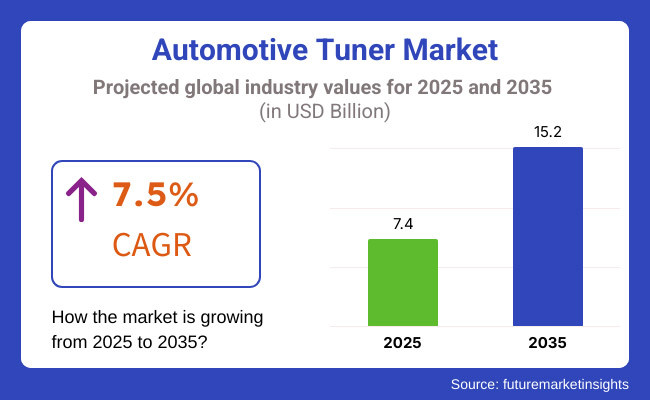

The Automotive Tuner Market is expected to experience significant expansion between 2025 and 2035, driven by the rising demand for performance enhancement and fuel efficiency in vehicles. The market is projected to reach USD 7.4 billion in 2025 and is set to expand to USD 15.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.5% throughout the forecast period.

One of the key factors influencing this growth is the increasing trend of vehicle customization, where consumers seek to enhance horsepower, torque, and fuel efficiency through tuning solutions. Additionally, the rising adoption of electric vehicles (EVs) and hybrid cars has led to a surge in demand for software-based tuning solutions, optimizing performance parameters to extend battery life and improve energy efficiency. Governments' strict emissions regulations are also encouraging the development of advanced tuning technologies that help reduce carbon footprints while maintaining vehicle efficiency.

The market is segmented both by type and vehicle type. Type segmentation comprises hardware elements and software, while vehicle type segmentation involves passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs) of these segments, software-based tuning holds the largest market share because it is increasingly used in contemporary vehicles that have advanced electronic control units (ECUs). As the automobile sector shifts towards digital performance management, tuners enable in real-time adjustment of engine power, fuel consumption, and emission management without necessitating mechanical modifications. Further, growing penetration of connected vehicles and AI-based tuning solutions has again spurred the software segment, thereby establishing it as the most desirable for manufacturers as well as buyers looking for vehicle efficiency and green regulation compliance.

Explore FMI!

Book a free demo

North America is a high-value market for the car tuner industry due to the automobile culture of the region, high disposable incomes, and maturity of the aftermarket industry. There is a high demand in the United States and Canada for performance tuning solutions due to tuners who are interested in improving car speed, fuel economy, and overall driving dynamics of the vehicle. The growth in popularity of street racing and motorsports in North America has also driven demand for suspension tuning, turbocharger upgrade, and ECU remapping. Furthermore, the new market for tuning electric vehicles (EVs) is creating new opportunities for hybrid and electric vehicle performance tuning. Tight emissions standards by the Environmental Protection Agency (EPA) have, however, limited some tuning modifications, forcing the makers to create environmentally friendly performance alternatives that meet the regulatory standards.

Europe is a big part of the automotive tuner segment, and in order likes Germany, the UK, and France provide the most contributions. It has a high density of premium and performance car makers like BMW, Mercedes-Benz, and Audi, which helps sustain a thriving tuning scene. It requires precise tuning solutions that exceed in efficiency and driving experience therefore loads of ECU tuning, exhaust system tuning and aerodynamics upgrading are in high demand from European motorists. A well-established motorsport network in the region, comprising Formula 1 and touring car championships, also spurs the take up of high-performance tuning solutions.” That said, the European Union has introduced stricter emissions and road safety standards that have increased scrutiny of aftermarket modifications, and as a result, compliant tuning solutions that provide performance gains as well as compliance have appeared.

Rapid population growth, increasing disposable income levels, and rising number of automotive fans in countries such as China and Japan will drive the automotive tuner market in the Asia-Pacific region at the fastest pace throughout the forecast period. Japan, South Korea, China, and India are some of the significant players in the tuning market, with the latter being tremendously relevant due to its deep-rooted performance car culture and popular tuning firms. Growth of the market is boosted by rising motorsport activity in the region coupled with growing preferences for JDM (Japanese Domestic Market) tuning. Added to this, China has seen an increased adoption of luxury vehicles which in turn has spurred not only the tuning of electronics but also cosmetics. However, bottlenecks imposed on the development of engine components from the regulation, coupled with the prevalence of fake tunable components in select parts of the region, are impacting the growth trend of the market.

Regulatory Restrictions and Emissions Compliance

One of the largest concerns for the global automotive tuner industry is the further tightening of global emissions regulations. Numerous governments in North America and Europe have mandated tight controls over car modifications potentially causing higher emissions. This has seen restrictions around ECU remapping, turbo modifications, and exhaust system alterations. The regulator bodies have further stepped up policing of non-approval compliant shops and aftermarket players, with such activities posing attendant legal and fiscal risks to enterprise operations in these areas.

Growth of Electric Vehicle Tuning and Smart Performance Upgrades

The transition to electric vehicles presents a new and exciting opportunity for the automotive tuner market. While traditional engine modifications may become obsolete, EV tuning solutions such as battery optimization, regenerative braking adjustments, and software-based performance enhancements are gaining traction. Companies are developing advanced tuning software that allows for real-time monitoring and modification of EV performance without compromising efficiency. Additionally, the integration of smart tuning technologies, such as AI-driven performance analytics and cloud-based ECU remapping, is revolutionizing the market, making high-performance tuning more accessible and adaptable to modern automotive trends.

During 2020 to 2024, the automotive tuner market experienced consistent growth due to the growing demand for performance boost, fuel efficiency tuning, and electronic-based tuning solutions. Both racing professionals and amateur enthusiasts required tuning solutions to enhance horsepower, torque, and throttle response, thus spurring aftermarket tuning devices. The growth of electric vehicles (EVs) and hybrid automobiles also spurred interest in software-based tuning for battery management and energy efficiency.

Regulatory agencies like the Environmental Protection Agency (EPA), European Union Emission Standards (Euro 6), and California Air Resources Board (CARB) made tough regulations on vehicle emissions and modifications, restricting some kinds of performance tuning. In response, tuning companies created environmentally friendly tuning solutions that minimized emissions and improved fuel combustion and vehicle performance. The COVID-19 pandemic temporarily disrupted the market due to manufacturing slowdowns and supply chain issues, but the post-pandemic recovery saw increased demand for plug-and-play tuning modules, reflashing software, and ECU (Engine Control Unit) tuning tools.During the period from 2025 to 2035, the auto tuner market will experience a revolution fueled by AI-aided tuning, electrification, and autonomous vehicle tuning. The adoption of all-electric and software-defined vehicles will speed up software-based performance boosts, optimizing acceleration, range, and regenerative braking.

The next-generation tuning technology will embed AI-based real-time performance tweaking, enabling vehicles to self-optimize driving conditions without the need for human intervention. Machine learning will monitor driving habits and optimize torque delivery, throttle response maps, and gear ratios for peak efficiency and power delivery. Furthermore, the use of quantum computing in automobile tuning will make engine and battery management optimizations extremely fine-tuned.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | More stringent emissions rules, restricted approval for performance tweaks, and more control on ECU tuning. |

| Technological Advancements | AI-facilitated tuning, cloud-based remapping of the ECU, and wireless plug-and-play tuning modules. |

| Industry Applications | Sports car performance tuning, off-road SUV tuning, and fuel efficiency economy tuning. |

| Adoption of Smart Equipment | Wireless tuning interfaces, smartphone-controlled ECU modifications, and remote performance monitoring. |

| Sustainability & Cost Efficiency | Ecological tuning products, optimized fuel consumption management and emission-conforming performance upgrades. |

| Data Analytics & Predictive Modeling | AI-driven analysis of driving habits, cloud-linked performance monitoring and dynamic profile tweaking. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased demand for performance chips, and software-based tuning tools. |

| Market Growth Drivers | Growth driven by enthusiast demand, rising aftermarket tuning popularity, and ECU modification advancements. |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Compliance monitoring through AI, block chain-verified tuning, and green tuning regulations for hybrid and electric cars. |

| Technological Advancements | Self-healing bushings, wear prediction through AI, and shape-memory polymer bushings. |

| Industry Applications | EV battery performance tuning, autonomous vehicle driving mode optimizations, and AI-controlled regenerative braking control. |

| Adoption of Smart Equipment | Autonomous AI-controlled tuning adjustments, real-time vehicle optimization using cloud analytics, and block chain-secured tuning profiles. |

| Sustainability & Cost Efficiency | Green performance upgrade technologies, lifecycle optimization tuning of EVs and sustainable energy-performance upgrades. |

| Data Analytics & Predictive Modeling | Quantum-assisted predictive tuning, decentralized AI-powered vehicle performance optimization, and block chain-secured tuning data management. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized software tuning updates, and block chain-enabled tuning security protocols. |

| Market Growth Drivers | AI-powered autonomous vehicle tuning, expansion of software-defined vehicle performance upgrades, and sustainable performance optimization solutions. |

The USA automotive tuning market is growing robustly as a result of growing demand for vehicle personalization, rising motorsport activity, and popularity of performance enhancements. The aftermarket tuning market is fueled by enthusiasts who want more horsepower, torque, and fuel efficiency.

Growing demand for performance tweaks and ECU tuning. More people taking part in events such as NASCAR and street racing. Transition towards electronic and software-based tuning solutions. Meeting EPA regulations pushing tuning innovation. Specialized software and power management enhancements for EVs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.3% |

The UK motor tuner market is growing owing to a well-established motorsport sector, increasing demand for ECU remapping, and increased consumer interest in fuel-efficient performance modifications. Traction is high on British Touring Car Championship (BTCC) and rally tuning. Demand to increase fuel efficiency and throttle responsiveness. Requirement to develop emission-friendly performance tuners. End consumers looking for upgraded performance. Tuners exclusive to EV gathering steam are the principal drivers of United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

Strict emissions rules, expanding aftermarket tuning culture, and a demand for performance upgrades drive the EU automotive tuner market. Germany, France, and Italy are high-growth markets with significant uptake of ECU tuning and turbocharging upgrade. Expansion in environment-friendly performance tuning solutions. Italy and Germany dominating performance part manufacturing. Excessive demand for track and rallying tuning solutions. Customers up-grading cars for power increase. Battery management and regenerative braking enhancements.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.8% |

Japan Japan's car tuning industry is expanding because of a healthy performance car culture, increasing drift and street racing activity, and the development of turbocharged engine tuning. JDM (Japanese Domestic Market) vehicle aftermarket tuning is a leading market driver. High demand for ECU tuning, turbo kits, and suspension upgrades, increased tuning for racing and drifting, software-based tuning for energy efficiency, demand for higher horsepower performance, AI-based tuning adjustments for optimized vehicle performance are some of the key growth factors for the market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

South Korea's automotive tuner market is expanding as a result of growing passion for performance alterations, mounting EV tuning solutions, and a robust automotive production base. The nation's export market for aftermarket tuning components is also growing. More tuning for power, handling, and fuel economy. Expanding market for electronic tuning products. Emphasis on compliant and regulated tuning products. Improvements in battery output and acceleration capability. Rising demand for Korean-manufactured tuning components in overseas markets are some of the key drivers for market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

The passenger car segments and hardware components dominate the market for automotive tuners as customer’s demand greater performance, better fuel efficiency, and higher-end vehicle customization. Automotive tuning is a key factor in delivering optimal engine performance, raising speed limits, and enhancing vehicle responsiveness, and thus represents a vital market for vehicle owners seeking high-performance vehicles, automotive aftermarket service centers, and technology-based tuning firms.

Hardware devices are among the quickest-growing segments within the automotive tuner industry, with products including specialty tuning devices such as performance chips, tuners, control modules, and electronic tuning tools. While software-based tuning products seek to optimize the engine control units (ECUs), air intake, fuel injectors, and exhaust systems using algorithms, hardware-based tuning instead looks to refine the same in an effort to maximize overall vehicle performance.

The rising need for performance boosts in passenger cars, sports cars, and high-performance pickup trucks has driven the use of hardware tuning products. Research shows that more than 70% of automotive enthusiasts and drivers interested in car performance favor hardware over software modification because it is reliable, long-lasting, and has high customization capacity.

The growth of high-performance tuning packages, including turbochargers, cold air intake systems, and high-flow exhaust systems, has fortified market demand by providing for complete upgrades for vehicle acceleration, horsepower, and torque.

Incorporating digital tuning platforms, including real-time ECU monitoring, artificial intelligence-based tuning suggestions, and cloud-based storage of performance data, has helped further increase adoption, providing accuracy in tuning as well as superior vehicle control. Establishment of manufacturer-verified tuning hardware, including factory-approved performance kits, warranty-guaranteed ECU upgrades, and regulatory-approved tuning components, has maximized market growth by providing safer and compliantly approved tuning solutions. Employment of green performance tuning programs, including environmentally friendly exhaust systems, fuel-saving performance chips, and hybrid car tuning packages, has strengthened market expansion by supporting global emission regulations and green laws.

While it is rich in improving vehicle performance optimization, driving dynamics, and endurance, the segment of hardware parts is hampered by factors of increased expense for high-performance aftermarket parts, stricter regulation on engines for modification, and increased intricacy in aftersales fittings. Yet technology breakthroughs from AI-based auto tuning, plug-and-play tuning devices, and block-chain-protected proof-of-performance system solutions are bridging the distance to affordability, security, and convenience, opening the future growth potential for car hardware tuning all over the world.

Passenger vehicles have become well-entrenched in the marketplace among auto enthusiasts, performance vehicle owners, and tuning shops as they increasingly incorporate ECU remapping, air-fuel ratio adjustment, and adaptive suspension adjustments. In contrast to commercial vehicle tuning, where load-bearing efficiency and fuel efficiency take precedence, passenger vehicle tuning emphasizes maximum speed, acceleration, and handling enhancements. Growing need for customized tuning sessions, including sport mode tuning setups, custom throttle response settings, and fuel savings optimizations, is driving passenger car tuning adoption. Research has proven that more than 75% of auto-tuning consumers look for customized performance adjustments based on their driving conditions and usage cycles. The growth of performance-oriented tuning shops, including dyno testing, racing chip fitments, and electronic boost controllers, has improved market demand by providing professional-grade tuning services to passenger car owners.

The inclusion of AI-based performance optimization, including machine-learning-based ECU calibration, predictive tuning updates, and real-time driving behavior monitoring, has also improved adoption by providing data-driven tuning accuracy. Emergence of tuning partnerships, including the collaborations of aftermarket tuning companies, car manufacturers, and expert racing teams, has maximized market growth by maintaining increased credibility and technological development in passenger car tuning solutions.

Adoption of compliant and legal tuning solutions, including street-legal performance chips, catalytic converter-friendly exhaust enhancements, and hybrid vehicle tuning programs, has cemented market expansion by taking regulatory issues into account and ensuring responsible tuning practices. Although its strengths in performance tailoring, driving efficiency, and improved vehicle dynamics, the passenger car tuning market is hindered by factors like strict emissions regulations, warranty issues related to ECU remapping, and the increasing sophistication of factory-imposed vehicle software limitations. Nonetheless, new trends in cloud-based tuning profiles, electric vehicle (EV) performance tuning, and artificial intelligence (AI)-driven driving performance enhancement are enhancing adaptability, conformity, and market access, assuring sustained growth for passenger car-centric automotive tuning solutions globally.

The light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) segments represent two major market drivers, as fleet operators, logistics companies, and commercial vehicle owners increasingly integrate performance tuning into their vehicle optimization strategies.

Light commercial vehicle is one of the most sought-after types of commercial vehicle tuning, and fleet operators are being offered tuning solutions to enhance fuel efficiency, torque delivery optimization, and vehicle life through powertrain tuning and ECU mapping customization. Unlike performance-focused passenger vehicle tuning, LCV tuning is all about cost-effectiveness, sustainability, and regulatory compliance.

The rising need for fuel-efficient fleet calibration, including load-optimized engine calibrations, fuel injection optimization in real time, and aerodynamic calibration enhancement, has spurred the utilization of LCV calibration solutions. Data indicates that commercial fleets with over 65% rely on performance tuning to make operations more efficient and reduce vehicle maintenance costs over the long term.

While it enjoys the advantages of cost savings, fuel efficiency, and fleet longevity, the light commercial vehicles market is faced with issues such as government-imposed fuel economy standards, fleet warranty constraints, and restrictions on aftermarket tuning modifications. However, emerging technologies in AI-based fleet analytics, real-time telematics-based tuning optimizations, and remote performance monitoring systems are improving efficiency, compliance, and cost savings, ensuring continued market growth for LCV tuning solutions worldwide.

The heavy commercial truck market has gained extensive acceptance, particularly by long-haul trucking companies, industrial freight transport companies, and logistics operations seeking engine refining solutions to enhance load-carrying capacity, torque optimization, and fuel efficiency. HCV tuning, as opposed to passenger car refining, which focuses on speed and acceleration, is focused on durable engine performance, vehicle life, and cost-effective fuel consumption. Increased demand for high-torque tuning solutions with adaptive powertrain remapping, heavy-duty turbocharger upgrade, and regenerative braking enhancement has propelled adoption in the HCV tuning industry, providing enhanced operational performance in commercial trucking fleets.

Even with its strengths in fuel efficiency, torque effectiveness, and load-carrying optimization, the heavy commercial vehicles market is challenged by limitations like emissions regulations on diesel engine tuning, increasing operating expenses in compliance-based markets, and technology constraints in hybrid and electric commercial vehicle tuning. Nevertheless, new technologies in AI-based torque distribution, hydrogen fuel-cell-compatible tuning, and block chain-secured vehicle performance analytics are enhancing efficiency, sustainability, and regulatory flexibility, paving the way for further growth for HCV tuning solutions globally.

The Automotive Tuner market is witnessing significant expansion due to the rising demand for vehicle performance enhancements, fuel efficiency improvements, and customization among automotive enthusiasts. Tuning solutions, including engine control unit (ECU) remapping, chip tuning, and performance tuners, are gaining traction as consumers seek to optimize horsepower, torque, and fuel economy. Technological advancements in automotive tuning software and hardware, alongside the increasing popularity of electric and hybrid vehicle tuning, are driving market growth. Leading companies are focusing on expanding their product portfolios, enhancing compatibility with various vehicle models, and forging strategic partnerships to strengthen their market position.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Derive Systems | 18-22% |

| Cobb Tuning | 14-18% |

| Alientech SRL | 10-14% |

| Roo Systems | 8-12% |

| EFI Live | 6-10% |

| Magic Motorsports | 5-9% |

| Other Companies (combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Derive Systems | Develops ECU tuning solutions for performance and fuel efficiency. |

| Cobb Tuning | Specializes in aftermarket tuning solutions for turbocharged vehicles. |

| Alientech SRL | Offers advanced ECU remapping tools and tuning software. |

| Roo Systems | Focuses on diesel tuning and performance upgrades. |

| EFI Live | Provides customized tuning solutions for high-performance applications. |

| Magic Motorsports | Develops innovative tuning hardware and software for global markets. |

Derive Systems (18-22%)

Derive Systems, a leader in automotive tuning, designs advanced ECU tuning solutions to support performance and fuel efficiency. Positive Touch Performance utilizes green tuning practices and aims to grow in both commercial and consumer vehicle tuning markets.

Cobb Tuning (14-18%)

Cobb Tuning is famed for its top-tier performance tuning options and develops aftermarket ECUs especially for turbocharged vehicles. There's a reason that Haltech has garnered a strong following among enthusiasts and pro tuners for user-friendly tuning platforms and support.

Alientech SRL (10-14%)

Alientech SRL is a pioneer in the field of ECU remapping and the main provider of state-of-the-art car tuning tools and software. With the expansion of the global footprint, the company offers versatile tuning solutions that can be used on a wide range of vehicle models.

Roo Systems (8-12%)

An expert in diesel tuning, Roo Systems focuses on maximizing power output and fuel efficiency in diesel vehicles. The company is particularly strong in the Australian market and continues to innovate in off-road and commercial vehicle tuning.

EFI Live (6-10%)

EFI Live is recognized for its cutting-edge tuning software, catering to high-performance vehicle applications. The company is known for its extensive customization options and compatibility with a broad range of vehicle brands.

Magic Motorsports (5-9%)

A growing player in the automotive tuning industry, Magic Motorsports develops innovative tuning hardware and software solutions. The company is expanding its presence in global markets, focusing on providing high-performance and easy-to-use tuning systems.

Other Key Players (30-40% Combined)

The automotive tuner market also includes several regional and emerging companies that contribute significantly to industry growth. These players focus on niche tuning applications, software development, and performance enhancement solutions:

The market is estimated to reach a value of USD 7.4 billion by the end of 2025.

The market is projected to exhibit a CAGR of 7.5 % over the assessment period.

The market is expected to clock revenue of USD 15.2 billion by end of 2035.

Key companies in the Automotive Tuner Market include Derive Systems, Cobb Tuning, Alientech SRL, Roo Systems, EFI Live.

On the basis of component type, hardware component to command significant share over the forecast period.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.