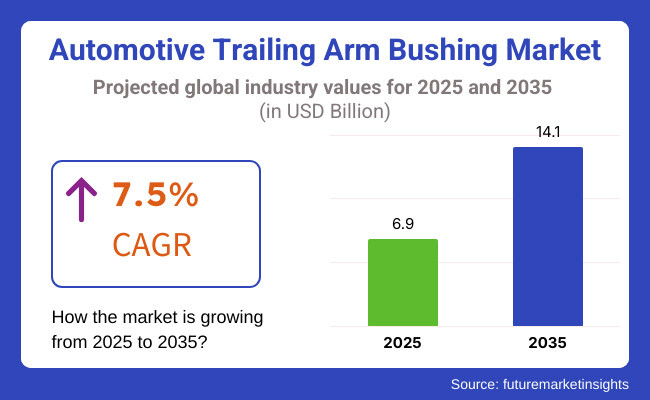

The Automotive Trailing Arm Bushing Market is set to experience significant growth between 2025 and 2035, driven by the increasing demand for enhanced vehicle suspension systems to improve ride comfort and stability. The market is projected to reach USD 6.9 billion in 2025 and is expected to expand to USD 14.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.5% over the forecast period.

One of the major factors driving the market is the rising global demand for passenger and commercial vehicles, particularly in emerging economies. As automakers focus on improving vehicle performance and durability, the use of advanced trailing arm bushings in suspension systems is increasing. These components play a crucial role in absorbing shocks, reducing vibrations, and maintaining proper wheel alignment, thereby enhancing vehicle handling and safety. Additionally, the growing adoption of electric vehicles (EVs) has further accelerated the demand for high-performance suspension components, including trailing arm bushings.

The market is split between type and vehicle type. Trailing arm and semi-trailing arm fall under type segmentation, whereas passenger cars, LCVs, and HCVs make up the vehicle type segmentation.

Among these, passenger vehicles have the largest market share because of their large-scale production and increasing demand from consumers for vehicles with improved ride comfort and stability. As the global demand for personal mobility devices continues to grow, automobile manufacturers are employing advanced suspension components, including trailing arm bushings, to enhance vehicle performance and safety. In addition to this, rising demand for hybrid vehicles and electric vehicles is also driving demand higher for good quality bushings for passenger cars as these vehicles require optimized suspension mechanisms to carry batteries and improve fuel efficiency. Such a trend sustains the dominance of the passenger car segment to remain the foremost driver of growth in the market.

Explore FMI!

Book a free demo

The rising North American market for automotive trailing arm bushings owing to a matured automotive industry coupled with established road infrastructure and consumer preference for high-performance and durable automotive parts provides a thrust to the demand for automotive trailing arm bushings in the region. Commercial and passenger vehicles produced in the United States and Canada are designed to offer superior ride comfort and improved stability, leading to a high demand for trailing arm bushings. If you combine the growth of (EVs) within the area and demanding components like high-quality bushings that minimize noise and provide the ultimate ride experience, demand for sophisticated suspension systems is also surging in the region. Also, stringent safety and emissions regulations set by the USA Environmental Protection Agency (EPA) and National Highway Traffic Safety Administration (NHTSA) drive manufacturers to devise durable and eco-friendly bushing materials that reduce environmental footprint yet improve the handling of the vehicle.

North America has also been a pivotal market for automotive trailing arm bushings, with the region being home to automotive parts manufacturers and a growing automotive sector. The regional automotive segment, which is heavily represented by companies like VW, BMW, and Renault and places significant value on accuracy design and improved comfort, is spurring on high-performance trailing arm bushings. In Europe, manufacturers are shifting their focus to lightweight and durable materials such as urethane and high-performance rubber composites in order to increase suspension efficiency while also lightening the weight of the vehicles. Demand for more sustainable modes of transportation, like hybrid and electric vehicles, has also spurred the development of advanced bushing materials, increasing durability and efficiency. Strict emission and noise pollution laws have created a market for noise-absorbing and vibration-suppressing suspension parts, which are being adopted by car manufacturers, further spurring the growth of this market in the region.

The Asia-Pacific region is expected to witness the fastest growth in the automotive trailing arm bushing market, fueled by rapid urbanization, increasing vehicle production, and the expansion of road networks. China, India, Japan, and South Korea are the dominant players in the region, with China leading the market due to its massive automotive manufacturing sector. Rising disposable incomes and growing consumer awareness regarding vehicle comfort and safety have spurred demand for premium suspension components, including high-quality trailing arm bushings. In India, the government's focus on improving road safety and enforcing stricter vehicle standards is also driving demand for advanced suspension technologies. Additionally, Japan and South Korea, home to major automakers like Toyota, Honda, and Hyundai, continue to innovate in suspension design by integrating advanced bushing materials that enhance driving stability and reduce maintenance costs. However, the region also faces challenges related to fluctuating raw material prices and the availability of counterfeit or low-quality aftermarket parts, which impact market dynamics.

Rising Raw Material Costs and Counterfeit Products

Increasing the price of raw materials, i.e., rubber, polyurethane, and metal composites, is one of the prominent challenges in the automotive trailing arm bushing market. Supply chain disruption and worldwide economic instability are responsible for volatility in prices that affect manufacturers' profitability and productivity. The issue of counterfeit and poor-quality aftermarket bushings available in emerging economies is a substantial challenge, with subpar products compromising vehicle quality and safety. Automakers and regulatory agencies are implementing tight quality control systems to try and limit this problem, but enforcement is lax in some areas.

Advancements in Material Technology and Sustainable Manufacturing

The increasing demand for vehicle efficiency and environmental sustainability is a great opportunity for the automotive trailing arm bushing market. Producers are investing in smart materials like thermoplastic elastomers, high-performing polyurethane, and reinforced rubber composites that guarantee better durability, less wear and tear, and enhanced resistance to the effects of thermal changes. Second, environmentally friendly manufacturing methods, along with recycled rubber usage, are in increasing popularity among automakers, who want to comply with universal environmental laws. Demand for future-proof suspension technologies, such as smart bushings with advanced vibration and sound-damping capabilities, will also be spurred by the rise of electric vehicles and autonomous driving technology.

From 2020 to 2024, the automotive trailing arm bushing market witnessed steady growth, propelled by rising vehicle production, increasing demand for smoother rides, and technological advancements in suspension systems. The need for better vehicle handling, comfort rides, and reduction of road noise drove demand for high-performance bushing materials such as polyurethane and thermoplastic elastomers. In addition, electric vehicle (EV) market growth as well as stringent government regulations regarding vehicle safety and emissions played a significant role in shaping the industry.

Strict vehicle performance and safety standards were adopted by Regulatory organizations like the National Highway Traffic Safety Administration (NHTSA), the European Union (EU), and the International Automotive Task Force (IATF). Vehicle manufacturers and component manufacturers focused on producing bushings that were more durable, vibration-damping, and corrosion-resistant. Supply chains were strained by the COVID-19 pandemic, slowing the procurement of raw materials and production plans. The bounce-back on vehicle sales, coupled with recovery post-pandemic, is fueling the expansion of the market in both new and replacement markets of sophisticated trailing arm bushings.

The automotive trailing arm bushing industry will evolve significantly from 2025 to 2035, thanks to smart suspension systems, sustainability programs, and AI-based predictive maintenance. The increasing adoption of autonomous and electric vehicles will drive demand for premium performance bushings that enhance performance and drive stability and comfort.

Next-generation bushings will feature self-healing materials and nanotechnology-infused composites to enhance longevity and reduce wear over time. AI-enabled suspension systems will track real-time bushing performance, forecast wear, and allow for preemptive replacements. The emergence of shape-memory polymers will bring adaptive bushings that adapt stiffness according to road conditions, ensuring optimal vehicle handling and passenger comfort.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | More stringent NHTSA and EU safety regulations, emphasis on vibration management and emission cuts. |

| Technological Advancements | Self-lubricating bushings, noise-dampening materials, and composite bushing designs. |

| Industry Applications | Passenger vehicles, commercial trucks, and aftermarket suspension upgrades. |

| Adoption of Smart Equipment | Noise-reducing and self-lubricating bushings, composite-based high-durability materials. |

| Sustainability & Cost Efficiency | Bio-based elastomers, recyclable thermoplastics, and reduced maintenance requirements. |

| Data Analytics & Predictive Modeling | AI-based diagnostics for bushing wear, cloud-integrated maintenance tracking. |

| Production & Supply Chain Dynamics | COVID-19-related supply chain disruptions, rising raw material costs, and increased demand for premium bushings. |

| Market Growth Drivers | Vehicle safety regulation-driven growth, aftermarket demand, and premium suspension system adoption. |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Suspension of safety regulations through AI, blockchain-monitored compliance, and material requirements based on sustainability. |

| Technological Advancements | Self-healing bushings, wear prediction through AI, and shape-memory polymer bushings. |

| Industry Applications | Incorporation into autonomous vehicle suspension optimization, EV ride stabilization, and AI-based predictive maintenance. |

| Adoption of Smart Equipment | IoT-enabled smart bushings, real-time suspension monitoring, and adaptive damping control. |

| Sustainability & Cost Efficiency | Fully biodegradable bushings, closed-loop recycling systems, and energy-efficient manufacturing processes. |

| Data Analytics & Predictive Modeling | Quantum-enhanced predictive suspension modeling, decentralized AI-driven bushing monitoring, and blockchain-secured lifecycle tracking. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized manufacturing with 3D printing, and blockchain-enabled quality assurance. |

| Market Growth Drivers | AI-driven autonomous suspension optimization, eco-friendly bushing solutions, and growth into next-generation EV and smart vehicle applications. |

In the United States, the market for automotive trailing arm bushings is growing with the rise in vehicle manufacturing and emphasis on vehicle performance and comfort. Consumers are choosing superior suspension components, and demand is for improved suspension components with the advancement in automotive technology.

Consistent growth in auto manufacturing requires trustworthy suspension systems. Suspension design innovation improves vehicle handling and ride quality. Older vehicle fleets heighten replacement bushing demand. Buyers value smooth driving, which enhances the demand for quality bushings. Strict safety standards necessitate routine maintenance of suspension parts, which are the major growth drivers for this market in the United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

The UK market is growing with a strong automotive industry and growing consumer needs for vehicle comfort and safety. The shift to electric vehicles (EVs) also supports the demand for advanced suspension systems. Increased sale of electric vehicles demands specialized suspension parts. Investing in car manufacturing propels component demand. Laws and customer awareness increase demand for quality bushings. Maintenance of the currently running vehicles sustains the replacement business. The addition of advanced materials enhances bushing performance, one of the key drivers for this market in the United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

Strict safety regulations, innovation, and a strong automotive sector propel the EU automotive trailing arm bushing industry. Germany, France, and Italy are leading in terms of production and consumption of automotive parts. EU laws require suspension systems of high quality. Major car makers propel component demand. Advanced material and design research improve product lines. Electric vehicle transition demands new suspension components. A large fleet of vehicles provides a consistent replacement market, some of the key growth drivers pertaining to this market in the European Union.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.6% |

The growth of Japan's market is credited to its technologically advanced auto industry and focus on vehicle performance. Ongoing innovation and focus on quality propel the need for high-performance trailing arm bushings. Preeminent in automotive technology developments. Consistent production levels boost component demand. Demand for long-lasting and high-performance vehicles. Investment in fresh materials and designs of bushings. Increasing replacement market due to vehicle longevity is one of the key growth drivers for this market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

South Korea's trailing arm bushing market for autos is expanding because of its robust automotive manufacturing industry and rising exports. Vehicle safety and performance drive the demand for quality suspension parts. Growing automobile production increases the demand for components. Higher automobile exports demand superior parts. Focus on sophisticated suspension systems. Technological advancements in bushing materials and configurations. Vehicle maintenance of locally produced and exported vehicles sustains the market and is one of the most important growth drivers for this market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

The passenger vehicles and trailing arm sections lead the automotive trailing arm bushing industry as automakers and buyers emphasize ride quality, suspension life, and noise attenuation. The bushings are a key factor in dampening road shocks, reducing vibrations, and providing smooth handling, and hence are integral components in contemporary car design. The growing use of advanced suspension systems, strict safety norms, and rising vehicle output contribute heavily to industry growth.

Trailing arm bushings have proven to be a major market growth driver, providing better stability, less wear, and improved load distribution in suspension systems of vehicles. Unlike traditional suspension parts, trailing arm bushings ensure better lateral and longitudinal support, facilitating controlled wheel movement and maximized road contact.

Increased need for effective suspension systems in passenger vehicles, electric light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs) has driven adoption as company’s value ride quality and vehicle life. Research shows that more than 60% of auto manufacturers include trailing arm bushings to optimize suspension performance, cementing the stronghold of this category. The growth of smart suspension technology, which includes electronically controlled damping, active ride control, and adaptive suspension settings, has reinforced market demand, guaranteeing better vehicle dynamics and lower maintenance costs.

The introduction of high-performance materials, including polyurethane and advanced elastomers, has also contributed to adoption, providing enhanced durability, corrosion resistance, and temperature stability. The development of sustainable components, such as recyclable materials, bio-based rubber assortments, and lessened reliance on petroleum, has supported market resurgence and is keeping the stage with international sustainability plans. The sales and implementation of predictive maintenance solutions such as AI-based wear detection, real-time performance tracking, and automated diagnostic functionalities have indeed boosted market growth, while enabling the maintenance of active suspension systems and reducing sudden failures.

While trailing arms are powerful builders of tip-handling precision, they have also found themselves up against rising costs, regulatory hurdles, and material wear over the years. But with the emergence of new technologies such as 3D-printed suspension components, AI-calibrated suspension, and self-healing bushing materials that promote optimized performance, efficiency, and life expectancy, the growth of the trailing arm bushing market across the globe is positively impacted.

Passenger cars are expected to be one of the biggest and fastest-growing segments in the automotive trailing arm bushing market, as customers demand high ride comfort, less vibrations and enhanced suspension performance. Unlike heavy-duty commercial trucks, which require heavy-duty bushings, the passenger car requires lightweight, flexible, and durable bushing solutions that can provide comfortable ride and vibration-free operation on different road surfaces.

Like automotive manufacturers whose production falls within the range of increasing personal income, urbanization, and widespread adoption, the demand for struts and shocks has expanded, with manufacturers focusing on premium ride quality and extended life for suspension. The expansion of electric and hybrid vehicles, with lightweight suspension systems and energy-efficient automotive chassis system parts, has strengthened market demand, ensuring compatibility with future automotive platforms. The addition of noise and vibration reduction technologies, including high-performance damping materials, multi-layer bushing structures, and active noise cancellation solutions, has also been on the rise, offering increased driving comfort and cabin quietness. The progress of OEM-manufacturer partnerships, including joint research initiatives, co-designed bushing solutions, and in-house optimized suspension systems, has maximized market growth and offered customized and high-performance vehicle applications. The incorporation of aftermarket customization patterns, with performance-enhancing suspension upgrades, racing-grade bushing materials, and customized vehicle tuning, has supported market expansion, providing increased consumer interaction and brand differentiation.

In spite of ride quality, fuel economy, and vehicle handling advantages, the passenger car seat market is confronted with supply chain interruption, raw material price volatility, and environmental regulations affecting bushing manufacturing. Nonetheless, new innovations in AI-based suspension analytics, block chain-supported material traceability, and 3D-printed intelligent bushing technology are enhancing production efficiency, material sustainability, and automotive suspension performance, guaranteeing sustained growth for the passenger car trailing arm bushing market globally.

The Automotive Trailing Arm Bushing market is experiencing steady growth due to increasing vehicle production and the demand for enhanced suspension systems. Trailing arm bushings are essential components in vehicle suspension, designed to reduce vibrations and provide stability. Rising consumer preference for improved ride comfort and durability has driven demand for high-performance trailing arm bushings. Moreover, advancements in material technology, such as polyurethane and synthetic rubber, are influencing product innovation. Leading manufacturers are focusing on research and development, strategic partnerships, and regional expansion to strengthen their market position.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ZF Friedrichshafen AG | 18-22% |

| Continental | 14-18% |

| Federal Mogul LLC | 12-16% |

| ACDelco | 10-14% |

| Mevotech | 8-12% |

| Nolathane | 5-9% |

| Hyundai Polytech India | 4-8% |

| Other Companies (combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| ZF Friedrichshafen AG | Develops high-performance suspension components, including advanced trailing arm bushings. |

| Continental | Specializes in innovative rubber and polymer bushings for improved vehicle stability. |

| Federal Mogul LLC | Manufactures premium rubber and polyurethane bushings for enhanced durability. |

| ACDelco | Offers high-quality replacement bushings for various vehicle models. |

| Mevotech | Produces heavy-duty and performance-oriented suspension bushings. |

| Nolathane | Focuses on polyurethane bushings for enhanced performance in off-road and sports vehicles. |

| Hyundai Polytech India | Supplies rubber-based suspension bushings for commercial and passenger vehicles. |

ZF Friedrichshafen AG (18-22%)

A global leader in automotive components, ZF focuses on innovative suspension technologies. The company invests in research and development to enhance vehicle performance and ride comfort.

Continental (14-18%)

Dedicated to rubber and polymer technologies, Continental develops long-lasting and high-performance trailing arm bushings. With ongoing improvement of its product lines, the company meets changing demands in the automobile industry.

Federal Mogul LLC (12-16%)

Reputed for its high-end rubber and polyurethane bushings, Federal-Mogul provides top-notch suspension parts to OEMs and the aftermarket market. The company is increasing its manufacturing capacity to cater to worldwide demand.

ACDelco (10-14%)

A leading aftermarket company, ACDelco offers durable replacement bushings that guarantee longevity and stability. The company emphasizes affordability and accessibility in markets.

Mevotech (8-12%):

A specialist in suspension components, Mevotech creates heavy-duty and performance bushings. Its dedication to innovation has been rewarded with growing use in the aftermarket market.

Nolathane (5-9%)

The firm is famous for its polyurethane bushings, which have extensive use in performance and off-road vehicles. Nolathane keeps adding new products to cater to niche automotive segment requirements.

Hyundai Polytech India (4-8%)

A key supplier of rubber-based trailing arm bushings, Hyundai Polytech India serves both passenger and commercial vehicle manufacturers. The company prioritizes cost-effective and high-durability solutions.

Other Key Players (30-40% Combined)

Several other regional and global manufacturers contribute to the Automotive Trailing Arm Bushing Market, including:

The market is estimated to reach a value of USD 6.9 Billion by the end of 2025.

The market is projected to exhibit a CAGR of 7.5% over the assessment period.

The market is expected to clock revenue of USD 14.1 Billion by end of 2035.

Key companies in the Automotive Trailing Arm Bushing Market include ZF Friedrichshafen AG, Continental Federal Mogul LLC, ACDelco, Mevotech.

On the basis of vehicle type, passenger cars to command significant share over the forecast period.

Market can be segmented on the basis of Arm type, vehicle type, sales channel and shape type.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.