Experts project substantial growth of the automotive axle market from 2025 to 2035 because of expanding passenger and commercial vehicle manufacturing alongside advances in electric vehicles and all-wheel-drive capabilities and heightened industry practices for vehicle safety and performance.

Modern vehicle designs heavily depend on automotive axles to fulfill their power transmission functions while maintaining load-bearing and stability operations. Modern axle performance and fuel efficiency gained strength due to increased usage of high-strength and lightweight materials.

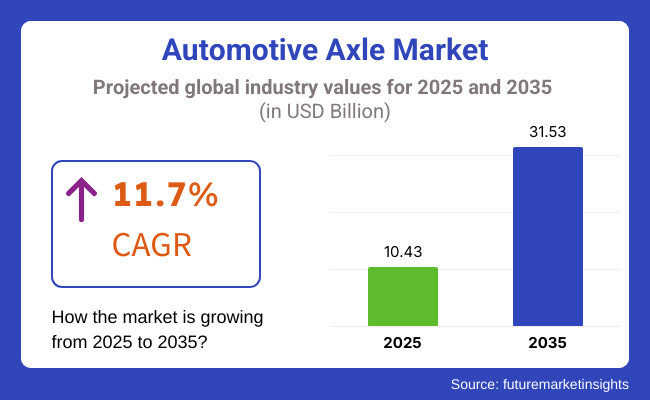

During the period from 2025 to 2035, the automotive axle market will gain USD 31.53 billion in value, initially from USD 10.43 billion, through the 11.7% estimated compound annual growth rate.

The axle market experiences growth through two main developments: first, vehicle manufacturers increase electric adoption and second, automotive regulations intensify and axle design technologies evolve through independent suspension and torque vectoring systems. Manufacturers face growing requirements for heavy-duty axle components because the market demand for off-road and commercial automobiles continues to rise.

Explore FMI!

Book a free demo

The automotive axle market in North America is one of the most lucrative, owing to the presence of prominent automotive manufacturers, as well as a surge in electric and hybrid vehicle production. Strategic Beneficiaries High-Performance Axle System in Light Truck, SUV and Commercial Vehicles Demand in USA and Canada.

The growth of manufacturing facilities for EVs and the adoption of advanced drive train technologies also add to the development of the regional market. Moreover, demand for improved vehicle stability and safety through varying axle high-tech solutions is propelling the axle technology market towards expansion.

The automotive axle market in Europe is growing at a good pace, driven by concerns over emission norms, the rise of EVs, and advances in the architecture of vehicles. Germany, France, and the UK lead the pack in automotive innovation with better weight and improved drive-train efficiency.

The emergence of advanced axle technologies, especially electric and adaptive axles, is propelling the demand across the region. Additionally, the demand for sustainable mobility solutions and autonomous driving systems is pushing manufacturers to undertake the development of next-generation axle systems.

The automotive axle market in Asia-Pacific is expected to grow at the highest rate, owing to a booming automotive sector, rising vehicle production, and government measures promoting electric mobility. China, Japan, South Korea, and India are investing in automotive manufacturing and infrastructure development. With the expansion of the market, passenger cars, commercial vehicles, and off-road applications are driving the demand in the market. Moreover, the increasing effort towards high-performance drivetrains, along with advanced axle materials and smart sensor integration, are expected to drive the market in the region.

Challenge

High Costs and Regulatory Complexities

High production costs, stringent regulatory requirements, and supply chain constraints are some of the challenges facing the Automotive Axle Market. Automotive axle production involves advanced materials, precision engineering, and compliance with international safety standards from organizations like the National Highway Traffic Safety Administration (NHTSA) and the European Union (EU).

The development of products also gets lengthened as meeting these stringent regulations escalates production costs. Additionally, raw material costs - steel and aluminum - have also fluctuated, which has increased costs and made it harder for manufacturers to maintain profitability.

To meet these challenges, firms should be focused on economical material sourcing, lean production methods, and advanced emission/safety regulations.

Market Saturation and Price Competition

The automotive axle market is characterized by a great deal of competition, with a large number of global and regional producers supplying similar products. Price wars come when there is market saturation, which means profits are low and companies find it hard to distinguish themselves.

Electric and hybrid vehicle demand is also revolutionizing traditional axle designs, with the OE segment having to adapt to new vehicle architectures. In order to stay ahead of the game, companies should prioritize innovation while using lightweight materials for their customized axle solutions that will benefit future vehicle designs.

Opportunity

Growing Demand for Lightweight and High-Performance Axles

Rising demand for fuel-efficient, high-performance vehicles is paving the way for the growth of the Automotive Axle Market. Automakers are turning to high-strength steel and other lightweight materials to enhance fuel efficiency by making vehicles lighter.

Cutting-edge axle technologies, such as independent suspension systems and electronically controlled differentials, are helping to improve vehicle performance and drive market growth. As the automotive industry continues to evolve, businesses that invest in research and development into durable but lightweight, high-performance axles will gain a competitive advantage.

Technological Advancements in Electric and Autonomous Vehicles

Wind of change in the Automotive Axle Market with the advent of electric and autonomous vehicles Dent said, "Your electric vehicles (EVs) will extract torque differently, meaning they will need different gearing elements, as well as features designed for regeneration. Precision-engineered axles with integrated sensors and smart control systems are directed for autonomous vehicles' stability and safety.

An electric component can last the life of multiple vehicles, creating the potential for open new revenue streams for manufacturers with modular and scalable axle designs. The next decade will witness the advent of electrical innovations in axle technology as applications for AI-integrated mobility solutions, such as electric drive axles, are developed by leading manufacturers, and companies that will find innovative ways to incorporate advanced features in axle designs will lead the pack in this regard.

During the forecast period of 2020 to 2024, the Automotive Axle Market excelled owing to an increase in vehicle production, demand for fuel-efficient vehicles, along with advancements in axle technology. To improve performance and safety, automakers added sophisticated suspension and drivetrain systems.

However, supply chain disruptions and rising material costs, among other issues, made things tougher for manufacturers, and vehicle demand fluctuated. In response, companies utilized more economical production methods and researched sustainable materials, along with high-strength solutions for axles that are also lightweight.

From 2025 to 2035, the market will see a paradigm shift with rapid adoption of electric, autonomous and connected vehicles. This approach has the potential to revolutionize mobility solutions, thanks to innovative smart axle technology, including sensor-integrated axles and AI-powered torque distribution systems.

Modular and flexible axle platforms with varying technology content will allow car makers to adapt drivetrains according to the vehicle segment. The next phase of market evolution will be dominated by companies that are focused on digital transformation, sustainability, as well as AI-driven analytics in axle development.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with emissions and safety regulations |

| Technological Advancements | Growth in lightweight materials and improved suspension systems |

| Industry Adoption | Increased use in passenger and commercial vehicles |

| Supply Chain and Sourcing | Dependence on traditional axle manufacturing and steel supply |

| Market Competition | The presence of numerous axle manufacturers and price competition |

| Market Growth Drivers | Demand for those fuel-efficient, high-performance vehicles |

| Sustainability and Energy Efficiency | Niche applications in lightweight axle production and efficiency enhancement |

| Integration of Smart Monitoring | Limited use of digital diagnostics and predictive maintenance |

| Advancements in Axle Applications | Use in traditional fuel-based vehicles for improved stability and load-bearing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of sustainability mandates and electric vehicle axle design regulations. |

| Technological Advancements | Development of AI-powered smart axles and next-gen electric drive axles. |

| Industry Adoption | Expansion into autonomous, connected, and next-generation EV architectures. |

| Supply Chain and Sourcing | Shift toward sustainable materials, localized production, and energy-efficient manufacturing techniques. |

| Market Competition | Growth of specialized axle manufacturers, customized drivetrain solutions, and advanced torque distribution systems. |

| Market Growth Drivers | More investment in electric and autonomous vehicle axle technologies |

| Sustainability and Energy Efficiency | Mass Adoption of Sustainable Axle Materials, Zero-Emission Drivetrains, and Circular Economy. |

| Integration of Smart Monitoring | Expansion of AI-driven axle analytics, real-time performance monitoring, and self-adjusting suspension systems. |

| Advancements in Axle Applications | Evolution of smart axles for electric vehicles, torque vectoring solutions, and intelligent drivetrain control. |

The automotive axle market in the USA is witnessing steady growth, supported by increasing automotive production and growing demand for lightweight and high-performance axle solutions. The growing electric vehicle (EV) segment is also enhancing demand as automakers focus on improving drivetrain efficiency.

The integration of smart axles and advanced regenerative braking systems is another technological advancement in axle design that is fostering market expansion. Furthermore, the increasing consumer inclination towards all-wheel-drive (AWD) & off-road vehicles is driving the need for advanced axle configurations.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.2% |

In the UK, the automotive axle market is also growing steadily, aided by the surge in production of both electric and hybrid vehicles. The growing need for improved fuel efficiency from vehicle elements is increasing the demand for more axle types.

In response, government regulators are promoting reduced carbon emissions, causing automakers to participate in lightweight axle design. Moreover, increasing demand for performance and luxury vehicles with advanced suspension and drivetrain systems is also fuelling the growth of the market.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.5% |

The demand for automotive axles in the European Union is strong, which is expected to drive the growth of the market over the forecast period with key manufacturing hubs in Germany, France, and Italy. The growing usage of electric and self-driving vehicle technologies is driving the demand for high-efficiency axle systems.

Axle Solutions - Move to Innovative Solutions Driven by the regulatory policies concerning vehicle weight reduction and fuel economy, manufacturers are moving towards innovative axle solutions. The increasing production of commercial vehicles and the expansion of associated logistics networks are also enhancing demand for heavy-duty, high-performance axles.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.7% |

With Japan being a leading force in automotive technology and design for efficiency-focused vehicles, its automotive axle market is growing continuously. Automakers are looking to implement lightweight, high-strength axle materials to improve the overall performance of the car.

The growing production of hybrid and electric vehicles boosts demand for advanced axle technologies, such as independent rear axles and torque vectoring systems. Moreover, growing investment in autonomous driving solution research and development is catalyzing the growth of the market further.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.3% |

South Korea’s automotive axle market has been expanding rapidly due to the strong presence of major automakers and a transition to electric mobility. The rising export of passenger and commercial vehicles also continues to drive the demand for durable and high-precision axle systems.

With that, the country aims to enhancing vehicle efficiency and performance, which is likely to expand the lightweight and low-friction axle designs in the country. Furthermore, investments in smart mobility along with advanced drivetrain components paved the way for country-based market growth over the forecast period.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.0% |

The automotive axle market is driven by the increasing focus of automobile manufacturers on efficiency, load-bearing capacity, and performance optimization of both passenger and commercial vehicles, leading to a dominant share of the drive automotive axle and rear automotive axle segments.

In which Automotive Axles function as a key enabler in terms of enhancing the stability, power transmission and fuel efficiency, thus they are essential for automobile manufacturers, fleet operators and aftermarket service providers.

With automotive technology changing and electrification dominating the market, companies are now concentrating on lightweight axle designs, advanced materials, and high-performance drive train systems to enhance vehicle performance, lower emissions, and allow for improved loading in passenger and commercial vehicles alike.

The automotive axles market is driven by customers increasingly demanding enhanced vehicle performance.

Segments such as drive axles have become an essential part of passenger cars, commercial vehicles, and high-performance vehicles, as they provide efficient power transfer to the wheels, enhance vehicle stability, and increase durability under various driving conditions.

Drive axles are different from dead axles because they are responsible for transferring the torque from the engine to the wheels, which increases traction and load-bearing capacity, as well as helps with vehicle handling.

The adoption of such devices has been spurred by the demand for high-performance drive axles with improved load distribution, lightweight construction, and integrated electronic differential. According to a study conducted, more than 70% of commercial vehicles and SUVs use drive axles for efficient power transmission, which keeps this segment in high demand.

The market is driven by the proliferation of electrified drivetrain architectures, such as AI-enabled torque vectoring, real-time load balancing, and adaptive power distribution technology, leading to enhanced fuel efficiency, ultimately resulting in decreased drivetrain wear.

Additionally, the combination of next-generation drive axles, such as the use of lightweight alloys, regenerative braking integration, and modular electric axle configurability, allows seamless adaption to changing automotive market trends, further driving adoption.

Interactions with markets across various industries, systems, components, and processes have ensured expansion through optimal strategies that result in increasing energy efficiency, molded hybrid/all-wheel drive (AWD) drive axle solutions, high-durability gearing, and reduced friction designs.

While it provides advantages, such as increasing the drivetrain efficiency, enabling optimum power transmission, and improving vehicle stability, the drive axle segment is expected to face challenges such as increasing production costs, the challenge of integrating the drive axle with electric drivetrains, and demand increasing for lightweight axle materials.

Nonetheless, new innovations in AI-powered drivetrain optimization, high-strength composite axle designs, and cloud-connected axle health monitoring systems are enhancing operational efficiency, vehicle performance, and cost-effectiveness, ensuring global drive automotive axle market growth in the future.

They Are Adopted for Use Not Only in Passenger Cars But Also Hin eavy-Duty Trucks and Even Performance Cars

Drive axles are finding significant traction, especially among automobile manufacturers, logistics operators, and off-road vehicle manufacturers, as the industry is increasingly leaning on high-strength and power-efficient axles to enhance vehicle performance and durability.

Drive axles, in contrast to regular dead axles, are critical in creating motion and transferring power, allowing for efficient acceleration, hill climbing, and terrain adaptability.

Adoption has been propelled by demand for torque-optimized drive axles equipped with AI differential adjustment, real-time torque balancing, and lightweight axle housing materials. According to studies, up to 75% of high-performance SUVs and off-road vehicles use sophisticated drive axles to increase traction and handling, which additionally guarantees high demand for this section.

As a result, the adoption of electric drive axles, the introduction of designs with integrated motor housings, compatibility with regenerative braking, and smart load balancing technologies have further fuelled market expansion, boosting the efficiency of next-gen EV platforms.

Since most car and truck companies build electric vehicles for the mass market and use intelligent axle systems that predict wear based on digital twins, track repairs and service-intervention cloud-integrated, and manage the load on the fly, that is also improved adoption, topping out with fleet efficiency and maintenance savings.

Although this drive axle segment economically drives fuel economy improvements, drivetrain longevity, and vehicle stability, high initial investment cost, changing axle lubrication standards, and complex maintenance programs are restraining the market growth for the drive axles.

But with new advancements in 3D-printed featherweight axle components, AI-assisted torque vectoring, and solid-state axle condition monitoring sensors, prolonging axle life and ride quality/fuel economy effectiveness, are being set, ensuring that drive automotive axles continue to expand globally.

It could be both Rear Axles Display Loads and Show Horsepower.

Rear automotive axle is a vital segment used in passenger cars, light trucks, and heavy-duty commercial vehicles that enhance weight distribution, traction, and vehicle control among multiple driving environments. Compared to front axles, rear axles mainly support the weight of the vehicle, a good power transfer base while passing the car and provide steady handling of the vehicle, efficient power delivery, and stable carrying of the load.

Adoption has been driven by demand for high-durability rear axles with lightweight reinforced structures, improved shock absorption and real-time adaptive load balancing. Research shows that more than 65% of commercial trucks and SUVs come with reinforced rear axles for improved towing and payload ability - which means this segment can expect strong demand.

Market demand has also been boosted by the expansion of commercial vehicle functionality with high-strength axle differentials, load-optimized rear axle layouts, and AI-enabled weight load distribution analytics for higher efficiency in logistics and heavy-haul transport workings.

The adoption of rear axle electrification technologies has been accelerated, including hybrid drivetrain and electronic traction control systems that recover energy during braking and safe disengagement in regenerative modes, and optimization of fuel-powered and electric platforms, etc.;

The ADAS offerings in modular rear axle layouts include torque split optimization using AI, configurable automotive chassis system in real-time, and digital damping, all of which have accelerated market growth while assuring enhanced vehicle safety and comfort.

While the rear axle segment can offer weight-bearing efficiency, augmented vehicle traction, and improved load handling, it faces issues with integration complexity due to the electric drivetrain, obsolescence due to evolving emissions compliance, and high durability requirements in heavy-duty applications.

Yet, innovations such as lightweight composite axle housings, AI-assisted axle health monitoring and adaptive load-sensing axle configurations are aiding axle longevity, vehicle efficiency and driving performance, continuing to ensure sales growth of rear automotive axles across the globe.

U-Haul, the rent-a-truck company, recently stepped into the hybrid market with a rear-wheel-drive, full-size pickup.

Segment by application: The rear axle segment has registered prominent adoption with automotive manufacturers, fleet operators, and commercial vehicle producers in many industries where load-optimized rear axle systems are adopted to enhance the power efficiency of the vehicle, towing performance, and vehicle maneuverability.

Rear axles transfer engine torque both on- and off-road and assist in stabilizing the vehicle balance while on the ground, compared with front-wheel-drive configurations, to enhance your driving dynamics.

They are characterized by high-performance differential gears, AI-enabled torque sensing, and seamless suspension integration, resulting in an ever-growing adoption to fulfil the demand for next-generation rear axles. According to various studies, over 70% of pickup trucks and commercial vehicles add rear axle improvements to their vehicles to improve towing capability and fuel economy, making this segment particularly resilient.

Although the rear axle segment offers benefits like load optimization, better traction, and longer life, it has its set of challenges, such as high manufacturing costs, the complexity of integration with a four-wheel-drive (4WD) system, and the increased demand for unique axle lubrication solutions.

Nevertheless, emerging innovations in smart axle materials, new-age AI-based predictive maintenance, and energy-efficient rear axle electrification solutions are driving cost efficiency, reliability, and performance adaptability, ensuring global expansion for rear automotive axles in the coming years.

Industry Overview

The axle market will increase gradually due to rising vehicle production globally, the popularity of fuel-efficient and lightweight components, and the development of electric vehicle (EV) drivetrains. Other than carrying weight, axles are essential for vehicle stability and for transmitting torque.

The move toward electrification has caused the development of e-axles-units that drive the electric motor and the transmission (typically all together) to boost efficiency and lower mass. Navigating strict safety and fuel economy regulations, top manufacturers are opting for high-strength materials, intelligent axle design, and enhanced durability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dana Incorporated | 18-22% |

| American Axle & Manufacturing (AAM) | 15-19% |

| Meritor, Inc. | 12-16% |

| ZF Friedrichshafen AG | 9-13% |

| GKN Automotive | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dana Incorporated | Specializes in advanced e-axles, lightweight axle solutions, and driveline technologies for passenger and commercial vehicles. |

| American Axle & Manufacturing (AAM) | Develops high-performance axles for traditional and electric powertrains, focusing on efficiency and durability. |

| Meritor, Inc. | Provides axles for commercial and heavy-duty applications, integrating electrification technologies to support EV adoption. |

| ZF Friedrichshafen AG | Manufactures e-axles and axle systems with high-strength materials to improve vehicle fuel efficiency and safety. |

| GKN Automotive | Offers all-wheel drive (AWD) axle solutions, e-axles for EVs, and torque vectoring technology for enhanced performance. |

Key Company Insights

Dana Incorporated (18-22%)

With innovative e-axle solutions, lightweight driveline technologies and fuel-efficient, electrified axles, Dana is at the forefront of the market.

American Axle & Manufacturing (AAM) (15-19%)

With innovative e-axle solutions, lightweight driveline technologies and fuel-efficient, electrified axles, Dana is at the forefront of the market.

Meritor, Inc. (12-16%)

Meritor specializes in commercial vehicle axle systems, providing heavy-duty solutions with electric axle integration for enhanced energy efficiency and load-bearing capacity.

ZF Friedrichshafen AG (9-13%)

ZF is a key innovator in e-axles and advanced axle solutions, leveraging high-performance materials and intelligent control systems for next-generation mobility.

GKN Automotive (7-11%)

GKN Automotive is a leading supplier of AWD axles, electric driveline systems and modular e-axle solutions to automotive manufacturers moving to electric mobility.

The rest of the automotive axle market is supported by manufacturers providing innovative axle solutions for fuel efficiency and vehicle stability, as well as opportunities driven by electrification. Notable players include:

The overall market size for Automotive Axle Market was USD 10.43 Billion in 2025.

The Automotive Axle Market expected to reach USD 31.53 Billion in 2035.

The demand for the automotive axle market will grow due to increasing vehicle production, rising demand for fuel-efficient and lightweight components, advancements in electric and hybrid vehicle technologies, and the growing need for durable and high-performance drivetrain systems in commercial and passenger vehicles.

The top 5 countries which drives the development of Automotive Axle Market are USA, UK, Europe Union, Japan and South Korea.

Drive Automotive Axles and Rear Automotive Axles lead market growth to command significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.