The balance shaft market for automotive is anticipated to grow at a steady rate of between 2025 to 2035 wherein escalation in mass production of inline 3 and 4 cylinder engines, stricter emission norms and demand for smoother engine performance from passenger vehicles will bolster demand in the global automotive balance shaft market.

They serve to counterbalance the secondary imbalances found in internal combustion engines (ICEs) minimizing unwanted vibration and noise, thus improving driving comfort and allowing for better fuel efficiency. Despite the gradual transition to electric vehicles (EVs), ICE vehicles particularly in developing markets will still support balance shaft demand for the next decade.

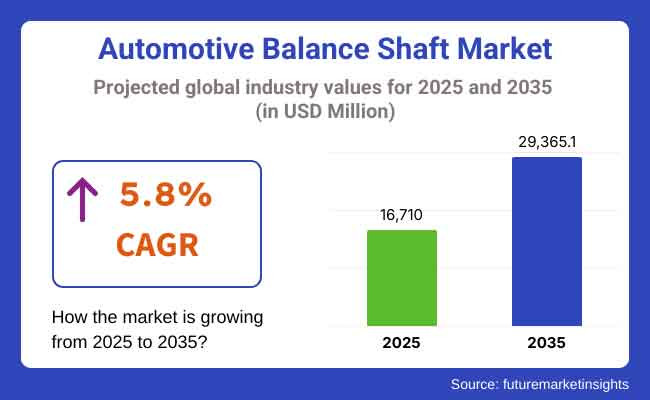

Adoption is further fuelled by technological advancements such as lightweight materials, modularity of engine designs and integration of balance shafts with variable valve timing systems. Despite the long-term impact of EV penetration, hybrid vehicles, commercial fleets and markets where electrification will happen relatively late in the game will keep the balance shaft industry relevant. The global automotive balance shaft market is projected to exhibit a 5.8% CAGR from USD 16,710 Million in 2025 will surpass USD 29,365.1 Million by 2035.

Automotive balance shaft market will continue expanding, as carmakers aim to lower vibration for automobiles while improving ride comfort in compact, mid-size & performance vehicle. Balance shafts help to counteract the secondary forces generated in internal combustion engines, wherever the configuration might propound vibration.

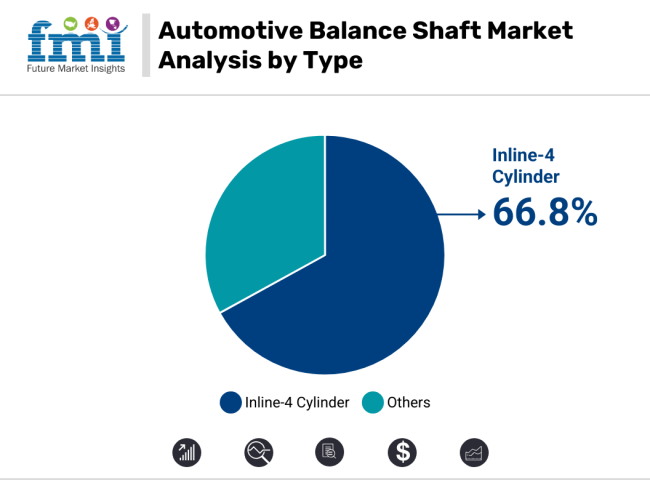

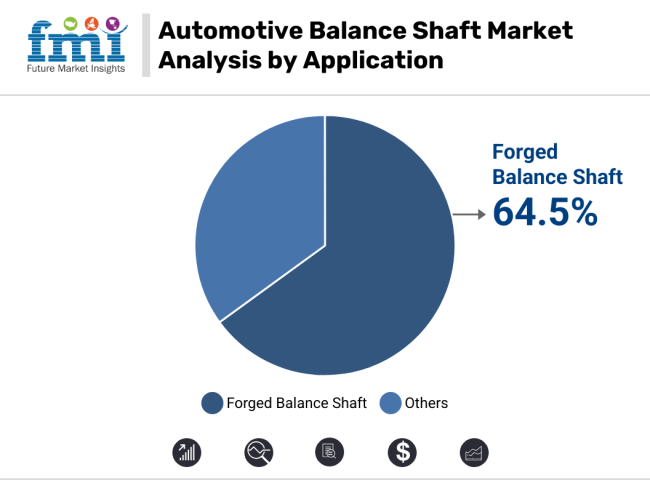

Inline-4 cylinder engines comprise nearly all global market share of key engine types and manufacturing techniques, owing to their mass adoption, structural reliability, and mechanical efficiency, followed by forged balance shafts. These segments guarantee a more seamless functioning of the vehicle, higher durability, and the ability to cater to both gasoline and diesel powertrains.

No compromise on performance or downsizing the engine while maintaining comfort and quality with quiet driving experience as consumers demanded, the forged balance shaft actually integrated in the most common inline-4 engines remains the focus area in the original equipment manufacturers (OEMs) strategy for regional and global platforms.

Intrinsically, four-cylinder-cylinder powered automobile engines currently dominate the balance shaft market share owing to their widespread usage across compact cars, a multitude of sedans, SUVs, and light trucks. These engines provide good fuel economy, performance, and cost but have high second order vibrations that require balancing shaft systems for refinement.

That inline-4 configuration remains a firm favorite among automakers in North America, Europe, and Asia-Pacific, due to its simplicity, lower production costs, and its ability to save real estate under the hood. Especially on high-revving and turbocharged variants that were more prone to vibration, balance shafts made engines smoother, yielding better NVH (noise, vibration and harshness) ratings.As fuel economy and emissions regulations force manufacturers to smaller displacement engines, inline-4 designs continue to be the layout of choice with regards to efficient power delivery, driving the need for integrated balance shaft systems.

Of course, V6 and inline-3 engines also benefit from a balance shaft system, but given the overwhelming number of inline-4 platforms, it's hard to argue against their absolute supremacy on the market.

Manufacturers prefer forged balance shafts for some of the same reasons as other parts: a high strength-to-weight ratio and precision tolerances; also for their long-term operational integrity under high engine loads. Usually, these components are used in high-performance and heavy-duty vehicles, which have superior engine durability and high rotational balance as a result.

Forging process used to maintain the density as well as defect free shafts with refined [9] grain alignment which helps in increasing the fatigue resistance of component and minimize the breakage chances. They are often preferred by OEMs for premium and high-output engines-where performance stability and limited maintenance is critical.

The advanced CNC machining and special heat treatment process results in an excellent dimensional accuracy of the forged balance shaft mentioned in the brochure that ensures a smoother working topology of the engine and tighter dynamic balancing. They also resist thermal expansion, torsional stress and long-term high-speed operation better.

Forged balance shafts are better mechanically in performance and export-oriented vehicle platforms, whereas cast balance shafts are comparatively lower in cost and remain a mainstay in low powered engines and cost sensitive segments.

North America continues to be a focus area with ongoing demand for large engine vehicles and light trucks, especially in the USA Turbocharged inline engines with balance shafts are on the rise, particularly in the SUV and crossover segments. OEM modular engine platform and noise reduction system investments support consistent growth across regions, even as EV competition intensifies.

Markets in Europe have also been underpinned by ever-stricter emission regulations and growing focus on fuel efficiency and vehicle refinement. Germany, France and the UK lead in balance shaft adoption for mid-sized and luxury vehicles.As automakers downsize their powerplants while still meeting performance metrics, the role of balance shafts has taken on increased importance. Balance shafts in ICE components also live on in hybrid powertrains.

The most active region is the Asia-Pacific, with mass automotive production fuelled by China, India, and Southeast Asia. Growing demand for cost-effective, fuel-efficient compact cars, and rising adoption of turbocharged petrol engines are the factors driving market for balance shafts. Balance shafts are used by local OEMs and global brands making in Asia to meet stricter NVH (noise, vibration, harshness) and fuel efficiency norms.

Electrification trend and weight-efficiency trade-offs present key obstacles

The surge of electric vehicles is a key long-term challenge for the automotive balance shaft market because EVs do not have combustion vibrations and therefore do not need balance shafts. Car makers, meanwhile, are also pushing to reduce the weight of engine parts in order to achieve fuel economy and emissions targets leading them to be more selective about adding balance shafts, especially as engines get smaller.

The other issue is it is complex to retrofit or house balance shafts into new modular engine platforms without making significant compromises to cost (no one wants to raise the price of a car just to have better balance shafts) or compactness. This restricts their adoption into entry-level vehicle segments and causes design inefficiencies otherwise if not effectively optimized. Low-quality shafts also have more perceived need for replacement, which inevitably affects image of aftermarket reliability in cost-driven markets.

Hybrid vehicle adoption and demand for NVH optimization drive future growth

Balance shaft applications present a very strong opportunity for hybrid vehicles as they still have internal combustion components. Global automakers now place more balance shafts in hybrid engines to minimize vibrations when operating in electric and ICE modes. As demand for premium ride quality and noise suppression increases across all vehicle segments the need for advanced vibration control systems is increasing.

Lightweight balance shaft materials such as hollow forged steel, some composite alloys and even additive-manufactured components. And it offers a tremendous opportunity with the NVH reduction trend becoming the mainstay in the commercial vehicle and two-wheeler segments as well. Also, demand for quieter internal combustion vehicles among developing markets will extend demand well into the forecast period.

In between 2020- 2024, the market recovered moderately from automotive production disruptions resulting from the COVID-19 pandemic. With automakers moving to downsized powertrains for emissions compliance, demand for smaller, turbocharged engines grew, further increasing the need for balance shafts in inline configurations. But supply chain disruptions and soaring costs for materials limited big upgrades and aftermarket replacements throughout the period.

From 2025 onwards, the market will shift to specialized applications for hybrid ICEs, high-performance engines, and emerging markets. Although EV growth will offset overall growth in developed markets, the requirement for smoother operations in commercial fleets, long-haul transport, and hybrid passenger vehicles will enable ongoing adoption. OEMs will continue working on optimized shaft configurations that help meet NVH suppression and fuel economy targets.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Push for fuel efficiency, Euro 6 and BS-VI compliance |

| Consumer Trends | Demand for comfort in compact vehicles |

| Industry Adoption | Strong in turbocharged 4-cylinder ICEs |

| Supply Chain and Sourcing | Delays due to material shortages and labor gaps |

| Market Competition | Dominated by OEM engine suppliers and component integrators |

| Market Growth Drivers | Post-pandemic production recovery, engine downsizing |

| Sustainability and Impact | Interest in lightweight components for CO₂ reduction |

| Smart Technology Integration | Limited to advanced machining and alignment systems |

| Sensorial Innovation | Enhanced ride comfort and reduced cabin noise |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Enhanced focus on NVH performance in hybrids and emerging emissions norms |

| Consumer Trends | Growing interest in refined hybrid and commercial vehicle segments |

| Industry Adoption | Continued in hybrid ICEs, premium SUVs, and light trucks |

| Supply Chain and Sourcing | Diversification toward local sourcing and lightweight alloy machining |

| Market Competition | Entry of material tech firms, hybrid powertrain designers |

| Market Growth Drivers | Hybrid adoption, NVH focus, and vehicle modularization |

| Sustainability and Impact | Focus on recyclable alloys and modular balance shaft assemblies |

| Smart Technology Integration | Integration with engine sensors and real-time NVH monitoring |

| Sensorial Innovation | Adaptive shaft configurations tuned for hybrid mode transitions |

The United States automotive balance shaft market is projected to expand owing to steady production of high-performance vehicles supported by increasing need for balcony clearance along with smooth functioning of engine in luxury and mid-sized cars. Typically found on 4-cylinder engines, balance shafts work to minimize vibration for a smoother ride.

"OEM's and Tier 1 suppliers" in Michigan and Ohio are utilizing aluminum and other lightweight materials to maximize fuel efficiency. However, the march towards hybrid powertrains, is sharpening the need for compact electronically-controlled balance-shaft assemblies. Ever-increasing thermal load therefore tended to be in the domain of material science.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The balance shaft market in automotive in the UK is made up by continuous development in internal combustion engine optimization, especially for high-end automotive segments. This, coupled with the need for advanced NVH (noise, vibration, and harshness) control systems in domestic brands, such as Jaguar Land Rover, is accelerating demand for precision-engineered balance shafts.

CNC automation & real-time quality analytics provided by local machining centers is improving production quality. Incentives for post-Brexit manufacture are encouraging more localized sourcing of engine components. International Research Issues and Innovations in Simulation-Based Vibration Design.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

The automotive balance shaft market for the application in the EU will exhibit steady growth driven by the persistence of fuel-efficient internal combustion to be produced across the regions of Germany, France and Italy. Diesel and turbocharged petrol engines use balance shafts to achieve compliance with Euro 7 emissions regulations, in addition to minimizing vehicle shake and vibration. We are adopting dual-shaft systems for automotive OEMs to enhance their performance on high-output compact vehicles.

EU-funded initiatives are promoting thermal efficiency developments and material light-weighting in engine assemblies. Also, manufacturers are investing in production lines flexible enough to build an ICE, hybrid, or pure electric propulsion module.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

The automotive balance shaft market in Japan is influenced by the country’s highly developed automotive engineering ecosystem and strong demand for compact, smooth running engines. Toyota, Honda, and Nissan still use balance shafts in midsize sedans and compact crossovers as a way to smooth out engine operation.

The latter factor (low-friction coatings) is key to extending shaft life in start-stop operating conditions and, therefore, Japanese manufacturers are concentrating on tighter tolerances and low-friction coatings. They are also investigating modular balance shaft assemblies for hybrid electric vehicles. In Aichi and Kanagawa, supplier parks are streamlining supply chain efficiencies to shorten component lead times.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The South Korean automotive balance shaft market is witnessing above average growth with increasingly lightweight, vibration-dampening engine architectures being developed by players such as Hyundai and Kia. Adoption of aluminum and composite based balance shaft materials are boosting fuel economy in a wide range of compact and mid-size vehicle platforms.

Robots automate high-volume shaft production at precision machining centers in Ulsan and Incheon. R&D centers are also exploring sensor-integrated shafts to monitor and quantify engine dynamics in real time. The drive for global vehicle exports is accelerating the standardization of balance shaft specifications in a product line.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

The market for automotive balance shafts is increasing slowly as engine makers seek to enhance smoothness in engines, minimize NVH (noise, vibration, harshness), and comply with regulatory needs for downsized, high-efficiency powertrains. Inline-3 and inline-4 cylinder engines remain top drivers of adoption because of inherent imbalance issues.

OEMs and Tier-1 manufacturers are investing in light-weight balance shafts, refined forging processes, and integration into engine lubrication systems. With the advent of hybrid powertrains and downsizing of ICE, balance shaft design is increasingly becoming modular, robust, and cost-effective.

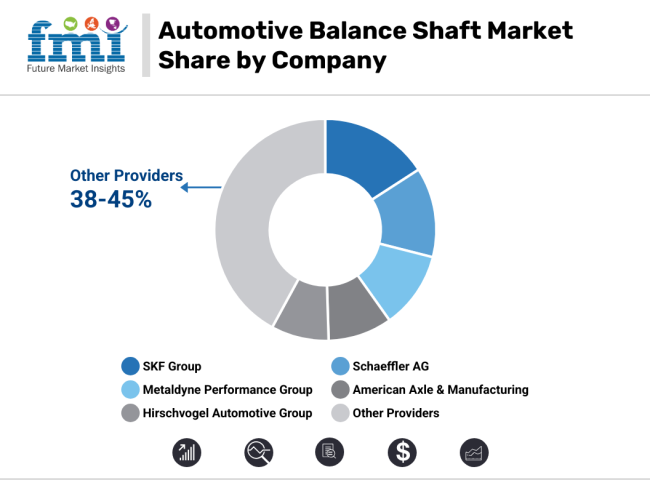

Market Share Analysis by Key Players & Automotive Balance Shaft Providers

| Company Name | Key Offerings/Activities |

|---|---|

| SKF Group | In 2024, launched ultra-lightweight forged balance shafts for 3-cylinder engines; in 2025, introduced integrated oil-pump designs to reduce part count and engine mass. |

| Schaeffler AG | In 2024, developed modular balance shaft systems for hybrid and conventional ICEs; in 2025, expanded manufacturing of hollow-shaft assemblies for premium automakers. |

| Metaldyne Performance Group | In 2024, rolled out powder metal balance shafts with enhanced damping performance; in 2025, introduced cost-optimized balance shaft kits for emerging-market OEMs. |

| American Axle & Manufacturing | In 2024, enhanced thermal treatment processes for shaft durability; in 2025, launched custom NVH-optimized shafts for electric-assist turbo applications. |

| Hirschvogel Automotive Group | In 2024, added friction-welded balance shafts to reduce rotating mass; in 2025, expanded its Asia-Pacific production to meet compact car engine demand. |

Key Market Insights

SKF Group (14-17%)

SKF Group continues to lead in the high-precision components segment with balance shafts engineered for weight reduction and noise suppression. In 2024, the company launched ultra-lightweight forged shafts for 3-cylinder engines, helping OEMs meet stricter emissions and fuel economy targets. In 2025, SKF introduced integrated oil-pump balance shaft assemblies, reducing component complexity and contributing to overall powertrain efficiency. Its balance between performance and cost makes it a go-to partner for global OEMs.

Schaeffler AG (11-14%)

Schaeffler maintains a strong presence through innovation in modular, hybrid-compatible balance shaft systems. In 2024, it introduced plug-and-play designs adaptable for both ICEs and hybrid drivetrains. By 2025, it scaled up hollow-shaft production with variable balancing mass to match powertrain demands of luxury vehicle platforms. Its global manufacturing and R&D facilities support fast localization, allowing Schaeffler to serve both mass-market and premium segments with tailored NVH solutions.

Metaldyne Performance Group (9-12%)

Metaldyne brings value engineering to the forefront of balance shaft design. In 2024, it released advanced powder metal shafts optimized for damping and cost efficiency. In 2025, it launched modular balance shaft kits targeted at high-volume compact vehicles in Asia and South America. Its expertise in forging and metal injection molding allows customization at scale, enabling OEMs to meet performance goals without sacrificing affordability in price-sensitive markets.

American Axle & Manufacturing (7-10%)

American Axle focuses on durability and thermal stability in balance shafts for high-load applications. In 2024, the company refined its heat treatment processes to improve component lifespan under high-RPM conditions. In 2025, it unveiled NVH-optimized shafts for turbocharged engines with integrated electric assist, addressing growing hybridization needs. Its vertical integration across machining and surface treatment enables superior quality control and shorter product development cycles.

Hirschvogel Automotive Group (6-9%)

Hirschvogel leverages forging expertise to enhance rotational performance and lightweighting. In 2024, it developed friction-welded balance shafts, offering reduced mass and improved energy transfer. In 2025, it expanded regional production in Southeast Asia to support growing compact car engine manufacturing. Hirschvogel’s commitment to metallurgical research and energy-efficient forming processes positions it as a sustainable supplier in the evolving ICE-to-hybrid transition.

Other Key Players (38-45% Combined)

Numerous regional suppliers and Tier-2 manufacturers are innovating in low-cost, lightweight, and thermally stable balance shafts. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Engine Type, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Engine Type, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Engine Type, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Engine Type, 2017 to 2032

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Engine Type, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Engine Type, 2017 to 2032

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 22: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 23: Europe Market Value (US$ Million) Forecast by Engine Type, 2017 to 2032

Table 24: Europe Market Volume (Units) Forecast by Engine Type, 2017 to 2032

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: East Asia Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: East Asia Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 29: East Asia Market Value (US$ Million) Forecast by Engine Type, 2017 to 2032

Table 30: East Asia Market Volume (Units) Forecast by Engine Type, 2017 to 2032

Table 31: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 33: South Asia & Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 34: South Asia & Pacific Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 35: South Asia & Pacific Market Value (US$ Million) Forecast by Engine Type, 2017 to 2032

Table 36: South Asia & Pacific Market Volume (Units) Forecast by Engine Type, 2017 to 2032

Table 37: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: MEA Market Volume (Units) Forecast by Country, 2017 to 2032

Table 39: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 40: MEA Market Volume (Units) Forecast by Product Type, 2017 to 2032

Table 41: MEA Market Value (US$ Million) Forecast by Engine Type, 2017 to 2032

Table 42: MEA Market Volume (Units) Forecast by Engine Type, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Engine Type, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 12: Global Market Value (US$ Million) Analysis by Engine Type, 2017 to 2032

Figure 13: Global Market Volume (Units) Analysis by Engine Type, 2017 to 2032

Figure 14: Global Market Value Share (%) and BPS Analysis by Engine Type, 2022 to 2032

Figure 15: Global Market Y-o-Y Growth (%) Projections by Engine Type, 2022 to 2032

Figure 16: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 17: Global Market Attractiveness by Engine Type, 2022 to 2032

Figure 18: Global Market Attractiveness by Region, 2022 to 2032

Figure 19: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 20: North America Market Value (US$ Million) by Engine Type, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis by Engine Type, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Engine Type, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Engine Type, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Engine Type, 2022 to 2032

Figure 34: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 35: North America Market Attractiveness by Engine Type, 2022 to 2032

Figure 36: North America Market Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 38: Latin America Market Value (US$ Million) by Engine Type, 2022 to 2032

Figure 39: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by Engine Type, 2017 to 2032

Figure 49: Latin America Market Volume (Units) Analysis by Engine Type, 2017 to 2032

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Engine Type, 2022 to 2032

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Engine Type, 2022 to 2032

Figure 52: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Engine Type, 2022 to 2032

Figure 54: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 55: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 56: Europe Market Value (US$ Million) by Engine Type, 2022 to 2032

Figure 57: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 59: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 66: Europe Market Value (US$ Million) Analysis by Engine Type, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Engine Type, 2017 to 2032

Figure 68: Europe Market Value Share (%) and BPS Analysis by Engine Type, 2022 to 2032

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Engine Type, 2022 to 2032

Figure 70: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 71: Europe Market Attractiveness by Engine Type, 2022 to 2032

Figure 72: Europe Market Attractiveness by Country, 2022 to 2032

Figure 73: East Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: East Asia Market Value (US$ Million) by Engine Type, 2022 to 2032

Figure 75: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 77: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 81: East Asia Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 84: East Asia Market Value (US$ Million) Analysis by Engine Type, 2017 to 2032

Figure 85: East Asia Market Volume (Units) Analysis by Engine Type, 2017 to 2032

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Engine Type, 2022 to 2032

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Engine Type, 2022 to 2032

Figure 88: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Engine Type, 2022 to 2032

Figure 90: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 91: South Asia & Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 92: South Asia & Pacific Market Value (US$ Million) by Engine Type, 2022 to 2032

Figure 93: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 95: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 96: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: South Asia & Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 99: South Asia & Pacific Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 100: South Asia & Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 101: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 102: South Asia & Pacific Market Value (US$ Million) Analysis by Engine Type, 2017 to 2032

Figure 103: South Asia & Pacific Market Volume (Units) Analysis by Engine Type, 2017 to 2032

Figure 104: South Asia & Pacific Market Value Share (%) and BPS Analysis by Engine Type, 2022 to 2032

Figure 105: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Engine Type, 2022 to 2032

Figure 106: South Asia & Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 107: South Asia & Pacific Market Attractiveness by Engine Type, 2022 to 2032

Figure 108: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 109: MEA Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 110: MEA Market Value (US$ Million) by Engine Type, 2022 to 2032

Figure 111: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 112: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 113: MEA Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 114: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 115: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 116: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 117: MEA Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 118: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 119: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 120: MEA Market Value (US$ Million) Analysis by Engine Type, 2017 to 2032

Figure 121: MEA Market Volume (Units) Analysis by Engine Type, 2017 to 2032

Figure 122: MEA Market Value Share (%) and BPS Analysis by Engine Type, 2022 to 2032

Figure 123: MEA Market Y-o-Y Growth (%) Projections by Engine Type, 2022 to 2032

Figure 124: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 125: MEA Market Attractiveness by Engine Type, 2022 to 2032

Figure 126: MEA Market Attractiveness by Country, 2022 to 2032

The overall market size for the automotive balance shaft market was USD 16,710 Million in 2025.

The automotive balance shaft market is expected to reach USD 29,365.1 Million in 2035.

The demand for automotive balance shafts is rising due to increasing production of inline-4 cylinder engines, growing need for improved engine performance and reduced noise, vibration, and harshness (NVH). The adoption of forged balance shafts for enhanced durability and precision is further fueling market growth.

The top 5 countries driving the development of the automotive balance shaft market are the USA, China, Germany, Japan, and South Korea.

Inline-4 cylinder engines and forged balance shafts are expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA