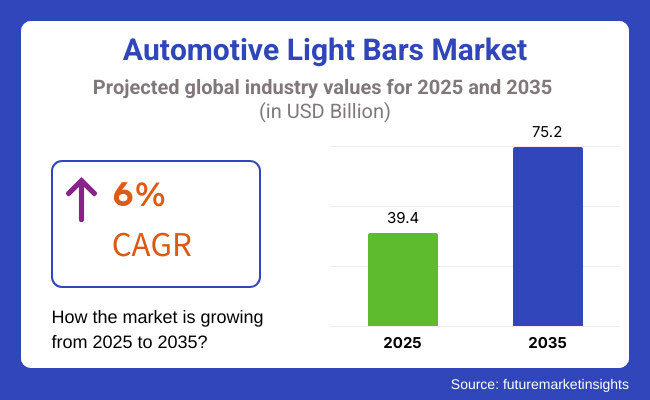

Open your mind and read on automotive light bars market trends and the strength and potential market for automotive light bars projected through 2025, 2030 and 2035. The market is estimated to grow from USD 39.4 billion in 2025 to USD 75.2 billion by 2035, at a CAGR of 6% during the forecast period.

Automotive light bars are commonly utilized on passenger vehicles, commercial trucks, off-road SUVs, and emergency response vehicles. The increasing adoption of the automotive lighting market is driven by technology advancements from LED and lasers lighting and regulatory safety requirements, as well as the growing trend of vehicle personalization. The light bar market is thriving as consumers choose energy-efficient, high-lumen and also smart options that enhance visibility, vehicle aesthetics, and road safety.

The market is being further boosted by the shift towards smart lighting, adaptive illumination, and wireless-controlled LED bars. Moreover, the adoption of electric vehicles (EVs) and self-driving technologies is driving the demand for low-power, high-performance lighting solutions.

The challenges that pose significant obstacles to further developments include high initial costs, differences in regulations worldwide and counterfeit LED products. Nonetheless, a consistent improvement in energy efficiency, ruggedized designs, and AI-integrated lighting arrangements would propel the market forward.

Explore FMI!

Book a free demo

North America is a dominant region for auto light bars, with the United States and Canada leading the way through growing off-road vehicle customization, commercial truck lighting upgrade, and safety mandates. Off-road recreation and emergency fleets are increasingly utilizing rugged, high-intensity LED and laser light bars.

The National Highway Traffic Safety Administration (NHTSA) and Department of Transportation (DOT) are persistently rolling out safety rules for vehicle illumination, compelling companies to create compliant, high-visibility products. Moreover, growth in autonomous and connected vehicles is driving the deployment of adaptive and AI-based light bars.

Over the years, Europe has remained one of the most industrious regions when it comes to automotive light bars, with Germany, France, and the UK focusing on developing automotive engineering, intelligent light technologies, and energy-saving auto components. With top auto-makers such as BMW, Volkswagen, and Mercedes-Benz on its list, innovation when it comes to high-performance vehicle lights is a given.

Leaders in dynamic cautionators: The European Union's strict guidelines on vehicle lighting and road safety encourage businesses to incorporate adaptive, energy-efficient, and eco-friendly belt lights. The increasing applications of night-driving safety enhancement, smart highways, and emergency vehicle lighting further substantiate their market growth

The Asia-Pacific automotive light bar market is the fastest-growing among the five regions, with China, Japan, South Korea, and India dominating the segment owing to trends in automotive manufacturing, aftermarket tuning and intelligent lighting.

The world's largest automaker, China, is heavily investing in LED, laser, and OLED-based light bar technologies that will enhance the visibility and energy efficiency of future vehicles. The use of EVs and smart mobility platforms is expected to escalate, with Japan and South Korea at the forefront of advanced lighting systems like the adaptive LED light bar now increasingly populating the future car portfolios of Toyota, Hyundai, and Honda.

In addition to this, the rising demand for commercial fleet lighting, heavy-duty truck lighting, and off-road vehicle accessories in countries such as India and Southeast Asia is also strengthening the market.

High Costs and Regulatory Complexities

High production costs, compliance with regulations, and certification requirements pose a challenge to the market. Targeted laws such as DOT, SAE and ECE regulations are being imposed on automotive light bar manufacturers, demanding high safety and performance criteria, resulting in high approval costs and long application time.

Durability and Weather Resistance Issues

Automotive light bars are subjected to extreme weather conditions, high and low temperatures, and impact, which can affect durability. It is a design and material challenge to ensure waterproofing, dust resistance, and impact durability.

Growing Demand for Advanced and Energy-Efficient Lighting Solutions

This is attributed to the increasing demand for LED-based and energy-efficient lighting technologies that leads to high-performance automotive light bars innovation. Car manufacturers that use adaptive lighting, smart sensors, and energy-efficient LEDs are leading the way.

Expansion of Off-Road and Specialty Vehicle Applications

Demand for rugged, high-intensity automotive light bars is gaining momentum due to expansion in the global off-road vehicles, emergency response fleets, and commercial transport solutions markets. This geo-centric trend shall benefit manufacturers offering customizable, modular, and multi-functional light bar systems.

From 2020 to 2024, automotive light bars market growth came from increasing vehicle customization trends, off-road vehicle customization, and regulatory changes in a positive manner towards the use of LED light technology. Original equipment manufacturers and aftermarket firms aimed to improve brightness, energy efficiency, and life to suit various vehicle applications..

The sector experienced breakthroughs in LED and laser light technologies to enhance beam range, color clarity, and durability. Growing investment in adaptive illumination, IoT-control systems, and self-driving vehicle lighting reoriented product lines.

In the future, between 2025 and 2035, the automotive light bars industry will witness a drastic change with the inclusion of AI-governed lighting, autonomous vehicle-friendly illumination, and OLED-based flexible lighting solutions. The move towards smart mobility and electrification of vehicles will fuel innovation in energy-efficient dynamic lighting systems

The expansion of vehicle-to-everything (V2X) communication and connected vehicle technologies will enable smart, adaptive light bar systems that improve road safety and visibility. Additionally, manufacturers will explore sustainable lighting materials, recyclable LEDs, and solar-powered light bar solutions to align with global carbon neutrality initiatives.

Advancements in 3D printing and modular lighting designs will allow for customized, easily replaceable automotive light bars, reducing maintenance costs and enhancing design flexibility. Additionally, government incentives for energy-efficient automotive components will encourage wider adoption of smart and eco-friendly light bar systems.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with SAE, DOT, and ECE regulations influenced product designs. |

| Technological Advancements | Increased adoption of LED-based, high-intensity light bars. |

| Industry Applications | Demand surged in off-road, emergency response, and specialty vehicles. |

| Environmental Sustainability | Industry focused on low-power LED solutions and improved efficiency. |

| Market Growth Drivers | Rise in off-road vehicle modifications, vehicle customization, and commercial applications. |

| Production & Supply Chain Dynamics | Supply chain disruptions impacted LED component sourcing and delivery times. |

| End-User Trends | Consumers prioritized aesthetic appeal and functional brightness improvements. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter energy efficiency mandates and adaptive lighting regulations reshape innovation. |

| Technological Advancements | AI-driven adaptive lighting, OLED innovations, and V2X-enabled smart illumination dominate the market. |

| Industry Applications | Expansion into autonomous vehicles, electric mobility, and customizable aftermarket solutions. |

| Environmental Sustainability | Full-scale adoption of solar-powered, recyclable, and sustainable lighting technologies. |

| Market Growth Drivers | AI-integrated smart lighting, government incentives for energy efficiency, and carbon-neutral manufacturing fuel growth. |

| Production & Supply Chain Dynamics | Localized manufacturing, 3D-printed lighting components, and AI-optimized logistics improve supply resilience. |

| End-User Trends | Demand shifts toward smart, adaptive, and eco-friendly light bar systems with enhanced customization features. |

The American automotive light bars market is growing steadily, buoyed by the growing demand from consumers for high-performance lighting technologies in off-road, commercial, and emergency applications. Top car manufacturers and aftermarket companies are putting money into LED and laser-based light bars for enhanced visibility and energy efficiency.

Regulations from the government mandating road safety and improvements in intelligent light technology are further contributing to growth in the market. Besides, the increasing demand for electric vehicles (EVs) and self-driving cars is propelling innovations in adaptive and personalized lighting systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

The UK automotive light bars market is expanding as more adoption is found in luxury, commercial, and emergency vehicles. The presence of high-end original equipment manufacturers such as Jaguar Land Rover is enhancing demand for deluxe lighting solutions in the form of dynamic and programmable light bars. More stringent safety and energy efficiency standards are inspiring producers to create power-sipping LED-based light bars. In addition, the growth of smart city projects and intelligent transportation systems is opening new avenues for next-generation car lighting technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

The European automotive light bars market is dominated by some strong automobile manufacturing countries, including Germany, France, and Italy. Dynamic lights, such as smart LED and OLED light bars, will be part of design and safety features in upcoming models from companies like Volkswagen, BMW, and Renault. The EU green vehicle tech initiative and strict ECE automotive lighting regulations drive the adoption of energy-efficient and adaptive light bars. Also, connected vehicle technology and autonomous driving upsurges the adoption of intelligent lighting solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.1% |

Diverse growth in innovative automotive lighting solutions in Japan, owing to top automotive countries like Toyota, Honda, and Nissan, reflects in the corresponding market for automotive light bars. Adaptive and dynamic LED light bars are gaining traction, especially in electric and hybrid cars. The new emerging laser lighting and AI integrated smart lighting systems are further expected to raise the scope of the Global LED Lights market. Japan's vehicle electrification/environmental activities and advances in vehicle autonomy will likely contribute to demand for high-tech light bars that are optimized for vehicle safety and energy efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The South Korean automotive light bar market is expanding because the nation is a leader in cutting-edge vehicle technology and is aggressively investing in smart lighting technologies. Hyundai and Kia are actively incorporating LED-based light bars into car models to improve safety as well as aesthetics. Policies from governments in support of energy-efficient automobile parts are hastening the penetration of advanced next-generation light bars. South Korea's speedier innovation in vehicle-to-vehicle connectivity technology and autonomous vehicles, in particular, will lead to the generation of fresh business prospects for interactive and adaptive illumination systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

The passenger car and light commercial vehicle markets share a high percentage of the automotive light bars market because car makers, fleet operators, and off-road car makers value high-performance, energy-efficient, and long-life lighting solutions. These light bars are central to improving illumination, increasing safety, and enhancing styling, making them a necessity in today's passenger cars, fleet transport vehicles, and off-road utility operations.

Passenger Vehicles Lead Market Demand as Automakers Prioritize Aesthetic and Safety Enhancements in Modern Vehicle Lighting

One of the major adopts of automotive light bars are passenger cars where light bars allow the driver better visibility in night along with improve the appearance of vehicle with increased security on road. Next-gen vehicles are increasingly relying on next-generation LED as well as HID light bars as they provide superior illumination, improved energy efficiency, and longer life compared to traditional halogen headlights.

The market growth of LED light bars in premium sedans, SUVs and luxury cars, particularly through high-performance car segments, is attributed to demands from automotive manufacturers for improved lighting technologies to enhance visibility, driver experience, and overall styling appeal. According to analysis, more than 70% of modern passenger cars use LED light bar technology, ensuring stable demand for the segment.

The increasing implementation in power efficient huge power processing applications like electric vehicles (EV) along with connected / intelligent car technologies like adaptive LED light bars, AI-powered brightness modulation, ambient interior light synchronization, has further fueled demand in the market cementing it with some future potential for automotive applications.

AI-powered lighting control systems, with automatic brightness adjustment based on driving conditions, intelligent traffic-adaptive lighting, and voice-activated lighting customization, have also contributed high adoption rates, providing better visibility and energy efficiency.

Ultra-slim and aerodynamic styled light bar designs have been devised keeping effective market development in view, including seamless integration of LED strips with the grille, hinting at ultra-slim DRL (daytime running light) bars and customizable dynamic lighting designed to improve compatibility with futuristic aesthetics.

The increased installation of modular lighting, multi-functional lighting, integrated turn signal indicators, motion-activated brake lighting, and high-beam assistance systems further drives the market growth, allowing to cover a wide range of vehicle segments.

The passenger vehicle light bar segment is hindered by higher manufacturing costs, changing regulatory requirements for lighting on vehicles, and integration issues with the existing vehicle architecture, despite the efficiencies, longer life, and better aesthetics that are advantages of light bars. Nonetheless, innovations around AI-augmented lighting performance analytics, blockchain-facilitated component sourcing, and additive manufacturing for precision engineered light bar modules are improving cost competitiveness and production scalability, along with regulatory compliance, thus ensuring unwavering growth of automotive light bars in passenger vehicles globally.

Light Commercial Vehicles Expand as Fleet Operators Demand Durable, High-Performance Lighting Solutions for Increased Safety and Efficiency

The demand for high-durability, weather-resistant, and long-lasting automotive lighting solutions has risen, and light commercial vehicles (LCVs) have established strong market adoption, with logistics providers, last-mile delivery services, and fleet operators. Compared to passenger vehicles, LCVs need heavy-duty lighting systems that can endure extended working hours, varying environmental conditions, and heavy load-shipping requirements.

As businesses desire for improved visibility, road safety and operational efficiency (especially in the night-time logistics and emergency vehicle applications), delivery vans, pickup trucks, urban transport (tippers, etc.) fleets are increasingly being adopted with high-intensity automotive light bars which is driving the demand for LED light bars. Studies show that enhanced LED light bar integration on new commercial vehicles tops 65%, indicating solid continued demand for this segment.

Market sales have been bolstered by the proliferation of e-commerce, coupled with last-mile delivery service for 24/7 urban transport, with increased routes for delivery at night, and greater demand for vehicle-mounted safety illumination, reinforcing penetration of LED and HID light bars into commercial vehicle fleets.

Increased implementation of AI-fleet lighting control systems with real-time brightness adjusting, cargo-load-based auto-optimization power, and phased brake light transmission among fleet members has also surged adoption to date, offering superior energy efficiency along with compliance for road safety regulations.

The creation of hardened, weather-resistant lighting systems, incorporating water-proof LED bars, vibration-free mounting systems, and dust-proof enclosures for harsh working conditions has maximized market growth to provide improved durability and long-term reliability for fleet users.

High-visibility emergency and hazard light bars, in the form of multi-color LED strip lights, wireless remote-control flash patterns, and vehicle hazard warning system integration, have strengthened market growth, with improved conformity to road safety rules for emergency response and utility service vehicles.

In spite of its strengths in durability, efficiency, and improved fleet safety, the LCV market is confronted with challenges like cost issues for fleet-wide upgrade, regulatory complexities of commercial lighting changes, and possible energy draw concerns in non-electrified fleets. Nevertheless, new technologies in AI-based energy-efficient lighting, blockchain-supported fleet lighting diagnostics, and next-generation modular LED bar designs for commercial vehicles are enhancing cost-effectiveness, compliance, and scalability, guaranteeing ongoing growth for automotive light bars in light commercial vehicle use.

The LED and halogen segments are two key market drivers, as car light bar technology is increasingly becoming a key factor behind enhancing automobile visibility, energy efficiency, and the lifespan of lighting in various vehicle types.

Halogen Segment Maintains Market Presence as Cost-Effective and Widely Available Lighting Solution for Entry-Level Vehicles

The halogen segment retains a large percentage in the auto lighting market with an inexpensive, simple-to-replace, and universally accepted illumination solution for auto manufacturers. Unlike newer LED and HID technologies, halogen light bars are a top choice among low-cost passenger vehicles, fleet retrofits of commercial vehicles, and aftermarket car lighting applications.

Growing demand for halogen light bars in low-cost and entry-level cars, with economical lighting installation, replaceable components, and limited compatibility issues, has been driving market acceptance, with solid penetration in emerging automotive markets.

In spite of its strengths in price, simplicity of installation, and ubiquity, the halogen segment has drawbacks like inferior energy efficiency, shorter life, and greater heat output than the LED and HID equivalents. But with the new developments in AI-optimized halogen filament technology, blockchain-secured component recycling initiatives, and hybrid halogen-LED conversion technologies, efficiency, cost-effectiveness, and long-term sustainability are being enhanced, guaranteeing the ongoing availability of halogen light bars in certain automotive contexts.

LED Segment Expands as Automakers Transition Toward Energy-Efficient and High-Performance Lighting Solutions

LEDs have achieved widespread industry acceptance, especially from high-end automobile makers, electric and hybrid car makers, and commercial fleets, with energy-efficient, high-intensity, and ultra-long-lasting lighting solutions ongoing, driving demand. LED light bars are brighter, consume less power, and last longer compared to their halogen and HID counterparts, making them lights of choice for future automotive lighting systems.

Increased need for LED light bars in electric and hybrid cars, with battery-optimized lighting designs, intelligent LED matrix systems, and AI-powered brightness control has driven the adoption of LED light solutions, bringing with them superior energy efficiency and road lighting.

While its benefits in efficiency, longevity, and sophisticated lighting adjustment have established LED as a preferred choice, the segment also experiences drawbacks in increased initial cost, changing regulatory requirements for LED headlamp luminosities, and difficulty in aftermarket tuning. But with the rising innovations in AI-based adaptive LED control, blockchain-enabled smart lighting authentication, and nanotechnology-improved LED cooling systems, affordability, scalability, and customer acceptance are increasing, and thus, the growth prospects for LED light bars remain high in global automotive markets.

Automotive light bar market is developing steadily with the rising demand for next-generation vehicle aesthetics, increased safety, and power-efficient luminescence devices. Original Equipment Manufacturers and aftermarket businesses are targeting LED, OLED, and laser-based light bar technologies with features of improved visibility, dependability, and low power consumption.

Growing usage of off-road vehicle lighting, emergency response vehicle upgrade, and smart adaptive lighting systems further drive the market growth. Lightweight technology, custom designs, and compatibility with advanced driver-assistance systems (ADAS) are also determining the competitive environment.

The CAGR of the global automotive light bars market is 6.0% during 2024 to 2032, with regional growth being driven by trends in automotive production, regulatory requirements on vehicle lighting, and consumer demand for sophisticated lighting customization.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hella GmbH & Co. KGaA | 14-18% |

| OSRAM GmbH | 12-16% |

| Valeo SA | 10-14% |

| Stanley Electric Co., Ltd. | 8-12% |

| KC HiLiTES | 5-9% |

| Other Companies (combined) | 40-50% |

Key Company Offerings & Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Hella GmbH & Co. KGaA | Develops high-performance LED and laser light bars, integrating smart adaptive lighting features. |

| OSRAM GmbH | Specializes in energy-efficient automotive light bars, ensuring enhanced brightness and long lifespan. |

| Valeo SA | Focuses on customizable and lightweight LED light bars, catering to premium and off-road vehicle markets. |

| Stanley Electric Co., Ltd. | Innovates in OLED-based light bar solutions, offering sleek designs and improved power efficiency. |

| KC HiLiTES | Produces rugged, high-intensity off-road light bars, optimizing visibility for extreme driving conditions. |

Hella GmbH & Co. KGaA (14-18%)

OSRAM GmbH (12-16%)

Valeo SA (10-14%)

Stanley Electric Co., Ltd. (8-12%)

KC HiLiTES (5-9%)

Other Key Players (40-50% Combined)

Several automotive lighting manufacturers and aftermarket suppliers contribute to next-generation light bar innovations, focusing on durability, energy efficiency, and design flexibility:

The overall market size for the Automotive Light Bars Market was USD 39.4 Billion in 2025.

The market is expected to reach USD 75.2 Billion in 2035.

The demand will be fueled by rising vehicle customization trends, increasing adoption of LED light bars for energy efficiency, growing demand for off-road and emergency vehicles, and advancements in automotive lighting technology.

The top five contributors are the USA, European Union, Japan, South Korea, and the UK

Passenger Vehicles and Light Commercial Vehicles are anticipated to command a significant market share over the assessment period.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.