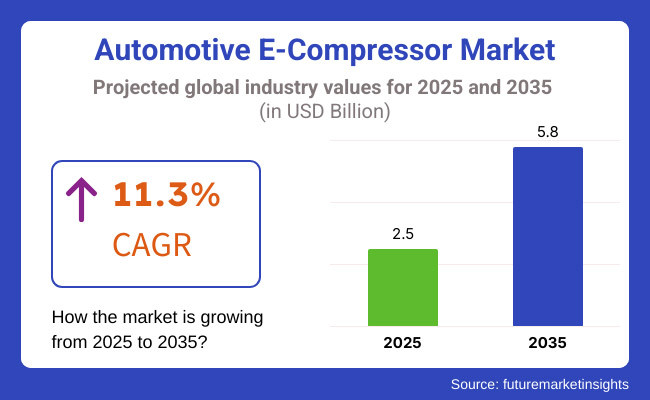

In 2025, the automotive E-compressor market is set to reach a valuation of USD 2.5 billion. It is estimated that by 2035, it will grow to USD 5.8 billion at a CAGR of 11.3%. The main drivers of this growth rate are the higher diffusion of electric vehicles, the reformation of standards of environmental protection, along with the improvement of technology in e-compressors, which, in turn, will make power consumption less and performance more.

The industry development is also supported by the comprehensive process of electrification of vehicles and the increased production of air conditioning units and battery-cooling units for electric vehicles and hybrids. The automotive e-compressor market enjoys consistent upward trend being favored by the rising need for electric vehicles (EVs) and the expanding interest in energy efficiency and sustainability in automotive business.

Rather than conventional belt-driven compressors, e-compressors are able to operate without the engine running, thereby offering improved energy efficiency, reduced emissions, as well as design flexibility in the vehicle. However, automotive e-compressors despite the favorable potential for growth have to overcome issues such as high initial costs, difficulties in integration, and concerns about battery efficiency.

Although e-compressors tend to deliver better efficiency eventually, they incur more costs in terms of purchase at the beginning when they are compared to conventional compressors. This is why we notice refusal of the technology in some price-oriented/spared markets. Besides, the incorporation of these systems into traditional internal combustion engine vehicles or hybrid models requires extensive engineering modifications, and this raises the cost of production.

Another significant problem is to make sure that e-compressors will function satisfactorily without draining the EV batteries so fast, especially in severe heat where thermal management is key to the vehicle range. The requirement of energy-saving solutions during cooling performances and the lifespan of the battery is a must for the manufacturers.

The industry turns to be favorable mainly because of the global growth of electricity-based vehicles, technological advances that keep happening, as well as the formation of new regulations that promote sustainability.

With the rise of electric vehicles on the industry, the demand for heat management systems such as e-compressors will increase too. Car manufacturers are investing plenty of resources in the development of EV technology. This gives the right time for e-compressor manufacturers to find their way to the industry through the creation of unique services that will help improve car performance and fuel usage. Apart from that, developments in compressor technology, such as quieter operation, smaller sizes, and enhanced energy efficiency will be the main push for the industry.

Government rules that limit carbon emissions and promote better fuel efficiency have also pitched in significantly by encouraging e-compressors adoption. The tighter the emission regulations get globally, so the more e-compressors the car manufacturers will have to turn to, thus putting long-lasting pressure on demand. Companies bound to technological innovation, cost-cutting and sustainability practices are well-placed in the automotive e-compressor industry, which now is changing.

Explore FMI!

Book a free demo

Between 2020 and 2024, the automotive e-compressor industry expanded rapidly due to the rise of electric and hybrid vehicles, stringent emission norms, and advancements in thermal management. Unlike traditional belt-driven compressors, e-compressors operated independently of the engine, enhancing efficiency and optimizing battery performance.

Automakers heavily invested in high-efficiency compressors with variable-speed drive technology, lowering energy consumption and increasing EV range. North American, European, and Asian government policies, such as fuel economy regulations and EV incentives, also accelerated adoption. Even with supply chain disruptions, the market was robust, helped by growing consumer demand for better vehicle climate control.

Between 2025 and 2035, the industry will experience several changes in AI-based climate control, modified and better-quality refrigerants, and heat pump integration. AI-based thermal management will make compressors extremely efficient, and its battery will be used at an optimum level.

Automakers will transition to green refrigerants such as R-744 and hydrofluoroolefins (HFOs) to ensure sustainability goals are achieved. Use of 48V hybrid systems and bidirectional charging will continue to enhance e-compressor efficiency. Emerging manufacturing methods, such as 3D printing, will drive costs down, so smart, efficient e-compressors continue to be at the heart of EV thermal management's future.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter emissions norms, EV incentives | Zero-emission mandates, sustainable refrigerants enforcement |

| Variable-speed e-compressors, semiconductor integration | AI-driven thermal management, solid-state battery optimization |

| Growth in EV and hybrid vehicle adoption | Expansion into autonomous mobility and V2G integration |

| Cloud-based remote diagnostics | AI-powered climate control, real-time energy optimization |

| Transition to low-GWP refrigerants | 100% recyclable materials, closed-loop manufacturing processes |

| Basic telematics integration | AI-based predictive maintenance, energy consumption forecasting |

| Semiconductor shortages, limited scalability | Scalable manufacturing, cost-effective modular designs |

| EV adoption, enhanced passenger comfort | Fully autonomous climate systems, wireless energy management |

While the transition to electric vehicles has undoubtedly been a key driver for e-compressors, this disruptive switch has introduced some risks markedly different from the present, especially around consumer-driven demand. High production costs are a major issue, with conventional belt-driven compressors priced about USD 250 per unit and the latest e-compressors topping over USD 500. That price differential makes it hard to reduce the costs, so manufacturers have to flower fresh.

A lack of semiconductors and supply chains problems, as seen in those same 2021 to 2022 years, make production stability more uncertain; Reliance on semiconductor-based inverter control units puts companies at risk of varying component availability and possible time setbacks.

Performance limitations also present critical risks: too much battery energy in an e-compressor can reduce EV range by as much as 10-15%, decreasing overall vehicle efficiency and customer satisfaction. These performance considerations require a constant improvement of cost-efficiency in order to meet energy efficiency concerns, along with worthy investments in research and development. Individually and in aggregate, these circumstances create a challenging market backdrop that will require risk management and planning from leaders in the sector.

Tariffs on e-compressors are still at the higher, premium price point, especially for hybrids and battery-electric vehicles. A typical belt-driven compressor costs approximately USD 250 per unit, while electric models cost USD 500 or more, reflecting higher production costs and better features. Such high prices are claimed by companies including Hanon Systems and MAHLE, with efficiency improvements and performance boost.

Individual e-compressors are often sold together with complete thermal management systems, which enter into bulk pricing agreements with original equipment manufacturers (OEMs). But market dynamics have become competitive as the likes of low-cost Chinese suppliers SANDEN erode prices by selling products at 20-25% lower prices, often leading established players to re-examine their pricing strategies.

Thus, the need for cost pressures must create a balance for firms, as the next generations of products must remain innovative, profitable, and sustainable. Negotiate insulates you from volatility. In an evolving industry, value-based pricing models intend to preserve market share and maintain premium margination, supported by proven energy savings and performance benefits.

For 2025 alone one of the most common applications of the e-compressor is in battery thermal management systems (BTMS). But unlike conventional gasoline-powered engines that utilize engine-cooling systems, electric vehicles (EVs) cool down their batteries through state-of-the-art cooling systems that prevent overheating of their batteries.The electronic compressors let you actively cool using liquid cooling loops and drive heat pumps, which will help you manage thermal in all operating scenarios.

Industry giants like Mahle, Valeo, and Panasonic are heavily investing in AI-driven dynamic thermal management systems that modulate cooling intensity in response to real-time driving conditions and battery temperature. These advancements improve battery performance, increase the range of electric vehicles, and optimize energy efficiency.

Although several challenges including high rate energy usage, adverse weather conditions, complexity of the system, and selection of inexact phase-change material still exist, e-compressors are expected to witness continuous evolution in battery thermal management applications with developments in phase-change materials, forecasted cooling algorithms, and modular cooling architectures.

E-compressors are becoming increasingly popular in hybrid vehicles since they improve fuel efficiency and decrease greenhouse gases. In contrast to the conventional belt-driven compressor that works on the engine load, giving rise to engine loss, the e-compressors operates independently, hence are more efficient and environment-friendly.

This makes it a good candidate for hybrid-drive applications as independence enables effective cooling and temperature control, even while stationary or at low-speed, effectively addressing one of the main challenges in hybrid-vehicle thermal management.

Automakers that already have hybrid vehicles with full hybrid or plug-in hybrid technology, such as Toyota, Honda and Hyundai, are adding e-compressors to enhance climate control without impacting the efficiency of the engine. Nonetheless, significant challenges remain in the need for higher system complexity and dependency on high-voltage devices

The largest application segment for e-compressors is the battery electric vehicle (BEV) segment where the e-compressor is one of the key enablers for battery thermal management. Proper thermal management not only maintains battery health, but also ultimately translates into vehicle performance and range.

Growing Adoption of Advanced e-compressors for Smart Cooling in EVs: As we see automakers playing around with built-in smart cooling technologies in advanced e-compressors to optimize and manage battery balance temperature and address efficiency issues in extreme weather conditions.

The region's market dominance is fuelled by the increasing number of EV makers and the early adoption of new technology in North America and Europe. Concurrently, Asia-Pacific is emerging as the go-to market for expansion, largely resulting from high investments in EV manufacturing and adoption across countries like China and India.

E-compressors are increasingly being used in hybrid and plug-in hybrid vehicles to assist with fuel economy and emissions-reducing efforts. Due to the dual powertrain architectures of these vehicles, they require specialized cooling solutions, and e-compressors are therefore key to maximizing performance benefits under different driving conditions.

North America is a target market for automotive e-compressors, particularly the US and Canada, where penetration of electric vehicles is gaining momentum. Growing demand for electric and hybrid vehicles is propelling consumer demand for e-compressors, as electric and hybrid vehicles require effective thermal management systems in order to deliver optimal battery performance and air conditioning systems.

There exist United States regulatory requirements to decrease emissions and enhance energy efficiency, and for that reason, there is also prompting automobile producers to adopt new-generation technologies like e-compressors. Increased demand for electric cars like Tesla Model 3 and other electric cars by organizations like Ford and GM is also driving the increase in demand for e-compressor systems.

The European market is one of the top-tier markets, with electric vehicle adoption and EU emissions legislation being major contributors. Behind the push for EVs are Germany, France, and the UK, where an increasing number of e-compressor models are being commercially brought forth as automakers strive to enhance vehicle efficiency and sustainability.

Integration of e-compressors into electric and hybrid vehicles enables European manufacturers to enhance air-conditioning and cooling system performance. Simultaneously, demands for carbon neutrality and reduction of vehicle emissions are also pushing electric air-conditioning and cooling systems powered by e-compressors into the spotlight. Greater focus on providing a smooth driving experience, like efficient climate control, further boosts the demand for e-compressor systems in Europe.

The Asia-Pacific region, particularly China, Japan, and South Korea, is projected to experience the fastest growth in the market. China, as the largest market for electric vehicles, is at the forefront of the adoption of e-compressor systems, driven by the government’s push to reduce emissions and encourage EV production.

In China, the growth of the electric vehicle market, coupled with the government’s aggressive policies to promote green technologies, is contributing to the rising demand for e-compressors. South Korea and Japan, which have cutting-edge technology in the field of automobiles, are also experiencing great demand increase for e-compressors as automakers integrate such systems into their electric and hybrid vehicles.

The increasing focus on energy efficiency and improving the efficiency of EV air conditioning and thermal management systems increases demand for e-compressors in the region. In addition, the increasing presence of major automotive players in the region further buoyed the growth of the e-compressor market.

In regions such as Latin America, the Middle East, and Africa (LAMEA), automotive e-compressor demand is gradually increasing because electric and hybrid vehicles are gaining popularity. In Latin America, Brazil and Mexico are witnessing growing needs for electric cars, which is creating an opportunity for advanced thermal management solutions, including e-compressors.

In the Middle East, the adoption of electric vehicles is slowly increasing, and with it, the demand for efficient cooling systems in vehicles. The region’s growing emphasis on sustainability and reducing carbon emissions is expected to drive the adoption of e-compressor systems in the coming years.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.7% |

| UK | 8.3% |

| European Union | 8.9% |

| Japan | 8.5% |

| South Korea | 7.3% |

The USA is among the fastest-growing e-compressor markets, driven by increasing EV sales, federal incentives, and advancements in battery technology. EV sales in the USA have increased exponentially, with electric vehicles accounting for a significant percentage of total vehicle sales. The Inflation Reduction Act (IRA) has provided billions of tax credits and subsidies for electric vehicle production, generating demand for high-efficiency e-compressors.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Increasing EV Adoption | USA EV sales have picked up with more and more new car sales becoming electric. This puts pressure on demand for efficient e-compressors for climate control and thermal management. |

| Industry Collaboration | Tesla, General Motors, and BorgWarner are developing lightweight AI-based e-compressors for range driving and for improving passenger comfort. |

| Battery & Thermal Innovations | Innovations in fast charging networks and solid-state batteries are powering the next generation of high-performance compact e-compressors. |

The UK continues to be in action to embrace EVs on the power of its promise to ban internal combustion engines (ICEs) from use starting 2035. The Road to Zero Strategy by the UK government has put out stimuli to consumers and producers purchasing and manufacturing electric cars, significantly expanding the number of electric vehicles being sold. Britain boasts one of Europe's biggest e-charging networks, and it is stimulating the automotive industry to create more efficient HVAC technology on the back of high-quality e-compressors.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Net-Zero Emission Targets | The UK net-zero by the mid to 2030s strategy is stimulating innovation in electrified HVAC solutions, and e-compressors are becoming the key element in EV design. |

| Heat Pump Integration | Use of heat pump systems on electric vehicles is growing, and multi-functional e-compressors capable of executing maximum heating and cooling with least energy are necessary. |

| Automotive Investment | There is investment on behalf of Valeo, Denso, and Jaguar Land Rover in compact high-performance e-compressors with the aim of enhancing the vehicle aerodynamics as well as their efficiency. |

The European continent is still the technology leader in EV, propelled by tight emissions regulations and subsidies leading to a rushed drive toward electrification. The European Green Deal targets reducing CO₂ emissions from new vehicles by more than 50% in the next few years, compelling manufacturers to shift their focus to high-efficiency vehicle parts like e-compressors. Germany, France, and the Netherlands are at the forefront for EVs, with tens of millions of electric cars on the road and charging points growing at a frenzied pace.

Growth Drivers in European Union

| Key Drivers | Details |

|---|---|

| Strict Emission Regulations | Phased-in ICE vehicles under strict regulations are persuading automobile manufacturers to focus efforts on efficient, light e-compressors for maximum EV performance and efficiency. |

| AI-Based Cooling Systems | Bosch and Volkswagen are adopting AI-driven predictive climate control for maximum battery efficiency and driving range. |

| 800V Compressors | Automakers are moving to 800V e-compressors, with improved cooling efficiency and compatibility for future EV architectures. |

Japan is a world leader in energy-saving car technology, with government-backed EV policy fueling innovation in e-compressors. Japan is world-leader in hydrogen fuel cell and hybrid vehicles with high-performance, compact e-compressors for efficient heat dissipation. Japan's automakers, such as Toyota, Honda, and Nissan, are world leaders in quiet, compact e-compressors that maximize energy efficiency and comfort for passengers.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Carbon Neutrality Targets | Japan's carbon zero vision is centered on electrified HVAC technologies, driving demand for next-generation e-compressors. |

| Hydrogen & Solid-State Tech | Honda and Toyota are accelerating the transition to hydrogen fuel cell-based HVAC technology with light-weight and energy-efficient e-compressors. |

| AI-Powered Thermal Management | Nissan and Denso are developing adaptive e-compressors that dynamically adapt to ambient conditions in real-time, enabling improved energy utilization and vehicle range. |

South Korea is experiencing remarkable growth driven by state stimulus, the speed of EV manufacturing, and robust innovation in smart cooling technologies. Energy-efficient e-compressors are a hot product with Hyundai and Kia leading the transition to an all-electric and hybrid electric model.

Fast-speed AI e-compressors that are more energy efficient and higher in cooling power are subsidized by the Ministry of Trade, Industry, and Energy (MOTIE). Apart from this, the combination of ultra-fast charging infrastructure and wireless charging is presenting a plethora of opportunities for thermal management. Industry leaders like LG Electronics, Hanon Systems, and Samsung SDI are creating light and modular e-compressors that are silent and highly efficient and can be integrated with prospective EV platforms very efficiently.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| Government Incentives | The South Korean government by MOTIE is investing in high-speed AI e-compressors with high cooling performance. |

| Wireless & Ultra-Fast Charging |

Technical growth in wireless charging and ultra-fast charging is elevating the need for next-generation thermal management solutions backed by e-compressors. |

| Leadership in the Automotive World | Hyundai and Kia are pioneering electrification and hybridization, which is triggering new-generation low-noise, highly efficient, and modularity e-compressors. |

| Innovations by Key Players | LG Electronics, Hanon Systems, and Samsung SDI are developing light-weight, modular e-compressors that can be used with next-generation EV platforms. |

The future is being shaped by advances in solid-state cooling, climate control through AI, and fuel-cell vehicle conversion through hydrogen. This technology for cooling devices eliminates all forms of noise and much of the inefficiency associated with heat conversion and maintenance costs associated with traditional cooling systems, thereby leading to the next generation of such heat-sinks, the e-compressors.

Sophisticated ways of making smart climate conditions improve cabihermal performance of the vehicle.

Hydrogen fuel cell vehicles (FCEVs) an comfort as well as efficiency with the modification of compressive performance depending on passenger occupancy, the weather outside, and the preferences of one driver. Such intelligent climate solutions will cut energy losses while maximizing tre also expected to be the determinants of the e-compressor industry as OEMs are looking to develop systems for fuel cell cooling applications and/ therefore, high voltage compressor systems. With the rising hydrogen infrastructure and fuel cell adoption, demand for special-purpose e-compressors will also further drive industry growth.

The industry is moving upward, driven by the advancements in electrification, smart vehicle technologies, and regulatory needs. With the advent of battery cooling, hybrid vehicle integration, and networked climate control systems, e-compressors will be instrumental in shaping the future of energy-efficient and sustainable mobility solutions.

The automotive e-compressor industry has increased traction owing to the growing demand for electric vehicles (EVs) and requirements for efficient thermal management systems. The industry players include prominent names such as DENSO Corporation, Hanon Systems, MAHLE GmbH, Valeo, and Sanden Corporation, who are chiefly concentrating on technological advancements, strategic partnerships, and the expansion of production capacities to meet the increasing demand for e-compressors.

For instance, DENSO Corporation is heavily investing in R&D to improve the efficiency and performance of their e-compressors in supporting the changing needs of EV manufacturers. Likewise, Hanon Systems larger global footprint with invested capability from new production plants and joint ventures to tap into the regional industry more effectively.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Denso Corporation | 20-25% |

| Hanon Systems | 15-20% |

| MAHLE GmbH | 12-16% |

| Valeo | 10-14% |

| Sanden Holdings Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Denso Corporation | Develops high-performance e-compressors for EVs with intelligent thermal management. |

| Hanon Systems | Focuses on compact and lightweight e-compressors to enhance vehicle energy efficiency. |

| MAHLE GmbH | Innovates in integrated e-compressor solutions with low power consumption. |

| Valeo | Pioneers' smart climate control e-compressors with AI-driven efficiency features. |

| Sanden Holdings Corporation | Specializes in high-capacity e-compressors for commercial as well as passenger EVs. |

Key Company Insights

Denso Corporation (approximately 20-25%)

Denso continues to expand its cutting-edge designs that better maintain cooling efficiencies while reducing electric consumption and enriches total EV performance.

Hanon Systems (15-20%)

Hanon Systems is a company that specializes in developing e-compressors that are both extremely compact and lightweight, thereby optimizing the efficiency of energy use by the vehicle and ensuring superior climate control.

MAHLE GmbH (12-16%)

MAHLE has integrated thermal management at its best with e-compressors that operate draining less energy while optimizing cooling performance.

Valeo (10-14%)

Valeo innovates the AI-enabled e-compressor technologies that promote efficient climate control in pursuit of added EV range and comfort for the passengers.

Sanden Holdings Corporation (6-10%)

Sanden specializes in high-capacity e-compressors for both passenger and commercial EVs, ensuring reliable cooling performance in varying operational conditions.

Others Important Players (30-40% Combined)

Several other companies are making strides in the industry by investing in energy-efficient designs as well as smart cooling systems.

The overall market size for the market was USD 2.5 Billion in 2025.

The market is expected to reach USD 5.8 Billion in 2035.

The demand will grow due to the increasing adoption of electric vehicles, demand for energy-efficient HVAC systems, and advancements in e-compressor technology.

DENSO Corporation, Valeo S.A., MAHLE GmbH, Hanon Systems, Sanden Holdings Corporation are some of the key players in the market.

Electric scroll compressors and rotary compressors are expected to command a significant share over the assessment period.

Based on type, the market is segmented into belt-driven e-compressor and electrically driven e-compressor.

According to application, the market is categorized into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs).

Based on electric vehicle, the market is segmented into battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV).

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Germany Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United Kingdom Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United States Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.