Global management of autosomal dominant polycystic kidney disease (ADPKD) would experience extraordinary growth for the period 2025 to 2035 because incidence of ADPKD goes up alongside therapeutics advancement. ADPKD is a hereditary disease and the patient acquires numerous cysts in kidneys which cause failure of the kidney if left untreatable. A rise in awareness, improving diagnostics, and competitive R&D efforts drive industry growth. The treatment process involves various modalities ranging from pain and inflammation therapy to progressive therapies as the disease advances.

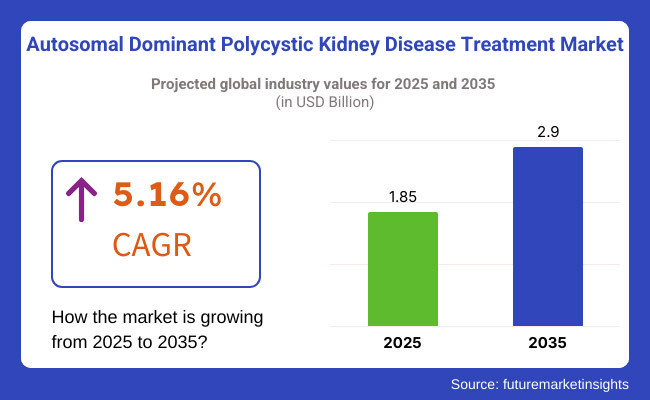

ADPKD treatment is evolving across industries at a compound annual growth rate (CAGR) of 5.16% from 2025 to 2035. Market size will be close to USD 2.90 billion by the year 2034 from the current market size of USD 1.85 billion in the year 2025. The process is further driven by policies of the government towards the advancement of healthcare centers and gene disorder research. Also driving the development process of the drug therapy using the research from the drug firms and research centers is the union of the drug firms' research with research centers.

Explore FMI!

Book a free demo

North America's ADPKD treatment market is predominantly made up of the majority of the reported United States cases. Gains in the funding to research on and treat ADPKD were also estimated by the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK). Government initiatives, such as the Accelerating Medicines Partnership (AMP) initiative, fuel market growth with the help of public-private partnership development to advance novel treatments to discovery. Patient groups in the United States also generate awareness and sponsor clinical trials, fueling more demand for successful therapy.

Europe too is witnessing ADPKD patient growth, headed by Germany and the United Kingdom. The European Renal Association (ERA) has seen research networks into the polycystic kidney diseases increase. The health care systems are countering this with increased diagnostic technology and updated treatment protocols. There is collaboration between the universities within the European Union through research on obtaining normal processes for treating ADPKD, thus stimulating market growth. A prime example is the European ADPKD Forum, where experts meet in the sharing and application of best practice in patient care.

The Asia-Pacific market will experience the highest growth during this period for any of the ADPKD management markets.Japan and China are making investments in the healthcare centers and increased awareness of genetic disease. Treatment guidelines region-specific and new therapies are being researched. For example, Japanese researchers have determined high level of certainty regarding the ADPKD genetic alterations that took place among the Asian countries, resulting in treatment based on. Reimbursement for government-sponsored healthcare reform and the establishment of specialized nephrology clinics also contribute to expanding the market for this region.

Multiple Treatments and High Treatment Costs and Accessibility

New treatment for ADPKD is inaccessible to the majority of patients, and new treatment is impossible as it is inaccessible. Without proper coverage for quality health, out-of-pocket payments are high and there are unequal treatments. Stakeholders are hence advocating for alternatives such as access to generic drugs and health reforms in a bid to enhance access. Pharmaceutical industries are also employing differential pricing and patient support schemes with the hope of enhancing access.

Lack of Awareness and Delayed Diagnosis

Even with these developments, delayed diagnosis arises due to ignorance on the part of primary physicians and the general population about ADPKD. Mild and nonspecific symptoms and signs at first presentation are presented to health practitioners by patients, who are attended to. Public and professional education need to include early diagnosis and treatment campaigns. Professional organizations will implement continuing education modules for orientation of practitioners to existing diagnostic and treatment algorithms for development.

Targeted Therapy Development

Greater understanding of the molecular biology of ADPKD holds out the promise that targeted therapies will be created that will further inhibit disease progression.

Pharmaceutical companies are developing novel drug candidates that inhibit some of the pathways, e.g., the mTOR signaling pathway, which contribute to cyst development. For instance, studies on vasopressin receptor antagonists resulted in the identification of drugs like tolvaptan, which have been proved to be effective in renal function impairment prevention in ADPKD patients. Targets like against inflammation and fibrosis are also under exploration by clinical trials.

Emerging Markets Growth

Developing economies of countries like Southeast Asia and Latin America are catching up with the public health burden of ADPKD. Effective treatment, with greater awareness, is also required. Developing economies are where pharmaceutical industries can make an entry by visiting local healthcare facilities and governments and providing diagnostics and treatments. Having manufacturing facilities within these countries reduces the cost and simplifies the supply chain, and hence the treatment becomes affordable to the population of patients. Culturally specific educational interventions also improve patient compliance and adherence to treatment regimens.

Over 2020 to 2024, the ADPKD treatment market grew steadily primarily driven by increased awareness and improved diagnosis. The COVID-19 climate fairly significantly re-directed attention towards therapy of chronic disease and capital and research interest in genetic disease but on costly therapies and lesser awareness nevertheless.

Between 2025 to 2035, the market will be moving towards innovation and accessibility. Apart from ongoing progress in molecular biology and genomics, ongoing progress will help in establishing more personalized therapy and personalized medicine approaches.The Autosomal Dominant Polycystic Kidney Disease (ADPKD) Treatment Market transformed drastically between 2020 to 2024 and will transform again between 2025 to 2035.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Institution of ground-level regulations for ADPKD treatment approval, with regulatory bodies like the FDA giving priority review to such breakthrough treatments as Otsuka Pharmaceutical's tolvaptan. |

| Technological Advancements | Creation of high-resolution imaging modalities like MRI, supporting early ADPKD diagnosis. |

| Industry Adoption | Pharma firms focusing research on vasopressin receptor antagonists, with tolvaptan being a leading therapy. |

| Supply Chain and Sourcing | Reliance on traditional pharma supply chains for drug distribution. |

| Market Competition | Domination by incumbent drug players like Otsuka Pharmaceutical in the market for treatment of ADPKD. |

| Market Growth Drivers | Greater prevalence and higher awareness that lead to higher diagnosis. |

| Sustainability and Conservation | Initiatives being taken towards sustainable production processes within pharma manufacturing. |

| Integration of Smart Monitoring | Limited uses of digital devices, with patients monitoring symptoms and drug adherence themselves. |

| Advancements in Experiential Care | Patient support groups and education workshops being held onsite and focusing on disease management. |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Implementation of expedited approval pathways for gene-editing treatments, with regulatory agencies cooperating globally to align standards for ADPKD treatments. |

| Technological Advancements | Integration of AI-based diagnostic tools that foretell disease advancement, and adoption of CRISPR-based gene-editing technologies that seek to repair PKD1 and PKD2 mutations. |

| Industry Adoption | Development into personalized medicine strategies, with biotech companies investing in gene therapy and regenerative medicine to provide patient-tailored ADPKD treatments. |

| Supply Chain and Sourcing | Transition to localized production of gene therapies, cutting reliance on international supply chains and making treatments available in a timely fashion. |

| Market Competition | Penetration of biotech firms that focus on genetic therapies, making the market more competitive and forcing innovative approaches to treatment techniques. |

| Market Growth Drivers | Breakthroughs in genetic studies that hold promise for cures, combined with higher healthcare expenditure on rare disorders, fueling market expansion. |

| Sustainability and Conservation | Green chemistry concepts adopted in drug manufacturing and environmentally sound processes in the production of gene therapies to reduce ecological footprint. |

| Integration of Smart Monitoring | Use of wearable devices sending real-time health information to medical professionals, facilitating early management of ADPKD. |

| Advancements in Experiential Care | Virtual reality websites providing immersive learning regarding ADPKD, and telemedicine delivering remote consultation and care, increasing patient engagement and accessibility. |

The USA ADPKD treatment market has grown multi-fold with mammoth R&D expenditures. It has rendered cost-effective therapies like tolvaptan affordable in limitations, avoiding kidney disease loss. ADPKD can be accessed through diagnosis and treatment through the national health system, including rare disease specialist centers. Apart from that, a modern pharma industry and government funding and assistance towards treating orphan diseases presents gigantic research grant funding and investment prospects. They drive rapid drug discovery together, and hence America is still the world market leader in the ADPKD market. Hence, the regulatory approval pipeline compared with the funding pipeline through research continues to impact therapy decisions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.16% |

UK ADPKD treatment is organized through clinical trials and patient registries with the capacity for diagnosis of disease pattern and planning of personal therapy organizational. NHS and research center coordination has played a significant role in clinical trial planning of emerging treatments. UK Evidence-based healthcare system has developed a new friendly system where the final product to the patient is on the production agenda due to an incentive of improving it. In addition, steps towards integration of new treatment have been made by the NHS with better treatment being delivered to patients suffering from ADPKD.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.97% |

EU's European Union ADPKD treatment market is facilitated through cross-border collaboration research programme to develop novel treatment. Clinical trial is undertaken at the same time by member state through exchange of information and data in development of therapeutic approach. Marketing regulatory intervention of European Medicines Agency (EMA) as orphan designation medication has commenced pharma industry to like investing into treatment of orphan disease. These interactive settings enjoy unrestricted access to new drugs but within the EU for healthcare providers and patients. Such focus on such orphan illnesses has provided impetus to a movement towards consolidation of ADPKD treatment, with greater healthcare delivery and improved care in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.97% |

The Japanese ADPKD treatment health sector is commanded by medical technology development with the strongest focus on early diagnosis. Mass screening of the whole country for general health makes ADPKD easier to diagnose and treat early, and this results in better patient outcomes. The government also funded research on orphan diseases in all avenues available, such as grants and clinical trials. The trend has also resulted in new cures for ADPKD, and Japan is one of the best places where it is possible to test new drugs. Government-sponsored Japanese medicine has enabled it to grow and develop into newer therapy, physician- and patient-choice.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.97% |

The South Korean market for ADPKD treatment has expanded exponentially with enormous investment in healthcare infrastructure and biotechnology. The well-established medical infrastructure of the country makes it easy to utilize new treatment, thereby improving the management of ADPKD. Public awareness and patient advocate groups helped increase awareness about the disease, thus promoting earlier detection and compliance with therapy. The R&D focus of South Korea and strong biotech industry also promoted R&D on new ADPKD treatments, leading to improved disease treatment practice.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.97% |

Treatment market for Autosomal Dominant Polycystic Kidney Disease is segmented by treatment of pain & inflammation, kidney stones treatment, treatment of kidney failure, and treatment of urinary tract infection (UTI). All these therapies are very important in the management of the chronic complications of ADPKD in millions of patients worldwide. Market growth is fueled by the growing demand for effective treatments that reduce the symptoms of the disease, retard the rate of progression of the kidney damage, and improve the quality of life of the patient. End users consist of ambulatory surgical centers, clinics, and hospitals whose treatment is planed depending on the chronicity of ADPKD.

Pain and inflammation management is the largest treatment segment in ADPKD as well because flank pain is experienced by most patients with the increase in size of the cysts. Pain relief demands for pain like acetaminophen and NSAIDs like ibuprofen drive the demand, and practitioners also now routinely prescribe lower amounts of toxin to treat pain so that risk for nephrotoxicity is not taken. The segment is supplemented with other therapies like transcutaneous electrical nerve stimulation (TENS) and localized area corticosteroid therapy providing non-surgical pain relief for chronic pain.

Technological pain management like precision medicine therapy supported by AI and genetic marker-based anti-inflammatory therapy protocols also fuels the growth of the market. In research, over 65% of patients with ADPKD must endure pain on a regular basis, and thus the sheer potential for this market's growth is perceived.

ADPKD patients are much more likely to form stones and the evidence is in favor of being in the range of 20–35% prevalence. Stones were managed with increased use of less invasive therapy in the form of extracorporeal shock wave lithotripsy (ESWL) and ureteroscopy with progressively more liberal application. Pharmacologic therapy in the form of thiazide diuretics and citrate supplementation is greatly sought after and averts recurrent stone formation.

The use of surgery for removal was more precise via 3D scan aid and robotic surgery, recovery enhanced, and patient outcome enhanced. Greater than 70% of the ADPKD kidney stone disease among patients need to be treated other than via hydration and food, as is evident, thus making the market opportunity segment justifiable to expand.

Urinary tract infection or UTI is the most common complication of ADPKD and also plays vital roles in renal damage and disease severity. UTI treatment is also facing remarkable growth due to massive prescribings of antibacterial-broad spectrum drugs such as fluoroquinolones and cephalosporins to treat antibacterial-resistant diseases.

The market also witnessed the advent of probiotic-mediated therapy as well as experimentation with antibiotic-free therapy, e.g., D-mannose supplementations combined with cranberry extract-treatment, barely at the fringes of the case against misusing antibiotics. Furthermore, digital health technology, i.e., artificial intelligence-based UTI diagnosis software, has also improved early diagnosis as well as therapeutic precision. The study identifies recurrent UTIs in approximately 50% of ADPKD subjects, thus warranted raw demand for disease-specific regimens of treatment.

Treatment for ADPKD is the largest segment among treatments since 50% highest age group rate of 50% of ADPKD population is below the age of 60 and the trend is towards end-stage renal disease (ESRD). The segment is also seeing growth in renal replacement therapy like hemodialysis, peritoneal dialysis, and kidney transplant.

As demand increases for home dialysis facilities, artificial kidneys implanted and worn are being sold by industry giants. More powerful immunosuppressants more highly optimize kidney transplant results, immune rejection prevention, and better graft survival among ADPKD patients receiving kidney transplant. Regenerative medicine treatments like bioengineered kidney organoids and stem cell therapy are some of the treatments of kidney failure. The market's future will be led by developments in transplant technology and dialysis technology with enhanced survival rates and quality of life among patients, reports state.

Hospitals require lion's share of majority of ADPKD treatment market via specialty therapy, high-end diagnostic testing, and stable panel of nephrologists, urologists, and transplant surgeons. Hospital treatment is required most for the most technologically advanced and most complex dialysis, surgery, or complex infection control.

Market trends suggest that more and more hospitals are investing in artificial intelligence-nephrology care platforms, precision medicine initiatives, and telemedicine for optimal patient care. Government-funded healthcare policy and insurance also fuel the growth of the industry.

The major rivals to treating ADPKD are clinics because they have affordable and economical outpatient treatment. Due to the rapid early identification of ADPKD, more often than before, patients come to nephrology and urology clinics for follow-up, drug administration, and adjustment in lifestyle. ADPKD clinics are utilizing RPM platforms and wearable health sensors to track disease activity and alter treatment protocols. ADPKD treatment will become more prevalent in clinics, especially in urban cities where patients are accessing readily available specialty nephrology care.

Ambulatory surgical centers (ASCs) are becoming procedure-based, cost-efficient hospital substitutes for the treatment phase of ADPKD as procedure-based, cost-efficient hospital substitutes. Pain-free procedures like laparoscopic cyst decompression and laser lithotripsy for kidney stones are generating demand for therapy on an ASC basis.

The technology is shifting towards robot-assisted procedures with AI and image-guided procedures to enable more accurate procedures and post-procedure recovery of the patient. Telemedicine follow-up programs are also being instituted in ASCs to provide improved post-procedure care and patient compliance.

Regardless of availability of benefits like shorter hospital stay and procedure cost, issues of reimbursement policies and low volumes of highly specialist nephrology surgeons are among the challenges. In spite of that, the widespread adoption of more sophisticated and cost-effective surgery equipment and enabling regulation will drive long-term ASC growth for the treatment of ADPKD.

ADPKD Treatment is increasing at a quicker rate due to the increase in the prevalence of the disease, product launches, and awareness for genetic disorders. The pharma industry is putting huge investments into R&D for developing newer therapies such as gene therapies and targeted therapies that slow down the disease process and treat the symptoms more effectively. They are the output of increased synergy among the three research centers and biotech industries in the universities, which develop disease-modifying therapy. Increased awareness of ADPKD, more specific formulas and tailored treatment that are being developed, and which enhance the response in the patient and allow long-term control of the disease are being achieved. The aggregate marketplace offers evidence of mind-boggling unmet medical need and science in the treatment of ADPKD.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Otsuka Pharmaceutical Co., Ltd. | 25-30% |

| Regulus Therapeutics Inc. | 15-20% |

| Reata Pharmaceuticals | 10-15% |

| Sanofi | 8-12% |

| Galapagos NV | 5-10% |

| Other Companies (combined) | 20-30% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Otsuka Pharmaceutical Co., Ltd. | Developed and markets tolvaptan (JYNARQUE), the first FDA-approved treatment to slow kidney function decline in adults at risk of rapidly progressing ADPKD. |

| Regulus Therapeutics Inc. | Advances RGLS8429, an investigational drug targeting microRNA-17, currently in Phase II clinical trials for ADPKD treatment. |

| Reata Pharmaceuticals | Focuses on bardoxolone methyl, an oral antioxidant inflammation modulator, evaluated for its potential to improve kidney function in ADPKD patients. |

| Sanofi | Engages in research collaborations to explore gene therapy approaches for ADPKD, aiming to address the underlying genetic causes of the disease. |

| Galapagos NV | Investigates GLPG2737, a cystic fibrosis transmembrane conductance regulator (CFTR) inhibitor, as a potential treatment to reduce cyst growth in ADPKD. |

Otsuka Pharmaceutical Co., Ltd. (25-30%)

Otsuka Pharmaceutical has been a pioneer of tolvaptan (JYNARQUE) in the market in the treatment of ADPKD, being the first to make history in halting the advancement of the kidney function disease of the disease in adult patients with high risk of transmission of the ADPKD disease. Its commitment towards filling unmet medical need has solidly established it as the market leader.

Regulus Therapeutics Inc. (15-20%)

Regulus Therapeutics is advancing with RGLS8429, an anti-microRNA-17. Phase II clinical stage RGLS8429 has the potential to provide a new therapeutic intervention by gene expression in ADPKD disease pathology.

Reata Pharmaceuticals (10-15%)

Reata Pharmaceuticals is advancing bardoxolone methyl, an oral anti-inflammatory modulator. It is under development to improve the kidney function of ADPKD patients by modulation of inflammatory and oxidative stress pathway.

Sanofi (8-12%)

Sanofi also seeks collaborations in gene therapy research to develop ADPKD medicines. Avoiding the gene mutations causing the disease, Sanofi will create new biologicals that would alter the course of the disease.

Galapagos NV (5-10%)

Galapagos NV holds GLPG2737, an ADPKD drug and a CFTR inhibitor utilized in the inhibition of cyst growth. They achieve this in their efforts to regulate ion transport mechanisms in a bid to inhibit cyst growth and development.

Other Players Involved (20-30% Total)

There are essentially no other players whose activities go towards the construction of the competitive forces for the treatment market for ADPKD:

The overall market size for the Autosomal Dominant Polycystic Kidney Disease Treatment Market was USD 1.59 billion in 2025.

The Autosomal Dominant Polycystic Kidney Disease Treatment Market is expected to reach USD 2.90 billion by 2034.

The demand for the Autosomal Dominant Polycystic Kidney Disease Treatment Market will be driven by the increasing prevalence of ADPKD, advancements in therapeutic options, rising awareness about the disease, and growing investments in research and development for novel treatments.

The top 5 countries driving the development of the Autosomal Dominant Polycystic Kidney Disease Treatment Market are the United States, Germany, France, Italy, and Spain.

The Vasopressin Antagonists segment is expected to command a significant share over the assessment period.

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.