The automotive door sills market is expected to grow steadily during the period between 2025 and 2035 owing to increasing vehicle customization trend, growing consumer preference for premium aesthetics, and development in materials and smart lighting technologies.

Growing consumer inclination toward vehicle personalization is one of the significant factors influencing the market growth. Door sill plates include LED lighting, engraved branding, and multi-color choices often appear as highly customized features on luxury and high-end vehicles through automaker- and aftermarket-supplied content. Just like you have ambient lighting or some sort of smart features in your car, now they have illuminated and smart door sills with motion sensors that open up when you approach the car.

Another key factor contributing to growth is increasing demand for lightweight and durable materials. The momentum is building to aluminum, carbon fiber, and high-strength plastics as automakers look to lower vehicle weights and enhance fuel economies. Moreover, the penetration of electric vehicles (EVs) is increasing high-tech and illuminated door sills as a fundamental design feature.

So, the aftermarket segment too is helping in the market growth, as automotive enthusiasts are spending on high-quality and customizable door sills to amplify the appearance of their vehicles whilst increasing the vehicle resale value. Market expansion is also attributed to increasing online sales of automotive accessories, as they provide a wider array of door sill supplies with rebates and discounts.

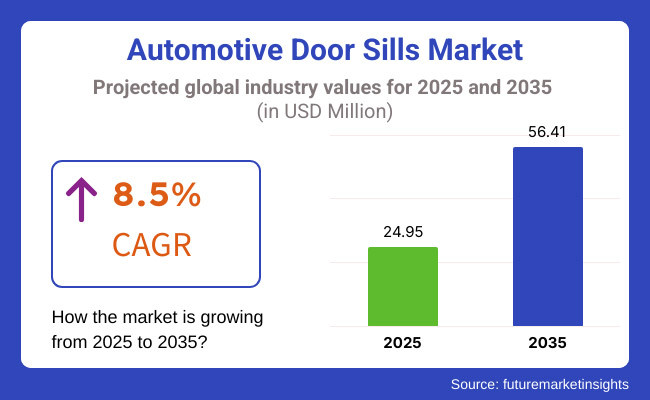

The automotive door sills market accounted for USD 24.95 million in the year 2025 and is expected to reach USD 56.41 million by the year 2035, at a CAGR of 8.5% during the forecast period.

High-end, illuminated door sills are witnessing higher demand in North America, especially in luxury and sports cars, according to the report, in which the United States and Canada are expected to drive significant demand for those products. Sales are further bolstered by a sizable aftermarket customization brand presence.

Europe is still a core market, as luxury automakers like BMW, Mercedes-Benz and Audi build tooled and LED-illuminated door sills into the expensive trims of their vehicles as standard equipment. This is another key factor fuelling the growth of futuristic, lightweight sill designs as the adoption of electric and hybrid vehicles continues to increase.

Asia-Pacific, especially China, Japan and South Korea, is observing rapid growth owing to the automotive industry expansion and rising consumer inclination toward vehicle aesthetics. Strong market activity is driven in part by the influx of EV production and aftermarket upgrades.

With vital automotive in Brazil and Mexico, Latin America is experiencing heightened interest in affordable and durable door sill solutions. Adoption of disposable income and increasing vehicle customization trend is further driving the market.

In the Middle East & Africa, manufacturers have found a niche in the region, especially in UAE and South Africa, where buyers prefer a luxury car, along with customized feature that include branded door sills with premium branding and lighting. Growing adoption for high-end automotive customization is propelling growth in the market.

Challenges

Material Durability and Cost Constraints

The Trading of Automotive Door Sills Market is affected by challenges relating to material selection, durability, and cost-efficiency. Luxury vehicles use premium stainless steel, aluminum or illuminated door sills that employ sophisticated lighting, while cost-sensitive markets gravitate towards the cheaper plastic or composite alternatives. Manufacturers have yet to find the sweet spot between affordable manufacturing and durability.

Door sills also suffer frequent wear and tear, corrosion, and impact damage which raises maintenance concerns for consumers. To improve product longevity, manufacturers must create scratch-resistant, lightweight, and durable materials.

Opportunities

Growing Demand for Customization and Smart Features

Growing consumer inclination towards vehicle customization creates lucrative opportunities for Automotive Door Sills Market. In both the aftermarket and OEM segments, custom branding, illuminated sills with LED or OLED lighting and touch-sensitive or smart door sills (with motion sensors) are seeing increased activity.

Furthermore, the advent of anti-bacterial coatings and self-healing material used in door sill components perfectly coincides with the rising consumer requirements for hygiene and maintenance free components. This helps brands get a competitive edge by investing in smart, durable, and aesthetically aggressive door sills.

The years 2020 to 2024 have seen a gradual transition to illuminated and branded door sills, replacing classic plastic and stainless steel products. LED-illuminated sills became an option for premium-car packages offered by more and more automakers. Cost limitations, however, hindered the general use of high-end materials across more affordable models.

The future between 2025 and 2035 will see the evolution of smart and interactive door sills. Connected-car ecosystem integration, motion-detection door sills, and customizable digital displays will bring new cars into the market. Future product offerings will also be driven by sustainability-led innovations, such as recycled materials and biodegradable materials.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Material Advancements | Stainless steel, aluminum, and plastic-based door sills |

| Customization & Aesthetics | LED-illuminated and branded door sills |

| Industry Adoption | OEMs offering illuminated sills in luxury segments |

| Sustainability & Efficiency | Initial use of eco-friendly and corrosion-resistant materials |

| Market Competition | Presence of aftermarket suppliers and OEM-focused manufacturers |

| Integration with Smart Vehicles | Limited connectivity and functionality |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Material Advancements | Lightweight, impact-resistant, and self-healing materials |

| Customization & Aesthetics | Digital displays, motion-sensing illumination, and dynamic color-changing sills |

| Industry Adoption | Wider adoption of customizable and smart door sills across all vehicle segments |

| Sustainability & Efficiency | Expansion of biodegradable, recycled, and sustainable material-based door sills |

| Market Competition | Increased innovation from tech-driven companies entering the automotive accessories market |

| Integration with Smart Vehicles | AI-driven sills with proximity sensors and voice-activated illumination |

The United States automotive door sills market is witnessing profound growth on the back of escalating consumer preference toward vehicle personalization, growing production of electric vehicles (EVs), and development in lightweight composite materials. With automakers making great strides in vehicle styling and quality, from illuminated door sills to stainless steel and aluminum door sill protection, the demand for high product value is increasing.

Increasing consumer preference for luxury and premium vehicle trims is further driving demand for premium class door sill plates equipped with LED lighting, brand logos and customized designs. Electric vehicle makers such as Tesla, Rivian and General Motors are also installing premium quality door sills to enhance the passenger experience while providing scratch resistance and durability.

As aftermarket automotive sales continue to grow, more consumers are opting for aftermarket door sill protectors to improve vehicle resell value and interior aesthetics. Smart, illuminated door sills with motion sensors and programmable lighting are also becoming more popular, spurring more innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.9% |

The United Kingdom automotive door sills market is also on the rise owing to rising sales of premium and performance vehicles, increase in the adoption of electric vehicles, and growing consumer preference towards vehicle customization. Segments were also observed for premium car brands, such as Jaguar Land Rover, Aston Martin and Rolls Royce, the demand is significantly high for illuminated branding by premium car door sill plates with high-quality finish.

With UK consumers and businesses transitioning to eco-friendly automotive solutions, EV manufacturers are incorporating lightweight aluminum and composite door sills to maximize efficiency. Moreover, the demand for customized and laser-engraved as well as illuminated door sills is propelled by the growth of aftermarket automotive accessories industry.

Governments continue to enforce strict regulations on vehicle aesthetics and increase safety standards which is also pushing automakers to integrate features such as scratch- and impact-resistant door sills to provide durability and longevity to the vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.3% |

The European Union (EU) automotive door sills market is gaining significant traction, propelled by the trends of sustainability, sale of EVs, and the increasing demand for other premium Automotive Interior parts. As a result, rising demand for illuminated and premium-finish door sills as leading car manufacturers are emphasizing the luxury as well as durability in the vehicle such as BMW, Audi, and Mercedes-Benz.

So the EU’s stringent emissions regulations and sustainability goals are also compelling automakers to make more recyclable materials in door sill production, including lightweight aluminum, carbon fiber and biodegradable polymers. New door sill innovations are also being driven by advanced vehicle design, including smart lighting and touch-sensitive controls.

A growing European aftermarket automotive industry is also driving sales of custom, branded and high-end door sill protectors, particularly in SUVs, crossovers and luxury cars.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 8.5% |

Japan automotive door sills market is growing rapidly owing to the country’s prowess in precision engineering, development of smart automotive interiors, and rapid expansion of hybrid and electric vehicles. The same lightweight aluminum and scratch-resistant door sills that have graced Japanese cars from Toyota, Honda, and Nissan have all found their way into newer production models as well.

Rapid increasing usage of smart and lit up door sill technology in luxury and premium type of automobiles is also driving market growth. Japanese automakers are bringing utility and styling up to the next level with LED, OLED, and programmable lighting systems integrated into next gen door sills.

As Japan’s car accessories aftermarket grows, consumers looking for custom-fit, high-quality door sills to enhance the resale value and aesthetics of their rides have been in high demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.7% |

South Korea automotive door sills market is a rapidly growing market due to the country’s robust automotive manufacturing base, increasing demand for premium vehicle aesthetics, and production of electric vehicles. As Hyundai, Kia, and Genesis increase their luxury and sporty offerings, high-end, lit, and custom-branded door sills are in demand.

The South Korean emphasis on collectively smart automotive interiors is prompting technological innovations in door sill lighting, motion-sensing controls and upmarket material finishes. The growing aftermarket auto accessories market in the country is also fueling the demand for custom-fit door sill with laser engraving plates and scratch-resistant protectors.

To improve efficiency and sustainability, automakers have been incorporating lightweight, eco-friendly, and high-strength materials into door sill designs as EV adoption rises; EVs tend to be heavier than gas-powered vehicles, prompting the need for lighter materials which include but are not limited to carbon fiber and aluminum.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.6% |

Steel and aluminum door sill segments are prominent in the automotive door sills market as manufacturers emphasize greater durability, corrosion resistance and best aesthetics. These materials are commonly used in passenger cars, luxury vehicles and performance vehicles that provide extensive protection from wear and tear while adding to the vehicle making it appear better in terms of aesthetics.

High durability, scratch resistance, and the ability to withstand harsh environmental conditions have made stainless steel door sills a preferred choice for automakers. Their corrosion-resistant design makes them suitable for vehicles used in wet, coastal, and high humidity areas without the concerns of plastic and rubber versions clogging up or losing structural integrity over time.

For the latest data, it would be advisable to refer to industry reports and market analyses regarding the adoption of stainless steel door sills by type of vehicle. Many automakers combine these integrated illuminated stainless steel door sills with custom branding and LED lighting to enhance their allure in the upper stretches of the premium vehicle spaces.

The growing availability of aftermarket stainless steel door sills with customized designs, brushed metal finishes, and laser-etched logos has reinforced demand in the market, promising further personalization and aesthetic improvement for the diverse of vehicle owners.

However, the use of stainless steels presents drawbacks, including higher production costs, increased weight of the vehicle without being able to gain anti-skid, and the issue of fingerprint marks and smudges. Nevertheless, the automotive door sills market is poised for lucrative impersonation in this segment globally, as lightweight stainless steel alloys, self-cleaning coatings and advanced surface treatments are all featured in emerging innovations that would aid in efficiency, maintenance ease and cost-effectiveness.

As automakers increasingly seek lighter components, fuel efficiency and sustainable materials, demand for aluminum door sills is on the rise. While most similar to stainless steel in durability, aluminum is an even lighter alternative but still very resistant to the corrosion and impact damage.

Demand for aluminum door sills has remained sustained due to a rising adoption of electric vehicles (EVs) and fuel-efficient cars as manufacturers are exploring ways to produce lighter materials that can enhance energy efficiency and reduce emissions. Many EV makers incorporate aluminum-based door sills in line with sustainability and energy saving initiatives.

Carrying scratch-resistant coatings and a matte or glossy finish, the increase of anodized aluminum door sills with built-in LED lights has helped the market further, making them more customizable and durable for contemporary vehicles.

Although the use of aluminum provides benefits including lightweight, sustainable and corrosion resistance, it is less popular in the door sill segment as consumers trade off their budget for downside elements including more prone to dent, less impact resistance than stainless steel, and oxidation over time.

Conversely, technology developments in areas such as reinforced aluminum alloys, self-healing surface coatings, and precision manufacturing techniques are contributing to durability, longevity, and performance, adding to the prospects for aluminum door sills in the automotive market across the globe.

As OEMs focus on protection of entry of the vehicle, wear resistance, and aesthetics, the front side and back side door sill segments hold a prominent proportion of the automotive door sills market. These applications are especially critical for cars, SUVs, and passenger applications that are prone to frequent traffic and can potentially result in scratches, scuffs, and the degradation of the material.

The rise in integration of illuminated and branded front of door sills in high-end vehicles further propels the growth of the market, since automakers are shifting their focus to providing luxury appeal while also ensuring functional durability.

Front side door sills also have disadvantages despite their benefits in vehicle protection and design improvement, like higher exposure to environmental circumstances and maintenance. Nevertheless, advanced scratch-resistant coatings, anti-slip textures, and smart illumination technologies are enhancing performance, ease of maintenance, and overall user experience, facilitating market growth moving ahead.

Performance, rear passenger, and SUV vehicles are making back side door sills even more critical when rear passenger access needs an added touch of strength and refinement. Obligated in both day-to-day and high-end car architectures, these sills are intended to protect door frames and sanding of floor coverings from scuffs, damage from foot traffic, and impacts from luggage.

The adoption of rail is therefore fueled by the huge demand for customized and illuminated back sills in luxury and premium SUVs etc., as these key players opt for aesthetic components to complement functional components when designing SUVs.

Back side door sills are useful in the sense that they not only provide functionality to make sure the entrance to the passenger area is strong, but they also contribute to the aesthetics of the interior, helping complete of the overall look of the vehicle.

Nonetheless, progressive production approaches furnished with 3D-printed sill designs, green material coatings, and in-built smart lighting solutions are pushing market achievability, having offered customization flexibility, product durability, thus ensuring sustained demand for back side door sills across a myriad of vehicle categories.

The Automotive Engineering Services Market is growing at a high CAGR rate due to the growing demand of electric vehicles (EVs), autonomous driving technologies, and digital prototyping. Engaged with engineering service providers, leading automakers and Tier 1 suppliers want to speed up their vehicle electrification, software-defined vehicle (SDV), and AI-enabled automotive design efforts. Moreover, the demand for lightweight materials, sophisticated safety mechanisms, and intelligent mobility solutions is also fuelling the market growth.

Market Share Analysis by Key Players & Door Sill Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| AKKA Technologies | 17-21% |

| Alten Group | 14-18% |

| Bertrandt AG | 11-15% |

| FEV Group | 9-13% |

| Ricardo PLC | 7-11% |

| Others | 27-37% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| AKKA Technologies | Provides end-to-end vehicle engineering, EV powertrain development, and ADAS integration. |

| Alten Group | Specializes in software-defined vehicle (SDV) development, connected car solutions, and digital twin simulations. |

| Bertrandt AG | Offers automotive design, lightweight material integration, and advanced safety system engineering. |

| FEV Group | Focuses on electric and hybrid vehicle R&D, emission control technologies, and performance optimization. |

| Ricardo PLC | Develops sustainable mobility solutions, battery thermal management systems, and AI-driven vehicle simulations. |

Key Market Insights

AKKA Technologies (17-21%)

A major player in automotive engineering services, AKKA provides full-stack vehicle development, including autonomous driving software and electrification strategies.

Alten Group (14-18%)

Alten is leading the shift towards software-driven mobility, focusing on cloud-connected vehicles and digital twin modelling.

Bertrandt AG (11-15%)

Bertrandt specializes in safety-critical systems, including crash simulations, aerodynamics optimization, and lightweight vehicle structures.

FEV Group (9-13%)

FEV is a key innovator in powertrain electrification and hydrogen fuel cell technology, supporting OEMs in sustainable mobility solutions.

Ricardo PLC (7-11%)

Ricardo is developing advanced propulsion systems and AI-powered simulation platforms to support next-generation vehicle engineering.

Other Key Players (27-37% Combined)

Several global engineering service providers and automotive technology firms contribute to innovations, including:

The overall market size for automotive door sills market was USD 24.95 million in 2025.

The automotive door sills market is expected to reach USD 56.41 million in 2035.

The expansion of the automotive door sills market will be driven by the increasing focus on vehicle aesthetics and durability, supported by the rising adoption of illuminated and customizable door sills, advancements in material technology.

he top 5 countries which drives the development of automotive door sills market are USA, European Union, Japan, South Korea and UK

Front Side and Back Side Door Sill to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Homologation Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tappet Market Size and Share Forecast Outlook 2025 to 2035

Automotive Chain Sprockets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA