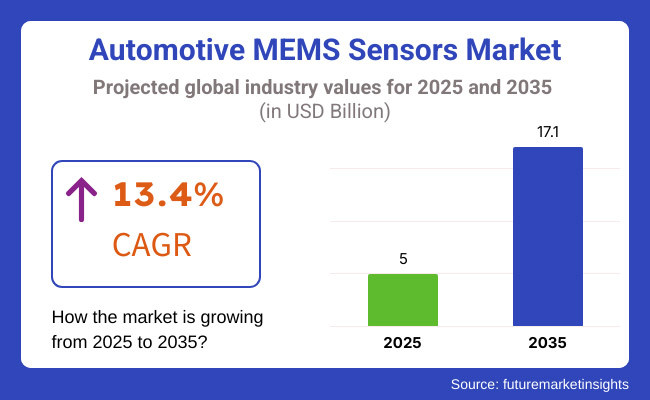

The Automotive MEMS Sensor Market is projected to experience substantial growth between 2025 and 2035, driven by the increasing demand for vehicle automation, safety features, and advanced driver assistance systems (ADAS). The market is expected to expand from USD 5 billion in 2025 to USD 17.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 13.4% over the forecast period.

Micro-electromechanical systems (MEMS) sensors are essential components in modern automobiles, enabling precise motion sensing, crash detection, tire pressure monitoring, and vehicle stability control. The shift toward electric vehicles (EVs), autonomous driving, and smart mobility solutions is further accelerating the adoption of MEMS accelerometers, gyroscopes, pressure sensors, and inertial measurement units (IMUs).

Automakers are integrating MEMS-based sensor networks to enhance collision avoidance, electronic stability programs (ESP), and real-time vehicle diagnostics. Additionally, the increasing focus on vehicle electrification and battery management systems (BMS) is driving demand for MEMS temperature, pressure, and current sensors in EVs.

Despite its strong growth trajectory, challenges related to sensor calibration, miniaturization complexities, and integration with AI-powered automotive systems remain key obstacles. However, continuous advancements in MEMS packaging, sensor fusion technology, and AI-driven predictive maintenance are expected to drive the market forward.

Explore FMI!

Book a free demo

North America remains a leading market for automotive MEMS sensors, with the United States and Canada driving demand due to increasing regulatory mandates for vehicle safety, autonomous vehicle development, and smart transportation initiatives. The National Highway Traffic Safety Administration (NHTSA) and USA Department of Transportation (USDOT) continue to enforce advanced safety regulations, pushing automakers to adopt MEMS-based crash detection, stability control, and airbag deployment sensors.

Companies such as Tesla, Ford, and General Motors are investing in sensor fusion technology, AI-powered MEMS applications, and next-generation EV sensor integration to enhance vehicle intelligence and energy efficiency.

Europe remains a strong market for automotive MEMS sensors, with Germany, France, and the UK leading in automotive innovation, ADAS technology, and EV sensor advancements. The European Union’s stringent vehicle safety regulations and focus on emission reduction are driving MEMS adoption in EVs, hybrid vehicles, and advanced driver monitoring systems.

Automakers such as Volkswagen, BMW, and Renault are integrating MEMS-based environmental sensors, motion detectors, and real-time tire pressure monitoring systems (TPMS) to comply with EU safety mandates and CO₂ emission targets. Additionally, the growing market for autonomous and connected vehicles in Europe is fueling demand for MEMS gyroscopes, LiDAR stabilization units, and accelerometers.

Asia-Pacific is the fastest-growing market for automotive MEMS sensors, led by China, Japan, South Korea, and India, where automotive production, ADAS integration, and EV adoption are expanding rapidly.

China, the largest automotive producer, is investing heavily in smart mobility, vehicle automation, and AI-driven sensor applications, enhancing demand for MEMS accelerometers, gyroscopes, and environmental sensors. Meanwhile, Japan and South Korea lead in precision sensor manufacturing, with companies like Denso, Panasonic, and Murata pioneering MEMS technology for self-driving and electrified vehicles.

The region’s expanding EV market and 5G-connected car ecosystem are accelerating demand for high-performance MEMS sensors in battery management, adaptive cruise control, and digital cockpits. Additionally, government-backed smart city and V2X (Vehicle-to-Everything) communication projects are strengthening Asia-Pacific’s role in MEMS automotive sensor innovation.

High Costs and Regulatory Complexities

The market faces challenges associated with high production costs, stringent regulatory approvals, and integration complexities. Automotive MEMS sensor manufacturers must comply with ISO 26262 (Functional Safety) and UNECE regulations, leading to increased development costs and longer certification timelines.

Accuracy and Reliability in Harsh Environments

MEMS sensors operate in extreme temperatures, vibrations, and electromagnetic interference, posing challenges in ensuring long-term reliability, calibration stability, and real-time performance accuracy for safety-critical applications.

Growing Demand for ADAS and Autonomous Vehicles

The rapid adoption of Advanced Driver Assistance Systems (ADAS) and self-driving technologies is fueling demand for high-precision MEMS sensors. Companies investing in multi-sensor fusion and AI-driven MEMS integration will benefit from the growing need for enhanced vehicle perception and safety systems.

Advancements in Smart Mobility and Electrification

The rise of electric vehicles (EVs), connected cars, and predictive maintenance technologies is driving innovation in MEMS gyroscopes, accelerometers, pressure sensors, and inertial measurement units (IMUs). These advancements enable smart diagnostics, real-time monitoring, and optimized energy efficiency.

Between 2020 and 2024, the automotive MEMS sensor market experienced substantial growth due to increasing vehicle electrification, regulatory mandates for safety, and demand for real-time data processing. Automakers and Tier 1 suppliers focused on integrating high-precision MEMS sensors for ADAS, automated braking, and vehicle dynamics control.

The industry saw major advancements in MEMS-based inertial navigation, LiDAR-enhanced sensor fusion, and smart airbag deployment systems. Innovations in sensor miniaturization, edge AI processing, and high-G shock resistance improved sensor accuracy and system integration.

The COVID-19 pandemic caused temporary supply chain disruptions, impacting MEMS semiconductor fabrication and raw material sourcing. However, post-pandemic recovery accelerated investment in autonomous mobility, connected vehicles, and AI-driven sensor optimization, fueling a surge in demand for high-reliability MEMS solutions.

Looking ahead, from 2025 to 2035, the automotive MEMS sensor market will witness transformative advancements, driven by AI-powered sensor fusion, predictive maintenance algorithms, and next-generation vehicle architectures. The shift toward fully autonomous mobility and AI-enhanced sensor ecosystems will redefine automotive sensor applications.

The development of neuromorphic computing, quantum sensor integration, and bio-inspired MEMS architectures will unlock new possibilities in hyper-accurate motion sensing, smart diagnostics, and immersive in-cabin experiences. The expansion of solid-state LiDAR, 6-axis MEMS IMUs, and self-learning automotive sensors will further strengthen MEMS market penetration.

Sustainability and efficiency will also play a crucial role, as manufacturers focus on low-power MEMS designs, eco-friendly semiconductor materials, and sustainable packaging. Governments and regulatory bodies will drive energy-efficient automotive sensor adoption, ensuring compliance with net-zero emission goals and carbon neutrality policies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ISO 26262 safety and emissions standards influenced MEMS sensor adoption. |

| Technological Advancements | MEMS sensors enhanced ADAS, in-cabin monitoring, and electric powertrain efficiency. |

| Industry Applications | MEMS adoption focused on braking, airbag systems, vehicle stability, and pressure sensing. |

| Environmental Sustainability | Increased emphasis on miniaturized, power-efficient MEMS sensor designs. |

| Market Growth Drivers | Rising demand for ADAS, connected vehicles, and enhanced driver safety. |

| Production & Supply Chain Dynamics | Semiconductor shortages temporarily impacted MEMS sensor manufacturing and distribution. |

| End-User Trends | Consumers prioritized enhanced safety, real-time diagnostics, and improved ride comfort. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-integrated safety mandates, low-power MEMS standards, and cybersecurity regulations reshape sensor requirements. |

| Technological Advancements | AI-driven multi-sensor fusion, quantum-enhanced MEMS, and neuromorphic sensor processing dominate the market. |

| Industry Applications | Expansion into autonomous navigation, predictive vehicle diagnostics, and real-time V2X communication. |

| Environmental Sustainability | Full-scale adoption of energy-harvesting MEMS sensors and recyclable semiconductor materials. |

| Market Growth Drivers | AI-integrated sensor ecosystems, autonomous mobility advancements, and cloud-based predictive analytics drive growth. |

| Production & Supply Chain Dynamics | Localized chip fabrication, AI-driven inventory optimization, and sustainable MEMS production improve supply chain resilience. |

| End-User Trends | Demand shifts toward self-learning, AI-powered MEMS sensors with real-time over-the-air updates. |

The USA automotive MEMS sensor market is witnessing substantial growth due to the increasing adoption of advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies. Major automotive and semiconductor companies, including Tesla and Texas Instruments, are investing in next-generation MEMS sensors for enhanced safety, navigation, and performance monitoring.

Government regulations on vehicle safety, such as mandates for electronic stability control (ESC) and tire pressure monitoring systems (TPMS), are further driving market expansion. Additionally, the integration of MEMS sensors in connected car ecosystems is fueling demand for high-performance sensor solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.2% |

The UK automotive MEMS sensor market is growing due to the rising demand for high-precision sensing solutions in autonomous vehicles, smart mobility applications, and electric cars. With a strong presence of luxury and performance vehicle manufacturers such as Jaguar Land Rover, the demand for MEMS-based accelerometers, gyroscopes, and pressure sensors is increasing. Government-backed investments in autonomous vehicle development and stricter emissions regulations are driving innovation in MEMS sensor technologies. Additionally, collaborations between automotive manufacturers and AI-driven sensor analytics firms are expanding the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.8% |

Germany, France, and Italy are leading the European automotive MEMS sensor market, driven by the presence of major automakers such as Volkswagen, BMW, and Renault. The growing focus on electrification, safety regulations, and autonomous vehicle research is accelerating MEMS sensor integration in European vehicles. The European Union's strong regulatory framework on vehicle safety, including mandates for automatic emergency braking (AEB) and lane departure warning systems, is boosting demand for MEMS sensors. Additionally, innovations in microfabrication and sensor fusion technologies are expanding market opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 13.6% |

Japan’s automotive MEMS sensor market is expanding due to the country’s leadership in automotive electronics and sensor miniaturization. Companies such as Toyota, Honda, and Denso are investing in MEMS-based sensor technologies to enhance vehicle safety, fuel efficiency, and automation. The increasing adoption of hybrid and electric vehicles in Japan is fueling demand for MEMS sensors for battery management, motion sensing, and vehicle stability control. Additionally, advancements in AI-integrated sensor systems are driving new market innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.4% |

South Korea’s automotive MEMS sensor market is growing rapidly, driven by Hyundai and Kia’s push for smart vehicle technology and autonomous driving solutions. The country’s leadership in semiconductor manufacturing, with companies like Samsung and SK Hynix, is further boosting the development of high-precision MEMS sensors for automotive applications. Government incentives for electric and connected vehicle technologies, along with increasing investments in ADAS and self-driving cars, are fueling market expansion. Additionally, advancements in sensor fusion and AI-driven data analytics are expected to enhance MEMS sensor capabilities in next-generation vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.5% |

The accelerometer and pressure sensor segments hold a dominant share in the automotive MEMS sensors market, as automakers, component suppliers, and technology developers prioritize high-precision, real-time sensor integration to improve vehicle safety, efficiency, and performance. These MEMS (Micro-Electro-Mechanical Systems) sensors play a critical role in stability control, collision detection, tire pressure monitoring, and airbag deployment, making them indispensable for modern connected vehicles, autonomous driving systems, and electric mobility solutions.

Accelerometers Lead Market Demand as Automakers Prioritize Motion Detection, Stability Control, and Crash Sensing

Accelerometers have emerged as one of the most widely deployed MEMS sensors in modern vehicles, offering high-precision motion tracking, vibration detection, and real-time impact sensing. Unlike conventional mechanical sensors, MEMS accelerometers provide fast-response, multi-axis motion detection, making them essential for vehicle stability systems, airbag deployment, and crash detection mechanisms.

The rising demand for MEMS accelerometers in advanced driver assistance systems (ADAS), electronic stability control (ESC), and rollover detection, particularly in passenger vehicles, luxury cars, and autonomous driving prototypes, has fueled market adoption, as automakers integrate next-generation sensor technology for enhanced vehicle safety. Studies indicate that MEMS accelerometers improve airbag deployment efficiency by up to 40%, ensuring strong demand for this segment.

The expansion of electric and hybrid vehicles, featuring AI-driven sensor fusion, predictive motion analytics, and energy-efficient inertial monitoring systems, has strengthened market demand, ensuring greater compatibility with evolving vehicle electrification trends.

The integration of AI-powered sensor calibration, featuring self-learning accelerometer tuning, real-time vibration compensation, and automated gyroscopic error correction, has further boosted adoption, ensuring better accuracy and reliability in motion sensing applications.

The development of ultra-miniature MEMS accelerometer modules, featuring sub-micron silicon wafer technology, high-G impact resistance, and low-power signal processing, has optimized market growth, ensuring better adaptability for autonomous vehicle navigation and impact safety monitoring.

The adoption of multi-axis accelerometer arrays, featuring three-axis motion tracking, AI-driven vehicle posture optimization, and predictive collision avoidance, has reinforced market expansion, ensuring better adaptability across diverse vehicle categories.

Despite its advantages in motion tracking, impact detection, and multi-application adaptability, the MEMS accelerometer segment faces challenges such as sensor drift over time, complex calibration requirements, and vulnerability to electromagnetic interference. However, emerging innovations in AI-assisted error correction, blockchain-backed accelerometer calibration tracking, and next-generation nanotechnology-enhanced MEMS fabrication are improving accuracy, reliability, and production scalability, ensuring continued growth for MEMS accelerometers across global automotive markets.

Pressure Sensors Expand as Automakers Prioritize Tire Pressure Monitoring, Engine Efficiency, and Emission Control Compliance

Pressure sensors have gained strong market adoption, particularly among automakers, fleet operators, and commercial vehicle manufacturers, as demand for real-time pressure monitoring, fuel efficiency optimization, and emission regulation compliance continues to rise. Unlike conventional mechanical pressure sensors, MEMS-based pressure sensors offer higher sensitivity, rapid response times, and digital signal output, making them ideal for modern automotive applications.

The rising demand for MEMS pressure sensors in tire pressure monitoring systems (TPMS), fuel injection optimization, and exhaust gas recirculation (EGR) control, particularly in passenger cars, commercial fleets, and hybrid-electric vehicles, has driven adoption of high-precision pressure sensing solutions, as automakers seek improved energy efficiency and regulatory compliance. Studies indicate that MEMS pressure sensors contribute to a 3-5% improvement in fuel efficiency when integrated into advanced vehicle management systems, ensuring strong demand for this segment.

The expansion of stringent global emissions regulations, featuring real-time pressure monitoring in exhaust systems, AI-driven fuel-air mixture optimization, and predictive maintenance for fuel injectors, has strengthened market demand, ensuring greater penetration of MEMS pressure sensors in both ICE (Internal Combustion Engine) and hybrid vehicle segments.

The integration of AI-powered pressure monitoring, featuring real-time TPMS alerts, predictive fuel efficiency mapping, and self-learning tire wear analysis, has further boosted adoption, ensuring better vehicle safety and operational cost savings.

The development of ultra-low-power MEMS pressure sensor modules, featuring sub-micron piezoelectric transducers, nano-coating protection for high-temperature environments, and AI-enhanced data signal processing, has optimized market growth, ensuring better adaptability for real-time vehicle health diagnostics.

The adoption of multi-application pressure sensing platforms, featuring brake system pressure monitoring, electronic power steering feedback loops, and AI-powered adaptive suspension control, has reinforced market expansion, ensuring better integration across diverse automotive applications.

Despite its advantages in real-time monitoring, regulatory compliance, and energy efficiency improvements, the MEMS pressure sensor segment faces challenges such as long-term signal drift, sensor contamination in harsh environments, and limitations in extreme pressure sensing ranges. However, emerging innovations in AI-driven pressure calibration, blockchain-based tire maintenance tracking, and MEMS nanomaterial enhancements for extreme pressure tolerance are improving accuracy, longevity, and operational reliability, ensuring continued expansion for MEMS pressure sensors in global automotive markets.

The OEM (Original Equipment Manufacturer) and aftermarket segments represent two major market drivers, as MEMS sensor technology increasingly plays a critical role in improving vehicle performance, predictive maintenance, and real-time safety diagnostics.

OEM Segment Leads Market Demand as Automakers Integrate MEMS Sensors into Next-Generation Vehicle Platforms

The OEM segment has emerged as one of the largest consumers of MEMS sensors, offering automakers the ability to integrate next-generation sensor technology into vehicle architectures, ensuring real-time diagnostics, improved safety, and regulatory compliance. Unlike aftermarket installations, OEM-integrated MEMS sensors provide seamless data connectivity with vehicle control units (VCUs) and advanced driver assistance systems (ADAS).

The rising demand for MEMS sensors in ADAS-enabled vehicles, featuring collision avoidance systems, automatic emergency braking (AEB), and AI-powered predictive maintenance, has fueled adoption of factory-installed sensor modules, ensuring strong market traction.

Despite its advantages in seamless integration, direct compatibility with vehicle ECUs, and enhanced performance monitoring, the OEM segment faces challenges such as supply chain disruptions, higher production costs for advanced MEMS sensors, and regulatory compliance complexities. However, emerging innovations in AI-powered MEMS calibration, blockchain-based OEM supply chain tracking, and next-generation MEMS sensor miniaturization are improving cost-effectiveness, production efficiency, and scalability, ensuring continued expansion for MEMS sensors in the OEM automotive sector.

Aftermarket Segment Expands as Fleet Operators and Automotive Service Providers Adopt Retrofitted MEMS Sensor Solutions

The aftermarket segment has gained strong market adoption, particularly among fleet operators, vehicle service providers, and commercial vehicle owners, as demand for retrofitted sensor-based diagnostics, predictive maintenance solutions, and safety monitoring systems continues to rise. Unlike OEM-installed sensors, aftermarket MEMS sensor solutions offer flexible integration options for older vehicles, ensuring compliance with modern safety and efficiency standards.

The rising demand for aftermarket MEMS sensors in TPMS retrofits, fuel efficiency monitoring upgrades, and ADAS enhancement kits, featuring plug-and-play sensor modules, AI-powered predictive diagnostics, and cloud-connected vehicle analytics, has driven adoption of retrofit sensor solutions, ensuring better vehicle performance and extended operational lifespan.

Despite its advantages in affordability, flexibility, and extended vehicle service life, the aftermarket segment faces challenges such as compatibility concerns with older vehicle models, limited standardization in MEMS sensor retrofits, and regulatory complexities surrounding aftermarket vehicle modifications. However, emerging innovations in AI-assisted sensor recalibration, blockchain-backed aftermarket component authentication, and next-generation wireless MEMS sensor modules are improving cost-effectiveness, compatibility, and adoption rates, ensuring continued expansion for MEMS sensors in the automotive aftermarket sector.

The automotive MEMS sensors market is experiencing rapid growth due to the increasing adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), autonomous driving technologies, and stringent vehicle safety regulations. MEMS (Micro-Electro-Mechanical Systems) sensors play a critical role in vehicle stability, collision detection, tire pressure monitoring, and in-cabin environmental sensing.

Automakers and component suppliers are focusing on miniaturization, high-performance MEMS sensors, and AI-driven sensor fusion technology to enhance vehicle efficiency and safety. The growing demand for gyroscopes, accelerometers, pressure sensors, and LiDAR-integrated MEMS solutions is further propelling market expansion.

The global automotive MEMS sensors market CAGR stands at 13.4% from 2024 to 2032, with country-specific growth driven by government mandates for vehicle safety, EV and hybrid adoption, and the expansion of connected vehicle infrastructure.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Robert Bosch GmbH | 18-22% |

| STMicroelectronics | 14-18% |

| Infineon Technologies AG | 12-16% |

| Texas Instruments Inc. | 8-12% |

| NXP Semiconductors | 5-9% |

| Other Companies (combined) | 35-45% |

Key Company Offerings & Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Robert Bosch GmbH | Develops MEMS gyroscopes, accelerometers, and pressure sensors for ADAS, ESC, and airbag systems. |

| STMicroelectronics | Specializes in MEMS motion and environmental sensors, integrating sensor fusion for smart vehicle applications. |

| Infineon Technologies AG | Innovates in MEMS radar and LiDAR sensors, enhancing autonomous driving and obstacle detection. |

| Texas Instruments Inc. | Produces MEMS-based ultrasonic and pressure sensors, ensuring enhanced vehicle monitoring and battery management. |

| NXP Semiconductors | Focuses on MEMS gyroscopes and tire pressure monitoring systems (TPMS) for EVs and connected vehicles. |

Robert Bosch GmbH (18-22%)

STMicroelectronics (14-18%)

Infineon Technologies AG (12-16%)

Texas Instruments Inc. (8-12%)

NXP Semiconductors (5-9%)

Other Key Players (35-45% Combined)

Several semiconductor and automotive electronics manufacturers contribute to MEMS sensor advancements, focusing on high-precision sensing, sensor miniaturization, and AI-driven data processing:

The overall market size for the Automotive MEMS Sensor Market was USD 5 Billion in 2025.

The market is expected to reach USD 17.1 Billion in 2035.

The demand will be fueled by the rising integration of advanced driver assistance systems (ADAS), increasing adoption of electric and autonomous vehicles, growing focus on vehicle safety and emissions control, and advancements in sensor miniaturization and performance.

The top five contributors are the USA, European Union, Japan, South Korea, and the UK.

Accelerometers and gyroscopes, primarily used in vehicle stability control and airbag deployment systems, are anticipated to command a significant market share over the assessment period.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Crawler Excavator Market Growth - Trends & Forecast 2025 to 2035

Automotive Ignition Coil Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.