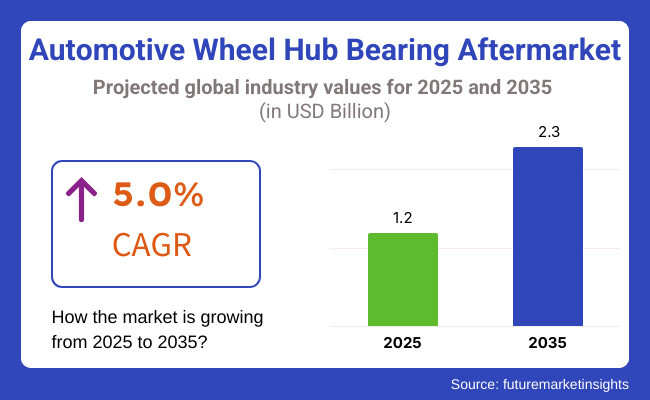

The automotive wheel hub bearing aftermarket is growing steadily as the forecasted demand is set to rise from USD 1.11 billion in 2023 to USD 1.2 billion in 2025. In 2035, the market size is expected to grow to USD 2.3 billion, maintaining a 5.0% CAGR. This escalation is due to the larger number of vehicles on the roads, the rise in the demand for spare parts, and the introduction of new bearing technologies that last longer and run better.

The construction of rim bearings, which is indispensable in wheel rotation, friction reduction, and vehicle stability, is credible in the aftermarket sector. The passing of time is the main factor in component failure and bearing replacements, hence the ever-increasing demand for quality wheel bearings.

The aftermarket section is a mainstay for introducing low-cost, high-quality solutions, and vehicle safety besides vehicle life extension is imperative. The need for durable and cost-effective alternative parts is paramount for consumers and hence, the aftermarket stands to be a crucial entity in the automotive supply chain.

Though the segment is following a healthy growth line, the aftermarket has issues to tackle, including price sensitivity in emerging markets, where customers prefer fewer-costly substitutes over branded, but the quality is very good bearings. Furthermore, the presence of counterfeit auto parts is a serious threat as sub-standard, illegal wheel hub bearing can likewise affect car safety issues.

So, it is of utmost importance to make sure that the aftermarket parts are original and reliable as per the consumer trust and the regulatory compliance. Again, another problem lies with being updated on the new technologies with wheel design and materials which bear makers must work on for the aftermarket suppliers to have a good stock of innovation that will lead to better performance and life.

But aspirations are never lacking as the market reveals a number of avenues for growth. With the number of cars reaching new heights, there will be a constant requisition of spare parts meanwhile cars are being utilized for long periods, and they must be serviced often.

The introduction of cutting-edge lightweight and strong wheel hub bearings as well as new materials presents another ground for aftermarket manufacturers to promote their products of superior quality to both the end customers and the repair shops. Apart from that, the automotive aftermarket has been through a revolution by the rise of e-commerce where clients gain steadily easy access to a vast array of wheel hub bearings and other related components.

Explore FMI!

Book a free demo

Between 2020 and 2024, the automotive wheel hub bearing aftermarket grew steadily due to increased vehicle longevity, rising repair and maintenance needs, and the expansion of e-commerce distribution channels. Consumers prioritized cost-effective replacement solutions, driving demand for high-quality, durable aftermarket bearings.

As the number of electric vehicles (EVs) increased, it also influenced the market. EVs need low-friction bearings to make them more efficient. Supply chain disruptions and fluctuating raw material prices posed challenges, but manufacturers responded with localized production and advanced materials to improve durability and performance.

From 2025 to 2035, technology will get advanced. For example, smart bearings with integrated sensors for real-time condition monitoring might get used in vehicles. Autonomous and electric vehicles are gaining more attention. There will be a high demand for lightweight, high-performance hub bearings.

Sustainability will be a key focus, with manufacturers using recycled materials and adopting eco-friendly production methods. The growth of predictive maintenance, enabled by IoT and AI, will further transform the aftermarket, reducing vehicle downtime and enhancing safety.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate emission policies, limited sustainability mandates | Stricter environmental regulations, circular economy integration |

| Sensor-integrated hub bearings, improved durability | AI-powered diagnostics, self-healing materials |

| Expansion of e-commerce platforms, increased EV adoption | Customizable modular bearings, autonomous vehicle integration |

| ABS-integrated hub bearings, telematics adoption | Cloud-based remote diagnostics, predictive maintenance |

| Rising raw material costs, supply chain fluctuations | Recyclable materials, 3D-printed bearing components |

| Early-stage AI integration, limited real-time monitoring | Fully automated diagnostics, AI-driven performance optimization |

| Supply chain disruptions, higher steel prices | Localized manufacturing, reduced reliance on global suppliers |

| Vehicle longevity, increased replacement demand | Expansion of autonomous mobility, smart maintenance solutions |

With the increasing penetration of electric vehicles, there are multiple risk factors affecting the automotive wheel hub bearing aftermarket. EVs produce higher torque and weigh more than traditional vehicles which leads to a 15 to 20% reduction in bearing life. This accelerated use causes higher wear to be applied when used, increasing the need for replacements - with manufacturers needing to balance performance and durability.

To justify the price, advanced ceramic hybrid bearings can reduce wear significantly, up to 30%, making them more resilient to fatigue, wear, and corrosion, particularly oxidation, compared to traditional bearings; however, broader acceptance remains challenged by high prices, particularly in price-sensitive markets. The market is also flooded with counterfeit and inferior bearings which not only threaten the safety of the vehicle but also cause a loss of reputation for the brand and faith in the consumer.

The market landscape is also complicated by uncertainties in the supply chain, discrepancies in quality control, and the potential for regulatory scrutiny. These factors present challenges that manufacturers and aftermarket suppliers will need to address through robust quality control, effective authentication protocols, and pricing strategies, while maintaining a focus on safety and reliability in a dynamic and competitive industry.

Automotive wheel hub bearing aftermarket pricing strategies are tightly coupled with performance and market segmentation. High-performance bearings for demanding applications, say, electric vehicles and high-performance sports cars, always cost a 20-30% premium compared to their standard counterparts. This larger price differential represents higher-quality materials and design features that make bearings last longer and are better at dissipating load under greater torque and weight.

Standard bearings for the conventional vehicle market, however, continue to be mass-produced and thus affordable and available. Some suppliers work to carve away market share by providing warranty-backed bearings paired with replacement guarantees, attracting fleet operators for whom long-term reliability and lower fleet downtime are a top priority, even if it comes at a premium cost. Hence, they can shape the tiered pricing approach in a subtle manner to meet the needs of various consumers while maintaining a balance in production cost versus profit margin.

The ideal range is probably an inner diameter distance between the outer race and inner race between 26 mm and 50 mm as it would span the performance load-bearing capacity, durability and compatibility would covers the vast majority of passenger and lighter commercial vehicles.

Strangely actually, such wheel courses are specially planned to persevere through the radial and axel weaknesses that occur while working a vehicle and help wheels slant easily and help simply wheel change and furthermore a more expanded future. The most used size range is 5 to 10kN, making it easy to balance the forces and weights coming from wheels in a vehicle-simulated direction based on normal driving scenarios i.e. acceleration, braking and cornering.

For automotive applications, smaller inner diameters like 12 mm to 25 mm do not possess adequate strength and load-bearing capacity. It was the small sizes that could not handle all the heavy loads and stresses experienced by wheels of a vehicle which made them not ideal for normal vehicles. In contrast, the axis diameters larger than 51 mm and up to 100 mm and more.

These sizes are more infrequently used with standard passenger vehicle wheel hubs. In an automotive wheel hub bearing application, the 26-50 mm range is still the best option for practicality and reliability. Reliable and durable enough to resist wearing well into the lifecycle of most passenger vehicles, ensuring the right balance of performance and cost through the third-party logistics process.

In wheel hub applications of automotive use, tapered roller bearings are the products of choice because of their high angular load carrying capacity in conjunction with high radial and axial loads. These bearings are designed to bear dynamic high-impact forces (derived from braking, acceleration, and cornering) as well as the dead weight of the vehicle itself. Its innovative design allows for the provision of consistent and reliable performance, which is why they are at the heart of modern automotive wheel hub systems.

Compared to ball bearings, which are generally designed for light-duty applications, tapered roller bearings are far more durable and handle a significantly heavier load. This means that they are less prone to the heavy loads that passenger vehicles tend to come across. Cylindrical and needle roller bearings are efficient enough at managing high radial loads, but they fail to absorb axial loads which is critical for wheel hubs.

In much the same way, angular contact ball bearings, which are sometimes utilized in high-performance or specific automotive applications, do not have the ruggedness and durability of tapered roller bearings as a facility for general use in common passenger vehicles. Angular contact ball bearings can be effective in more limited applications, but they do not have the same durability-to-load capacity ratio.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

| UK | 6.5% |

| European Union | 7.1% |

| Japan | 6.8% |

| South Korea | 7.3% |

The USA is particularly promising as, with the age of the vehicles on the road still increasing, demand for performance products continues to be strong, coupled with the increasing importance of the electric vehicle (EV) market. A vehicle in the United States is well over 12 years old on average, and this shifts the focus away from the consumers and towards the replacement and performance aftermarkets.

The growth in the DIY car repair culture and cheap garage shops with inexpensive options also benefits the wheel hub bearings market. The stringent standards of vehicle safety imposed by the National Highway Traffic Safety Administration (NHTSA) mandate the use of high-durability and corrosion-resistant hub bearings.

Timken, SKF, and NTN Corporation are at the forefront in producing low-friction wheel bearings, hub-mounted sensors with real-time sensing, and high-performance lubrication systems to enhance ride quality and vehicle life

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Aging Vehicle Fleet | Following a 12+ year average fleet age, aftermarket wheel bearing demand increases. |

| Stringent Safety Regulations | NHTSA requires high-quality corrosion-resistant bearings. |

| Technologically Sophisticated Bearings | Timken, SKF, and NTN produce low-friction, sensor-based hub bearings to enhance ride quality. |

The UK automotive aftermarket continues to grow robustly, driven by a growing parc of vehicles, increased take-up of EVs, and customers' demand for high-quality replacement components. The UK government's recently introduced ban on the sale of new petrol and diesel cars by 2035 has accelerated a shift to next-generation wheel hub bearings that are EV and hybrid platform compatible.

Mass deployment of e-commerce portals is changing the UK aftermarket and making available high-quality, pre-sealed, and lubricated hub bearings that reduce service life and maintenance.

Industry players such as GKN Automotive, Schaeffler, and NSK Ltd. are creating weight-reducing, energy-saving wheel hub bearings that enhance EV efficiency and riding quality.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| EV Market Growth | UK's planned 2035 petrol/diesel ban boosts hybrid and EV-specialist bearing demand. |

| E-commerce Growth | e.hawk makes it simple to buy low-friction, high-performance bearings. |

| Innovative Light Bearing | Schaeffler and GKN Automotive create efficient and weight-savvy bearings to propel EVs further and longer. |

Aftermarkets in the European Union are expanding with increasing EU emission requirements, longer vehicle lifetimes, and customers insisting on best-in-class replacement bearings. The migration to electric and hybrid cars has fueled innovation in power-saving, noise-minimizing wheel bearings.

Germany, France, and Italy, among others, are transitioning to lightweight, fuel-efficient parts for vehicles from ceramic and hybrid materials for improved performance. The development of connected mobility and autonomous technology also fueled the application of sensor-based wheel bearings that can offer vehicle stability and predictive maintenance.

Major industry stakeholders like Bosch, Continental, and ZF Friedrichshafen are investing in smart bearing technology, IoT diagnosis, and real-time performance monitoring for enhancing safety and reliability.

Growth Drivers in European Union

| Key Drivers | Details |

|---|---|

| EU Emissions Regulations | Market growth is fuelled by the need for low-friction, energy-efficient wheel hub bearings. |

| Connected Mobility Innovation | Bearings-mounted sensors and IoT diagnosis provide increased stability for vehicles. |

| Lightweight Innovations | Bosch, Continental, and ZF investment in hybrid and ceramic materials for low-energy bearings. |

Japanese auto aftermarkets are growing as a result of advances in technology, aging vehicles' population, and fuel economy. Japan's support for reaching carbon neutrality by 2050 has been flowing into a behemoth demand for light low-rolling-resistance bearings that can make vehicles more efficient.

Japanese manufacturers such as NTN Corporation, NSK Ltd., and JTEKT Corporation produce self-lubricating, low-maintenance, long-life wheel bearings with superior strength. Increased use of autonomous and connected vehicles also boosts demand for sensor-enabled hub bearings to track in real time and enhance car safety.

Japanese motorists require high-precision OEM-quality replacement bearings, and that supports continued demand for top-quality aftermarket bearings too.

Growth Drivers in Japan

| Key Drivers | Description |

|---|---|

| Aging Vehicle Fleet | Older Japanese cars drive long-life, high-durability replacement bearing sales. |

| Carbon Neutrality Targets | Market low-friction, energy-efficient bearings to reduce emissions. |

| Sensor-Equipped Bearings | NTN and NSK engineer smart hub bearings for in-service safety inspection. |

The wheel hub bearing market in South Korea is growing very aggressively with the industry leadership of EV manufacturing growth, rising vehicle lifecycles, and technological advancements in high-performance bearings. Hyundai and Kia, the world's top vehicle manufacturers, are spearheading the world electric vehicle revolution fueling the growth in demand for low-energy wheel hub bearings.

The Ministry of Trade, Industry, and Energy (MOTIE) promotes auto-component technology innovation, particularly noise-reducing and friction-reducing bearings that enable greater driving comfort and energy saving. The development of new materials like ceramic and polymer coatings enhanced bearing corrosion resistance and durability.

Industry giants ILJIN, Hyundai WIA, and LS Automotive take the lead in smart bearing technology that unites wireless monitoring and predictive maintenance with artificial intelligence to drive enhanced vehicle safety and operating performance.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| EV Growth & Hyundai-Kia Leadership | Hyundai & Kia electric vehicle manufacturing requires high-efficiency wheel hub bearings. |

| Government Innovation Support | MOTIE invests in noise-reducing and friction-reducing bearing technology. |

| AI & Wireless Monitoring | ILJIN and LS Automotive create AI-based predictive maintenance solutions. |

The market demand for wheel hub bearings differs across regions and depends on climate conditions, road network, and automobile ownership patterns. Unlike temperate regions where bearings experience moderate wear, areas with extreme weather conditions, such as North America and Northern Europe, see higher demand for corrosion-resistant and heavy-duty bearings.

In emerging markets such as Asia-Pacific and Latin America, the increasing number of used vehicle imports and rising disposable income levels are driving the adoption of aftermarket replacement parts. Businesses are extending distribution channels and introducing localized product options to meet regional market requirements, providing a greater reach and enhanced availability of service.

There are challenges in the form of counterfeit bearing distribution and disintegrated supply chains. Nevertheless, collaborations with official dealers, Blockchain-based authentication solutions, and direct-to-consumer sales strategies will help to bolster brand reputation and market penetration.

Future Trends: Smart Bearings, Sustainability, and Advanced Manufacturing

Technological advancements like smart bearing technology, green manufacturing methods, and smart material science set the aftermarket's future agenda. Contrary to conventional bearings, smart bearings with sensors incorporated within are capable of monitoring real-time wear, temperature variations, and vibration rates and offer predictive maintenance with a reduced likelihood of unexpected failures.

Sustainability is also becoming more popular, with producers investigating biodegradable lubricants, recycled metal alloys, and energy-efficient manufacturing. These initiatives support worldwide efforts to minimize carbon footprints and ensure environmentally friendly automotive production.

Advanced manufacturing techniques such as additive manufacturing (3D printing), precision machining, and automated assembly are further improving bearing consistency, reducing waste, and enhancing cost-efficiency. As the post facto industry adopts these technologies, the consumer will enjoy new durable performance-oriented wheel hub bearings capable of fulfilling the changing needs of modern vehicles.

The market is destined to keep on growing with age of an increasing number of vehicles in tandem with technological advancements in bearings and changes in customer needs. While manufacturers will be refining their products with better durability, diagnostics made smart, and environmentally friendly initiatives, the market will offer replacement systems that are becoming increasingly efficient, reliable, and economically priced in automotive terms.

The aftermarket for automotive wheel hub bearings is an intensely competitive environment with several major players attempting to gain optimum advantages in the market via different growth strategies. Key companies in this sector are NSK Ltd., NTN Corporation, Schaeffler AG, and The Timken Company.

They focus on product innovations, strategic alliances, and increasing their global presence due to the growing demand for high-quality wheel hub bearings. For example, Timken's acquisitions of American Roller Bearing and Engineered Solutions Group (iMECH) in 2023 were aimed at developing engineered bearings in order to consolidate its position and diversify its product offerings.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SKF Group | 20-25% |

| NTN Corporation | 15-20% |

| Timken Company | 12-16% |

| NSK Ltd. | 10-14% |

| Schaeffler Group | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| SKF Group | Develops high-performance wheel hub bearings with advanced sealing technology. |

| NTN Corporation | Specializes in precision-engineered hub bearings with extended lifespan. |

| Timken Company | Innovates in corrosion-resistant bearings and high-load capacity solutions. |

| NSK Ltd. | Focuses on energy-efficient bearing designs with reduced friction. |

| Schaeffler Group | Provides high-quality wheel bearings with intelligent lubrication solutions. |

Key Company Insights

SKF Group (20-25%)

SKF is a pioneer in premium-quality aftermarket wheel hub bearings with advanced sealing technology to extend durability as well as vehicle performance.

NTN Corporation (15-20%)

NTN emphasizes accuracy in design and manufacturing, producing wheel hub bearings that serve longer and thus enhance road performance and reduce cost of maintenance for vehicle owners.

Timken Company (12-16%)

Timken leads the world in making corrosion-resistant bearing technology, which adds reliability under extreme road conditions and extends the life of vehicles.

NSK Ltd. (10-14%)

NSK designs energy-efficient wheel bearings that work towards the reduction of friction, contributing to fuel efficiency, which is one reason why it is preferred among aftermarket suppliers.

Schaeffler Group (6-10%)

Schaeffler Heavy Knowledge in lubrication and the intelligent design of bearings contribute to smooth operations and longevity of the vehicle.

Several other players (30-40% Combined)

Various companies are helping in the automotive wheel hubs bearing aftermarket through the introduction of new materials, smart lubrication systems, and enhanced durability of the bearings.

The overall market size for the aftermarket was USD 1.2 billion in 2025.

The aftermarket is expected to reach USD 2.3 billion in 2035.

The demand will grow due to increasing vehicle maintenance activities, growth in automotive production, and advancements in bearing technologies.

Continental AG, Tenneco Inc., Schaeffler AG, Mahle GmbH & The Timken Company are some of the key players.

Ball bearings and tapered roller bearings are expected to command a significant share over the assessment period.

By vehicle type, the market is segmented into EV (passenger car, LCV, HCV) and IC engine (passenger car, LCV, HCV, two-wheelers).

By inner diameter, the market is categorized into 12 mm to 25 mm, 26 mm to 50 mm, 51 mm to 100 mm, and above 100 mm.

By product type, the market is divided into ball bearings, tapered roller bearings, cylindrical roller bearings, angular contact ball bearings, and needle roller bearings.

By sales channel, the market is classified into original equipment manufacturers (OEM) and the independent aftermarket.

By region, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltics Countries, East Asia, South Asia & Pacific, Middle East & Africa

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.