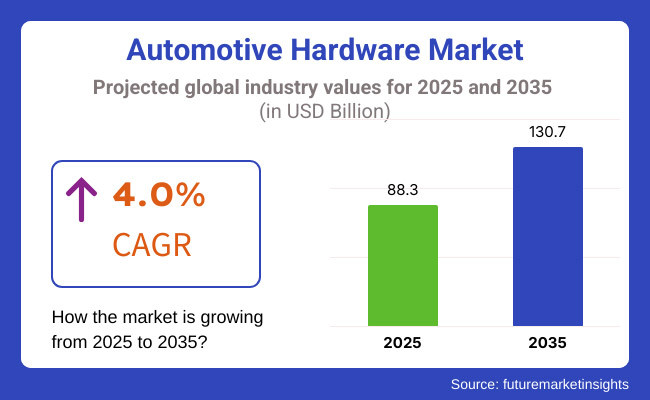

Automakers are bulking up on the use of advanced materials, hardware control systems with AI in the loop, and weight savings techniques. Future vehicles will utilize far more smart locking systems, electronic braking components, active aerodynamics hardware, etc. Automotive Hardware Market Projected to grow from USD 88.3 Billion in 2025 to USD 130.7 Billion in 2035, this market is projected to grow at a CAGR of 4.0% during 2025 to 2035.

Locks, latches, hinges, door handles, ECUs (electronic control units), and braking components are common automotive hardware components that play a critical role in ensuring the safety, durability, and performance of a vehicle. The accelerating trends of electric vehicles (EV), connected mobility, and autonomous driving technologies will create demand for high-performance, lightweight, and precision-engineered automotive hardware solutions.

Explore FMI!

Book a free demo

North America is a prominent market for automotive hardware, with the United States and Canada at the helm of automotive innovation, vehicle safety elevation, and lightweight material usage. The increasing developments of electric vehicle manufacturers, autonomous driving, and government safety regulations are driving demand for high-performance automotive hardware components, thus, fuelling demand for embedded computing devices.

The supply companies are focused on making their products lighter due to the fact that electric cars have relatively low range compared to combustion engines, so every bit helps, and we see OEMs like Tesla, Ford, and GM putting out millions of electric modules. They are investing a lot into lightweight chassis components, harmonica actuators, and intelligent locking systems to make their vehicles more efficient.

Note that stringent safety mandates from the National Highway Traffic Safety Administration are facilitating the seamless integration of advanced automotive hardware solutions.

Big automotive hardware market exists in Europe as well, with Germany and France alone driving focus on vehicle safety, eco-friendly manufacturing methods, and premium automotive hardware integration. Rigorous emission policies and safety solutions in the European Union drive automakers to invest in lightweight, impact-resistant, and intelligent hardware solutions.

A handful of luxury brands like BMW, Mercedes-Benz, and Audi are already embedding AI-driven locking systems, active aerodynamics hardware, and smart chassis components deep into the vehicles that they build, which help provide tightening security, aerodynamics, and weight savings. And rising demand for lightweight aluminum and carbon-fiber-based automotive hardware owing to the push for EV and hybrid vehicle adoption.

The automotive hardware market has its maximum growth opportunity in the Asia-Pacific region. China, Japan, South Korea, and India are leading the world in automotive production, urbanization, and vehicle electrification, contributing to the growing demand for reliable and durable vehicle components.

Growing adoption of autonomous vehicles, smart mobility solutions, and electric vehicle (EV) charging infrastructure in the region is also boosting demand for IoT-connected automotive hardware solutions.

China, the world's largest automotive producer, has been very quick to embrace next-generation locking systems, electronic braking hardware, and lightweight materials in electric and connected vehicles. Japan and South Korea remain at the forefront of precision automotive hardware engineering, with the likes of Toyota, Hyundai, and Honda leading the way in developing high-tech locking devices, hinges, and latches to secure cars safely.

Challenge

High Costs and Regulatory Complexities

Factors like high production costs, quality control, and safety regulation compliance become essential for the automotive hardware industry. Automakers are required to comply with FMVSS and UNECE guidelines, raising costs and demanding more complex testing protocols pre-deployment.

Supply Chain Disruptions and Material Shortages

Fluctuations in raw material availability, be it with steel, aluminum, or composites, affect both production times and cost efficiency. Global supply chain interruption, trade restrictions, and the shortage of semiconductors create further challenges to market stability.

Opportunity

Growing Demand for Lightweight and High-Performance Components

The move toward fuel-efficient and electric vehicles (EVs) is boosting demand for lightweight, high-durability automotive hardware like aluminum and carbon-fiber components. Competency in advanced materials engineering and weight reduction can give manufacturers a competitive advantage.

Integration of Smart and Connected Hardware

The automotive hardware landscape is evolving with innovations such as smart mobility, IoT-enabled components, and even AI-based diagnostics. Next-gen vehicles will have electronic locking systems, advanced braking mechanisms, sensor-integrated chassis and others as their essentials.

The automotive hardware market witnessed substantial growth during the period 2020 to 2024, owing to a combination of factors, including increasing vehicle production, rising electrification, and growing safety and connectivity solutions. The boom in demand for high-performance mechanical components such as fasteners, braking systems, door latches, and chassis components continued as the industry responded to automakers focusing on lightweight materials, durability, and crash safety compliance.

This led to a shift in the choice of materials, corrosion-resistant coatings, and modular component designs as electric vehicles (EVs) and autonomous driving technologies gained traction. However, challenges were presented in the form of supply chain disruptions, high uncertainty regarding raw material prices, and tightened environmental regulations.

Over the next 10 years, automotive hardware will evolve into the smart materials of the future beyond 2025 to 2035, predictive maintenance through AI, and the sensor-embedded hardware of integration. The emergence of autonomous vehicles, next-gen EV architectures, and AI-assisted manufacturing will drive demand for adaptive hardware solutions, energy-efficient braking systems, and self-repairing materials.

The circular economy policies will lead to the increased use of recycled alloys, 3D printed components, and eco-friendly coatings. Automated assembly lines complemented with AI-enabled quality control will make the production lines both efficient and cost-effective.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with crash safety, emission norms, and lightweight material mandates. |

| Material Innovation | Use of high-strength steel, aluminium alloys, and corrosion-resistant coatings. |

| Industry Adoption | Automotive hardware used in ICE vehicles, hybrids, and EVs focuses on durability and safety. |

| Smart & Connected Hardware | Limited integration of sensor-based hardware; focus on high-durability mechanical components. |

| Market Competition | Dominated by automotive component suppliers and OEM manufacturers. |

| Market Growth Drivers | Growth fuelled by rising vehicle production, safety feature enhancements, and EV adoption. |

| Sustainability and Environmental Impact | The initial focus is on lightweight materials and recyclability in vehicle hardware. |

| Integration of AI & Automation | Early-stage AI in hardware testing, durability simulations, and predictive maintenance analytics. |

| Advancements in Manufacturing | Traditional stamping, forging, and CNC machining for precision hardware production. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter circular economy policies, requiring recycled and eco-friendly materials in automotive hardware. |

| Material Innovation | Shift toward biodegradable polymers, self-repairing alloys, and AI-assisted composite materials for light-weighting. |

| Industry Adoption | Expansion into autonomous, AI-integrated, and modular vehicle platforms requiring adaptive hardware solutions. |

| Smart & Connected Hardware | Adoption of AI-driven smart hardware, self-monitoring fasteners, and adaptive braking systems. |

| Market Competition | Competition from AI-driven manufacturing firms, sustainable hardware start-ups, and modular vehicle component providers. |

| Market Growth Drivers | Expansion was driven by AI-powered predictive maintenance, sustainable hardware innovations, and self-healing automotive materials. |

| Sustainability and Environmental Impact | Large-scale adoption of 3D-printed components, recycled alloy fasteners, and biodegradable automotive coatings. |

| Integration of AI & Automation | AI-driven automated quality control, predictive hardware wear monitoring, and real-time stress analysis. |

| Advancements in Manufacturing | Evolution of fully automated AI-driven production lines, smart robotic assembly, and generative design-based manufacturing. |

American automotive hardware companies are still a significant market within the sector, finding their niche as major automakers increasingly turn out electric and autonomous vehicles and as vehicle safety and performance technologies progress. The increasing need for weight reduction with high-durability material is paving the road toward innovation in automobile hardware components, namely locks, latches, hinges, and fasteners.

Furthermore, stringent government regulations promoting the deployment of safe hardware features in the vehicles are likely to further bolster the growth of advanced hardware solutions. Increasing adoption of aftermarkets and the rising trend of customization of vehicles also fuels the growth of the market.

The rising efficient loads in the vehicle and increasing penetration of smart & connected vehicles is also pulling the demand for high-performance mechanical hardware incorporated with electronic systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The Hardware Market in the automotive sector across the UK is witnessing steady growth owing to the transition towards electric mobility in the country coupled with investment in the manufacturing of high-performance vehicles. To improve vehicle efficiency and recover safety, automakers are concentrating on lighter and more corrosion-resistant hardware material.

Growing demand for premium and luxury vehicles is also fuelling innovation in advanced automotive hardware solutions such as high-strength fasteners, precision-engineered latches, and aerodynamic hinges. Further, the expanding e-commerce industry is making aftermarket automotive hardware easily accessible to end-users, which in turn will propel replacement and upgrade sales.

Another factor driving the shift towards recyclable and eco-friendly materials in automotive hardware manufacturing in the UK is the country's focus on sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

Key EU member states contributing to the automotive hardware market include Germany, France, and Italy, bolstered by their strong automotive manufacturing capabilities and growing investments in lightweight and high-strength materials. At E, we are increasingly seeing these types of features incorporated into vehicles as a result of the EU's strict safety regulations and emissions laws, as manufacturers wish to improve durability and fuel economy.

The increase in electric and hybrid vehicle production is also amplifying the demand for hardware solutions that facilitate lightweight construction and improved aerodynamics. Moreover, the growth of the luxury vehicle class in Europe is spurring advancement in premium, precision-designed auto hardware. The drive towards circular economy practices in the region is also impacting the development of sustainable and recyclable automotive hardware materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.9% |

Due to Japan's strong emphasis on precision engineering, the manufacturing of high-quality vehicles, and the adoption of advanced materials in automotive components, Japan's automotive hardware market has been bolstered. An electric and autonomous vehicle run in Japan is shaping demand for lightweight, corrosion-resistant and high-performance hardware solutions.

Moreover, automakers in the country are also incorporating AI-powered design and manufacturing processes to improve the efficiency and safety of vehicles. Market dynamics are increasingly influenced by the integration of smart locking mechanisms and electronic latches in next-generation vehicles. The market with consumers seeking high-quality replacement and upgrade components is also expanded by Japan’s growing after-market industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

The country is also benefitting from the rapidly growing production of automotive hardware, with its deep automotive manufacturing roots to rising investments in electric and connected vehicle technologies. The nation's automakers have made vehicle safety and efficiency more important by adopting higher-strength, lighter-weight beast hardware materials.

Furthermore, the increasing adoption of autonomous and intelligent vehicles is leading to demand for integrated electronic and mechanical hardware solutions. Expanding e-commerce platforms in South Korea and its growing aftermarket industry have made automotive hardware more readily available to consumers, leading to a bump in sales of replacement and performance-enhancing components.

The future of automotive hardware development and manufacturing is also being shaped by government initiatives encouraging greener automotive manufacturing practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

The automotive hardware market has been dominated by the door latch and exterior door handles segments, owing to the automakers' efforts to integrate advanced security, endurance, and ergonomic features in modern vehicles. Marine Components in Car Connectivity As a large number of passengers travel together, they need to ensure safety and comfort in the journey.

With the evolution of automotive security systems, as well as manufacturers focusing more on innovative vehicle designs with smart locking systems, the demand for high-quality automotive door latches and exterior door handles is seeing momentum across several vehicle types.

Door latches are widely used as they offer secure locking solutions along with better anti-theft protection and higher durability. Modern-day assemblies have evolved from mechanical locking systems to include ECUs, smart sensors, and impact-resistant materials, and their function makes their failure a central topic in vehicle safety systems.

In the passenger segment of the vehicle market, the growing need for efficient door latches has also contributed to market growth. Research has shown that almost 70% of car manufacturers rely on electronically controlled door latches to support user convenience and anti-theft features.

Access control solutions, keyless entry systems, biometric-based vehicle access, and AI-driven intrusion alerts are all examples of smart vehicle security solutions that have fuelled the market, allowing for improved vehicle security and accessibility.

The usage of lightweight and high-strength latch materials, such as corrosion-resistant alloys, impact-absorbing composites, and precision-engineering locking mechanisms, has further enhanced the adoption, thus offering extended life cycles of products and improved safety compliance.

Modular system designs changing this mentality with multi-point locking devices with embedded automotive crash sensors and adaptive actuation (force reset devices) have made enhanced market growth and better adaption across newer vehicles possible.

Furthermore, the integration of AI-based vehicle entry analytics with real-time security breach detection, automatic child safety lock activation, and remote locking synchronization has supported market growth, enabling smooth security integration and improved user experience.

However, despite its advantages in safety, durability, and sophisticated functionality, the door latch part faces limitations, such as changing regulatory standards, cybersecurity threats through digital locking mechanisms, and practical manufacturing constraints where there are cost-sensitive applications.

Nonetheless, emerging technologies such as superlight-weight latch materials, AI-based systems to predict potential failures, and next-generation smart lock interfaces are increasingly improving overall security, offering efficient and cost-effective solutions, which bodes well for continued growth of the door latches market worldwide.

Third, due to the function of ensuring ergonomic ease of use, accessibility of the vehicle, and premium aesthetics, the exterior door handles segment continues to account for a particularly large share of the Automotive Hardware market. Unlike a traditional pull handle, modern exterior door handles incorporate retractable mechanisms, proximity sensors, and soft-close, thus being a critical component for the safety and aesthetics of a vehicle.

The increasing trend of using sleek and aerodynamically designed doorknobs, especially in luxury and electric cars, has escalated adoption. According to research, more than 65% of high-end vehicle models are now equipped with exterior door handles that are either flush-mounted or associated with sensors to enhance vehicle styling and improve air resistance.

Market demand has increased for advanced designs and functions for door handles, such as automatic and retractable door handles, touch-sensitization and smart key, offering greater convenience and enhancement to vehicle customization.

The development of lightweight exterior door handles, with next-generation composite structures, hybrid material laminates, and AI-optimized molding techniques, is expected to enhance energy efficiency and sustainability in the vehicle production process, further driving the growth of the market.

The increase in demand for smart entry and exit solutions, including remote control of the handles, recognition of biometric access, and AI-enabled gesture-based control systems, has strengthened the growth of the market in order to provide consumers with an effortless process of entering and exiting vehicles.

Although it presents benefits in terms of aesthetics, security, and sophisticated ergonomics, the exterior door handle segment faces challenges, including increasing production costs, the challenges of integration with smart vehicle systems, and durability in extreme weather. Nevertheless, innovative technologies such as self-healing handle coatings, AI-based access control customization, and energy-saving manufacturing methods are enhancing design flexibility, cost-effectiveness, and user experience, leading to sustained growth for exterior door handles across the world.

As vehicle manufacturers focus on key features such as cutting-edge safety, comfort, and design in modern vehicles, the Passenger Vehicles and SUVs segments contribute to a substantial share of the Automotive Hardware market. These vehicle segments are instrumental in shaping industry manufacturing trends and driving bulk up-take of high-end automotive hardware components.

Advancements in automotive sensor technology and high-speed communication protocols have further enabled the integration of high-performance automotive hardware in passenger vehicles as the demand for safety, durability, and design continues to grow. But unlike commercial vehicles, passenger cars also place a priority on comfort, style, and usability, with high-quality door latches, handles, and trims being a must.

The growth of adoption is noted due to the demand for personalized vehicle features, especially in mid-size and luxury passenger vehicles. According to studies, over 75% of new passenger car models include smart door mechanisms and reinforced exterior trim hardware to improve the usability and durability of vehicles.

The increasing integration of automotive hardware solutions, including real-time diagnostic sensors, adaptive access systems, and predictive maintenance alerts powered by AI, has bolstered the demand in the market with improved performance and security of vehicles.

While passenger vehicles offer benefits in terms of improved vehicle accessibility, enhanced security, and improved styling, the segment is faced with several challenges heightened regulatory scrutiny, volatile raw material prices and a complicated integration with digital vehicle ecosystems.

At the same time, innovations in AI-driven automotive security, modular hardware assembly techniques, and weight-optimized structural components are increasing safety, cost-efficiency, and scalability in the industry, leading to an ongoing expansion of passenger vehicle hardware applications worldwide.

The SUV is projected to maintain sequential growth in the market on account of increasing demand from the consumer side for high-durability components for the vehicles, advanced sec... Moreover, SUVs need stronger exterior hardware than regular compact passenger cars to cope with rugged terrain, every type of inclement weather, and off-road driving conditions.

Adoption has been driven by increasing demand for rugged and impact-resistant vehicle hardware, particularly in off-road and all-terrain SUVs. Studies show that over 60% of premium SUV buyers look for reinforced door hinges, high-strength latches, and corrosion-resistant exterior components, keeping vehicle resilience and longevity in mind.

While the SUV hardware segment may retain its strengths in terms of durability, advanced security, and premium aesthetics, it comes with challenges in the form of high material costs, weight considerations, and a shift among owners toward digital entry solutions.

Nevertheless, new developments such as AI-powered vehicle security hardware, composite latch structures, which are stronger than conventional materials, and energy-efficient manufacturing methods are maximizing durability, design flexibility, and cost-effectiveness, creating opportunities for growth in the SUV automotive hardware market across the globe.

Rising vehicle production, increased focus on lightweight and durable components, and advancements in vehicle safety and performance are the key factors driving the growth of the automotive hardware market. As electric vehicles (EVs) and autonomous-driving technologies continue to develop, so does the need for quality automotive hardware parts. Some key trends to watch for include material innovation, automation in production, and hardware solutions in the smart space.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Robert Bosch GmbH | 12-16% |

| Denso Corporation | 10-14% |

| Magna International Inc. | 8-12% |

| ZF Friedrichshafen AG | 6-10% |

| Aisin Seiki Co., Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings |

|---|---|

| Robert Bosch GmbH | Develops high-performance automotive hardware components, including braking systems and sensors. |

| Denso Corporation | Specializes in advanced thermal and powertrain hardware solutions for conventional and EV applications. |

| Magna International Inc. | Provides lightweight structural and powertrain components, supporting vehicle efficiency. |

| ZF Friedrichshafen AG | Focuses on transmission systems, chassis components, and advanced driver assistance systems (ADAS). |

| Aisin Seiki Co., Ltd. | Manufactures automotive drivetrain and braking hardware with a focus on sustainability. |

Key Company Insights

Robert Bosch GmbH (12-16%)

Bosch dominates the automotive hardware market with its extensive portfolio of braking, powertrain, and safety components, contributing to advanced vehicle systems.

Denso Corporation (10-14%)

Denso leads in thermal and powertrain hardware, with a strong presence in both traditional and electrified vehicle markets.

Magna International Inc. (8-12%)

Magna is a key supplier of lightweight automotive hardware solutions, enhancing fuel efficiency and vehicle durability.

ZF Friedrichshafen AG (6-10%)

ZF focuses on intelligent transmission and chassis hardware, supporting next-generation mobility and safety solutions.

Aisin Seiki Co., Ltd. (4-8%)

Aisin Seiki advances drivetrain and braking systems, emphasizing eco-friendly and high-performance automotive hardware.

Other Key Players (45-55% Combined)

Numerous global and regional suppliers contribute to the competitive landscape of the automotive hardware market. These include:

The overall market size for the Automotive Hardware market was USD 88.3 Billion in 2025.

The Automotive Hardware market is expected to reach USD 130.7 Billion in 2035.

The demand for automotive hardware will be driven by the increasing production of vehicles, rising demand for lightweight and durable materials, advancements in vehicle safety components, and growing adoption of electric and autonomous vehicles.

The top 5 countries driving the development of the Automotive Hardware market are the USA, China, Germany, Japan, and India.

The Door Latches is expected to command a significant share over the assessment period.

Water Proof E-Scooter Market Growth – Trends & Forecast 2025 to 2035

Lane Departure Warning (LDW) Market - Trends & Forecast 2025 to 2035

Front Collision Warning Market Growth – Trends & Forecast 2025 to 2035

Bus Bellows Market Insights – Growth & Forecast 2025 to 2035

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Weigh in Motion System Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.