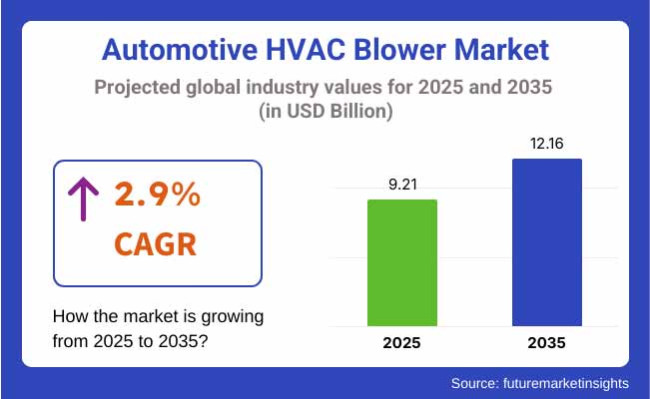

The global automotive HVAC blower market is valued at USD 9.21 billion in 2025, with growth forecast to USD 12.16 billion by 2035 at a CAGR of 2.9% over the period. Demand is being driven by vehicle electrification, cabin comfort expectations, and regulatory pressure to reduce acoustic emissions and energy use in thermal management systems.

In April 2025, MAHLE introduced a bionic radial blower for automotive air conditioning systems, leveraging AI optimized fan blades based on penguin fin shapes. This innovation was reported to reduce noise output by approximately 4 dB and increase airflow efficiency by around 15%, positioning it for use in both electric vehicles and conventional platforms.

According to Dr. Uli Christian Blessing, Vice President R&D at MAHLE, “Evolution has equipped the penguin with fins that allow it to glide through the water with minimal resistance. That shape served as a model in the optimization process of our blower blades.”

In 2024, Bosch expanded its aftermarket HVAC parts portfolio to include compressors, condensers, and cabin blowers. According to Bosch, replacement components have been subjected to strict leakage, durability, and corrosion testing to ensure compatibility with modern systems. Blower motors were reported to be available as OEM-quality direct replacements for European vehicle makes.

Design updates have emphasized compact footprint, motor efficiency, and module integration. MAHLE’s bionic blower is reported to fit directly in front of evaporators, allowing HVAC units to occupy less space-an important factor in electric vehicle design .Bosch has similarly emphasized compact motor modules with reduced weight and axial length, such as the GBB brushless blowers, which reportedly offer up to 80% efficiency and enhanced EMC and NVH performance.

Market demand has been influenced by thermal management standards in electric vehicles as well as passenger comfort requirements in ICE vehicles. Regulatory shifts toward lower cabin noise and higher energy efficiency have encouraged adoption of smarter blowers. OEMs have been specifying variable-speed brushless motors and vibration-reducing impellers across new vehicle platforms.

Aftermarket interest has grown due to the necessity of cabin venting system servicing. Shop owners have preferred blower modules that meet or exceed OEM specifications and can be installed using standard licensing. Clear user guidance documents and testing protocols have been provided to establish performance benchmarks under part-load and full-operational conditions.

Momentum is expected to persist as HVAC modules evolve into system-level energy and noise control units. Continued innovation in impeller engineering, brushless fan motor systems, and software-controlled airflow is expected to sustain market advances through 2035-while avoiding unverified claims.

Centrifugal blowers are estimated to hold approximately 67% of the global automotive HVAC blower market share in 2025 and are projected to grow at a CAGR of 4.0% through 2035. Their dominance is driven by superior pressure handling, quiet operation, and efficient air distribution within vehicle cabins. Automakers integrate centrifugal blowers across a wide range of passenger and commercial vehicles to support automatic climate control systems and multi-zone ventilation.

These blowers are preferred for their ability to maintain consistent airflow across HVAC ducts, even under varying resistance. Manufacturers continue to enhance motor efficiency, noise insulation, and airflow stability to meet evolving thermal comfort and energy efficiency standards-particularly critical in electric vehicles where HVAC loads impact driving range.

Passenger cars are projected to account for nearly 58% of the global HVAC blower market in 2025 and are expected to grow at a CAGR of 4.1% through 2035. Growth is supported by the rising installation of automatic climate control, cabin air filtration, and rear-seat ventilation in compact and mid-size vehicles. In 2025, automakers continue to adopt energy-efficient blower modules equipped with brushless DC motors, enabling quieter operation and reduced power draw.

As consumers demand improved cabin comfort and air quality, HVAC blower systems are scaled across both ICE and electric passenger vehicles. The segment also benefits from strong production volumes in Asia-Pacific and Europe, where regulatory mandates on in-cabin thermal safety and emissions indirectly boost HVAC blower integration across model variants.

The automotive HVAC blower market is set for steady growth, driven by rising vehicle electrification, regulatory mandates for energy efficiency, and increasing consumer demand for enhanced in-cabin comfort.

Automakers and HVAC component suppliers focusing on lightweight, energy-efficient, and smart climate control technologies will benefit, while traditional blower manufacturers relying on outdated systems may struggle to remain competitive.

Asia-Pacific will lead the market due to high vehicle production, while North America and Europe will see sustained demand from premium and EV segments.

Invest in Smart and Energy-Efficient Blowers

Stakeholders must prioritize R&D in smart HVAC blower technologies, focusing on brushless motors, AI-driven climate control, and energy-efficient airflow systems. By developing solutions that enhance performance while reducing power consumption, companies can align with the growing demand for sustainable and high-efficiency automotive components.

Adapt to Electrification and Regulatory Shifts

With the rise of electric vehicles and stricter environmental regulations, stakeholders need to refine their product strategies to meet evolving efficiency standards. Aligning with automakers' EV roadmaps, optimizing blower designs for low energy consumption, and ensuring compliance with global emissions norms will be key to long-term competitiveness.

Strengthen OEM and Aftermarket Distribution Channels

Expanding OEM partnerships and enhancing aftermarket distribution networks will be critical for capturing demand across both new and existing vehicle segments. Companies should explore strategic alliances, digital sales channels, and localized manufacturing to improve supply chain resilience and gain a stronger foothold in emerging markets.

| Risks | Probability/Impact |

|---|---|

| Supply Chain Disruptions | Medium-High |

| Regulatory Compliance Costs | High-High |

| Technological Obsolescence | Medium-Medium |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| EV Market Alignment | Conduct feasibility study on energy-efficient blowers for EVs |

| OEM Collaboration | Initiate feedback loops with automakers on next-gen HVAC needs |

| Aftermarket Expansion | Launch incentive programs to boost aftermarket distribution |

The automotive HVAC blower market is evolving, and stakeholders must act decisively to stay ahead. The shift toward EVs, stricter emission norms, and rising demand for smart climate control solutions require investments in energy-efficient technologies and strategic partnerships with OEMs.

Companies should optimize their R&D, refine their product portfolios for electrification, and build a robust aftermarket presence to maximize long-term growth. By taking a proactive stance on innovation and market alignment, stakeholders can secure a competitive edge in an increasingly dynamic automotive landscape.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across OEMs, tier-1 suppliers, aftermarket distributors, and automotive fleet operators in North America, Europe, China, and India.

Energy efficiency and regulatory compliance remain the top concerns across the automotive HVAC blower value chain. 79% of global stakeholders identified energy efficiency improvements as a "critical" priority, given tightening fuel economy and EV battery efficiency regulations.

Regional Variance

The transition to brushless DC (BLDC) motors and AI-driven climate control solutions is reshaping the market. 62% of stakeholders confirmed active investments in smart HVAC blowers with auto-adjusting airflow based on real-time cabin conditions.

Technology Variance

ROI Considerations

74% of North American and European respondents believe automation in HVAC blowers is "worth the investment," while only 33% in China and India see it as a short-term priority.

Durability and weight reduction are key factors influencing material selection for HVAC blower components. 69% of global stakeholders prefer composite materials and lightweight metals to balance longevity with efficiency.

Regional Variance

Rising raw material costs and supply chain disruptions have increased price sensitivity across the industry. 81% of stakeholders cited procurement cost fluctuations as a major challenge impacting product pricing.

Regional Differences

Manufacturers

Distributors

End-Users (Automakers/Fleet Operators)

Investment in R&D for energy-efficient and smart blowers is the dominant strategy across regions, with 72% of manufacturers planning to allocate resources to automation and AI-based climate control solutions.

Regional Focus Areas

Global regulations on energy efficiency and vehicle emissions are shaping the HVAC blower market. 76% of stakeholders believe compliance costs will increase over the next decade, necessitating proactive investment in regulatory adaptation.

Regulatory Influence by Region

High Consensus

Key Variances

Strategic Insight: A uniform approach will not work across all markets. Companies must adopt a regionalized strategy, emphasizing premium efficiency in North America, sustainability in Europe, affordability in China, and aftermarket accessibility in India.

Key Developments in 2024

The automotive HVAC blower market in the United States is expected to grow at a CAGR of approximately 3.1% from 2025 to 2035, driven by strong demand for energy-efficient and smart climate control systems. The USA has a mature automotive industry, with a high penetration of premium and electric vehicles, both of which require advanced HVAC blower technologies.

Government regulations such as Corporate Average Fuel Economy (CAFE) standards are pushing automakers to integrate energy-efficient components, benefiting high-performance blower manufacturers. Additionally, the rising adoption of electric vehicles (EVs) is increasing demand for low-noise and low-power HVAC solutions to optimize battery performance.

The presence of major automakers and tier-1 suppliers in North America ensures continuous innovation and strong aftermarket demand. However, supply chain disruptions and semiconductor shortages remain challenges. Manufacturers are focusing on lightweight and durable materials, while OEMs and suppliers are investing in AI-driven climate control systems to enhance passenger comfort.

The HVAC blower market in the United Kingdom is projected to expand at a CAGR of around 2.7% between 2025 and 2035, influenced by the country’s focus on sustainability and electrification. The UK government’s ban on new petrol and diesel car sales by 2035 is accelerating the shift toward electric and hybrid vehicles, increasing the need for energy-efficient HVAC systems.

The market is also witnessing a strong push for recyclability and sustainable production methods, with automotive companies emphasizing low-carbon manufacturing. British consumers have a strong preference for comfort-driven and noise-free cabin environments, pushing demand for premium HVAC blower solutions.

The aftermarket sector remains robust, as vehicle owners seek efficient replacements for older blower systems. Challenges include Brexit-related trade complexities, which have increased costs for imported components. However, ongoing investments by local manufacturers in R&D and smart HVAC technologies are expected to strengthen the UK's market position in the coming years.

The French automotive HVAC blower market is expected to grow at a CAGR of approximately 2.8% from 2025 to 2035, driven by the country's leadership in sustainable automotive innovation. France has one of the strongest electric vehicle adoption rates in Europe, supported by government subsidies and strict carbon neutrality targets.

These trends are pushing automakers to adopt highly efficient, low-power HVAC systems that align with emission reduction goals. The presence of major French automakers, such as Renault and Peugeot, along with a strong focus on local component manufacturing, provides a favorable environment for HVAC blower market expansion. Additionally, France’s commitment to circular economy principles is promoting the use of recyclable materials in blower manufacturing.

However, cost pressures due to inflation and rising raw material prices remain challenges for manufacturers. The market is seeing increased partnerships between tier-1 suppliers and EV manufacturers to develop advanced climate control solutions that balance efficiency, cost, and sustainability.

The German automotive HVAC blower market is projected to grow at a CAGR of around 3.2% between 2025 and 2035, supported by the country's strong automotive manufacturing ecosystem. Germany is home to some of the world’s leading premium automakers, including BMW, Mercedes-Benz, and Volkswagen, all of which are heavily investing in advanced climate control technologies.

The demand for ultra-quiet and high-performance HVAC systems is rising, particularly in the luxury and electric vehicle segments. The German government’s push for energy-efficient automotive components and sustainable production methods is further driving innovation in HVAC blower technologies.

The country’s advanced engineering expertise enables the development of lightweight and durable materials for blower systems, enhancing vehicle efficiency. However, supply chain constraints and increasing labor costs are key challenges. To maintain competitiveness, manufacturers are integrating AI-driven climate control and predictive maintenance features into their HVAC systems, ensuring optimal performance across diverse driving conditions.

The HVAC blower market in Italy is expected to grow at a CAGR of approximately 2.6% from 2025 to 2035, fueled by the country’s evolving automotive landscape. Italy has a strong presence of luxury and sports car manufacturers, such as Ferrari and Lamborghini, which demand high-performance HVAC systems with superior airflow and noise reduction capabilities.

The rising adoption of electric and hybrid vehicles is also driving demand for energy-efficient HVAC solutions. Additionally, Italy's automotive aftermarket sector remains strong, with consumers frequently upgrading their vehicles with advanced climate control systems. However, economic fluctuations and supply chain challenges pose hurdles for market expansion.

Italian manufacturers are focusing on modular blower designs that can be easily integrated into both internal combustion engine (ICE) and electric vehicle architectures. The increasing emphasis on sustainable materials and low-emission production methods is also shaping the market’s future growth, aligning with European Union environmental policies.

The automotive HVAC blower market in New Zealand is anticipated to grow at a CAGR of around 2.5% between 2025 and 2035, driven by increasing EV adoption and stringent environmental regulations. New Zealand has a strong focus on sustainability, and its government incentives for electric vehicles are encouraging the integration of energy-efficient HVAC components.

The market is primarily import-driven, with HVAC blowers being sourced from major automotive hubs like Japan, China, and Australia. Due to the country's varied climate conditions, there is a growing preference for smart climate control systems that can automatically adjust airflow based on external temperatures. However, the relatively small automotive manufacturing base and high logistics costs pose challenges for HVAC blower suppliers.

Local distributors are expanding their partnerships with international OEMs to introduce advanced blower technologies in the region. The aftermarket sector remains an essential contributor to market growth, particularly for fleet operators seeking durable and cost-effective climate control solutions.

South Korea’s automotive HVAC blower market is projected to grow at a CAGR of approximately 3.4% from 2025 to 2035, supported by the country's strong automotive and electronics industries. Home to Hyundai, Kia, and other leading automakers, South Korea is investing heavily in next-generation HVAC technologies, including AI-driven climate control and ultra-quiet blowers.

The country’s rapid EV adoption is further fueling demand for highly efficient, low-power blower systems that optimize battery performance. Government initiatives promoting eco-friendly vehicle production are pushing manufacturers to develop lightweight, recyclable HVAC components. The market also benefits from strong R&D collaborations between automotive and electronics companies, enhancing innovation in climate control solutions.

However, global supply chain disruptions and fluctuating raw material costs remain key challenges. To stay competitive, South Korean manufacturers are focusing on digital integration, allowing for real-time airflow adjustments and predictive maintenance to enhance vehicle efficiency and passenger comfort.

Japan’s automotive HVAC blower market is expected to expand at a CAGR of around 2.9% from 2025 to 2035, driven by the country’s advanced automotive technology landscape. As a global leader in hybrid and electric vehicle production, Japan is at the forefront of developing smart and energy-efficient HVAC solutions.

Automakers such as Toyota, Honda, and Nissan are investing in AI-powered climate control systems that enhance vehicle efficiency while reducing energy consumption. The emphasis on lightweight materials and compact blower designs is also shaping market trends, aligning with Japan’s focus on space-saving and efficient engineering. However, high production costs and slow aftermarket adoption of new blower technologies remain challenges.

To maintain growth, Japanese manufacturers are expanding partnerships with global automakers and exploring new materials that improve durability while reducing environmental impact. The demand for quieter HVAC solutions is also increasing, particularly in urban mobility and autonomous vehicle applications.

China’s automotive HVAC blower market is projected to grow at a CAGR of approximately 3.6% from 2025 to 2035, making it one of the fastest-growing markets globally. As the world’s largest automobile producer and consumer, China is witnessing rapid advancements in electric and connected vehicles, driving demand for intelligent climate control solutions. Government policies promoting energy efficiency and reduced emissions are pushing manufacturers to adopt high-performance HVAC blowers with improved airflow efficiency.

The competitive landscape is intensifying, with both domestic and international players investing in R&D to enhance product offerings. However, price sensitivity remains a critical factor, with automakers seeking cost-effective yet efficient blower solutions.

The expansion of ride-hailing and shared mobility services is also fueling demand for durable and long-lasting climate control systems. To capitalize on growth, companies are leveraging digitalization and AI integration to develop self-adjusting HVAC blower systems for mass-market and premium vehicles.

First Fit

The growing adoption of electric and hybrid vehicles, increasing consumer demand for enhanced in-cabin comfort, and regulatory mandates for energy-efficient vehicle components are major factors boosting demand.

Advancements such as brushless DC motors, AI-driven climate control, and lightweight materials are improving energy efficiency, reducing noise levels, and enhancing overall vehicle performance.

Asia-Pacific, particularly China and India, is witnessing significant growth due to rising vehicle production, while North America and Europe are seeing steady demand driven by premium and electric vehicle trends.

OEMs are integrating advanced climate control solutions into new vehicle models, while the aftermarket sector is benefiting from increased demand for high-efficiency replacement and upgraded components.

Key challenges include rising raw material costs, supply chain disruptions, regulatory compliance requirements, and the need for continuous innovation to meet evolving vehicle efficiency standards.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 & 2032

Table 3: Global Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 4: Global Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 5: Global Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 6: Global Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 9: Global Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 10: Global Market Volume (Units) Forecast by Region, 2017 & 2032

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 12: North America Market Volume (Units) Forecast by Country, 2017 & 2032

Table 13: North America Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 14: North America Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 15: North America Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 16: North America Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 17: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 18: North America Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 19: North America Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 20: North America Market Volume (Units) Forecast by Region, 2017 & 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 & 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 24: Latin America Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 26: Latin America Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 28: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 30: Latin America Market Volume (Units) Forecast by Region, 2017 & 2032

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2017 & 2032

Table 33: Western Europe Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 34: Western Europe Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 35: Western Europe Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 36: Western Europe Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 37: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 38: Western Europe Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 39: Western Europe Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 40: Western Europe Market Volume (Units) Forecast by Region, 2017 & 2032

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2017 & 2032

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 44: Eastern Europe Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 46: Eastern Europe Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 48: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 50: Eastern Europe Market Volume (Units) Forecast by Region, 2017 & 2032

Table 51: East Asia Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 52: East Asia Market Volume (Units) Forecast by Country, 2017 & 2032

Table 53: East Asia Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 54: East Asia Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 55: East Asia Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 56: East Asia Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 57: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 58: East Asia Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 59: East Asia Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 60: East Asia Market Volume (Units) Forecast by Region, 2017 & 2032

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 62: South Asia Market Volume (Units) Forecast by Country, 2017 & 2032

Table 63: South Asia Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 64: South Asia Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 65: South Asia Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 66: South Asia Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 67: South Asia Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 68: South Asia Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 69: South Asia Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 70: South Asia Market Volume (Units) Forecast by Region, 2017 & 2032

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2017 & 2032

Table 72: MEA Market Volume (Units) Forecast by Country, 2017 & 2032

Table 73: MEA Market Value (US$ Million) Forecast by Blower Type, 2017 & 2032

Table 74: MEA Market Volume (Units) Forecast by Blower Type, 2017 & 2032

Table 75: MEA Market Value (US$ Million) Forecast by Vehicle, 2017 & 2032

Table 76: MEA Market Volume (Units) Forecast by Vehicle, 2017 & 2032

Table 77: MEA Market Value (US$ Million) Forecast by Sales Channel, 2017 & 2032

Table 78: MEA Market Volume (Units) Forecast by Sales Channel, 2017 & 2032

Table 79: MEA Market Value (US$ Million) Forecast by Region, 2017 & 2032

Table 80: MEA Market Volume (Units) Forecast by Region, 2017 & 2032

Figure 1: Global Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 2: Global Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 & 2032

Figure 5: Global Market Value (US$ Million) by Region, 2022 & 2032

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 11: Global Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 15: Global Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 19: Global Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 20: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 22: Global Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 23: Global Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 24: Global Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 25: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 26: Global Market Attractiveness by Blower Type, 2022 to 2032

Figure 27: Global Market Attractiveness by Vehicle, 2022 to 2032

Figure 28: Global Market Attractiveness by Sales Channel, 2022 to 2032

Figure 29: Global Market Attractiveness by Region, 2022 to 2032

Figure 30: Global Market Attractiveness by Region, 2022 to 2032

Figure 31: North America Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 32: North America Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 33: North America Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 34: North America Market Value (US$ Million) by Region, 2022 & 2032

Figure 35: North America Market Value (US$ Million) by Country, 2022 & 2032

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 40: North America Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 41: North America Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 42: North America Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 43: North America Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 44: North America Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 45: North America Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 47: North America Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 48: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 49: North America Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 50: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 52: North America Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 53: North America Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 54: North America Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 55: North America Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 56: North America Market Attractiveness by Blower Type, 2022 to 2032

Figure 57: North America Market Attractiveness by Vehicle, 2022 to 2032

Figure 58: North America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 59: North America Market Attractiveness by Region, 2022 to 2032

Figure 60: North America Market Attractiveness by Country, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 62: Latin America Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 63: Latin America Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 64: Latin America Market Value (US$ Million) by Region, 2022 & 2032

Figure 65: Latin America Market Value (US$ Million) by Country, 2022 & 2032

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 70: Latin America Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 71: Latin America Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 75: Latin America Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 79: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 82: Latin America Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 83: Latin America Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 86: Latin America Market Attractiveness by Blower Type, 2022 to 2032

Figure 87: Latin America Market Attractiveness by Vehicle, 2022 to 2032

Figure 88: Latin America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 89: Latin America Market Attractiveness by Region, 2022 to 2032

Figure 90: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 91: Western Europe Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 92: Western Europe Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 93: Western Europe Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 94: Western Europe Market Value (US$ Million) by Region, 2022 & 2032

Figure 95: Western Europe Market Value (US$ Million) by Country, 2022 & 2032

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 100: Western Europe Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 101: Western Europe Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 104: Western Europe Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 105: Western Europe Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 108: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 109: Western Europe Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 112: Western Europe Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 113: Western Europe Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 116: Western Europe Market Attractiveness by Blower Type, 2022 to 2032

Figure 117: Western Europe Market Attractiveness by Vehicle, 2022 to 2032

Figure 118: Western Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 119: Western Europe Market Attractiveness by Region, 2022 to 2032

Figure 120: Western Europe Market Attractiveness by Country, 2022 to 2032

Figure 121: Eastern Europe Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 122: Eastern Europe Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 123: Eastern Europe Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 124: Eastern Europe Market Value (US$ Million) by Region, 2022 & 2032

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2022 & 2032

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 131: Eastern Europe Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 135: Eastern Europe Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 139: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 143: Eastern Europe Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 146: Eastern Europe Market Attractiveness by Blower Type, 2022 to 2032

Figure 147: Eastern Europe Market Attractiveness by Vehicle, 2022 to 2032

Figure 148: Eastern Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 149: Eastern Europe Market Attractiveness by Region, 2022 to 2032

Figure 150: Eastern Europe Market Attractiveness by Country, 2022 to 2032

Figure 151: East Asia Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 152: East Asia Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 153: East Asia Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 154: East Asia Market Value (US$ Million) by Region, 2022 & 2032

Figure 155: East Asia Market Value (US$ Million) by Country, 2022 & 2032

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 157: East Asia Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 160: East Asia Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 161: East Asia Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 162: East Asia Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 163: East Asia Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 164: East Asia Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 165: East Asia Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 168: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 169: East Asia Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 172: East Asia Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 173: East Asia Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 174: East Asia Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 175: East Asia Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 176: East Asia Market Attractiveness by Blower Type, 2022 to 2032

Figure 177: East Asia Market Attractiveness by Vehicle, 2022 to 2032

Figure 178: East Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 179: East Asia Market Attractiveness by Region, 2022 to 2032

Figure 180: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 181: South Asia Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 182: South Asia Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 183: South Asia Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 184: South Asia Market Value (US$ Million) by Region, 2022 & 2032

Figure 185: South Asia Market Value (US$ Million) by Country, 2022 & 2032

Figure 186: South Asia Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 187: South Asia Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 188: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 189: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 190: South Asia Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 191: South Asia Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 192: South Asia Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 193: South Asia Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 194: South Asia Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 195: South Asia Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 196: South Asia Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 197: South Asia Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 198: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 199: South Asia Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 200: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 201: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 202: South Asia Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 203: South Asia Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 204: South Asia Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 205: South Asia Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 206: South Asia Market Attractiveness by Blower Type, 2022 to 2032

Figure 207: South Asia Market Attractiveness by Vehicle, 2022 to 2032

Figure 208: South Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 209: South Asia Market Attractiveness by Region, 2022 to 2032

Figure 210: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 211: MEA Market Value (US$ Million) by Blower Type, 2022 & 2032

Figure 212: MEA Market Value (US$ Million) by Vehicle, 2022 & 2032

Figure 213: MEA Market Value (US$ Million) by Sales Channel, 2022 & 2032

Figure 214: MEA Market Value (US$ Million) by Region, 2022 & 2032

Figure 215: MEA Market Value (US$ Million) by Country, 2022 & 2032

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2017 & 2032

Figure 217: MEA Market Volume (Units) Analysis by Country, 2017 & 2032

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2022 & 2032

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 220: MEA Market Value (US$ Million) Analysis by Blower Type, 2017 & 2032

Figure 221: MEA Market Volume (Units) Analysis by Blower Type, 2017 & 2032

Figure 222: MEA Market Value Share (%) and BPS Analysis by Blower Type, 2022 & 2032

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Blower Type, 2022 to 2032

Figure 224: MEA Market Value (US$ Million) Analysis by Vehicle, 2017 & 2032

Figure 225: MEA Market Volume (Units) Analysis by Vehicle, 2017 & 2032

Figure 226: MEA Market Value Share (%) and BPS Analysis by Vehicle, 2022 & 2032

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Vehicle, 2022 to 2032

Figure 228: MEA Market Value (US$ Million) Analysis by Sales Channel, 2017 & 2032

Figure 229: MEA Market Volume (Units) Analysis by Sales Channel, 2017 & 2032

Figure 230: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2022 & 2032

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 232: MEA Market Value (US$ Million) Analysis by Region, 2017 & 2032

Figure 233: MEA Market Volume (Units) Analysis by Region, 2017 & 2032

Figure 234: MEA Market Value Share (%) and BPS Analysis by Region, 2022 & 2032

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 236: MEA Market Attractiveness by Blower Type, 2022 to 2032

Figure 237: MEA Market Attractiveness by Vehicle, 2022 to 2032

Figure 238: MEA Market Attractiveness by Sales Channel, 2022 to 2032

Figure 239: MEA Market Attractiveness by Region, 2022 to 2032

Figure 240: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA