World auto wheel spindle market would be expanding at a robust rate in 2025 to 2035 owing to an increase in the manufacture of auto vehicles and technology used while making spindles. Growing demand for commercial and passenger vehicles and greater use of hybrid and electric vehicles have grown the demand for high-quality wheel spindles. Furthermore, growing demand for alloy wheels by consumers through light weight and superior look also supports market growth.

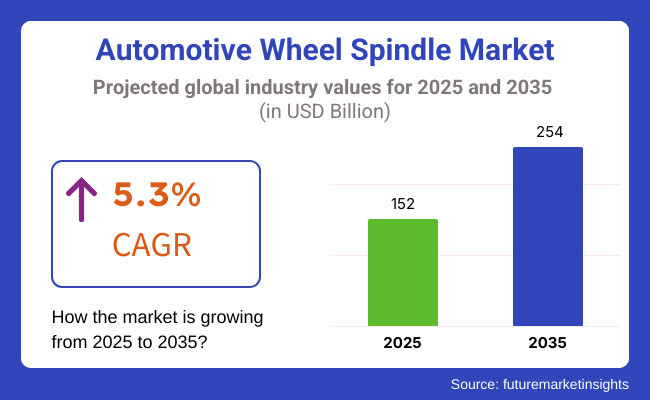

Future projections illustrate the growth of the automobile wheel spindles market from USD 152 billion in 2025 to USD 254 billion in 2035 with a compound annual growth rate (CAGR) of 5.3% during the forecast period. Towards this, enhanced production levels of automobiles, long-life vehicles, and stringent government control of car emissions are contemplated as driving factors, which call for low-cost and durable parts like the wheel spindles.

Explore FMI!

Book a free demo

Auto wheel spindle market in North America is thriving due to strong automobile sector and periodical upgrading in technology. The two, both Canada and United States of America, are major driving points and sales for electric cars of cars have expanded tens of thousands. EV culture imposes massive investment from the companies to electrify the technology and subsequently develop the finer grade of wheel spindles to operate the EV's particular structure. Apart from this, public sector uptake promotion of EVs, policy of incentive and subsidy, and strict emissions legislation are stimulating the demand for high-performance green wheel spindle to suit changing car needs.

European automobile industry is technologically driven by an extremely sophisticated industry in Europe with major countries like Germany, France, and the United Kingdom among the world-leading automobile producing nations and fashion trend setters. Past emphasis on sustainability in the continent has propelled the use of light materials like aluminum in producing wheel spindles through production to improve fuel consumption and emissions reduction. The development of autonomous vehicle systems and advanced driver assistance systems (ADAS) has also propelled high-precision components. High-precision components require precision-processed wheel spindles to support performance and security, propelling industry development and technology advancement in European automotive manufacturing.

Asia-Pacific will see highest growth of the auto wheel spindle market during the forecast period. The nations covered are China, India, Japan, and South Korea, where there is mass urbanization, increasing disposable incomes, and expansion in the middle-class population, thereby ultimately leading to increased vehicle sales as well as production. Besides this, free government policies for the growth of the automobile industry, along with infrastructure investment, are helpful to the market. For instance, China's "Made in China 2025" is a plan to improve its ability to produce automobiles, a challenging segment of demand for heavy-duty automobile components such as wheel spindles.

Durability and Low Replacement Rates

One of the largest flaws of the auto wheel spindle aftermarkets is replacement cost and low rate of spindle replacement, particularly on passenger cars. Excellent quality to the consumer, horrible to the factory and to the aftermarkets dealerships that are famished for volume consistency. Attempting to counteract this, automobile manufacturers are gravitating toward innovation, launching upgraded features, and selling to growing markets with fleets of antiquated units that have to be replaced.

Effect of Economic Recessions on Automobile Production

Economic recessions have the effect of reduced consumption of new cars, thereby on automobile component demand such as wheel spindles. For example, an economic recession caused by the COVID-19 pandemic led to subdued car production and sales. Business firms are trying portfolio diversification and surfing the electric and hybrid car market space, though recessionary pressures still bear down.

Development of Hybrid and Electric Vehicles

Increasing pace of hybrid and electric vehicles is a massive business prospect for the car wheel spindle market. Electric cars will be expected to employ spindles suitable for new drivetrain designs. Businesses that invest in research and development that enables spindles to produce to be used in electric vehicles can take advantage of this emerging market segment. For example, companies that make light but strength-improving spindles for electric drivetrain have monumental future opportunities of benefiting from shifting requirements of the automotive industry.

Manufacturing technology development

Use of manufacturing technologies such as multi-electric spindle systems and automation provides manufacturing and product efficiency. The technologies provide manufacturers with an opportunity to withstand increasing pressure for high-performing wheel spindles as well as reducing costs. Use of smart technology and sensors on wheel spindles also manifests in the form of a predictive maintenance system alongside improved vehicle performance as car manufacture shifts towards autonomous and connected cars.

Between 2020 and 2024, the automobile wheel spindle market increased steadily on the back of post-pandemic growth in the automobile industry and growing use of electric vehicles. Companies in the automobile industry concentrated on enhancing the manufacturing capacity and R&D expenditure to produce spindles with proper strength to handle new emerging vehicle technologies. But the call to develop agile strategies in response to supply chain problems and volatile raw materials prices meant seeking out substitute supplies.

In the 2025 to 2035 vision, the company will be sustainable, technology-enabled, and personalized. Light-weight yet high-strength material will be the driver of spindle design and production. In addition, autonomous and luxury driver-assistance system vehicles will need sensors, precision, and connectivity from spindles. Technology-savvy next-generation firms therefore investing in trend-setting technology will be best positioned to leverage the new car era.

Overall, the global automotive wheel spindle market is on an ascending path on the strength of emerging technologies, growing automobile manufacturing, electric and self-driving vehicles. There are dangers, but purposeful investment in innovation and sustainability will enable the players to maximize opportunities and serve the changing requirements of the global automobile industry.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Governments imposed minimum quality and safety standards for the manufacture of wheel spindles, focusing on material strength and ability. |

| Technological Advancements | Wheel spindle designs witnessed manufacturers incorporating higher performance materials such as high-strength steel and aluminum alloys to make them stronger but lighter. |

| Industry Adoption | Automotive makers focused on producing wheel spindles for use in traditional internal combustion engine (ICE) cars with increasing studies on electric vehicle (EV) application. |

| Supply Chain and Sourcing | The supply chain relied heavily on experienced suppliers of legacy materials with low diversification. |

| Market Competition | Established motor component makers dominated the market with competition based on price and quality. |

| Market Growth Drivers | Industry growth of the motor vehicle industry and rising levels of car ownership worldwide resulted in greater demand for wheel spindles. |

| Sustainability and Conservation | Initiatives towards eco-friendly production processes, focusing on waste reduction and energy consumption. |

| Integration of Smart Monitoring | Partial application of sensor technologies to wheel spindles in premium car models. |

| Advancements in Experiential Travel | The consumers expressed preference for vehicles that were more responsive and comfortable to drive and hence had a subtle influence on design considerations in wheel spindles. |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Regulatory bodies will enforce stricter fuel efficiency and emissions standards, which will drive manufacturers to adopt lightweight materials and innovative designs in manufacturing wheel spindles. |

| Technological Advancements | The industry will adopt composite materials and additive manufacturing processes in order to be capable of making high-strength, light-weight, and intricate wheel spindles. |

| Industry Adoption | There will be a revolutionary transition to the design of wheel spindles for EVs with tailor-made drivetrain setups and vehicle-level efficiency. |

| Supply Chain and Sourcing | Wheel spindles will experience rising demand due to the high penetration of electric and hybrid vehicles and developments in autonomous driving technologies. |

| Market Competition | Advanced materials suppliers and intelligent technologies experts in new entrants will contribute to competition with higher level of innovation and differentiated product. |

| Market Growth Drivers | Emergence of intelligent functionality in wheel spindles with the help of technology and cutting-edge material suppliers for supply chain diversification is going to be a necessity for manufacturers. |

| Sustainability and Conservation | The industry will totally embrace green manufacturing, employing reusable materials and eco-friendly production procedures to minimize the environment footprint. |

| Integration of Smart Monitoring | Mass application of IoT-based wheel spindle sensors is anticipated, allowing for real-time tracking of stress, temperature, and wear, hence enhancing vehicle safety and maintenance effectiveness. |

| Advancements in Experiential Travel | The trend of high-performance and customized vehicles will initiate the creation of customized wheel spindles according to individual driving patterns and conditions. |

The USA auto wheel spindle market has been propelled by a robust automobile industry and focus on technology innovation. The companies are investing heavily in R&D to manufacture light wheel spindles with improved performance and higher safety. Due to growing demands for electric vehicles (EVs), there is an increasing demand for specialty wheel spindles to support innovative drivetrain configurations in EVs. The spindles have to be specially designed to cater to the unique powertrain and weight distribution requirements of electric vehicles, hence compelling the manufacturers to invest significant capital in high-technology solutions supporting performance and safety in EV applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

Automotive wheel spindle market in United Kingdom expanded significantly with technology and sustainability being the focal point for the majority. UK used advanced manufacturing techniques like additive manufacturing to improve wheel spindle design. Composite materials also enable the manufacture of clean, high-performance components. Government efforts towards the use of electric vehicles (EVs) are also creating more demand for efficient and innovative wheel spindle solutions. EV demand has enabled the manufacture of spindles that improve car performance as well as meet sustainability objectives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The EU car wheel spindles market has expanded through collaborative research and stringent environmental protection measures. Regional automobile makers wish to create lightweight, durable wheel spindles to meet EU emission and reduce overall efficiency weight for vehicles. Since the EU focuses more on the environment, the industry saw the demand for next-generation materials-based wheel spindles like composites and aluminum rise. It has also been demanded by increased domestic production of electric vehicles (EVs) among EU members that necessitates extremely advanced spindles being used on EV drivetrains, promoting local market growth and development.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

The auto wheel spindle industry of Japan is initiated by Japan's emphasis on the standards of manufacturing quality, technical advancement, and precision engineering. Intelligent high tech materials and intelligent technology have also featured on Japan's manufacturing sector agenda with a view to making spindles in wheels efficient and reliable. Japan's transition to electric vehicles (EVs) has also stimulated the demand for new spindles that would be engineered to address the distinctive needs of EVs, e.g., accommodating new powertrain designs. Japan's rapid advancement of EVs is driving local companies to manufacture products for the emerging automobile market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's automobile wheel spindles have grown substantially because of the country's thriving automobile market and ongoing technological innovations. The firms have utilized sophisticated manufacturing technologies and use of new materials in manufacture, which allow for production of effective quality wheel spindles. Government support for electric vehicle (EV) charging stations and EV production has also contributed significantly to market growth. With South Korea promoting the evolution of EVs, more specialized wheel spindles to accommodate electric drives will be required in order to drive further growth in the market and technology development.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The wheel spindle industry for motor vehicle is classified as non-driven and driven wheel spindles and both of them are used in vehicle dynamics and load distribution. The aftermarkets and OEMs are assisting in the development of high-volume wheel spindles that are performing well in the endeavor to achieve longer life and better safety. The product does make its own contribution to the suspension system of a car and riding dynamics parameters that influence driving quality, handling, etc.

Spindles are powered by power units, particularly business cars and sport utility vehicles, for their ideal location of driving power from drivetrain to wheels. Higher sales of hybrid and electric cars have also attracted higher demand for lighter yet tougher spindles to ensure higher efficiency without lowering life. For instance, leading automobile companies like Tesla and Ford are utilizing enhanced alloy-based driven spindles to raise the efficiency of energy and even lengthen vehicle life.

In the meantime, undriven wheel spindles are still common among mass market cars due to mechanical stiffness and capacity for maximum wheel geometry. The manufacturers continue to create spindles with an objective of yet further enhancing aerodynamics and making the vehicle as a whole lighter, and auto industry giants Toyota and Volkswagen spearhead this utilization of composite material in spindle manufacture. Apart from this, technological advances in precision engineering technology such as CNC machining and AI quality inspection have allowed producers to produce extremely precise spindles with minimum maintenance and extended the lifespan of the vehicles.

Segment-to-segment research of the wheel spindle market of automobile shows fierce demand from the commercial vehicle segment (CVs) and passenger vehicle segment (SUVs), the segments with expansion prospects having several traits. Although the overall vehicle production is on a rising scale to cater to increased mobility demands, auto wheel spindle groups are embarking on initiatives to address individual needs of the segments.

SUV is one of the most lucrative segments of the automobile wheel spindle market as a result of increasing customer demand for strong, off-road-friendly vehicles. Major producers such as BMW, Mercedes-Benz, and Jeep are targeting high-performance spindles with the ability to handle off-road duties with improved ride quality. Forged aluminum and high-strength steel spindles are increasingly being applied in the SUV segment as the material of choice because of increased load-carrying capacity without increased weight.

Though this, heavy-duty spindles of the wheel remain the go-to trucks and commercial vehicles rely upon for long work hours and added loads. Low-maintenance yet quality parts do trucking call for, hence manufacturers came to create spindles that do feature improved coating which is not only wear- but also corrosion-resistant. Volvo Trucks and PACCAR are betting heavily on ultra-high-precision heat-treated spindles to provide best-in-class performance and durability for as long a time as possible, with cost of ownership benefits to the fleet owners. Application of telematics in commercial vehicles is also giving rise to intelligent spindles with sensors that monitor load distribution, vibration level, and pattern of wear in real time.

Automotive spindle wheel market is also divided based on the sales channel, and the most significant growth driver of the market is the OEMs and aftermarkets segment. The spindle wheel technology, material content innovation, and the manufacturing technology innovation are under constant process to create the supply chain that supplies the high-performance product through both channels.

The drive for innovation is spearheaded by OEMs through the installation of newly constructed cars with the newest spindle wheel technology. Such competitors as General Motors, Hyundai, and Toyota are collaborating with the manufacturers of spindles to design automobiles that consume less fuel and are safer. The OEMs are emphasizing significantly on highly precision-engineered spindles that make a positive impact towards fuel efficiency and emissions control in line with the very stringent environmental conditions globally. For instance, auto companies are using lighter and stronger laser-welded spindles to a very large extent, and hence the overall dynamics of the vehicle are being improved.

However, the aftermarkets industry is growing impressively due to extended vehicle life and a growing demand on behalf of consumers for better quality replacement parts. Independent manufacturers and specialist motor car repair stores are manufacturing varied numbers and varieties of vehicles. The growth of e-commerce websites has also provided end-users with high-performance spindles aftermarket, and ACDelco and Moog are a couple of them, whose products are direct-to-consumer. In addition, the spread of Do-It-Yourself (DIY) automobile culture has promoted increased demand in after-sales as car owners call for low-price yet performance-oriented replacement spindles to maximize vehicle performance and riding comfort.

New trends in green manufacturing and smart spindle technologies are transforming the automotive wheel spindle market. IoT sensors in spindles are a game-changer, offering real-time data on vehicle load conditions, wear-and-tear patterns, and failure risk. Automotive digitalization companies like Bosch and Continental are leading the charge with smart spindle systems that improve predictive maintenance, minimizing downtime for individual customers as well as fleet operators.

On the greener side, spindle companies are becoming greener through the implementation of greener production processes and recyclable materials in response to international sustainability objectives. The competition for carbon-free vehicle components has accelerated the innovation of lightweight composite components and biodegradable coating ensuring increased spindle durability and reduced environment footprint. Experience shows that manufacturers employing environmentally friendly spindle materials to purchase attain up to 20% savings in production emissions, aligning with the greening goal of the cleaner motor vehicle products market.

Where opportunity is tremendous in the marketplace, threats are volatility in raw material prices, stringent regulation, and smart technologies complexity to adapt. Even considering these threats, long-term investment in better manufacturing practices, quality inspection by AI, and automation is neutralizing the threats to create a more efficient and technology-enabled automobile wheel spindle market.

The auto wheel spindle market is also changing hugely, driven by increasing vehicle production and wheel assembly technology improvements. The customers are focusing heavily on precision engineering wherein they are adopting high-strength materials to fabricate light-weight but heavy-duty components that infuse performance as well as safety enhancements. Growing demand for electric and hybrid vehicles is also fueling market growth, since these cars call for tailored wheel spindles to accommodate specific design and drivetrain requirements. The trend toward electric drivelines and their specialized power and weight conditions is driving the evolution of sophisticated spindle designs to meet the changing automotive paradigm.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GKN Automotive | 15-20% |

| NTN Corporation | 12-16% |

| Dana Incorporated | 10-14% |

| Nexteer Automotive | 8-12% |

| Hyundai-Wia Corporation | 5-9% |

| Other Companies (combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| GKN Automotive | Develops and supplies high-performance wheel spindles and driveline components for various automotive applications. |

| NTN Corporation | Manufactures precision-engineered wheel spindles and bearings, focusing on enhancing vehicle efficiency and safety. |

| Dana Incorporated | Provides advanced wheel spindle solutions integrated with their axle and driveline systems for improved performance. |

| Nexteer Automotive | Specializes in electric power steering systems and related components, including wheel spindles designed for modern vehicles. |

| Hyundai-Wia Corporation | Produces a range of automotive parts, including wheel spindles, with a focus on innovation and quality. |

GKN Automotive (15-20%)

GKN Automotive leads in wheel spindle engineering and supply as well as driveline parts. With quality and innovation as its core, GKN Automotive has evolved to be a very highly sought-after collaborator for the majority of automobile organizations.

NTN Corporation (12-16%)

NTN Corporation is in the best position among leaders in the wheel spindle industry through the production of precision-engineered bearings and wheel spindles. NTN Corporation's focus on vehicle efficiency and safety has placed it as a reliable supplier in the automotive sector.

Dana Incorporated (10-14%)

Dana Incorporated offers advanced wheel spindle solutions in addition to their axle and driveline systems. Their focus on improved performance and reliability has placed them on an equal footing in the market.

Nexteer Automotive (8-12%)

Nexteer Automotive deals in electric power steering systems and components thereto, i.e., wheel spindles for new cars. Their strategy of innovation satisfies the changing demands of the automobile industry.

Hyundai-Wia Corporation (5-9%)

Hyundai-Wia Corporation produces different automobile parts, including wheel spindles, focusing on innovation and quality. They use their components in a number of vehicle models, and they help in building their reputation in the market.

Other Key Players (30-40% Total)

A number of regional and emerging participants constitute the remaining market share, with new items and multiple offerings. The main players include:

The overall market size for the Automotive Wheel Spindle Market was USD 141.23 Billion in 2025.

The Automotive Wheel Spindle Market is expected to reach USD 230.05 Billion by 2035.

The demand for the Automotive Wheel Spindle Market will be driven by the rise in vehicle production rates, increasing average vehicle age, advancements in wheel spindle manufacturing processes, and the growing popularity of electric and hybrid vehicles.

The top 5 countries driving the development of the Automotive Wheel Spindle Market are China, Japan, India, the United States, and Germany.

The Passenger Cars segment is expected to command a significant share over the assessment period.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.