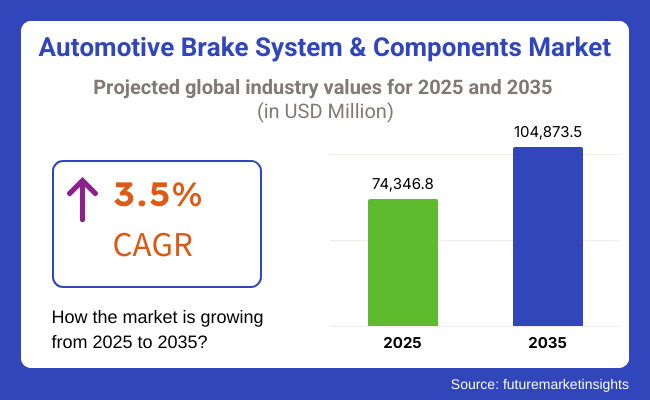

The Automotive Brake System & Components Market is projected to experience steady growth over the next decade, driven by increasing vehicle production, advancements in braking technology, and stringent safety regulations. The market is expected to grow from USD 74,346.8 million in 2025 to USD 104,873.5 million by 2035, registering a CAGR of 3.5% during the forecast period. Rising consumer demand for enhanced vehicle safety, along with the integration of advanced driver-assistance systems (ADAS), is expected to further boost market expansion.

The Automotive Brake System & Components Market is on the course of persistent growth due to various factors like the rise in vehicle production, the increase in safety regulations, and the technological development in braking systems. The most influential are electronic braking systems, regenerative braking technologies for EVs, and the integration of lightweight brake components.

The government's ruling for antilock braking systems (ABS) alongside electronic stability control (ESC) has provided additional push to the market growth. The advent of autonomous and electric vehicles has also had a bearing on the corresponding innovation of the smart braking solutions, which now in return ensure the transportation systems are safer, efficient, and perform better.

Most of the trends that are the cause for the automotive brake system & components market to change are the growing trend for electronic braking systems, regenerative braking technology in the electric vehicles (EV), and the main driving force for new light and strong brake components which are helping to develop vehicle efficiency.

The growth of disc brakes in passenger cars rather than drum brakes due to the transition shift over is another key factor added to the list. New rules by the government that are oriented towards the protection of vehicle occupants have been effective

For instance, they have made it a requirement for antilock braking systems (ABS) and electronic stability control (ESC) to be fitted in vehicles. These have indeed speeded up the innovation process in braking systems. Further on, the popularity of the electrification and the autonomous driving trend has led the brake manufacturers to push for smart brake solutions, that is, the incorporation of brake-by-wire technology.

Explore FMI!

Book a free demo

The North American automotive brake system and components market is propelled by the stringent vehicle safety standards and the accelerated implementation of the advanced braking technologies. The National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) require features like antilock braking systems (ABS) and electronic stability control (ESC), which increases the need for high-performance braking solutions.

On top of that, the penetration of electric vehicles (EVs) and the autonomous vehicles as a factor of innovation in these technologies is a strong push for manufacturers to develop regenerative braking and brake-by-wire technologies. The exploration of new concepts connected with braking systems is promoted not only by the presence of key automotive players in the USA and Canada but also by their commitment to research and development.

Europe is still one of the main markets for automotive brake systems, and with major contributions from Germany, France, and the UK, where most of the automobile manufacturers are located, the region is expected to see growth in this domain. The area is the leader in braking system innovation due to strict EU emissions regulations and the rising demand for lightweight, high-performance brake solutions.

The transition to electric and hybrid vehicles is further fuelling investments in regenerative braking and electronic brake systems. Furthermore, the European promotion of road safety measures and the installation of ADAS technologies in the latest cars are driving up the sales of disc brakes, brake-by-wire, and low-noise, high-efficiency braking components.

The Asia-Pacific region is the fastest-growing market segment for automotive brake systems, with the growth partly propelled by the record volume of automobile production in China, India, and Japan. The region gains from rapid urbanization, more disposable incomes, and government support for the adoption of electric vehicles (EVs). China is, being the largest car manufacturer in the world, is spurring the transition to regenerative and electronic brake systems in the electric vehicles sector.

Furthermore, India is ushering in a new wave of stricter vehicle safety rules and regulations, for instance, the requirement of ABS in two-wheelers and passenger vehicles, which pushes the aftermarket sale as well. Japan, the land of breakthrough automotive technologies, has not ceased to develop new generation braker solutions by focusing on efficiency and environmental sustainability.

The automotive brake system in the Rest of the World (RoW) like Latin America, the Middle East, and African countries is quite different and overlooks the requirement for handling problematic markets and the car manufacturers. Latin America, Brazil, and Mexico, in particular, have been experiencing a surge in the demand for advanced but economical brake systems, which are made inevitable by governments' newly passed legislation implying mandatory ABS and ESC systems.

The Middle East, which has a different character due to the very luxury car demand which drives the premium braking technology to become a viable option, is also preferring the premium braking technologies. In Africa, the automotive industry is in its infancy and is steadily broadening, thus, the requirement for both low-cost and long-lasting braking products increases as the number of vehicles in developing countries continues to skyrocket.

Challenges

High Costs of Advanced Braking Technologies

The introduction of advanced braking technologies like electronic braking systems (EBS), brake-by-wire, and regenerative braking is a major drawback for vehicle costs. These systems need the most advanced higotech sensors, actuators, and electronic control units (ECUs), which certainly increase the manufacturing expenses. Plus, there are carbon-ceramic and composite brake materials, which are very durable and light-weight but are generally much costlier than traditional steel parts.

The price increase of these advanced braking systems makes them not well-suited in certain markets, especially in developing areas. Car manufacturers carry the dual burden of balancing cost as well as performance apart from adhering to stringent safety norms, hence making them cheap a viable obstacle for expansion.

Counterfeit and Low-Quality Brake Components

The increasing number of counterfeit and low-quality brake components has added a strong issue to the automobile brake system and brake parts market. A number of illegal companies are selling low-quality products like brake pads, rotors, and calipers which do not conform to standard safety and performance levels, thus allowing for an increased brake failure and accidents risk.

Emerging regions, where government actions are scanty, have proved to be hollow shells for such false products. Further, the market for genuine and high-quality solutions is undervalued due the existence of cheaper alternatives, thus entailing a loss of revenue for the honest producers. The counterfeit brake piece industry would be best combated by stronger regulations and increased consumer vigilance.

Opportunities

R&D in Lightweight and High-Performance Brake Materials

The market for brake systems and components in the automotive sector has a new professional opening thanks to the quest for lightweight and high-performance brake materials. Producers are jumping into the development of carbon-ceramic and composite brake materials that last longer, resist high temperatures, and weigh less, thereby allowing vehicles to be more efficient and use less fuel. This initiative for lighter vehicles with advanced braking components is also addressing the car makers' obligations to stringent emissions regulations.

Plus, this movement is accompanied by the growing diffusion of electric and hybrid types of vehicles, the braking efficiency of which impacts battery performance, thus promoting the groundwork of the next generation with enhanced safety, sustainability, and performance.

Integration of IoT and AI in Braking Systems

Merging the Internet of Things (IoT) with Artificial Intelligence (AI) into braking systems forms an exceptional opportunity for the market. Smart braking solutions such as predictive maintenance, real-time diagnostics, and adaptive braking systems add up to the safety and performance of the cars. AI-driven autonomous emergency braking (AEB) systems are being announced in modern cars, hence significantly affecting the number of accidents.

Moreover, the connected vehicle technology creates conditions for integrating braking systems with other vehicle systems, thus improving the responsiveness and efficiency of both. Development of electric and autonomous vehicles will reach the peak as the companies will spin their wheels on various IoT-enabled and AI-driven braking technologies.

The automotive brake system and part market is now up at the top with high-tech features due to the leaps made from 2020 and 2024, resulting from the riff of electric cars, safety policy regulations, and the increase in manufacture of vehicles. The performance of such systems as anti-lock braking systems (ABS), electronic stability control (ESC), and regenerative braking systems turned the brakes feature of choice also during the period of electric car development. Similarly, brakes are now designed under the auspices of autonomous systems that brake on their own.

The next ten years will be the era of revolution starting with the smart braking mechanisms passing through the artificial intelligence (AI) in the vehicle safety lines and the lightweight sustainable materials use will be at the top. The regulations will mandate more strictness and the innovation of products would be in the direction of the already mentioned advanced braking systems.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Framework | Implementation of Euro 6 and other stringent emission standards, thus demanding the installation of advanced braking solutions for improved safety. |

| Innovative Developments | Increase in rates of adoption of ABS, ESC, and electronic brakeforce distribution (EBD). The process of regenerative braking was improved in hybrid and electric vehicles. |

| Specialized Market Need | Overwhelming demand from passenger vehicles, commercial fleets, and electric mobility solutions. |

| Circular Economy& Sustainability | First use of lightweight brake components and a shift to low-copper friction materials. |

| Manufacturing and Distribution | Unavoidable hindrances due to shortages in semiconductors and the instability of commodity prices. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Framework | Introduction of next-generation safety regulations, including the stricter braking efficiency standards for electric vehicles and self-driving vehicles. |

| Innovative Developments | AI-assisted braking systems, incorporation of machine learning algorithms on a predictive maintenance basis, and the further advancement of fully autonomous braking technologies. |

| Specialized Market Need | Development of new applications in self-driving cars, next-generation battery electric vehicles, and fleet management solutions in smart cities. |

| Circular Economy& Sustainability | Using more eco-friendly brake pads, carbon-ceramic braking solutions, and closed loop recycling schemes for used brake components. |

| Manufacturing and Distribution | AI-powered supply chain optimization, local production hubs with sustainable sourcing, and block chain-enabled traceability of the brake component originality. |

The USA automotive brake system & components market is propelled by the buoyant vehicle production, stringent safety regulations, and the increasing consumer preference for advanced braking technologies. The rise of electric vehicles (EVs) and autonomous driving features is an additional factor which serves as the enabler market development.

In the same way, the NHTSA and FMVSS regulations are improving not only the brake performance standards but the overall safety of the vehicles themselves. The application of regenerative braking technology in EVs is being rapidly introduced to the market. Furthermore, sustainability trends, such as eco-friendly brake pads, are a major factor in the development of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The UK market gets an advantage as EV adoption increases, cash grants are offered for green transportation, and adherence to Euro NCAP safety ratings is achieved. The demand for regenerative and electrical braking systems is being driven forward by the desire for sustainable mobility. The market gets the benefit from the presence of high-end car brands and the premium vehicle safety concern.

Despite the Brexit challenges, next-generation automotive technologies investments make significant contributions to the development of the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.3% |

The European Union's (EU) automotive industry is driven by stringent emission norms, advanced vehicle safety requirements and unprecedented growth of electric vehicles (EVs). The European Green Deal and Euro 7 regulations are the major drivers of the development of low-dust and high-efficiency braking systems.

Major OEMs, such as the three leading innovative countries Germany, France and Italy, are actively involved in the development of smart brake technologies. The transition to the usage of lightweight materials and electronic braking systems further back the market upturn.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.6% |

Innovation in technology, the implementation of high-grade safety measures, and the strong commitment of the automotive sector in research & development stand out as the major characteristics of the Japanese automotive market. Top car manufacturers in the country are now concentrating on the ranks of hybrid and electric vehicles which in turn increases the need for cutting-edge braking systems.

The increase in the use of electronic stability control and regenerative braking solutions is being recorded. The government also supports the development of autonomous vehicles which makes the market more viable. In contrast, the automotive industry as a whole, being an old player, contributes only a small measure of growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

One of the main factors driving the growth of South Korea's market is the electric vehicle industry's rapid growth, advances in ADAS integration, and government policies that support the automotive industry. Major local car manufacturers such as Hyundai and Kia, together with the need for high-performance braking components, are the key players in that market.

On the other hand, the development and manufacturing of smart braking systems and sensor-based technologies are next to the country’s paradigm for connectivity and autonomous mobility.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.4% |

Drum Brake Segment Leads in Durability and Cost-Effectiveness

Drum brakes remain a popular choice in OEMs due to their lower cost and longer life, particularly in entry-level vehicles and utility trucks. They are the most preferred option for reliable braking applications of rear wheels, which is the concept for reducing the weight of the device. Plus, the research and development of new materials and mechanisms for self-reflex adjustment have resulted in a higher reconfiguration probability and better service.

The emerging markets of India and Southeast Asia are adopting the drum brake system due to issues of affordability and maintenance. Nevertheless, the segment is challenged by disc brakes in high-performance and luxury vehicles as they outperform in heat dissipation and braking power.

Disc Brake Segment Gains Prominence with Safety and Performance Benefits

Disc brakes, particularly rotor-caliper systems, have progressively taken over the OEM market as a result of their excellent braking efficiency, heat dissipation, and shorter stopping distances. Starting to become a standard in mid-range passenger cars besides high-performance and premium vehicles, disc brakes are attractive for customers who demand better safety and for manufacturers who have to comply with stricter regulations.

The progress in the use of ceramic and composite materials for rotors has further improved the performance. North America and Europe are at the forefront with their strict braking efficiency regulations. Also, the spreading of electric vehicles (EVs) that need regenerative braking is contributing to the increase of this technology.

Passenger Car Segment Dominates with Growing Demand for Safety and Performance

Passenger cars represent the most significant portion of the total automotive brake system and components market, predominantly due to the rising production of vehicles and consumers' demand for better safety features. This segment accrues the adaptation of high-end technology braking systems like anti-lock braking systems (ABS) and electronic brakeforce distribution (EBD), which is intertwined with the new global safety standard and thus are becoming widespread.

The emergence of electric and hybrid vehicles has also accelerated the production of new braking technologies like regenerative braking. The Asia-Pacific region has been is the leading engine for development in this sector, primarily due to China and India thriving as automobile sales giants and having a higher disposable income contributing to a growth in car ownership.

Heavy Commercial Vehicles (HCV) Rely on Advanced Braking for Safety Compliance

Heavy commercial vehicles (HCVs) need effective and durable braking systems, as their weight is enormous, and the distance for a full stop is vast. Air disc brakes and electronic braking systems (EBS) are fast becoming the most popular in this segment for better braking performance and safety. Regulatory mandates such as ECE R13 in Europe and FMVSS 121 in the USA are urging manufacturers to install state-of-the-art brake technologies to save lives on the road.

Fleet operators are opting for brake components that are not only economical over the long run but also tend to last longer thus aiding in decreasing the time out of commission. The market for HCV brake components is experiencing tremendous growth in logistics, construction, and minerals sectors particularly in North America and Europe.

The automotive brake system and components sector is a vital subsect of the automotive industry worldwide, and it's being propelled by the ever-increasing number of new vehicles on the road, more focused safety policies, and development in braking technology.

The market is expanding due to growth in the consumption of electric vehicles (EVs), high-performance brake systems, and electronic braking as well as the deployment of products like Anti-Lock Braking Systems (ABS) and Electronic Stability Control (ESC). The main actors maintain their significance with product innovation, the establishment of strategic partnerships, and expansion into new regions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Robert Bosch GmbH | 15-20% |

| Continental AG | 12-16% |

| ZF Friedrichshafen AG | 10-14% |

| Brembo S.p.A. | 8-12% |

| Akebono Brake Industry Co., Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Robert Bosch GmbH | Develops ABS, ESC, regenerative braking, and iBooster technology. Focuses on safety, efficiency, and sustainability. |

| Continental AG | Manufactures hydraulic braking, disc brakes, and electronic braking systems. Invests in smart braking solutions. |

| ZF Friedrichshafen AG | Produces advanced brake-by-wire and integrated brake control systems. Enhancing electrification strategies. |

| Brembo S.p.A. | Specializes in high-performance braking solutions for sports cars, luxury vehicles, and motorsports. |

| Akebono Brake Industry Co., Ltd. | Focuses on ceramic and low-dust brake pads for improved durability and performance. |

Key Company Insights

Robert Bosch GmbH

Robert Bosch GmbH stands at the top of the world as the largest automobile parts manufacturer, especially in the braking technology sector, with an emphasis on safety and electronic braking solutions. The company has developed the pioneering booster technology, a state-of-the-art braking system that is particularly useful for the efficiency of hybrid and electric vehicles.

Bosch has concentrated on creating cutting-edge solutions such as regenerative braking and advanced ABS in order to meet ever more stringent safety and emissions regulations. Environment Bosch has built strong partner relationships with the global leading automotive manufacturers, ensuring the controversial market share the company's got. Bosch is all for sustainability and digitalization, and therefore it pumps a lot of money into research and development of the smart and self-driving braking systems for the mobility of the future.

Continental AG

Continental AG is a central player in the automotive brake sector, supplying diverse electronic and hydraulic braking systems. The company directs its focus towards connected and automated braking technologies, which consequently enhances vehicle safety and efficiency. Among its innovations are the intelligent brake control systems, adaptive braking mechanisms, and considerably reduced emissions and brake dust solutions.

Continental is planet-conscious and is making strides in the area by investing in the manufacture of sustainable brake materials and friction solutions that adhere to global environmental rules. In addition to having a strong global supply network, the company intends to increase the number of customers, especially in the electric vehicle field, via collaboration with automakers.

ZF Friedrichshafen AG

ZF Friedrichshafen AG has hands down the leading know-how concerning brake-by-wire and integrated brake control systems. The vehicle industry, including electric and autonomous cars, has altered the functions and technological prerequisites such systems need, and the company is just one of the businesses that have had to adapt.

Thermal and power consumption are two areas of material handling that ZF has been working on by integrating lightweight materials and energy-efficient braking solutions. Besides, ZF sees the added value in automated braking, making use of intelligent braking algorithms.

The transfer of knowledge from vehicle dynamics to braking technologies is the leading framework across ZF's next generation of brakes development. The company is gaining more and more additional density in a global market due to key acquisitions, which ensures the role of ZF in the changeover to electrification.

Brembo S.p.A.

Brembo S.p.A. is the recourse for high-performance braking systems primarily dedicated to sports cars, luxury vehicles, and motorsports. The corporation is a trailblazer in carbon-ceramic brake technology providing little or no braking to heat and high durability. In order to cover the ever-increasing demand of customers in the electric and high-performance vehicle segments, Brembo is creating lightweight and energy-efficient braking solutions.

Sustainability and innovation are the two areas where the company is making a mark, as it is investing in digital braking systems and advanced control systems. Brembo System controls the market due to its global presence and strong partnerships with premium car manufacturers.

Akebono Brake Industry Co., Ltd.

Akebono Brake Industry Co., Ltd. has earned a reputation for its quiet and dust-free brake pad technology and consequently supplies to OEMs and aftermarket customers around the world. It has emerged as a front-runner in ceramic brake solutions by sticking to the mission of better durability and performance. Akebono has solidified its competitiveness in global markets by having a strong presence in the North American and Asia-Pacific regions.

With a green commitment to manufacturing and environmentally friendly brake components, Akebono is developing innovative friction materials that cut down on emissions. The company is also innovating in electronic braking technologies by keeping step with the growth of electric and autonomous vehicles.

The global Automotive Brake System & Components market is projected to reach USD 74,346.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.5% over the forecast period.

By 2035, the Automotive Brake System & Components market is expected to reach USD 1,04,873.5 million.

The drum brake segment is expected to dominate the market, due to cost-effectiveness, durability, simpler maintenance, and higher effectiveness in rear-wheel applications, especially in budget-friendly and commercial vehicles, ensuring widespread adoption.

Key players in the Automotive Brake System & Components market include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Brembo S.p.A., Akebono Brake Industry Co., Ltd.

In terms of sales channel, the industry is divided into OEM, Drum, Brake Shoes, Wheel Cylinder, Rotor, Caliper, Brake pad

In terms of Vehicle Type, the industry is divided into Passenger Car, LCV, HCV

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.