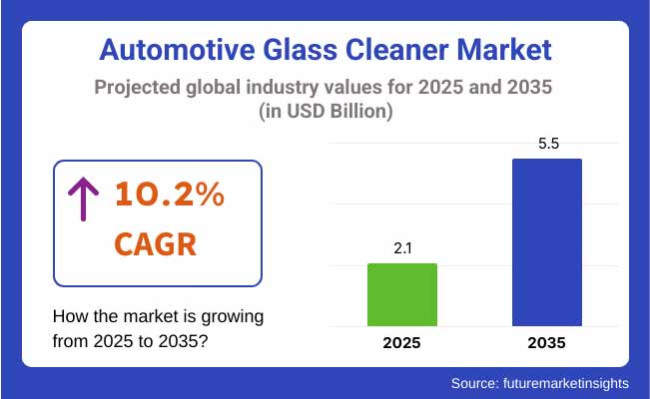

The global Automotive Glass Cleaner Market is valued at USD 2.1 billion in 2025. It is expected to grow at a CAGR of 10.2% and reach USD 5.5 billion by 2035. This market is expected to sustain its upward trajectory over the next decade, driven by increasing vehicle production, rising urbanization, and heightened consumer preference for vehicle aesthetics and hygiene.

Advancements in cleaning technology, including the development of ammonia-free and water-repellent formulations, will further support market expansion. With growing environmental concerns, demand for eco-friendly, non-toxic, and bio-based glass cleaners is anticipated to surge.

Additionally, the rise in electric vehicle (EV) adoption will contribute to higher sales, as EV owners tend to prioritize vehicle cleanliness and maintenance.

The integration of nanotechnology in cleaning solutions for improved dirt resistance and anti-glare properties will also influence market dynamics. The Asia-Pacific region will likely remain a dominant market, propelled by high vehicle ownership and increasing consumer spending.

The automotive glass cleaner market is set for strong growth, driven by rising vehicle ownership, increasing consumer awareness of car maintenance, and demand for eco-friendly cleaning solutions. Innovations in nanotechnology and ammonia-free formulations will further enhance product adoption, particularly among electric vehicle owners and environmentally conscious consumers.

Manufacturers investing in sustainable and high-performance cleaning solutions stand to benefit, while traditional chemical-based cleaners may struggle to maintain market share.

The windshield cleaner segment will continue to dominate the automotive glass cleaner market over the forecast period, as it remains an essential component of routine vehicle maintenance. With growing consumer preference for convenience, demand for different packaging sizes will increase.

Small-size windshield cleaners (0-50 ml) will appeal to on-the-go consumers looking for quick cleaning solutions, while larger sizes (above 50 ml) will be favored for long-term use. The rise in vehicle ownership and awareness of road safety will drive sustained demand for windshield cleaners across both personal and commercial vehicles.

Cleaning tablets will experience rapid adoption as consumers seek compact, eco-friendly, and cost-effective alternatives to liquid glass cleaners. Small-size packets (10 tablets) will cater to individual car owners who prioritize affordability and convenience, whereas mid-size packets (10-50 tablets) and large packets (above 50 tablets) will serve fleet operators and professional cleaning service providers. The increasing shift toward water-soluble, biodegradable cleaning formulations will contribute to the expansion of this segment.

The liquid spray segment will witness strong growth, fueled by its ease of application and effectiveness in removing dirt, grime, and stubborn stains from automotive glass surfaces. Smaller bottles (0.5 liters) will continue to attract consumers looking for personal-use products, while mid-sized (0.5-2 liters) and larger (above 2 liters) packaging will cater to service centers, detailing workshops, and fleet maintenance providers. The rise of ammonia-free, streak-free, and fast-drying liquid sprays will further bolster demand, particularly among eco-conscious consumers.

The OEM segment will experience steady expansion as automotive manufacturers increasingly integrate high-quality glass cleaners as part of vehicle maintenance packages. As automakers emphasize enhanced visibility and safety, pre-packaged cleaning solutions will become a standard feature in new car purchases.

The rise in electric vehicle production will further accelerate OEM sales, as EV manufacturers focus on promoting premium car care products. Collaborations between car manufacturers and leading glass cleaner brands will shape this segment, ensuring sustained growth through dealership-based sales.

The aftermarket segment will remain the dominant distribution channel, driven by consumer demand for accessible and affordable automotive cleaning solutions. With the expansion of online retail and e-commerce platforms, aftermarket sales will surge, providing customers with a wide variety of product options and bulk purchase deals.

Traditional brick-and-mortar retailers, including auto parts stores, supermarkets, and specialty car care outlets, will continue to serve as key distribution points. As DIY car maintenance gains popularity, aftermarket retailers will leverage digital marketing and subscription-based sales models to capture a larger customer base.

Invest in Sustainable and Innovative Cleaning Solutions

Executives should prioritize the development of eco-friendly, biodegradable, and non-toxic glass cleaning formulations to align with increasing environmental regulations and consumer preferences.

Investment in nanotechnology-based and ammonia-free solutions will create a competitive edge by offering superior cleaning performance while ensuring safety for users and the environment.

Strengthen Digital and Direct-to-Consumer Channels

Stakeholders must enhance their online presence and e-commerce strategies to capture the growing demand for automotive glass cleaners through digital retail channels. Leveraging AI-driven customer insights and implementing subscription-based sales models will drive repeat purchases and customer loyalty, ensuring alignment with evolving buying behaviors.

Expand OEM and Aftermarket Partnerships

Companies should establish strong collaborations with automotive manufacturers to integrate high-quality glass cleaners into vehicle maintenance packages. Strengthening aftermarket partnerships through distributor incentives, service center collaborations, and bundled product offerings will optimize supply chain efficiency and expand market reach.

| Risks | Probability/Impact |

|---|---|

| Regulatory restrictions on chemical-based cleaners | High-High |

| Supply chain disruptions affecting raw materials | Medium-High |

| Intense price competition from unbranded or low-cost alternatives | High-Medium |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Sustainable product innovation | Develop and test biodegradable cleaning formulations |

| Digital sales expansion | Strengthen e-commerce and direct-to-consumer marketing strategies |

| OEM integration | Secure partnerships with automakers for bundled maintenance packages |

Executives must accelerate innovation in sustainable automotive glass cleaners, leveraging biodegradable formulations and advanced cleaning technologies to capture the rising eco-conscious consumer base.

The shift toward digital sales channels require strategic investment in e-commerce and AI-driven customer engagement to maximize aftermarket opportunities.

Strengthening OEM and aftermarket partnerships will be critical to securing long-term growth, ensuring product visibility, and optimizing supply chain efficiency.

Now is the time to redefine market positioning by integrating sustainability, technology, and customer-centric distribution strategies into the corporate roadmap.

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, retailers, and end-users in North America, Western Europe, Asia-Pacific, and the Middle East & Africa

Product efficacy and environmental sustainability have emerged as top priorities for stakeholders in the automotive glass cleaner market. A majority of stakeholders highlighted that consumers are increasingly demanding streak-free, ammonia-free, and biodegradable cleaning solutions. Across all regions, ease of use and long-lasting protection against dirt and rain were identified as critical purchase drivers.

Regional Variance

In North America, 73% of participants emphasized the growing demand for eco-friendly and VOC-free formulations due to stricter environmental regulations. Western Europe saw the highest concern for sustainability, with 81% of respondents prioritizing recyclable packaging and carbon-neutral production processes.

In the Asia-Pacific, 64% of respondents cited affordability and multipurpose cleaners as key factors due to high price sensitivity. Meanwhile, Middle East & Africa stakeholders (57%) focused on durability and resistance to extreme weather conditions, given the region's harsh climate.

Technological advancements in cleaning formulations and application methods are gaining traction. A significant portion of the market is shifting towards advanced glass cleaners that incorporate nanotechnology for water repellency and anti-glare properties. Innovations such as spray-and-forget coatings and sensor-enabled smart dispensers are gaining interest, though adoption varies by region.

High Variance

In North America, 62% of retailers reported increased demand for hydrophobic nanocoatings, particularly from luxury car owners. Western Europe led in the adoption of bio-based cleaning agents, with 55% of distributors focusing on plant-derived, non-toxic ingredients.

Asia-Pacific showed moderate adoption, with 43% of participants interested in smart dispensers for automatic car washes. Middle East & Africa had the lowest adoption rate (28%), citing cost concerns and a preference for traditional cleaning solutions.

Convergent and Divergent Perspectives on ROI

While 69% of North American and 58% of Western European respondents considered premium nano-coating cleaners to be “worth the investment,” only 37% of Asia-Pacific and 25% of Middle East & Africa participants agreed, due to lower price elasticity in these regions.

Packaging choices are driven by a combination of convenience, cost, and environmental concerns. Spray bottles and cleaning tablets are the most preferred formats due to their ease of use and controlled application. However, preferences vary by region and user type.

Consensus

Spray bottles remain the dominant choice worldwide, selected by 68% of participants, while cleaning tablets are gaining traction as an eco-friendly alternative.

Variance

In Western Europe, 59% of stakeholders preferred biodegradable refillable bottles, aligning with sustainability goals. Asia-Pacific markets showed the highest interest in bulk packaging (47%) due to cost efficiency for professional cleaning services. North American distributors reported a growing demand (54%) for concentrated formulas that allow dilution, reducing plastic waste. Middle East & Africa participants (45%) leaned towards durable, heat-resistant packaging to withstand high temperatures.

Cost remains a major factor in purchasing decisions, with clear differences across regions. While premium features are attractive, many buyers remain price-sensitive, especially in emerging markets.

Shared Challenges

78% of global respondents cited rising raw material costs (chemicals, packaging) as a primary concern.

Regional Differences

In North America and Western Europe, 61% of respondents indicated a willingness to pay a 15-25% premium for eco-friendly formulations and advanced cleaning properties. In contrast, Asia-Pacific and Middle East & Africa markets showed strong price sensitivity, with 72% of participants prioritizing affordability over premium features. Middle East & Africa also showed a preference (49%) for bulk purchasing or lower-priced cleaning tablets instead of premium liquid sprays.

Manufacturers, distributors, and retailers face distinct operational challenges, influencing market dynamics.

Manufacturers

In North America, 52% of manufacturers cited increasing regulatory requirements for chemical formulations as a challenge. Western European manufacturers (58%) struggled with sourcing sustainable raw materials at competitive prices. Asia-Pacific stakeholders (46%) expressed concerns over counterfeit products impacting brand reputation, while Middle East & Africa (63%) faced logistical challenges in product distribution.

Distributors & Retailers

Inventory management and distribution remain significant hurdles. North American distributors (67%) faced delays in importing specialized chemical components. Western Europe (53%) reported increasing competition from private-label brands, impacting pricing power. Asia-Pacific (48%) struggled with varying regulatory compliance across different markets. Middle East & Africa (55%) reported logistical issues, particularly in rural regions.

Stakeholders across regions are focusing on long-term investments that align with market trends.

Alignment

Globally, 72% of manufacturers plan to invest in sustainable and high-performance cleaning technologies.

Divergence

In North America, 64% of companies are focusing on developing smart cleaning solutions integrated with car wash automation. Western Europe (57%) prioritizes carbon-neutral production methods. Asia-Pacific (53%) is emphasizing cost-effective, multi-purpose cleaners. Middle East & Africa (49%) is investing in logistics infrastructure to expand market reach.

Evolving regulations across different regions are shaping the future of the automotive glass cleaner market.

High Consensus

There is a universal emphasis on sustainable, streak-free, and easy-to-use automotive glass cleaners. Consumers are increasingly favoring products that align with environmental and regulatory trends, making eco-friendly formulations and innovative packaging crucial.

Key Variances

| Countries /Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The Environmental Protection Agency (EPA) regulates volatile organic compounds (VOCs) in cleaning products, limiting the use of ammonia and other harmful chemicals. The Toxic Substances Control Act (TSCA) requires compliance for chemical formulations. Companies must adhere to California’s Proposition 65, which mandates labeling of products containing hazardous chemicals. |

| Canada | The Canadian Environmental Protection Act (CEPA) regulates chemical safety, restricting certain cleaning agents that impact air and water quality. The EcoLogo certification (UL 2759) is required for environmentally friendly automotive cleaning products. |

| European Union | The EU’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation strictly controls the use of hazardous substances in cleaning formulations. The EU Ecolabel certification is necessary for companies marketing eco-friendly automotive glass cleaners. The European Green Deal encourages sustainable packaging and carbon-neutral production. |

| United Kingdom | Post- Brexit, the UK follows its own REACH framework, with regulations mirroring the EU but managed by the Health and Safety Executive (HSE). Cleaning products must comply with the UK Ecolabel standards for sustainability and safety. VOC content limits remain in line with EU standards. |

| China | The Ministry of Ecology and Environment (MEE) enforces restrictions on VOC emissions under the Air Pollution Prevention and Control Action Plan. The China Compulsory Certification (CCC) is required for chemical-based cleaning products entering the market. There is an increasing push for biodegradable and water-based cleaning solutions. |

| India | The Bureau of Indian Standards (BIS) regulates automotive cleaning products, ensuring they do not contain banned chemicals such as phosphates. The Plastic Waste Management Rules encourage companies to adopt recyclable or biodegradable packaging. The Green Pro certification is gaining traction for sustainable products. |

| Japan | The Ministry of the Environment regulates chemical usage under the Chemical Substances Control Law. Cleaning products must comply with the Japan Industrial Standards (JIS) for safety and effectiveness. There is growing preference for low-VOC, water-based cleaners to align with strict air quality regulations. |

| South Korea | The Act on Registration and Evaluation of Chemicals (K-REACH) regulates hazardous chemical usage. The Korea Eco-Label certification is required for companies marketing environmentally friendly automotive glass cleaners. Government incentives support the development of ammonia-free cleaning solutions. |

| Australia | The National Industrial Chemicals Notification and Assessment Scheme (NICNAS) regulates the import and use of chemical-based automotive cleaners. Compliance with the Australian Ecolabel Program is necessary for companies marketing sustainable products. Increasing pressure to phase out high-VOC formulations. |

| Middle East & Africa | Regulations vary widely, with the UAE implementing strict VOC emission limits under the Emirates Authority for Standardization and Metrology (ESMA). Saudi Arabia enforces chemical safety under the Saudi Standards, Metrology, and Quality Organization (SASO). Africa has fewer strict regulations, but South Africa’s Environmental Management Act is pushing for greener formulations. |

The automotive glass cleaner market is led by a competitive mix of multinational giants and niche innovators. At the forefront is 3M Company, commanding an impressive 18.2% market share.

Known for its strong R&D capabilities and a broad product portfolio, 3M benefits from both its direct offerings and the performance of its subsidiary, Meguiar’s Inc., which adds another 9.8%, bringing its combined market presence to over 28%. Meguiar’s specializes in premium car care and detailing products, catering to enthusiasts and professionals seeking high-performance formulations.

Rain-X, owned by ITW Global Brands, holds the second-largest individual share at 14.5%, thanks to its established reputation for water-repellent glass treatments and widespread presence across retail and automated car wash channels.

Turtle Wax Inc. follows with a solid 12.3%, driven by its affordability, brand legacy, and expanding eco-friendly product lines. Brands like Armor All (8.6%) and Chemical Guys (7.9%) continue to capitalize on their appeal to DIY consumers and detailing professionals alike, with the latter gaining popularity through influencer marketing and social media.

Stoner Inc., particularly its “Invisible Glass” line, has carved a niche with 5.4% share, offering specialized, streak-free products that resonate with quality-focused buyers. Sonax GmbH, a premium German brand, holds 4.7% and is especially popular in Europe, where demand for biodegradable and high-performance cleaners is strong.

Interestingly, regional and private-label brands collectively account for the largest chunk after the top players-at 18.6%. This highlights the growing fragmentation in the market, especially in price-sensitive and emerging markets, where local brands cater to specific regional preferences with competitive pricing and tailored distribution. This segment is expected to gain ground as private labels from large retail chains continue to challenge incumbents on both price and perceived value.

Key Developments in 2024

The automotive glass cleaner market in the United States is expected to grow at a CAGR of approximately 9.8% from 2025 to 2035, driven by rising consumer awareness about vehicle maintenance and stringent environmental regulations.

The demand for high-performance, ammonia-free, and biodegradable glass cleaners is increasing as both consumers and regulatory bodies push for sustainable alternatives. Stringent VOC regulations enforced by the Environmental Protection Agency (EPA) and California’s Proposition 65 are prompting manufacturers to develop eco-friendly formulations.

The market is dominated by leading brands such as 3M, Rain-X, and Turtle Wax, which have a strong presence in both the retail and professional car care segments. The rise of e-commerce platforms and direct-to-consumer sales is also reshaping distribution channels, with Amazon and Walmart playing key roles in market expansion. Additionally, the increasing penetration of automated car wash centers is driving demand for bulk automotive glass cleaners, particularly concentrated solutions used in professional detailing services.

Sustainability trends are also influencing packaging innovations, with many companies shifting to recyclable and refillable bottles to reduce plastic waste. Private-label brands are gaining traction, especially in mass-market retail chains, challenging premium brands with cost-effective alternatives. The adoption of nanotechnology in glass cleaning solutions, offering water-repellent and anti-glare properties, is another emerging trend.

The UK automotive glass cleaner market is projected to grow at a CAGR of 8.5% between 2025 and 2035, driven by increasing consumer preference for eco-friendly and high-performance cleaning solutions.

The country’s stringent environmental laws, aligned with EU standards despite Brexit, are pushing manufacturers to focus on VOC-free, biodegradable formulations. The growing trend of electric vehicles (EVs) and increased vehicle ownership in urban areas is also boosting demand for premium car care products.

Supermarkets and auto specialty stores dominate the distribution landscape, with major players such as Halfords and Tesco driving sales. Online sales through platforms like Amazon UK and direct-to-consumer brand websites are also growing.

The professional detailing industry is experiencing increased demand, particularly for premium and ceramic-based glass cleaners that provide long-lasting protection against dirt and water stains.

British consumers are increasingly drawn to sustainability, preferring brands that offer refillable and recyclable packaging.

Additionally, innovations such as hydrophobic glass coatings are gaining popularity among high-end car owners, contributing to the market's premiumization trend. While global brands maintain dominance, there is a rising preference for private-label alternatives that offer affordability without compromising performance.

France’s automotive glass cleaner market is expected to grow at a CAGR of 8.2% from 2025 to 2035, fueled by a strong automotive culture and government-led sustainability initiatives. French consumers are highly conscious of environmental impact, leading to increasing demand for bio-based and ammonia-free glass cleaners. The country’s compliance with EU regulations such as REACH and the European Green Deal is pushing manufacturers to develop low-VOC and carbon-neutral products.

Retailers like Carrefour and Auchan play a key role in market distribution, alongside specialized auto care chains. E-commerce is witnessing rapid growth, with platforms like Amazon France and Cdiscount becoming preferred channels for purchasing automotive cleaning products. Additionally, the trend of self-service car washes is expanding, contributing to higher sales of bulk glass cleaner solutions.

Premium brands such as Sonax and Meguiar’s have a strong foothold in the French market, but there is also significant demand for locally produced, eco-friendly alternatives. Consumers prioritize ease of use, with spray-based glass cleaners being the most preferred format. Product innovation, such as streak-free and rain-repellent formulations, is a key differentiator in this highly competitive market.

Germany’s automotive glass cleaner market is projected to expand at a CAGR of 9.0% between 2025 and 2035, supported by the country’s strong automotive industry and growing consumer demand for high-quality vehicle maintenance products. The presence of major car manufacturers and a well-developed car care culture drive consistent demand for advanced glass cleaning solutions.

Regulatory frameworks such as the EU’s REACH guidelines and Germany’s own sustainability targets encourage the use of biodegradable and eco-friendly glass cleaners.

The demand for water-repellent and long-lasting protection coatings is particularly high, with brands like Sonax and 3M leading the market. The increasing number of automated car wash centers and professional detailing services further boosts the industry’s growth.

Retail distribution is dominated by large supermarkets, auto care chains, and e-commerce platforms like Amazon Germany and Auto-Teile.de. There is a strong shift towards refillable packaging and concentrated formulations, aligning with Germany’s emphasis on reducing plastic waste. Additionally, the rise of electric vehicles is influencing consumer behavior, with many EV owners opting for premium, long-lasting glass cleaners to maintain visibility and aesthetics.

The Italian automotive glass cleaner market is expected to grow at a CAGR of 8.0% during the 2025 to 2035 period, driven by increasing consumer interest in high-performance vehicle maintenance products. Italy’s strong car enthusiast culture fuels demand for premium automotive cleaning solutions, including advanced glass cleaners with anti-fog and water-repellent properties.

The market is influenced by EU environmental regulations, prompting manufacturers to develop non-toxic and biodegradable cleaning solutions. Italian consumers prefer easy-to-use spray formulations, and there is a growing demand for multipurpose cleaners that work on both automotive glass and interior surfaces. Brands like Ma-Fra and Arexons, alongside global leaders such as Meguiar’s and 3M, dominate the landscape.

Retail distribution is primarily through auto specialty stores, supermarkets, and online platforms. The professional detailing industry is expanding, with a rise in demand for high-quality bulk cleaning solutions in car washes and auto service centers. Private-label brands are also gaining traction, offering cost-effective alternatives to premium products.

Japan’s automotive glass cleaner market is expected to grow at a CAGR of 7.5% from 2025 to 2035, reflecting the country’s focus on innovation and sustainability in car care products. Japanese consumers prioritize quality and ease of use, leading to strong demand for streak-free, quick-drying, and ammonia-free glass cleaners.

Domestic brands such as Soft99 and Prostaff dominate the market, offering advanced formulations with nanotechnology and water-repellent properties. The rise of electric vehicles and the aging vehicle population are increasing the demand for high-performance glass cleaners. Japanese regulations under the Chemical Substances Control Law promote the use of environmentally friendly ingredients, further influencing product formulations.

Retail sales are driven by auto specialty stores like Autobacs, along with convenience stores and e-commerce platforms like Rakuten and Amazon Japan. There is also increasing adoption of refillable and eco-friendly packaging, aligning with Japan’s sustainability goals.

China’s automotive glass cleaner market is anticipated to expand at a CAGR of 10.5% between 2025 and 2035, driven by rapid urbanization, rising car ownership, and increasing awareness of car maintenance. The growing middle class and expansion of professional car wash centers are key factors boosting demand.

The Chinese government’s stricter environmental policies, including VOC restrictions and green manufacturing incentives, are encouraging the shift toward eco-friendly cleaning solutions. International brands such as 3M and Turtle Wax compete with domestic players like Botny and Blue Sky, which offer competitively priced alternatives.

E-commerce is the dominant sales channel, with platforms like Alibaba, JD.com, and Pinduoduo leading the market. Bulk packaging options for commercial car washes are in high demand, while private-label brands continue to gain traction in retail sectors.

The automotive glass cleaner market in Australia is projected to grow at a CAGR of 8.3%, while New Zealand is expected to expand at 7.9% from 2025 to 2035. Both markets are influenced by growing consumer preference for sustainable and high-performance vehicle cleaning products.

Australian regulations under NICNAS promote low-VOC and biodegradable cleaning solutions. Retail distribution is dominated by auto specialty chains like Supercheap Auto and Repco, alongside e-commerce platforms. New Zealand’s market, though smaller, mirrors Australia’s trends, with increasing demand for eco-friendly formulations.

Professional detailing services are on the rise, with increasing demand for bulk solutions and refillable packaging. Hydrophobic and streak-free cleaners are gaining traction, particularly in urban areas where vehicle maintenance culture is strong.

Windshield Cleaner (0-50 ml, Above 50 ml), Cleaning Tablets (Small Size Packet (10 TBLT), Mid-Size Packet (10-50 TBLT), Large Packet (Above 50 TBLT), Liquid Spray (0.5 LIT, 0.5 - 2 LIT, Above 2 LIT).

OEM, Aftermarket.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, The Middle East & Africa.

The rising awareness about vehicle maintenance, coupled with the need for streak-free visibility and eco-friendly cleaning solutions, is fueling demand for high-quality automotive glass cleaners.

Consumers prioritize factors such as ammonia-free formulations, anti-glare properties, water-repellent technology, and eco-friendly ingredients when choosing automotive glass cleaners.

Innovations like nanotechnology-based coatings, biodegradable ingredients, and streak-free formulations are enhancing product performance and meeting regulatory compliance standards.

Stringent environmental laws across regions, including VOC restrictions and bans on certain chemicals, are pushing manufacturers to develop sustainable and compliant cleaning solutions.

Supermarkets, auto specialty stores, e-commerce platforms, and professional detailing centers are key distribution channels catering to both individual consumers and bulk buyers.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 18: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 24: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 32: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 34: East Asia Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 36: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 37: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 38: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 39: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 40: South Asia Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 42: South Asia Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 44: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 45: MEA Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 46: MEA Market Volume (Units) Forecast by Product Type, 2018 & 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 & 2033

Table 48: MEA Market Volume (Units) Forecast by Sales Channel, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 13: Global Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 20: North America Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 31: North America Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 38: Latin America Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 49: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 56: Western Europe Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 92: East Asia Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 95: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 96: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 97: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 99: East Asia Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 100: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 101: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 103: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 104: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 105: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 106: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 107: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 110: South Asia Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 111: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 113: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 114: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 115: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 117: South Asia Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 118: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 119: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 121: South Asia Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 122: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 123: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 124: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 126: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 128: MEA Market Value (US$ Million) by Sales Channel, 2023 & 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 131: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 135: MEA Market Volume (Units) Analysis by Product Type, 2018 & 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 & 2033

Figure 139: MEA Market Volume (Units) Analysis by Sales Channel, 2018 & 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 & 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA