the global car Automotive uninterruptible power supply (UPS) market will continue to grow rapidly between 2025 and 2035, owing to the increased application of high-end electronics in vehicles and the growing use of electric vehicles (EVs). We offer in-vehicle UPS solutions to maintaining the power to critical in-car electronics which makes the system more reliable and safe. Local emissions-governing impact in strict patterns of regulations, Energy backup (back to image on how traditional ups power solution is turning obsolete) with belief on fancy vision of ADAS and enabling power source on standalone operation (power,12000mAh, can reserve in then out another device in parallel) driving up the car up solutions.

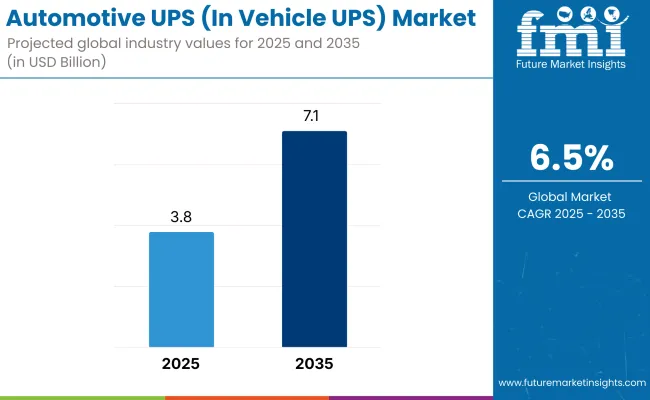

The automotive UPS market is gaining momentum with different industries with a projected compound annual growth rate (CAGR) of 6.5% between 2025 to 2035. Back-up power solutions must come from a high-reliability source with the growing electronic complexity in cars and consumer demand for features to boost safety. The EV phenomenon is also important for adoption of smart, reliable UPS solutions for powering critical functions to EVs.

The North America car UPS market is urbanized in nature and primarily driven by the increasing passenger car sales in the region owing to the growing awareness of car safety, developing infrastructure, and acceptance of a new technology. For instance, the USA government puts a lot of importance on the newly enforced safety standards, so the manufacturers choose to utilize UPS systems to provide stable power to critical safety components. An example of this would be Tesla cars use an UPS system to provide power to their Autopilot system, making cars more extensively safe after sudden change in power.

The Europe automotive UPS market is proliferating due to the region's focus on reducing carbon emissions and electric mobility. In Germany, for instance, and France, strong production of electric and hybrid vehicles will require our professional Uninterruptible Power Supplies to support their increasingly complex electrical architectures. Volkswagen's ID. line of electric vehicles, as an example; utilizes UPS systems for ensuring seamless operation of critical control units thereby enhancing the reliability of the vehicle.

Due to urbanization, increase in disposable income and boosting motor vehicle industry, Asia-Pacific region is expected to deliver the highest growth in auto UPS systems. China has the world’s biggest overall car market, the world’s biggest electric car market - and it’s burning up in China. UPS systems used in electric motor vehicles are coordinated in such a manner that they deliver continuous energy into sensitive components so that both safety and efficiency are optimized, and this is one of the reasons BYD as a huge Chinese manufacturer of electric motor vehicles uses UPS systems in electric motor vehicles.

Cars Integrated with Vehicle Systems

A significant challenge for that automotive UPS market is ensuring UPS devices work within installed vehicle electrical systems without contingencies. UPS solutions are attached through clutter-free engineering as per the new-generation cars and new-generation electronic structures. For instance, the interference avoidance of a UPS system for a car's battery management system is critical for the vehicle's overall operations.

Cost Constraints

The installation of the vehicle UPS system also has an impact on the cost of the vehicle, being a constraint for price-sensitive markets. Manufacturers have to balance the advantage of UPS integration with cost increase to stay competitive. For example, the cost in UPS systems might impair sellability of the vehicle in price sensitive markets where price sensitivity is a concern.

Packaging to a minimum, UPS units provide a more efficient and compact UPS system. This means, for example, if you are able to produce solid-state batteries, you will receive higher energy density and faster charging times used to generate more effective UPS systems. It is commonly thought that Toyota is working on solid-state batteries in order to make its electric cars' power backup units more efficient and with smaller size.

Rapid Growth of the Electric Vehicle Market

The EV phenomenon adds to the reason why robust UPS systems are in demand for supporting sensitive applications such as battery control, navigation, and protection schemes. With accelerated adoption of EVs, the demand for Car UPS products will progressively scale up. The Leaf range from Nissan, for example, make use of UPS systems to help provide continuous supply electrical power to the electrical power train as well as power supplies for control systems.

The automotive UPS market was on a growth path from 2020 to 2024, driven mainly by increased penetration of electronic systems in vehicles and initial penetration of electric vehicles. The competitors pooled efforts to create UPS solutions designed for special application conditions in the automotive sector, the chief of these being reliability and space. Their journey was not without roadblocks, however: Integration complexity and associated costs were just a few in their path.

Moving forward, with 2025 to 2035, auto UPS would revolutionize along with technology and automotive world. The way UPS systems work with renewable energy is one such transformation that will be seen here. Meanwhile, the UPS equipment would have to handle the peaks and troughs of power levels and deliver a steady amount of power to the essential vehicle elements as vehicles would be designed with solar panels and other types of renewable power sources that would be harnessing ever higher levels of energy.

Modular design in UPS solutions will be another milestone. The latter will mark innovative, scalable but flexible solutions as per demand regarding the corresponding vehicle with economic efficiency and flexibility. Power solutions will become more modular and flexible, addressing the increasing heterogeneity of automotive applications.

Light-weight materials will also be developed so as to provide greater energy efficiency in the industry. From next-generation light-weight material the firms will try towards fabricating UPS systems without compromising in performance and with direction towards global motor vehicle market weight-reduction strategy. This trend too will aid in greater efficiency and sustainability of the vehicles.

The automotive uninterruptible power supply (UPS) market has already made excellent strides from 2020 to 2024. The same will also be manifested between 2025 and 2035, where it adapts and transforms itself towards advanced automotive technology to fulfill the unmet needs.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Governments put in place basic safety and performance regulations for in-car UPS systems, with an emphasis on reliability and integration with other vehicle electronics. |

| Technological Advancements | Producers started adding lithium-ion batteries and rudimentary monitoring systems to UPS designs, increasing energy density and reliability. |

| Industry Adoption | Vehicle manufacturers concentrated on integrating UPS systems mostly into luxury and high-end automobiles to power essential electronic subsystems. |

| Supply Chain and Sourcing | The supply chain was dependent largely on incumbent battery suppliers and electronic component makers, with minimal diversification. |

| Market Competition | Established automobile electronics firms controlled the market, with competition largely centered on price and fundamental performance criteria. |

| Market Growth Drivers | The growth of the automobile industry and the growth in complexity of onboard electronics helped drive demand for dependable UPS systems. |

| Sustainability and Conservation | Preliminary initiatives were taken towards environmental-friendly production practices in the form of minimizing hazardous materials and enhancing energy efficiency during manufacture. |

| Integration of Smart Monitoring | Limited use of simple diagnostic tools in UPS systems, mainly in high-end vehicle models. |

| Advancements in Experiential Travel | Customers expressed interest in cars that provided improved infotainment and comfort features, which indirectly impacted UPS design factors. |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Regulatory authorities are anticipated to implement stricter regulations focusing on energy efficiency and compatibility with electric vehicle (EV) architectures, driving the implementation of advanced UPS solutions. |

| Technological Advancements | The industry is anticipated to implement solid-state batteries and sophisticated energy management systems, supporting quicker charging times and longer lifecycles for in-vehicle UPS units. |

| Industry Adoption | There will be a considerable movement toward the implementation of UPS systems on a wider scale of vehicles, such as mid-range and electric ones, in order to provide power uninterruptedly for vital systems. |

| Supply Chain and Sourcing | Automakers are expected to diversify their supply base by partnering with technology companies with expertise in innovative energy storage technology and investing in captive manufacturing facilities. |

| Market Competition | New players with expertise in emerging battery technologies and intelligent energy management solutions are likely to increase competition, promote innovation, and provide differentiated offerings. |

| Market Growth Drivers | Increased adoption of electric and autonomous cars and vehicle connectivity is likely to propel growth in advanced in-vehicle UPS solutions. |

| Sustainability and Conservation | The industry should come to fully adopt green manufacturing practices, using recyclable materials and employing energy-efficient production techniques to lower environmental impact. |

| Integration of Smart Monitoring | Massive adoption of IoT-based monitoring systems is expected, enabling real-time diagnostics, predictive maintenance, and smooth integration with vehicle management systems. |

| Advancements in Experiential Travel | The shift towards highly connected and autonomous vehicles is likely to drive the creation of UPS systems that can support advanced driver assistance systems (ADAS) and continuous connectivity features. |

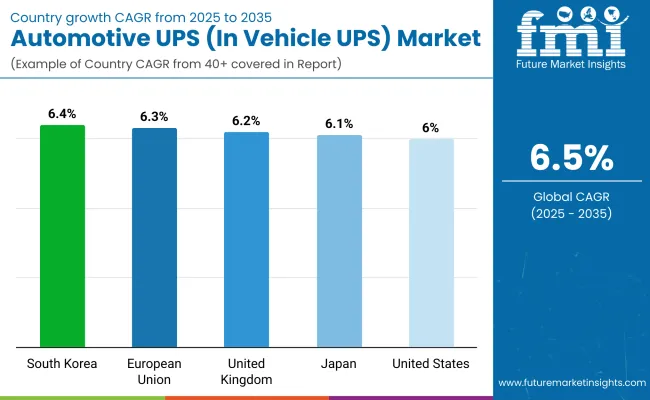

The top automotive industry and focus on technology development have fueled the United States automotive UPS market. Organizations have invested in research and development activities to provide efficient UPS systems with enhanced safety features. The shift to electric and self-driving vehicles has also increased the demand for tailor-made in-car UPS solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

In the UK, the market for automobiles UPS has expanded, as a result of improvements in manufacturing technologies and excessive focus on sustainability. Firms have employed innovative energy storage solutions to provide eco-friendly, high-performance UPS systems. Also, government incentives programs to raise the use of EVs have driven industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

The European Union automotive UPS market has been driven by collaborative research and stringent environmental standards. Manufacturers have been engaged in developing light-weight, high-strength UPS systems in line with vehicle performance and emission norms. Increased EV production among member countries has also driven demand for advanced in-vehicle UPS technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan's automotive UPS sector has been influenced by its large automobile industry's focus on precision technology and quality. Integration of innovative new battery technologies and advanced energy management systems into the UPS design has been the focus. Japan's aggressive push for EVs has also necessitated the development of in-vehicle UPS solutions purpose-designed.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

South Korean automobile UPS industry grew due to the flourishing auto industry in South Korea and new-generation manufacturing processes and materials' implementation by the firms to provide good quality UPS systems. Efforts from the government toward expanding EV manufacturing and supporting infrastructure had a significant influence on market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

Automotive UPS Types are Static, Dynamic, and Hybrid power supplies, and manufacturers and fleets of cars more and more demand solutions to mitigate power disruption inside the vehicle. Automotive UPS solutions bring vehicle resilience to power disruptions, maintaining vital electronics, infotainment, and higher-order ADAS functionality even in voltage dips. Power solutions are now the bare minimum for safeguarding passengers, enhancing fleets, and more and more for mass deployment of electric and autonomous vehicles.

The global Automotive UPS market is seeing widespread adoption by automobile manufacturers and fleet operators to increase the dependability of vehicles. Static UPS, where power is turned on without employing a moving part, is gaining popularity in new passenger cars as well as electric cars due to efficiency as well as a thin body design. Dynamic UPS, with the aid of real-time power management with the integration of kinetic energy storage units, is better appropriately implemented in commercial fleets with high levels of energy fluctuation demands. Hybrid UPS systems are actually being developed as an option of preference for heavy-duty and high-performance vehicles with battery-based and mechanical energy storage configuration to achieve optimum power stability.

The market is expanding with increased demand for power supply without any disruption in the solutions in vehicle segments, especially electric vehicles (EVs), since now the power must be kept constant in order to deliver better battery performance and vehicle control systems. It is reported that more than 65% of commercial fleet operators have started incorporating UPS systems to fight growing fleet electrification, keeping operations continuous and running vehicles smoothly.

Technologies such as smart UPS systems on the basis of AI-powered power management and cloud-based monitoring continue to propel the market value. Real-time vehicle diagnosis impacting power distribution in dynamic UPS systems is changing fleet operations by saving power wastage and extending component life to its fullest level.

Depending on the power input range, Low Voltage (Less than 9V), Mid Voltage (Between 9V to 48V), and High Voltage (More than 48V) segmented market are served. High voltage UPS solutions are increasingly in demand day by day, particularly for heavy commercial vehicles (HCVs) and premium Electric Vehicles (EVs), where power intensive applications need a backed-up power supply for some.

Mid-voltage UPS systems (9V to 48V) represent the largest market share in the passenger car and LCV segments because they are plug-and-play compatible with the current power infrastructure. Mid-voltage UPS solutions are increasingly being used spurred by infotainment, telematics, and high-protection systems with the requirement for uninterrupted availability of power. Mid-voltage UPS solutions are employed by fleet managers to prevent battery discharge and ensure maximum fuel efficiency with zero downtime and hassle-free vehicle running.

Low-voltage UPS units (up to 9V), on the other hand, continue to find usage in fuel-efficient cars for basic power backup of essential electronics. These usages are ideally suited for growth markets, where price-conscious consumers are looking for cost savings without affecting vital vehicle functionality.

By vehicle category, the company deals with Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Electric Vehicles (EVs) - which are Battery Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs).

Passenger vehicles are the biggest market segment, and auto original equipment makers increasingly employ UPS systems to supply power to in-car entertainment, digital instrument clusters, and safety-critical functions. The more demanding consumers become on their vehicles regarding connectivity, the higher the demand for turnkey power supply solutions. Premium car makers and performance car makers are leading the charge, equipping vehicles with intelligent UPS modules to maintain high-end infotainment and navigation systems.

LCVs and HCVs also feel the effects of UPS adoption fueled primarily by adoption for fleet and logistics management use. Fleet logistics and delivery trucks are augmented by captive power to operate telematics apps, GPS routes, and onboard diagnostic support to enable highest route optimization and cargo monitoring. UPS onboard technology in enormous commercial vehicles powers energy-thirsty comforts like refrigeration, loading equipment, and brake assistance, hence an absolute need of logistics and supply chain members.

The EV segment has superior growth potential, and BEVs and HEVs are the largest beneficiaries with UPS integration. BEVs require power management without any window of opportunity to maintain battery efficiency and avoid system downtime, while HEVs utilize UPS for seamless transition between internal combustion and electric drive. Leading EV manufacturers are investing in intelligent UPS integration to provide optimal energy distribution for long battery life and long vehicle life.

Splitting the market is the Below 40 Amp and Above 40 Amp UPS solutions based on ampere rating.

Under 40 Amp UPS solutions have a majority market share, mostly for light commercial and passenger cars. They aim at delivering infotainment, navigation, and safety features without drawing power from the battery during prolonged idling time. Miniature high-efficiency UPS modules are being adopted by automakers more and more to enable vital vehicle functions while keeping the weight and complexity of the electrical system unchanged.

In addition to that, Above 40 Amp UPS systems are increasingly being used in heavy-duty commercial trucks and electric buses, where higher energy needs call for a robust power management. The solutions have a significant role to play in facilitating operation stability in different electronic subsystem vehicles, including autonomous driving features, advanced driver assistance systems (ADAS), and high-power air conditioning units. Transit authorities and fleet owners are installing high-amp UPS systems as an investment to provide power with no downtime to transport commercial vehicles with reduced risk of electronic system failure.

Manufacturers are launching such technologies as real-time monitoring of energy supply, rapid charging, and AI-enabled diagnostics for the UPS as more energy-efficient and high-performance UPS systems are sought.

UPS products that have IoT capabilities also advance vehicle efficiency by predicting maintenance alerts, decreased downtime, and power consumption optimization.

Even though the Automotive UPS market is expected to grow robustly, it is being hindered by some challenges such as regulatory problems, installation costs, and incompatibility with current vehicle structures. Nevertheless, AI-driven energy management, high-switching power converters, and the next generation of solid-state battery technology are countering these challenges to make UPS adoption more feasible on different types of vehicles.

Government initiatives to fuel cars in an environmentally friendly manner and stringent control over automobile power efficiency are also taking the market in the right direction. The trend towards green automobile UPS solutions, such as lithium-ion-based backup and renewable energy-friendliness-capable power supplies, also follows world sustainability initiatives and vehicle trends.

The market for Automotive Uninterruptible Power Supply (UPS) is growing at a rapid rate with the demand for robust backup power solutions for cars, growth in electric and hybrid vehicle markets, and increasing power quality and vehicle safety issues. The vendors are concentrating on the adoption of high-end technology, including silicon carbide (SiC) MOSFETs, to make UPS systems more efficient and smaller. Besides, the increase in autonomous and networked vehicles demands dependable power support systems, and hence this is driving growth in the market.

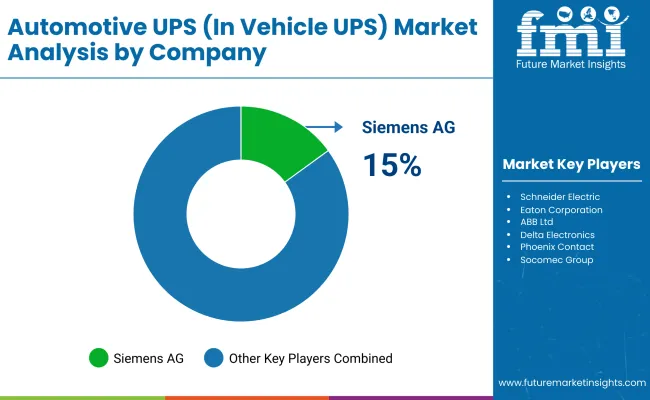

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 15-20% |

| Schneider Electric | 12-16% |

| Eaton Corporation | 10-14% |

| ABB Ltd | 8-12% |

| Delta Electronics | 5-9% |

| Other Companies (combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | Develops automotive-grade UPS systems featuring advanced power management and energy-efficient technologies. |

| Schneider Electric | Offers in-vehicle UPS solutions with a focus on sustainability and integration with electric vehicle architectures. |

| Eaton Corporation | Provides compact and reliable automotive UPS units designed to support critical vehicle functions during power disruptions. |

| ABB Ltd | Supplies robust UPS systems tailored for automotive applications, emphasizing high performance and durability. |

| Delta Electronics | Manufactures energy-efficient in-vehicle UPS products, incorporating cutting-edge power conversion technologies. |

Siemens AG (15-20%)

Siemens AG dominates the automotive UPS market by creating automobile-grade UPS solutions with the most advanced power management and energy-saving technology. Their solutions are created to suit the high demands of current vehicles with flawless power provision for core functionalities.

Schneider Electric (12-16%)

Schneider Electric leads the market share of vehicle UPS solutions focused on sustainability and plug-and-play in electric vehicle architectures. Its focus on green technology also reflects the automotive industry's move towards greener options.

Eaton Corporation (10-14%)

Eaton Corporation offers reliable and space-saving car UPS units that can support mission-critical car operations in case of power loss. Due to their reliability and space-saving features, they are among the best options for most car applications.

ABB Ltd (8-12%)

ABB Ltd offers high-performance UPS units specifically tailored to the automotive market with long-life and high-performance features. They manufacture equipment designed specifically to perform in the rough automobile environment without compromising on high quality and seamless output.

Delta Electronics (5-9%)

Delta Electronics provides energy-saving in-vehicle UPS solutions through the latest power conversion technology. Its products make it possible for vehicle energy use to be lowered according to the move of the industry towards sustainability.

Other Big Players (30-40% Overall)

The following other players drive competition within the automotive UPS market:

The overall market size for the Automotive UPS (In Vehicle UPS) Market was USD 3.35 Billion in 2025.

The Automotive UPS (In Vehicle UPS) Market is expected to reach USD 6.2 Billion by 2035.

The demand for the Automotive UPS (In Vehicle UPS) Market will be driven by the increasing adoption of electric vehicles (EVs), advancements in automotive electronics, the need for reliable power backup systems, and stringent emission norms promoting the use of energy-efficient technologies.

The top 5 countries driving the development of the Automotive UPS (In Vehicle UPS) Market are the USA, China, Germany, Japan, and South Korea.

The Electric Vehicles segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Homologation Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tappet Market Size and Share Forecast Outlook 2025 to 2035

Automotive Chain Sprockets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA