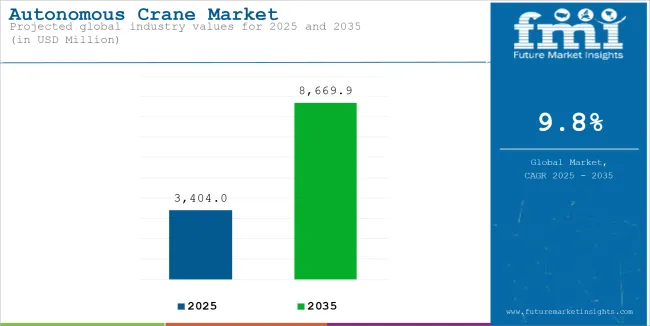

The Autonomous Crane Market is poised for steady growth, driven by the increasing global focus on electrification and energy efficiency in railway transportation. The market size is projected to grow from USD 3,404.0 million in 2025 to USD 8,669.9 million in 2035, expanding at a CAGR of 9.8% during the forecast period.

The market's growth is driven by high demand in industries such as marine and offshore, building and construction, and mining, which require precise, efficient, and safe lifting solutions. The marine sector, in particular, dominates the market due to increasing offshore exploration and port automation.

The governments and private organizations are investing tremendous sums around the world in smart infrastructure and sustainable energy solutions. Demand for electric and hybrid cranes is being stimulated by such movements, which prove to be advantageous due to lower operational costs, low emissions, and quieter operation.

The trend puts it in line with greater goals of sustainability globally and under the push for cleaner, more energy-efficient construction practices. It can rightly be said that emerging economies in Asia-Pacific are an expansion leader by rapid urbanization and industrialization.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 3,404.0 million |

| Projected Size (2035) | USD 8,669.9 million |

| Value-based CAGR (2025 to 2035) | 9.8% |

Technological innovations are playing a crucial role in reshaping the autonomous cranes market. AI-pioneered technologies in navigation and IoT-enabled observation capabilities, prediction maintenance technologies bring a new meaning to the work. Advanced features such as these allow autonomous cranes to operate at minimum downtime, higher energy usage, and productivity boost. The inclusion of smart technologies also ensures greater safety, thus making them invaluable in industries requiring precision and reliability.

Although the autonomous crane offers a large number of advantages, its disadvantage remains that many companies cannot afford to buy autonomous cranes; it is far too expensive in the first investment, especially to smaller companies who don't have so much capital to spare.

Instead, long-term savings are a consequence of enhanced efficiency, a decrease in man-power needs, and low maintenance cost, making this a very promising investment. This, over time, will balance the investment and give a more sustainable and cost-effective solution.

The adoption of autonomous cranes in the market is growing in alignment with global sustainability objectives and technological advancements in all major regions. With the continued emphasis of the industry on efficiency, safety, and environmental responsibility, demand for autonomous cranes will significantly rise and solidify their place in transforming modern construction practices.

The table below presents the annual growth rates of the global Autonomous Cranes market from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 9.6% in H1-2024. In H2, the growth rate increases to CAGR of 9.8%.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 9.6% (2024 to 2034) |

| H2 2024 | 9.8% (2024 to 2034) |

| H1 2025 | 9.7% (2025 to 2035) |

| H2 2025 | 9.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly increase to 9.7% in the first half and relatively increase to 9.9% in the second half. In the first half (H1) and second half (H2), the sector saw a similar increase of 10 BPS.

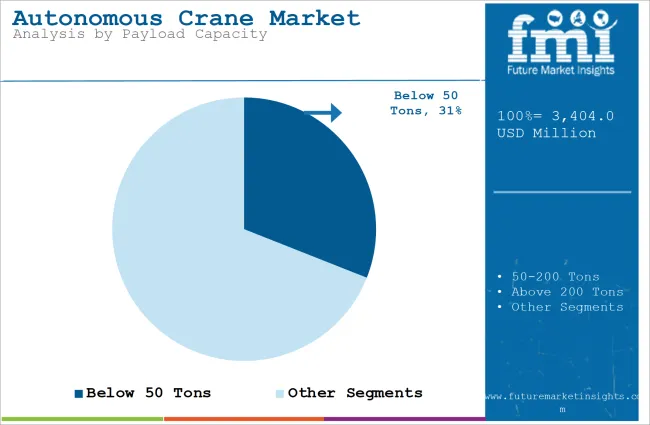

The section explains the market value share of the leading segments in the industry. In terms of Payload Capacity, the Below 50 Tons type will likely dominate and generate a share of around 30.2% in 2025.

Based End User, the Marine & Offshore type is projected to hold a prominent share of 32.4% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value Share (2025) |

|---|---|

| Below 50 Tons (Payload Capacity) | 30.2% |

Autonomous cranes with below 50-ton capacity dominate due to their versatility and adaptability in urban construction, marine, and industrial applications. These cranes are particularly effective in confined spaces where precision and mobility are essential. Recent advancements in lightweight materials and compact electric motors have enhanced their operational efficiency, making them an economical and eco-friendly choice.

For instance, in urban metro projects in Southeast Asia, below 50-ton cranes are extensively used for precise handling of construction materials. Their compatibility with electric and hybrid power sources further boosts their appeal in regions adopting stringent emission standards. As industries prioritize smaller, more efficient solutions for specialized tasks, the demand for below 50-ton autonomous cranes continues to rise globally.

| Segment | Value Share (2025) |

|---|---|

| Marine & Offshore (End User) | 32.4% |

The marine and offshore industry leads in adopting autonomous cranes due to its reliance on high-capacity and precise lifting solutions in challenging environments. Offshore wind farm installations, such as those in the North Sea, utilize AI-driven cranes for safe and efficient handling of large components. Additionally, port automation projects like Hamburg Port’s smart terminal initiative are deploying advanced cranes for seamless cargo movement and reduced operational delays.

These cranes are critical for heavy lifting, even under adverse conditions, ensuring operational continuity and safety. As global trade and offshore exploration activities grow, the marine and offshore sector remains the largest consumer of autonomous crane technologies, leveraging advancements in AI and IoT for enhanced performance.

AI revolutionizing precision in crane operations

Material handling with artificial intelligence integrated into self-governing cranes is faster and more reliable. AI-infused systems now allow real-time monitoring, balanced loads, and autonomous navigation systems that reduce direct human intervention by ensuring safety factors. For instance, AI can be used by sensors to opt for the appropriate positioning of load to minimize risks associated with manual handling.

The latest ones are the commissioning of artificial intelligence-driven cranes for special urban construction that demands precision onsite, as used with high-rise buildings. Companies utilize machine learning algorithms to predict operation needs and optimize crane movement. For example, AI-enabled tower cranes in Singapore have improved the rates of project completion with fewer safety incidents on site.

AI autonomous cranes gain easy acceptability in highly demanded sectors, like construction and mining, in industries which are mainly risk-averse and efficiency-oriented, with unmatched precision and reliability.

Electrification driving energy-efficient operations

The development towards electric or hybrid-powered cranes is very important to increase the efficiency towards an environment-friendly and energy-friendly operations. An electric crane does not look the same as traditional diesel cranes, since they give low emission, and also quiet in sound; these features lead them to being widely popular in usage.

In recent times, European ports have been introducing electric cranes, which are implemented at Rotterdam and Hamburg ports. Such cranes, with their regenerative braking system, provide enhanced energy efficiency in recovering energy while performing operations.

Hybrid cranes that run on electric and diesel power are most beneficial for places with an unreliable supply of electricity. For example, hybrid autonomous cranes have been applied in Indian metro construction projects where it has saved on the cost of operation and emission, besides speeding up the project. In this light, the future prospects of electric cranes will gain more ground in terms of increased usage due to government policies and corporate sustainability measures.

Marine industry leads crane deployment

The marine and offshore sector is one of the biggest consumers of autonomous cranes, driven by demand for high-capacity and reliable lifting solutions in challenging environments. They are excellent at handling heavy loads in ports, offshore exploration, and shipbuilding activities, where precision and durability are critical.

Recently, AI-powered autonomous cranes have been deployed in deep-sea oil and gas exploration projects. For example, dynamic-positioning cranes are used in subsea equipment lift under clear operational reliability conditions at high seas. Autonomous cranes in Norway have ensured port operations streamlined with cargo handling efficiency and labour dependency.

Besides real-time monitoring and predictive maintenance, it made them even more attractive due to IoT integration. The exploration offshore is gathering pace and the ports around the world are being modernized; the marine industry is becoming an unstoppable platform for the uptake of high-capacity autonomous crane solutions.

Emerging markets creating opportunities

Emerging markets in Asia-Pacific and Africa offer significant growth potential for autonomous cranes, driven by rapid urbanization and infrastructure development. Governments are prioritizing smart city projects, urban transit systems, and industrialization, fuelling the demand for technologically advanced cranes.

In India, initiatives like “Make in India” and metro expansions in cities like Bengaluru and Pune have accelerated the adoption of autonomous cranes. Similarly, Indonesia’s ambitious capital city relocation project has spurred investments in infrastructure, creating a surge in crane deployments for construction activities.

Africa’s rising investments in renewable energy and large-scale projects, such as Egypt’s solar parks, are also driving demand for autonomous cranes. These regions are benefiting from collaborations with international crane manufacturers, who bring expertise and innovation to local markets. With supportive government policies and growing foreign investments, emerging economies are poised to become key growth drivers for the global autonomous crane industry.

High costs hindering SME adoption

The high acquisition and maintenance costs of autonomous cranes remain a significant barrier for small and medium enterprises (SMEs), especially in developing regions. These costs are compounded by the need for advanced infrastructure and trained personnel, making it challenging for smaller companies to adopt such technologies.

For example, in Southeast Asia, where SMEs dominate construction and logistics sectors, the preference for traditional cranes persists due to their affordability. Additionally, inconsistent government incentives and limited financing options further deter SMEs from investing in autonomous solutions.

However, ongoing innovations are making these systems more accessible. Companies are introducing modular designs and rental models to lower entry barriers. For instance, manufacturers in Europe are now offering leasing options, allowing SMEs to adopt cutting-edge crane technologies without substantial upfront investments. While challenges persist, such efforts may gradually enable wider adoption among smaller enterprises.

The Autonomous Cranes recorded a CAGR of 7.5% during the historical period between 2020 and 2024. The growth of Autonomous Cranes was positive as it reached a value of USD 3,100.2 million in 2024 from USD 2,221.0 million in 2020.

Between 2020 and 2024, the autonomous crane industry grew steadily due to increasing investments in automation technologies and sustainable energy solutions across sectors like construction, marine, and mining. During this time, advancements in artificial intelligence, machine learning, and IoT enhanced the precision and reliability of autonomous cranes.

Regions like Asia-Pacific and Europe experienced strong demand driven by infrastructure development, urbanization, and large-scale construction projects. These cranes also gained popularity in marine operations, where they played a critical role in lifting heavy payloads in challenging environments.

From 2025 to 2035, rapid technological advancements are expected to redefine the industry. IoT-enabled systems and AI-powered features will improve real-time monitoring, predictive maintenance, and operational safety. The adoption of hybrid and electric-powered cranes will align with global efforts to reduce emissions and operational costs. Integration of advanced navigation systems will enhance the efficiency of mobile cranes, especially in construction and port automation.

Countries like India and China are driving demand through smart city initiatives and infrastructure expansion, while Europe’s stringent environmental regulations accelerate the shift to electric-powered systems. Innovations in lightweight materials and energy-efficient designs are set to improve performance and scalability, making these systems indispensable for diverse applications. Despite challenges like high acquisition costs, autonomous cranes are expected to play a vital role in achieving automation and sustainability objectives across industries globally.

Tier-1 companies account for around 55% to 60% of the overall market with a product revenue from the Autonomous Cranes market of more than USD 300 Million. The Tier-1 manufacturers like Liebherr Group, Konecranes and other players would have prominent share in the market.

Tier-2 and other companies such Palfinger AG, Hiab (Cargotec) and other players are projected to account for 40% to 45% of the overall market with the estimated revenue under the range of USD 300 Million through the sales of Autonomous Cranes.

The section below covers the industry analysis for Autonomous Cranes in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

| Japan | 6.1% |

| China | 5.5% |

| Germany | 4.9% |

| United States | 4.5% |

China’s expansive infrastructure projects and marine development efforts position it as a leader in adopting autonomous cranes. The Belt and Road Initiative has significantly increased demand for high-capacity cranes, especially in logistics hubs and mega ports. Recent expansions at the Shanghai Yangshan Port included the deployment of AI-driven cranes, enhancing operational efficiency and accommodating rising trade volumes.

Integration of IoT and real-time monitoring systems enhances the accuracy of cargo handling, reducing delays and optimizing energy usage. China is also integrating renewable energy into crane systems to meet the sustainability goals set by the national government. The above developments, encouraged by policies of the government and substantial investments, have ensured China's leading role in the development of autonomous crane technology globally, especially for infrastructure and marine applications.

The United States market is a pioneer in adopting autonomous cranes, propelled by significant port automation projects. Their primary impetus to this are major port automation projects, where Los Angeles Automated Terminal and similar initiatives utilize AI-powered cranes that lead to efficient cargo handling with lower emissions. These cranes are accompanied by real-time monitoring systems and thus are a necessity for modern ports.

Hybrid cranes are also increasingly used in urban construction projects, which offers flexibility and sustainability in densely populated areas. The government incentives on sustainable construction technologies further fuel demand and position the USA as a key country in crane automation.

Indian market rapid push toward renewable energy and urban infrastructure development is increasing the adoption of autonomous cranes. Advanced cranes are increasingly used in the installation of massive units, such as that of Rewa Ultra Mega Solar Park, with the capacity for efficient handling. The rise of greenfield airports and urban transit systems, like Delhi-Meerut RRTS Corridor, is driving the demand for AI-powered cranes that can handle difficult terrains. The Make in India program's local manufacturing initiatives further increase affordability and technological accessibility, making India a prime growth region for automated material handling solutions.

The autonomous crane industry is highly competitive, with key players investing in advanced automation and sustainable technologies to stay ahead. Leading companies such as Liebherr Group, Konecranes, Manitowoc, and Zoomlion are focusing on AI-powered systems and electrification to enhance efficiency and safety. For instance, Liebherr has introduced cranes with integrated IoT and real-time monitoring capabilities to optimize operations in construction and marine sectors.

Collaborations between manufacturers and end-users, such as port operators and construction firms, are driving innovation and tailored solutions. Konecranes has developed hybrid-powered cranes for port applications, reducing emissions while maintaining high load-handling efficiency. With increasing demand for sustainable and versatile solutions, competition is set to intensify as companies innovate to meet industry-specific needs.

Recent Industry Developments:

The segment is further categorized into Static and Mobile.

The segment is further categorized into Below 50 Tons, 50-200 Tons, and Above 200 Tons.

The segment is further categorized into Diesel, Electric and Hybrid.

The segment is further categorized into OEM and Aftermarket.

The segment is further categorized into Building & Construction, Marine & Offshore, Mining & Excavation, and Other End Users.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The Autonomous Cranes was valued at USD 3,100.2 million in 2024.

The demand for Autonomous Cranes is set to reach USD 3,404.0 million in 2025.

The autonomous cranes market is driven by advancements in AI, automation, increased construction efficiency, safety, and labor cost reduction.

The Autonomous Cranes demand is projected to reach USD 8,669.9 million by 2035.

Below 50 Tons capacity is expected to lead during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Crane Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Crane Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Crane Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Crane Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Crane Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Crane Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Crane Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Crane Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Crane Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Crane Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Crane Type, 2018 to 2033

Table 34: MEA Market Volume (Units) Forecast by Crane Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: MEA Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Crane Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Crane Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Crane Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Crane Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Crane Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Crane Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Crane Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Crane Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Crane Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Crane Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Crane Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Crane Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Crane Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Crane Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Crane Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Crane Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Crane Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Crane Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Crane Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Crane Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Crane Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Crane Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Crane Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Crane Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Crane Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Crane Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Crane Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Crane Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Crane Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Crane Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Crane Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Crane Type, 2018 to 2033

Figure 99: MEA Market Volume (Units) Analysis by Crane Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Crane Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Crane Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: MEA Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: MEA Market Attractiveness by Crane Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Autonomous Crane Market Analysis – Growth, Trends & Forecast 2025-2035

China Autonomous Crane Market: Driving Growth Through Smart Infrastructure and Industrial Automation

Japan Autonomous Crane Market Report – Growth, Trends & Forecast 2025-2035

India Autonomous Crane Market Growth – Innovations, Trends & Forecast 2025-2035

Germany Autonomous Crane Market Insights – Size, Demand & Outlook 2025-2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Autonomous Imaging Market Size and Share Forecast Outlook 2025 to 2035

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Radiology Systems Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Agents Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Parking Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Drone Platform Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Mobile Robots for Logistics and Warehousing Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Vehicles Market Growth - Trends & Forecast 2025 to 2035

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Autonomous Robot Toys Market

Autonomous Intelligent Vehicle Market

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA