Automotive engineering services are extensive solutions for all aspects related to vehicle design, powertrain optimization, connectivity solutions, software integration, and testing. The increasing connectedness of cars, AI, and sustainable mobility solutions are challenging the capabilities of traditional engineering services in the automotive industry.

In fact one of the main drivers of the market change is towards electrification and sustainability. An increasing number of countries are enforcing strict emission norms, pushing car manufacturers to invest in EVs, battery technology, and hybrid powertrains. This trend is increasing the need for engineering services that emphasize energy-saving drivetrains, lightweight components, and aerodynamics to improve vehicle performance and meet environmental rules.

Moreover, the rising acceptance of autonomous and connected vehicles is driving demand for advanced engineering services associated with artificial intelligence (AI), machine learning, and sensor integration. Autonomous creatives are "Beyond the Engineers" who provide engineering services for the automotive, focusing on ADAS (Advanced Driver-Assistance Systems), software-defined vehicles (SDVs), and V2X (Vehicle-to-everything) technologies. Innovation in this space is being pushed further with the advent of 5G-ready vehicles and OTA (Over-The-Air) software updates.

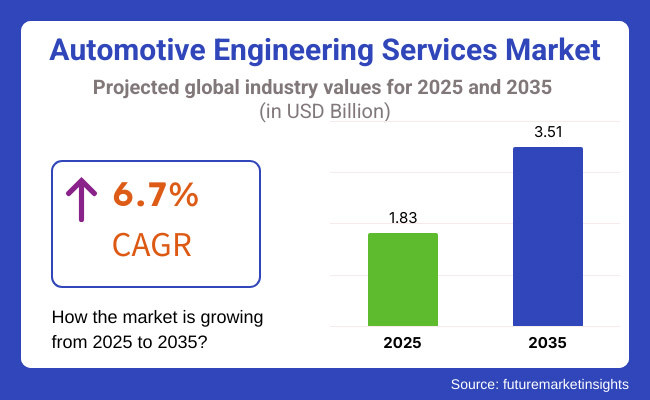

The automotive engineering services market accounted for USD 1.83 billion in the year 2025 and is expected to reach USD 3.51 billion by the year 2035, at a CAGR of 6.7% during the forecast period.

Explore FMI!

Book a free demo

North America is projected to be a prominent region due to considerable investment for electric mobility, autonomous driving, and digital vehicle platforms. Auto OEMs like Tesla, Ford, GM and Scale in engineering services for software development, AI and automation.

Europe is one of the continents with the largest concentration of automotive engineering innovation, with major players like Volkswagen, BMW, and Daimler investing billion USD in EV technology, ADAS, and sustainable engineering-oriented services. Strict Euro 7 emission regulations are also pushing the manufacturers to improve vehicle efficiencies by providing them with engineering solutions.

The Asia-Pacific region will register the highest growth, propelled by growing automotive production in China, Japan, South Korea, and India. The region leads the world in the manufacturing of EVs and battery research and development, driving the demand for engineering services around battery management systems, lightweight structures, and AI-powered vehicle diagnostics.

In the Latin American market, with automotive manufacturers looking for cost-effective engineering solutions for fuel efficiency and emissions compliance. Emerging as market for outsourced engineering services are Brazil, Mexico, etc.

Rising demand in the Middle East & Africa region for luxury and high-performance vehicles is driving investments in engineering services involving vehicle customisation, aerodynamics and advanced infotainment systems. A few key markets emerging in this region are UAE and South Africa.

Challenges

High R&D Costs and Complex Regulations

Automotive Engineering Services Market is Home to Several Challenges Because of High R&D (Research & Development) Cost Related to Advanced Vehicle Design, Electrification, and Autonomous Technologies On the other hand, with manufacturers focused on cutting edge solutions like electric (EV) powertrains, ADAS (Advanced Driver Assistance Systems), and lightweight materials, the engineering service providers need to invest a lot in new capabilities, which pushes their operating costs higher.

Requirements around emissions, safety and cybersecurity vary widely across the global automotive ecosystem and can be challenging for companies to navigate. The need to tailor vehicles to regional regulations adds to the cost and length of time associated with developing a new vehicle for marketers.

Opportunities

Growth in Electric and Autonomous Vehicle Development

The market for Automotive Engineering Services Market is also driven by major opportunities in information and communication technology with regards to electric and autonomous driving vehicles. Auto manufacturers and startups are outsourcing engineering services to shorten timelines for EV platforms, battery optimization, and advanced safety system integration.

Furthermore, the demand for connected vehicle solutions, software-driven automotive designs, and AI-powered mobility services is driving the need for specialized engineering expertise. Companies that focus on software-defined vehicles, digital twin technology, and smart mobility solutions will gain a competitive edge in the evolving automotive landscape.

The adoption of electric mobility and connected vehicle technologies, along with the digitization of automotive engineering, had rapidly transformed the automotive market between 2020 and 2024. However supply chain disruption, semiconductor shortages, and cost pressures tempered the pace of hire in the engineering service expansion.

Moving towards 2025 to 2035, the market is gushing towards AI-infused automotive development, digital prototyping, and cloud-powered engineering solutions. Software curtains on vehicles, sustainable vehicle architectures and 5G enabled automotive applications will redefine the role of engineering services in the automotive 4.0.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Compliance | Focus on emissions regulations and safety compliance |

| Engineering Service Expansion | Growth in EV and hybrid vehicle development |

| Cost Considerations | High R&D and software development costs |

| Market Competition | Traditional engineering firms competing with new tech-driven service providers |

| Integration with Smart Technologies | Initial adoption of IoT, AI, and connected vehicle technologies |

| OEM and Supplier Collaboration | Increased outsourcing of design and validation processes |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Compliance | Stricter global mandates for cybersecurity, AI-driven safety, and autonomous vehicle validation |

| Engineering Service Expansion | Expansion into autonomous vehicle engineering, smart mobility, and AI-powered automotive solutions |

| Cost Considerations | AI-driven cost optimization, cloud-based digital engineering, and reduced prototyping expenses |

| Market Competition | Increased competition from AI-driven automotive software companies and tech startups |

| Integration with Smart Technologies | Full-scale integration of digital twin, blockchain-based automotive security, and 5G-enabled vehicle networks |

| OEM and Supplier Collaboration | Strategic partnerships for end-to-end software-defined vehicle development and mobility-as-a-service models |

Steadily increasing automotive engineering services market is driven by accelerating electric vehicle (EV) development, surging investments in autonomous driving technology and hasty government regulation on emission and safety.

Major manufacturers including General Motors, Ford, and Tesla are pouring hundreds of millions of dollars into vehicle electrification, lightweight materials, and advanced driver-assistance systems (ADAS), driving a booming demand for engineering solutions across the vehicle design, testing and validation workflows.

The Biden administration’s drive towards EV adoption and investments in smart infrastructure also fuel applications of engineering services in battery technology, powertrain optimization and connectivity solutions. Further, organizations are increasingly turning to AI, IoT and cloud computing to enable better simulation, predictive maintenance and digital twin technology for vehicles, fueled by growing consumer demand for personalized and software-defined vehicles.

With large-scale automotive R&D centers located in Michigan, California, Texas, and regional entities involving OEMs, startups, and tech giants, the USA is providing the future of mobility engineering. Over-the-air (OTA) updates, whose integration, along with 5G connectivity and cybersecurity solutions, presents an addressable market for software engineering services in modern vehicle.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

The UK automotive engineering services market is growing gradually, driven by the fast transition to EV manufacturing, increasing need for sustainable automotive solutions and the country’s robust presence in high-performance vehicle engineering. The UK government’s 2035 ban on new petrol and diesel vehicles is pushing automotive R&D in areas like battery technology, electric powertrains and lightweight structures.

It is a growing area for high performance EVs and hybrid vehicles, led by luxury marques such as Jaguar Land Rover, Aston Martin and Bentley that are demanding the type of advanced engineering services including aerodynamics, design with AI and intelligent vehicle testing. Software-driven engineering innovations are also being driven by the emergence of AI-powered autonomous vehicles and connected mobility solutions.

The UK's tight focus on motorsport engineering, and specific areas such as Formula 1 and performance vehicle research, is propelling advancements in aerodynamic simulation, material science and hybrid powertrain development.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.6% |

Automotive Engineering Services Market in Europe automotive engineering services market is expected to witness an annual growth for the forecast period 2023 to 2030.The scope of data includes all existing automotive engineering services over the last few years.

The European Green Deal and Euro 7 emissions standard are creating new regulations pushing automakers to develop zero-emission and energy-efficient vehicles, inducing a strong demand for EV battery technology, hydrogen fuel cells, and lightweight materials engineering services.

Innovations in ADAS, autonomous driving and AI-integrated vehicle software are being led mainly by Germany, France and Italy which are major automotive hubs. European automakers like Volkswagen, BMW, and Stellantis are pouring billions into next-generation vehicle platforms and need cutting-edge vehicle testing, powertrain and aerodynamics expertise.

EU government focus on smart city initiatives and connected mobility infrastructure further drives demand for engineering services in areas such as vehicle-to-everything (V2X) communication, 5G integration, and IoT-supported predictive maintenance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.6% |

The automotive engineering services market in Japan is expanding on the back of technological advancements in hybrid and electric vehicle development, high government regulations on vehicle safety standards, and greater investment in artificial intelligence powered mobility solutions.

The pioneering work being done by Japanese automakers (Toyota, Honda, and Nissan) in solid state battery research, autonomous driving technology, and hydrogen fuel cell vehicles is generating a demand for breakthrough engineering solutions.

The Japanese government’s goal of carbon neutrality by 2050 is one of many factors urging the industry to embrace innovative powertrain development, make use of sustainable materials, and adopt energy-efficient manufacturing processes.

The country’s strong focus on robotics and enhanced integration with AI in automotive design is also fostering demand for a more machine-learning-based approach to simulation and predictive maintenance engineering.

Japan’s aging population is another population-driving investment category, considering the country is already the destination of choice for so much ADAS and safety-enhancing engineering solutions, with a particular focus on collision prevention, driver monitoring, and automated braking systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The automotive engineering services market in South Korea is rapidly growing, owing to its dominance in producing electric and automated vehicles, breakthroughs in batteries, and robust investments in smart mobility systems. With global automakers such as Hyundai, Kia and Genesis spearheading the EV transition, the demand for engineering expertise in lightweight design, aerodynamics, and AI powered vehicle controls is high.

The Korean government’s push for zero-emission transportation is additionally driving investment in hydrogen fuel cell vehicles, necessitating state-of-the-art engineering services for gas cell optimization and energy efficiency. What’s more, South Korea’s tech-driven ecosystem, bolstered by Samsung and LG’s progress in automotive electronics, is going to fuel next-gen, in-car connectivity and smart infotainment engineering.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

As automakers are becoming highly focused toward vehicle performance and safety compliance, as well as technology integration; hence, the Automotive Engineering Services Market is mainly driven by the Testing & Diagnostic and System Integration segments.

They are critical to making a vehicle reliable, operationally efficient and regulatory compliance. While these technologies are shaping the future of the auto industry, their continuous evolution is driving a growing need for specialized automotive engineering services.

The Testing & Diagnostic segment has a significant share in the automotive engineering services market. Automotive manufacturers use these services to maintain their vehicle performance, decrease failure rates, and meet industry safety standards.

The growing intricacy of vehicle architecture with advanced driver-assistance systems (ADAS), electric powertrains, and AI-powered automotive systems has increased their adoption in the market, providing improved safety and reliability.

Market Demand Growth Strengthened by the growing need for real-time diagnostic solutions which include AI-based fault detection, predictive maintenance analytics, and sensor-based vehicle health monitoring that help to address issues before they become a significant problem, thus promoting cost reduction in order to optimize performance.

Next-gen testing technologies with HIL simulation, digital twin-based testing frameworks, and high-fidelity test automation was integrated to boost further optimize vehicle validation with reduced time-to-market and improved accuracy of performance.

Growing adoption of integrated automotive testing solutions with energy-efficient test rigs, minimised emissions in validated cycles and use of eco-friendly materials for crash test assessment has reinforced market expansion in accordance with international environmental policies.

While the Testing & Diagnostic segment does have benefits for vehicle reliability, compliance with regulations, and preventing defects, it does face challenges including high implementation costs, evolving global compliance specifications, and the complexity of testing highly integrated automotive systems.

Nevertheless, new developments in cloud-oriented automotive diagnostics, AI-based test optimization, and virtual simulation platforms are enhancing efficiency, scalability, and cost-effectiveness in the automotive engineering market, boding well for continued expansion in testing & diagnostic services across the globe.

Strong market momentum is observed in the System Integration segment, driven by soaring demand for connected vehicle technologies, autonomous driving, and electric drive system solutions. Automotive manufacturers rely on these services to integrate the software, hardware, and electric components into cohesive system innovation to enhance vehicle functional capabilities.

The increasing popularity of software-defined vehicles, packed with AI-based connectivity, cloud-based fleet management, and over-the-air (OTA) software updates, has led to market acceptance, promoting continuous integration of digital solutions.

Automotive Cybersecurity Market has experienced robust growth, thanks to the booming demand for real-time threat detection, encrypted data communication, and AI-driven vulnerability assessments offered by automotive cybersecurity solutions, ensuring enhanced network security and data protection in vehicles.

Advanced infotainment systems, equipped with gesture control interfaces, augmented reality (AR) dashboards, with voice-command navigation, have also further optimized in-vehicle user experience, providing ultimate driver engagement and convenience.

Additionally, modular system integration frameworks with architecture agnostic designs, plug-and-play compatibility of components, and AI-based vehicle control unit optimization has facilitated market growth by enabling cost effective and scalable automotive solutions.

Automotive Engineering Services Market is primarily concentrated within the ADAS & Safety and Powertrain & Exhaust segments, with automakers striving to improve vehicle safety and fuel economy and meet increasingly stringent environmental regulations. These segments are at the forefront of advances in intelligent driving systems and sustainable powertrain technologies.

The ADAS & Safety segment is growing rapidly among manufacturers as they are integrating advanced features, such as adaptive cruise control, automatic emergency braking (AEB), and lane-keeping assistance to help reduce road accidents and increase overall vehicle safety.

Intensifying regulatory mandates, comprising Euro NCAP safety ratings, NHTSA crash test compliance, and UN ECE autonomous driving regulations, have bolstered market uptake, as they guarantee standardized safety add-ons.

The proliferation of AI-powered driver monitoring systems, which use real-time fatigue detection, biometric driver recognition, and voice-command-enabled emergency response, has reinforced demand in the market, delivering proactive accident prevention and passenger safety.

Advanced safety features have also been optimized, thanks to the adoption of the next-generation LiDAR, radar, and camera-based perception systems, multi-sensor fusion algorithms, real-time object recognition, and predictive collision avoidance.

V2X (Vehicle-to-Everything) communication technologies, with set-up for real-time vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) data transmission play a vital role in speedy marketplace escalation, paving a road for intelligent traffic monitoring and enhanced road protection.

While helpful in accident prevention, compliance with regulations, and intelligent automation in vehicles, ADAS & Safety market are facing several challenges like high sensor costs, cybersecurity threats, and intricate software validation challenges.

However, new innovations through AI-enabled safety analytics, quantum computing-enabled sensor fusion, and high-efficiency real-time data processing are focusing on enhancing safety performance and efficiency, and industry-wide adoption whilst ensuring the continued growth of ADAS & Safety engineering services in the global automotive sphere.

AMETEK will accelerate its value proposition in the Powertrain & Exhaust segment as OEMs move to efficient propulsion systems, efficient powertrains, and low emission exhaust—segments which have already seen impressive growth. Services falling under this category relate to the optimization of engine performance, thereby improving carbon footprints, and enhancing energy efficiency.

The expansion of lightweight powertrain materials, featuring carbon-fiber-reinforced polymers, high-strength aluminum alloys, and advanced composite components, has strengthened market demand, ensuring improved vehicle aerodynamics and fuel efficiency.

Such innovations as phase-change-cooled storage, heat-dissipation algorithms capacitated by artificial intelligence, and liquid-cooling battery tech have allowed advanced thermal management systems to maximize powertrain performance to achieve unrivalled energy conservation.

The automotive engineering services market is one of the fast growing industries due to high demand in electric vehicle (EV) and autonomous driving technologies, and digital prototyping. To get there, automakers and Tier 1 suppliers are teaming up with engineering service providers to drive faster vehicle electrification, software-defined vehicle (SDV) development, and AI driven automotive design. Besides, the demand for lightweight materials, cutting-edge safety systems, and intelligent mobility solutions is another trend propelling market growth.

Market Share Analysis by Key Players & Engineering Service Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| AKKA Technologies | 17-21% |

| Alten Group | 14-18% |

| Bertrandt AG | 11-15% |

| FEV Group | 9-13% |

| Ricardo PLC | 7-11% |

| Other Engineering Service Providers (combined) | 27-37% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| AKKA Technologies | Provides end-to-end vehicle engineering, EV powertrain development, and ADAS integration. |

| Alten Group | Specializes in software-defined vehicle (SDV) development, connected car solutions, and digital twin simulations. |

| Bertrandt AG | Offers automotive design, lightweight material integration, and advanced safety system engineering. |

| FEV Group | Focuses on electric and hybrid vehicle R&D, emission control technologies, and performance optimization. |

| Ricardo PLC | Develops sustainable mobility solutions, battery thermal management systems, and AI-driven vehicle simulations. |

Key Market Insights

AKKA Technologies (17-21%)

A major player in automotive engineering services, AKKA provides full-stack vehicle development, including autonomous driving software and electrification strategies.

Alten Group (14-18%)

Alten is leading the shift towards software-driven mobility, focusing on cloud-connected vehicles and digital twin modelling.

Bertrandt AG (11-15%)

Bertrandt specializes in safety-critical systems, including crash simulations, aerodynamics optimization, and lightweight vehicle structures.

FEV Group (9-13%)

FEV is a key innovator in powertrain electrification and hydrogen fuel cell technology, supporting OEMs in sustainable mobility solutions.

Ricardo PLC (7-11%)

Ricardo is developing advanced propulsion systems and AI-powered simulation platforms to support next-generation vehicle engineering.

Other Key Players (27-37% Combined)

Several global engineering service providers and automotive technology firms contribute to innovations, including:

The overall market size for automotive engineering services market was USD 1.83 billion in 2025.

The automotive engineering services market is expected to reach USD 3.51 billion in 2035.

The expansion of the automotive engineering services market will be driven by the increasing focus on vehicle electrification, autonomous driving technologies, and digitalization, supported by the growing demand for advanced design, testing, and simulation solutions.

The top 5 countries which drives the development of automotive engineering services market are USA, European Union, Japan, South Korea and UK

ADAS & Safety Engineering Services to command significant share over the assessment period.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.