Automotive display units market are expected to witness significant growth during the year 2025 to 2035 owing to rapid technological advancements in vehicle infotainment systems, rising consumer demand for smart and connected vehicles and increasing penetration of electric and autonomous vehicles.

Training on modern automobiles in the context of vehicles equipped with advanced displays and infotainment systems, display units play a significant role in delivering real-time information, entertainment, and safety features to users. Whether from digital instrument clusters and head-up displays (HUDs) to center stack touchscreen panels, modern display technologies are changing how we experience being in the cabin of a vehicle.

The increasing penetration of digital cockpits in modern vehicles is one of the primary factors driving the growth of the digital cockpit market. Automakers are swapping out traditional analog gauges for fully digital instrument clusters with cameras, more customization options, and integration with navigation, driver assistance, and connectivity reasons.

Graphic solution demand for high-resolution OLED, TFT-LCD, and AMOLED displays is on the rise as automotive manufacturers strive for enhanced appearance and functionality.

This is followed by the growing popularity of augmented reality (AR) and head-up displays (HUDs), which is further enhancing market growth. Such systems, called HUDs (heads-up displays), project crucial driving information (speed, navigation, safety alerts) onto the windshield, allowing drivers to stay focused on the road and improving safety.

The availability of autonomous and semi-autonomous vehicles will also drive demand for AR-based displays that can provide interactive road guidance, hazard detection, and contextual information.

The demand for automotive display units is being fueled significantly by the growth of electric vehicles (EVs) as well. EV makers are focusing on forward-looking and interactive cabin layouts, and for next-gen vehicles, large, high-resolution touchscreens are among the defining elements. Tesla has paved the way, for example, with its single touchscreen inside every car, and other manufacturers are jumping in the same direction.

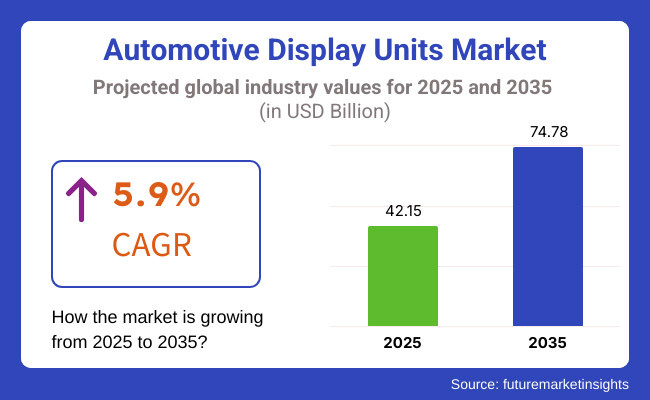

The automotive display units market accounted for USD 42.15 billion in the year 2025 and is expected to reach USD 74.78 billion by the year 2035, at a CAGR of 5.9% during the forecast period.

Explore FMI!

Book a free demo

The market for luxury and connected vehicles is strong, especially in the North American market in the USA and Canada. Furthermore, the market growth is driven by the presence of key automakers and technology companies that are investing in advanced infotainment and AR-based HUDs.

Europe, with Germany, the UK & France leading the charge, a major territory for premium car manufacturers (e.g. BMW, Audi, Mercedes-Benz) integrating next-gen digital cockpit solutions. EVs and smart mobility solutions are also driving demand for advanced display technologies.

Most of the development are occurring land of Asia-Pacific, where the smart vehicles market are mainly driven by countries like Japan, China, and South Korea. Chinese EV makers like NIO and XPeng are introducing massive touchscreen interfaces and voice-activated AI assistants that are setting new trends. In conjunction with 5G infrastructure rollout and IoT integration, the market growth is being driven even higher.

As automotive production in Latin America continues to increase, particularly in Brazil and Mexico, mid-range and high-end vehicle displays are also becoming more prevalent. Supportive government incentives to encourage automotive digitization are fueling market growth.

Middle East & Africa, particularly the UAE and South Africa, are emerging as niche market for premium vehicles equipped with modern infotainment and display systems. Future advancement is likely to be aided by rising disposable revenues and smart urban trends.

Challenges

High Manufacturing Costs and Technological Complexity

Leading constraints of the Automotive Display Units Market in terms of new product rollout by players are the new display technologies including OLED, Micro LED, and augmented reality (AR) heads-up displays (HUDs) that necessitate investment in infrastructure. Combining high-resolution touchscreens with haptic feedback and AI-driven interfaces means higher R&D costs, adding to production.

Also, display units need to work seamlessly with a vehicle’s on-board systems, such as infotainment, navigation, and driver assistance features — adding further to the complexity. Concerns about screen glare, driver distraction and long-term durability also pose challenges for manufacturers.

Opportunities

Rise of Connected Vehicles and Smart Cockpit Systems

Huge opportunities are present in the automotive display units market owing to the rapid growth of the connected vehicles like autonomous driving technologies. It is the consumer who is demanding larger, more interactive displays on their dashboard, with advanced UI/UX capabilities and smart dashboards, curved displays, and AI-driven personal assistants built-in to the vehicles.

In addition to independent developments in flex and transparent display technologies, the integration of augmented reality into vehicle interiors would not be possible without advances in flexible electronics, which represent a powerful combination that will create further opportunities for display technologies to transform the passenger experience and improve driving assistance systems.

However, between 2020 and 2024, we saw more use of digital instrument clusters, larger infotainment screens, and touch-sensitive controls in the market. Automakers were centered on linking multi-display setups with smartphone integration, voice-controlled functions and. But supply chain disruptions and semiconductor shortages decreased production and pushed technology rollouts to a later date.

Towards 2025 to 2035, the market is predicted to shift towards ultra-high-definition (UHD) displays, augmented reality HUDs, and AI-enhanced interfaces. Dynamic and flexible displays are on the verge of revolutionizing vehicle interiors and allowing drivers and passengers personalized, adaptive experiences. The proliferation of autonomous vehicles will lead to greater demand for immersive entertainment-oriented display solutions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Standardization of infotainment and safety display guidelines |

| Market Growth | Increasing demand for digital instrument clusters and infotainment screens |

| Industry Adoption | Integration of touchscreens and voice-controlled interfaces |

| Technology Innovations | Advancements in OLED, curved displays, and multi-screen setups |

| Market Competition | Presence of major automakers and Tier 1 suppliers focusing on display innovation |

| Sustainability and Efficiency | Initial steps toward energy-efficient, lightweight displays |

| Vehicle Automation Impact | Displays supporting ADAS and semi-autonomous features |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on driver distraction and cybersecurity for connected displays |

| Market Growth | Expansion into AR-based HUDs, fully digital cockpits, and smart windshield displays |

| Industry Adoption | Rise of AI-driven personalized dashboards and gesture control systems |

| Technology Innovations | Widespread adoption of transparent, flexible, and holographic display units |

| Market Competition | Entry of tech companies and startups specializing in AI-powered automotive interfaces |

| Sustainability and Efficiency | Increased focus on eco-friendly materials, reduced power consumption, and recyclable display components |

| Vehicle Automation Impact | Fully immersive in-car entertainment and information screens for autonomous mobility |

The automotive display units market in North America is projected to witness steady growth owing to the rising demand for advanced in-car infotainment systems, increasing adoption of electric vehicles (EVs), and surging popularity of connected and autonomous vehicles. But with consumers demanding tight, intuitive interfaces using all things tech, automakers are pouring investment into big touchscreen displays, head-up displays (HUDs) and digital instrument clusters to aid and protect the ride.

As new smart mobility solutions gain traction, and partnerships between tech firms and automakers continue to develop, the market for next-gen display technologies is expected to mushroom. Designing an interactive augmented reality (AR) HUD with OLED and AMOLED integrated by the major players like Tesla, General Motors, and Ford to make driving more real-time information enabled.

Moreover, USA government regulations regarding distracted driving are pushing the development of voice-controlled, gesture-based, and AI-enabled display units that minimize driver distractions and enhance navigation and vehicle diagnostics. The upcoming advanced 5G connection and professional over-the-air part (OTA) Software Updater are supposed to create more customized, Integrated, and accurate automotive reveal devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

UK Automotive Display Units Market Research Work the United Kingdom automotive display units market is anticipated to be supported by numerous factors, including increasing consumer inclination for digital dashboards, favourable government regulations towards electric and connected cars, and rapid implementation of AI-based in-car systems. Two companies are in a joint venture on developing fully digital cockpits for UK Automakers which replaces analog gauges with high-resolution displays.

Now that the UK has banned internal combustion engine (ICE) vehicles from 2035, the EV transition is driving demand for advanced digital displays that can deliver real-time battery diagnostics, navigation, and driver assistance data. You are also exposed to AI-based virtual assistants and voice-controlled infotainment systems, which are changing the user interface of modern cars.

The buoyant luxury and premium car market in the UK, supported by manufacturers like Jaguar Land Rover, Aston Martin and Bentley, is also driving demand for high-end OLED and multi-screen display configurations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The European Union automotive display units market is experiencing robust growth, due to rising emphasis on connected mobility, rising vehicle safety regulations, and innovations in display technologies. Germany, France, and Italy are the powerhouses of automotive manufacturing and there is increasing demand for advanced, high-performance, and immersive display units.

The European Green Deal has placed sustainability and electrification at the forefront of the EU's agenda, leading carmakers to pursue intelligent display solutions that maximize energy efficiency and driving performance. The adoption of HUDs and augmented reality dashboards that improve situational awareness and reduce driver distractions are also being accelerated by new Euro NCAP safety procedures.

The growing popularity of luxury and performance car brands like BMW, Audi, and Mercedes-Benz is helping to fuel OLED, 3D, and AI-enabled dashboard displays, providing customizable driving experiences and high-definition graphics.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.9% |

The automotive display units market in Japan is expanding at a moderate pace. Japanese automakers like Toyota, Honda, and them Nissan leads the way with integrating AI, augmented reality (AR), and smart connectivity into digital dashboards.

And with Japan at the forefront of precision engineering, high-quality OLED, AMOLED, and flexible display panels have become routine in new vehicle designs. Rising investments in the autonomous driving procedure will also accelerate the demand for AI-driven displays that include features like real-time traffic data, hazard detection, and predictive analytics.

The focus on increased safety and reduced driver distraction is also driving the adoption of HUDs and hands-free voice-controlled infotainment systems, as well as 3D holographic displays. In addition, Japan has a well-established supply chain for electronic components that helps drive innovations and enables cost-efficient production of next-generation automotive displays.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The automotive display units market in South Korea is burgeoning, driven by the country’s prowess in display technology, growing adoption of EVs, and positive growth prospects for smart vehicle interiors. South Korea is also a global center for next-generation automotive screens, including OLED, micro LED and foldable displays, thanks to major display manufacturers like Samsung Display and LG Display.

Growing usage of connected cars and autonomous drive technologies is driving demand for AI-integrated, multi-functional digital dashboards featuring augmented reality-based navigation, split-screen and 3D visualization. Moreover, manufacturers like Hyundai and Kia are pioneering a move to 100 percent digital cockpits, which has driven up the demand for interactive, gesture-controlled and ultra-high-definition (UHD) displays.

As 5G connectivity and smart car ecosystems continue to grow, automotive displays are growing smarter, customizable and integrated with real-time cloud information services.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Full Digital and Head-Up Display (HUD) occupy the largest market shares of the automotive display units market as the manufacturers have been focusing on improving the driver experience, enhancing vehicle safety and integration of smart connectivity.

They make use of visual elements and are critical for real time data delivery, minimizing driver distractions, and aiding advanced driver assistance systems (ADAS). With the automotive industry moving towards next gen in-vehicle infotainment and AR-enabled interface applications, the need for high-performance digital displays is on the rise.

Fully digital instrument clusters can be found in over 75% of new models, according to studies, a testament to the shift toward a software-driven automotive experience.

The high-resolution, ultra-slim display panels are widely adopted in the segment, including OLED panels, curved screens, and adaptive light control, which have further strengthened market demand owing to their high visibility and driver convenience.

This, coupled with the availability of AI-powered digital cockpit solutions with voice recognition, gesture controls and haptic feedback mechanisms has augmented the adoption of digital cockpit solutions with enhanced user interaction and an overall comfort on the road.

The technological advancements made in the development of multiple display configurations, such as split screen, augmented reality overlays, and seamless integration with smartphones, have further facilitated market growth, thus enabling an enhanced and interactive experience while driving.

On account of the environmental regulations for displays and the sustainability goals of several automakers, the adoption of sustainable display manufacturing practices incorporating panel crafting with low-power consumption, eco-friendly materials and recyclability of screen components has complemented market expansion.

The full digital display segment offers great benefits in terms of vehicle intelligence, customization, and next-gen ADAS, but high production costs, display durability issues, and the requirement for continuous software updates remain challenges.

Nonetheless, advances in AI-powered interface optimization, self-healing display technologies, and ultra-thin flexible screens are enhancing cost-effectiveness, performance reliability, and market scalability, paving the way for the global automotive industry's sustained growth potential for full digital displays.

HUD technology allows the driver to keep their eyes on the road instead of glancing down at the dashboard, thus eliminating distractions, maximizing situational awareness and improving focus on driving behaviour, making it one of the standard features of modern vehicles.

Adoption has been fueled by the growing demand for AR-enhanced heads-up displays (HUDs), especially in high-end and electric vehicles. More than half of luxury car makers install Heads-Up Display systems as either standard or optional equipment to enhance driving convenience and safety, according to studies.

Powered by these technological advancements, demand for next-generation HUD technology is further supported by the increasing integration of wider projection fields, adaptive brightness controls, and driver monitoring systems into commercial vehicles.

Enhanced adoption is also aided by the deployment of AI-enabled HUD interfaces with voice-centric navigation, live traffic information, and driver assistance features.

AS the demand for improved road safety continues to rise, AR-enabled HUD solutions integrating real-time object recognition, offering 3D mapping overlays, predictive driving alerts and more have revolutionized the market, driving growth.

The growing adoption of lightweight and energy-efficient Malaysian HUD components, which include transparent OLED technology, compact laser projection systems, and high-contrast display coatings, has bolstered the market growth by ensuring wider accessibility and reduced power consumption.

While HUD displays offer benefits like improved situational awareness, minimized distraction, and development of advanced driver assistance systems, the HUD display segment may be challenged by factors such as cost, lack of affordability in mid-range vehicles, and complexities in projection alignment.

Nonetheless, the growing prowess of myriad technological breakthroughs including but not limited to holographic HUD systems, adaptive eye-tracking projection solutions and cloud-based adherence to driver-assistance are steadily leading to improved affordability, system efficiency and user-adaptability among HUD displays in the global automotive industry, thus enabling an expanding range of solutions.

Over the past few years, the SUV and Luxury Car Segments have accounted for a considerable share of automotive display units due to the rising adoption of advanced digital interfaces, high-resolution displays, and immersive infotainment systems in vehicles. These types of vehicles generate demand for premium in-car technology, AI-driven display improvements, and next-gen driver assistance systems.

SUV Segment Drives Market Growth as Automakers Focus on Enhancing Digital Dashboard Capabilities

SUV manufacturers are using digital instrument clusters, large infotainment touchscreens and panoramic display configurations to drive engagement with the driver and occupant experience. The surging demand for electric SUVs, off-road vehicles, and urban crossovers has bolstered the need for high-resolution, all-embedded AI-based display units.

Adoption has been fuelled by rapidly increasing demand for smart connectivity features especially in family and adventure-oriented SUV models. According to research, more than 10% of the new SUVs have multi-display configurations, touch-responsive control panels, and smartphone integrated navigation screens.

Growth in SUV-specific infotainment solutions with split-screen functionality, rear-seat entertainment displays, and advanced voice-controlled associated interfaces to ensure greater passenger convenience and vehicle entertainment experiences have supported demand in the market.

While this technology has benefits for driver connectivity, infotainment capabilities, and digital dashboard functionality, its adoption in the SUV segment is hampered by factors such as production cost spikes, screen fragility, and various compatibility difficulties with the traditional vehicle architecture.

Nonetheless, the automotive display units in SUV category globally will further expand with the upcoming trends of 5G enabled devices in infotainment system of the vehicles, adaptive screen calibration and modular design of a digital dashboard system, which will make the production process more scan able, cost-effective and market-ready.

Automotive Display Units Market is growing quickly as the customers are demanding modern in-vehicle infotainment where they want Advanced Technology with Augmented Reality head-up displays (AR-HUD) and digital dashboards. Automakers are now incorporating larger, high-resolution OLED and AMOLED screens for enhanced user experience and connectivity, with AI-powered interfaces and gesture controls becoming the norm.

This will be even more visible in electric vehicles (EV) and autonomous driving innovations as companies work to design their display unit and focus around ADAS (advanced driver-assistance systems) integration and smart cockpit design.

Market Share Analysis by Key Players & Display Technology Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 18-22% |

| Visteon Corporation | 15-19% |

| Panasonic Automotive | 12-16% |

| Denso Corporation | 10-14% |

| Harman International (Samsung Electronics) | 8-12% |

| Others | 25-35% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Continental AG | Develops curved OLED displays, 3D instrument clusters, and AR head-up displays for enhanced driver experience. |

| Visteon Corporation | Specializes in fully digital cockpits, integrated touchscreen interfaces, and AI-powered infotainment systems. |

| Panasonic Automotive | Provides high-resolution automotive-grade displays with haptic feedback and energy-efficient screen technologies. |

| Denso Corporation | Focuses on multi-layered display technologies with enhanced visibility and improved driver assistance integrations. |

| Harman International (Samsung Electronics) | Offers premium automotive display solutions, including multi-screen infotainment and AI-driven UI systems. |

Key Market Insights

Continental AG (18-22%)

Continental dominates the market with its high-resolution curved OLED dashboards and AR-HUD systems, designed to improve driver engagement and safety.

Visteon Corporation (15-19%)

Visteon is a leader in AI-driven infotainment systems and fully digital instrument clusters, offering seamless connectivity with ADAS.

Panasonic Automotive (12-16%)

Panasonic specializes in touchscreen and gesture-controlled interfaces, with haptic feedback and low-power display solutions for energy efficiency.

Denso Corporation (10-14%)

Denso provides high-brightness, anti-glare displays optimized for autonomous driving and head-up display technology.

Harman International (Samsung Electronics) (8-12%)

Harman offers multi-screen infotainment units, voice-assisted AI controls, and advanced HUD displays for luxury and premium vehicles.

Other Key Players (25-35% Combined)

Several companies are contributing to next-generation automotive display innovations, focusing on OLED, mini-LED, and transparent displays for advanced mobility solutions. These include:

The overall market size for automotive display units market was USD 42.15 billion in 2025.

The automotive display units market is expected to reach USD 74.78 billion in 2035.

The growth of the automotive display units market will be driven by the rising integration of advanced infotainment and driver-assistance systems, supported by increasing consumer preference for digital dashboards, head-up displays, and touchscreen interfaces.

The top 5 countries which drives the development of automotive display units market are USA, European Union, Japan, South Korea and UK

SUV and Luxury Car to command significant share over the assessment period.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Automotive Connecting Rod Bearing Market -Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.