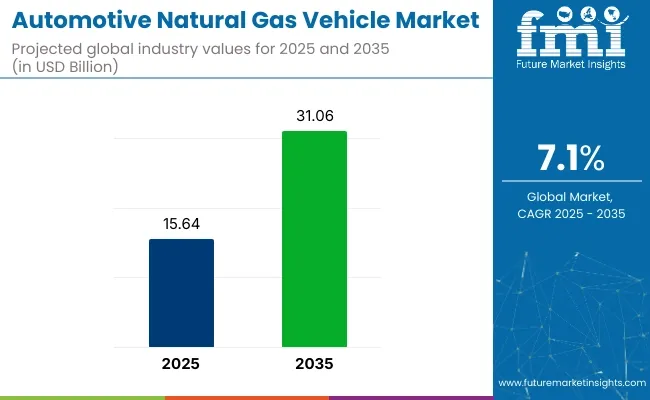

The global automotive natural gas vehicle (NGV) market is projected to reach USD 15.64 billion in 2025 and is expected to grow to USD 31.06 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. Growth is being driven by increasing fuel cost volatility, emission regulations, and rising demand for low-emission alternatives to diesel in commercial transport applications.

Cummins Inc., a major supplier of natural gas powertrains, continues to invest in dedicated and dual-fuel engines for light, medium, and heavy-duty commercial vehicles. As noted on the company’s official engine portfolio page, the B6.7N and L9N natural gas engines are certified to meet near-zero emission standards and are in use across refuse, transit, and regional haul fleets. These engines are engineered to operate on both compressed natural gas (CNG) and renewable natural gas (RNG), offering a reduction of up to 90% in greenhouse gas emissions compared to diesel.

In February 2025, Slashdot Tech reported on Honda’s new USA plant capable of producing both electric vehicles and gas-powered models, including alternative fuel platforms. While EVs remain a central focus, the flexibility to build CNG-compatible vehicles was included to meet market-specific demand in Latin America and select parts of Asia where natural gas vehicle adoption remains high.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 15.64 billion |

| Projected Market Value (2035F) | USD 31.06 billion |

| Value-based CAGR (2025 to 2035) | 7.1% |

In the Caribbean, a milestone was achieved in 2024 with Barbados launching its first bio-CNG vehicle, powered by Sargassum seaweed-derived gas. As reported by the Caribbean Community (CARICOM), this project marked a key step in advancing renewable natural gas applications in transport and reducing ocean waste through integrated fuel generation.

Meanwhile, in the United States, utilities like Nicor Gas are promoting NGVs through fleet conversion programs and infrastructure development. As stated on its official platform, Nicor has supported school districts, municipalities, and delivery fleets with fueling stations and incentive models to expand natural gas adoption in transportation.

With growing interest in RNG, lower total cost of ownership, and infrastructure expansion, the automotive NGV market is expected to remain a critical component of the global low-emission transport ecosystem through 2035.

Commercial use accounted for 46% of the global gaseous-fueled vehicle market in 2025 and is projected to grow at a CAGR of 7.4% through 2035. Growth was primarily driven by increased adoption among logistics fleets, taxi service operators, and municipal agencies seeking cost-effective and cleaner-burning alternatives to diesel and gasoline.

In 2025, fleet conversions to CNG and LNG vehicles were undertaken across urban delivery, public works, and contracted taxi operations in regions with established refueling infrastructure. Municipal bodies in India, Brazil, and Eastern Europe prioritized gaseous-fueled vehicles to meet city-level air quality mandates.

Long-term fuel cost savings and lower particulate emissions supported procurement in waste collection, transit shuttles, and last-mile logistics. Operational fleets adopted dual-fuel and dedicated gas models based on route requirements, supported by favorable government subsidies and local fuel pricing structures.

Medium-range vehicles (300 to 600 km) held 39% of the market share in 2025 and are projected to grow at a CAGR of 7.5% through 2035. This range category offered a practical balance between fuel storage capacity, refueling frequency, and vehicle weight-especially critical for commercial vehicles operating beyond city limits.

In 2025, CNG and LNG-powered vans, mini-trucks, and buses with medium driving ranges were widely adopted for regional distribution, fixed-route intercity services, and utility operations. OEMs optimized engine tuning and onboard tank configurations to extend operational range without compromising payload.

Adoption was concentrated in countries like China, Italy, and Argentina, where policy incentives and widespread refueling networks supported gaseous fuel use. Medium-range configurations were particularly favored by operators managing consistent route distances, enabling efficient refueling schedules and predictable fuel cost structures.

Many countries are heavily investing in reducing carbon emissions. For example, in July 2023, the Department of Energy (DOE) announced to spend over USD 23 million to decrease carbon emissions across the USA Moreover, natural gas is climate-neutral and can be a feasible approach toward sustainability.

Thus, the rising concerns about carbon emissions among governments of different nations has led to the adoption of natural gas vehicles.

Many companies are investing huge amounts in the production of natural gas vehicles such as Honda, Suzuki, and others. In this regard, they are engaged in intense research and development activities for the launch of new and innovative capabilities of products.

Additionally, many companies are formulating important strategies to deploy sustainable fuel cell technology due to the growing concern for decreasing carbon emissions. For instance, in July 2024, Suzuki announced that it has started the construction of biogas plant in Haryana, India.

Many consumers are beginning to adopt natural gas vehicles for their fleets. Companies that rely on delivery services are finding natural gas vehicles (NGVs) to be cost-effective.

According to the USA Energy Information Administration, total sales of battery electric vehicles, hybrid vehicles, and plug-in hybrid electric vehicles rose from 19.1% of total new light-duty vehicle sales in the USA in 2024 to 21.2% in 2034.

The governments of various developed and developing nations are also providing subsidies on the purchase on electric vehicles, which is working in favor of the market growth.

The general public is becoming more aware of the benefits of NGVs, due to rising educational initiatives. As per the USA Department of Energy in October 2020, the USA Department of Energy’s Office of Fossil Energy announced the launch of a new report that showed the benefits of natural gas.

Moreover, government-led campaigns also focus on educating the community about the benefits of NGVs. These factors, coupled with rising per capita income of people backed by the growing working class population is encouraging them to invest in natural gas vehicles.

Technological Innovations in Vehicles

Natural gas vehicles have witnessed many technological innovations. Nowadays, dual-fuel engines are being integrated in these vehicles, which helps decrease range anxiety.

Additionally, advanced manufacturing methods and materials are resulting in stronger tanks, which boosts storage capacity while cutting down vehicular weight. Moreover, advancements in refueling systems have also been made which are making it convenient to refill natural gas vehicles.

Many automobile manufacturers are also focusing on sourcing natural gas through virtual pipelines. Now, this gas can be distributed with the help of specialized containers, which may expand the reachability in remote locations across the world.

Improvement in Refueling Infrastructure

The establishment of refueling locations specifically for natural gas is ramping up. With more stations available, drivers feel more comfortable choosing natural gas vehicles as their primary vehicles.

The Indian government is investing significantly in increasing the network of natural gas refueling places across the nation. This is part of a broader effort to promote the use of natural gas as a cleaner and extra-cheap transportation fuel.

High Cost of Natural Gas May Hamper Market Growth

The price of natural gas is influenced by many factors, such as rising demand, economic growth, and energy transition. The political unrest and war scenario also affects the price of natural gas, which restrains its adoption among many automobile manufacturers. Extreme weather events, such as cold winters, hurricanes, or unusually can also disrupt production or surge demand, disrupting prices.

Scarcity of Natural Gas Reserves May Affect Product Sales

The occurrence of natural gas can differ significantly from region to region due to many factors including weather. Thus, the finite availability of this resource is leading to insufficient infrastructure specifically in developed and developing regions across the world. Additionally, the number of refueling stations for this resource is less, which is a major barrier to market growth in developing countries.

China

The Asia Pacific continues to dominate in NGV uptake, credited to nations such as India and China. Moreover, a considerable rise in the number of LNG-powered trucks have been reported owing to China’s emphasis on decreasing emissions, which has resulted in a reduction in demand for diesel.

The region is also observing a significant rise in the uptake of LNG-powered heavy-duty trucks specifically in China where LNG trucks made up 42% of heavy-duty truck sales in early 2024.

The government in the country is also providing financial assistance for buying LNG trucks, which amounts 20-50% of the vehicle’s price. The government has built more than 5,000 LNG refueling networks countrywide. It is also mandating public buses in key cities to switch to CNG/LNG.

India

The Indian government is also providing financial assistance for the retrofication of vehicles with CNG kits. It also levies 50% decreased road taxes in many states. Additionally, it has made CNG buses and three-wheelers in urban centers compulsory and is offering financial aid for fleet conversion.

USA

The USA held 16.7% market share in 2024. The USA government offers credits to natural gas vehicle owners for using RNG fuel under the Low Carbon Fuel Standard (LCFS).

Additionally, under California's Advanced Clean Trucks Program, the government provides grants and rebates for natural gas vehicles, specifically for transit and freight vehicles. The USA also leads the charge in NGV acceptance, encouraged by stringent government policies and an established infrastructure.

Germany

In Germany, no tax has been levied on natural gas vehicles till 2026. It also offers funding for the establishment of LNG and CNG refueling stations under the National Hydrogen and Fuel Cell Technology Innovation Program. Moreover, for fleet operators, discounts on the purchase of natural gas vehicles and special leasing terms are also offered by the government.

France

The French government offers up to €3,000 for shifting from diesel to natural gas vehicles. Additionally, decreased excise duties on natural gas fuel are being levied as compared to petrol and diesel. The government also offers subsidies for commercial vehicles and offers assistance to businesses to switch to LNG trucks.

UK

The UK held 5.8% market share in 2024. Countries such as the UK are at the forefront in Europe, promoting NGVs as a major part of their sustainability goals. Additionally, Europe’s regulatory environment often favors natural gas as an in-between fuel to help replacements.

There is a healthy competition among companies such as Volkswagen, Fiat Chrysler Automobiles, Honda, and Scania, which are investing in R&D to enhance fuel efficiency and vehicle presentation. Moreover, these companies are working to ensure that the user experience aligns with what drivers anticipate from modern vehicles, focusing on comfort and ease of use.

Original Equipment Manufacturers (OEMs) companies such as General Motors, Honda, and Ford offer factory-built NGV models, using their recognized supply networks and brand credit.

Moreover, aftermarket conversion companies have expertise in converting traditional vehicles to run on natural gas, providing a wider range of vehicle models and offering more reasonable alternatives for consumers.

he automotive natural gas vehicle market is on a rising course, driven by scientific developments, better infrastructure, and changing consumer preferences. As this market grows, it presents an opportunity for both automakers and drivers to reconsider their roles in creating a more ecological future.

Furthermore, the market is observing improved competition from technology companies, traditional automakers, and new entrants. Established automakers are emerging their own NGV models, while new players are concentrating on innovative technologies and business models.

The market size reached USD 15.64 billion in 2025.

The market is predicted to reach a size of USD 31.06 billion by 2034.

The prominent companies in the market include Hyundai Motor Company, Honda Motor Co. Ltd. Suzuki Motor Corporation, and Ford Motor Company.

China is a lucrative country for many automotive natural gas vehicle manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA