Increased adoption of the electric and hybrid vehicles (EVs and HEVs), advances in vehicle electrification, as well as complexity of the electronic systems being used in vehicles is contributing to the demand for the global automotive DC-DC converter market, especially in the upcoming years. DC-DC converters regulate the voltage levels by converting the electrical power from one level of DC voltage to another.

The Rising Demand for High-Efficiency, Space-Saving, and Reliable DC-DC Converters. On one hand, adoption of advanced driver assistance systems (ADAS) and infotainment is driving demand for more ECUs per vehicle, on the other hand, as vehicles include more electronic control units (ECUs), the ongoing penetration of efficient, compact, and reliable DC-DC converters is on the rise.

Furthermore, the shift to 48V mild hybrid systems and higher-voltage battery packs deployed in both EVs and HEVs are also expected to fuel the growth of the market. These converters play an important role in electric powertrain energy management, battery extension, and overall vehicle performance.

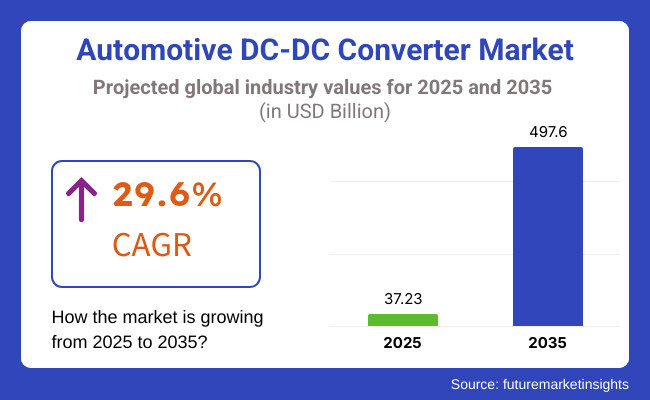

With electrification trending across several global markets, the automotive DC-DC converter market is poised for rapid innovation and steady growth well into 2035. USD 37.23 Billion in 2025, and estimates of the automotive DC-DC converter market is predicted to be due around USD 497.6 Billion by 2035, which equates to a CAGR of 29.6 %.

The robust growth trajectory emphasizes the increasing adoption of electric mobility, thrusting the penetration of electronic components in next-generation vehicles and leveraging ongoing improvements in the DC-DC converter technologies.

Explore FMI!

Book a free demo

North America is a key market for automotive DC-DC converters, owing to the region's focus on EV adoption, established automotive manufacturers, and development of vehicle electronics. Notably, the United States has taken the lead in the development of high-performance electric and hybrid vehicles, which rely heavily on reliable power conversion donors.

Furthermore, well-established automotive industry and government incentives and regulatory measures to boost the adoption of electric vehicles (EVs) are likely to create a steady demand for DC-DC converters in North America.

Europe is one of the prominent markets when it comes to automotive DC-DC converters, attributed to stringent environmental regulations, aggressive carbon reduction goals, and increasing electrification components. Germany, the UK, and France are examples of countries making a shift towards electric mobility that is creating demand for sophisticated power conversion solutions.

Europe, with its strong automotive manufacturing base, an established supply chain, and investments in EV infrastructure and battery technology, is set to become a key growth region for DC-DC converters. In addition, the growing application of 48V mild hybrid systems in European vehicles is increasing the demand for these components.

The automotive DC-DC converter market will flourish in the Asia-Pacific while being the largest regional market and fastest-growing market for automotive DC-DC converters, where the automotive applications segment also account for the largest market shares on the back of rapid urbanization in the region in addition to increasing EV production and supporting government policies.

The world’s largest EV market, China, is integral for driving demand, buoyed by a large manufacturing base and a major thrust into clean energy vehicles. The Japanese and South Korean automotive giants are also benefitting the global market demand for DC-DC converters with the manufacturing of compact and efficient solutions.

The overlaying trends of a growing middle class, increasing vehicle ownership and a commitment to electrification cements the region's position as a global automotive DC-DC converter leader.

Challenges

Increasing Power Demand, Thermal Management Issues, and High Manufacturing Costs

There are a number of challenges that automotive dc-dc converter market faces, largely stemming from the increasing power requirements of vehicles today, especially electric (EV) and hybrid vehicles (HEV).

Although DC-DC converters are necessary to efficiently down step energy from high-voltage batteries to drive low-voltage systems in vehicles, managing thermal conditions is crucial due to increased heat generation with high power loads.

Profit margins are also affected due to increasing material costs across high-efficiency semiconductors, MOSFETs, and other power electronics. Additionally, the market has design complexities related to producing compact, lightweight, and energy-efficient converters to satisfy stringent automotive safety regulations.

Opportunities

Growth in EV Power Electronics, Wide-Bandgap Semiconductors, and AI-Optimized Power Management

Despite these challenges, the automotive dc-dc converter market is expanding due to the significant increase in EV sales and the advancements in power electronics and smart energy management technologies. Wide-bandgap semiconductors (SiC, GaN) are enabling increased converter efficiency and reduced losses.

Moreover, the implementation of AI-based power optimization systems facilitates real-time voltage regulation, thermal management, and predictive maintenance, thereby improving converter efficiency and energy utilization in vehicles.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with automotive power safety standards and efficiency regulations. |

| Semiconductor Advancements | Use of silicon-based power transistors and standard MOSFETs. |

| Industry Adoption | Increasing DC-DC converter integration in hybrid and electric vehicles (HEVs, EVs). |

| Supply Chain and Sourcing | Dependence on traditional semiconductor suppliers with limited recycling initiatives. |

| Market Competition | Dominated by automotive component manufacturers and power electronics firms. |

| Market Growth Drivers | Growth fueled by EV expansion, increasing onboard electronics, and advanced infotainment systems. |

| Sustainability and Environmental Impact | Early-stage efforts to improve energy efficiency and reduce heat dissipation losses. |

| Integration of Smart Technologies | Basic voltage regulation and thermal sensors for power management. |

| Advancements in Power Management | Development of high-efficiency, compact converters for next-gen vehicle architectures. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on energy efficiency, thermal safety, and environmental impact. |

| Semiconductor Advancements | Shift toward wide-bandgap semiconductors (SiC, GaN) for higher efficiency and lower heat dissipation. |

| Industry Adoption | Widespread use of high-power converters in autonomous vehicles, energy harvesting systems, and smart grids. |

| Supply Chain and Sourcing | Transition to sustainable semiconductor manufacturing and localized production to reduce supply chain risks. |

| Market Competition | Entry of AI-driven energy management companies and next-gen semiconductor startups. |

| Market Growth Drivers | Accelerated by smart energy optimization, wireless power transfer systems, and predictive power management. |

| Sustainability and Environmental Impact | Large-scale adoption of low-energy-loss semiconductors, AI-driven cooling systems, and recyclable components. |

| Integration of Smart Technologies | Expansion into AI-powered power conversion, real-time energy load balancing, and self-healing power circuits. |

| Advancements in Power Management | Shift toward autonomous energy optimization, bidirectional power converters, and ultra-fast charging compatibility. |

The USA market of automotive dc-dc converter is a burgeoning market due to the increasing demand for electric vehicles (EV) and development of power electronics. The surge in government incentives for EV purchases and stringent emissions regulations are compelling automakers to adopt efficient power conversion technologies.

The aggressive development of the EV market is also aided by the presence of major EV manufacturers and strong R&D focus.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 29.8% |

The automotive dc-dc converter market in the United Kingdom is rapidly diversifying owing to its push for fostering electric mobility. The nation's promising government plans, like banning petrol and diesel cars within a decade, are greatly accelerating requirements for highly capable yet energy-savvy DC-DC converters to regulate vitality in battery-powered cars and plug-in hybrid electric automobiles.

While some forecasters predict a smooth transition to zero-emission transportation over the next ten years, developing the necessary charging infrastructure and affordable EVs available to all remains a colossal challenge that will require coordinated efforts between public and private sectors

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 29.4% |

The automotive dc-dc converter market in European Union is doing great and is being driven by ambitious emission targets by European Commission and increasing penetration of electric and hybrid vehicles. Market demand for advanced DC-DC converters is further strengthened by leading automakers in Germany, France and Sweden investing in high-efficiency power management solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 29.6% |

Japan automotive DC-DC converter market is anticipated to grow significantly as it replicates its pioneering position in hybrid and electric vehicle technology. To this end, both major automakers and battery manufacturers are making significant investments in next-generation power conversion systems to improve vehicle efficiency and minimize energy losses.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 29.5% |

In South Korea, the automotive DC-DC converter market is experiencing significant growth, fueled by the presence of EV manufacturers and battery technology innovators. The initiatives taken by the government in favor of foreign investments in electric mobility and the emergence of smart vehicle infrastructure are some other factors driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 29.7% |

The Automotive DC-DC Converter Market is witnessing rapid expansion as electric vehicle (EV) adoption accelerates globally. DC-DC converters play a crucial role in EV power systems by converting high-voltage battery output to lower voltages for auxiliary components such as infotainment systems, lighting, and control modules.

The market is segmented by Vehicle Type (NEV, BEV, HEV, PHEV, FCEV) and Voltage (3V-14V, 15V-36V, 36V-75V, >75V).

Governments and auto manufacturers have prioritized zero-emission mobility, spurring the booming Battery Electric Vehicle (BEV) economy which continues to dominate the automotive DC-DC converter market share.

BEVs leverage a DC-DC converter to step down electrical potential from sizable lithium-ion battery packs, normally in the 300-800 volt range, to a lower voltage suitable for other vehicular systems like power steering, braking and infotainment modules.

As fast-charging infrastructure proliferates and battery technology progresses, BEV adoption is mushrooming exponentially. Automakers obsess over optimized DC-DC converters with an overarching goal of maximizing energy efficiency per kilometer traveled, a primary driver anticipated to propel growth in the EV DC-DC converter industry.

Alternative powertrains are undoubtedly the future, though mass rollout faces challenges - DC-DC converters must balance performance and affordability as the market motors ahead.

Plug-in Hybrid Vehicles (PHEVs) are another strong-growth segment that sits between ICE vehicles and full electric vehicles. The PHEV type features dual voltage conversion systems for managing power distribution across internal combustion engines, battery packs, and auxiliary systems.

Government incentives designed to nudge consumers toward hybrids as a bridge to total electrification hand PHEVs the second strongest sales of the bunch, especially in areas where charging stations are still being built out.

As the majority of passenger Electric Vehicles (EVs), Passenger Hybrid Electric Vehicle (PHEV), and Hybrid vehicles operate within the voltage range of 15V-36V, thus 15V-36V voltage segment is said to hold a sizable share of the Automotive DC-DC Converter market.

These converters provide stable low-voltage energy for the auxiliary systems operating at 12V that power lighting, HVAC, infotainment and safety elements.

The demand for 15V-36V DC-DC converters is also expected to rise, driven by their ability to enhance the efficiency of ADAS and smart cockpit tech, and they have emerged as a key growth driver in this segment.

High performance electric vehicle (EV) and commercial electric truck market are rapidly transitioning to higher voltage battery architectures (400V-800V) resulting in boom in demand for 36V-75V DC-DC converters. These converters enable advanced energy distribution, increased efficiency, and minimized heat losses of the contemporary electric drivetrains.

Automakers are still optimizing high-voltage power architectures, so 36V-75V converters increasingly will be important as next-generation EV platforms come onto the market.

The automotive DC-DC converter market, the increasing penetration of electric vehicles (EVs), hybrid electric vehicles (HEVs), along with advancements in energy efficiency are primarily driving the growth of the automotive DC-DC converter industry.

Intuitive power management based on AI technology, ultra-low-standby smooth voltage conversion technologies, and compact high-density designs are being executed in the development of new solutions such as vehicle electrification, battery life optimization, and improved energy conversion functionality.

The landscape is represented by industry-leading automotive component manufacturers, power electronics companies, and EV system integrators that are leveraging cutting-edge technologies such as high-power DC-DC converters, AI-enabled thermal management, and fast-charging capabilities.

Market Share Analysis by Key Players & DC-DC Converter Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Robert Bosch GmbH | 18-22% |

| Continental AG | 12-16% |

| Denso Corporation | 10-14% |

| Delphi Technologies (BorgWarner Inc.) | 8-12% |

| Toyota Industries Corporation | 5-9% |

| Other Automotive Power Electronics Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Robert Bosch GmbH | Develops high-efficiency DC-DC converters, AI-driven power optimization, and next-generation EV energy management solutions. |

| Continental AG | Specializes in DC-DC converters for hybrid and electric vehicles, AI-powered thermal management, and fast-charging integration. |

| Denso Corporation | Provides compact and lightweight DC-DC converter solutions, high-voltage power management, and AI-assisted power distribution analytics. |

| Delphi Technologies (BorgWarner Inc.) | Focuses on advanced 48V mild hybrid DC-DC converters, AI-driven smart powertrain integration, and extended battery life solutions. |

| Toyota Industries Corporation | Offers DC-DC converters for hybrid vehicles, AI-powered power control systems, and high-efficiency voltage regulation. |

Key Market Insights

Robert Bosch GmbH (18-22%)

As the world market leader in this area, Bosch also provides high-efficiency voltage regulation, energy management based on artificial intelligence, and innovative power conversion solutions in the automotive sector.

Continental AG (12-16%)

Continental deals in DC-DC power electronics to optimize the performance of these batteries with the use of AI along with the smart distribution of electric power.

Denso Corporation (10-14%)

Denso supplies small type of DC-DC converter technology for optimized powertrain electrification and AI analytic of electric energy.

Delphi Technologies (BorgWarner Inc.) (8-12%)

Promoting high-performance DC-DC power conversion with AI-powered Hybrid Power Management, 48V Mild Hybrid

Toyota Industries Corporation (5-9%)

Toyota develops high-efficiency DC-DC converters for hybrid electric vehicles, ensuring smart energy conversion and AI-powered powertrain optimization.

Next-gen DC-DC converter technology, AI-based efficiency gains, and high-power conversion solutions are just a few areas being driven forward by a multitude of power electronics companies (including automotive component makers) and energy conversion experts. These include:

The overall market size for automotive dc-dc converter market was USD 37.23 Billion in 2025.

Automotive dc-dc converter market is expected to reach USD 497.6 Billion in 2035.

The demand for automotive dc-dc converters is expected to rise due to the increasing adoption of electric and hybrid vehicles, the growing need for efficient power management systems, and advancements in automotive electronics. Additionally, stringent emission regulations, rising investments in EV charging infrastructure, and technological innovations in high-efficiency and compact converter designs are driving market growth.

The top 5 countries which drives the development of automotive dc-dc converter market are USA, UK, Europe Union, Japan and South Korea.

BEVs and 15V-36V Voltage Range to command significant share over the assessment period.

Automotive Fuel Return Line Market Insights - Trends, Demand & Growth 2025 to 2035

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive Glass Cleaner Market Growth - Demand, Trends & Forecast 2025 to 2035

Automotive Fuel Gauge Sending Unit Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Automotive Fuel Gauge Market: Trends, Technologies, and Growth Outlook

Automotive Disc Couplings Market Growth - Demand, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.