. Although smaller than the Australian industry, New Zealand's aerospace sector is a growing economy with expanding satellite manufacturing and UAV development. Although demand is stable, the low domestic titanium production in both countries means they depend on imports.

FMI opines that the Australia-NZ aviation titanium alloy sales will grow at nearly 6.2% CAGR through 2025 to 2035.

The use of commercially pure titanium continues to be highly important to the aerospace commercial industries because of its excellent corrosion resistance, high strength-to-weight ratio, and extremely high melting point.

It will find wide application in structural components where the materials must be resistant to harsh environmental conditions. Since lightweight materials are becoming more and more essential, commercially pure titanium will be used in a wider range of aircraft applications, especially for non-load-bearing structures.

High-performance materials and composites are becoming the preferred choice in the aerospace sector, with titanium alloys expected to remain in the lead. Further, aluminum alloys are used in advanced aircraft structures, while titanium alloys are preferred for high-temperature components due to their high strength, heat resistance, and fatigue resistance.

Steady industry growth will be driven by their increasing application in next-generation aircraft, such as supersonic and electric aviation. The quest for heavier load-carrying in the aerospace domain will lead to titanium alloys replacing traditional high-density metals, as innovations in materials science continue to fuel efficiencies, create a better operational position, and increase payload capacity. Increasing budgets on defence and space programmes will be the other key factors underpinning demand over the forecast period.

Titanium alloys will continue to be essential in structural airframes, with their high strength-to-weight ratio and good fatigue resistance. Titanium will be used more than ever, allowing manufacturers to create more fuel-efficient aircraft and increasing the life cycle of new planes. Its excellent resistance to corrosion makes it suitable for outdoor structures exposed to extreme conditions. Titanium will remain the favoured material for aerospace companies looking to build lighter yet more robust jets.

In engines, titanium alloys will be critical in high-heat applications such as turbine parts and exhaust systems. They are also being commonly used in Aerospace and Defense. The increasing demand for fuel-efficient aircraft with better performance will significantly increase the adoption of titanium-based materials in both commercial and military aviation.

The titanium consumption in the commercial aircraft manufacturing industry has been surging significantly due to the expansion of global air travel demand. The addition of titanium alloys will allow leading aerospace manufacturers to maintain their focus on lightweight structures and fuel economy. The durability and low maintenance nature of the material will improve operational efficiency that will help to lower lifecycle costs for airlines.

Demand for titanium will also keep using it for other aerospace applications such as defense and space exploration. Titanium will be used in increasing amounts in military aircraft, helicopters unmanned aerial vehicles to improve performance and durability. The growth of space exploration programs will likewise present new applications for titanium in spacecraft components due to the extreme strength and temperature resistance of the metal.

Alpha and near-alpha titanium alloys will play a crucial role in aerospace applications requiring high temperature resistance and corrosion protection. The alloys will play a significant role in high-stress components in aircraft, including applications requiring long term durability and reliability. Their resistance to extreme environmental conditions will be needed for both commercial and defense aircraft.

Alpha + beta titanium alloys will be the most popular owing to their favourable properties covering strength, corrosion, and workability. These alloys will still be used by aerospace manufacturers for structural components, landing gear, and engine parts. Due to their suitability for different processing techniques, they will become the material of choice for aerospace applications.

High demand will arise in high-performance aviation applications for alpha & near-alpha titanium alloys. Their better resistance to heat and fatigue will make them an important material in the development of next-generation aerospace technologies, including supersonic and hypersonic aircraft.

| 2020 to 2024 | 2025 to 2035 (Forecast) |

|---|---|

| The industry experienced fluctuations due to supply chain disruptions caused by the COVID-19 pandemic, which affected aerospace manufacturing and titanium production. | The industry is expected to grow steadily as aviation demand recovers, with increasing production of commercial and defense aircraft driving titanium consumption. |

| The global airline industry struggled with reduced travel demand, impacting new aircraft orders and titanium demand. | A surge in air travel demand, particularly in emerging economies, will boost aircraft production and titanium consumption. |

| Increased focus on lightweight materials for fuel efficiency encouraged limited but steady titanium adoption. | Advancements in aerospace technology and sustainability goals will drive higher titanium alloy usage in new aircraft models. |

| The defense sector remained a key titanium consumer, with governments prioritizing military modernization. | Rising global defense budgets will further accelerate titanium adoption in next-generation fighter jets, helicopters, and UAVs. |

| Supply chain issues and raw material price fluctuations affected industry stability. | Improved titanium production capabilities and supply chain resilience will support stable growth with increased investments in mining and processing facilities. |

The titanium alloy industry for aviation comes under the category of advanced metallurgy and aerospace materials in the global aerospace and defense industry. The industry is dominated by macroeconomic determinants like GDP growth, defense spending, air travel demand, and the availability of raw materials.

With the airline and defense industries getting over the pandemic, the demand for titanium alloys is likely to rebound strongly. Increased fuel prices and strict emission standards will compel aircraft makers to use light materials such as titanium for better fuel efficiency.

Notably, supply chain disruptions between 2020 and 2024 resulted in additional emphasis on indigenous titanium production and diversification of sources. Due to the rise in additive manufacturing and 3D printing technology, the price of titanium manufacturing will reduce in the future, making it widely available. However, emerging economies, specifically in the Asia-Pacific, will dictate future demand, while rising defense budgets and space exploration programs will continue to bolster industry growth till 2035.

The industry for aviation titanium alloy offers robust opportunities for growth propelled by increasing plane production, increased defense spending, and innovation in aerospace materials. Investors should pump money into R&D to further develop titanium alloys for future generations of aircraft, such as supersonic and hydrogen-powered planes. Building stronger partnerships with Boeing, Airbus, and defense contractors will ensure long-term supply agreements.

Vertical integration by direct raw material procurement and processing within the company will enhance cost effectiveness. The use of 3D printing will minimize waste and optimize the use of materials. Increasing local production in major aviation centers and investment in recycling for titanium will help improve sustainability. Diversification into military and space use will provide long-term industry stability and profitability while remaining compliant with changing aerospace regulations.

Top players in the aviation titanium alloy industry compete on price strategies, innovation in high-end alloys, strategic alliances with aerospace titans, and geographical expansion. Companies emphasize cost savings through long-term raw material contracts and production efficiency optimization. Innovation in high-performance titanium alloys for light and fuel-efficient aircraft is a major differentiator.

Firms employ various growth strategies like entering into partnerships with Boeing, Airbus, and defense contractors to win large-scale contracts. Firms are increasing production facilities in high-demand areas like China and the USA to fortify supply chains. Additive manufacturing and green titanium recycling investments are also defining long-term competitiveness in the industry.

Market Share Analysis

The market for aviation titanium alloy remains dominated by a limited number of industry leaders in 2025. As per the latest industry trends, ATI (Allegheny Technologies) enjoys around 28% of the world market share, upholding its leading position with its extensive range of specialty titanium alloys designed specifically for use in aerospace applications.

VSMPO-AVISMA is close behind with approximately 25% market share, driven by its vertically integrated production and long-term relationships with leading aircraft makers. Timet (Titanium Metals Corporation) under Precision Castparts Corp. owns about 21% of the industry.

Baoji Titanium Industry and Howmet Aerospace (formerly of Arconic) both hold about 10-12% of the market with their specialty aerospace-grade titanium products. The other 14-16% goes to smaller manufacturers such as Kobe Steel, Toho Titanium, and other local suppliers, which are usually confined to niche usage or act as secondary suppliers for major aerospace companies.

These industry positions mirror continued industry consolidation, rising technical demands for the design of new airplanes, and the slow return of commercial aviation after the post-pandemic era.

Recent Key Developments

Commercially pure titanium and titanium alloys

Structural Airframes, Engines, civilian aerospace, and others

Alpha & Near-Alpha Titanium Alloy, Alpha +Beta Titanium Alloy, Beta & Near-Beta Titanium Alloy and Beta & Near-Beta Titanium Alloy

North America, Latin America, Europe, Japan, Asia Pacific Excluding Japan, and Middle East and Africa.

Its strength, light weight, and heat resistance make it ideal for airframes and engines.

They use 3D printing, automation, and recycling to enhance efficiency and reduce costs.

It enables lightweight, fuel-efficient, and high-performance designs for next-generation aviation.

They form long-term supplier partnerships and invest in in-house processing.

High costs and complex processing, but innovation and recycling are improving accessibility.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Aviation Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Aviation Compliance Monitoring Software Market Size and Share Forecast Outlook 2025 to 2035

Aviation Analytics Market Size and Share Forecast Outlook 2025 to 2035

Aviation Cloud Market Size and Share Forecast Outlook 2025 to 2035

Aviation Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Aviation Fuel Additives Market Growth 2025 to 2035

Aviation Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Aviation Connector Market

Aviation IoT Solutions Market

Aviation Biofuel Market

Aviation Cabin Cleaning Chemical Market

Aviation Gas Turbines Market

Aviation Lubricants Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Aviation Fuels Market

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

5G in Aviation Market – Future of In-Flight Connectivity

Titanium Aluminide Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA