The market for auto load floors in Korea remained steady in 2024, supported by growing demand for the Application of lightweight, durable materials in the manufacturing of vehicles. The growing industry for electric vehicles (EVs), which demands new load floor solutions for improved efficiency and organization, has helped these industries to grow.

In response, Korean car manufacturers were actively seeking new materials, such as composite and honeycomb structures, to enhance their cars' performance and sustainability. The rise in sales was supported by government incentives for the purchase of EVs, as carmakers geared up for increasing fuel efficiency and emission regulations.

Then, there was a change in consumer preferences in 2024 away from sedans and toward SUVs and crossovers that tend to have larger cargo areas and, therefore, drive more complex load floor designs. The growth of the e-commerce sector also propelled the demand for commercial vehicles, indirectly benefitting the automotive load floor industry.

Projections indicate growth to USD 86.4 million by 2025. Growing EV production will complement technological progress in lightweight materials, supporting the industry's growth. By 2035, the industry is expected to reach USD 131.63 million with a CAGR of 4.3%. Sustainable and recyclable materials will also be an important trend in manufacturing, and these developments will affect the future of the Korean automotive load floor industry.

Market Size Table

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 86.4 million |

| Market Value (2035F) | USD 131.63 million |

| CAGR (2025 to 2035) | 4.3% |

Explore FMI!

Book a free demo

Insights on Korea's Automotive Load Floor Industry Trends The latest survey by Future Industry Insights (FMI) delivered the following insights from prospective stakeholders of Korea's Automotive Load Floor Industry.

The study included automotive manufacturers, material suppliers, and afterindustry service providers, as well as industry experts, providing insights into changing consumer expectations, technological developments, and regulatory developments.

Many people, 72% of those who answered, already use lightweight and strong materials like composites and honeycomb structures. This is because electrification and sustainable mobility are having a bigger impact on the sector as a whole.

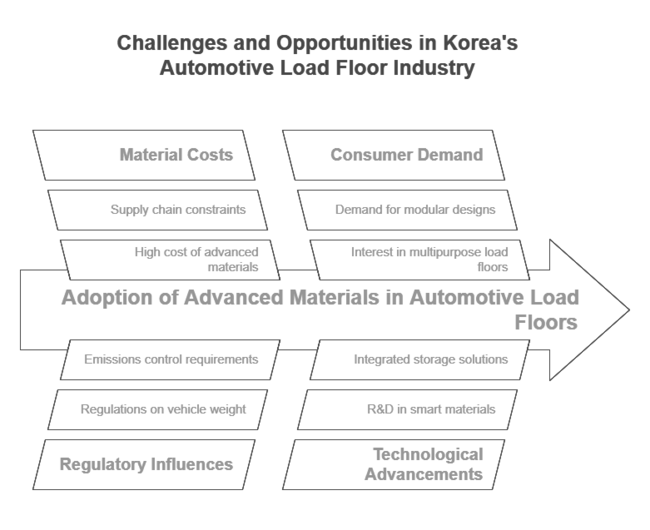

In the data, 60 percent of respondents identified the high cost of advanced materials as an obstacle to widespread adoption. Although OEMs are eager to incorporate recyclable and bio-based materials, many voiced concerns about supply chain constraints and cost pressures.

Government regulations for reducing vehicle weight and emissions control are also influencing material choice and production processes for more than 65 percent of respondents, the highest response to this question. Automakers and fleet operators pointed out that more and more people want modular and multipurpose load floors to fit their changing lifestyles.

This is an example of demand-side potential. Over 50% of the surveyed manufacturers plan to incorporate customizable and foldable load floors into their vehicle designs, especially for SUVs and commercial vans, which are expected to see increased demand.

The growth of e-commerce logistics has also fuelled the demand for loading floors in delivery vehicles that can withstand high impacts and heavy loads. Smart materials and integrated storage solutions are anticipated to dominate the industry in the coming years, with industry experts predicting further R&D investments in these materials over this decade.

The results imply that partnerships between automakers and material scientists will be necessary to tackle current obstacles and seize new opportunities. Korean automotive load floors will be reinvented as the industry shifts toward more innovation and sustainability in global mobility.

| Province/Region | Regulatory Impact on the Automotive Load Floor Industry |

|---|---|

| South Gyeongsang | Stricter passenger and commercial vehicular weight reduction requirements, accounting for the increased use of lightweight composite material. |

| North Jeolla | Faced with incentives for EV production, manufacturers are preparing to use sustainable and recyclable floor materials. |

| South Jeolla | With the investment in automotive R&D clusters, there is a push towards the development of modular and multifunctional designs of load floors. |

| Jeju | Zero-emission vehicle (ZEV) policies are propelling the transition to bio-based, environmentally friendly load floors for EVs. |

| Rest of Korea | National fuel efficiency and emission standards are driving the use of high-strength, lightweight materials across all vehicle segments. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Industry growth was consistent but came mainly from the manufacture of traditional vehicles. | The growth of DSM, EVs, and lightweight material innovations will drive the industry. |

| Automakers concentrated on inexpensive load floors based on conventional materials, including plywood and fiberboard. | Manufacturers are shifting toward composites, honeycomb structures, and recyclable materials to achieve sustainability objectives. |

| Sales of SUVs and commercial vehicles primarily drove demand. | Growth will be diversifying with modular and smart load floor solutions that capture increased share. |

| Regulations were relatively relaxed, focusing mainly on basic vehicle safety and durability. | Governments cracking down on emissions and weight reduction regulations will drive advanced material adoption. |

| R&D investment was modest, driving evolutionary changes in design and functionality. | More R&D spending is driving next-gen load floor efficiencies and durability. |

Composites are a leading material due to their high strength-to-weight ratio, durability, and increasing use in electric vehicles (EVs). Composite load floors are more popular for high-end vehicles like luxury cars, SUVs, and LCVs, owing to their appearance and performance.

The fastest growing segment is honeycomb polypropylene, thanks to demand for lightweight but impact-resistant solutions, such as cargo systems and load floor systems. While it is pricier than thermoplastics like textured PP, fluted polypropylene is becoming popular for cost-effective, flexible designs, primarily in midsize and compact vehicles. Despite the continued use of hardboard in cost-effective applications, its sales are declining in favor of more environmentally friendly and sustainable materials.

The largest and fastest-growing application segment is load floor systems, driven mainly by SUVs, LCVs, and commercial vans, which consistently require increasingly high-strength, lightweight, and modular designs. Cargo systems also capture a large industry share, with adjustable and sliding load floor innovations supporting e-commerce logistics and fleet vehicles.

Interior systems (such as rear seatbacks and trunk covers) exhibit moderate levels of demand but are being transformed by the replacement of traditional materials with composites and polypropylene honeycomb structures. The trend of prioritizing personalization and multi-utility across applications is changing the design landscape.

| Category | Industry Share in 2025 |

|---|---|

| Composites | 33% |

| Fixed | 81% |

Compact, midsize, and luxury vehicles prioritize durability and cost-effectiveness, making rigid load floors the most common and cost-effective solution. Nonetheless, the sliding load floor segment is growing fastest, especially in SUVs, LCVs, and vans, as individuals and fleets call for more accessible and easier-to-use cargo spaces-automakers are incorporating automated or modular sliding floor technologies to enable better storage efficiency in delivery and passenger vehicles. Urban mobility solutions and the need for space optimization in cars are driving this transition.

Strong consumer preference for spacious, premium, multifunctional SUVs has made them the vehicle of choice in the industry. These are heavy users of composite and honeycomb polypropylene for light, durable load floors. Light commercial vehicles (LCVs) and vans are the fastest-growing segment (by volume) of the commercial vehicle industry, especially in cargo and logistics, where the need for robust cargo spaces that can adjust load floors is increasing.

Luxury vehicles employ high-end composite materials for their appearance and lightweight performance. Meanwhile, compact and midsize cars have a steady share of the industry, and the introduction of affordable, eco-friendly materials is expected to drive adoption. In summary, mini-buses have a small but increasing demand, mainly in the commercial transport industry.

South Gyeongsang is a significant center for automobile production, with the region's automotive plants driving demand for advanced load floor systems. As such, the province has a large number of automotive OEMs or suppliers, resulting in a substantial uptake of composites and honeycomb polypropylene in SUVs, midsize cars, and commercial vehicles.

The government's emphasis on lightweight vehicle components to enhance fuel economy and sustainability is driving investments in R&D in material innovation. Also, production sites that are geared towards exporting are being replaced with ones that use modular and multifunctional load floors and follow the international rules for safety and weight reduction in the automotive industry.

North Jeolla's position as a hub for EV production and material innovation puts it in a strong position in the automotive load floor arena. The move is in line with the incentives being granted by the government to manufacture sustainable vehicles, and automakers in the region are working on adding more sustainable materials to their cars, such as recycled composites and fluted polypropylene.

As logistics and delivery demands increase, so too does the production of commercial vans, and load floors for cargo systems are quickly gaining adoption. This will also assist the province in investing in R&D clusters that focus on producing economical and light materials, thereby increasing the demand for honeycomb polypropylene and composite solutions.

There is an after-industry and vehicle modification industry growing more in South Jeolla, which has also increased the demand for customized and sliding load floors in SUVs, vans, and LCVs. The province's automotive export focus has driven the adoption of high-strength and lightweight materials, especially in luxury and midsize vehicles.

The demand for next-generation, modular load floors, particularly for electric SUVs and fleet vehicles, is growing even further due to government-backed EV initiatives. The region is also seeing greater investment in logistics and e-commerce-driven commercial vehicles, which require durable, impact-resistant cargo floors.

Jeju is influencing material choices in the automotive load floor industry with its efforts to promote zero-emission and electric vehicles (EVs). Manufacturers are increasingly focusing on bio-based composites and recyclable polypropylene for use in EV load floors due to the province's stringent sustainability rules.

The province also boasts a growing number of EV rental fleets, driving demand for robust yet lightweight loading floors that maximize vehicle efficiency. The fixed and sliding load floors are firmly positioned in the compact and midsize EV industry, which will expand significantly as Jeju rapidly turns into a carbon-neutral transportation hub.

The remainder of the country, including the major cities of Seoul, Incheon, and Busan, produces the bulk of automobiles and after-industry services for the automotive industry, contributing to its status as the biggest industry for automotive load floors. Demand for composite and honeycomb polypropylene load floors is high as SUVs and LCVs dominate sales. With Korea's drive to cut fuel usage and reduce emissions, these automakers are rapidly adopting lightweight, high-performance materials for cargo and interior systems. The need for sliding and multipurpose load floors is also growing because of changes in urban mobility trends and the growth of coasting and delivery vehicle fleets.

Local and foreign players compete with each other in the structure of the South Korean industry. Based on the current trends, here is the analysis of the best players with the approximate industry share in 2024.

Hyundai Mobis

Industry Share: ~35%

Hyundai Mobis, a subsidiary of Hyundai Motor Group, is a leading player in the South Korean industry, recognized for its strong domestic presence, commitment to innovation, and high-quality automotive solutions.

TS TECH Co., Ltd.

Industry Share: ~20%

TS TECH is a Japanese company with a significant presence in South Korea, specializing in the production of auto seats and interior parts, including load floors. TS TECH is known for manufacturing high-quality products with a focus on innovation.

Magna International Inc.

Industry Share: ~15%

Magna is one of the world's largest producers of automotive parts and systems, including load floors. Magna's South Korean footprint supports both local and global automakers.

Hanwha Advanced Materials

Industry Share: ~12%

Hanwha Advanced Materials is a Korean advanced materials manufacturer & supplier-its automotive load floor materials are among its automotive applications. Shunning traditional means of capital and investment, the company thrives on sustainability and innovation.

IAC Group

Industry Share: ~10%

IAC Group is a large supplier of auto components, including load floors. The company, which focuses on innovation and shopper fulfillment, has been increasing its footprint in South Korea.

Other Players

Industry Share: ~8%

The remaining industry share is held by smaller regional players and new entrants, many of whom are focused on targeting niche industries or high-spec materials.

Hyundai Mobis's Introduction of Lightweight Load Floors

Hyundai Mobis introduced a series of lightweight load floors made out of sophisticated composite materials. This innovation is designed to cater to the growing demand for fuel-efficient and electric cars in South Korea.

TS TECH's Expansion in Production Capacity

TS TECH declared increased production capacity in South Korea to serve the increasing demand for load floors in hybrid and electric vehicles. The new development will strengthen TS TECH's industry position.

Magna Strategic Partnership

Magna also made a strategic partnership with one of South Korea's major automobile manufacturers to produce new-age electric vehicle load floors. It aims to become innovative and popular as a supplier to South Korea by virtue of the tie-up.

Hanwha Advanced Materials' Green Load Floor

Hanwha Advanced Materials unveiled its new environmentally friendly load floor, which is recyclable. It's a solution toward making South Korea greener as per South Korean government mandates and, hence, likely to do better in the South Korean industry.

IAC Group's R&D Expansion

IAC Group increased its R&D facilities in South Korea to create sophisticated load floor solutions for the local industry. The expansion is likely to improve IAC Group's strength and industry standing.

The Korean automotive load floor industry is part of automotive components, which itself is part of automotive materials and components or the broader automotive manufacturing industry. This industry is sensitive and affected by macroeconomic factors, including GDP growth, industrial production, automotive exports, emission-related government regulations, and sustainability.

Korea is home to major global automotive manufacturers, which drives a constant requirement for high-end lightweight material solutions as vehicle componentry, including load floors. The growth of electric vehicles (EVs) is one of the main macroeconomic pushes of this industry.

As the Korean government aggressively promotes carbon neutrality by 2050, there is an increasing emphasis on using lightweight and high-strength materials for vehicle interiors, such as composites and polypropylene-based load floors, to accommodate the growing adoption of EVs. Material price volatility impacts production costs-driven by the prices of raw materials like plastics, carbon fiber, and polymers-and material innovation will be crucial for industry growth.

As Korea's export-driven automotive companies supply to North America, Europe, and Southeast Asia, the demand for automotive load floors remains constant. On the other hand, rapid urbanization, along with booming e-commerce logistics, will keep driving demand for cargo system load floors in light commercial vehicles (LCVs) and vans, adding long-term stability to the industry.

The automotive load floor industry in Korea is growing due to the increasing adoption of electric vehicles (EVs), the development of lightweight materials, and the growing demand for modular cargo solutions.

For applications such as load floors, manufacturers can take advantage of this trend by using composite and honeycomb polypropylene to help make vehicles more fuel-efficient and durable-customizable, multifunctional load floors for growing SUV and LCV segments. Also, in order to be aligned with Korea's sustainability regulations, the trend to use recyclable and bio-based materials can be a green source of advantage over competitors there.

New entrants should focus on niche opportunities in EVs, LCVs, and load floors for cargo systems, where demand is rapidly growing due to urban logistics and the expansion of last-mile delivery. Investing in research and development of unique, lightweight materials will separate the product from its conventional counterparts.

By installing production units close to the green field: the automotive core location of South Gyeongsang and North Jeolla, it improves supply chain efficiency and reduces costs. Partnerships with automakers and fleet operators will yield long-term contracts, and leveraging direct and indirect incentives for greening the vehicle fleet will mean a quicker industry entry. The emphasis on smart, modular, and high-durability designs will accommodate the continuous growth of this growing industry.

What are the general materials used in Korea for automotive load floors?

EVs are making use of lighter, better materials, leading to greater use of composite and recyclable solutions for improved energy efficiency.

They enhance cargo accessibility and convenience, particularly in SUVs, light commercial vehicles, and delivery vehicles used in e-commerce logistics.

Tougher weight reduction and sustainability regulations push automakers toward cutting-edge, eco-friendly materials in vehicle interiors.

SUVs and commercial vans have been the primary drivers of adoption, while interest in electric and luxury vehicles continues to grow due to their modular and high-strength designs.

The industry is segmented into hardboard, fluted polypropylene, honeycomb polypropylene, and composites

It is segmented into interior systems, cargo systems, and load floor systems

It is divided into fixed and sliding

It is fragmented into compact, midsize, luxury, SUV, and LCV (mini-bus & van)

It is segmented into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and Rest of Korea

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Crawler Excavator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.