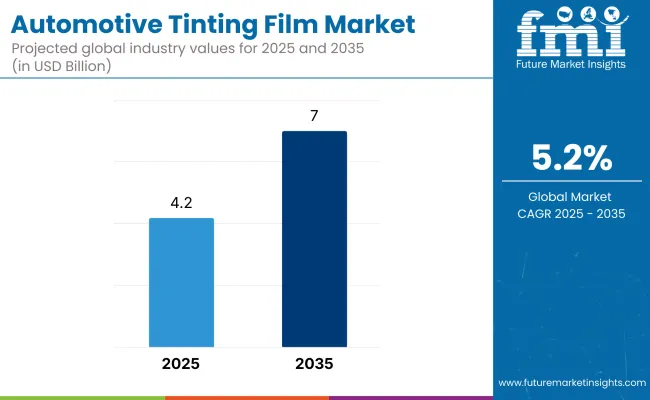

The automotive tinting film market is valued at USD 4.2 billion in 2025 and is expected to reach nearly USD 7.0 billion by 2035, advancing at a 5.2 % CAGR throughout the forecast period.

Within the automotive tinting film market, the United States remains the most lucrative country in 2025 thanks to stringent UV-exposure regulations and a thriving customization culture. Meanwhile, China is poised to be the fastest-growing national market from 2025 to 2035 as premium electric-vehicle (EV) adoption accelerates across Tier-1 and Tier-2 cities.

Rising cabin-temperature concerns, stricter glare-reduction laws, and consumer focus on privacy are reshaping the automotive tinting film landscape. OEMs and aftermarket installers alike prioritise films with infrared (IR) rejection above 90 % and UV blockage over 99 %. Energy-efficient nano-ceramic films gain traction as EV makers seek to extend battery range by cutting air-conditioning load.

However, inconsistent tint-legislation enforcement restrains penetration in several developing economies, prompting manufacturers to launch tint-compliance calculators and modular shade kits. Key trends include colour-stable pigments, paint-protection hybrid laminates, and do-it-yourself pre-cut kits sold via e-commerce channels.

Looking ahead, the automotive tinting film market is set to transition toward adaptive, smart-glass-ready solutions. Electro-chromic overlays that shift visible-light transmission (VLT) in real time will begin commercial rollout by 2030, allowing drivers to toggle tint levels via infotainment apps.

Self-healing top-coats infused with elastomeric resins are expected to reduce swirl marks and extend film life by up to 40 %. Suppliers that embed open-protocol IoT tags for warranty tracking, meet UNECE R-43 optical-clarity thresholds, and offer subscription-based “film-as-a-service” packages will capture outsized share as global fleets electrify and personalise.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 4.2 billion |

| Projected Value (2035F) | USD 7.0 billion |

| Value-based CAGR (2025 to 2035) | 5.2 % |

Nano-ceramic films-engineered with non-metallic oxide particles that block up to 99 % of UV and 95 % of IR without radio-signal interference-are hitting an adoption inflection point as EV makers and luxury OEMs demand high clarity and thermal rejection.

Dyed films retain volume leadership in cost-sensitive aftermarket channels, while metallized films face a slow decline due to GPS and mobile-signal disruption concerns. Manufacturers now bundle nano-ceramic SKUs with lifetime colour-stability warranties and anti-scratch coatings, spurring premium replacement cycles in North America, Europe, and the Middle East.

| Film Type | CAGR (2025 to 2035) |

|---|---|

| Nano-Ceramic Films | 6.8 % |

Passenger cars-including sedans, hatchbacks, and SUVs-contribute more than 70 % of global tinting-film revenue, propelled by rising ride-sharing usage and heightened occupant-comfort expectations. Commercial fleets follow, adopting IR-reflective films to cut fuel spent on climate control.

The nascent robo-taxi segment favours electro-chromic tints that auto-adjust for camera and LiDAR performance. As urban heat-island effects intensify, municipalities are also mandating OEM-level tints on public buses, broadening the market base.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Passenger Vehicles | 5.6 % |

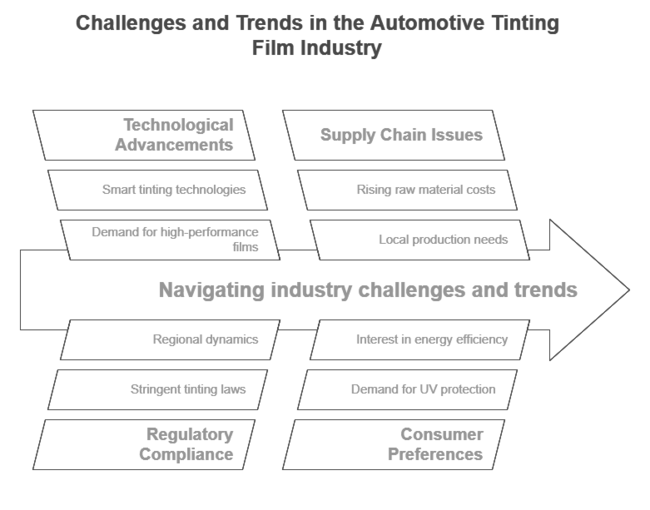

According to Future Market Insights, one of the major findings was the rise in high-performance film demand, especially ceramic and nano-ceramic types that offer better heat rejection and durability. According to the survey, over 65% of industry professionals stated that consumers prioritize UV protection and energy efficiency over aesthetics when selecting tinting films.

Another key finding was the trend toward a greater emphasis on regulatory compliance and regional industry dynamics. 58% of respondents expressed concerns about strict tinting laws, particularly in Europe and North America, where VLT regulations are stringent.

Asia-Pacific stakeholders, however, pointed to a loosened regulatory frame that contributed to quicker adoption rates. Nearly 40% of OEMs are exploring collaborations with smart glass technology companies, reflecting the growing interest in electrochromic and photochromic tinting solutions.

Supply chain issues emerged as another major topic of discussion. More than 70% of manufacturers identified rising raw material costs and global supply chain disruptions as major constraints to scalability. Distributors specifically cited local production facilities to minimize delays and save money. Some companies are investing in sustainable and recyclable materials to lift supply chain constraints and respond to growing consumer demand for greener solutions.

Overall, the survey reaffirmed that innovative technologies, regulatory compliance measures, and eco-friendly initiatives will characterize the future of the automotive tinting film industry. Next-generation tinting films that have smart, heat-regulating capabilities will help drive up vehicle energy efficiency and passenger comfort, according to experts.

| Countries | Regulations on Automotive Tinting Films |

|---|---|

| United States (USA) | Most states require at least 70% VLT (Visible Light Transmission) for their front windows; laws vary from state to state. Darker tints may be permitted in some states with a medical exemption. |

| United Kingdom (UK) | The windscreen must allow at least 75% VLT to replace the front, and the front side windows must allow at least 70% VLT. Rear windows are unrestricted. |

| France | Front side windows must have at least 70% VLT, but there are no restrictions on rear windows. Heavy tinting of front windows has been prohibited since 2017. |

| Germany | Front window tint must be a factory option and must have at least 70% VLT. There are no restrictions on rear windows, but they must have outside mirrors. |

| Italy | Front windows must only be tinted to 70% VLT; rear windows can be tinted, but dual side mirrors are needed. Police enforcement is strict. |

| South Korea | There is no specific VLT front window limitation, but the front window tint can be ticketed if it is excessively affecting visibility. |

| Japan | Frontside windows can have at least 70% VLT. The only restriction is that it cannot be dark enough to impede rear visibility. |

| China | Front windscreen: 70% VLT; side windows: Varies by province. Normally, one cannot tint the front windows darkly. |

| Australia & New Zealand | Australia: 35% VLT on the front side windows; top strip only for windscreens. NZ: 35% VLT front windows; darker behind that. |

| India | Front windshield and front side windows must allow at least 70% VLT; rear windows must allow at least 50% VLT. Dark tints are banned for security reasons. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry showed ongoing growth due to increased applications for UV protection and heat rejection. | The industry is expected to see rapid growth, driven by technological advancements and a growing focus on sustainability. |

| Ceramic and nano-ceramic films became the most sought-after over-dyed films. | Trends in smart tinting technologies (electrochromic & photochromic) are gaining popularity in EVs and luxury vehicles. |

| In countries such as the USA, UK, and Germany, strict government regulations have affected adoption. | The regulatory environment is changing, with some countries loosening their tinting laws to support energy efficiency. |

| Supply chain disruptions (COVID-19, raw material shortages) affected manufacturing and pricing. | Localized production and sustainable materials will address supply chain concerns. |

| Personal car owners and after-industry installs primarily drive demand. | Partnerships between OEMs and tint manufacturers to grow-tinting solutions becoming integrated as factory-installed features. |

| Asia-Pacific continues to lead global sales, with China and India experiencing the fastest growth. | North America and Europe are expected to be key industries due to the surge in EVs and higher efficiency standards. |

The USA automotive tinting film industry is driven by the interaction of state-level legislation, increasing consumer demand for UV protection, and the increasing presence of electric vehicles (EVs). Federal regulations do not mandate tinting restrictions, but individual states have varying Visible Light Transmission (VLT) laws, and the majority require front windows to have a minimum of 70% VLT.

Due to their heat rejection and non-metallic nature, ceramic and nano-ceramic films are increasingly in demand for smart cars and EVs. The USA has a healthy after-industry industry, with many auto owners looking for customized tinting solutions for privacy and beauty.

In the UK, the vast majority of the industry is fuelled by strict tinting legislation that calls for 75% VLT on the windscreen, 70% VLT on front windows, and none on rear windows. The cars in the luxury and executive class are exhibiting increasing demand for high-clarity and IR-blocking films.

The UK's push toward a cleaner, more electric future has set smart tinting solutions and heat-reducing films squarely under the international spotlight. Vehicle owners and fleets are considering tinting options to enhance energy efficiency. The size of premium automobile makers in the UK also fuels the OEM application of upscale tinting films.

Since 2017, France has enforced strict tinting laws requiring front windows to have at least 70% VLT. Such regulation has affected the after-industry sector, redirecting consumers toward lawful, high-visibility tints, which include crystalline and clear nano-ceramic films.

With parts of the south of France particularly sunny more often than not, there is a growing need in the industry for films that protect against UV rays and anti-glare films. Growth is also supported by the increasing sales of EVs and hybrid vehicles, whereby OEM tints are introduced in several automotive brands. Furthermore, the French government's focus on energy efficiency is boosting the use of heat-rejecting films.

In Germany, VLT transfer from the factory is allowed on front windows, but a minimum of 70% should be supplied there. It has led to strong OEM adoption, with luxury automakers such as BMW, Audi, and Mercedes-Benz offering tint-from-the-factory windows.

In Germany, high-performance ceramic and hybrid films are in high demand as there is no compromise with legal visible light transmission (VLT) limits with these films, and they also provide heat rejection. In EVs and luxury vehicles, infrared-reflective and self-tinting technologies are gaining interest. Regulatory compliance and quality certification requirements in Germany channel manufacturers towards high-end, durable, and sustainable tinting solutions.

For front windows, Italy uses the 70% VLT rule, and rear window tinting has fewer restrictions if dual side mirrors are present. As ceramic and hybrid films offer superior UV protection, their adoption is on the rise in Italy, a country with a warm climate. Another important segment is sports cars and luxury vehicles, which often use high-clarity and non-reflective tints.

Italy's automotive after-industry segment is significant for expansion, as local customers opt for customized window tinting products. The increasing adoption of EVs is further driving the demand for high-end heat-rejecting films for enhanced battery efficiency and cabin comfort.

With tinted windows, the country has the loosest tinting laws in South Korea, which means moderate tinting is permitted even on front windows as long as the visibility is not compromised. There is a growing demand for ceramic and nano-ceramic films in the country, particularly in premium cars and EVs. Given Hyundai and Kia's big moves into EV production, smart tinting technologies are gaining traction.

Film for the latter two segments could be popular in Korea due to the country's growing tech-friendly automotive sector (i.e., photochromic & electrochromic). They ensure the production of high-quality films both domestically and for export, thanks to strengthened manufacturing capabilities and competitive prices.

Rear window tinting, which reduces glare and protects the interior, requires more than 70% VLT on front windows. Due to high consumer awareness of UV protection and heat reduction, sales of ceramic, hybrid, and crystalline films are witnessing strong growth. Brands in the rapidly expanding EV and hybrid car industry-including Toyota and Nissan-will also drive the heat-reducing and smart tinting solutions.

Moreover, Japan’s focus on vehicle aesthetics is accelerating the implementation of premium non-reflective tints. High-tech automotive suppliers also promote innovation in self-tinting and electrochromic film technologies.

A booming automobile industry, in addition to an increasing appetite for UV protection films, makes China one of the largest automotive tinting film industries. Provincial law is iffy, but the 70% VLT rule for the front windscreens appears to be pretty widely enforced. With high-performance films for heat rejection becoming standard, the industry is switching to ceramic and nano-ceramic tints. The increasing adoption of EVs in China, catered to by brands such as BYD and Nio, is driving demand for smart tinting films.

Moreover, government subsidies for energy-efficient vehicles are driving the use of infrared-blocking and heat-reducing tinting technologies to enhance vehicle efficiency during high temperatures. Over the next ten years (2025 to 2035), the demand for automotive tinting film in China is likely to rise by 5.0% CAGR.

Australia-35% VLT is required for the front side windows in Australia, and large tinted windscreens are not allowed, only a top strip. New Zealand has similar rules that permit darker tints for rear windows. Warmer climates create a robust need for films that block heat and UV rays, particularly in commercial vehicles and SUVs.

The most common types of films are ceramic and hybrid films because of their robust nature and high heat rejection properties. The expanding EV industry in Oz and NZ is also encouraging demand for smart tinting technologies. Also, government programs that enable people to buy energy-efficient cars are promoting the use of infrared and crystalline tinting films to lower the load on air conditioners and make cars more efficient overall.

The VLT percentage for windscreens must be at least 70%, and for side windows, at least 50%. Despite rising temperatures, the demand for heat-reducing films permitted by the regulation is increasing. Luxury and EV owners are turning to ceramic and nano-ceramic films for UV protection and energy efficiency. OEMs are adding factory tinting, and fleet operators are looking for fuel-saving options. The after-industry industry is still busy despite the enforcement against illegal films.

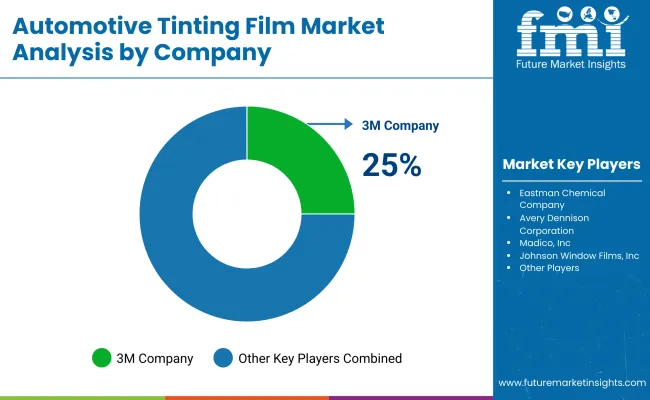

Regional and global players fragment the automotive tinting film industry. Below, are the top four companies and project their industry share for 2024.

3M Company

Industry Share: ~25%

3M is a global leader in automotive tinting film, provides a wide range of high-performance window films that can help protect and enhance the appearance of any vehicle. They offer various tinting films, which are listed below, which also give helps in UV protection and heat reduction options for a cooler and more comfortable ride.

Eastman Chemical Company (LLumar, SunTek)

Industry Share: ~20%

Eastman Chemical Company is one of the automotive tinting film companies that own the brands LLumar and SunTek. The company has a rich catalog of film technologies and a sophisticated distribution network.

Avery Dennison Corporation

Industry Share: ~15%

A global materials science and manufacturing company that is a leader in adhesive technologies, including automotive tinting films. It provides a comprehensive suite of products for original equipment manufacturers (OEM) and after-industry applications.

Madico, Inc.

Industry Share: ~12%

Madico is a leading manufacturer of window films, including automotive tinting films. In fact, the company is known for its high-quality products and strong customer support.

Johnson Window Films, Inc.

Industry Share: ~10%

Johnson Window Films specializes in automotive tinting films and offers various products that provide heat reduction, UV protection, and privacy.

Other Players

Industry Share: ~18%

A significant portion of the industry share is shared among smaller local operators and new competitors, with many focusing on niche industries or specialized film technology.

3M Introduction: A New Series of Eco-Friendly Tinting Films

3M Holographic Tinting Films For the environmentally conscious, 3M recently released a new line of eco-friendly tinting films that are made from sustainable substrates, adding to their lineup, which includes holographic films. The development of this trend took into account the growing demand for sustainable automotive products.

Eastman Chemical Company expands production capacity for

UK: Eastman Chemical Company added production capacity in Asia, where automotive tinting films are experiencing rapid expansion. The move is expected to strengthen the company's industry presence.

Avery Dennison High-Performance Films

Avery Dennison Launches New Line of Durable, Scratch-Resistant, High-Performance Tinting Films Hence, it will be quite significant since the demand for durable and premier-quality tinting film is continually on the rise.

OEMs will regularly use Madico Automotive products on their vehicles

Madico formed a new strategic partnership with a leading automotive OEM for window-tinting films for new cars. We expect these partnerships to provide additional assistance for both industry growth and expansion.

Johnson Window Films New Product Launch: Ceramic-Based Films

Johnson Window Films adds a new series of ceramic tinting films. Expanding their product lineup with advanced tinting solutions, these acquisitions can provide significant benefits.

The automotive tinting film industry is closely connected to the automotive after-industry and specialty materials industries, including sectors such as automotive manufacturing, energy efficiency solutions, and consumer trends in vehicle personalization. Macroeconomic factors such as global automotive production trends, raw material prices, energy prices, and legislative structures greatly influence its growth.

Growing vehicle production on an industrial scale and ownership levels in emerging economies, particularly in Asia, the Pacific, and Latin America, are fuelling demand for automotive tinting films. However, in mature industries like North America and Europe, there is an increasing trend towards high-performance and eco-friendly tinting products with regulatory standards on vehicle emissions, fuel economy, and improved passenger safety acting as catalysts to the new demand. The shift to electric vehicles (EVs) is another key macroeconomic driver.

However, growing consumer awareness regarding UV protection, energy savings, and aesthetic customization keeps the industry steady. Moreover, the introduction of smart and self-tinting films is further propelled by government policies promoting energy-efficient transportation infrastructure in countries including China, Germany, and the US.

These factors bring a wide pool of growth opportunities for the automotive tinting film industry due to technological advancement, rising EV usage, changes in regulations, and consumer trends. High-performance ceramic and nano-ceramic films are likely to see a significant increase in demand because these films are being designed to meet specific needs for heat resistance, UV blocking, and energy efficiency. In developing economies like China, India, and Southeast Asia, growth is particularly robust, spurred by rising car ownership and weather extremes that incentivize tinting.

Next-gen smart tinting technologies, particularly photochromic, electrochromic, and self-tinting films, are gaining traction as well, with a growing footprint in the luxury and EV space. Furthermore, the stricter government regulations concerning energy efficiency and vehicle safety are driving OEMs to adopt factory-installed tinting solutions, thereby offering top-tier tint manufacturers the chance to collaborate with OEMs through B2B programs. They can grow even further by entering commercial vehicle and fleet industries, where companies are seeking to cut costs by reducing interior cooling.

For new entrants, innovation and compliance are critical differentiators. Eco-friendly, sustainable, and smart tinting technologies give an edge. ML-based development in smart materials collaborating with OEMs, automotive dealerships, and fleet operators can hasten the time to industry.

The industry is segmented into hybrid film, ceramic film, carbon tints, crystalline (or clear) glass Tints, metalized tints, and others

It is fragmented into passenger cars (compact, midsize, SUV & luxury), light commercial vehicles, and heavy commercial vehicles

It is divided into windows and windshields

It is fragmented into North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltics, East Asia, South Asia Pacific, and Middle East Africa

Automotive screens tinted with specialized tinting technology block UV rays, scale back temperature and glare and enhance comfort degree by increasing power efficiency.

Due to their resistance to fading, durability, and better heat rejection properties, ceramic and nano-ceramic films have the longest life span.

Yes, different countries/states have laws regarding visible light transmission (VLT) limits, especially for front windows and windscreens.

High-quality tints also reduce heat reaching the interior, which reduces air-conditioning use and improves battery efficiency, so the industry is booming for electric vehicles, too.

This technology is yielding intelligent tints, films that change according to electrical inputs, and coatings that reflect infrared for increased energy savings, privacy, and dynamic shading.

Table 01: Global Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 02: Global Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 03: Global Market Volume (Th. Sq. Mt) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 04: Global Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 05: Global Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 06: Global Market Size Volume (Th. Sq. Mt) Analysis and Forecast By Region, 2018 to 2022

Table 07: Global Market Size Volume (Th. Sq. Mt) Analysis and Forecast By Region, 2023 to 2033

Table 08: Global Market Size (US$ Million) Analysis and Forecast By Region, 2018 to 2033

Table 09: North America Market Size (US$ Million) and Volume (Th. Sq. Feet) Analysis and Forecast By Country, 2018 to 2033

Table 10: North America Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 11: North America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 12: North America Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 13: North America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 14: North America Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data By Application

Table 15: North America Market Value (US$ Million) and Volume (Th. Sq. Feet) Forecast 2023 to 2033 By Application

Table 16: Latin America Market Size (US$ Million) and Volume (Th. Sq. Feet) Analysis and Forecast By Country, 2018 to 2033

Table 17: Latin America Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 18: Latin America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 19: Latin America Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 20: Latin America Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 21: Latin America Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 By Application

Table 22: Latin America Market Value (US$ Million) and Volume (Th. Sq. Feet) and Forecast 2023 to 2033 By Application

Table 23: Western Europe Market Size Volume (Th. Sq. Feet) Analysis and Forecast By Country, 2018 to 2033

Table 24: Western Europe Market Size (US$ Million) Analysis and Forecast By Country, 2018 to 2033

Table 25: Western Europe Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 26: Western Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 27: Western Europe Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 28: Western Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 29: Western Europe Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 By Application

Table 30: Western Europe Market Value (US$ Million) and Volume (Th. Sq. Feet) Forecast 2023 to 2033 By Application

Table 31: Eastern Europe Market Volume (Th. Sq. Feet) and Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 32: Eastern Europe Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 33: Eastern Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 34: Eastern Europe Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 35: Eastern Europe Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 36: Eastern Europe Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 By Application

Table 37: Eastern Europe Market Value (US$ Million) and Volume (Th. Sq. Feet) Forecast 2023 to 2033 By Application

Table 38: Central Asia Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 39: Central Asia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 40: Central Asia Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 41: Central Asia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 42: Central Asia Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 By Application

Table 43: Central Asia Market Value (US$ Million) and Volume (Th. Sq. Feet) Forecast 2023 to 2033 By Application

Table 44: Russia & Belarus Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 45: Russia & Belarus Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 46: Russia & Belarus Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 47: Russia & Belarus Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 48: Russia & Belarus Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 49: Russia & Belarus Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 50: Balkan & Baltics Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 51: Balkan & Baltics Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 52: Balkan & Baltic Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 53: Balkan & Baltic Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 54: Balkan & Baltic Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 By Application

Table 55: Balkan & Baltic Market Value (US$ Million) and Volume (Th. Sq. Feet) Forecast Data 2023 to 2033 By Application

Table 56: East Asia Market Size (US$ Million) and Volume (Th. Sq. Feet) Analysis By Country, 2018 to 2022

Table 57: East Asia Market Size (US$ Million) and Volume (Th. Sq. Feet) Analysis and Forecast By Country, 2023 to 2033

Table 58: East Asia Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 59: East Asia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 60: East Asia Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 61: East Asia Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 62: East Asia Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 By Application

Table 63: East Asia Market Value (US$ Million) and Volume (Th. Sq. Feet) Forecast 2023 to 2033 By Application

Table 64: SAP Market Size (US$ Million) and Volume (Th. Sq. Feet) Historical By Country, 2018 to 2033

Table 65: SAP Market Size (US$ Million) and Volume (Th. Sq. Feet) Analysis and Forecast By Country, 2023 to 2033

Table 66: South Asia Pacific Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 67: South Asia Pacific Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 68: South Asia Pacific Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 69: South Asia Pacific Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 70: South Asia Pacific Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data Analysis By Application

Table 71: South Asia Pacific Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 72: Middle East & Africa Market Size (US$ Million) and Volume (Th. Sq. Feet) Historical Analysis By Country, 2018 to 2022

Table 73: Middle East & Africa Market Size (US$ Million) and Volume (Th. Sq. Feet) Analysis and Forecast By Country, 2023 to 2033

Table 74: Middle East & Africa Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 75: Middle East & Africa Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Film Type

Table 76: Middle East & Africa Market Volume (Th. Sq. Feet) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 77: Middle East & Africa Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Vehicle Type

Table 78: Middle East & Africa Market Value (US$ Million) and Volume (Th. Sq. Feet) Historical Data 2018 to 2022 By Application

Table 79: Middle East & Africa Market Value (US$ Million) and Volume (Th. Sq. Feet) Forecast Data Analysis 2023 to 2033 By Application

Figure 01: Global Market Historical Volume (Th. Sq. Feet), 2018 to 2022

Figure 02: Global Market Current and Forecast Volume (Th. Sq. Feet), 2023 to 2033

Figure 03: Global Market Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Market Current and Forecast Value (US$ Million), 2023 to 2033

Figure 05: Global Market Incremental $ Opportunity (US$ Million), 2023 to 2033

Figure 06: Global Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 07: Global Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Dyed Film Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Hybrid Film Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Ceramic Film Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity by Carbon Tints Segment, 2018 to 2033

Figure 13: Global Market Absolute $ Opportunity by Crystalline Glass Tints Segment, 2018 to 2033

Figure 14: Global Market Absolute $ Opportunity by Metallised Tints Segment, 2018 to 2033

Figure 15: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 16: Global Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 17: Global Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 18: Global Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 19: Global Market Absolute $ Opportunity by Passenger Cars Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by Light Commercial Vehicles Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity by Heavy Commercial Vehicles Segment, 2018 to 2033

Figure 22: Global Market Share and BPS Analysis By Application, 2023 & 2033

Figure 23: Global Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 24: Global Market Attractiveness Analysis By Application, 2023 to 2033

Figure 25: Global Market Absolute $ Opportunity by Windows Segment, 2018 to 2033

Figure 26: Global Market Absolute $ Opportunity by Windshields Segment, 2018 to 2033

Figure 27: Global Market Value Share and BPS Analysis By Region, 2023 & 2033

Figure 28: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 29: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 30: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 32: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 34: Global Market Absolute $ Opportunity by Central Asia Segment, 2018 to 2033

Figure 35: Global Market Absolute $ Opportunity by Russia & Belarus Segment, 2018 to 2033

Figure 36: Global Market Absolute $ Opportunity by Balkan & Baltic Countries Segment, 2018 to 2033

Figure 37: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 38: Global Market Absolute $ Opportunity by South Asia & Pacific Segment, 2018 to 2033

Figure 39: Global Market Absolute $ Opportunity by Middle East & Africa Segment, 2018 to 2033

Figure 40: North America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 41: North America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 42: North America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 43: North America Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 44: North America Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 45: North America Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 46: North America Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 47: North America Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 48: North America Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 49: North America Market Share and BPS Analysis By Application, 2023 & 2033

Figure 50: North America Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 51: North America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 52: Latin America Market Share and BPS Analysis By Country, 2023 & 2033

Figure 53: Latin America Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 54: Latin America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 55: Latin America Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 56: Latin America Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 57: Latin America Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 58: Latin America Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 59: Latin America Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 60: Latin America Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 61: Latin America Market Share and BPS Analysis By Application, 2023 & 2033

Figure 62: Latin America Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 63: Latin America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 64: Western Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 65: Western Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 66: Western Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 67: Western Europe Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 68: Western Europe Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 69: Western Europe Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 70: Western Europe Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 71: Western Europe Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 73: Western Europe Market Share and BPS Analysis By Application, 2023 & 2033

Figure 74: Western Europe Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 75: Western Europe Market Attractiveness Analysis By Application, 2023 to 2033

Figure 76: Eastern Europe Market Share and BPS Analysis By Country, 2023 & 2033

Figure 78: Eastern Europe Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 79: Eastern Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 80: Eastern Europe Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 81: Eastern Europe Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 82: Eastern Europe Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 83: Eastern Europe Market Share and BPS Analysis By Region, 2023 & 2033

Figure 84: Eastern Europe Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 85: Eastern Europe Market Attractiveness Analysis By Region, 2023 to 2033

Figure 86: Eastern Europe Market Share and BPS Analysis By Application, 2023 & 2033

Figure 87: Eastern Europe Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness Analysis By Application, 2023 to 2033

Figure 89: Central Asia Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 90: Central Asia Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 91: Central Asia Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 92: Central Asia Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 93: Central Asia Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 94: Central Asia Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 95: Central Asia Market Share and BPS Analysis By Application, 2023 & 2033

Figure 96: Central Asia Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 97: Central Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 98: Russia & Belarus Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 99: Russia & Belarus Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 100: Russia & Belarus Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 101: Russia & Belarus Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 102: Russia & Belarus Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 103: Russia & Belarus Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 104: Russia & Belarus Market Share and BPS Analysis By Application, 2023 & 2033

Figure 105: Russia & Belarus Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 106: Russia & Belarus Market Attractiveness Analysis By Application, 2023 to 2033

Figure 107: Balkan & Baltics Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 108: Balkan & Baltics Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 109: Balkan & Baltics Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 110: Balkan & Baltic Market Share and BPS Analysis By Vehicle Type, 2023 & 2033

Figure 111: Balkan & Baltic Market Y-o-Y Growth Projections By Vehicle Type, 2023 to 2033

Figure 112: Balkan & Baltic Market Attractiveness Analysis By Vehicle Type, 2023 to 2033

Figure 113: Balkan & Baltic Market Share and BPS Analysis By Application, 2023 & 2033

Figure 114: Balkan & Baltic Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 115: Balkan & Baltic Market Attractiveness Analysis By Application, 2023 to 2033

Figure 116: East Asia Market Share and BPS Analysis By Country, 2023 & 2033

Figure 117: East Asia Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis By Country, 2023 to 2033

Figure 119: East Asia Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 120: East Asia Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 121: East Asia Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 122: East Asia Market Share and BPS Analysis By Region, 2023 & 2033

Figure 123: East Asia Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 124: East Asia Market Attractiveness Analysis By Region, 2023 to 2033

Figure 125: East Asia Market Share and BPS Analysis By Application, 2023 & 2033

Figure 126: East Asia Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 127: East Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 128: South Asia Pacific Market Share and BPS Analysis By Country, 2023 & 2033

Figure 129: South Asia Pacific Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 130: South Asia Pacific Market Attractiveness Analysis By Country, 2023 to 2033

Figure 131: South Asia Pacific Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 132: South Asia Pacific Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 133: South Asia Pacific Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 134: South Asia Pacific Market Share and BPS Analysis By Region, 2023 & 2033

Figure 135: South Asia Pacific Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 136: South Asia Pacific Market Attractiveness Analysis By Region, 2023 to 2033

Figure 137: South Asia Pacific Market Share and BPS Analysis By Application, 2023 & 2033

Figure 138: South Asia Pacific Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 139: South Asia Pacific Market Attractiveness Analysis By Application, 2023 to 2033

Figure 140: Middle East & Africa Market Share and BPS Analysis By Country, 2023 & 2033

Figure 141: Middle East & Africa Market Y-o-Y Growth Projections By Country, 2023 to 2033

Figure 142: Middle East & Africa Market Attractiveness Analysis By Country, 2023 to 2033

Figure 143: Middle East & Africa Market Share and BPS Analysis By Film Type, 2023 & 2033

Figure 144: Middle East & Africa Market Y-o-Y Growth Projections By Film Type, 2023 to 2033

Figure 145: Middle East & Africa Market Attractiveness Analysis By Film Type, 2023 to 2033

Figure 146: Middle East & Africa Market Share and BPS Analysis By Region, 2023 & 2033

Figure 147: Middle East & Africa Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 148: Middle East & Africa Market Attractiveness Analysis By Region, 2023 to 2033

Figure 149: Middle East & Africa Market Share and BPS Analysis By Application, 2023 & 2033

Figure 150: Middle East & Africa Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 151: Middle East & Africa Market Attractiveness Analysis By Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA