The automotive industry focuses on safety, durability, and efficiency in braking systems, the global automotive brake tube market is poised for consistent growth. Brake tubes, a key part of hydraulic brake systems, power the supply of high pressure brake fluid behind the brake pads allowing for effective and reliable braking performance.

The need for high-quality and corrosion resistance brake tubes have been consistently growing, with increasing vehicle production, rising focus on road safety, and increasing regulatory requirements for the performance of brake. Moreover, the development of stainless steel, copper alloys, and premium polymer-coated tubes is improving brake line durability, thus augmenting the market growth.

The automotive brake tube market will witness sustained demand throughout the period between 2025 and 2035, supported by growing adoption of electric vehicles (EVs) and advanced driver assistance systems (ADAS).

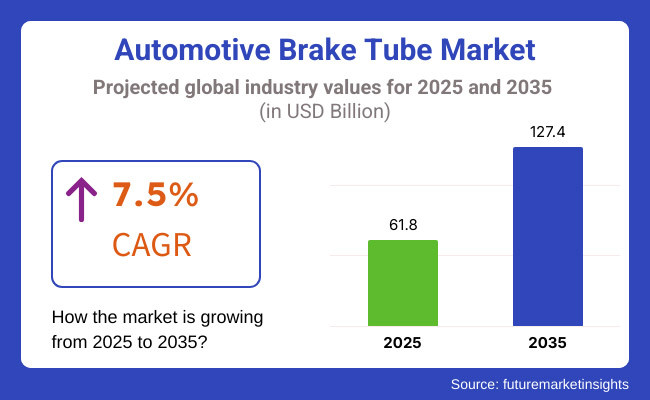

The estimated global automotive brake tube market was about USD 61.8 Billion in 2025. The market is expected to grow at a CAGR of 7.5% and reach around USD 127.4 Billion by 2035.

Steady growth can be attributed to increasing need for safer and more reliable braking systems coupled with the overall shift toward lighter and corrosion-resistant materials.

Explore FMI!

Book a free demo

North America is another market that accounts for a decent share of automotive brake tubes, thanks to an established automotive manufacturing base, well established aftermarket segment, and strict regulatory standards regarding vehicle safety.

Notably, demand for automotive brake tube advanced materials is resilient, with continued demand from the USA and Canada, as systems need to withstand harsh conditions and improve braking reliability. As the region shifts towards electrification and development of autonomous vehicles, there is a focus on new-age braking technologies that heavily relies on strong and steadfast brake tubing for its functionality.

Europe is another critical automotive brake tubes market with a strong focus on safety, performance, and regulatory compliance. World-class automotive countries like Germany, France, and Italy have gone above and beyond in material innovation and production processes, making high-quality brake tube systems.

The region’s massive uptake of hybrid and electric vehicles has also necessitated next-generation hydraulic systems, which is where durable and lightweight tubing comes in. The consistent growth of the market is also supported by European automakers' commitment to reducing vehicle weight and enhancing brake efficiency.

Asia-pacific is in the area of fastest growth of automotive brake tubes driven by increasing production of vehicles, developing automotive infrastructure and growing adoption of safety standards. China led, in addition to Japan and India were the top contributors, and growing consumer demand for cheap and high-performance car.

The competitive manufacturing nature of the region, along with the government initiatives favoring road safety and improved emissions, has propelled the use of advanced material and technology of brake tubing across the region. The Asia-Pacific market for brake tubes is anticipated to witness strong growth in the next few years, with the automotive industry in the region experiencing considerable expansion.

Challenges

Stringent Safety Standards, Corrosion Resistance, and Supply Chain Constraints

The report also contains the challenges faced by automotive brake tube market during the course of this forecast period. Brake tubes have to cope with high-pressure braking systems, extreme temperature changes and exposure to corrosion, which boils down to a big investment in durable, high-performance materials.

Also, it faces cost-related challenges due to fluctuating raw material prices, especially for metals such as copper, steel, and nickel-based alloys. Logistics constraints, raw material shortages, and geopolitical uncertainties have also impacted the global supply chain for automotive components, leading to production timelines and availability challenges.

Opportunities

Advancements in Corrosion-Resistant Materials, EV Integration, and Smart Brake Systems

Automotive Brake Tube Market amid all these challenges do have good significant growth opportunities as the material innovation in corrosion-resistant brake tubing such as polymer-coated tubes, stainless steel, aluminum-based alternatives. With electric vehicles (EV) on the rise, there is an increasing need for lightweight brake tubes to improve overall vehicle efficiency. And finally, the convergence of smart braking systems with AI-based diagnostics is also enabling digitally optimized brake tubes capable of monitoring pressure, temperature, and fluid dynamics instantly for enhanced vehicle safety and control.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with NHTSA, SAE, and ISO safety and pressure resistance standards. |

| Material Innovation | Use of copper, steel, and nickel-based alloy tubes for durability and corrosion resistance. |

| Industry Adoption | Primarily used in internal combustion engine (ICE) vehicles with moderate adoption in EVs. |

| Supply Chain and Sourcing | Dependence on traditional metal suppliers and imported raw materials. |

| Market Competition | Dominated by automotive component suppliers and brake system manufacturers. |

| Market Growth Drivers | Growth fueled by vehicle safety regulations and demand for high-pressure brake systems. |

| Sustainability and Environmental Impact | Limited efforts in reducing emissions from brake fluid leaks and recycling brake tubes. |

| Integration of Smart Technologies | Early-stage use of pressure sensors and fluid monitoring in high-end vehicles. |

| Advancements in Manufacturing | Traditional welding, brazing, and extrusion techniques for brake tube production. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global safety mandates, including sustainability-focused materials and recyclability. |

| Material Innovation | Adoption of lightweight aluminum, polymer-coated steel, and carbon-composite brake tubes. |

| Industry Adoption | Widespread adoption in EVs and autonomous vehicles, prioritizing lightweight and high-performance materials. |

| Supply Chain and Sourcing | Shift toward localized production, advanced recycling techniques, and AI-driven inventory management. |

| Market Competition | Entry of high-performance material innovators and AI-integrated brake system companies. |

| Market Growth Drivers | Accelerated by EV adoption, advanced braking technologies, and lightweight vehicle development. |

| Sustainability and Environmental Impact | Large-scale adoption of biodegradable coatings, fully recyclable materials, and carbon-neutral production. |

| Integration of Smart Technologies | Expansion into AI-powered predictive maintenance, real-time pressure monitoring, and smart fluid management. |

| Advancements in Manufacturing | Use of 3D printing, automated precision manufacturing, and nano-coating technologies for enhanced performance. |

In the USA, the automotive brake tube market is on the rise due to high demand, the increase in vehicles produced, and advancements in technology and safety regulations. Henceforth, the use of lightweight and corrosion-resistant brake tube materials further expands the market. Moreover, rise root of electric vehicle (EV) segment is also boosting the demand for advanced braking components.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

The automotive brake tube market in the United Kingdom has been witnessing steady growth as car manufacturers increasingly prioritize vehicle safety and optimization of braking performance. The shift towards electric and hybrid cars is driving the demand for lightweight, durable, and high-performance brake tubes.

Furthermore, regulatory limits related to brake performance and environmental sustainability are also driving innovations in materials used for manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

The automotive brake tube market in the European Union is growing owing to the presence of major automobile companies and growth of investments in the sector pertaining to vehicle safety technologies.

Manufacturers are under pressure to innovate and produce high-quality brake tube materials, thanks to stringent EU regulations regarding braking performance, durability, and corrosion resistance. Market demand is also being bolstered by the increasing adoption of electric and hybrid vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.5% |

The Japan Automotive Brake Tube market is anticipated to grow as the automotive sector of the country remains to be on the forefront of innovation and technological developments. Major OEMs dominate the market offering long-lasting and high-efficient braking components. Furthermore, the increasing penetration of advanced braking technologies for hybrid and electric vehicles is acting as a growth circuit for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

The automotive brake tube market in South Korea is growing due to rising vehicle output and growing emphasis on advanced braking solutions. The government’s push for stricter safety standards, coupled with the rapid adoption of electric vehicles, is driving demand for high-quality brake tubes. Manufacturers are also investing in lightweight, corrosion-resistant materials to improve brake performance and durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

The automotive brake tube market in modern vehicles, hydraulic brake tubes pump pressurized fluid from the master cylinder to the braking system, making them an often-overlooked but critical component. It covers Market Segment by Applications, Product Types, Types and Regions and Application (Passenger Vehicle, Hatchback, Sedan, and SUV).

Thermoplastic brake tubes are segmented for a small share of Automotive Brake Tube Market since these tubes can only withstand less pressure with high temperatures. These tubes are commonly implemented in high-performance vehicles, heavy-duty trucks, and sport utility vehicles when more rugged braking systems are desired.

Stainless steel brake tubes are preferred by manufacturers as they tend to provide longer durability and less expansion under pressure which provide more consistent braking performance. Especially in racing and off-road cars, where the efficiency of the braking system is a paramount concern, stainless steel braided brake lines have become increasingly common.

Rising pressure on safety regulations and performance expectations will fuel the adoption of stainless steel brake tubes in both the OEM and aftermarkets segments.

Because of the flexibility and lower pricing points, as well as ease of installation, rubber brake tubes are still heavily utilized in many economy vehicles and mass market applications. These tubes are commonly strengthened with synthetic fibers to improve durability and withstand abrasions.

While rubber brake tubes are prone to aging, they expand and degrade under heat better than plastic, so manufacturers are working to keep showing improvement with the geometry and material used - either through improved rubber composites or multi-layer designs.

Although the demand for stainless steel brake tubes will increase, rubber brake tubes will still be preferred in cost-sensitive markets and lighter-duty vehicles where cost and ease-of-replacement are important.

The segment of SUV is likely to dominate the automotive brake tube market, owing to increasing number of off-road, all-terrain, and family SUV vehicles. While SUVs have greater weight, larger braking loads, and increased safety requirements, brake tubes that are durable and high-performance for SUVs are essential to maintain braking performance.

In the SUV segment, manufacturers demand high pressure resistant, corrosion resistant and extended service life stainless steel, as well as epoxy coated satin hollow products and reinforced rubber brake tubes. The demand for high-performance automotive brake components, such as high-quality brake tubes, is anticipated to be strong as SUV sales continue to increase globally.

Another important segment in the Automotive Brake Tube Market is sedans. Sedan model brake tubes tend to emphasize smooth braking performance, fuel efficiency, and compliance with safety regulations.

With the growing number of electric sedans, manufacturers are interested in high efficiency brake tube systems (as well as regenerative braking systems and electronic braking, etc.) which deliver lightweight solutions.

The automotive brake tube market is being driven by rising need for superior braking systems, improved safety standards, and technological advancements in material properties. As a result, companies are adopting AI-powered brake tube production processes, corrosion-resistant coatings, and lightweight materials integration for improving braking performance, vehicle safety, and sustainability.

This includes OEM suppliers, aftermarket manufacturers, and specialized automotive component providers, who offer high-pressure brake tube design, AI-based quality control, and sustainable manufacturing process.

Market Share Analysis by Key Players & Brake Tube Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Parker Hannifin Corporation | 18-22% |

| Sumitomo Riko Company Limited | 12-16% |

| Eaton Corporation | 10-14% |

| Nichirin Co., Ltd. | 8-12% |

| TI Fluid Systems | 5-9% |

| Other OEM & Aftermarket Brake Tube Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Parker Hannifin Corporation | Develops high-pressure hydraulic brake tubes, AI-driven material quality testing, and corrosion-resistant tube coatings. |

| Sumitomo Riko Company Limited | Specializes in rubber and metal brake tube assemblies, vibration-resistant brake tubing, and AI-assisted leak detection solutions. |

| Eaton Corporation | Provides advanced brake tube materials, high-durability metal tubing, and precision-engineered brake fluid transfer systems. |

| Nichirin Co., Ltd. | Focuses on stainless steel and rubber-coated brake tubes, ensuring flexibility, high-pressure resistance, and AI-integrated quality control. |

| TI Fluid Systems | Offers lightweight aluminum and stainless-steel brake tubing, AI-assisted tube bending precision, and environmentally sustainable coatings. |

Key Market Insights

Parker Hannifin Corporation (18-22%)

Parker Hannifin is a leader in the market for automotive brake tube: Hydraulic and metal brake tubing, artificial intelligence (AI) integrated quality control, and corrosion-resistant coatings

Sumitomo Riko Company Limited (12-16%)

Sumitomo manufactures OEM and aftermarket brake piping with high-flexibility, vibration resistance, and AI-accelerated durability testing.

Eaton Corporation (10-14%)

Eaton supplies superlative brake tubing materials to enhance efficiency during fluid transit, thermal friction durability, as well as artificial intelligence (AI)-empowered materials diagnostics.

Nichirin Co., Ltd. (8-12%)

Nichirin's specialty, stainless steel brake tubing, combines high pressure resistance, flexible design, and AI-assisted production monitoring together.

TI Fluid Systems (5-9%)

TI Fluid Systems operates in the field of lightweight brake tubing and AI-driven accuracy tube manufacturing, corrosion and environmental friendly coating.

Innovations for next-gen brake tube, AI-based automotive fluid system manufacturing efficiency, and sustainable green material enhancements come from several automotive fluid transfer system manufacturers, brake component specialists and original equipment manufacturer suppliers. These include:

The overall market size for automotive brake tube market was USD 61.8 Billion in 2025.

The automotive brake tube market is expected to reach USD 127.4 Billion in 2035.

The demand for Automotive Brake Tubes is expected to rise due to increasing vehicle production, stringent safety regulations mandating efficient braking systems, and the growing adoption of advanced braking technologies. Additionally, rising demand for lightweight and corrosion-resistant materials, expansion in electric and hybrid vehicle manufacturing, and advancements in brake tube design for improved durability and performance are driving market growth.

The top 5 countries which drives the development of automotive brake tube market are USA, UK, Europe Union, Japan and South Korea.

Stainless Steel Brake Tubes to command significant share over the assessment period.

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.