Between 2025 and 2035 the automotive brackets market will expand significantly because of two key factors: rising production of passenger and commercial vehicles along with developing lightweight materials combined with increasing structural stability requirements for automotive components.

Different automotive components like engine mounts as well as chassis and interior framework depend on brackets for sustainable performance and improved safety measures. Market growth becomes stronger because manufacturers use high-strength alloys and composite materials to achieve fuel efficiency and weight reduction.

The manufacturing industry contributes to enhanced bracket performance by implementing innovative methods such as precision machining and 3D printing which also decrease manufacturing costs.

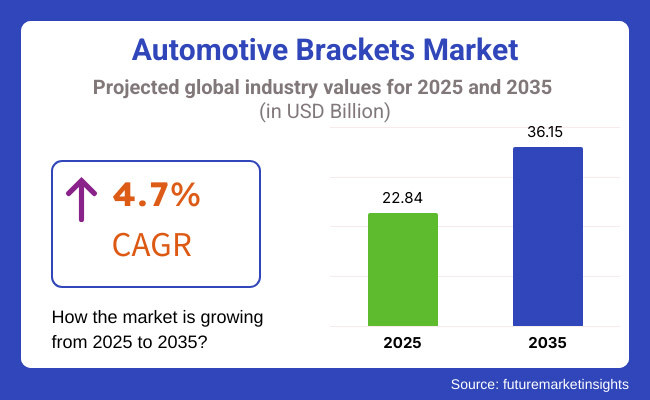

Research indicates that the automotive bracket market started from USD 22.84 Billion in 2025 and will attain USD 36.15 Billion by 2035 showing a 4.7% Compound Annual Growth Rate. Expansion in the market occurs due to the rising number of electric vehicles (EVs) and increasing demand for lightweight materials and recent safety standards becoming stricter.

Market developments in brackets focus on building integrated structural health monitoring and real-time diagnostic capabilities with sensors inside the brackets as a primary trend. The future of autonomous vehicles with ADAS technologies drives the need for exact engineering solutions to mount sensors and cameras.

Explore FMI!

Book a free demo

Automotive Brackets in North America the market opportunity is relatively overshadowed by vehicle production volume, consumer demand for EVs, and robust regulatory policies driving better automotive safety. Lightweight brackets manufactured using metal, such as aluminium, and carbon fiber composites are increasingly being adopted to reduce the weight of vehicles in North America.

Additionally, the presence of major automakers and technological advancements in vehicle assembly processes are likely to propel the growth of the market. Moreover, sustainability is becoming an increasingly important factor, resulting in new investments into recyclable or eco-friendly bracket materials.

Continued growth of the automotive brackets market in Europe is driven by revaluating CO₂ levels of automotive emissions imposed by the government, the swift electrification of vehicles, and innovative lightweight automotive materials. In places like Germany, France, and the UK, automotive standards for safety and efficiency lead the world, and issues like the use of high-performance brackets are strenuously debated.

Modular vehicle architectures in which parts can be inserted between brackets, and components built of 3D-printed parts, are transforming the sector. The push towards sustainable vehicle production and circular economy practices by the European Union is also supporting the trend towards advanced bracket materials.

By region, Asia-Pacific represents the top biggest automotive brackets forced in the world, expected to witness the highest boom in the market, backed by upsurge in the vehicle production, high adoption of electric and hybrid vehicles, and rapid development of automotive infrastructure.

Regions such as China, Japan, South Korea, and India are making substantial investments in producing high-strength, light-weight brackets for new automotive designs. Market growth is driven by the regional supply chain network, discovery of new material science and increasing partnerships between automakers and bracket manufacturers.

Government policies supporting EV production, as well as investment in advanced manufacturing technologies, have also been turbocharging demand for innovative automotive bracket solutions.

Challenge

High Costs and Regulatory Complexities

The Automotive Brackets Market contends with challenges such as increasing material costs, stringent regulatory compliance, and supply chain disruptions. It requires high-strength materials, including aluminium, steel, and composite alloys to manufacture brackets, leading to higher production costs.

Manufacturers also face stiff regulations for vehicle safety and emissions that affect the manufacturing and design of vehicles, such as the EU's CO2 emission targets and National Highway Traffic Safety Administration (NHTSA) standards. This is a challenge for OEMs to invest in lightweight yet high-performance brackets that meet performance along with the regulatory and durability requirements - balancing the overall cost.

Market Saturation and Competitive Pricing Pressures

Automotive brackets are used in high volume, and their mass market has pushed manufacturers to fight for price, leaving narrow profit margins. Competition is also increased by the availability of low-cost substitutes especially in developing countries. Changes in the availability of raw materials also have an effect on supply chain stability and production costs.

In order to compete, manufacturers will need to develop durable, corrosion-resistant, and weight-optimized brackets as well as increase supply chain resilience.

Opportunity

Rising Demand for Lightweight and High-Performance Brackets

Some of the industries that are increasingly more focused on vehicle weight reduction and fuel efficiency demand bracket assembly being made from advanced materials to reduce vehicle weight. Auto manufacturers are using aluminium and composite replacements for conventional steel brackets to provide additional structural integrity without adding weight.

Demand for battery packs and electronics results in specialized brackets for EVs Business with high tech manufacturing method like as additive manufacturing and exactness building will get business advantage in changing over business.

Advancements in Smart Brackets and Modular Designs

The industry is experiencing a transition phase, with technological breakthroughs, such as smart sensor integration and modular designs, changing the dynamics of automotive brackets market. Automakers are creating tough brackets with vibration-dampening technologies, real-time performance monitoring, and AI-assisted structural optimization.

This will continue to create growth opportunities due to the growing expansion of modular bracket designs that provide ease of assembly and maintenance. Market leaders will consolidate their position using newly developed advanced material compositions, AI-driven design enhancements, and adaptive bracket configurations.

During 2020 and 2024 the Automotive Brackets Market demonstrated steady growth which resulted from increasing vehicle manufacturers while demands for lightweight parts along with progress in structural reinforcement solutions. Car manufacturers used corrosion-resistant materials while refining bracket dimensions to achieve better vehicle performance.

Manufacturers faced hurdles because of supply chain interruptions together with unstable material expenditure and requirements to abide by changing pollution standard regulations. The market evolution required companies to purchase sustainable materials while improving their supplier networks as well as their production efficiency.

The market transformation from 2025 to 2035 will debut because of AI-assisted structural engineering alongside sustainable material innovations and 3D-printed bracket adoption growth. The development of multifunctional brackets which unite electric and mechanical capabilities will advance because of autonomous and electric vehicle growth.

Automakers will create environmentally friendly bracket solutions through their focus on circular economy initiatives and recyclability. The Automotive Brackets Market's evolution will be driven by businesses who implement AI production methods combined with intelligent materials alongside sustainable distribution systems.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with emissions reduction and safety standards |

| Technological Advancements | Development of corrosion-resistant and high-strength brackets |

| Industry Adoption | Increased use in internal combustion engine (ICE) vehicles and hybrid models |

| Supply Chain and Sourcing | Dependence on traditional metal suppliers and global distribution networks |

| Market Competition | Presence of global and regional component manufacturers |

| Market Growth Drivers | Demand for lightweight and high-performance vehicle components |

| Sustainability and Energy Efficiency | Initial focus on reducing material waste and improving strength-to-weight ratios |

| Integration of Smart Monitoring | Limited use of real-time diagnostics and predictive maintenance |

| Advancements in Bracket Applications | Use in traditional vehicle frames, engine mounts, and suspension systems |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of lightweight material regulations, recyclability mandates, and advanced safety compliance. |

| Technological Advancements | Integration of AI-driven bracket designs, real-time performance monitoring, and smart sensor applications. |

| Industry Adoption | Expansion into electric and autonomous vehicles, focusing on battery and sensor support brackets. |

| Supply Chain and Sourcing | Shift toward sustainable sourcing, localized production, and AI-assisted supply chain optimization. |

| Market Competition | Growth of AI-assisted bracket design firms, additive manufacturing specialists, and modular system developers. |

| Market Growth Drivers | Increased investment in sustainable brackets, multifunctional designs, and eco-friendly manufacturing solutions. |

| Sustainability and Energy Efficiency | Large-scale adoption of circular economy practices, carbon-neutral manufacturing, and biodegradable bracket materials. |

| Integration of Smart Monitoring | Expansion of AI-based stress analysis, automated durability testing, and self-healing material applications. |

| Advancements in Bracket Applications | Evolution of intelligent brackets for smart vehicle architectures, electric battery integration, and adaptive aerodynamics. |

Increasing vehicle production and technological advancements in lightweight materials are sustaining the growth of the USA automotive brackets market. The key manufacturers involved in the global Automotive Bracket market include:

The increasing adoption of electric vehicles (EVs) is driving the demand for this market, as manufacturers are incorporating lightweight brackets for a better range and battery efficiency. Moreover, the adoption of advanced designs for brackets to uphold safety standards has led to the implementation of safety regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

UK Automotive Brackets Market: Growth Overview and Predictions 2020 to 2030 Although managed, the huge demand factor associated with automotive brackets can be accredited to the changing automotive industry with the transition to electric and hybrid vehicles. With automakers seeking to reduce weight and energy consumption to register substantial gains in fuel economy, the need for aluminium and composite brackets is growing.

However, changes to bracket production are also being informed by advances in additive manufacturing and 3D printing technologies that are helping to shape new custom and high performance parts. This demand for lightweight and recyclable materials in automobile production is being further fuelled by the demand for sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

According to Europe Automotive Brackets Market 2023, the European Union presents a promising automotive brackets market, with Germany, France, and Italy at the forefront of advanced vehicle component production during this period. The transition to electric mobility and roaming vehicles gives rise to the demand for brackets that are high-strength but low-weight.

To comply with strict emissions regulations, automakers are making investments in high-performance materials that reduce vehicle weight, like carbon fiber composites and aluminium alloys. The increasing trend of modular vehicle architectures is also leading to innovative designs released for the brackets to make manufacturing efficient and cost-effective.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan is steadily growing in its automotive brackets market due to a rising number of R&D initiatives relevant to the light weighting of automotive and optimizing the vehicle structure. These advanced brackets are being integrated by automakers to improve aerodynamics and crash safety performance in vehicles.

The growth of hybrid and electric vehicle production is driving the demand for precision-engineered brackets that can accommodate electronic components and battery enclosures. Moreover, developing robots and automated production systems improve their ability to produce efficiently.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

Robust automotive manufacturing base and growing demands from next-generation vehicle platforms are driving the market for automotive brackets in South Korea. Production increase of EVs and smart vehicles technologies are boosting the demand for lightweight and high strength brackets.

Leading automakers innovate with magnesium alloys and reinforced plastics materials in vehicles for better performance. In addition, 3D printing, as well as automated fabrication methods, support market growth by lowering production costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The automotive brackets market is essentially dominated by engine brackets and active engine bracket segments, due to the high focus of being placed by vehicle manufacturers towards the stabilizing the engine, dampening vibrations, and offering structural strength in order to achieve higher performance, durability, and comfort while driving.

By dampening vibrations, facilitating weight distribution, and providing stability, they are integral to both automobile manufacturers, aftermarket suppliers, and automotive structural engineers.

With automotive evolution and vehicle weight reduction becoming more crucial, various manufacturers are looking to high strength bracket designs, innovative material combinations, and AI-enabled dynamic control for increasing bracket life, enhancing engine performance, and boosting structural stiffness.

Engine Brackets as a Market-Driven Segment Focused on Structural Stability and Vibration Control

The rear engine brackets help in locking the engine position and minimizing the vibration which goes into the body of the vehicle.

The engine bracket segment has become a major structural element in passenger cars, commercial vehicles (CVs), and performance cars, offering strength, precision alignment, and vibration-dampening characteristics that lead to superior stability of the engine and reduced strain on the drivetrain.

Engine brackets, unlike traditional mounting solutions, offer essential load distribution capabilities, ensure proper engine positioning, and contribute to increased operational life, promoting improved performance, fuel efficiency, and lower maintenance costs.

Increasing adoption of high-performance engine brackets with advanced features, including heat resistant coatings, artificial intelligence-driven vibration damping, and reinforced aluminium construction, are driving this demand. According to studies published, over 65% of automotive manufacturers prefer engine brackets focusing on anti-noise factors and finding the best vehicle performance, which will keep the demand for this segment strong.

Automotive light weighting strategies, which include composite brackets of the next generation, AI-assisted load-balancing designs, and the integration of smart materials, has increased market demand, providing better durability and better fuel efficiency.

Adoption has further flourished with stamping configuration and vibration-sensitive elastomers, high-strength material, real-time sensors to monitor stress, an amalgamation of which has been integrated into hybrid engine bracket configurations, ensuring adaptation with the evolution of automotive engine technologies.

Growth of smart engine bracket solutions, with AI-controlled active damping systems, electronically-actuated vibration damping devices in addition to real time performance analytics, has become the best practice of the automotive sector for market sustainability, while minimizing engine wear.

The engine bracket segment, although capable of reducing overall engine movement, enhancing structural integrity, and providing load optimization, struggles in terms of incrustation of the material fatigue issues, increasing production costs, and changing regulatory compliance standards.

But new advancements, including AI driven analysis of bracket performance at runtime, next-gen nanomaterial based bracket reinforcements, and self-healing polymer based coatings for brackets, have been addressing their longevity, vehicle reliability, and economic efficiency, thereby fuelling sustained growth for engine brackets across the globe.

New Engine Brackets for High-Performance Vehicles, Commercial Trucks, and Electric Powertrains

High-strength, lightweight, and vibration-resistant brackets are increasingly employed in powertrains to improve stability and longevity, and the engine bracket segment has achieved even stronger penetration among manufacturers of high-performance vehicles, electric vehicles (EVs), and commercial fleets.

Engine effectiveness may be compromised compared to static mounting, affecting performance under heavy load, but unlike conventional, fixed mounting solutions, engine brackets provide dynamic vibration containment and impact resistance combined with an optimized distribution of engine weight that ultimately results in improved structural efficiency of the vehicle and decreased drivetrain stress.

Adoption has been driven by a demand for AI-assisted engine bracket designs with advanced stress distribution modelling, noise-reducing elastomer coatings and high-precision alloy reinforcements. According to studies, more than 70% of heavy-duty and performance-oriented vehicles install next-generation engine brackets for enhanced vibration control and structural rigidity, providing strong demand in this segment.

MTD powertrain mounting solutions across hybrid-electric powertrains, introducing AI-based noise culprit-detecting brackets, adaptive damping materials and energy-absorbing composites for design of engines, further foster global market growth, ensuring greater simultaneous integration with latest-generation EV and hybrid platforms.

Embedding engine brackets with in-field AI capabilities such as stress-sensing sensors, digital twin simulation models, and predictive maintenance algorithms, has given the adoption a further boost, as it increases the component reliability and decreases instances of failure.

Though, the engine bracket segment has the lower hinge-mounted structures that optimize the load applied to the vehicle structure to enhance the vehicle durability, and reduced stress on the powertrain, but also facing disruption by fluctuating material prices and rising demand for lighter and sustainable raw materials.

Emerging innovations in next-generation carbon fiber-reinforced brackets, AI-powered fatigue analysis tools, and adaptive bracket geometry technologies are enhancing manufacturing efficiency, component sustainability, and regulatory compliance to help drive global expansion for engine brackets.

For modern vehicles, the engine brackets have become next-generation structural components that can enable real-time adaptive vibration control, more dynamic load sensing, and AI-assisted damping optimization that enhance driving comfort and engine performance at the same time.

Active engine brackets differ from passive ones, as they employ electromagnetic or hydraulic systems that actively counteract engine vibration to improve ride comfort, minimize cabin noise, and improve vehicle dynamics.

The adoption has been facilitated by demand for advanced active engine brackets with AI-optimised damping control, Mg (magnesium) shock absorption, and electronically controlled damping. Research suggests that more than 60% of luxury and high-performance vehicle models now feature active engine brackets, which enhance driver experience and mitigate noise, vibration, and harshness (NVH) levels, determining strong demand for the segment.

The rise of automated drive and AI-assisted driving, with self-tuning powertrain mounts, electromagnetic noise-cancellation suspension mounts, demand-led bracket tuning, has solidified market momentum, enabling better efficiency and comfort ride quality.

Moreover, the digital real-time damping adjustment, high-frequency neutralization of vibrations, and stress analytics predictive analytics provided by smart engine bracket technologies have significantly contributed to better long-term performance, which has fuelled higher technology uptake while ensuring all-weather maintenance-free operation

Related market growth opportunities have been realized through the adoption of hybrid active engine bracket systems that deliver multi-axis load balancing complemented by real-time feedback adaptation, with micro-adjustments influenced by artificial intelligence (AI); these efforts have resulted in enhanced vehicle longevity and overall ride comfort.

However, manufacturing costs, complex infrastructure for electronic integration, and limited use in entry-level vehicles are the challenges which can hamper the growth of the active engine bracket segment, despite the advantages in providing smoother operation of the vehicle, increased robustness of the drivetrain, and lowering of cabin noise.

But, innovations in AI-based vibration control, hybrid active-passive bracket alternatives and energy-oriented electromagnetic damping systems are optimizing cost, technology scalability and adoption rate in the long-run making sure the global active engine brackets market has no stage of stagnancy.

Increased Adoption of Active Engine Brackets in Luxury Vehicles, High-Performance Sports Cars, and Autonomous Driving Platforms

The active engine bracket segment has witnessed the largest adoption, especially among luxury car makers, EV developers, and self-driving vehicle platforms, as automakers progressively incorporate intelligent damping systems to enhance driving comfort, powertrain stability, and ride experience.

Active engine brackets differ from passive brackets and make real-time adjustments to changing road and driving conditions, allowing for greater responsiveness, enhanced structural flexibility, and decreased vibration-induced wear.

Adoption has been driven by demand for AI - enhanced active engine brackets, with noise-cancelling algorithms, energy-efficient electromagnetic actuators, and smart damping control systems. More than 75% of luxury and high-performance electric vehicles deploy active engine brackets to provide improved ride quality and comfort to drivers, demonstrating strong growth potential in the market.

Although the use of active engine brackets provides various benefits, including improving vehicle stability, decreasing NVH levels, and providing real-time optimization of vibration control, the active segment faces major challenge, including higher integration complexity, a need for software-driven tuning, and cost associated with mass-market adoption.

On the other hand, upcoming applications comprising block chain-based automated vehicle parts monitoring, AI-enabled brackets condition tracking, and smart-structure-driven self-adjusting damping systems facilitate better part adaptability with increased manufacturing efficiency and market penetration which will keep the growth of active engine brackets across the globe.

Industry Overview

Increased vehicle production together with technical material development and superior structural component requirements drive the steady growth of the automotive brackets market. Automobile parts require brackets for security applications in engines as well as chassis components in addition to transmission systems and electronic elements.

The drive toward efficient fuel consumption and electric vehicles has prompted bracket development from aluminium combined with magnesium along with composite materials. High-strength bracket solutions with corrosion resistance at affordable costs become possible through the implementation of 3D printing and advanced manufacturing approaches.

The market leading companies place their emphasis on developing advanced designs and manufacturing brackets which meet durability requirements as well as integration capabilities for electric and autonomous vehicles.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Magna International Inc. | 18-22% |

| Gestapo Automation | 15-19% |

| Benteler Automotive | 12-16% |

| KIRCHHOFF Automotive | 9-13% |

| Aisin Corporation | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Magna International Inc. | Develops lightweight aluminium and composite brackets for enhanced vehicle efficiency and durability. |

| Gestapo Automation | Specializes in high-strength steel and hot-stamped brackets for chassis and structural applications. |

| Benteler Automotive | Offers multi-material bracket solutions, integrating advanced manufacturing techniques for lightweight design. |

| KIRCHHOFF Automotive | Focuses on stamped metal and welded brackets for crash protection and structural reinforcement. |

| Aisin Corporation | Provides precision-engineered brackets optimized for hybrid and electric vehicle platforms. |

Key Company Insights

Magna International Inc. (18-22%)

Through its lightweight aluminium and composite bracket products Magna maintains leadership position in the automotive brackets market to help vehicles become more fuel-efficient.

Gestapo Automation (15-19%)

Gestapo is a major player in high-strength steel bracket manufacturing, utilizing hot-stamping technology to improve crash resistance and vehicle safety.

Benteler Automotive (12-16%)

Benteler focuses on innovative multi-material brackets, incorporating hybrid metal and polymer structures for enhanced performance and weight optimization.

KIRCHHOFF Automotive (9-13%)

KIRCHHOFF develops stamped metal and welded brackets which serve as affordable reinforcements for modern vehicles.

Aisin Corporation (7-11%)

Aisin develops precision-engineered brackets, focusing on hybrid and electric vehicle applications to enhance structural integrity and durability.

Various firms in the market provide lightweight bracket solutions which maintain durability at affordable costs across multiple automobile applications. Notable players include:

The overall market size for Automotive Brackets Market was USD 22.84 Billion in 2025.

The Automotive Brackets Market expected to reach USD 36.15 Billion in 2035.

The demand for the automotive brackets market will grow due to increasing vehicle production, rising adoption of lightweight materials for fuel efficiency, advancements in electric and autonomous vehicles, and the growing need for durable and high-performance structural components in modern automobiles.

The top 5 countries which drives the development of Automotive Brackets Market are USA, UK, Europe Union, Japan and South Korea.

Active Engine Brackets lead market growth to command significant share over the assessment period.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Crawler Excavator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.