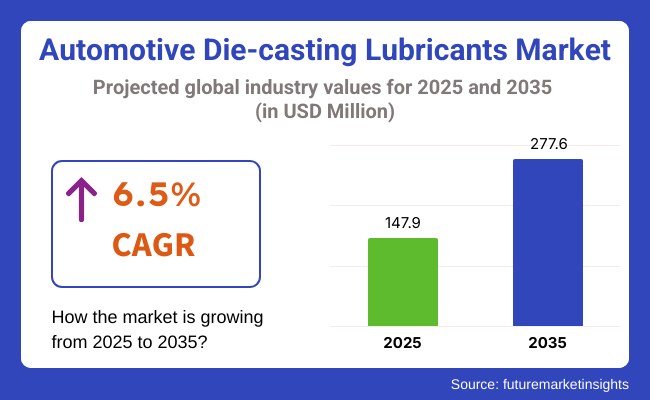

The global automotive die-casting lubricants market is expected to grow from USD 147.9 million in 2025 to USD 277.6 million by 2035, expanding at a steady CAGR of 6.5%. This growth is largely driven by increasing demand for lightweight automotive components, particularly aluminum and magnesium die-cast parts, which require specialized lubricants to enhance casting quality and minimize defects.

The rising adoption of electric vehicles (EVs), along with stricter emission regulations worldwide, is pushing automakers to incorporate more die-cast components, further boosting the need for advanced lubricants. Additionally, the expansion of automotive manufacturing in emerging economies and growing production of commercial vehicles contribute significantly to market growth.

Technological advancements are playing a key role in market development. Innovations such as eco-friendly, water-based lubricant formulations with improved thermal stability and real-time viscosity monitoring are helping manufacturers improve process efficiency and comply with environmental standards. Integration of Industry 4.0 technologies in die-casting operations enables better control and optimization, accelerating market adoption. Increased awareness of environmental impact and workplace safety is encouraging the development of low-emission, biodegradable lubricants.

The market is growing through ongoing investments in R&D and strong collaborations between lubricant manufacturers and automotive OEMs, driving steady development, product customization, and improved performance.

Regulatory frameworks globally emphasize environmental sustainability and worker safety in die-casting processes. Governments and industry bodies promote the use of lubricants with low volatile organic compound (VOC) emissions and biodegradable properties to reduce environmental footprint and occupational hazards.

Compliance with these standards is becoming increasingly important, prompting key players to focus on developing greener, safer lubricants without compromising performance. These regulatory pressures, combined with the growing demand for energy-efficient manufacturing processes, are driving innovation, competition, and long-term growth in the automotive die-casting lubricants market.

The global automotive die-casting lubricants market is segmented by lubricant type into die-casting lubricant and plunger lubricant; by formulation type into water-based, solvent-based, and other (bio-based and specialty lubricants); by die-casting material into aluminum, magnesium, zinc, and other (copper alloys, lead alloys, and tin alloys); and by region into North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, and Middle East & Africa.

The die-casting lubricant segment is the most lucrative in the automotive die-casting lubricants market, projected to grow at a 7.2% CAGR through 2035. Growth is fueled by the segment’s essential role in improving casting quality and reducing defects in high-volume production.

The higher CAGR is attributable to increasing demand for lightweight and complex die-cast components, particularly aluminum and magnesium parts, which require advanced lubricants with superior thermal stability and eco-friendly formulations.

The plunger lubricant segment, though essential for specific die-casting operations, represents a smaller portion of the market, and is expected to grow at a moderate pace aligned with the broader market trend.

The growth is supported by incremental adoption in emerging automotive manufacturing hubs and demand for improved casting efficiency. Overall, while both segments contribute to market expansion, the die-casting lubricant segment’s higher revenue base and superior growth trajectory position it as the primary growth engine through 2035.

| Lubricant Type Segment | CAGR (2025 to 2035) |

|---|---|

| Die-Casting Lubricant | 7.2% |

Water-Based Lubricants Emerge as Top Growth Driver

The water-based lubricant segment is projected to be the most lucrative within the automotive die-casting lubricants market. This segment is expected to grow at a robust CAGR of 7.5% from 2025 to 2035, outpacing the overall market CAGR of 6.5%.

The dominance of water-based lubricants stems from increasing environmental regulations and industry trends favoring eco-friendly, low-VOC formulations. The water-based segment's growth is further supported by continuous innovations in formulation technology, which improve lubricant lifespan and performance under high-temperature die-casting conditions.

The solvent-based lubricant segment holds a smaller market share, primarily driven by legacy applications where high lubricity is critical and it faces challenges due to environmental concerns and regulatory pressure. The other segment, comprising bio-based and specialty lubricants, is emerging and currently represents a niche market with growing interest driven by sustainability goals and specialized application needs.

| Type Segment | CAGR (2025 to 2035) |

|---|---|

| Water-based | 7.5% |

The aluminum segment is projected to be the most lucrative and expected to expand at a CAGR of 7.4% through 2035 by die-casting material within the automotive die-casting lubricants market. The superior performance of aluminum in die-casting stems from its optimal balance of strength, weight, and cost, making it the material of choice for lightweight vehicle parts amid tightening fuel efficiency and emission norms.

Consequently, the demand for high-performance aluminum-compatible lubricants has surged, particularly those that offer excellent thermal control and release properties during high-speed casting cycles. Magnesium remains relevant for ultra-lightweight applications and is often selected for parts where weight reduction is critical.

Zinc is commonly used in smaller components and decorative parts, although its application scope is narrower compared to the rapidly expanding demand for aluminum-intensive components. The other category such as copper, lead, and tin alloys continues to occupy a niche role, primarily in legacy or specialized applications with limited scalability.

| Die-Casting Material Segment | CAGR (2025 to 2035) |

|---|---|

| Aluminum | 7.4% |

Challenges

Environmental Regulations and Sustainability Concerns

Some of the restraints are related to stringent environmental regulations concerning lubricant formulation, which act as a challenge to the automotive die-casting lubricants market. Conventional lubricants usually consist of chemicals which cause air pollution and water contamination, thereby augmenting the pressure on manufacturers for eco-friendly alternatives. The high costs of biodegradable and water-based lubricants create an added financial burden on small and medium-sized die-casting companies.

Another big challenge is lubricant performance stability among various metal alloys, such as aluminum, magnesium, and zinc. Differentials in die temps and cycle times require precision-engineered lubricants to reap the benefits, and that ramps up production complexity.

Opportunities

Shift toward Lightweight Vehicles and Sustainable Lubricants

There are key opportunities for the Automotive Die-casting Lubricants Market owing to the increasing demand for lightweight vehicles and electric vehicles (EVs). With new automakers stepping up their race to use aluminum and magnesium alloys in their vehicles for light weighing and better fuel economy, the demand for high performance die-casting lubricants is likely to be on the rise.

Additionally, innovations in water-based and synthetic lubricants provide superior thermal stability, less residue accumulation, and extended die life. The report looks to provide 360-degree analysis of the global Lubrication Systems market, with market segmentation on the basis of product type, end user and region.

The United States automotive die-casting lubricants market is projected to grow at a steady pace, driven by the growth of electric vehicle (EV) industry army of lightweight automotive components and improvement within high-pressure die-casting (HPDC) technology.

With automakers working hard for not only fuel efficiency but also low emissions, the move to lightweight aluminum and magnesium alloys in vehicle manufacturing is expanding, leading to increasing demand for high-performance die-casting lubricants.

Die-casting lubricants that have low VOC, water-based, and bio-based characteristics, are also being adopted by manufacturers as a result of strict environmental guidelines made mandatory by the Environmental Protection Agency (EPA) and California Air Resources Board (CARB).

Automotive leaders such as Ford, General Motors and Tesla are also investing in next-gen die-casting processes, especially Giga Press technology, which needs cutting-edge and high-lubricity die-casting lubricants to guarantee smooth mold releases and long die lives.

Furthermore, the expansion of USA automotive parts manufacturing sector coupled with increasing investments in domestic die-casting plants is driving demand for high-performance lubricants that improve casting accuracy, minimize defects, and increase tool life.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

With increasing EV production, rising adoption of lightweight materials, and stringent sustainability regulations, the United Kingdom automotive die-casting lubricants market is growing. With the UK government striving towards zero-emission vehicle targets set for 2035, automotive manufacturers are gaining traction with aluminum and magnesium die-cast as a means to achieve weight savings in order to maximise energy efficiency.

As big auto and suppliers invest in die-casting technologies, the demand for high-performance lubricants that assist mold release, decrease porosity and enhance die life is on the rise. In addition, tightened environment laws in the UK’s REACH framework are pressuring developers to move to water-based, low-VOC lubricants that are in compliance with sustainability regulations.

It is likely that the trend in localized auto parts production and the growing partnerships between lubricant manufacturers and die-casting companies will foster innovation in advanced lubricant formulation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.4% |

Europe is leading the automotive die-casting lubricants market, supported by policies under EU Green Deal, broader adoption of electric and hybrid vehicles, and development of advanced manufacturing technologies. Countries that produce large numbers of vehicles, such as Germany, France and Italy, are rushing towards lightweight vehicle designs, thereby boosting demand for magnesium and aluminum die-casting lubricants

The European Union's strict carbon emission targets and emphasis on circular economy are driving the transition from petroleum-based lubricants to bio-based and water-based alternatives, ensuring environmentally friendly die-casting operations. The expansion of automated die-casting production lines are creating opportunities for self-lubricating coatings emerging and high-performance synthetic die-casting lubricants increasing efficiency and durability.

Major automakers - including Volkswagen, BMW and Stellantis - are surrounded by robust government support for EV production and investment in high-performance die-casting lubricants is expected to continue.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.5% |

The Japan automotive die-casting lubricants market is thriving due to technology advancements in high-pressure die-casting, increased demand for fuel-efficient vehicles, and growing investment in EV production. Major Japanese automakers, including Toyota, Honda and Nissan, are pushing magnesium and aluminum die-casting technologies hard to improve fuel economy and end-of-life sustainability.

Given Japan’s stringent precision manufacturing standards, the need for high-performance die-casting lubricants that provide optimal mold release, low friction, and excellent thermal resistance is pronounced. Moreover, the country's emphasis on eco-friendly and sustainable manufacturing is encouraging the use of water-based and biodegradable die-casting lubricants.

It also creates further demand for smart lubricants that utilize self-monitoring features by making die-casting operations smarter and reducing operational downtime.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.7% |

The automotive die-casting lubricants market in South Korea is on a rapid growth path, fuelled by the country's booming EV and battery manufacturing industry, a strong focus on green technologies, and expansion of local auto parts production. And, as auto manufacturers like Hyundai, Kia and LG Energy Solution turn to die-cast components to reduce weight in EV production, that's driving demand for advanced-performance die-casting lubricants.

The Korean government is also driving this transition towards low-VOC, bio-based, and water-soluble die-casting lubricants in line with its goal for zero net emissions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

Henkel AG & Co. KGaA (16-20%)

Henkel remains a dominant force in the automotive die-casting lubricants market, offering environmentally sustainable lubricants that enhance casting efficiency while reducing thermal stress on molds.

Chem-Trend L.P. (14-18%)

Chem-Trend continues to lead in innovative die-release technologies, providing lubricants that minimize defects, improve mold longevity, and optimize casting consistency.

Quaker Houghton (12-16%)

Quaker Houghton specializes in advanced synthetic and semi-synthetic formulations, helping manufacturers achieve high-quality die-cast components with reduced scrap rates.

FUCHS Lubricants (10-14%)

FUCHS offers specialty die-casting lubricants designed for extreme operating conditions, ensuring optimal metal adhesion and mold release in high-pressure applications.

Moresco Corporation (7-11%)

Moresco focuses on die-casting lubricants that enhance productivity and provide excellent lubrication properties, reducing energy consumption in automotive casting processes.

Other Key Players (30-40% Combined)

Several regional and global companies contribute to the growing automotive die-casting lubricants market, emphasizing sustainability, automation, and precision engineering. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Lubricant Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Lubricant Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Die-Casting Material, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Die-Casting Material, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 21: Global Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 45: North America Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Lubricant Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Die-Casting Material, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Lubricant Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Lubricant Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Lubricant Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Lubricant Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Die-Casting Material, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Die-Casting Material, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Die-Casting Material, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Die-Casting Material, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Lubricant Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Die-Casting Material, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for automotive die-casting lubricants market was USD 147.9 million in 2025.

The Automotive die-casting lubricants market is expected to reach USD 277.6 million in 2035.

The expansion of the automotive die-casting lubricants market will be driven by the growing emphasis on precision manufacturing, supported by the increasing production of lightweight vehicle components.

The top 5 countries which drives the development of automotive die-casting lubricants market are USA, European Union, Japan, South Korea and UK

ADAS & Safety Engineering Services to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.