The automotive grade inductor market is a key segment of the automotive electronics segment, which provides inductors utilized for automotive applications for power management, electromagnetic interference suppression, filtering & signal conditioning. The inductors are designed to demand automotive specifications for high-performance reliability under arduous conditions.

The market is driven by the increasing utilization of advanced electronic systems in vehicles, including infotainment systems, advanced driver-assistance systems (ADAS), and electric powertrains, which are contributing to market growth. Additionally, the growth in the number of electric vehicles (EVs) and hybrid electric vehicles worldwide is still an impetus for the necessity of efficient power conversion and energy storage, which in turn has further grown the necessity for automotive-grade inductors.

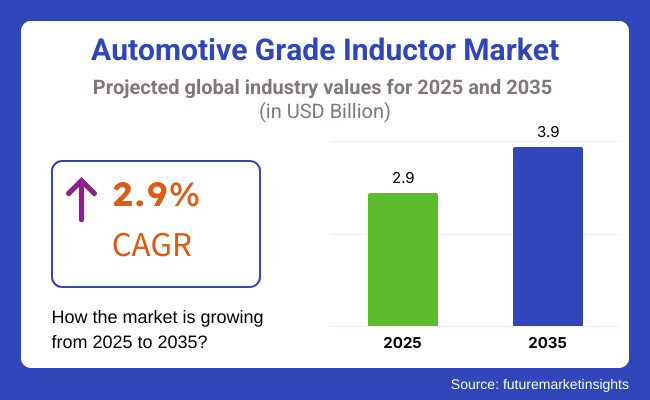

The worldwide automotive grade inductor market is anticipated to be worth USD 2.9 Billion in 2025. It will likely grow to USD 3.9 Billion by 2035, at a CAGR of 2.9% over the forecast period. This anticipated compound annual growth rate reflects a strong need for automotive grade inductors as a result of the automotive industry trend of growing use of electronic components in today's vehicles as well as greater usage for electric vehicles (EV) and hybrid electric vehicles (HEV). This has led to performance and efficiency improvements in many areas, consolidating this growth trend with advances in design and materials technology.

Explore FMI!

Book a free demo

North America has a predominant market share of the automotive grade inductor market due to the presence of well-mustached automotive and well-fastened automotive sectors. Early adoption of electronics and automotive sinks also plays an important role in the growing automotive grade inductor market.

With the rise in electric vehicle development and stringent emission regulations across the region, there has been a higher integration of advanced electronic systems in vehicles, which is driving the demand for high-quality inductors.

In addition, significant research and development investment by major market participants focuses on innovation and improvement of inductor performance in line with the changing needs of the automotive industry. Key automotive manufacturers and a strong supply chain also lend support to the growth of the market in this region.

Europe holds a significant share in the automotive grade inductor market, with leading countries such as Germany, France, and the United Kingdom driving automotive innovation and production. By ensuring this, the adoption of electric and hybrid vehicles in the region has surged owing to inductors that are automotive grade, stringent environmental regulations, and commitment towards carbon emission reduction.

European Car Manufacturers must adapt to the latest automotive trends and implement the necessary capabilities to ensure advanced electronic systems that provide the desired efficiency, performance, and safety in their vehicles, creating a strong need for manufacturability capabilities for empowered electronics, including inductive components that are fit for that purpose. Automotive Manufacturers and Electronic Component Suppliers Collaborate to Deliver Customized Inductor Solutions for Specific Vehicles

The automotive grade inductor market in the Asia-Pacific region is expected to grow at the highest CAGR due to fast industrialization and urbanization, along with a growing automotive manufacturing industry in countries like China, Japan, and India. The market continues to grow owing to rising consumer demand for cars equipped with a wide range of electronic functions and supportive government policies encouraging the adoption of electric vehicles.

To fulfill the domestic and international demand, local manufacturers are working on cost-effective and high-performance inductor design and development. The region is especially historical in electronics production, making it an ideal location for the adoption of higher-end electronics applications in the automotive sector.

Challenge

Volatility in raw material prices

Especially on metals like copper and ferrite materials that are used for inductors, Swinging material costs affect manufacturing and profit, especially when sold forward by producers. Moreover, for an industry that is subject to strict automotive standards and regulations, the pressure to follow these regulations constantly forces the industry to invest in quality assurance and testing processes. Further, the automotive electronics industry is changing quickly, making capabilities in research and development an important component for manufacturers to stay up-to-date with the latest technologies.

Opportunity

Development and adoption of advanced materials and miniaturization technologies

As vehicles transition to electrified powertrains and driverless or semi-driverless capabilities, the need for small, more efficient, and higher-performance inductors becomes even more critical. Advances in materials science, including Nanocrystalline cores and advanced magnetic materials, provide manufacturers with an opportunity to improve inductor performance and decrease their size and weight.

The harsh requirements of the present-day vehicles can be fulfilled through the joint efforts of material scientists, engineers, and automotive designers in the engineering of the inductors. Additionally, the rising trend of connected cars and the Internet of Things (IoT) in automotive applications is generating opportunities for inductors for high-frequency and high-power applications, thereby widening the market scope.

The Automotive Grade Inductor Market witnessed substantial growth from 2020 to 2024, fuelled by factors such as the increasing electrification of vehicles, advancements in automotive electronics, and the growing adoption of electric vehicles (EVs). Automotive-grade inductors are critical components in managing power, filtering signals, and storing energy in electronics within vehicles, with their demand surging amid the growing prevalence of infotainment systems, Advanced Driver Assistance Systems, and electric powertrains.

Material suppliers and manufacturers pursued miniaturization, improvements in thermal resistance, and high-reliability components designed to comply with tight AEC-Q200 regulations for automotive applications. However, industry-wide challenges arose from supply chain constraints and cost fluctuations in raw materials, as well as surging demand for high-frequency inductors.

By 2025 to 2035, the Automotive Grade Inductor market will experience the highest transformation with the surge of AI-driven power management systems, higher-efficiency magnetic components, and new inductor materials like nanocrystalline cores and ferrite-based magnetics.

The trend for solid-state battery technology, wireless charging systems, and next-gen power electronics will drive demand for high-current, compact, and thermally efficient inductors. Moreover, smart inductors integrated with real-time energy monitoring systems, AI-assisted power conditioning elements, and self-healing magnetic materials will improve their performance and longevity. Sustainability initiatives will centre around lead-free, recyclable inductor components coupled with energy-efficient manufacturing techniques.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with AEC-Q200 standards for automotive inductors, focus on EMI suppression and durability. |

| Technology Adoption | Ferrite-core and iron-powder inductors are used in powertrain, infotainment, and lighting systems. |

| Industry Adoption | Growth in 48V mild hybrid systems, EV power modules, and ADAS applications driving inductor demand. |

| Smart & Connected Components | Limited integration of smart inductors; primary focus on size reduction and thermal efficiency. |

| Market Competition | Dominated by passive component manufacturers and automotive electronics suppliers. |

| Market Growth Drivers | Growth driven by rising EV adoption, increased electronic content per vehicle, and 5G connectivity in automotive systems. |

| Sustainability and Environmental Impact | Initial steps toward lead-free inductors and reduced energy losses in passive components. |

| Integration of AI & Predictive Analytics | Early-stage AI implementation for circuit optimization and inductor selection. |

| Advancements in Manufacturing | Focus on compact, high-current inductors with improved thermal management. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter automotive safety and sustainability regulations push for lead-free, high-efficiency inductors in EVs and autonomous vehicles. |

| Technology Adoption | Transition to nanocrystalline, amorphous, and AI-optimized smart inductors for enhanced energy efficiency and high-frequency applications. |

| Industry Adoption | Expansion into solid-state battery power regulation, AI-driven vehicle electrification, and high-density power distribution units (PDUs). |

| Smart & Connected Components | AI-powered inductors with self-adjusting impedance, predictive fault detection, and dynamic energy conditioning. |

| Market Competition | Rising competition from AI-powered power management start-ups and advanced magnetics research firms. |

| Market Growth Drivers | Expansion fuelled by wireless EV charging systems, AI-integrated powertrain management, and smart grid-compatible automotive electronics. |

| Sustainability and Environmental Impact | Large-scale adoption of recyclable magnetic materials, eco-friendly power components, and energy-efficient inductor manufacturing. |

| Integration of AI & Predictive Analytics | AI-driven real-time power regulation, self-correcting inductors, and adaptive vehicle energy distribution systems. |

| Advancements in Manufacturing | Evolution of 3D-printed magnetic cores, advanced material science-driven inductors, and fully automated inductor fabrication processes. |

The automotive grade inductors market is driven by the presence of key players in the USA region, driving major advancement in automotive and automotive electronic systems. A strong ecosystem of the country’s leading automotive and semiconductor manufacturers is enabling innovations in inductor technology for applications such as power conversion, EMI suppression, and high-frequency applications.

Moreover, the growing movement toward electric and autonomous vehicles is increasing inductor content in powertrain, infotainment, and safety systems. Moreover, growing incentives for EV production in the government and the domestic manufacturing growth also lend a hand in the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

The UK automotive grade inductor market is getting driven steadily by growth. An increase in EV adoption and growth in advanced vehicle electronics are supporting the demand for automotive-grade inductors in the country. Government-led zero-emission transportation programs and domestic automotive semiconductor manufacturing investments are driving demand for high-performance inductors in the country.

Market growth is being driven by the incorporation of inductors into ADAS (Advanced Driver Assistance Systems) and battery management systems. Additionally, the growing emphasis on sustainable and energy-efficient automotive components is impacting the market, leading automotive inductor manufacturers to concentrate on the development of compact and high-power density inductor solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.7% |

Germany, France, and Italy are the major contributors to the automotive grade inductor market in the European Union, with the regional heavy automotive manufacturing base and rising investment in EV infrastructure. The EU’s stringent emission regulations and carbon neutrality targets drive automakers to adopt a great number of advanced electronic components such as inductors for next-generation vehicles.

Market growth is also being bolstered by small electric mobility and increasing semiconductor production capacity in the region. High-frequency power inductor demand in connected and autonomous vehicles in the high current application spectrum will further drive industry innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 2.8% |

In Japan, the automotive grade inductor market is expanding due to its strong focus on technological innovation, precision manufacturing, and automotive electrification components. The growing global use of hybrid and electric vehicles and the presence of major inductance manufacturers and automotive electronics companies have added fuel to the rapid development of high-efficiency automotive power inductors.

The Japanese leadership in miniaturized inductor and high-temperature-resistance inductor technology also further contributes to market growth, especially in terms of energy management systems. The demand for automotive-grade inductors is also set to increase owing to the growing implementation of semiconductor-based vehicle control units and high-voltage power applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.6% |

South Korea is also anticipated to witness significant growth in the automotive grade inductors industry, owing to the growing semiconductor manufacturing industry and significant investments in electric and autonomous vehicles. The automakers of the country are focused on improving vehicle efficiency with advanced power electronics, which is causing the demand for inductors in high-frequency converters and electric drive units.

Further, growth in the production of battery-electric vehicles (BEV) and government support for green automotive technology is also promoting the growth of the market. Industry dynamics will also continue to be influenced in the upcoming years by the adoption of AI-based electronic systems and smart inductor solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.0% |

The Automotive Grade Inductor in the 1 to 10 micro Henry and 10 to 20 micro Henry segment is expected to hold a great share as automobile makers are increasingly incorporating high-performance electronic components into contemporary vehicles.

Automotive inductors are vital components in automotive electronic systems, utilized for applications such as power management, electromagnetic interference (EMI) suppression, and signal filtering. The proliferation of vehicle electrification and advanced driver-assistance system (ADAS) technologies is driving a growing need for high-precision inductors in these automotive applications.

1 to 10 micro Henry inductors have seen pretty good market adoption because of filtering at high-frequency regions, more compact size, and efficient power regulation. With high inductance values comes undesirable slower response times, greater signal distortion, and poorer thermal performance; thus, these components are favoured to keep automotive electronic applications critical.

Market adoption has been driven by the growing need for compact power electronics, particularly in passenger vehicles. According to studies, more than 65% of automotive power management systems consist of from 1 to 10 micro Henry inductors with low core losses, better heat dissipation, and total electrical efficiency.

The growing adoption of automotive infotainment and connectivity solutions, equipped with AI-assisted navigation, wireless communication modules, and advanced digital dashboards, has boosted the demand for these market offerings, enabling enhanced signal integrity and power distribution.

AI-powered inductor fine-tuning, ultra-low resistance materials, and self-tuning resonance control have been integrated into power conversion circuits, and that has spurred the adoption of energy-efficient power conversion, contributing to seamless energy regulation and providing long component life.

Lightweight and miniaturized inductor designs, with an emphasis on high-density ferrite cores, sophisticated winding structures, and precision-molded enclosures, have promoted market growth, enabling improved performance for automotive electrification and connectivity applications.

The implementation of sustainable manufacturing techniques with less material wastage, recyclable inductor cores, and low-carbon production methodologies has supported market growth by complying with global environmental and regulatory initiatives.

While it offers benefits in terms of compact design, high-frequency response, and efficient energy regulation, the 1 to 10-micro Henry inductor segment struggles with greater thermal sensitivity, manufacturing complexity, and the volatility of raw material and commodity prices.

Nevertheless, remarkable advancements in Nano-material inductance enhancement technologies and AI-driven electronic circuit optimization are always improving the performance, cost-effectiveness, and scalability, ensuring the worldwide demand for 1 to 10 microhenry inductors.

Inductors within the 10 to 20 microhenry range maintain a major share in the Automotive Grade Inductor market owing to their capability of handling large current performance, power conditioning, and canceling EMI.

While smaller inductance values are used primarily for filtering, components in this range provide excellent energy storage capacity, improved ability to handle magnetic flux in the magnetic circuit path and best electrical noise reduction on noisy operating circuits; these attributes are essential for systems such as vehicle powertrain electronics and safety electronics.

Market adoption has been driven by the increasing demand for high-reliability inductors, specifically in electric and hybrid vehicles. As per the studies, 10 to 20 micro Henry inductors are used in over 60% of advanced automotive powertrain and charging infrastructure components to ensure stable power conversion and reduce EMI interference.

The emergence of high-voltage battery management systems with capabilities including high-speed charging, flow ability of energy in both directions, and built-in thermal observation has created robust demand in the market, delivering improved battery performance and system efficiency.

In addition, smart automotive control units equipped with Artificial Intelligence(static load balancing, inductor regulation, predictive maintenance analytics, predicting latency, and real-time current stabilization) have catapulted the adoption rate, offering long-term operational stability and energy optimization.

Next-generation noise suppression inductors, with ferrite-based shielding and high-permeability core materials and adaptive impedance balancing, continue to be the centre of market growth, optimally representing electromagnetic compatibility and signal fidelity.

The use of durable and high-temperature-rated inductor designs, such as thermally-stable winding topologies, corrosion-resistant casings, and sophisticated encapsulation methods, has contributed to increased market growth, ensuring survivability in extreme automotive conditions.

Even if benefits are given, such as reduced power consumption, lower electromagnetic noise, longevity, and automotive-grade durability, the 10 to 20 micro Henry inductor segment deals with integration issues within miniaturized electronic standard circuits, elevated manufacturing costs, and new regulatory standards for automotive electronic building blocks.

However, advancements in AI-based power management systems allow for increased adaptability and reliability while new strong industrial materials such as graphene open up possibilities of making high-frequency inductors and inductor manufacturing in multi-layers to enhance the practical value of very small inductors in the range of 10 to 20 microhenry.

As manufacturers focus on vehicle electrification, energy efficiency, and smart automotive technologies, the automotive grade inductor market is currently receiving a large share of investments in the passenger vehicles and SUVs segments. The vehicle segments are instrumental in industry trends to achieve broad adoption of high-performance inductors for power conversion, infotainment, and safety applications.

OEM automotive-grade inductors have achieved high market penetration in passenger vehicles owing to greater reliance on digital interfaces, ADAS, and energy-efficient power electronics. At the same time, since passenger cars also pay more attention to miniaturization, high-density electronic components, compact, high-frequency inductors have become a key part of modern automotive comprehensive design, while commercial vehicles have a high power demand, requiring large-volume power inductors.

Adoption has been accelerated by the rapidly growing demand for in-vehicle connectivity, particularly in mid-size and compact passenger vehicles. According to studies, more than 70% of automotive electronics systems utilize high-frequency inductors for various applications such as signal stabilization, power conditioning, and interference suppression.

The growing adoption of electric vehicle (EV) power management solutions such as high-voltage DC-DC converters, battery energy storage systems, and motor drive controllers, are bolstering market demand and enabling higher energy conversion efficiency with minimal power losses.

On the other hand, passenger cars are confronted with new challenges, including rising electronic component costs, changing industry safety regulations, and high-performance inductor thermal management constraints, despite its advantages of energy efficiency, miniaturization, and digital signal enhancement.

Nevertheless, recent advances in artificial intelligence (AI) powered vehicle power distribution networks, ultra-fast inductor energy recovery circuits and self-healing ferrite core materials are enhancing the reliability and efficiency and scalability of the industry, promising ongoing growth for automotive-grade inductors in passenger vehicles globally.

The rise in consumer demand for premium automotive technology, improved safety capabilities, and off-road-ready electronic components are contributing factors toward the strong market growth of SUVs. Such components exist in compact passenger cars, but SUVs require high-current and high-durability inductors to accommodate greater electrical loads, adaptive suspension systems, and all-terrain drive assist modules.

Growing adoption owing to surging demand for rugged and high-power electronic components, mainly in luxury and off-road SUV models has significantly fuelled adoption. Research indicates that more than 60% of premium SUVs incorporate high-reliability inductors to provide dynamic power steering, high-end infotainment systems, and electronic stabilization across their chassis.

Although offering benefits in terms of power endurance, electronics optimization, and premium feature enhancement, the SUV inductor segment is limited by increased heat dissipation management, weight, and automotive-grade durability levels.

However, with burgeoning innovations in AI-enabled inductor thermal management, next-generation electromagnetic shielding, high-frequency lightweight inductor designs, etc., the automotive-grade inductors deployed in the SUV segmentation globally will see an upbeat trend upward through automotive system efficiency, vehicle safety, and sustainability.

The growth is largely attributed to their high efficiency and excellent performance in power delivery, thermal cycles, and narrow temperature ranges. The market is significantly expanding, with OEMs and component manufacturers focusing on miniaturization and performance improvement. Inductors continue to find new applications in ADAS, EV powertrains, and infotainment systems and represent key trends shaping the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TDK Corporation | 12-16% |

| Murata Manufacturing Co., Ltd. | 10-14% |

| Vishay Intertechnology, Inc. | 8-12% |

| Panasonic Corporation | 6-10% |

| Taiyo Yuden Co., Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| TDK Corporation | Develops high-performance automotive inductors for power electronics and EMI suppression. |

| Murata Manufacturing Co., Ltd. | Specializes in compact and high-efficiency inductors for automotive power management. |

| Vishay Intertechnology, Inc. | Provides ruggedized inductors for automotive applications, focusing on reliability. |

| Panasonic Corporation | Develops automotive-grade power inductors with high thermal resistance and efficiency. |

| Taiyo Yuden Co., Ltd. | Focuses on compact, high-reliability inductors for EV and hybrid vehicle applications. |

Key Company Insights

TDK Corporation (12-16%)

TDK leads in high-performance automotive inductors, supporting EMI suppression and power management for modern vehicle electronics.

Murata Manufacturing Co., Ltd. (10-14%)

Murata specializes in compact, high-efficiency inductors tailored for EV and ADAS applications, enhancing vehicle electrification.

Vishay Intertechnology, Inc. (8-12%)

Vishay provides robust inductors designed to withstand harsh automotive environments and support high-power applications.

Panasonic Corporation (6-10%)

Panasonic focuses on thermal-resistant inductors optimized for automotive powertrain and infotainment systems.

Taiyo Yuden Co., Ltd. (4-8%)

Taiyo Yuden develops miniaturized automotive inductors with high power density for next-generation electric vehicles.

Other Key Players (45-55% Combined)

Several global and regional component manufacturers contribute to the expanding automotive-grade inductor market. These include:

The overall market size for the Automotive Grade Inductor market was USD 2.9 Billion in 2025.

The Automotive Grade Inductor market is expected to reach USD 3.9 Billion in 2035.

The demand for automotive grade inductors will be driven by the increasing adoption of electric vehicles, advancements in automotive electronics, rising demand for efficient power management systems, and growing integration of ADAS and infotainment systems.

The top 5 countries driving the development of the Automotive Grade Inductor market are the USA, China, Germany, Japan, and South Korea.

1 to 10 micro henry Inductor segment is expected to command a significant share over the assessment period.

Automotive Fuel Return Line Market Insights - Trends, Demand & Growth 2025 to 2035

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive Glass Cleaner Market Growth - Demand, Trends & Forecast 2025 to 2035

Automotive Fuel Gauge Sending Unit Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Automotive Fuel Gauge Market: Trends, Technologies, and Growth Outlook

Automotive Disc Couplings Market Growth - Demand, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.