Automotive exterior trim parts elements play an important role in both visual appearance, as well as aerodynamics, and safety. Drivers such as increasing consumer trends for vehicle customization, technology advancements in materials and manufacturing processes, and increasing worldwide production of passenger and commercial vehicles have driven the market growth.

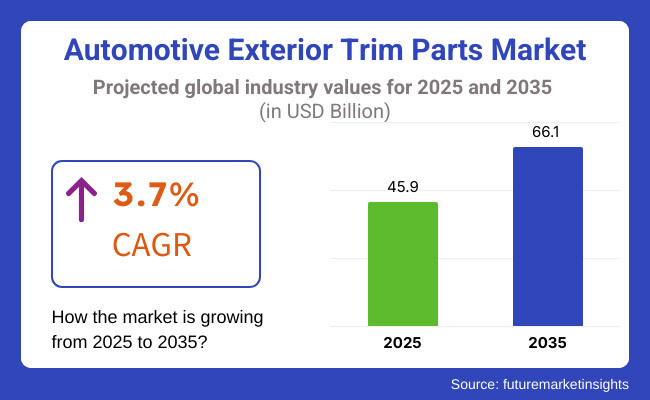

Introduction The global automotive exterior trim parts market, as per the latest research study, is predicted to be worth USD 45.9 Billion in 2025 and is likely to be worth USD 66.1 Billion by 2035 with a Compound Annual Growth Rate of 3.7%, over the forecast period.

A high CAGR projection further establishes positive and consistent growth, driven by drivers such as increasing emphasis on the looks of cars, advances in manufacturing technology. and increasing consumer trend towards car customization.

Explore FMI!

Book a free demo

North America accounts for a significant market share of the automotive exterior trim parts market on the back of a strong automotive industry and high demand of vehicle customization from the consumer. Additionally, existing major OEMs and a long-established aftermarket industry contribute to the demand of this market.

One of the most important trends in the automotive industry is technological innovation that is combined with light-weight materials which help boost performance along with lowering fuel consumption. Both regions' emphasis on sustainability have also made greater use of recyclable materials in trim parts possible.

The European market is significant, with Germany, France, and the United Kingdom being major players in automotive production and innovation. Strict safety and emissions laws in the region have led to manufacturers producing high-quality and compliant exterior trim parts.

EV production is becoming the main trend and is driving how trim components are designed and what materials they are made from to meet vehicle specifications. Besides, the demand for aesthetically pleasing and functional trim parts thus is driven by the European consumers who will always go for premium vehicles.

Asia-Pacific is expected to be the fastest-growing region in the automotive exterior trim parts market, owing to the rising vehicle production and sales in China, Japan, and India. Vehicle ownership is promoted by economic growth, urbanization, as well as increasing disposable income.

In order to serve both domestic and international demand, manufacturers in this region are making strides over cost-effective modes of production and deployment of high-tech solutions. The growth of the automotive aftermarket industry is also opening new opportunities for trim part suppliers.

Challenge

volatility in raw material prices

Volatility of Plastics and metals prices of these materials can lead to changes in production costs and profits for the manufacturers. The industry must also grapple with growing pressure to adopt sustainable practices, which require a shift towards eco-friendly materials and technologies that may raise operational costs.

Both trim part designs and materials used still need to adapt to the transition to electric vehicles which is also challenging for traditional combustion engine vehicle manufacturers.

Opportunity

Development and adoption of lightweight, sustainable materials

The demand for components aiding in weight reduction is largely driven by the ongoing trend in the automotive industry towards fuel efficiency and consequent reduction in emissions. New materials science innovations can give manufacturers the opportunity to satisfy regulatory and consumer demand through the use of innovative composites and bio-based plastics. The partnerships between material suppliers and vehicle Assembly can also result in high-performance, low-impact trim parts, giving competitive advantages in the marketplace.

The Automotive Exterior Trim Parts Market forecast from 2020 to 2024 showed a steady growth as vehicle customization trends, advancements in lightweight materials and rising demand for electric vehicles during that period. Car makers prioritised aerodynamic efficiency, durability and aesthetics, resulting in implementations of advanced polymers, carbon fibre composites and smart trim components.

Meantime, low fuel economy and high emissions regulations pressured manufacturers to investigate lightweight exterior trim materials. Yet, supply chain disruptions, changing raw material prices and integration challenges with smart automotive technologies were barriers.

Looking ahead, towards 2025 to 2035, the market will experience a step-change transformation, through AI powered design automation, 3D printed trim components and a mass-market adoption of self-healing and recyclable materials. Increasing popularity of autonomous and connected vehicles will improve the demand for integrated sensor-based trim parts, aerodynamic parts, and smart lighting components.

Plus, sustainable trim components, bio-based polymers, and nanomaterial coatings will change the way we manufacture exterior trim in line with global sustainability goals. Development of AI powered predictive maintenance, adaptive trim designs and smart external branding features will also boost the market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fuel efficiency and emission standards, focus on lightweight and recyclable materials. |

| Material Innovation | Increased use of carbon fibre composites, ABS plastics, and lightweight alloys. |

| Industry Adoption | Focus on vehicle aerodynamics, durability, and aesthetic enhancements for ICE and EV models. |

| Smart & Connected Trim Parts | Limited integration of LED lighting, passive aerodynamic designs, and impact-resistant trims. |

| Market Competition | Dominated by OEM suppliers and aftermarket component manufacturers, with moderate R&D investment. |

| Market Growth Drivers | Growth fuelled by vehicle personalization trends, EV adoption, and lightweight material advancements. |

| Sustainability and Environmental Impact | Early adoption of recyclable plastics, eco-friendly coatings, and lightweight aluminium. |

| Integration of AI and Automation | Limited AI use in design optimization and material selection. |

| Advancements in Manufacturing | Traditional injection moulding, CNC machining, and carbon fibre layering. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental policies, mandating sustainable trim materials and circular economy-based production. |

| Material Innovation | Development of self-healing coatings, AI-assisted trim optimization, and bio-based polymers. |

| Industry Adoption | Autonomous vehicle-compatible trims, sensor-integrated components, and adaptive aerodynamic trim solutions. |

| Smart & Connected Trim Parts | AI-driven dynamic trims, smart LED branding, and energy-harvesting exterior components. |

| Market Competition | Increased competition from 3D-printing specialists, sustainable material start-ups, and AI-driven component design firms. |

| Market Growth Drivers | Expansion driven by autonomous vehicles, AI-enhanced predictive maintenance, and smart exterior features. |

| Sustainability and Environmental Impact | Large-scale adoption of net-zero trim manufacturing, biodegradable exterior parts, and closed-loop material recycling systems. |

| Integration of AI and Automation | AI-powered predictive wear analysis, smart maintenance alerts, and adaptive trim customization. |

| Advancements in Manufacturing | Widespread use of 3D printing, nanotechnology-enhanced coatings, and generative AI-driven trim design. |

Automotive Exterior Trim Parts Market in US as major automakers are widely established in the United States, the industrial country is still one of the top markets for automotive exterior trim parts, along with consumer demand for customized vehicles and advancements in lightweight materials.

Thanks to the rising popularity of electric vehicles (EVs) and stricter fuel efficiency standards, manufacturers are being forced to create aerodynamic and energy-efficient trim parts. Moreover, mathematical innovations in smart trim parts, integrated with LED in mouldings and sensor in bumpers, are impacting the market ecosystem. This growth of the market is also propelled by the increase in online automotive spare parts retail and aftermarket customization trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

Rapid raw material research leading to advanced and eco-friendly design process is estimated to bolster the UK Automotive Exterior Trim Parts (Plastic & Other) Market growth at a CAGR of 11.0% during the forecast period. Increasing premium and luxury car segments and demand for high-grade trim parts such as carbon fibre, chrome, and advanced polymer are augmenting the automotive tailgate trim parts market.

And incentives from government bodies, convincing car manufacturers to design lightweight and aerodynamically favourable exterior trim parts. The growth of aftermarket vehicle customization is another key factor driving market growth, along with the growing e-commerce platforms for the distribution of auto parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Germany, France, and Italy dominate the European automotive exterior trim parts market, supported by robust automotive manufacturing hubs, advanced material technologies, and stringent environmental regulations. The move to lower emissions in cars has seen investment in lighter, recyclable trim materials.

High-end aesthetic applications in both passenger and commercial vehicles the need for aerodynamic efficiency will drive new innovations in trim designs. Manufacturers are increasingly integrating smart sensors and LED-enhanced trim components under the influence of rising rate of electric and autonomous vehicles in the region. The future development of products will be defined by stringent regulatory compliance with sustainable material.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.6% |

Japan's automotive exterior trim parts market is driven by its robust automobile manufacturing sector, focus on precision engineering, and rising demand for fuel-efficient vehicles. Some over the following months is producing aerodynamic trim functions to arrive vehicles industry can improve as well as efficiency. Moreover, nanomaterials and high-durability plastics are improving the look and feel of the trim components.

Japan’s drive for sustainability and eco-friendly vehicle design is also encouraging manufacturers to use recyclable materials for exterior trim parts. Increasing aftermarket industry in addition to the rising interest in vehicle cosmetics are other factors driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The sector is growing in south Korea, as the expansion of domestic automotive industry, continuous investment and growth of electric and autonomous automotive technologies are driving its expansion, making it an important market for automotive exterior trim components. Top tier South Korean automakers are utilising sophisticated exterior trim designs to improve vehicle aerodynamics and aesthetics.

Market growth of high-performance materials like carbon fibre-reinforced composites and smart trim components integrated with sensors is also fuelling the growth of the smart car body materials market. As a result, rising demand for customized vehicles and aftermarket modification is aiding the growth of external trim parts market. The government initiatives for green and sustainable automotive manufacturing practices are also shaping the growth trajectory of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

As the emphasis on aerodynamics, vehicle safety, and improved design aesthetics increases among automakers, the segment can be categorized into front bumpers and radiator grills, wherein front bumpers accounts for the majority share of the automotive exterior trim parts market.

These elements are vital to styling on the outside of a car, as well as enhancing the structural integrity and optimizing airflow dynamics of a car. As consumer trends turn more toward stylish and functional vehicle designs, the need for quality exterior trim parts is also increasing.

Due to their role in crash protection, pedestrian safety, and aesthetic enhancement, front bumpers have achieved widespread market acceptance. Contemporary front bumpers serve as a critical part of vehicle safety systems, as they now often incorporate energy-reflecting materials, impact-resistant polymers, and advanced sensors, unlike earlier models.

Growing vehicle production, especially in passenger, as well as commercial vehicles, has driven market adoption of lightweight but impact-resistant bumper materials. According to studies, above 70% of automakers are drawn towards advanced polymer based bumpers, owing to their high durability, low weight and better crashworthiness.

Additionally, the growing market demand, driven to a certain extent by the introduction of new technologies, such as smart bumpers that utilize artificial intelligence (AI) to detect collision, pedestrian impact mitigation systems, and the incorporation of sensors into the design, making it more potentially adaptive in shape enhance the vehicle's protection and ensure compliance with regulations further strengthens the smart bumper market.

With the increasing demand for vehicles with reduced environmental footprints, the adoption of these sustainable bumper materials, including recycled thermoplastics, bio-composite reinforcements, and eco-friendly coatings, further continue to propel the market, allowing the component manufacturers to align with global automotive sustainability trends.

The rising adoption of smaller and modular front bumper design with quick-replace assembly mechanisms, impact resistant shock absorbers and flexible design configurations has spurred market growth, providing enhanced serviceability and aftermarket availability.

Moreover, the use of cutting-edge manufacturing processes like 3D-printed bumper parts, advanced moulding methods, and AI-powered quality control technologies has reiterated market growth, providing better product uniformity and economical production.

The advantages of safety, durability, and sustainability of the front bumper segment will be offset due to challenges such as rising material prices, strict crash test requirements, and challenge designing for lightweight optimization.

Nevertheless, novel developments in advanced Nano-engineered bumper composites, artificial intelligence (AI)-driven damage prediction models, and sensor-embedded bumper systems are furthering durability, cost-efficiency, and vehicular safety, and leading to sustained growth in the global front bumper market.

The automotive exterior trim parts market remains dominated by radiator grills which help in the optimization of airflow, enhance cooling efficiency by reducing inertia and improve vertical inertia of the automotive exterior trim parts in addition with brand reinforcement on the automotive exterior trim parts. Modern radiator grills differ from the design of old; active air shutters, lightweight components, and advanced coatings make them an integral part of a car's aerodynamics and thermal management.

The growing need for energy-efficient cooling systems, particularly in electric and hybrid vehicles, has further driven the market. According to studies, over 65% of new vehicle models feature aerodynamically optimized radiator grills to effectively throttle airflow while minimizing drag.

Market demand has been supported by the growth of far more advanced smart grille technologies, like active grille shutters, dynamic air control systems, and integrated LED lighting enhancements for improved thermal management and fuel economy.

This innovation has resulted in further adoption of the market, with customizable grille designs, 3D-textured surfaces, high-gloss metallic coatings and branding-specific grille patterns taking the market by storm ensuring higher consumer engagement and vehicle aesthetics.

Market growth has been further boosted by the development of lightweight grille materials, including aluminium-alloy mesh structures, carbon-fibre reinforcements and impact-resistant polymeric designs, enabling better durability and performance.

Early adoption of AI-based grille design optimization with air flow simulation analytics, administrative structural testing, and real-time adaptive design modifications will ensure better efficiency and production scalability, which will be instrumental in pervading market expansion.

However, the radiator grille segment is challenged by increasing raw material prices, pressure on suppliers for rebates, complicated manufacturing processes, and changing tastes around the grille-less designs of electrical vehicles.

But revolutionizing technologies such as AI-enabled airflow analysis, smart grille shadowing, and eco-sensitive grille production techniques are enhancing performance, efficiency, and industry practice, propelling expansion of radiator grills worldwide.

The Automotive Exterior Trim Parts market is dominated by Passenger Cars and SUVs since consumers are looking for trendy, high-performance, and technologically advanced automotive exterior. These vehicle classes are critical contributors to innovation, aerodynamics, and design flexibility/creaminess.

Demand for exterior trim parts is largely powered by passenger cars seeking premium styling, aerodynamic efficiency, and lightweight construction. In contrast to commercial vehicles, passenger cars prioritize appearance, fuel efficiency, and high-tech material integration, requiring exterior trim parts for product differentiation and market positioning.

Adoption was stimulated by the growing demand for personalized appearances of vehicles, particularly in compact and mid-size passenger cars. According to research, 70% of vehicle owners want to upgrade their vehicles easier with customized front bumpers, grilles, and door trims to enhance their vehicles appearance and increase resale value.

The proliferation of high-strength thermoplastics, carbon-fibre composites, and sustainable coatings within lightweight exterior trim solutions has pervaded market demand, promising greater vehicle efficiency and sustainability.

Incorporation of smart exterior trim features with LED-rich embedded side panels, aerodynamic bumper styles and micro self-repairing coating technologies has also helped penetrate the market further, thus allowing better consumer engagement and performance optimization.

The growing number of vehicle models in the market has vaults in further surge with aerodynamic exterior trim solutions, including wind-resistant door seals, active air vent trims, and high-gloss body panels, among others, which have driven the prospect for enhanced vehicle handling and efficiency, thereby augmenting market growth during the past decade or so.

The advancement in manufacturing processes such as robotic precision moulding, laser-cut trim customization, and AI-based defect detection have augured well for the market, providing better scalability for production and quality assurance.

SUVs are still sold like hotcakes as consumer appetite for the rough-and-tumble, aesthetically pleasing and performance-oriented continues to soar. SUVs, on the other hand, need more ruggedized exterior trim parts to make up for a general lack in off-road abilities, weather resistance, and durability over time compared to sedans and compact cars.

Adoption has been driven by the increasing appetite for SUV styling, especially within the premium and performance vehicle spheres. Research shows that more than 60% of premium SUV buyers want high-end exterior trim upgrades, like muscular front bumper designs, chrome-studded grilles, and high-impact fender linings.

While SUV exterior trim offers benefits like improved aesthetics, durability, and enhanced vehicle functionality, the segment also faces challenges with higher material costs, design complexity, and compliance with safety and pedestrian protection regulations. The growth of SUVs in the exterior trim parts market globally is thus ensured with upcoming developments in modular exterior trim systems, AI-based optimization of materials, lightweight innovations in structural applications that enhance design flexibility, cost-effectiveness, and sustainability.

Factors driving the growth of this market include: advancements in vehicle aesthetics, increasing demand for lightweight and durable materials, and the expansion of the EV segment. So, the market has been growing steadily with automakers having a focus on aerodynamic efficiency and customization options. Some of the principal trends influencing the segments such as automotive textiles include the use of sustainable materials, smart trim components, and optimized manufacturing processes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Magna International Inc. | 12-16% |

| Plastic Omnium | 10-14% |

| Toyoda Gosei Co., Ltd. | 8-12% |

| SMP Deutschland GmbH | 6-10% |

| Minth Group Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Magna International Inc. | Develops advanced exterior trim solutions focusing on lightweight and aerodynamic efficiency. |

| Plastic Omnium | Specializes in sustainable and smart exterior trim components, integrating sensor technology. |

| Toyoda Gosei Co., Ltd. | Manufactures high-quality rubber and plastic trim parts with enhanced durability. |

| SMP Deutschland GmbH | Provides premium exterior trim parts for luxury and high-performance vehicles. |

| Minth Group Ltd. | Offers cost-effective and customizable trim components for global automakers. |

Key Company Insights

Magna International Inc. (12-16%)

Magna leads in the automotive exterior trim market, leveraging advanced materials and aerodynamics to enhance vehicle efficiency.

Plastic Omnium (10-14%)

Plastic Omnium focuses on innovative, lightweight, and smart trim solutions, aligning with sustainability and digitalization trends.

Toyoda Gosei Co., Ltd. (8-12%)

Toyoda Gosei excels in rubber and plastic exterior trim manufacturing, ensuring high durability and precision engineering.

SMP Deutschland GmbH (6-10%)

SMP specializes in premium automotive exterior trims, catering to the luxury and high-performance vehicle segments.

Minth Group Ltd. (4-8%) Minth provides cost-effective, customizable trim components, serving major global automakers with an extensive product portfolio.

Other Key Players (45-55% Combined)

Several global and regional players contribute to the expanding automotive exterior trim parts market. These include:

The overall market size for the Automotive Exterior Trim Parts market was USD 45.9 Billion in 2025.

The Automotive Exterior Trim Parts market is expected to reach USD 66.1 Billion in 2035.

The demand for automotive exterior trim parts will be driven by the growing vehicle production, rising demand for vehicle customization, advancements in lightweight and durable materials, and increasing adoption of electric vehicles.

The top 5 countries driving the development of the Automotive Exterior Trim Parts market are the USA, China, Germany, Japan, and India.

The Bumpers & Grilles segment is expected to command a significant share over the assessment period.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Aircraft Strut Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.