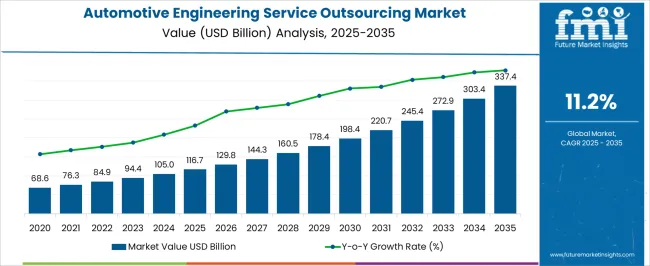

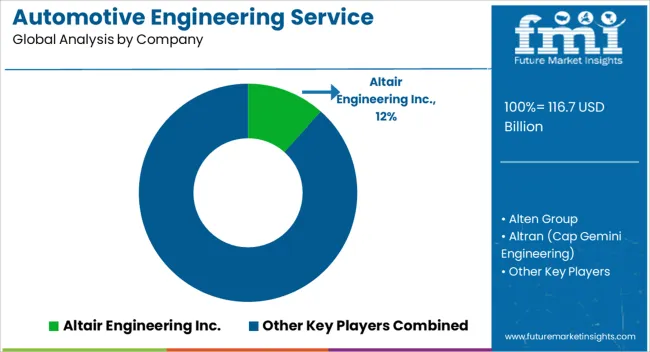

The Automotive Engineering Service Outsourcing Market is estimated to be valued at USD 116.7 billion in 2025 and is projected to reach USD 337.4 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Engineering Service Outsourcing Market Estimated Value in (2025 E) | USD 116.7 billion |

| Automotive Engineering Service Outsourcing Market Forecast Value in (2035 F) | USD 337.4 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

The automotive engineering service outsourcing market is expanding as global automakers and suppliers increasingly prioritize cost optimization, rapid innovation, and specialized expertise. The rising complexity of vehicle systems, particularly with electrification, autonomous driving, and connectivity, has created demand for external engineering capabilities that can deliver faster time to market.

Outsourcing is enabling companies to leverage domain-specific knowledge, digital engineering tools, and scalable resources while reducing operational overhead. Regulatory mandates for safety, emissions, and sustainability are further accelerating the reliance on engineering partners who can provide compliance-driven solutions.

The outlook remains strong as the industry moves toward software-defined vehicles, electric platforms, and advanced driver assistance systems, where engineering service providers play a pivotal role in supporting innovation pipelines and global competitiveness.

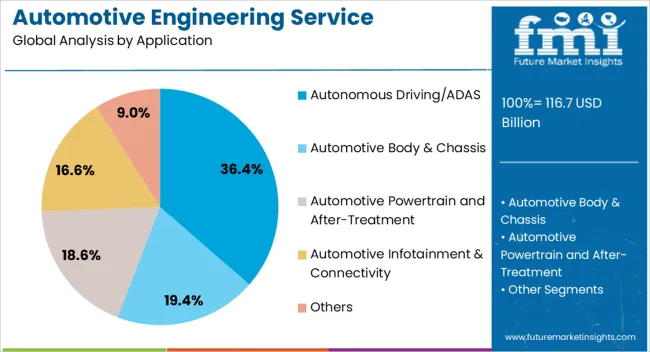

The autonomous driving and ADAS segment is projected to represent 36.40% of overall revenue by 2025 within the application category, making it the leading segment. This dominance is supported by the growing integration of safety technologies, rising demand for intelligent mobility solutions, and investments in self-driving capabilities.

Automakers are increasingly outsourcing engineering activities related to sensors, perception systems, and control algorithms to accelerate innovation while ensuring compliance with evolving safety regulations. Continuous advancements in artificial intelligence and machine learning have further elevated the outsourcing of ADAS and autonomous driving engineering services.

The ability to reduce development costs and leverage global expertise has consolidated this segment’s leadership in the market.

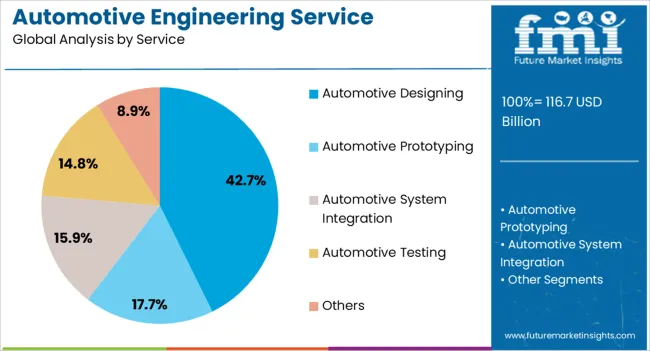

The automotive designing service segment is expected to account for 42.70% of total market revenue by 2025, positioning it as the most significant service category. This growth is being fueled by the need for lightweight materials, aerodynamic efficiency, and consumer-driven aesthetic preferences.

Outsourcing design services has enabled automakers to access creative talent pools, advanced simulation tools, and digital prototyping capabilities, ensuring faster design validation and reduced product development cycles. The emphasis on vehicle electrification and platform modularity has further heightened the need for specialized design solutions.

The ability to balance functional performance with brand differentiation continues to reinforce the dominance of automotive designing within outsourced engineering services.

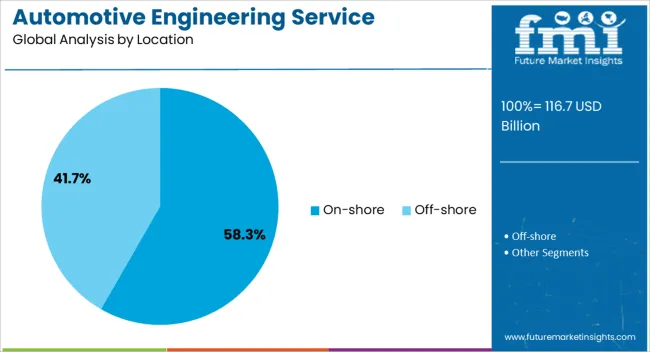

The on-shore location segment is anticipated to hold 58.30% of total market revenue by 2025, making it the preferred location model in the market. This preference is driven by the advantages of proximity, reduced communication gaps, and enhanced collaboration between automakers and service providers.

On-shore outsourcing ensures stronger intellectual property protection, compliance with local regulations, and alignment with regional market needs. Furthermore, the growing adoption of agile development practices and integrated project teams has reinforced the preference for on-shore engagement models.

The assurance of quality, efficiency, and direct control over outsourced functions has positioned on-shore outsourcing as the leading approach in the automotive engineering service outsourcing market.

According to recent research by Future Market Insights, the automotive engineering services outsourcing market is projected to expand at a rate of 11.2% during the forecast period from 2025 to 2035. The market outlook could be divided into the short-term, medium-term, and long-term.

Short-term (2025 to 2025): As vehicles become more complex, there is a growing demand for engineering services providers that can offer specialized skills and expertise to manage this complexity. This includes electric and autonomous vehicle technologies, software engineering, and end-to-end product development and integration.

Medium-term (2025 to 2035): The automotive industry is highly competitive, and manufacturers are under pressure to reduce costs while maintaining high levels of quality. Outsourcing engineering services to lower-cost regions such as India and China can help manufacturers reduce costs and stay competitive.

Long-term (2035 to 2035): Automotive manufacturers increasingly focus on their core competencies, design and branding, and outsourcing non-core activities, such as engineering services. This allows them to concentrate on their strengths while still maintaining high levels of quality in areas outside of their core competencies.

The automotive industry is on the cusp of a major revolution, with automation and robotics taking center stage. From machine vision and collaborative robots to AI for driverless cars and cognitive computing in IoT-connected cars, the industry is witnessing rapid advancements that are transforming the way we think about mobility. And as the industry looks towards a future that is increasingly automated, the scope for outsourcing automotive engineering services is taking a turn for the better.

The demand for precision agriculture, smart manufacturing, and digital medicine is paving the way for innovative technologies like Artificial Intelligence (AI) and machine learning. Automotive manufacturers are no strangers to these technologies, and they are harnessing their potential to push the boundaries of what is possible. Collaborations between OEMs and engineering service providers are becoming more common, with major players outsourcing everything from idea generation and system development to complete vehicle design.

The rising adoption of automotive engineering service outsourcing is being driven by a diverse set of pressures, including globalization, operational complexity, and technological challenges. As OEMs seek greater flexibility to meet customer needs in a wide variety of regional markets, they are outsourcing engineering services to service providers who can help them stay ahead of the competition. And with the advent of connected cars and cyber security challenges, software changes and software management tasks are becoming increasingly complex, leading to a higher demand for outsourcing.

The success of the automotive industry hinges on the seamless integration of these new technologies into the supply chain. Any glitch or kink in rendering these services could potentially disrupt the entire supply chain, causing significant ramifications for automotive manufacturers. Service providers like AVL and FVA are already ushering in a revolution in this marketplace, developing next-level transmission systems for key automobiles and facilitating data exchange between their respective systems.

As OEMs continue to focus on improving their core competencies, outsourcing engineering services to third-party providers is becoming increasingly common. By doing so, they can concentrate on their strengths while still maintaining high levels of quality in areas outside of their core competencies. This is a win-win situation for all parties involved, ensuring a smooth, uninterrupted workflow and pushing the industry toward an exciting future.

Increased Trend of In-house Design May Impedes the Automotive Engineering Service Outsourcing Market Growth.

Despite optimistic growth projections, the global automotive engineering service outsourcing market faces various obstacles restraining its growth to some extent. Due to the complexity of designing the transmission, powertrain, and engine, many manufacturers focus on designing these parts in their in-house facilities instead of outsourcing them from engineering service providers, which may impede market growth.

The delay in assignment by companies and the economical decline in the automotive sector may also hamper the market's growth. Also, the high cost of engineering services and technological limitations associated with outsourcing services can affect market growth.

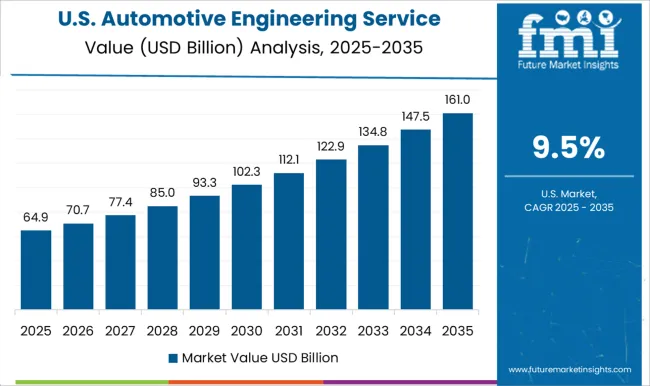

One of the main drivers in the United States is the need for automotive original equipment manufacturers (OEMs) to improve their core competencies while outsourcing other aspects of their businesses to service providers. With globalization's rise, demand fragmentation, operational complexity, and technological challenges, OEMs are seeking greater flexibility to meet customer needs in various regional markets. Outsourcing engineering services to third-party providers enables them to concentrate on their strengths while maintaining high-quality levels in areas outside of their core competencies.

The United States Automotive Engineering Services Outsourcing market is highly competitive with several prominent players. Here are some of the top companies in the United States market:

The automotive industry is shifting towards electric vehicles, driving the growth of the automotive ESO market in India. The government's initiatives, such as the National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India), are expected to accelerate the adoption of electric vehicles in the country. This, in turn, is expected to increase the demand for engineering services for electric vehicles.

Top companies in India’s Automotive Engineering Services Outsourcing market:

The research by Future Market Insights cites factors such as increasing demand for electric and hybrid vehicles, increasing focus on product innovation, and cost-cutting measures by automotive manufacturers as the key drivers of this growth.

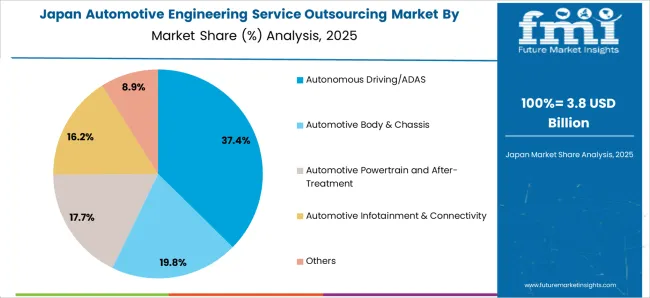

The Japanese government has also taken initiatives to promote the adoption of electric and hybrid vehicles in the country. The government's policies, including tax incentives, subsidies, and investments in infrastructure, are expected to drive the demand for engineering services outsourcing in the automotive industry.

Top companies in the Japanese Automotive Engineering Services Outsourcing market include:

China is the world's largest automotive market, with a growing middle class and increasing demand for high-quality vehicles. This has created opportunities for engineering service providers to partner with domestic automotive manufacturers to develop new products and technologies that meet the needs of Chinese consumers.

Top companies in the Chinese Automotive Engineering Services Outsourcing market include:

The powertrain and after-treatment experience major uptake

By application, the global market is segmented into autonomous driving/ADAS, body & chassis, powertrain, after-treatment, infotainment & connectivity, and others. Among these, the powertrain and aftermarket segment is likely to account for the largest share of outsourced automotive engineering services during the forecast period.

This can be attributed to the rising focus on curbing carbon emissions and designing a cost-effective engine. This has resulted in a rise in the adoption of green technologies including the electrification of the power train. powertrains are replacements for Internal Combustion Engines (ICE) fueled by petroleum and gasoline.

The powertrain and after-treatment segment accounts for a revenue share of around 30.5% of the automotive engineering service outsourcing market. On the other hand, the autonomous driving / ADAS segment accounts for a significant growth rate due to its ability to sense, identify its environment, and offer safe movement.

Prototyping to Remain the Lucrative service segment of Automotive Engineering Service Outsourcing

Based on service, the outsource automotive engineering services market has been segmented into designing, prototyping, system integration, and testing. However, FMI’s latest automotive engineering service outsourcing market forecast anticipates the prototyping segment to account for a market share of 30%, attributed to the increasing deployment of 3D printing technology in the automotive industry to design a prototype of an assembly, certain parts, or a model of an entire car.

3D technology helps manufacturers to find loopholes, this is expected to help them to take corrective measures. For high productivity of the design, to create a database for manufacturing, and to improve the quality of design companies are deploying 3D CAD software.

On the other hand, the design segment is anticipated to register significant growth. The growth of the designing segment is attributed to investments by the manufacturers in designing, research & development, and collaborating with the engineering service providers to construct advanced automobile features for the consumers.

Manufacturers are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential buyers and create a larger customer base. PVG Technology, Sai Auto & Engineering Company, Ari, Ficosa, and Borgward Technology India Pvt Ltd are some of the startup companies operating in the automotive engineering service outsourcing market.

Key players in the global outsource automotive engineering services market include AKKA, Altair Engineering Inc., Alten Group, Altran (Capgemini Engineering), ARRK Product Development Group Ltd., ASAP Holding Gmbh, AVL List GmbH, Bertrandt AG, EDAG Group, ESG Elektroniksystem- und Logistik-GmbH, FEV Group GmbH, Horiba, LTD., IAV, ITK Engineering GmbH Kistler Group, P3 group GmbH, RLE INTERNATIONAL Group. Recent updates from the industry are:

The global automotive engineering service outsourcing market is estimated to be valued at USD 116.7 billion in 2025.

The market size for the automotive engineering service outsourcing market is projected to reach USD 337.4 billion by 2035.

The automotive engineering service outsourcing market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in automotive engineering service outsourcing market are autonomous driving/adas, automotive body & chassis, automotive powertrain and after-treatment, automotive infotainment & connectivity and others.

In terms of service, automotive designing segment to command 42.7% share in the automotive engineering service outsourcing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA