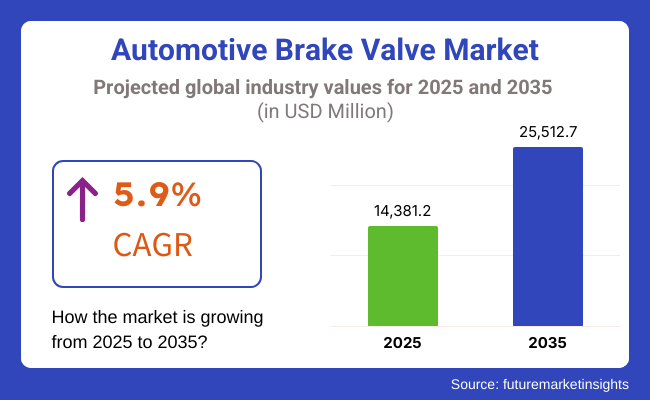

Automotive brake valve market is set to grow at a steady rate between 2025 to 2035 period due to rising production of the vehicles, growing penetration of advanced braking systems, and increase in safety compliance rules across the globe. The market is expected to reach USD 25,512.7 million by 2035 at a CAGR of 5.9% during the review period, an increase from USD 14,381.2 million in 2025.

Essential Items in Auto-Racing Braking Systems Brake valves are important parts of automotive braking systems, adjusting the circulation of brake fluid or air pressure to provide area of the braking system with best braking efficiency and safety.

Due to the growing demand for safer, fuel-efficient and high-performance vehicles around the world, automotive manufacturers and braking system manufactures are investing in advanced brake valve technologies, such as electronically controlled brake valves, anti-locking braking systems (ABS) and regenerative braking integration.

Also, the demand for intelligent and automated braking solutions are further driven by the growth of electric vehicles (EVs), hybrid vehicles, and autonomous driving technologies which increases requirements for high-precision and electronically controlled brake valves. Furthermore, increasing regulations on vehicle safety standards in North America, Europe and Asia-Pacific region is promoting the adoption of advanced braking components in passenger cars, commercial vehicles and off-road vehicles.

The growing adoption of electric and hybrid vehicles, government mandates regarding vehicle safety rules, and continuous innovations in braking technology are some of the prominent growth determining factors of this market through 2030. Automotive industry around the globe is making strides to get adherence to these stringent standards for safety and emission levied by the governments across the geographies which is taking toward improvement of braking efficiency and advance brake control system.

Manufacturers are emphasizing on designing and manufacturing brake valves with greater durability, precision, and response time in order to enhance performance and reduce energy consumption, coupled with lightweight materials, smart sensors, and AI-driven brake control systems.

Explore FMI!

Book a free demo

North America is another key region for automotive brake valves owing to stringent regulations over vehicle safety, increasing acceptance to adopt EVs, and the booming manufacturing base for the automotive market in the region. There is high demand for complex braking systems for passenger cars, commercial trucks, and off-road vehicles in the USA and Canada.

So, new regulations related to braking performance are driving NHTSA and FMVSS to implement new regulations, which is pushing forward the need for advanced brake valves for all vehicle segments with manufacturer focus on embedded innovations.

All these trends, as well as the demand for electronic control brake valves and connected mobility solutions such as smart braking systems for autonomous vehicles, are driving substantial investments in AI-powered braking technologies.

Europe is holding significant market share owing to increasing automotive safety standards, electric vehicle technology, and strong demand for commercial vehicles in Germany, France, Italy and the UK. The EU has made ESC and AEBS mandatory and wants to have these systems introduced in new vehicles which are remote controllable, which is expected to propel the uptake of intelligent, electronically controlled brake valves in modern vehicles.

Being one of the leaders in automotive engineering in the world, Germany is at the key country of brake valve technology, emphasizing on precision braking, diminished energy loss, and integration with hybrid and EV platforms.

Asia-Pacific is the fastest-growing market, with China, India, Japan, and South Korea leading in automotive production, electric vehicle adoption, and braking system advancements. Growing vehicle ownership and fast urbanization in the region and government-supported plans for enhancement of road safety are meaningfully contributing to brake valve demand. As the world's largest automobile representative, it has seen explosive growth in electric and autonomous cars, leading brake valve manufacturers to design ultra-efficient, regenerative, and electronically controlled brake systems.

Automotive R&D, especially in the high-performance segment, is thriving in Japan and South Korea, resulting in the development of next-gen brake valves with improved response times, durability, and optimized braking force distribution.

Emerging markets such as Brazil, Mexico, Saudi Arabia, and South Africa are facing rapid adoption of advanced brake valve technologies, led by growing automotive manufacturing, rising commercial vehicle production, and rising safety regulations.

The use of high-performance vehicles in the Middle East, along with increasing investments in logistics and off-road vehicles, drives the need for heavy-duty, durable brake valve solutions. Latin America’s automotive industry Brazil and Mexico in particular is benefiting companies looking to manufacture inexpensive brake components with high precision. The brake valve market for the regions in question will be at the mercy of automobile safety awareness programs in Africa, as well as improving a variety of vehicle import sales.

Challenges

High Manufacturing & R&D Costs for Advanced Brake Systems

The transition from traditional mechanical brake valves to electronically controlled, AI-powered braking systems demands significant investment in research and development (R&D), high-precision manufacturing, and advanced software integration. To build these next-gen brake valves with quicker response times, enhance braking performance, and enable seamless interaction with EBS and regenerative braking tech, manufacturers will need to work with semiconductor suppliers, software developers, and AI engineers.

Moreover, lightweight materials such as high-strength metallic alloys and composite polymers are being used to optimize the weight of vehicles for better fuel efficiency. However, these materials are expensive and necessitate specialized manufacturing processes, increasing production costs. Many smaller brake valve manufacturers unable to adopt with these latest technological updates and become unable to compete with more established automotive companies.

Complex Regulatory Compliance Across Different Regions

Brake valve manufacturers face rising in stringent safety and environmental regulations across North America, Europe, and Asia-Pacific, requiring them to customize product designs to meet specific regional standards. Global governments are introducing strict government vehicle safety policies that will require anti-lock braking systems (ABS), electronic stability control (ESC), advanced emergency braking systems (AEBS, and brake assist systems (BAS) among others in vehicles.

In the Asia-Pacific region, however, there are further complications, with developing nations such as India and Indonesia now enacting new safety measures, while long-established automotive markets such as Japan and South Korea are already home to advanced regulatory regimes.

Consequently, automotive brake valve manufacturers get required to invest in the different certification process, tailor made product testing, and applicable laws as observed for each region which tend to make the production complex and further adds on to the regulatory costs.

Supply Chain Disruptions & Semiconductor Shortages

The global supply chain crisis, caused by factors such as pandemic-related shutdowns, trade restrictions, and geopolitical conflicts, has severely impacted automotive component manufacturing. Semiconductor shortages specifically have pushed out production timelines, extended lead time for electronic brake control units and increased costs for smart brake valve makers, according to the companies.

With the surge in use of electrified vehicles and autonomous vehicles, the need for brake valves is expected to be integrated with electronic sensors, microcontrollers, and AI-based monitoring systems. Volatility around raw material prices have also amplified cost fluctuations; metals including aluminum, copper and steel - saw their price soar as supply chains were disrupted and demand increased. The brake valve availability also affected due to shipping delays and transportation bottlenecks which are causing higher procurement costs and decreased profit margins for manufacturers.

Opportunities

Advancements in AI, IoT & Smart Braking Technologies

The brake valve industry is undergoing a major transformation with the incorporation of artificial intelligence (AI), the Internet of Things (IoT), and smart sensors into braking systems. For improved safety and performance, next-generation brake design will incorporate vehicle speed, terrain conditions, and instantaneous driver behavior into an adaptive braking algorithm that modifies braking force as needed based on real-time conditions.

AI-powered brake valves improve vehicle stability by automatically distributing braking pressure between wheels, reducing skidding risks and optimizing stopping distances. Also, IoT-enabled brake valves enable remote diagnostics, predictive maintenance alerts, and cloud-based brake performance monitoring, minimizing vehicle downtime and repair costs.

Massive growth potential is for AI-integrated brake valves due to the need for High Responsive braking systems in Advanced Driver Assistance Systems (ADAS) such as lane departure warning, adaptive cruise control, and collision avoidance technology.

Growth in Electric & Autonomous Vehicles

The global EV boom is transforming the automotive brake valve market as EV manufacturers focus on optimizing regenerative braking, lightweight materials, and electronic brake control systems. Instead of traditional hydraulic braking, EVs employ electronic brake valves that promote energy efficiency and extend mechanical life.

This next generation will need brake valves that can control the braking of vehicles to recycle kinetic energy into electrical energy when braking using regenerative-braking technology while also ensuring minimization of friction losses at the same time.

Major players in the automotive industry, including companies like Tesla, Rivian, and BYD, are looking into smarter setups with high-tech electronic brake valves to recover that energy and further prolong the battery life. For smooth, safe braking operations, automated braking systems must constantly converse with onboard sensors, AI processors, and vehicle-to-vehicle (V2V) communication networks.

Expansion in Emerging Markets & Heavy-Duty Vehicle Applications

The expansion of the commercial vehicle sector, infrastructure development, and increasing transportation demand in emerging markets is creating strong opportunities for brake valve manufacturers. Truck and bus production is skyrocketing in emerging economies like India, Brazil, Indonesia and Mexico, driven by urbanization, the growth of e-commerce logistics and government-backed road safety initiatives.

These markets require strong, high-performance brake valves that deliver superior durability, long life and additional brake acting force for heavy duty applications. As the Middle East and Africa make vast investments in off-road and construction vehicles, the demand for heavy-duty brake valves that provide high-load bearing capacity and extreme-temperature resistance is expected to grow.

The automotive brake valve market was unceasing during the forecast period of 2020 to 2024 with the growing vehicular production, developing braking arrangements, and relentless safety parameters turning as driving modalities. Structural application brake valve that sustainably control the distribution of braking force.

In all vehicle types, including, passenger cars, commercial vehicles, and electric vehicles (EVs), brake valves are an integral functional component in controlling the distribution of braking responsibility to the respective brake assembly. In addition, the wealth of advanced brake valve technologies has been induced further by the increasing adoption of safety features like electronic braking systems (EBS) and anti-lock braking systems (ABS).

Looking ahead to 2025 to 2035, the market is expected to see significant advancements in smart braking technologies, increased integration of AI-driven predictive maintenance, and a shift towards lightweight and sustainable materials. The electrification of vehicles and the rise of autonomous driving will also influence the development of next-generation brake valves.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with safety standards like FMVSS, ECE R13, and ISO 26262. |

| Technological Advancements | Increased adoption of ABS and EBS for improved vehicle safety. |

| Industry-Specific Demand | Traditional vehicles with internal combustion engines (ICE) are also in high demand. |

| Sustainability & Circular Economy | Efforts to reduce brake dust emissions and improve durability. |

| Market Growth Drivers | More vehicle production, more safety standards, and further commitment to performance braking. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tougher global requirements regarding braking efficiency, emissions, and sustainability. |

| Technological Advancements | AI-integrated brake valves, regenerative braking optimization, and smart self-adjusting systems. |

| Industry-Specific Demand | Moving toward EVs, hybrid braking systems, and brake-by-wire technology. |

| Sustainability & Circular Economy | Development of sustainably sourced materials, recyclable components, & energy efficient manufacturing. |

| Market Growth Drivers | Rise in electric and autonomous vehicles, smart braking technologies, and advanced driver assistance systems (ADAS). |

The growth of the USA automotive brake valve market is attributed to the increasing number of vehicle production, rising consumer demand for advance braking systems to avoid fatal accidents, and stringent regulations implemented by the National Highway Traffic Safety Administration. So the rise in Intelligent braking technologies like anti-lock braking system (ABS) and electronic stability control (ESC) in the automotive industry due its dependency on high precision brake valves.

In pursuit of a more efficient, lighter-weight, and faster-responding brake valve, manufacturers and suppliers linked with the automotive industry have invested substantial resources toward the research and development of automotive brake valves. Moreover, the growing deployment of autonomous vehicles is further enhancing the demand for artificial intelligence to manage adaptive brakes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

The UK automotive brake valve market is growing steadily, driven by the rising adoption of advanced braking technologies, expanding EV infrastructure, and stringent safety regulations. The UK government's drive towards electric power across cars with the 2030 ban on new petrol and diesel vehicles on the road has seen manufacturers establish high-performance parts for brakes which suit the likes of EVs and hybrids.

Automotive UK companies are innovating lightweight and high-performance brake valve integration to minimize energy loss and enhance braking response. There is also growing demand for regenerative braking systems that utilize brake valves to improve energy recapture. Furthermore, the adoption of connected and autonomous vehicles is fuelling the demand for brake valves that can integrate with the highly advanced AI-based braking systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.8% |

The European Union automotive brake valve market is predicted to grow over the years owing to EU’s strict safety norms, rising production of electric vehicles and increasing investments in smart braking systems. The growth of leading automotive producers in Germany, France, and Italy is fueling innovations in brake valve systems.

This green initiative in the EU is pushing electronic braking solutions into the fast lane. The development of autonomous vehicles is further increasing the demand for high-precision braking organizations. To maintain effective braking power while keeping the weight down, companies are using innovative materials such as high-strength aluminum and composite materials in the structures.

market expansion, as fleet operators demand operating reliability and safety compliance, further boosted by increasing penetration of electronic braking systems in heavy commercial vehicles and public transportation.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

The Japan Automotive Brake Valve Market is witnessing steady growth owing to emergence of advanced technology in braking systems, rising production of electric and hybrid vehicles and stringent government regulations regarding vehicle safety. The reputation of the nation’s automotive industry for innovation pushes the envelope for lightweight, high-performance braking components.

Automakers are concentrating on fuel-efficient and low-emission vehicles, resulting in the need for brake valves that maximize performance while decreasing energy expenditure. The advancements in smart braking solutions will also be driven by Japan’s prowess in robotics and AI. Furthermore, the adoption of electronic braking systems coupled with advanced driver assistance systems (ADAS) is also witnessing significant growth, due to the advent of automated and semi-autonomous vehicle technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

South Korea automotive brake valve market is witnessing robust growth due to the country's strong position in manufacture of electric vehicles, rising emphasis on automotive safety and proliferation of connected car technologies. Production of autonomous and semi-autonomous vehicles is anticipated to rise, supporting the growing demand for the intelligent braking systems.

The government of South Korea has been advocating green transport solutions, which in turn encourages investments in electronic braking system components for EVs. Moreover, homegrown automakers in India are embracing next-gen braking technologies, incorporating AI-driven systems to ensure additional stability and safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Modern braking systems feature combination valves that integrate metering, proportioning, and pressure distribution multiple functions into a single piece of hardware. They balance the braking power between the front and rear wheels, and prevent the wheels from locking and causing the automobile to skip during braking.

Combination valves are experiencing increasing demand, as the penetration of advanced driver-assistance systems (ADAS) and electronic stability control (ESC) is driving demand for better braking efficiency, making it an important consideration for manufacturers. Furthermore, combination valve manufacturers are developing lightweight valve components made from high-strength, anti-corrosive materials to improve durability while reducing load on the overall vehicle.

Conclusion: The growing trend of stringent emissions regulations has forced automakers to improve the fuel efficiency of their vehicles, leading to the development of advanced combination valves that work in conjunction with regenerative braking systems in hybrid and electric vehicles.

Quick release valves are most often found in pneumatic braking systems of heavy-duty trucks, buses and commercial vehicles. With these valves in place, brake pressures can be released faster for an improved brake response and performance. Growing adoption of air brakes for commercial transportation and off-highway vehicles is driving the demand for high-performance quick release valves.

Moreover, innovations in material science and precision manufacturing are allowing manufacturers to create valves that are more durable, leak-proof and efficient even in the harshest operating environments. The demand for quick release valve segment is likely to grow, as fleet operators are looking for more reliable and efficient braking solutions.

With the emergence of autonomous and connected commercial vehicles, the demand for intelligent braking mechanism is also accelerating the need for quick release valves which must work in harmony with electronic braking systems (EBS) and adaptive cruise control to offer increased road safety and vehicle stability.

Automotive brake valves are mostly made of steel, which provides the necessary strength, longevity, and endurance in extreme high-pressure braking conditions. Rugged and durable, Steel brake valves are ideal for commercial vehicles, heavy-duty trucks, and off-road equipment. The growing emphasis on vehicle safety standards and improved breaking performance are contributing to the growing adoption of high grade steel alloys with enhanced corrosion and wear resistance.

Steel brake valves are becoming an integral component in next-gen brake systems coupled with precision machining and coating technologies, their lifespan and effectiveness is indeed increasing. As the automotive industry places greater importance on sustainability, manufacturers are looking at lightweight steel alloys and advanced heat treatments to help them maintain the same level of strength, while reducing the overall component weight, which can lead to enhanced fuel efficiency and reduced emissions in traditional and hybrid vehicles.

Copper brake valves are gaining popularity in specific automotive applications due to their excellent thermal conductivity, corrosion resistance, and machinability. These valves are found in the most high-end luxury and performance cars around the world, where the ability to modulate the brakes effectively is needed, and negative forces need to be expelled from the system.

The increasing penetration of electric and hybrid vehicles, which necessitate sophisticated thermal management solutions, is also driving demand for copper brake valves. While retaining excellent thermal properties, manufacturers are also studying new copper alloys and composite materials to improve the mechanical strength and other contributions of brake valves.

With the increasing electrification of the automotive industry and the advancement of braking technology, the demand for copper brake valves is projected to continue to grow consistently. Breaking news related to electric and fuel cell vehicles, for which braking systems need to be effective across a wide range of temperature conditions, also reinforces copper's position in next-gen braking solutions, delivering dependability and performance in the most challenging of operating conditions.

The automotive brake valve market is anticipated to grow in the coming years, driven by the growing demand for advanced braking systems, consistently increasing vehicle production, and strict safety regulations. Brake valves play an important role in passenger as well as commercial vehicles to ensure that braking force is evenly applied across all wheels for vehicle stability. Rising demand for advanced braking technologies which include anti-lock braking system (ABS) and electronic stability control (ESC) significantly drive the market.

Lightweight materials, the integration of electronic brake controls and precision engineering technologies are improving performance and safety of vehicle brake systems and these technologies would be used as brake valves. Moreover, the move towards electric and hybrid automobiles is driving innovations in brake valve designs, as manufacturers focus on energy efficient and high-performing solutions. The competitive landscape in the market is also being driven by regulatory requirements for improving brake and lowering emissions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Robert Bosch GmbH | 18-22% |

| Continental AG | 15-18% |

| ZF Friedrichshafen AG | 10-14% |

| Knorr-Bremse AG | 8-12% |

| WABCO Holdings Inc. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Robert Bosch GmbH | Designs high-performance brake unit valves that include ABS and ESC technology to improve safety features. |

| Continental AG | Focuses on electronic brake valves used in today’s automotive systems to enhance braking efficiency and precision. |

| ZF Friedrichshafen AG | Develops advanced braking technologies, focusing on lightweight construction and integrated electronic control. |

| Knorr-Bremse AG | Provides high-reliability brake valves for commercial vehicles with a strong emphasis on automation and predictive maintenance. |

| WABCO Holdings Inc. | Creates air brake valve systems for heavy-duty vehicles and intelligent braking solutions. |

Key Company Insights

Robert Bosch GmbH

Robert Bosch GmbH, we are a key player in the braking technology sector, providing advanced brake valve solutions to enhance vehicle safety and performance. They couple their brake valves with advanced ABS and ESC systems to provide braking in all conditions. Bosch persistently invests in new R&D projects to grow its business base with lightweight, high-durability brake components. Bosch's strong global footprint gives the company an excellent platform to harness the growing need for electronic brake systems in traditional and electric vehicles.

Continental AG

Continental AG specializes in electronic brake valve technologies that enhance braking efficiency, reduce stopping distances, and improve overall vehicle stability. The company advanced brake-by-wire systems have also removed hydraulic fluid from the equation and also that most important attribute of a brake snappy response time.

Continental is working on designing IoT and AI-based analytics into its braking systems, enabling real-time monitoring and predictive maintenance. Continental is demonstrating its commitment to sustainability by expanding its production capabilities and investing in sustainable materials for the automotive brake valve market.

ZF Friedrichshafen AG

ZF Friedrichshafen AG provides advanced braking solutions that incorporate electronic controls and lightweight materials to improve vehicle dynamics and safety. The brake valves from the company are also developed to integrate with autonomous driving technology and electric powertrains.

ZF is also working on regenerative braking systems that promote energy efficiency in hybrid and electric vehicles. Through this digitalization and automation, ZF is constantly further developing its braking product portfolio in the interests of changing vehicle needs.

Knorr-Bremse AG

Knorr Bremse is the global leader in braking systems for rail and commercial vehicles. The break valves made by the company are characterized by traits such as durability, reliability, and efficiency, making sure that the company retains the best performance even in tough conditions. Always at the forefront:

Knorr-Bremse develops automated and predictive maintenance solutions that minimize downtime and increase the efficiency of your fleet. The company is working on AI-enabled diagnostics and remote monitoring capabilities.

WABCO Holdings Inc.

WABCO Holdings Inc. provides intelligent braking systems and air brake valve solutions for commercial and industrial vehicles. Now, the company's brake valves have high pressure systems for heavy-duty trucks and buses, improving safety and control.

WABCO is a leader in smart braking systems to develop braked systems incorporating sensors and electronic controls. It is a sign of the company’s commitment to innovation are its advancements in adaptive braking, lane-keeping assistance and automated emergency braking systems.

The global automotive brake valve market is projected to reach USD 14,381.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.9% over the forecast period.

By 2035, the automotive brake valve market is expected to reach USD 25,512.7 million.

The ABS modular valves segment is expected to hold a significant share due to the increasing adoption of anti-lock braking systems (ABS) for enhanced vehicle safety and government regulations mandating ABS in commercial and passenger vehicles.

Key players in the automotive brake valve market include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Knorr-Bremse AG, WABCO Holdings Inc., Haldex AB, Hitachi Automotive Systems, Aisin Seiki Co., Ltd., Mando Corporation, and Dorman Products, Inc.

The market is segmented into Combination Valves, Quick Release Valves, Metering Valves, ABS Modular Valves, Foot & Hand Valves, Parking Brake Valves, Emergency Valves, Check Valves, Spring Valves, and Proportional Valves.

The industry is divided into Compact Cars, Mid-Sized Cars, Luxury Cars, SUVs, Heavy Commercial Vehicles (HCVs), and Light Commercial Vehicles (LCVs).

The market is categorized into Steel, Copper, Brass, and Alloys.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.