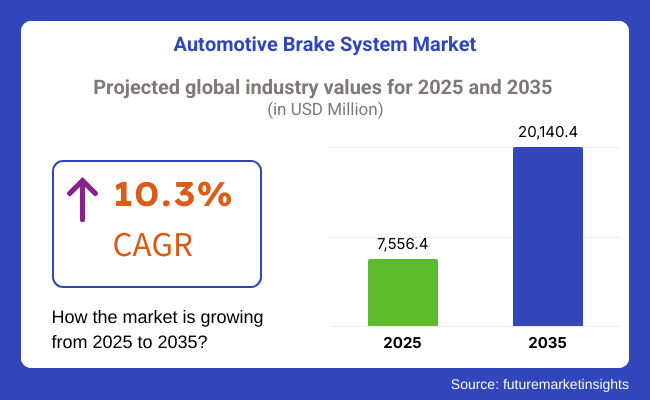

The global automotive brake system market is poised for significant growth between 2025 and 2035, driven by rising vehicle production, stringent safety regulations, and advancements in braking technology. The market is projected to expand from USD 7,556.4 million in 2025 to USD 20,140.4 million by 2035, registering a robust compound annual growth rate (CAGR) of 10.3% during the forecast period.

The market expansion will be primarily driven by Increasing consumer demand for improved vehicle safety and the implementation of regulatory mandates for advanced braking systems. The demand for advanced braking systems such as electronic and regenerative braking solutions is projected also to be driven by the growth in electric vehicles (EVs) and autonomous driving technologies.

Trends in automotive EV and autonomous driving are driving braking systems transformation. The rising adoption is attributed to the increasing integration of smart braking solutions brake-by-wire technology and autonomous emergency braking (AEB) have embellished the safety and efficiency of the vehicle. Moreover, the increasing preference for lightweight materials for brake components is further enhancing fuel efficiency and minimizing emissions.

Stricter regulations introduced by governments around the world require the integration of advanced braking systems in modern vehicles. All these factors combined make for a dynamic market landscape, driving innovative solutions and sustaining market growth throughout the forecast period.

The automotive brake system market trends are determined by the growing adoption of electronic braking systems such as Anti-Lock Braking System (ABS), Electronic Stability Control (ESC), and regenerative braking in electric and hybrid vehicles.

The pressure to meet these strict braking performance regulations has led automotive manufacturers to prioritize safety in their designs more than ever. Moreover, Smart braking technologies like brake-by-wire and AEB will unlock a new world of vehicle safety & performance.

The rising popularity of disc brake systems compared to conventional drum brakes, owing to their better braking performance, durability, and superior heat dissipation property, is another key factor boosting the market expansion. Moreover, due to increasing interest of motorsports and performance vehicles, the aftermarket segment is also growing as vehicle owners need high-performance braking components.

Explore FMI!

Book a free demo

North American Automotive Brake System Market Drivers Safety regulations, as well as the swift adoption of advanced driver assistance systems (ADAS) are driving North American Automotive Brake System market. Many technologies that are now commonplace in vehicles, such as Anti-Lock Braking Systems (ABS) and Electronic Stability Control (ESC), are mandated by regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA).

This increasing popularity of EVs in the United States and Canada is driving the demand for regenerative braking systems as well. Moreover, the growing manufacturing of high-performance and luxury vehicles also drives the demand for high-end braking solutions, thus, North America represents one of the prominent markets for manufacturers of brake systems.

Europe also holds a key market for automotive brake systems, driven by strict safety regulations and top players in the market including BMW, Mercedes-Benz and Volkswagen. In case of autonomous emergency braking (AEB), the EU is going to require AEB on all new vehicles and these rules had accelerated the adoption of electronic braking technologies. Furthermore, the region's emphasis on sustainability is creating a high demand for lightweight and green braking components.

Europe serves as a technology hub for braking systems growth owing to the increasing penetration of electric and hybrid vehicles, especially in Germany, France and the UK, further propelling the demand for regenerative and electronic braking systems.

China, India, Japan, and South Korea are developing large-scale industrial plants owing to the surge in automotive industry, which is expected to drive the growth of automotive brake system market in Asia-Pacific.

The demand for advanced braking systems is driven by rising disposable income, urbanization, and increasing ownership of vehicles. It is seen as a key manufacturing centre for both global and local automotive manufacturers, and major investments are taking place in smart braking solutions in the region.

Increased adoption of electric vehicles due to government initiatives in various countries, most notably in China is also opening doors for the growth of regenerative braking systems market. The growth of the market in Asia-Pacific is also fuelled by the presence of the key component suppliers along with strong aftermarket demand.

The Rest of the World (RoW) automotive brake system market is also propelling with regular growth on account of growing vehicle production and rising awareness towards safety in Latin America, Middle East and Africa. Generally, as safety regulations change, ABS and ESC are being adopted more in cars in countries like Brazil and Mexico.

Demand for advanced braking systems in luxury and sport vehicles is a trend that is emerging in the Middle East, while in Africa, there is slower adoption of safety technologies, which is being seen in other regions due to developing urbanisation in the countries. Overall market growth in these areas will remain gradual but steady as infrastructure expands, economies grow, and consumer demand for safer vehicles increases.

Challenges

High Cost of Advanced Braking Systems

The high cost associated with advanced braking technologies is one of the key challenges of automotive brake system market. Like AEB, ESC, and brake-by-wire, Advanced Brake Assist (ABA) systems, which help in collision avoidance, also require complex systems consisting of sensors, actuators, and electronic control units, all of which results in vehicular manufacturing costs. said the data left them with no useful information with which to price something well-suited for this price-sensitive market, especially in developing economies where everyone searches for budget-friendly solutions.

Moreover, the high cost of maintenance and replacement of electronic braking components may hinder the adoption of these systems among consumers. This cost optimization and economies of scale will be a necessary focus for the automakers and suppliers to ultimately make these platforms affordable and achieve greater market penetration and adoption.

Complex Integration and Compatibility Issues

Advanced brake systems can be found in every modern vehicle, but they come with a compatibility nightmare удар. The electronic braking systems have to enable seamless interaction with other vehicle systems such as ADAS, powertrains, and chassis control units.

It adds considerable development time and costs because it needs software algorithms for reliable communication between all those components, and it has to be calibrated as well. Old vehicles lack modern architecture and therefore retrofitting electronic braking solutions into them is complicated.

Car companies need to focus on R&D to make systems safer and more reliable, while taking into account the compatibility of systems. The integration issues facing the industry showcase the necessity of standardization efforts to overcome these hurdles and encourage the implementation of the technology on a wider scale.

Opportunities

Growth in Electric and Autonomous Vehicles

The rising adoption of electric and autonomous vehicles presents a significant opportunity for the automotive brake system market. Electric vehicles (EVs) involves the braking process, electric vehicles (EVs) have become increasingly reliant on regenerative braking systems designed to improve energy efficiency while extending battery life resulting in greater demand for advanced braking solutions.

Moreover, self-driving vehicles demand extremely responsive and fail-safe braking systems, resulting in advances like brake-by-wire and systems that integrate sensors directly into the braking process.

To address the twists and turns of self-driving and electric cars, automakers and suppliers are pouring money into next-gen braking technologies. Braking systems that are smarter and more efficient will have a competitive advantage and gain traction as global EV adoption speeds up.

Advancements in Smart and Lightweight Braking Systems

The demand for lightweight and intelligent braking systems is growing as automakers seek to enhance fuel efficiency and vehicle performance. These advancements including carbon-ceramic brake systems and certain aluminium-based components contribute to reducing the overall weight of the vehicle while preserving braking efficiency. Moreover, the cross-pollination of AI and IoT with braking systems is providing real-time feedback, predictive diagnostics, and improved safety measures.

Adaptive braking and remote diagnostics are some of the smart braking solutions witnessing high adoption in connected vehicles. With the evolving automotive technology, there are numerous opportunities for growth in the market landscape for manufacturers that can come up with lightweight, smart, and energy-efficient braking systems.

The automotive brake system market witnessed significant growth from 2020 to 2024, owing to rises in vehicle production, highlights in braking technology, and increased safety regulations across the globe. Widespread adoption of the disc brake, anti-lock braking system (ABS) and electronic stability control (ESC) occurred during this period on passenger and commercial vehicles alike. Trends such as enhanced vehicle safety and electrification also contributed to market growth.

Looking ahead to 2025 to 2035, the market is expected a wave of electric vehicles (EVs), autonomous driving technology and more stringent regulations on vehicle safety and emissions are predicted to change the market significantly. The future of the industry will be determined by the shift to regenerative braking in EVs, as well as smart braking systems that utilize artificial intelligence (AI) and connectivity capabilities.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory issues to stringent safety norms including ABS and ESC among other mandates across geographies. |

| Technological Advancements | Adoption of electronic braking systems and increasing utilization of lightweight materials, in addition to improvements in brake pad formulations. |

| Industry-Specific Demand | Growth driven by increase in vehicle production, higher demand for SUVs and commercial vehicles & stringent safety standards. |

| Sustainability & Circular Economy | Initial steps toward environmentally-friendly braking components, such as low and copper-free brake pads. |

| Production & Supply Chain | Shift in globalized supply chains, heavy dependence on key manufacturers in Asia, COVID-19 disruptions, semiconductor shortages |

| Market Growth Drivers | Growing vehicle ownership, increasing focus towards vehicle safety and movement of mobility-as-a-service (MaaS) platforms. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tougher safety regulations worldwide, reliance on AI-powered brake systems, and increased data security measures for brake-by-wire methodologies. |

| Technological Advancements | Regenerative braking on a mass scale, AI-based predictive maintenance, and fully Integrated smart braking solutions. |

| Industry-Specific Demand | Increased demand driven by EV proliferation, autonomous vehicle integration and ongoing innovations in fleet management systems. |

| Sustainability & Circular Economy | Wide usage of sustainable materials, better recycling of brake components, and biodegradable brake fluids. |

| Production & Supply Chain | Shift towards localized production, AI-driven supply chain forecasting, and enhanced automation in brake manufacturing. |

| Market Growth Drivers | Increased adoption of electric vehicles, the proliferation of autonomous vehicle fleets and renewed regulatory scrutiny around brake dust emissions. |

The demand for automotive brake systems in the USA market is primarily driven by the increasing production of vehicles, the implementation of stringent safety regulations, and the growing adoption of advanced braking technologies such as electronic stability control (ESC) and automatic emergency braking (AEB). A transition to EVs (electric vehicles) and regenerative brakes also contributes to growth in the market.

These main players are placing great emphasis on the use of lightweight materials and digital integration to improve performance. The industry's enlargement is bolstered by the presence of major automakers and suppliers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

In the UK market, strict safety regulations and fast growing van EV adoption are propelling the evolution. Government policies encouraging the use of green transport and low emission vehicles are gradually adopting regenerative braking systems.

The demand for disc brakes and electronic braking systems is on the rise as they are lightweight, cater to the demand of automakers for less weight and integrating electronic solutions. Hybrid vehicle popularity also helps the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

Stringent safety and environmental regulations along with the rising adoption of ADAS (Advanced Driver Assistance Systems) significantly influence the EU automotive brake system market. High-growth demand is integrated from regions, and countries such as Germany and France drive high technological innovations in the countries.

The shift toward electrification and autonomous vehicles is generating demand for the next generation of braking systems, including electro-hydraulic braking (EHB) systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

Japan's automotive market is well-driven by the high-demand vehicles in Japan, and automotive safety and vehicle quality are rigidly implemented in Japan. Shift towards brake-by-wire technology and integration of AI driven braking assist systems are on the rise.

Demand for regenerative braking solutions is being driven by a strong electric vehicle (EV) market in the country, supported by major manufacturers such as Toyota and Honda. The growth of the market is also backed by government policies in favour of green mobility.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The South Korean market is growing with an increased output of electric and autonomous vehicles. South Korea has also been made a top player in smart car technology, with major national manufacturers like Hyundai and Kia pouring money into smart brake methods, including AI-driven brake systems and preventative maintenance systems.

The drive toward sustainable practices and stringent emissions legislation are speeding up implementation of regenerative braking systems. Moreover, partnerships with international tech companies further strengthen market positioning.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The automotive brake system market segment in terms of brake type is dominated by disc brakes attributed to their automatic and anti-lock braking features with better heat dissipation than drum brakes. These types of brakes are commonly used in passenger vehicles and high-performance cars, where fast braking response is important. They even benefit from advancements, such as having ventilated and slotted rotors.

Tightening safety regulations in Europe and North America have contributed to the automaker trend toward disc brake adoption. Moreover, the market is also being driven by the growing penetration of electric and hybrid vehicles, which need dependable braking systems. The growing use of advanced braking technologies such as regenerative braking also drives the growth of disc brakes.

Drum brakes still account for a significant market share, especially in entry-level and budget vehicles because of their manufacturing and maintenance cost advantages. These brakes are widely adopted for the rear wheel applications of cars and commercial vehicles that don't necessarily focus on having higher braking force. Affordable systems excite sustained demand for emerging markets such as India and China in the Asia-Pacific.

Sure we see disc brakes start to take over a lot of applications, but things like self-adjusting mechanisms and new friction materials still keep drum brakes relevant. Their performance and life in heavy commercial vehicles, where more life is preferred over performance, also feeding data for the continues demand in market.

Mid-sized passenger cars represent a dominant segment in the automotive brake system market due to their widespread adoption across developed and developing regions. Demand grows for these vehicles, especially in countries such as China, India and Brazil, where there is an expanding middle-class population and growing urbanization.

And because mid-sized cars tend to be critical vehicles for manufacturers, they are focusing on advanced braking technologies - for example, anti-lock braking systems (ABS) and electronic stability control (ESC) systems to help ensure safety (and regulatory compliance).

Amidst growing customer preference around fuel-efficient and affordable vehicles, this segment ensures steady demand for reliable braking systems, subsequently positioning itself as one of the key revenue-generating segments of the overall market.

The light commercial vehicle segment is also booming, supported by the rapid growth of e-commerce and last-mile delivery fleets. LCVs demand for heavy-duty braking systems because they undergo frequently start-stop operations in the urban environment. Disc brakes are now getting to be used more in LCVs for its effectiveness and better safety features.

Moreover, government regulations that require improved braking ability and vehicle safety standards also demand more from brake systems in this segment. The increasing adoption of electric LCVs also fuels the demand for regenerative braking system and hence, this segment is a significant growth driver in the market for automotive brake system.

The Automotive Brake System Market is essential for ensuring vehicle safety, performance, and compliance with regulations. The growth of the market will be propelled by technological advancements, growing electric vehicles (EVs) adoption, and strict safety rules & regulations. Advanced Driver Assistance Systems (ADAS) along with electronic braking systems (EBS) minimize stopping distances and improve handling.

Sustainability trends have led to the creation of low-emission, eco-friendly brake materials. The world market has some key players investing in smart braking technology, regenerative braking, and AI-based safety systems.

Moreover, mergers and acquisitions (M&A) and strategic alliances are a part of the market evolution. With a determined focus on autonomous driving and electric mobility, intelligent, lightweight, high-performance braking solutions have greater demand.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Robert Bosch GmbH | 15-20% |

| Continental AG | 12-16% |

| ZF Friedrichshafen AG | 10-14% |

| Aisin Seiki Co., Ltd. | 8-12% |

| Brembo S.p.A. | 6-10% |

| Other Companies | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Robert Bosch GmbH | Leading in electronic braking systems, ABS, and regenerative braking for EVs. Focuses on automation and connectivity in braking technology. |

| Continental AG | Develop hydraulic brake systems, lightweight brake components and EV-specific braking solutions. |

| ZF Friedrichshafen AG | Provides solutions such as the electric park brakes, electromechanical brake control systems, and the mechatronic braking solution. |

| Aisin Seiki Co., Ltd. | Develops hydraulic brake systems, lightweight brake components, and EV-specific braking solutions. |

| Brembo S.p.A. | High-performance brake components including ultra-premium disc brakes and disk carbon-ceramic technologies. |

Key Company Insights

Robert Bosch GmbH

Robert Bosch GmbH continues to possess a considerable share of the global automotive brakes market along with being a forerunner in innovating electronic braking systems (EBS), anti-lock braking systems (ABS), and regenerative braking technology. Sensor System for Connected Mobility.

The new company commits itself to focus on automation, connectivity and sustainability while ensuring superior safety in the latest vehicles. Bosch is also developing brake-by-wire systems, as well as AI-based brake systems.

Bosch takes advantage of global reach and several partnerships with leading automotive producers, preserving its position as a leader in cutting-edge innovation for EV and autonomous-vehicle braking solutions. The focus on reducing brake dust emissions and promoting the use of eco-conscious materials further strengthens the company's position as a leader in sustainable braking solutions for the future.

Continental AG

Continental AG (CNCFF) is a leader in intelligent braking technologies and advanced driver assistance systems integration, improving vehicle safety and efficiency. The company focuses on electronic stability control (ESC), electric braking systems, and predictive maintenance.

Smart braking solutions require a strong focus on digitalization and AI which Continental is making a heavy investment into, stating it is key in producing solutions that support responsiveness and reliability.

A major focus area is on low-wear brake materials, to lessen environmental impact. Continental is active in markets around the world, and teams up with key OEMs and EV manufacturers to design brake systems for the future. Continental's investments in automation are paving way for smart infrastructure focusing on sustainable future mobility solutions.

ZF Friedrichshafen AG

ZF Friedrichshafen AG is a premier supplier of cutting-edge mechatronic braking systems, electronic park brakes and integrated brake control solutions for EVs. And the company’s smart control modules maximize efficiency of braking at compliant levels with safety regulations. The company is increasingly focused on the development of braking solutions for electric and autonomous vehicles, bolstering its role in the future mobility ecosystem.

This has helped it grow its share in the EV space through partnerships and acquisitions. As the demand develops for energy-efficient and high-reliability braking systems, the company's expertise in lightweight, high-performance braking technologies helps it to continue to drive its competitive position.

Aisin Seiki Co., Ltd.

Aisin Seiki Co., Ltd. is a major player in hydraulic braking systems and lightweight brake components. The company is focused on enhancing fuel efficiency and vehicle performance through advanced braking materials and manufacturing processes. Aisin has also entered into several strategic partnerships and joint ventures in North America and Asia to grow its presence in those markets.

As this segment continues to expand, Aisin is devoting resources to regenerative braking and friction reduction technologies that are tailored specifically for EVs. Focusing on cost-effective production and precision engineering, the company delivers high-quality braking components with global safety and environmental standards.

Brembo S.p.A.

Brembo S.p.A. is known for high-performance braking solutions catering to luxury, sports, and high-performance vehicles. The brand specializes in carbon-ceramic brakes, lightweight disc brakes and precision braking components. Brembo has also diversified its products with EV-compatible braking systems and smart braking systems designed for autonomous driving.

The company has developed long-lasting, low-noise, and eco-friendly braking materials due to their focus on sustainable and innovative solutions. Today, Brembo is present in motorsports and premium automotive segments, and is widely considered the quality and performance benchmark in the automotive brakes system market.

The global Automotive Brake System market is projected to reach USD 7,556.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 10.3% over the forecast period.

By 2035, the Automotive Brake System market is expected to reach USD 20,140.4 million.

The Disc Brake segment is expected to dominate the market, due to superior heat dissipation, consistent performance, lower fade risk, better stopping power, reduced maintenance, and increasing adoption in passenger and commercial vehicles for safety.

Key players in the Automotive Brake System market include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Brembo S.p.A.

In terms of System Type, the industry is divided into Disc Brake, Drum Brake.

In terms of Vehicle Type, the industry is divided into Mid-Sized Passenger Cars, Compact Passenger Cars, Luxury Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Premium Passenger Cars.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.