Forecast analysis predicts exponential expansion of automotive back-up camera technologies will continue through 2035 due to mandatory safety requirements along with enhancing security regulations and better camera instrumentation technology.

Vehicle safety standards require back-up cameras as they prevent collisions and boost driver visibility. Market expansion receives additional boost from AI-powered image processing together with night vision capabilities and wide-angle lens technology.

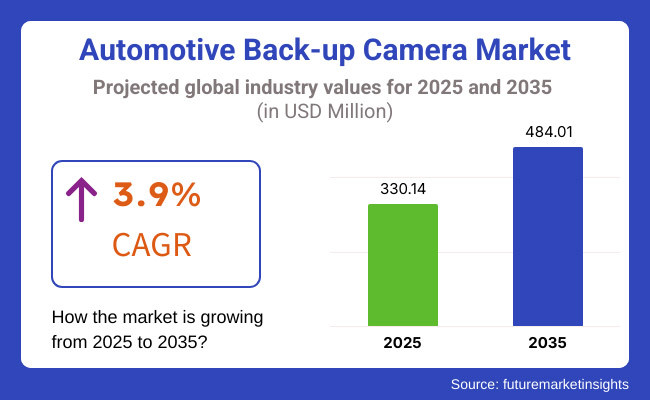

The value estimation for automotive back-up cameras reached USD 330.14 Million in 2025 before analysts expected the market to expand to USD 484.01 Million by 2035 with a 3.9% CAGR.

The automotive back-up camera market continues to expand because of increasing ADAS adoption rates along with rising vehicle premium sales requirements and smart parking technology development. The surge of electric vehicles combined with autonomous vehicles increases the market demand for high-resolution back-up camera systems.

Explore FMI!

Book a free demo

The North American market maintains its position as a primary sector for automotive back-up cameras because of mandatory vehicle safety rules together with widespread use of ADAS technologies as well as leading motor vehicle manufacturers in the region.

The demand for back-up cameras in both passenger vehicles and commercial vehicles keeps growing across the United States and Canada because of safety-focused government requirements coupled with customer preferences for better safety measures in their vehicles. Market growth throughout the region happens because AI-driven vehicle safety solutions have acquired increasing financial backing.

The automotive backup camera market in Europe shows continuous expansion because of growing safety regulations and expanding ADAS adoption and heightened customer interest in safety prevention technology.

Automotive safety innovation dominates in German and French and British markets where manufacturers merge adaptive back-up cameras with AI-powered object detection systems which operate in real time. Sustainable mobility combined with electric vehicle revolution drives the market for advanced vehicle safety systems throughout Asia Pacific.

The Asian Pacific market will demonstrate the most rapid expansion in automotive back-up camera sales because of soaring urban development combined with rising automotive manufacturing along with official safety regulations for roads.

Modern nations particularly China and Japan along with South Korea and India are using their budgets to construct intelligent transportation systems which encourages new vehicle models to adopt back-up cameras. Modern electric vehicles and autonomous driving solutions spur regional demand for camera-based safety systems because manufacturers desire high-quality solutions.

Challenge

High Costs and Regulatory Complexities

The Automotive Back-up Camera Market is affected by high production costs, stringent regulatory requirements, and integration complexities. The same vehicles must comply with safety regulations like the Federal Motor Vehicle Safety Standard (FMVSS) in the USA and other regions having similar standards, which raises compliance costs.

Also, the need to integrate back-up cameras with existing vehicle infotainment and driver assistance systems imposes additional complexity in terms of technology and calibration, which also adds to development costs. To remain affordably and competitively priced within their respective markets, companies are likely to have invested in cheap manufacturing and commodity style designs.

Market Saturation and Consumer Adoption Barriers

Moreover, owing to regulatory requirement, back-up cameras have found widespread acceptance resulting in market saturation in developed areas. Safety features are not a top priority for consumers in many emerging markets, which slows adoption rates in new premier digital markets and segments.

Moreover, the durability of camera components in extreme weather conditions & alleged malfunctions make many hesitant buyers. To combat these challenges, manufacturers need to build durable, weather-resistant camera systems and increase consumer education about the safety advantages of back-up cameras.

Opportunity

Rising Demand for Advanced Driver Assistance Systems (ADAS)

Autos becoming more and more advanced Driver Assistance Systems (ADAS) will lead to growth opportunities for the Automotive Back-up Camera Market. Automakers offer the back-up cameras in well-equipped ADAS packages that combine parking assistance, blind-spot recognition, and collision prevention.

As consumers increasingly crave protection and comfort, the need for high definition cameras with wide angle and night vision is growing. Forward-looking companies harnessing AI-driven image processing, sensor fusion technologies and real-time monitoring systems will be the top dogs in this burgeoning sector.

Technological Innovations and Smart Camera Systems

A dynamic of emerging technologies for back-up cameras including, but not limited to 360-degree vision and augmented reality overlays, as well as AI-driven obstacle detection is completely reshaping the landscape. Introducing smart camera systems powered with real-time analytics and enhanced image clarity that allow the driver to be more aware than ever before.

Demand is also being driven further due to the availability of along with seamless data-sharing cloud connected back-up camera solutions that provides integration with smart vehicle ecosystem. Market companies involved in small, high-density, and AI backup digital cameras will cash out of the rising pattern and fortify their market position.

The automotive back-up camera market grew steadily from 2020 to 2024 due to increasing vehicle safety regulations and rising awareness among consumers. Car manufacturers were pouring their energy in to equipping cars with high-res cameras, night vision, and wide-angle lenses to improve visibility from the back.

But manufacturers faced challenges, goals, cost pressures, regulatory compliance issues and global supply chain disruptions. In response to numerous failures, organizations began streamlining manufacturing processes, improving durability specifications, and diversifying product range for traditional as well as smart camera solutions.

By the year 2025 to 2035, the market is likely to encounter project compelling growth potentiating developments such as AI-enabled back-up camera tools, integration of such technologies within autonomous vehicle systems, respectively. Vehicle-to-everything (V2X) communication will also gain traction, allowing for backup cameras to communicate with smart infrastructure, which can enhance situational awareness and reduce incidents.

Green camera components and sustainable manufacturing practices will also influence the market in the coming years. Computer vision is rooted in several key fields of study: mathematics, computer science, and what we call “human perception modelling” techniques, which help AI systems learn from humans to identify images and drive.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety mandates for rear-view visibility |

| Technological Advancements | Growth in HD cameras, night vision, and wide-angle lenses |

| Industry Adoption | Increased use in passenger and commercial vehicles |

| Supply Chain and Sourcing | Dependence on specialized camera lens manufacturers |

| Market Competition | Presence of global automotive suppliers and ADAS developers |

| Market Growth Drivers | Demand for enhanced vehicle safety and compliance with rear-view camera mandates |

| Sustainability and Energy Efficiency | Initial focus on improving camera durability and power efficiency |

| Integration of Smart Monitoring | Limited use of AI-based real-time analytics and predictive imaging |

| Advancements in Camera Applications | Use in traditional passenger vehicles for improved parking and safety |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of smart vehicle safety regulations and AI-driven camera mandates. |

| Technological Advancements | Integration of AI-based image recognition, 360-degree cameras, and augmented reality overlays. |

| Industry Adoption | Expansion into autonomous vehicle systems, connected mobility solutions, and V2X integration. |

| Supply Chain and Sourcing | Shift toward sustainable camera components, localized production, and cloud-connected camera solutions. |

| Market Competition | Growth of AI-driven camera manufacturers, smart vehicle technology providers, and real-time monitoring solutions. |

| Market Growth Drivers | Increased investment in smart camera ecosystems, AI-driven analytics, and real-time driver assistance features. |

| Sustainability and Energy Efficiency | Large-scale adoption of eco-friendly camera components, energy-efficient imaging sensors, and carbon-neutral manufacturing processes. |

| Integration of Smart Monitoring | Expansion of self-learning camera systems, cloud-powered driver monitoring, and automated safety alerts. |

| Advancements in Camera Applications | Evolution of smart back-up cameras for autonomous vehicles, AI-powered real-time image processing, and next-gen mobility solutions. |

The growth of back up cameras market in the United States automotive sector is attributed to the implementation of safety regulations in the country which now requires all the new vehicles to be equipped with rear-view cameras. Growing consumer demand for advanced driver-assistance systems (ADAS) and vehicle safety features is also stimulating market growth.

The growing adoption of electric and autonomous vehicles is also fuelling the demand for higher resolution, wide-angle back-up cameras. Furthermore, innovations in camera technology, such as night vision and augmented reality overlays are further fuelling the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

As more safety-conscious consumers opt for vehicles with built-in ADAS features, the market for back-up cameras for vehicles in the UK continues to expand. Adoption rates are driven by government regulations promoting vehicle safety and road accident prevention.

Additionally, the growing popularity of premium and electric vehicles is also propelling the demand for high-definition back-up cameras, which offer improved visibility as well as smart parking assist capabilities. Automakers are also introducing advanced camera sensors for better driver safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The back of car cameras market in the EU has a high demand in Germany, France, and Italy as its leading countries driving the market forward. Key Market Drivers: Stringent Vehicle Safety Regulations and Increased Consumer Awareness about Road Safety

Increasing adoption of 360-degree camera systems in luxury & midsegment vehicles is also fuelling growth of the market. Also, growing developments in AI-driven parking assistance system will find a substantial room for long-term growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

Japan is witnessing growth in automotive back-up camera market owing to its well-established automaker background and its swift penetration towards progressive vehicle safety technologies. The need for high-precision rear-view cameras is increasing as a result of the rise of autonomous and connected vehicles.

Major automakers are betting on AI-enabled camera systems and sensor fusion technology to improve vehicle safety. Furthermore, a rising consumer demand for premium safety features in compact and hybrid vehicles is further boosting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

Demand for the automotive back-up camera in South Korea is set to expand as the country accelerates its foray into smart mobility and connected vehicle technologies. And leading automotive electronics manufacturers are driving innovations in high-resolution camera systems.

The growing number of electric and autonomous vehicles is also driving demand for high-performance back-up cameras with better night vision and the integration of automatic emergency braking. Furthermore, increasing government endorsement of vehicle safety standards is likely to fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Automotive back-up camera market share, by product type, 2017 (%). The demand for TFT-LCD monitors and surface-mounted cameras is expected to increase significantly as automakers and technology providers increasingly focus on advanced vehicle safety, driver assistance systems, and improved visual clarity during reversing.

Automotive camera systems are essential for mitigating blind spots, avoiding collisions and enhancing driver confidence, which is vital for passenger vehicles, commercial fleets, and consumer automotive enhancements.

Strides in rear visibility advances will enable new and enhanced existing technologies to increase back-up camera performance and reduce driver error and safety violations to meet and exceed the mandates while also achieving compliance worldwide at upcoming deadlines due through October 2023 and beyond.

High Resolution Display Solutions for Market Demand- The Growth of TFT-LCD Monitors

TFT-LCD Monitors: Enhance Rear Visibility and Better Real Time Imaging

The TFT-LCD monitor segment of automotive back-up camera systems is the most widely utilized display technology, offering improved contrast ratios, higher refresh rates, and visibility in the daytime and low-light settings. This TFT-LCD technology is higher in pixel density, colour reproduction, and lower in power consumption than standard LCD screens, producing clear, real-time images for reversing and parking.

Ekranıyorum usur about higher resolution TFT-LCD monitors equipped with anti-glare solutions, bright angles and boe ranging factor of retina. More than 60% of OEM-installed back-up camera systems employ TFT-LCD monitors with outstanding display clarity, corroborating solid demand for this segment, according to studies.

The growing presence of AI-enabled parking assist systems with real-time hazard awareness, motion detection capabilities, and overlaid dynamic trajectories has further enhanced market demand and increased driver confidence and safety standards.

Integration of next-gen TFT-LCD monitors with ultra-thin bezels, touchscreen-based control interface integration & AR (guidance overlay) solutions provides further impetus to adoption ensuring seamless adaptability to currently evolving set of in-vehicle display technologies.

Tailored TFT-LCD monitor solutions, including integrated split-screen cameras, wireless interface with smart vehicles, and adaptive contrast adjustment, have driven market expansion by ensuring optimal user experience and durability over time.

High costs of production, difficulties with display calibration, and a lack of industry standards regarding resolution for rear view displays remain issues for the TFT-LCD monitor segment though, even considering its advantages, including improving the clarity of images, decreasing latency, and more energy efficient performance.

On the other hand, new developments in AI-based image enhancement, quantum-dot TFT-LCD technology, and real-time glare reduction coatings are enhancing display performance, cost-effectiveness, and long-term usability, contributing to sustained market expansion for TFT-LCD monitors with automotive back-up camera systems globally.

Passenger vehicles, electric vehicles, and smart infotainment systems adopt TFT-LCD monitors

TFT-LCD (Thin-Film-Transistor Liquid Crystal Display) is the most commonly used display technology in exhibition monitors and has been adopted widely among passenger automobiles, commercial fleets, and aftermarket auto accessory factor providers worldwide, as car companies are continuously integrating high-definition rear view display systems to ensure safety and visibility of automobiles.

Such a mirrored device provides real-time digital visualization of the vehicle surroundings with advanced sensor fusion capabilities, which makes it more superior compared to regular rear view mirrors, while enhancing the overall field of view of the driver, especially in blind-spot regions.

Adoption has surged due to the need for high underperformance TFT-LCD monitors with AI-assisted low-light image enhancement, ultra-WDR (Wide dynamic range) capability, and HDR_ high dynamic range capabilities, which optimize visuals across production lines. More than 70% of vehicles in the premium and mid-range market today are provided with TFT-LCD back-up camera displays from the factory, ensuring robust growth for this sector.

The growing adoption of integrated infotainment displays with multi-camera switching capabilities, AI enabled driver assistance overlays, and gesture based controls has cemented market growth owing to better usability and space utilization and providing customization for better interaction with back-up camera systems.

The adoption of TFT-LCD monitors continues to gain momentum, as real-time vehicle proximity alerts and automated parking assistance display overlays, in addition to advanced edge-detection capabilities, have reinforced adoption to provide enhanced decision-making guidance for drivers upon reversing and parking manoeuvres.

However, the TFT-LCD monitor segment is expected to face challenges from evolving automotive safety regulations and the rising costs associated with adopting TFT-LCD monitors in entry-level vehicles.

Nonetheless, the arrival of novel solutions in self-healing coating for displays, artificial intelligence-driven reduction of glare, and hybrid OLED-TFT-LCD technologies are set to enhance durability, efficiency, and cost-effectiveness, securing further growth in TFT-LCD back-up camera monitors in every global corner.

Surface-Mounted Cameras: The Flexibility of Adjustable Angles and Simple Installation

The surface-mounted camera segment has become one of the most preferred solutions in the automotive back-up camera systems, as they allow greater flexibility in terms of installation, wider coverage of field-of-view and improved adaptability with various vehicle types.

Surface-mounted building block designs, on the other hand, are easy to retrofit, placement is more flexible so blind-spot interference is reduced, providing greater visible range and increased safe reversing and parking.

High resolution surface mount cameras coupled with ultra wide angle lenses, AI powered motion detection and night vision compatibility have only added to the adoption. According to studies, more than 65% of the above mentioned back-up camera installations are surface-mounted solutions as they allow versatility and customization, this will keep the demand in this segment high.

Furthermore, the adoption of rear cross-traffic alert systems has also supported market growth, employing real-time pedestrian detection, vehicle trajectory tracking using radar and AI-assisted algorithms for collision avoidance to enhance driver safety and provide improved parking assistance.

Moreover, the introduction of next-generation surface-mounted cameras equipped with digital image stabilization, wireless transmission capabilities, and smart infrared (IR) night vision capabilities have also contributed to the increased adoption through ensuring proper operation in low-light and high-motion environments.

Tailored for Trade - Custom Surface-Mounted Camera Solutions such as Adjustable Mounting Bracket, Vibration Resistant Enclosure, and IP68 rated Waterproof provides reliability and long-term durability that promotes the growth of this market.

While the benefits of surface-mounted cameras include greater installation compatibility, better field-of-view flexibility, and easier vehicle integration, they suffer disadvantages from exposure to external environmental conditions, possible lens obstruction, and changing safety compliance guidelines.

Nevertheless, upcoming technologies such as self-cleaning lenses with AI-assisted performance, weatherproof nano-coatings, and hybrid digital-analogy image processing solutions from leading players are elevating the image quality as well as operational life and reliability of these advanced back-up systems, which will aid the growth of their surface-mounted variants all over the world.

Surface-Mount Cameras Take Hold in SUVs, Heavy-Duty Vehicles, and Fleet Management Solutions

The market for surface-mounted cameras has also seen strong penetration among SUV manufacturers, commercial fleet operators, and vehicle safety technology providers, with industries focused on utilizing flexible and high-resolution back-up camera applications to enhance driver safety, visibility, and vehicle manoeuvrability.

Surface-mounted cameras, by contrast, deliver simple upgradability and compatibility with aftermarket systems, enabling a wider spectrum of accessibility across automotive segments than permanently integrated flush-mounted systems.

The need for smart surface mounted camera solutions with options such as Active Blind-Spot Monitoring, 360-degree digital surround-view integration and Active Driver Assistance overlays, has propelled adoption. Key Drivers and Restraints Instinctively the market for surface-mounted cameras is on the rise due to the growing adoption of Artificial Intelligence in these devices.

According to studies, worldwide more than 75% commercial and heavy-duty vehicles are integrated with surface-mounted back-up cameras, this helps in safety and manoeuvrability which ensures continuous demand for this segment.

Yet, obstacles like the exposure to environmental wear, vibration-related distortions, and rising regulatory scrutiny on back-up camera performance is anticipated to challenge surface-mounted camera market growth, despite their cost-effective installation, expanded rear-view visibility and efficiency in high-resolution image capture.

But, new developments in real-time AI-powered image enhancement, cloud-connected driver safety tracking and next-generation waterproof optical enclosures are enabling more crisp imaging, longer camera lifespans and adaptive new vehicle safety capabilities, driving further global expansion for surface-mounted back-up cameras.

Industry Overview

The market demonstrates substantial growth in automotive back-up cameras because of rising regulatory standards for vehicle safety next to the growing consumer interest in ADAS systems and rising deployment of rear-view cameras across various vehicle classes.

Modern back-up cameras serve as safety enhancements by minimizing blind spot areas and helping drivers with parking and vehicle movement tasks. The market growth happens because of evolving high-resolution imaging technology together with advanced night vision functions and wider lens systems and AI-powered object detection capabilities.

Leading automotive producers use wireless interfaces together with 360-degree surround-view technology and augmented reality visual layers to boost driver visibility and awareness.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Mobility Solutions | 18-22% |

| Magna International | 15-19% |

| Continental AG | 12-16% |

| Panasonic Automotive | 9-13% |

| Valeo SA | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Mobility Solutions | Provides high-resolution back-up cameras with AI-powered object detection, HDR imaging, and night vision capabilities. |

| Magna International | Specializes in 360-degree surround-view camera systems, integrated with ADAS for improved driver safety. |

| Continental AG | Develops rear-view cameras with ultra-wide-angle lenses, thermal imaging, and smart connectivity features. |

| Panasonic Automotive | Offers digital rear-view mirror cameras, wireless back-up camera solutions, and AI-enhanced image processing. |

| Valeo SA | Focuses on high-dynamic-range (HDR) back-up cameras with augmented reality overlays and real-time obstacle detection. |

Key Company Insights

Bosch Mobility Solutions (18-22%)

Bosch leads the automotive back-up camera market with its AI-powered imaging solutions, integrating night vision, object recognition, and real-time alerts for enhanced driver safety.

Magna International (15-19%)

Magna specializes in 360-degree surround-view camera systems, providing seamless integration with ADAS and parking assistance technologies.

Continental AG (12-16%)

Continental offers high-resolution, wide-angle back-up cameras with thermal imaging and real-time data processing to improve driver visibility in all conditions.

Panasonic Automotive (9-13%)

Panasonic focuses on digital rear-view mirror cameras and wireless connectivity solutions, delivering innovative imaging technologies for next-gen vehicles.

Valeo SA (7-11%)

Valeo ranks among the leader companies in the back-up camera field through its delivery of high-dynamic-range imaging capability and augmented reality instructions in addition to AI-based hazard detection systems.

Firms specializing in automotive technology supply solutions for back-up cameras by concentrating on high-resolution picture technology and ADAS controls and connected technology systems. Notable players include:

The overall market size for Automotive Back-up Camera Market was USD 330.14 Million in 2025.

The Automotive Back-up Camera Market expected to reach USD 484.01 Million in 2035.

The demand for the automotive back-up camera market will grow due to increasing vehicle safety regulations, rising consumer awareness about accident prevention, advancements in camera and sensor technologies, and the growing adoption of advanced driver assistance systems (ADAS) in modern vehicles.

The top 5 countries which drives the development of Automotive Back-up Camera Market are USA, UK, Europe Union, Japan and South Korea.

TFT-LCD Monitors and Surface Mounted Cameras lead market growth to command significant share over the assessment period.

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.