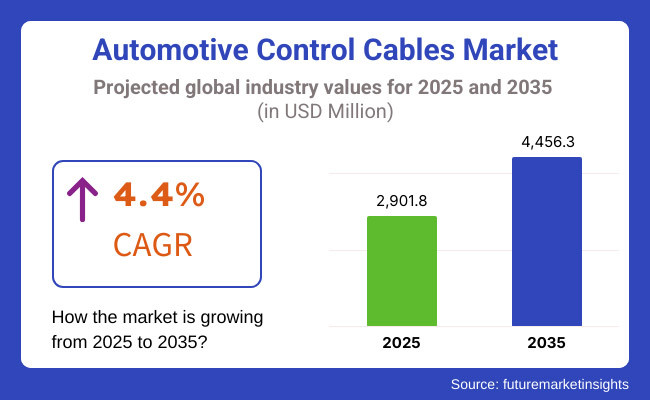

The global automotive control cables market is expected to witness steady growth between 2025 and 2035, driven by increasing vehicle production, advancements in transmission and braking technologies, and growing demand for enhanced vehicle control systems. The market is projected to reach USD 2,901.8 million in 2025 and expand to USD 4,456.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.4% during the forecast period.

Automotive control cables, a lifeline that connects your foot to the car's mechanics, was not manufacturing so long ago. Increasing evictions of electric vehicles (EVs), increasing safety regulations, and increasing deployment of lightweight high-performance cables are driving the growth of the market.

Moreover, technological development in cable manufacturing materials, increasing adoption of automated and semi-automated transmission systems, and rising need for high-durability cables in commercial and off-the-road vehicles are few factors will be influencing the market. With vehicle manufacturers further focusing on improving fuel economy, air conditioning, and driving comfort, the demand for advanced automotive control cables is anticipated to grow phenomenally.

Major factors driving the market growth are growth of automotive industry, increasing adoption of drive-by-wire technology and rising demand for better transmission control. Use of corrosion-resistant, heat-resistant and high-flexibility becomes alternative materials for products will help enhance the performance and life of the product.

Explore FMI!

Book a free demo

North America is also a prominent market for automotive control cables owing to robust automotive production, surging demand for electric vehicles (EVs) and growing adoption of ADAS technologies. Automotive manufacturing and advancements in control cable durability and efficiency are also seeing increasing investments in the United States and Canada.

The USA Department of Transportation (DOT) safety regulations along with the changing consumer preference in favour of smooth-driving, high-performance vehicles are anticipated to push the automakers to develop control cable technologies such as electronic throttle control systems (ETCS) in the future. Moreover, the increasing commercial and off-road vehicle fleet in North America is boosting the demand for high-durability, weather-resistant cables for heavy-duty applications.

Growth of the control cables market due to hybrid and fully electric vehicle (EV) penetration as hybrid and fully electric vehicles (EVs) are becoming more and more recap to the market, growth of demand for low-friction and lightweight control cables can also be expected over the coming years.

The European automotive control cables market is expanding due to stringent safety and emission regulations, increasing electrification in vehicles, and rising demand for high-performance automotive components. Countries such as Germany, France, and the UK are leading from front in control cable innovations for electric and autonomous vehicles.

EU sustainability initiatives and the demand for lightweight vehicle components are driving the development of new cable materials with high strength and corrosion resistance. Furthermore, increasing demand for high-performance sports cars and luxury vehicles is further bolstering the adoption of precision-engineered control cables, over high-end automotive applications.

Europe’s strong focus on vehicle automation and drive-by-wire systems is also spurring demand for electronic control cables and flexible cable solutions that help make vehicles more efficient and safe.

The Asia-Pacific automotive control cables market is expected to be a prominent growth market during the assessment period, largely due to rising vehicle production, high growth of automotive aftermarket, and soaring investments towards electric mobility. Expanded incorporation of gather, and brake control cables in passenger and business vehicles which will be made in nations like Jiangsu, Realize, Japan and S Korea is the chief reason for positive growth of the market.

High performance control cables demand is particularly accelerating in China where booming automotive sector and a swift migration to electric vehicles are significant booster factors for demand. At the same time, India’s growing automotive sector and renewed focus on localized manufacturing are fueling market growth.

The global automotive control cable market is being developed with strong entries by Japan and South Korea in the way of lightweight, heat resistance, and high durability automotive cables. Additionally, the growing popularity of other electric two-wheelers and hybrid cars across the region is also contributing towards the increasing inferential demand for compact and efficient control cable solutions.

The Middle East & Africa (MEA) automotive control cables market is observing gradual growth, owing to the rising sales of vehicles, farm-up investments toward automotive manufacturing, and storage demand for heavy duty commercial vehicles. Saudi Arabia, UAE, and South Africa are some of the nation’s investing in automotive infrastructure and off-road vehicle advancements, driving up demand for high-strength, durable control cables.

Moreover, the increasing number of public transport, taxies, and logistics vehicles is propelling demand for effective transmission and brake control cables. Increasing automotive component manufacturing hubs in the MEA region with countries such as Egypt and Morocco expected to drive vehicle demand and, in turn, regional market growth.

Durability and Performance Limitations in Harsh Environments

One of the major challenges in the automotive control cables market is performance degradation in extreme weather conditions and high-stress environments. A durability is a major concern for manufacturers as control cables are subjected to temperature fluctuations, moisture exposure and mechanical wear.

Squeezed joints and corrosion resistance are critical for high-performance vehicles, off-road trucks, and heavy-duty construction equipment that require additional flexibility and durability from cables. One of the main challenges that manufacturers face, especially in price-sensitive markets, is the cost incurred in the development of premium-grade control cables.

Industry stakeholders are effectively investing in next-gen coating technologies, novel material formulations, and very flexible cable designs to secure long-term reliability in rugged operating environments.

Increasing Shift Toward Drive-by-Wire and Electronic Control Systems

These advancements in technology, such as electronic throttle control, brake-by-wire, and shift-by-wire systems are further reducing customers' dependence on mechanical control cables which may be a threat to traditional cable manufacturers. With moving toward more fully electronic systems for vehicle control, the need for mechanical push-pull cables may shrink in some applications.

Control cables continue to be an integral element in hybrid and semi-automated vehicles, providing safety redundancy for operations handled mechanically. To maintain up with this trend, the manufacturers are working on hybrid cable solution that incorporate both electronic as well as mechanical control systems.

Advancements in Lightweight and High-Durability Cable Materials

The demand for lightweight, high-strength control cables is creating new opportunities for market players. The computer engineering sector has been driven by innovations in fiber-reinforced polymers, high-performance alloys, and low-friction coatings that are enabling the manufacture of ultra-durable cables with improved performance specifications.

Moreover, the polymer backbone technology and the incorporation of self-lubricating cable coatings and polymer/nano-material reinforcements is predicted to minimize wear, thus extending control cable lifetimes for high-performance hidden control cable applications and commercial vehicle applications.

Growing Adoption in Electric and Hybrid Vehicles

Automotive control cables are being driven by the increasing demand for electric and hybrid vehicles (EVs and HEVs). Although electric vehicles (EVs) depend heavily on electronic control systems, they still need advanced control cables for some mechanical functions like braking, steering and parking mechanisms.

As automakers are building more safety and redundancy features inside their EVs, hybrid mechanical-electronic cable systems are finding their way into production. The demand for lightweight energy efficient parts in EVs is already driving ever further high novel innovation in low-friction cable materials, such as rigid/flexible conductor compounds. As governments around the world create a push towards electric vehicles, vehicle control cables for next-generation mobility solutions will likely see an increasingly higher demand in the forecast period.

Between 2020 and 2024, the growth of the automotive control cables market can also be attributed to various factors such as increasing vehicle production, surging demand for electric and hybrid vehicles (EVs), and improvements in cable durability and lightweight materials. These automotive control cables are vital for throttle, clutch, gear shift, parking brake, and accelerator applications and therefore remained significant in passenger and commercial vehicles.

Looking ahead to 2025 to 2035, the automotive control cables market is likely to evolve with emergence of AI-integrated smart cables, self-lubricating materials and hybrid of mechanical-electronic control systems. The growing transition to electrification, AI-enabled vehicle diagnostics, and autonomous driving will alter control cable applications. New carbon-fiber cables, AI-based wear detection, and blockchain-enabled traceability systems will reimagine efficiency and safety in contemporary automotive control systems.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Demand from ICE & EV Segments | Growing demand from internal combustion engine (ICE) vehicles, with rise in use of hybrid and EVs. |

| Shift Toward Smart & Electronic Control Systems | Introduction of electronic throttle control (ETC) and shift-by-wire technologies helped to decrease reliance on traditional cables. |

| Material Innovations for Durability & Efficiency | Stainless steel, polymer-coated, and high flex synthetics are used for longer service life. |

| Automotive Electrification & Cable Efficiency | Lightweight cables for EVs and hybrids, replacing heavier conventional cables. |

| Autonomous & Connected Vehicle Impact | Semi-autonomous vehicles remained dependent on hybrid mechanical and electronic control systems. |

| Growth in Two-Wheeler & Commercial Vehicle Segments | Strong demand for control cables continued in motorcycles, scooters, and heavy-duty commercial vehicles. |

| Market Growth Drivers | Driven by surge in vehicle sales, rising demand of fuel-efficient components, and regulatory safety improvements. |

| Market Shift | 2025 to 2035 |

|---|---|

| Demand from ICE & EV Segments | Increased adoption of lightweight, high-strength cables in electric vehicles, autonomous driving systems and fuel cell-powered vehicles. |

| Shift Toward Smart & Electronic Control Systems | AI-controlled hybrid cable-electronic systems with real-time diagnostics and autonomous vehicle integration. |

| Material Innovations for Durability & Efficiency | Self-lubricating, nano-polymer cables reinforced with carbon fiber and coated in graphene for high-strength, low-weight applications. |

| Automotive Electrification & Cable Efficiency | Cable wear detection monitored by AI, smart cable routing optimization, recyclable eco-friendly cable materials. |

| Autonomous & Connected Vehicle Impact | Expansion of AI-powered smart control cables with automatic wear detection, digital twin-based diagnostics, and sensor-embedded designs. |

| Growth in Two-Wheeler & Commercial Vehicle Segments | Smart clutch systems powered by AI-integrated cables that work in tandem with load-sensitive braking and gear shifting for both commercial fleets and electric two wheelers. |

| Market Growth Drivers | Growing adoption of AI-enabled smart/connected automotive-embedded control systems along with advancements in lightweight materials and the increasing shift toward intelligent vehicle architectures. |

The United States automotive control cable market is experiencing steady growth, driven by rising vehicle production, increased demand for fuel-efficient vehicles, and the expansion of electric and hybrid vehicle (EV) manufacturing. driving demand for high-performance control cables in throttle, transmission, clutch, and brake applications is the increasing utilization of advanced automotive safety systems.

Furthermore, government rulings encouraging the passenger safety and emissions reductions are pushing the trend towards light weight and strong automobile control cables. The need for high precision control cables, to develop a better and last longer vehicle is increasing with the advancement of automated and semi-automated vehicles.

The growing sector of e-commerce-driven logistics has also increased demand for commercial vehicles and, in turn, aided market expansion for heavy-duty truck and fleet vehicle applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

The automotive control cable market in the United Kingdom is growing at a moderate pace due to the factors such as increasing electric vehicle (EV) adoption, lightweight vehicle technology developments, and government initiatives supporting low-emission vehicles.

As a result of the UK’s plans to ban polluting internal combustion engine (ICE) vehicles by 2035, demand for high-performance control cables in electric vehicles (EVs) and hybrids is growing. Moreover, the development of new cable materials can use technology to improve flexibility, allowing control cables to perform better in next-generation vehicles. Additionally, the expanding automotive aftermarket industry is further driving the demand for control cable replacements in both passenger and commercial vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The European Union automotive control cable market is witnessing steady growth, fuelled by increasing EV production, stringent emission regulations, and advancements in smart mobility solutions. Higher investments in electric mobility driving demand for specialized control cables in electric vehicles and autonomous vehicles in line with EU’s strong demand to reach climate neutrality by 2050.

Furthermore, growing demand for high-precision and flexible control cables with reduced weight are anticipated to foster the growth of automated and connected vehicles. For applications in high-performance and lightweight vehicles, Germany, France, and Italy hold leading positions in automotive control cable innovations.

Electric commercial vehicles and logistics fleets in Europe’s urban centers are also driving demand for rugged, long-life control cables to keep fleets going and replacements in service.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

Japan automotive control cable market is growing moderately owing to the presence of advanced hybrid & electric vehicle technology, high automation of vehicles components and Japan's dominance in precision automotive engineering.

While Japanese automotive companies have been preparing next generation mobility solutions, the availability of durable, lightweight, and high-temperature resistant control cables is increasing. The strong production of hybrid vehicles in the country is further providing a strength to the specialized automotive control cable market.

Furthermore, investments in autonomous driving technologies are influencing manufacturers to advance in high-precision electronic and mechanical control cables supplied as steer-by-wire and drive-by-wire systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The South Korea automotive control cable market is driven by the rise in electric vehicle (EV) production, a boom in high-tech automotive manufacturing, and investments in connected vehicle technologies.

As the global leader in battery-electric vehicle (BEV) production, South Korea has a growing need for specialized control cables that are responsible for electronics in EV propulsion, braking and charging systems. In fact, the development of smart control cables with integrated sensors for real-time vehicle diagnostics is already underway with the advent of AI powered driving systems.

The growth of South Korea’s luxury and performance vehicle segment, led by brands like Genesis and Hyundai’s N-performance division, is also boosting demand for high-precision, durable control cables.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

Transmission cables dominate the automotive control cable market, owing to their critical role in powertrain operations, ensuring smooth gear shifting and optimal vehicle performance. They are employed as part of the bodywork and in manual and automatic transmissions to control the engagement of gears in passenger vehicles and commercial automobiles.

Transmission cables can be operated in high-temperature engine environments, making it significantly more demanding in terms of durability factors, flexibility and heat resistance compared to brake or throttle cables. The increasing adoption of modern electric and hybrid vehicles is attracting manufacturers' attention toward weaving lightweight and high strength transmission cables that enhance energy efficiency and transmission response time.

On the other hand, the use of advanced cable materials, such as strong polymers and corrosion-resistant coatings, is improving the lifetime and dependability of transmission cables in current cars.

Rising vehicle safety standards, growing demand for SUV and commercial vehicles and evolving braking technology are important trainers for the global brake cables market. These cables are important in activating parking brakes (handbrakes) and emergency braking systems to provide vehicle stability and prevent accidents.

As governments around the world aggressively push for automated as well as electronic braking systems, manufacturers are slowly introducing enhanced brake cables consisting of high tensile strength and low friction materials, improving the overall efficiency of braking as well as safety of driver.

Brake cables, which are subjected to high tension and prolonged wear, are therefore a critical component of both passenger and high commercial vehicles when compared to clutch or throttle cables. The rise of the electric vehicle (EV) segment is also impacting the demand for optimized brake cables, as EV manufacturers are developing lightweight and high-performance braking solutions for enhanced energy efficiency.

SUVs constitute one of the rapidly expanding segments in the automotive control cable market, as consumers prefer larger and sturdier vehicles, suitable for urban and off-roading. Designed to accommodate tough driving conditions, these vehicles must employ high-quality control cables for the transmission, braking, throttle, and trunk operations for smooth handling and exceptional durability.

Control cables in SUVs must be more heavy-duty and corrosion-resistant than in compact and mid-size cars, as they must endure higher mechanical loads and more severe environmental conditions. Owing to the global inclination towards SUVs and crossover models, automobile manufacturers are focusing on advanced coating technologies, lightweight materials, and improved flexibility in next-generation control cables to improve vehicle performance and longevity.

The growing demand for high-durability control cables in commercial vehicles, such as light and heavy duty trucks, buses, and fleet vehicles, is driving the growth of the control cable market, so commercial vehicles operate under extremely high mileage and heavy load conditions. Control cables in commercial vehicles are required to have superior reliability, high tensile strength and resistance to mechanical fatigue, to keep maintenance cost low and a long operational life.

Brake, clutch, and transmission cables are vitally important in heavy commercial vehicles, where high-performance control cable solutions are required for frequent gear shifts, high-pressure braking, and continuous engine operations. In addition, smart and electronically controlled control cables are being developed in response to the adoption of ADAS (advanced driver-assistance systems) and automation in commercial vehicles, enhancing fleet operation and vehicle safety.

Automotive control cables are used worldwide and their market is booming owing to the growing production of vehicles, establishing electronic and mechanical control systems, and improving vehicle safety and performance technologies. Automotive control cables are vital components for efficient transmission of force and motion amongst various components of vehicles, such as throttle, clutch, gear shift, brake and accelerator systems in passenger cars, commercial vehicles and two wheelers.

Technological advancement in lightweight and high strength cable materials, rising demand for electric vehicles (EVs) and increased focus on durability and corrosion resistance are the some of the factors which are driving the growth of Global Automotive Cable Market. The top manufacturers are concentrating on the development of high performance, wear-resistant, and environment-friendly cables to comply with strict automotive equations and changing consumer demands.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tata AutoComp Systems Ltd. | 10-12% |

| Suprajit Engineering Ltd. | 9-11% |

| Kostal Automotive | 8-10% |

| Orscheln Products LLC | 6-8% |

| Dura Automotive Systems | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tata AutoComp Systems Ltd. | Manufacturer of durable, corrosion-resistant automotive control cables, designed to meet the needs of OEMs. |

| Suprajit Engineering Ltd. | Develops and manufactures basic unit control systems such as clutch, accelerator, brake cables with low-friction materials. |

| Kostal Automotive | A world-leader in the field of advanced gear shift and throttle cables, providing ultra-lightweight and ultra-high-strength solutions. |

| Orscheln Products LLC | Offers tailor-made mechanical control cables with applications in off-highway, military and heavy duty commercial vehicles. |

| Dura Automotive Systems | Provides high-precision automotive wire harnesses that fused electronic and mechanical actuators for hybrid and electric vehicle applications. |

Tata Auto Comp Systems Ltd.

Tata Auto Comp is a leading provider of high-durability automotive control cables, supplying OEMs with advanced clutch, throttle, and brake cable solutions. Some of the key specifications of the products in Tata Auto Comp’s portfolio are recycled cable with added recycled material an eco-friendly cable which uses the minimum number of wires possible which results in less use of plastic in the whole process; low-friction coating on cables to minimize the effort for wire movement.

Suprajit Engineering Ltd.

Suprajit is one of the world's largest manufacturers of automotive control cables and precision-engineered systems for passenger cars, two-wheelers, and commercial vehicles. The company's low-friction clutch and accelerator cables offer lower response time and more durability, which lend themselves well to modern fuel efficient vehicles. Suprajit is venturing into high-performance cable assemblies for electric & autonomous vehicles which will offer seamless integration with next-generation automotive technologies.

Kostal Automotive

Kostal specializes in high-strength gear shift and throttle cables, ensuring smooth transmission control and optimized vehicle performance. The company makes lightweight, wear-resistant materials that improve fuel efficiency and operational reliability. The smart automotive cables developed by Kostal feature real-time monitoring sensors, predicting when maintenance will be required, which can also ultimately extend their service life.

Orscheln Products LLC

Orscheln is a leading producer of mechanical control cables, and serves commercial, off-highway and military vehicle markets. Pull and park brake, as well as throttle cables from the company are designed to provide high performance actuation and durability in harsh conditions. Orscheln, for example, is growing its portfolio of custom cable solutions, which incorporates OEM-specific design and increased flexibility and strength.

Dura Automotive Systems

Dura Automotive is a worldwide leader in automotive cable assemblies and integrates hybrid electronic-mechanical control mechanisms that utilize electric power for EVs and hybrids. This is especially true for the company’s high-precision throttle and gear shift cables a solution that increases vehicle responsiveness and efficiency. Dura is investing in next-generation lightweight cable materials, ensuring lower vehicle weight and improved energy efficiency.

The global automotive control cable market is projected to reach USD 2,901.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.4% over the forecast period.

By 2035, the automotive control cable market is expected to reach USD 4,456.3 million.

The transmission cable segment is expected to dominate due to increasing vehicle production, growing demand for smoother gear-shifting mechanisms, and advancements in automatic and manual transmission systems.

Key players in the automotive control cable market include Dura Automotive Systems, Orscheln Products, Suprajit Engineering Limited, Cablecraft Motion Controls, and Sila Group.

Door cable, Hood cable, Transmission cable, Trunk cable, Brake cable, Clutch cable, Throttle cable, Fuel Cap Cable

PVC, Polyethylene

Compact Car, Mid-Size Car, Luxury Car, SUV, Commercial Vehicle, Heavy Commercial Vehicle

North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia and Pacific, Middle East and Africa

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.