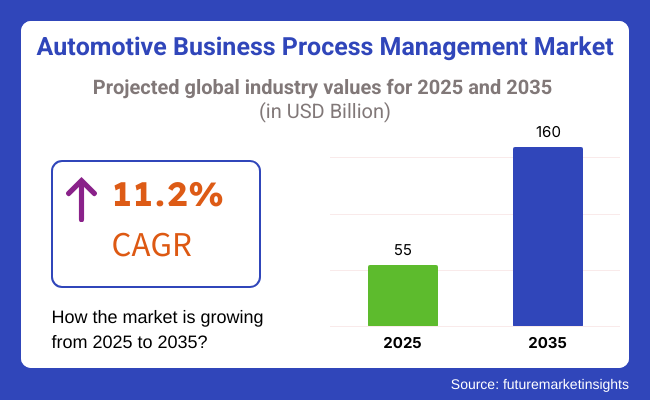

The automotive business process management market will reach USD 55 billion by 2025 and grow to USD 160 billion by 2035, reflecting a CAGR of 11.2% through the forecast period. Key growth drivers are the extensive adoption of AI-enabled workflow automation, real-time data analysis, and cloud-based BPM solutions. Also, investments in automobile-related ecosystems and regulatory requirements for effective automotive processes will drive industry growth.

Automotive firms employ BPM solutions to streamline production operations and improve supply chain management and customer relationship management. The convergence of IoT, AI, and block chain in BPM systems will fuel innovation and facilitate end-to-end coordination across the automotive value chain.

Moreover, the growing demand for digitalization in the automotive sector is forcing companies to adopt scalable BPM solutions for end-to-end process enhancement. Small and medium-sized enterprises (SMEs) are finding more cloud-based BPM platforms increasingly being adopted to enhance operational responsiveness and cost savings. Large enterprises, however, are focusing on AI-powered predictive analytics and robotic process automation (RPA) for automating finance, HRM, and procurement processes.

Explore FMI!

Book a free demo

The automotive business process management (BPM) sector is experiencing fast-paced changes mainly due to heightened digitization, automation, and the demand for productivity. Car manufacturers are allocating more resources to BPM platforms besides the automation initiatives that are widely adopted in the strategy of digitalization of the production process and the improvement of the supply chain as well as the vehicle development cycle.

In addition to that, second-hand service providers apply AI running machines, forecast maintenance, and business processes automation to increase the quality of services. Throughout all areas, regulatory compliance influences both safety, and environmental, and data protection standards. In the quest for more adaptable and extensible BPM solutions, technologies such as AI, IoT, and Cloud are spearheading the change.

The main focus of automotive BPMs will be achieved through real-time process optimization, connected vehicle ecosystems, and the integration of AI in decision-making that will improve the performance of the entire system.

| Company | Contract Value (USD Million) |

|---|---|

| L&T Semiconductor Technologies and Six Automobile Companies | Approximately USD 150 annually |

| eBay and Caramel | Approximately USD 300 - USD 350 |

In the latter half of 2024, L&T Semiconductor Technologies secured contracts valued at approximately USD 150 million annually with six automobile manufacturers, focusing on automotive chip design services. These decade-long agreements underscore the industry's commitment to advancing electronic functionalities in vehicles.

In early 2025, eBay's acquisition of Caramel, valued at approximately USD 300 - USD 350 million, marked a strategic move to enhance its automotive transaction processes, reflecting a trend towards integrating comprehensive digital solutions in automotive business process management.

From 2020 to 2024, the industry expanded as automakers adopted digital transformation to streamline operations and reduce expenses. The growth of EVs, connected vehicles, and autonomous driving drove demand for BPM solutions in manufacturing, logistics, and customer service.

Cloud computing made workflows smoother and enhanced decision-making. IoT-enabled real-time monitoring improved predictive maintenance, and lowered the risks of operations. Yet, cybersecurity issues, data silos, and integration difficulties with legacy systems still posed obstacles that led to AI-based security investments and block chain-based BPM platforms.

Between 2025 and 2035, AI-based automation, decentralized supply chains, and quantum computing will transform the marketplace. Predictive analytics and managing processes automatically will improve production scheduling and customer relationships.

Block chain will protect supplier contracts and data transparency, while quantum computing will speed up R&D simulations for car design and efficiency. Software-defined vehicles and MaaS will fuel BPM adoption in real-time vehicle monitoring and OTA updates. BPM platforms with a focus on sustainability will maximize energy consumption, green supply chains, and carbon monitoring to enable net-zero ambitions.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tighter regulations prompted automakers to adopt BPM solutions for supply chain visibility, and ensure the quality. | AI-powered, block chain-protected BPM platforms guarantee real-time regulatory compliance, automated auditing, and decentralized process validation in worldwide automotive ecosystems. |

| AI-based BPM tools streamlined workflow automation, predictive analytics, and process efficiency for automotive manufacturing and dealerships. | AI-native, self-learning BPM engines automatically improve workflows, anticipate production bottlenecks, and self-optimize resource allocation for hyper-efficient automotive operations. |

| Automotive companies moved to cloud BPM platforms due to scalability, cost-effectiveness, and distributed process management. | AI-powered, decentralized BPM systems offer real-time cloud synchronization, they can predict tasks, and the AI also supports in decision-making for quick automotive business processes. |

| Automobile manufacturers incorporated IoT-based BPM systems to track manufacturing lines, fleet management, and supply chain logistics. | AI-fueled, real-time digital twins facilitate autonomous manufacturing process optimization, predictive maintenance, and AI-based adaptive production planning. |

| Automotive firms utilized RPA for repetitive administrative tasks automation, order processing, and tracking compliance. | Cognitive RPA solutions integrated with AI handle intelligent process automation, real-time fraud detection, and AI-driven self-healing workflows for automotive firms independently. |

| Managing fleets in real-time and monitoring traffic smartly were possible because of BPM systems. | Predictive maintenance processes and real-time fleet automation are controlled by AI-based, 6G-supported BPM frameworks. |

| Emerging cyber-attacks made a way for AI-powered security monitoring and automating the process in BPM systems. | AI-native and quantum-safe BPM systems detect cyber-attacks independently, block data breaches, and provide tamper-proof, real-time workflow integrity for automotive business processes. |

| BPM enabled with 5G enhanced real-time monitoring, process coordination, and AI-based workflow automation for manufacturing and dealerships. | AI-powered, ultra-low-latency BPM solutions take advantage of 6G connectivity to enable real-time supply chain optimization, AI-driven dealership automation, and predictive industry insight. |

| Firms embraced green BPM practices to monitor carbon emissions, maximize energy consumption, and minimize waste in production. | AI-driven, carbon-conscious BPM ecosystems autonomously optimize energy efficiency, enable circular economy workflows, and integrate sustainable supply chain strategies for automotive companies. |

| Automakers explored block chain-based BPM systems for secure tracking, contract automation, and fraud prevention. | AI-integrated, decentralized BPM frameworks provide real-time trustless transaction validation, automated block chain-powered process workflows, and AI-driven compliance tracking for the automotive sector. |

The industry finds itself at a number of high-risk threats, including data privacy and security issues, integration issues, regulatory issues, supply chain disruptions, and technology obsolescence.

The data security and privacy issue arises mostly because of the co-existence of cloud-based BPM solutions, IoT-enabled vehicles, and AI-based process automation. A cyberattack might cause functional impairments, loss of intellectual property, or data breaches, which consequently, would necessitate establishing firm cybersecurity frameworks, end-to-end encryption and rigid access controls.

Integration challenges spring up as automotive companies possess outdated IT infrastructure, ERP systems, and third-party applications. Achieving seamless data flow, process automation and real-time analytics throughout these disparate systems mainly entails custom APIs, middleware solutions, and AI-driven automation platforms.

Regulatory compliance risks are serious challenges of the automotive sector as they deal with global emission levels, safety standards, and data protection laws (e.g., GDPR, CCPA, ISO 26262 for automotive safety). Firms must ensure their BPM solutions are in line with regional and international regulations to avert legal issues and financial consequences.

The automotive supply chain reflects a greater extent of the challenge as the industry heavily relies on the global manufacturing supply chain for semiconductors, batteries, and raw materials. As such, BPM solutions ought to provide comprehensive real-time supply chain visibility, predictive analytics and risk control mechanisms to counteract the impacts of downtime and inefficiencies.

Technological obsolescence is a prevalent discourse as AI, block chain, and digital twin technologies are dramatically altering the field of automotive BPM. In order to keep touch with the pace of the competition, companies should periodically renew and upgrade their BPM platforms along with the assurance of compatibility with interconnected vehicles, autonomous transport, and Industry 4.0 technological advancements.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 9.2% |

| UK | 8.9% |

| European Union | 9.1% |

| Japan | 9.0% |

| South Korea | 9.4% |

The USA industry is expanding as automakers implement AI-driven solutions to improve operational efficiency, streamline workflows as well as enhance customer experiences. Cloud-based BPM platforms are being developed to optimize supply chain management, automate compliance processes, and improve production efficiency. The need for data-driven decision-making, predictive analytics, and digital transformation supports industry growth.

The USA industry is to increase production agility and strengthen aftersales services. Additionally, regulatory policies encourage businesses to implement secure and scalable business process management solutions. FMI is of the opinion that the USA industry is slated to grow at 9.2% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI-Driven Solutions | Automakers apply AI to optimize workflows and boost efficiency. |

| Cloud-Based BPM | Companies develop BPM platforms to enhance supply chain management. |

| Regulatory Policies | Policies promote the adoption of secure and scalable BPM. |

| Digital Transformation | Businesses use BPM for predictive analytics and process automation. |

The UK industry is growing as businesses and manufacturers integrate AI-powered workflow automation and process optimization. BPM solutions improve operational transparency, strengthen supply chain coordination, and support digital transformation.

The increasing adoption of cloud-based BPM, robotic process automation (RPA), and real-time analytics contributes to industry expansion. Additionally, regulatory frameworks that support process efficiency and data-driven operations are accelerating BPM adoption across the automotive sector. FMI is of the opinion that the UK industry is slated to grow at 8.9% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI-Powered Automation | Businesses implement AI for workflow automation and optimization. |

| Cloud-Based BPM | Companies use BPM to enhance operational transparency and efficiency. |

| Regulatory Support | Policies encourage BPM adoption for data-driven operations. |

| Digital Transformation | Firms use BPM to improve supply chain integration. |

The European Union industry is advancing as enterprises implement AI-enhanced workflow management, automation tools, and digital transformation strategies. Germany, France, and Italy lead the industry by integrating BPM platforms into automotive manufacturing and service operations.

The EU enforces strict compliance and sustainability regulations, prompting companies to invest in BPM solutions for better resource management and operational transparency. Advancements in cloud computing and machine learning further contribute to the adoption of BPM across the automotive industry. FMI is of the opinion that the European Union industry is slated to grow at 9.1% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| AI-Enhanced Workflow | Enterprises use AI to improve automation and workflow management. |

| Compliance Regulations | EU policies drive BPM investment for better operational transparency. |

| Cloud and Machine Learning | Firms integrate BPM with advanced computing technologies. |

| Digital Transformation | Companies implement BPM in manufacturing and service operations. |

The Japanese industry is evolving as businesses adopt AI-driven process automation, lean manufacturing principles, and real-time workflow analytics. BPM solutions enhance production efficiency, reduce operational costs, and improve supplier collaboration.

Japan’s emphasis on precision-driven automotive manufacturing and digital transformation contributes to the adoption of advanced BPM systems. Additionally, electric vehicle production and connected car technologies drive investments in BPM solutions to enhance process control and scalability. FMI is of the opinion that the Japanese industry is slated to grow at 9.0% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI-Driven Automation | Companies integrate AI for real-time workflow analytics. |

| Lean Manufacturing | BPM solutions improve production efficiency and reduce costs. |

| Digital Transformation | Businesses use BPM for process control and scalability. |

| Supplier Collaboration | BPM strengthens coordination with suppliers. |

The South Korean industry is expanding rapidly as manufacturers integrate AI-powered analytics, automated process management, and cloud-based BPM platforms. Government support for digital transformation initiatives is further accelerating BPM adoption across the automotive sector.

Companies are using BPM with IoT-enabled production, predictive maintenance, and real-time performance monitoring to optimize efficiency. Additionally, advancements in block chain for secure process automation and 5G-enabled BPM are contributing to industry growth. FMI is of the opinion that the South Korean industry is slated to grow at 9.4% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-Powered Analytics | Manufacturers use AI for automated process management. |

| IoT Integration | BPM solutions enhance predictive maintenance and monitoring. |

| Block chain and Security | Companies implement BPM with block chain for secure automation. |

| 5G-Enabled BPM | Businesses leverage 5G for advanced BPM solutions. |

Encouraged by the increase in consumers opting for monthly pricing in the automotive sector, small and medium-sized enterprises (SMEs) and startups are leaning toward a Monthly Pricing model as well. This pricing model offers adaptability and scalability, enabling organizations to fine-tune their BPM software usage based on changing business objectives.

Monthly pricing has also become increasingly popular with the advent of cloud-based solutions and subscription-based business models, as it allows organizations to minimize upfront costs while enjoying ongoing updates and technical support.

BPM platforms like Pega Systems, IBM, and Appian provide powerful BPM solutions to enterprises as they need to make agile decisions that involve business process automation. These agile platforms provide all-in-one with automation tools, workflow optimization, and real-time analytics, allowing automotive enterprises to manage their business processes without committing long-term financially.

This is evidenced in the newly published report stating that the monthly pricing model is expected to cover 45.6% of the industry size share in 2025 as it is being steadily adopted, and doing so particularly to burgeoning automotive business companies that are inclined towards flexibility instead of long-term contracts.

On the other hand, Yearly Pricing still dominates, and it is expected to maintain 54.4% of the industry in 2025. This pricing model is most popular with large automotive manufacturers, suppliers, and multinational companies because it is the most inexpensive and easily integrates with complex enterprise systems. SAP, Oracle, and Software AG are among the leading companies operating the BPM industry under the annual pricing model.

These fastest, light speed, enterprise-grade BPM platforms help automotive with task-critical integrations of supply chain management, dealership automation, compliance, and operational performance. Businesses can realize long-term process optimization through these solutions, complemented by strategic partnerships with the BPM solution provider by engaging in yearly pricing plans.

Automotive human resource management (HRM) has carved a distinct niche solution for the automotive industry, which helps organizations manage employee operations for improved performance management, such as recruitment flow management, payroll management, and labor law compliance, which shows that automotive enterprises with global workforces look authentically of BPM solutions to streamline complex HR-related tasks and boost employee workplaces productivity and engagement.

BPM platforms also provide an extensive suite of solutions to organizations that contain HRM features as its components, such as SAP SuccessFactors, ADP, and Workday, which provide BPM platforms that function singularly for organizations, enabling them to

automate all menial operations of HR using BPM and to use talent acquisition specifically driven by AI while keeping accurate records of the employees. As digital workplace management solutions become increasingly prominent, the HRM segment is projected to hold an industry share of 21.9% in 2025.

The other major contributor that is driving the adoption of BPM solutions in the automotive industry is the Sales and Marketing segment. Some of them include automotive manufacturers, dealers, and aftermarket service providers using BPM software for CRM (customer relationship management), lead generation, campaign automation, and Omni channel marketing strategies.

BPM tools help enterprises enhance customer engagement, increase sales converting rates, and have better insight into consumer behavior. This includes solutions such as AI-optimized BPM for Automotive sales and marketing from leading players like Salesforce, HubSpot, Oracle Eloqua, and Microsoft Dynamics 365.

With features such as advanced analytics, customized marketing automation, and real-time customer interactions, these platforms help businesses stay ahead in a fast-paced industry. The sales and Marketing segment accounts for 18.5% industry share in 2025, with an increase in digital industry management tools & automation in the automotive industry.

The industry is the fastest-growing as digital transformation has penetrated every aspect of automotive and supplier operations, including operational efficiency, supply chain management, and customer experience improvement. Investment in artificial intelligence automation, cloud-based BPM platforms, and data-based analytics around this streamlining process and optimization workflow is increasing.

IBM, SAP, Oracle, Pega, and Software AG have one of the largest individual budgets of the industry share in composite BPM solutions, with AI-driven process automation and sophisticated workflow optimization tools. Young sprinters and niche players are now focusing on industry-specific BPM applications, robotic process automation (RPA), and predictive maintenance solutions, consequently creating intense and fierce competition.

Increased industry evolution continues from increased Industry 4.0 implementation, smart manufacturing by applying IoT technologies, and digital twin technology pushes real-time process monitoring, block chain supply chain solutions, and cloud-native BPM adoption.

Joint ventures with key automotive OEMs, an AI-driven decision-making model, integrated enterprise solutions among other strategic initiatives should be considered in determining the competitive landscape. Cost reduction, agility, and regulatory-compliant processes are priorities among automakers. BPM vendors will thus focus on scalable, flexible, and AI-powered process management solutions to remain competitive.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| IBM | 20-25% |

| SAP SE | 15-20% |

| Oracle Corporation | 12-17% |

| Pega Systems | 8-12% |

| Software AG | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| IBM | Provides AI-driven BPM solutions, predictive analytics, and cloud-based process automation for automakers. |

| SAP SE | Develops enterprise BPM software, supply chain optimization tools, and digital transformation solutions. |

| Oracle Corporation | Specializes in cloud BPM, data analytics, and business automation for the automotive sector. |

| Pega Systems | Focuses on AI-powered workflow automation, customer engagement solutions, and intelligent process modeling. |

| Software AG | Offers digital twin integration, IoT-driven BPM, and real-time operational process management. |

Key Company Insights

IBM (20-25%)

IBM is the dominant player in automotive BPM through AI-led automation, predictive analytics, and cloud process management solutions.

SAP SE (15-20%)

SAP SE supports enterprise BPM software, supply chain optimization, and digital transformation tools to improve operational efficiency.

Oracle Corporation (12-17%)

Oracle Corporation is a developer of cloud BPM, AI-fueled business intelligence, and workflow automation solutions for automotive enterprises.

Pega Systems (8-12%)

Pega Systems provides AI workflow automation solutions to help automotive companies speed up their operations and engage with their customers.

Software AG (5-9%)

Software AG concentrates its innovations on the IoT-enabled BPM, real-time operational intelligence, and digital twin for smart manufacturing.

Other Key Players (20-30% Combined)

The industry will continue to grow as manufacturers and suppliers integrate AI, cloud computing, and process automation to improve operational agility, reduce costs, and enhance overall efficiency.

The industry is projected to reach USD 55 billion in 2025.

The industry is expected to grow significantly, reaching USD 160 billion by 2035.

South Korea is poised for the fastest growth, with a CAGR of 9.4% from 2025 to 2035.

Key companies in the industry include SAP SE, Peoplesoft, Oracle, International Business Machines Corporation, Capgemini Group, Infosys Ltd., Wipro Ltd., Larsen & Toubro Infotech, Doforttech, Steepgraph, and IBM.

Human Resource Management (HRM) is widely used in the industry, enabling streamlined workforce operations.

By enterprise size, the industry is segmented into small and medium enterprises (SMEs) and large enterprises.

By deployment type, the industry is segmented into on-premises and cloud-based.

By pricing, the industry is segmented into monthly and yearly.

By functions, the industry is segmented into human resource management (HRM), procurement and supply chain management (SCM), sales and marketing, accounting and finance, customer service support, and others.

By region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.