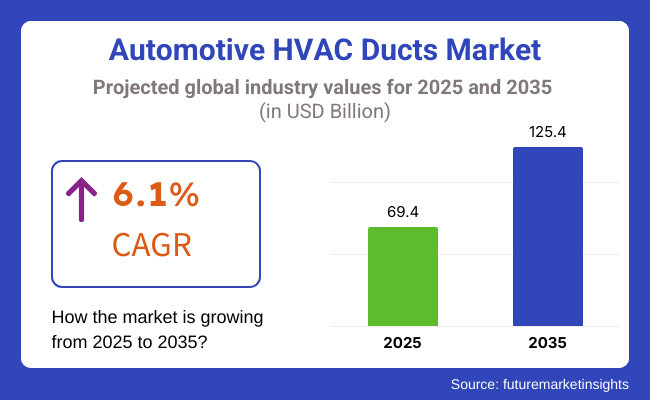

Automotive HVAC ducts market would most probably develop strongly in 2025 to 2035 with growing requirements for sophisticated climate control systems, energy-efficient auto components, and light-weighted components. Size of Automotive HVAC ducts market will rise from USD 69.4 Billion in 2025 to USD 125.4 Billion in 2035 at a 6.1% compound annual growth rate (CAGR) during the forecast period.

HVAC ducts are a critical component of passenger car and commercial vehicle indoor climate control, airflow, and thermal comfort. Gaining momentum for smart climate control systems, luxury vehicles, and electric vehicles (EVs) is propelling demand for aerodynamically shaped, lightweight, and robust HVAC ducts.

Automakers' fuel efficiency and vehicle lightness are driving the demand for polymers, composites, and high-performance 3D-printed parts in HVAC duct manufacturing. AI-based climate control, zonal air distribution, and eco-friendly materials also characterize the industry.

Although it offers fantastic growth, material-intensive nature of the technology with subsequent high cost and complexity of production procedures and issue of standardization continue to be main restrainers. Despite that, investment in green HVAC technology, intelligent sensors, and nanomaterial-based ducting are going to drive the market forward.

Explore FMI!

Book a free demo

North America remains a strong market for automobile HVAC ducts with the USA and Canada being crucial in driving the vehicle electrification, climate control technology, and light auto component markets. Demand for energy-saving HVAC systems for conserving battery life is fueled by growing applications of EVs and hybrid vehicles.

Vehicle makers such as General Motors, Ford, and Tesla are investing in intelligent air distribution systems and high-performance duct material in order to optimize passenger comfort and increase range extension. Aggressive EPA fuel efficiency targets are also compelling manufacturers to use aerodynamically and thermally designed HVAC ducts.

Europe is among the most significant markets for the auto HVAC ducts market, and nations such as Germany, France, and the UK are placing high value on sustainability and fuel-efficient car technology. The strict emission regulations and EV promotion schemes in the region are compelling auto manufacturers to utilize light-weight and recyclable HVAC duct material.

The presence of these global players in the form of Volkswagen, BMW, and Mercedes-Benz is driving smart climate control and smart air regulation systems based on AI. Zero-emission push by European Union once again encourages the way towards greener-friendly HVAC components for cars in the future.

Asia-Pacific is the highest-growing market for automobile HVAC ducts, followed by Japan, China, South Korea, and India due to rapid urbanization and growing automobile production resulting in demand for sophisticated HVAC solutions.

The world's biggest producer of EVs, China, is making huge investments in polymer-based lightweight HVAC ducts to encourage the efficiency of hybrid and electric vehicles. Japan and South Korea remain out in front in the competition for smart climate control technology, with motor industry giants like Toyota, Hyundai, and Honda including AI-managed HVAC management systems to extract maximum efficiency of airflow, eliminate energy wastage, and comfort passengers.

Besides, government policies favoring fuel-efficient cars and tough emissions control regulations in India and Southeast Asia are making the adoption of energy-efficient and green HVAC duct materials more difficult still.

High Costs and Regulatory Complexities

Manufacturers of auto air-conditioning ducts have to meet high emission standards, safety standards, and energy efficiency standards. The cost of operations for this kind of manufacturer will naturally rise as they strive to attain perfection in sustainable low carbon development. The industry is also confronted with issues of increased cost of production and tighter regulatory clearances, impacting manufacturing and distribution effectiveness.

Supply Chain Disruptions and Material Sourcing

Price fluctuations in raw material availability make up the entire cost of manufacturing, as any business knows. Political events and trade barriers that affect raw materials prices have the same effect on production costs, with typically disastrous results for manufacturers' profit margins Manufacturers of auto air-conditioning ducts have to meet high emission standards, safety standards, and energy efficiency standards. The cost of operations for this kind of manufacturer will naturally rise as they strive to attain perfection in sustainable low carbon development.

Growing Demand for Energy-Efficient HVAC Systems

The sector relies on raw materials like plastics, composites, and polymers that are prone to price fluctuations and supply chain interruptions. Organizations which are leading the way in the market, with materials like thermo-plastics and composites that last longer are green and high performing. These organizations have also begun to invest heavily in development of eco-friendly products. The automotive industry is developing toward electric and environmentally friendly vehicles. More efficient cars are constantly appearing on the market, and exhaust gases will eventually be a thing of the past. So light-weight and energy-efficient heating, ventilation, and air conditioning equipment will increasingly be needed by users of these new systems.

Technological Innovations and Smart Climate Control

A warming function that can be activated by voice control is a stand-out. An importantly so concept appropriately does much for those riding or driving in winter climates; surrounding air conditioning makes motorists feel warmer and more comfortable. Smart climate control, along with the constant monitoring and regulation of airflow via AI leaning logic all working together holistically, represents a comprehensive solution to satisfy indoor mobile environments. Some advanced ideas like this must be tried and proven in practice. IoT-connected HVAC systems are increasing vehicle comfort levels. Sensor-based temperature control and intelligent airflow regulation reduce the need for air conditioning by monitor the surrounding environment while also lowering energy consumption of cooling equipment. Manufacturers incorporating these cutting-edge devices will rule tomorrow's market.

Between 2020 and 2024, as modern vehicles increasingly adopted high-speed air-conditioning systems, business in the automotive HVAC ducts market rose significantly. As vehicle performance and demands made by pollution control regulations grow higher, automobile engineers sought lightweight and highly efficient HVAC duct materials.

The boosts in demand for electric and hybrid cars were critical factors in HVAC system modifications, because highly efficient energy-saving climate control subsystems were required by these vehicles. Manufacturers actively brought in HVAC ducts based on high-performance polymers in order to reduce weight and at the same time ensure that the stream of air moved through them is efficient.

Looking ahead, in the 2025 to 2035 period the automotive HVAC ducts market will undergo enormous technological advances-AI-powered climate control systems will become integrated and nanomaterial-based ducts break through into production by self-regulating airflow distribution. Autonomous and connected vehicles will further generate the demand for highly efficient, low-noise HVAC systems.

As manufacturers turn increasingly to materials for their production of HVAC ducts that are both recyclable and bio-derived, sustainability will certainly play an important role in market development. Encouraging the practice of "green" manufacturing and campaigns to reduce carbon emissions become benchmarks that must be satisfied against the background of global sustainability objectives.

Emergences such as 3D printing and digital twins help HVAC duct design to catch the mood. Therefore, new kinds of personal life can be led, and while high-speed custom made ventilation machines start being manufactured under United Nation International Industrial Development Organization Technology Co., customers no longer have to pay through the nose anymore to put up with annoying little machines. Against this growing background of environmental awareness coupled with social obligations to reduce pollution for even more than narrow reasons, we find that electrical and hydrogen fueled cars need the revision by developers with a thoroughgoing emphasis placed on thermal performance criterion, orchestration of battery cooling temperatures as well recovering energy from sewage heat involved in that operation.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent emission norms and fuel efficiency mandates influenced HVAC duct material selection |

| Technological Advancements | Lightweight polymer HVAC ducts improved vehicle efficiency and air circulation. |

| Industry Applications | HVAC ducts primarily optimized for internal combustion engine vehicles and hybrid models. |

| Environmental Sustainability | Increased focus on low-emission HVAC components and improved recyclability. |

| Market Growth Drivers | Rising demand for comfort-focused climate control systems in passenger vehicles. |

| Production & Supply Chain Dynamics | Material shortages and supply chain disruptions impacted manufacturing timelines. |

| End-User Trends | Consumers prioritized efficient and quieter climate control solutions. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Sustainability regulations and carbon-neutral manufacturing reshape production standards. |

| Technological Advancements | AI-driven intelligent climate control and smart airflow regulation redefine HVAC performance. |

| Industry Applications | Widespread application in electric, self-driving, and hydrogen cars. Environmental Sustainability |

| Environmental Sustainability | Full transition to bio-based, fully recyclable, and lightweight HVAC materials. |

| Market Growth Drivers | Expansion of smart, energy-efficient HVAC solutions for next-gen mobility. |

| Production & Supply Chain Dynamics | AI-driven inventory management, localized production, and material innovation improve supply chain resilience. |

| End-User Trends | Demand shifts toward adaptive, AI-controlled HVAC systems with enhanced sustainability features. |

Thanks to the growth of climate control systems in both passenger and commercial vehicles America's automotive HVAC duct market is growing steadily. Especially with major automakers and HVAC components manufacturers such as Ford, General Electric or Delphi Technologies robust, energy-efficient duct materials have become a competitive field for innovation.

Tougher rules for car emissions and fuel efficiency are driving the adoption of advanced HVAC duct designs. Such designs optimize airflow management and save energy. Meanwhile, the growing popularity of electric and hybrid vehicles is helping stimulate a new generation HVAC system specially tailored to optimize environment-friendly climate control.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.6% |

Rising demand for luxury vehicles with advanced climate control systems means that the UK automotive HVAC ducts market is expanding. In order to be able to use DCT based on the DCT technology that originated here and is represented abroad by brands such as Jaguar Land Rover or Aston Martin, the structure of this market is supported with local advantages. The car's fuel efficiency is higher as manufacturers invest in sustainable auto components and lightweight materials for ducts. After all it is changing factory floor processes that will power these adjustments into reality as production shifts toward electric and hybrid vehicle, while government subsidies for green technology make it much more likely.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

Germany, France, and Italy are three of the largest contributors to the European automotive HVAC ducts market as these countries have a dominant presence of automotive manufacturers including, Volkswagen, BMW, and Renault. The global automotive industry is pushing for lightweight materials and energy-efficient HVAC systems to also promote duct material and design innovation. Demand for recycled and bio-based materials for HVAC duct production is spurred by the EU's stringent emissions regulations and its sustainability policies. In addition, high adoption rates of electric vehicles (EVs) in Europe will create demand for climate control systems that meet EV-specific needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.2% |

The Japanese market for automotive heated, ventilated and air-conditioned (HVAC) ducts is growing with developments in the design of climate control systems and strong demand for fuel-efficient vehicles. While automakers such as Toyota, Honda, and Nissan are concentrating on reducing weight and energy consumption, making the HVAC better need's more advancement. Such trends are catching up for polymer-based ducts and 3D-printed HVAC components that contribute to improving vehicle comfort and efficiency. Moreover, Japan's emphasis on electric and hydrogen vehicles is spurring the advancement of next-gen HVAC duct materials which enhance thermal management.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The automotive HVAC ducts market in South Korea is expanding owing to the leadership of Hyundai and Kia in the international automotive market. In the country, a large investment in electric vehicle technology is enabling lightweight and thermally efficient HVAC components. Also, increasing government initiatives towards promoting green mobility and energy-efficient vehicle systems are another key factor enhancing the market growth. Moreover, the growing adoption of smart climate control systems in premium cars is driving the demand for optimized HVAC duct designs compatible with connected and automated vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Thermal comfort and safety of driving are at the core of consumer and commercial vehicle value propositions, which is on the rise due to the noteworthy portion of the automotive HVAC ducts market occupied by rear outlet HAVC ducts and windshield demist ducts. For passenger vehicles, commercial fleet vehicles, and luxury automobile manufacturers, these HVAC duct parts are crucial for managing airflow, regulating temperature, and defogging windshields.

Rear Outlet HVAC Ducts Lead Market Demand as Automakers Prioritize Passenger Comfort in Multi-Zone Climate Control Systems

These new ducts are becoming one of the most popular HVAC duct components: rear outlet HVAC ducts enhance passenger comfort, promote efficient air distribution, and improve the thermal comfort of rear-seat occupants. These rear outlet ducts facilitate multi-zone climate control, differentiating them from standard single-zone HVAC systems and providing passengers in the rear segment of the vehicles with a comfortable and personalized experience.

Increasing acceptance of rear outlet HVAC ducts in high-end and mid-priced passenger cars, including SUVs, sedans, and luxury variants has propelled their demand on the market, as vehicle manufacturers deploy sophisticated air distribution systems to enhance passenger satisfaction. Currently, over 65% of new vehicle models have rear HVAC outlets according to the studies, making this segment quite promising by assuring that the demand generation will remain strong.

Growing market demand has made EV adoption, covering climate-optimized HVAC system designs, energy-optimized airflow systems, and AI-adaptive in-cabin temperature management, more compatible with sustainable mobility trends.

Then again, with the introduction of AI-powered climate control technologies, including adaptive rear-seat heating and cooling algorithms, real-time passenger temperature preference recognition algorithms, and automated airflow modulation, are further contributing to the rise of suspend climate control adoption to ensure optimal passenger comfort and energy efficiency.

The presence of weight-effective and environment-friendly materials for HVAC duct products, such as thermoplastic polymer composites, biodegradable HVAC ducts, and recyclable duct components among others has resulted in an improved market growth to comply with eco-friendly vehicle manufacturing norms.

A variety of HVAC duct designs with modular construction and the use of rear duct units for quick installation, removable air distribution panels, and flexible airflow routing configurations have strengthened market development, delivering improved adaptability across a diverse range of vehicle models.

But the rear outlet HVAC duct segment comes with too high manufacturing costs, weight increase, and a requirement to adapt duct assist into a compact automotive environment. Nonetheless, new innovations in AI-powered air flow modeling, blockchain-based HVAC component procurement, and 3D-printed rear outlet duct prototypes are revolutionizing cost effectiveness, production efficiency and scalability, making rear outlet HVAC ducts a continuously growing prospect for all automotive markets across the world.

Windshield Demist Ducts Expand as Safety Regulations and Winter-Weather Driving Conditions Demand Efficient Defogging Systems

Due to the growing need for quick windshield defogging and defrosting solutions, windshield demist ducts have seen substantial market penetration, especially from car manufacturers that make vehicles targeting colder regions, fleet operators that demand improved visibility options, and commercial vehicle manufacturers that prioritize safety compliance. As opposed to regular HVAC air vents, windshield demist ducts are used to blow air out at the front of the car directly toward the windscreen to keep visibility clear in extreme climates.

The increasing adoption of advanced defogging system to meet the demand of windshield demist ducts for commercial vehicles is also significant with buses, trucks, and emergency response vehicles looking for better safety, reduced windshield icing, and faster demisting performance. It is no secret that more than 75 percent of all road accidents occurring in winter conditions is due to visibility issues, which ensures the segment to remain in strong demand as a result.

The rising trends associated with vehicle safety and regulatory compliance, including government-mandated defogging system standards, advanced driver-assistance system (ADAS) compatibility, and real-time sensor based windshield fog detection sensors, have further enhanced market demand, anchoring themselves toward greater integration of automobile windshield demist duct systems across next-generation vehicle types.

AI-powered climate control algorithms, such as automatic fog detection, smart airflow redirection based on external temperature conditions, environment temperature, and adaptive windshield heating technologies that require less power have further contributed to the adoption of this feature, as they help guarantee better safety and driving visibility under diverse weather conditions.

Innovations such as energy-saving fan-driven demist technology, low-noise windshield defogging ducts, and self-regulating airflow modulation create state-of-the-art HVAC air distribution networks that have improved market potential, being better adaptable with fuel-efficient and electric vehicle layouts.

Widespread adoption of multi-functional windshield HVAC duct systems with long-lasting air purification, pollen and dust filtration, and humidity level controlled airflow has strengthened market growth by facilitating greater implementation across various automotive segments.

For example, despite the fact that the windscreen demist duct segment has potential benefits such as improving safety features, regulatory compliance and driving in all weather conditions, the features suffer from challenges and market limitations such as ineffective airflow distribution patterns, high energy required for defogging, as well as low performance during extreme humidity conditions. However, upcoming developments in AI-driven climate data analytics, blockchain-based HVAC component tracking, and nanotechnology-infused windshield coatings for improving windshield demisting efficiency continues to improve effectiveness, energy optimization, and consumer buy-in that will secure sustained growth for windshield demist ducts across global automotive markets.

Passenger cars and light commercial vehicles (LCVs) segments are two retention market drivers, wherein HVAC duct technologies are being used to enhance in-cabin air quality, temperature control, and distribution of airflow across a cabin effectively and energy efficiently.

Passenger Cars Segment Leads Market Demand as Automakers Focus on Premium Climate Control Features

By delivering vehicle cabin comfort improvements and maintaining a healthier air quality while benefiting consumers with enhancements that increase consumer satisfaction, the passenger cars segment is one of the largest consumers of HVAC duct technologies. In contrast with commercial vehicles, passenger cars need finesse between compact HVAC implementation and high-efficiency airflow distribution to maximize usage of space and minimize power draw.

While passenger cars offer comfort in the cabin with more integrated premium features and energy-efficient air distribution, this segment is also facing challenges regarding production cost fluctuations, system complexity for compact car models, and regulatory limitations on refrigerant emissions. Nevertheless, upcoming trends in AI-based personalized climate management, blockchain-supported component traceability, and 3D-printed HVAC duct components are enhancing manufacturing output, compliance with regulations, and cost efficiency, cementing growth opportunities for HVAC ducts in passenger vehicles

Light Commercial Vehicles Segment Expands as Fleet Operators Demand Reliable and Efficient Airflow Systems

Expanding across smart HVAC systems, including the light commercial vehicles (LCVs) segment, enjoy robust market penetration, especially in application with fleet operators, delivery services, & logistics companies where demand for energy-efficient, durable and low-maintenance HVAC systems is likely to thrive. Unlike passenger cars, the HVAC system in LCVs must be heavy duty and capable of handling temperature management in different cargo and passengers load conditions.

Need for temperature controlled cargo transport, especially in refrigerated delivery vans, food distribution fleets, pharmaceutical cold chain logistics, etc. has spurred adoption of advanced HVAC duct systems, ensuring better air flow distribution and cargo integrity.

"Larger cargo areas require energy-inefficient climate control systems and HVAC duct systems are typically costly to maintain," continued Riese. "The tradeoff here is that segment has a lot of potential for efficient mining, but it's weighed down by energy-draining variables as well as the potential for imbalance due to the shape being more top-heavy. But, some of the unprecedented innovations such as AI enabled climate monitor, blockchain lift whole fleet HVAC performance tracing and ultra-light HVAC duct material proved efficient, durable, and a way to fleet-wide cost management, which assure the further rise of HVAC duct use in light commercial vehicle applications.

The automotive HVAC ducts market is poised to witness significant growth due to the rising demand for thermal comfort, fuel-efficient climate control systems, and lightweight materials in vehicle production. Automation engineers, HVAC component suppliers, and automotive manufacturers are concerned with improving the efficiency of airflow, reducing noise in the space, and integrating smart climate control technology to increase passenger comfort.

Mirroring trends from vehicle electrification on sustainability via vehicle light weighting, companies are making investments in advanced polymer composites, 3D-printed duct designs, and recyclable thermoplastics. Tools enabling this transformation are driven by the trend toward electric and hybrid vehicles (EVs and HEVs), which further accelerates the engineering of compact and energy-saving HVAC duct systems.

The global automotive HVAC ducts market is projected to grow at a CAGR of 6.1% over the years 2024 to 2032, with regional growth influenced by trends in automotive production, regulatory policies aimed at reducing vehicular emissions, and advancements in cabin air filtration technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| MAHLE GmbH | 14-18% |

| Denso Corporation | 12-16% |

| Valeo SA | 10-14% |

| Hanon Systems | 8-12% |

| Continental AG | 5-9% |

| Other Companies (combined) | 40-50% |

Key Company Offerings & Activities

| Company Name | Key Offerings/Activities |

|---|---|

| MAHLE GmbH | Manufactures lightweight HVAC ducts with optimized air distribution systems for ICE and EV platforms. |

| Denso Corporation | Develops high-performance HVAC duct solutions, integrating smart climate control sensors and airflow regulation. |

| Valeo SA | Focuses on thermoplastic-based duct materials, ensuring improved insulation and reduced environmental impact. |

| Hanon Systems | Specializes in compact HVAC duct designs for electric and hybrid vehicles, improving battery cooling efficiency. |

| Continental AG | Innovates in 3D-printed air ducts, reducing vehicle weight and enhancing airflow dynamics. |

MAHLE GmbH (14-18%)

Denso Corporation (12-16%)

Valeo SA (10-14%)

Hanon Systems (8-12%)

Continental AG (5-9%)

Other Key Players (40-50% Combined)

Several automotive component manufacturers contribute to HVAC duct system innovations, focusing on lightweight materials, advanced aerodynamics, and cost-effective production solutions:

The overall market size for the Automotive HVAC Ducts Market was USD 69.4 Billion in 2025.

The market is expected to reach USD 125.4 Billion in 2035.

The demand will be fueled by rising vehicle production, increasing consumer demand for thermal comfort in automobiles, advancements in lightweight and eco-friendly duct materials, and stringent regulations on vehicle efficiency and emissions.

The top five contributors are USA, European Union, Japan, South Korea and UK

Passenger vehicles, particularly in sedans and SUVs, are anticipated to command a significant market share over the assessment period.

Germany Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United Kingdom Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United States Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.