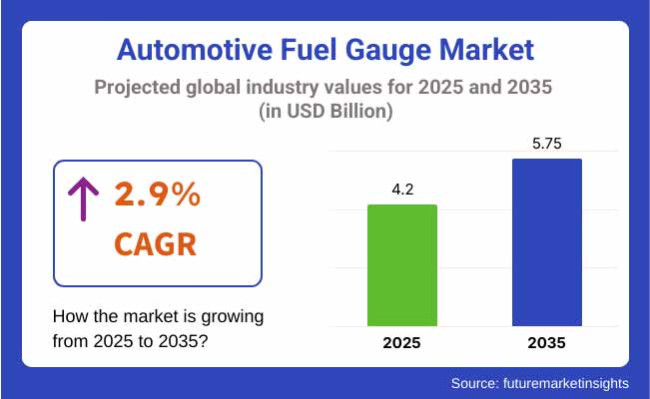

The global automotive fuel gauge market is estimated at USD 4.2 billion in 2025 and is projected to reach approximately USD 5.75 billion by 2035, expanding at a compound annual growth rate (CAGR) of 2.9% during the forecast period. Growth has been shaped by ongoing vehicle electrification, evolving diagnostics standards, and demand for improved fuel consumption insights in both conventional and hybrid vehicles.

Fuel monitoring systems are being refined to meet newer emission standards and digital diagnostics requirements. In 2024, Mako Networks introduced its SmartATG Automated Tank Gauge Interrogator, a cloud-connected system designed to optimize retail fuel operations by enabling secure, real-time remote tank level readings.

According to Simon Gamble, President and Co-Founder at Mako Networks, “For the first time, SmartATG is delivering real-time fuel monitoring and management so our customers can optimize their operations without undue complexity”

The automotive industry is integrating fuel gauge sensors more deeply into broader vehicle electronics and telematics. CAN-bus compatibility has become standard in most OEM platforms, enabling transmission of fuel-level data to onboard computers for emission control functions and trip optimization. This integration also supports predictive maintenance alerts when anomalies in fuel behavior are detected.

Instrumentation vendors are focusing on application-specific accuracy enhancements. Products released by Pegasus Auto Racing are being designed for motorsport and high-performance applications where temperature tolerance and rapid-response characteristics are critical. These systems are often adopted in both OEM performance lines and aftermarket segments.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 4.2 billion |

| Industry Value (2035F) | USD 5.75 billion |

| CAGR (2025 to 2035) | 2.9% |

Electronics manufacturers are also adapting sensor material specifications for compatibility with new-age fuels, including ethanol blends and synthetic fuel derivatives. Component durability under high-voltage architectures in hybrid powertrains is now being validated as part of OEM test procedures.

Fuel gauge suppliers are increasingly aligning with digital dashboard and HMI vendors to enable graphical fuel representations and warning systems for modern instrument clusters. These integrations are intended to ensure compliance with regulatory mandates and enhance user engagement through visual fuel analytics.

Resistive fuel gauges are estimated to account for approximately 42% of the global automotive fuel gauge market share in 2025 and are projected to grow at a CAGR of 2.7% through 2035. These systems operate using a variable resistor linked to a float mechanism, offering simplicity and low manufacturing cost.

Automakers continue to use resistive-based gauges in compact cars, light commercial vehicles, and cost-sensitive markets due to proven reliability and ease of calibration. While advanced technologies such as magnetostrictive and radar-based gauges are emerging in premium segments, the resistive type remains dominant in internal combustion engine (ICE) platforms where digital fuel accuracy is not mission-critical. Suppliers focus on improving corrosion resistance, float materials, and compatibility with ethanol-blended fuels to enhance operational longevity.

Digital fuel gauges are projected to hold approximately 48% of the global market share by 2025 and are forecast to grow at a CAGR of 3.2% through 2035. This growth is driven by the transition toward fully digital instrument clusters and the rise of software-defined vehicle interiors.

In modern vehicles, digital displays offer real-time fuel readouts, diagnostics integration, and customizable visuals that enhance user experience and dashboard design. OEMs favor digital displays for their scalability across vehicle variants and ability to consolidate multiple vehicle parameters within a single interface.

As hybrid and electric vehicles continue to scale, digital gauges increasingly serve dual purposes-tracking fuel, range, and energy consumption metrics in hybrid drivetrains and PHEVs solidifying their long-term relevance in evolving vehicle architectures.

The Automotive Fuel Gauge industry is likely to develop consistently at a 2.9% CAGR over the 2025 to 2035 period, as driven by progress in automotive technology and increasing demands for efficient fuel monitoring systems. The shift toward electric vehicles and smart fuel gauge solutions will be key drivers for growth.

Automotive companies and technology suppliers with a focus on fuel efficient and innovative gauge systems stand well-placed to gain, while traditional fuel gauge manufacturers can find it difficult to adapt to evolving industry demands.

Embrace Smart Fuel Gauge Technologies

Investors should target investing in intelligent fuel gauge technologies that offer real-time information, smooth connectivity, and integration with automotive infotainment systems. As consumers' demand for more advanced and efficient systems increases, automobile manufacturers and vendors need to emphasize the creation of digital and electronic fuel gauges to remain at par in the market. Not only do these technologies enhance customer experience but also fuel efficiency, which is vital in the expanding electric and hybrid car industries.

Align with the Electric Vehicle (EV) Shift

Executives will need to fit their strategies with the increasing requirement for electric cars, especially by modifying fuel gauge systems to address the unique needs of EVs. This will involve creating tailored technologies like ultrasonic and electronic fuel gauges that are better suited to electric drivetrains.

Additionally, firms ought to concentrate on the development of gauge systems that function in perfect harmony with alternative fuels and emerging types of vehicles such as autonomous and hybrid vehicles to remain ahead of the curve while the market develops.

Strengthen R&D and M&A for Technological Advancement

Stakeholders should prioritize investments in R&D and strategic M&A to acquire the capabilities and technologies needed to stay at the forefront of fuel gauge innovation. By partnering with tech companies specializing in sensor technology, ultrasonic systems, or electric vehicle components, companies can enhance their product offerings and accelerate the time to market. Expansion into new segments and the development of next-generation fuel monitoring systems will be critical for long-term growth.

| Risk | Technological Obsolescence |

|---|---|

| Probability | High |

| Impact | High |

| Risk | Shift Towards Electric Vehicles |

|---|---|

| Probability | Medium |

| Impact | High |

| Risk | Technological Obsolescence |

|---|---|

| Probability | Medium |

| Impact | Medium |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Priority Item #1: Invest in Smart Gauges | Run feasibility studies on integrating IoT and AI-driven fuel gauges for enhanced accuracy. |

| Priority Item #2: Adapt to EV Needs | Engage with OEMs to develop fuel gauge systems tailored for electric vehicles and hybrids. |

| Priority Item #3: Strengthen Supply Chain | Review and enhance supply chain partnerships for sensor components critical to fuel gauge production. |

Stakeholders must pivot to prioritize the integration of smart fuel gauge technologies into their product portfolios, particularly focusing on innovations for electric and hybrid vehicles. This strategic shift should influence the roadmap by encouraging investments in R&D, aligning with technological advancements such as IoT-enabled fuel systems, and fostering partnerships with key tech companies to stay ahead of market demands.

Expanding into next-gen fuel monitoring solutions will ensure stakeholders remain competitive in an evolving automotive landscape, securing long-term growth.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across automotive manufacturers, suppliers, distributors, and technology providers in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

Consensus

Steel: Selected by 68% of stakeholders globally due to its durability, especially for high-traffic and high-demand vehicle segments.

Variance

Shared Challenges

Rising Costs: 80% cited increasing material costs (steel and aluminum) as a significant challenge in fuel gauge manufacturing, impacting profit margins.

Regional Differences

Manufacturers

Distributors

End-Users (Automotive Manufacturers/Consumers)

Alignment

Global: 65% of stakeholders plan to invest in R&D for smart, integrated fuel gauges and related technologies, including IoT and real-time monitoring features.

Divergence

USA

65% cited rising regulatory pressures, such as stricter emissions and fuel efficiency standards, as a significant factor influencing their fuel gauge system designs.

Western Europe

72% viewed the EU's emissions and fuel monitoring regulations as drivers for innovation, particularly in EV fuel gauges and sustainability-focused technologies.

Japan/South Korea

45% felt regulatory changes had a moderate impact on their fuel gauge purchasing decisions, citing less stringent enforcement compared to Western markets.

High Consensus

Stakeholders worldwide agree on the need for accuracy, reliability, and durability in fuel gauges, with a strong focus on sustainability in Western Europe.

Key Variances

Strategic Insight

A regional approach will be key for success in the automotive fuel gauge market, with USA stakeholders focusing on advanced tech integration, Western Europe leading in sustainability, and Japan/South Korea leaning toward cost-efficient, durable solutions for smaller vehicles.

| Countries | Impact of Policies and Regulations |

|---|---|

| United States | Stricter emissions regulations such as the Clean Air Act and California’s Prop 65 influence the development of fuel-efficient and accurate fuel monitoring systems. OEMs must also comply with FMVSS (Federal Motor Vehicle Safety Standards) for vehicle components, including fuel gauges. Additionally, growing interest in EVs is driving demand for fuel monitoring systems compatible with electric drivetrains. Certification : UL (Underwriters Laboratories) and EPA (Environmental Protection Agency) certification for fuel systems. |

| Western Europe | The EU’s Regulation (EU) 2018/858 requires stringent vehicle safety and environmental standards that include fuel monitoring and accuracy. Regulations are also pushing for sustainable materials and low carbon emissions in fuel system technologies, especially for electric vehicles. Certification : CE (Conformité Européenne) marking for safety and environmental compliance, and ISO 14001 for environmental management. |

| Japan | Japan’s Energy Conservation Law and the Road Transport Vehicle Law impose strict guidelines on fuel efficiency, encouraging automakers to invest in fuel-efficient technologies and precise fuel gauges. However, regulations in Japan are less stringent than in the US and EU for fuel systems, with a stronger focus on small, compact vehicle design. Certification : JIS (Japanese Industrial Standards) for materials and safety standards. |

| South Korea | Like Japan, South Korea enforces regulations through the Ministry of Environment and Ministry of Land, Infrastructure and Transport, focusing on energy efficiency, fuel monitoring, and adoption of electric vehicle (EV) standards. The K-mark certification ensures compliance with national standards for safety and environmental requirements for automotive components, including fuel gauges. |

The United States automotive fuel gauge market CAGR from 2025 to 2035 is expected to be 3.4%, in line with global trends, and is spurred by growing demand for accuracy, internet of things (IoT)-connected fuel systems both on internal combustion engine (ICE) cars and electric vehicles (EVs).

The USA automotive industry is advanced, with a substantial emphasis on cutting-edge technologies such as digital and ultrasonic fuel gauges, which are becoming integral to modern vehicles. The rising trend for electric vehicles (EVs) and hybrid cars will drive the growth of advanced fuel gauge systems with high accuracy and integration of other vehicle sensors.

The USA also boasts a robust regulatory framework that promotes innovation, with standards like the Environmental Protection Agency (EPA) guidelines and state-level programs such as California's low-emission vehicle rules influencing fuel system innovation.

Additionally, the nation's transition towards autonomous vehicles is driving demand for sophisticated fuel monitoring solutions that can deliver real-time data on fuel levels, consumption, and vehicle performance. As companies keep investing in R&D for emerging technologies, the United States is still among the most profitable markets for automotive fuel gauges in the coming decade.

The automotive fuel gauge market in the United Kingdom is expected to grow at a CAGR of 3.1% from 2025 to 2035, slightly below the global average. This growth is largely driven by the UK’s commitment to sustainability and transitioning towards electric and hybrid vehicles. The UK government’s push for low-emission vehicles and stringent carbon reduction targets are fueling the demand for advanced fuel monitoring solutions.

As part of the UK's Road to Zero strategy, the market for electric vehicles (EVs) is expanding rapidly, contributing to the increased demand for fuel gauge systems that are optimized for electric drivetrains.

The UK also benefits from its significant presence in automotive manufacturing, with key players investing in the development of smart fuel gauge systems. There is a growing demand for highly accurate and integrated fuel systems that not only monitor fuel levels but also provide data on vehicle performance and energy consumption.

UK consumers and manufacturers are showing increasing interest in digital and IoT-enabled solutions, as well as sustainable materials in fuel gauge production, further boosting market growth. As the EV adoption rate continues to rise and regulatory pressures tighten, the UK is expected to remain an important market for fuel gauge technologies.

In France, the automotive fuel gauge market is expected to experience a CAGR of 3.2% from 2025 to 2035, slightly above the global average. The country’s focus on sustainability, supported by the European Union's ambitious goals for carbon neutrality, is a key driver of this growth.

The French government has introduced numerous incentives for the adoption of electric vehicles (EVs) and hybrid cars, prompting a shift in consumer preferences towards more energy-efficient vehicles. As the automotive industry in France transitions towards greener alternatives, fuel monitoring solutions that are compatible with electric drivetrains will continue to grow in demand.

Additionally, France's automotive sector is home to major manufacturers who are increasingly investing in innovation and the integration of advanced technologies such as IoT-enabled fuel gauge systems. These solutions are designed to provide more accurate fuel consumption data and integrate seamlessly with electric vehicle platforms.

The French market will also benefit from regulatory requirements for higher fuel efficiency and the reduction of greenhouse gas emissions, both of which are pushing automakers to adopt smarter, more efficient fuel systems. As a result, the French market will play a significant role in shaping the development of next-gen automotive fuel gauge technologies.

Germany is expected to witness a CAGR of 4.0% in the automotive fuel gauge market from 2025 to 2035, reflecting the country’s strong automotive sector and its focus on sustainability and innovation. As one of the world’s largest producers of vehicles, Germany’s automotive industry is at the forefront of adopting advanced fuel monitoring systems, especially in electric and hybrid vehicles.

The country is also a leader in green technology, and Germany’s ambitious goals to reduce carbon emissions and promote renewable energy have further fueled the demand for fuel-efficient vehicles.

The German automotive market is expected to continue growing as manufacturers invest heavily in digital fuel gauge solutions that integrate with vehicle telematics and assist in improving fuel efficiency. Innovations such as ultrasonic and electronic fuel gauges are becoming more common in German vehicles, particularly in luxury and premium segments, where technology integration is a key selling point.

Germany’s strict environmental standards also push for greater accuracy and reliability in fuel monitoring systems, making it a lucrative market for manufacturers focused on compliance and regulatory alignment. As EV adoption continues to rise and the demand for precise data grows, Germany remains one of the most significant markets in Europe for automotive fuel gauges.

The automotive fuel gauge market in Italy is expected to grow at a CAGR of 3.0% from 2025 to 2035. Italy’s automotive industry is seeing an increasing shift towards fuel-efficient and electric vehicles, which is driving the need for advanced fuel monitoring technologies.

Italy’s automotive sector has a strong presence in compact and luxury vehicle segments, with consumers demanding high-performance vehicles equipped with precise and reliable fuel gauge systems. This shift towards electric vehicles, alongside the country's adoption of stricter emissions regulations, is encouraging the development of innovative fuel gauge systems optimized for electric drivetrains.

The Italian market is also highly responsive to technological advancements and the need for integration with in-vehicle infotainment systems, which is helping to drive the demand for digital and electronic fuel monitoring systems.

Additionally, Italy’s focus on sustainability is making it a prime market for fuel gauges made from recyclable materials and those that contribute to reducing the carbon footprint of the automotive sector. As Italian consumers continue to favor high-tech, environmentally friendly vehicles, the market for automotive fuel gauges will continue to see steady growth throughout the forecast period.

New Zealand’s automotive fuel gauge market is projected to grow at a CAGR of 2.5% from 2025 to 2035. While smaller in scale compared to other global markets, New Zealand is increasingly adopting electric vehicles (EVs), supported by the government’s efforts to promote clean energy and reduce carbon emissions.

New Zealand’s growing electric vehicle market is expected to drive demand for fuel gauge technologies that are specifically designed for EVs. The shift towards EVs in New Zealand is expected to mirror trends seen in larger markets, with increasing adoption leading to higher demand for precise fuel and battery monitoring systems.

The New Zealand automotive market is also influenced by a rising preference for environmentally sustainable solutions, which includes adopting fuel-efficient vehicle components. However, the market size and adoption rates remain relatively modest compared to countries like the USA or Germany, limiting the overall growth potential for fuel gauge manufacturers. Nevertheless, as the shift towards green vehicles gains momentum, fuel monitoring technologies tailored for EVs will see steady growth in the country.

The automotive fuel gauge market in South Korea is expected to grow at a CAGR of 3.7% from 2025 to 2035, driven by the country's strong push towards electric vehicles (EVs) and the increasing adoption of smart technologies in the automotive sector. South Korea is home to leading global automakers like Hyundai and Kia, who are aggressively expanding their electric vehicle portfolios. As a result, the demand for advanced fuel monitoring systems that can accurately track both traditional fuel and electric energy consumption is expected to rise significantly.

The South Korean government’s policies to promote clean energy, along with the country’s growing focus on smart automotive technologies, will fuel the demand for integrated, digital fuel gauge systems. Moreover, the high level of consumer interest in high-tech solutions and the country’s strong focus on sustainability will contribute to the market's growth. South Korea’s automotive market is expected to embrace innovative solutions like IoT-enabled fuel gauges, which will offer real-time data on fuel efficiency and energy usage, further propelling market expansion.

Japan’s automotive fuel gauge market is expected to experience a CAGR of 3.3% from 2025 to 2035. Japan, being one of the most advanced automotive markets globally, has seen an increasing shift towards electric and hybrid vehicles, driving the demand for more sophisticated fuel monitoring systems.

The country’s regulatory environment, which emphasizes fuel efficiency and environmental sustainability, is a key driver of this market. With major automakers like Toyota, Honda, and Nissan investing heavily in hybrid and electric vehicles, the demand for accurate fuel and battery gauge systems is on the rise.

Japanese consumers and manufacturers are particularly focused on integrating fuel monitoring systems with other vehicle technologies, such as infotainment and telematics. This demand for integrated systems is driving the adoption of smart fuel gauge solutions that provide real-time data on fuel levels, energy consumption, and vehicle performance.

While Japan is known for its preference for traditional fuel systems in some segments, the rising popularity of electric vehicles and the growing demand for high-tech solutions in the market are expected to significantly impact the fuel gauge market in the coming decade.

The automotive fuel gauge market in China is expected to grow at a CAGR of 4.2% from 2025 to 2035, driven by the rapid expansion of the electric vehicle (EV) market. As the world’s largest automotive market, China has seen a significant shift towards electric mobility, with the government heavily supporting the adoption of EVs through incentives and subsidies.

This transition is fueling demand for advanced fuel gauge technologies tailored to the unique needs of electric drivetrains, such as battery level monitoring and integration with other smart vehicle systems.

In addition to EV growth, China’s automotive market is seeing increasing consumer demand for high-tech features, such as digital and IoT-enabled fuel monitoring systems. These systems are designed to improve accuracy, efficiency, and integration with overall vehicle performance.

The Chinese market is also influenced by the government’s push for stricter emissions standards, which are driving automakers to adopt more efficient fuel systems. As China continues to be a leader in the global EV revolution, the automotive fuel gauge market in the country is expected to experience robust growth over the next decade.

Australia’s automotive fuel gauge market is projected to grow at a CAGR of 2.8% from 2025 to 2035. The Australian automotive market is undergoing a gradual transition towards electric vehicles (EVs), supported by government incentives and growing consumer awareness of environmental sustainability.

While the adoption of EVs in Australia is still in its early stages compared to other markets like Europe and the USA, the demand for fuel gauge systems, especially those tailored for electric drivetrains, is expected to rise steadily in the coming years.

Australia’s automotive sector is increasingly focused on fuel efficiency and reducing carbon emissions, which is driving the need for more sophisticated and reliable fuel monitoring systems. Manufacturers are adopting digital and IoT-enabled fuel gauges to meet the growing demand for real-time data and improved fuel management in vehicles.

Additionally, Australia’s vehicle fleet, which includes a significant proportion of SUVs and light trucks, is expected to require more advanced fuel monitoring solutions to meet stringent environmental standards. As the market for electric and hybrid vehicles expands, the demand for cutting-edge fuel gauge technologies will continue to grow.

Electrical (A.C. Electric Fuel Gauge with Balanced Coils, Bimetal-Type Electric Fuel Gauge, Thermal-Type Electric Fuel Gauge, Thermostatic Type Electric Fuel Gauge), Mechanical, Other, Ultrasonic, Electronic

2 Wheeler, 3 Wheeler, Passenger Car (Compact, Mid-Size, SUV, Luxury), Light Commercial Vehicle, Heavy Commercial Vehicle

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, The Middle East & Africa

Fuel gauge technologies include electrical types like A.C. Electric Fuel Gauges with Balanced Coils, Bimetal-Type Electric Fuel Gauges, Thermal-Type Electric Fuel Gauges, and Thermostatic Type Electric Fuel Gauges. There are also mechanical, ultrasonic, and electronic fuel gauges, each offering different features and benefits.

As electric vehicles become more popular, the demand for specialized fuel gauge systems that monitor battery levels instead of traditional fuel is growing. These systems need to be more accurate, efficient, and integrated with other vehicle sensors to provide real-time data to users.

Advanced fuel monitoring systems are used in various vehicles, including 2-wheelers, 3-wheelers, passenger cars (such as compact, mid-size, SUV, and luxury), light commercial vehicles, and heavy commercial vehicles. These systems help optimize fuel efficiency and improve performance across all vehicle types.

Fuel gauges provide real-time data about fuel levels, allowing vehicle owners to monitor consumption and manage efficiency. In electric vehicles, these systems track battery life and energy consumption, helping drivers optimize their driving experience and extend the vehicle’s range.

Regional preferences for fuel gauge technologies are influenced by factors like vehicle adoption rates, regulatory requirements, and consumer preferences. For instance, regions with a high concentration of electric vehicles, like East Asia, tend to focus more on electronic and battery-level monitoring systems, while regions with a greater number of traditional vehicles might prioritize mechanical and electrical systems.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 9: North America Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 10: North America Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 16: Latin America Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 18: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 22: Western Europe Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 24: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 32: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 34: East Asia Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 36: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 37: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 38: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 39: South Asia Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 40: South Asia Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 42: South Asia Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 44: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 45: MEA Market Value (US$ Million) Forecast by Technology, 2018 & 2033

Table 46: MEA Market Volume (Units) Forecast by Technology, 2018 & 2033

Table 47: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 & 2033

Table 48: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 9: Global Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 13: Global Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Technology, 2023 to 2033

Figure 17: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Technology, 2023 & 2033

Figure 20: North America Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 27: North America Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 31: North America Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Technology, 2023 to 2033

Figure 35: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Technology, 2023 & 2033

Figure 38: Latin America Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 45: Latin America Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 49: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Technology, 2023 & 2033

Figure 56: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Technology, 2023 & 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Technology, 2023 & 2033

Figure 92: East Asia Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 95: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 96: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 97: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 99: East Asia Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 100: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 101: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 103: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 104: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 105: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 106: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 107: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 108: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) by Technology, 2023 & 2033

Figure 110: South Asia Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 111: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 113: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 114: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 115: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: South Asia Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 117: South Asia Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 118: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 119: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 120: South Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 121: South Asia Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 122: South Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 123: South Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 124: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 126: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Technology, 2023 & 2033

Figure 128: MEA Market Value (US$ Million) by Vehicle Type, 2023 & 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 131: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Technology, 2018 & 2033

Figure 135: MEA Market Volume (Units) Analysis by Technology, 2018 & 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 & 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 & 2033

Figure 139: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 & 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 & 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 143: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Fuel Gauge Sending Unit Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA