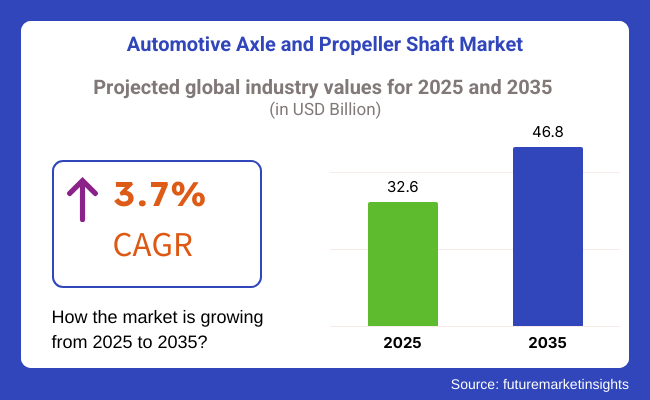

The world automobile axle and propeller shaft market are expected to grow steadily throughout the forecast period, from USD 32.6 billion in 2025 to USD 46.8 billion by 2035, at a CAGR of 3.7%. The rise of condominiums and the latest technical equipment jet propulsion trolley and railing fragment execution drive the market. Aside from that, vehicle technology improvements and installation of the best materials have turned this market into its modern version.

The axle and propeller shaft automotive market is undergoing a change with the introduction of new mobility solutions, like electric and hybrid drivetrains. Car manufacturers are, more and more, paying attention to the issues of improving the vehicle efficiency, durability, and performance through the application of new lightweight materials and high-strength materials in the axle and driveshaft systems.

Also, the movement of becoming full-time all-wheel-drive (AWD) and independent suspension systems is another factor that stimulates the demand for special axles and propeller shafts. Due to the large investment size in the electric vehicle's architecture, different manufacturers are emerging in the market by developing their e-axles and flagship driveline components, making it always vibrant and flexible for changing automotive trends to be adopted.

The expansion of the automotive axle and propeller shaft market forms the base for several central factors. The hike in global automobile production, especially in the case of emerging economies, is the main driver.

Auto manufacturers are putting the stress on the reduction of vehicle weight for the purpose of increasing fuel economy, which is the cause of the growing problematic of bulky axles and propeller shafts that are even made out of high-performance materials like aluminium and carbon fibre.

Along with the growing segment of electric vehicles (EVs) which is actually the main factor of changing the situation in the market of automobile components, this all makes the manufacturers deal on axles and e-propulsion systems just for EV platforms. Also, emission norms and regulatory policies across the globe are further compelling OEMs to embrace the use of novel driveline technology which, in turn, increases the market volume.

Explore FMI!

Book a free demo

The strong demand for pickup trucks, SUVs, and commercial vehicles in North America, especially in the USA and Canada, is the major driver of the automotive axle and propeller shaft market in the area. The region is emphasizing fuel efficiency and emission reduction, which brings the adoption of lightweight axles and driveshaft’s made from aluminium and composite materials.

Furthermore, the growing penetration of electric vehicles (EVs) is giving the much-needed fillip to the e-axles and advanced drivetrain technologies. The major automakers and Tier-1 suppliers are supporting the performance-oriented drivetrain solutions, alongside the insistence of government regulations on green and efficient vehicle components.

Emission regulations have played a crucial role in the European automotive axle and propeller shaft market, which strongly focuses on lightweight vehicle technology. Renowned car manufacturers such as the German, French, and UK leading companies are putting their funds into advanced multi-component driveline systems to enhance their performance and efficiency.

The higher rate of electric and hybrid vehicles being sold has also added to the demand for customized e-, or lightweight driveshaft. Also, the introduction of all-wheel drive (AWD) and independent rear suspension (IRS) systems as standard in high-performance vehicles is propelling the development of high-strength and low-weight axle and propeller shafts.

The Asia-Pacific automotive axle and propeller shaft market are likely to be the fastest-growing across the globe with the major players being China, India, Japan, and South Korea. This belt of prosperity has turned the region into a manufacturing hub for automobiles and their components where electric mobility and hybrid drivetrains projects are gathering pace.

EV government policies and the growth of commercial vehicle fleets have led to a spike in the requirement for lightweight and high-strength axles and shafts. Furthermore, with the big rise in consumer demand for SUVs and AWD in developing countries, manufacturers are motivated to improve the quality and effectiveness of their driving solutions by implementing local conditions through tailoring their designs.

Among the regions included in the global automotive axle and propeller shaft market, there are Latin America, the Middle East, and Africa, which are completely in the process of hiking auto parts production on a worldwide scale. The logistics and transportation sectors, which are being expanded with the increasing use of commercial vehicles, are responsible for the upsurge no more than these additional consumable line items in the robust high-performance driveline markets.

The new automotive products and brands resulting from the expansion of these trends will feature the SUVs and the off-road vehicles with facilities such as logistics and transportation. The exception to this article would be those regions that face negative economic conditions, not to mention the side-effects caused by and supply chain disruptions that happen from time to time unsteady raw material costs.

Challenges

Raw Material Price Fluctuations

The automotive axle and propeller shaft market is significantly impacted by fluctuating raw material prices, especially pertaining to steel, aluminium, and carbon fibre composites.

The pricing changes due to disruptions in the supply chain, geopolitical conflicts, and modifications of trade policies thus affecting the cost of manufacturing and profit margins. The raw material problem that the automakers confront is large scale shifting to lightweight materials for the purpose of achieving better fuel efficiency apart from adhering to emission regulation compliances.

In addition to that, it is the diminishing energy source costs from metal production that are additionally causing unrest in the market. The manufacturers are directing their attention towards alternative materials, local sourcing, and supply chain optimization to alleviate the influence of price variations.

Shift Toward Electric Drivetrains

The increasing presence of electric vehicles (EVs) is a disruption for traditional axle and propeller shaft manufacturers, as EVs generally deploy direct drive systems which displace conventional propeller shafts.

Besides, the electric axles that need to be designed with a specific configuration will be the main challenge for these companies, since they will have to include the motor and electronic components. This will result in the companies having to invest in the latest production technology and research and development.

The electrification of powertrains also requires light and efficient components, which adds pressure to the suppliers to find new solutions. The request for innovative e-axles is spurring the growth, however, the manufacturers of traditional parts are having their difficulties as they try to change the production lines to comply with the new market demands.

Opportunities

Growth in Electric and Hybrid Vehicles

The fast growth of electric and hybrid vehicles (EVs and HEVs) presents a semiconductor opportunity for automotive axle and propeller shaft producers.

As car makers are coming up with dedicated EV platforms, the demand for electric axles (e-axles) with integrated motors, power electronics, and advanced drivetrain systems has been increasing. Lightweights such as carbon fibre and aluminium have become the preference to make the vehicles more efficient. The companies that can innovate and tailor driveline elements for electric mobility are to be the forerunners in the market.

Advancements in Lightweight Materials and Manufacturing

Light weighting applications focused on driving higher fuel economy and lower overall emissions rates remain the single most important force driving innovation in axle & propeller shaft-making. High-strength aluminium, carbon fibre composites and advanced alloys now allow the all-mighty task of direct driver motors operating at twice the current strength to be as lightweight as possible. Advances in precision engineering and additive manufacturing (3D printing) are also creating greater production efficiencies and reducing material wastage.

To evolve the driveline solutions of tomorrow, automakers partner with material science manufacturers and their suppliers. Hence, the companies that invest in lightweight, high-performance drivelines, will in turn, enjoy the leverage of producing they're automotive components on efficient and 'greener' lines.

The automotive axle and propeller shaft sector was very active in the period from 2020 to 2024 and was driven by the surge in vehicle production, technology advances, and a growing emphasis on fuel efficiency.

The demand for lighter materials and longer operational life was the main reason for product innovation, where the manufacturers employed cutting-edge production methods. Eco-friendliness measures accompanied most government regulations in terms of the promotion of emission cuts and the sustainability of the market sector.

Furthermore, a significant portion of electric vehicles and hybrids, along with artificial intelligence-driven manufacturing, and new materials, can be expected to usher in the era of electric vehicle production and propeller shafts, among other products, in the years from 2025 to 2035.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emission norms encouraged lightweight components and fuel efficiency improvements. |

| Technological Advancements | Increased use of high-strength steel and carbon fiber-reinforced plastics for lightweight yet durable axles. |

| Industry-Specific Demand | High demand from traditional automotive manufacturers and commercial vehicle sectors. |

| Sustainability & Circular Economy | Initial adoption of recyclable materials and efficiency-focused designs. |

| Market Growth Drivers | Rising vehicle production, urbanization, and increased transportation demands. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates to drive the adoption of eco-friendly materials and fully electric vehicle-compatible axles. |

| Technological Advancements | Adoption of AI-driven design, advanced composites, and smart monitoring systems for predictive maintenance. |

| Industry-Specific Demand | Shift towards electric vehicle manufacturers, autonomous vehicles, and advanced logistics solutions. |

| Sustainability & Circular Economy | Greater emphasis on closed-loop recycling, green manufacturing, and energy-efficient drivetrains. |

| Market Growth Drivers | Expansion of EV infrastructure, regulatory support for electrification, and continuous material innovation. |

The USA automotive axle and propeller shaft market is basically riding on the vehicle manufacturing industry along with the ever increasing popularity of electric vehicles (EVs) and the introduction of lighter materials.

The push for automakers to rethink their driveline components using metal and composite materials is due to the expanding need for fuel-efficient and low-emission vehicles. Regulatory pressures from government agencies such as the EPA and NHTSA are additionally accelerating the transition to greener powertrain solutions. The rise of driverless cars and connected mobility is claimed to be behind the wheel of investment in next-generation axle and shaft technologies too.

The strong aftermarket sector sees to it that the company generates profit since consumers tend to first upgrade performance and replace the old components. Nevertheless, the real concerns such as supply chain constraints and raw material prices that keep fluctuating are always there.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.5% |

The UK automotive axle and propeller shaft market is heavily influenced by the country's persistent eco-friendly approach, weight-saving elements, and strict emission standards. The country, which has a solid luxury and performance car manufacturing base, is putting money in advanced driveline technologies that will both efficiency and reduce carbon footprints. Car manufacturers are rapidly changing to electrified platforms which makes it necessary to develop new shaft and axle designs.

The state policies that support net-zero objectives by 2050 encourage the adoption of EV-friendly drivetrains even further. Trade adjustments due to Brexit, however, keep on affecting the automotive supply chain, resulting in cost variations and shipping troubles. Research and upgrading of strong and lightweight’s materials are a manufacturer priority to ensuring the retaining of their competitive edge.

| Country | CAGR (2025 to 2035) |

|---|---|

| United kingdom | 3.3% |

The European Union automotive axle and propeller shaft market is seriously affected by the region's mandatory CO₂ emission targets imposed on manufacturers of mainly electric vehicles as well as the innovations in mobility that are environmentally friendly.

Cars manufacturers are gradually concentrating more on the design of the complex transmission system that corresponds both to the law and at the same time boosts the car performance. The high number of foreign car-producing companies in Germany, France, and Italy pushes the demand of the market for special-purpose axle and shaft deals to the top.

In addition, the rise in investment in electric commercial vehicles like logistics and public transport accompanies the market growth. Yet, the prevailing supply chain issues in terms of political reasons and unstable raw material prices act as hurdles. The attempts to create a circular economy and integrate recycled materials into component manufacturing are gaining significant impetus.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.6% |

The impressive technological developments in hybrid and electric vehicles have made Japan a major player in the automotive axle and propeller shaft market. The world-leading automotive manufacturers in the country, such as Toyota, Honda, and Nissan, are constantly working on advanced software programs for improving transmission efficiency and minimizing the overall vehicle weight.

Besides, the demand for materials that are lighter in weight for electric and hydrogen-powered vehicles is increasing because of the fact that they are more widely adopted. The vision of Japan in the area of autonomous and connected vehicle technology is very influential in market dynamics, since this kind of mobility solutions requires different parts for driveline systems.

The scenario looks a bit different because of a decreasing number of people in the own country and the erratic sales of cars thus these factors can limit even an overall market increase. However, the market viability will be guaranteed through the application of strategies that primarily focus on export and establishment of long-term partnerships with automakers all over the globe.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

Automotive axle and propeller shaft market in South Korea is flourishing as it is among the global leaders in electric vehicle manufacturing and innovation. Major auto manufacturers such as Hyundai and Kia are based in this country and it indeed invest a great deal of money in electrified drivetrains which in turn requires high end axle and shaft designs.

Green mobility incentives from the government, toward, besides highly active R&D efforts, are driving market growth. The total global hike in the interest circling of SUVs and high-performance electric vehicles is secondarily the reason the advanced driveline components are sold and used more.

Nevertheless, the primary problem is that they solely depend on some overall raw materials mostly rare-earth elements, especially in times of indecisiveness in geopolitics. Positive export with the addition of the use of smart manufacturing technologies is expected to make the automotive industry stronger and it is going to be more competitive.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The rear axle is in a first place in the automotive axle sector due to the direct and indirect role given it as a part of torque transmission from engine to the wheels; its essentiality is vividly illustrated in the rear-wheel and all-wheel-drive vehicles.

It Serves as a platform for the vehicle's weight and ensures the stability of the truck, SUVs, and others that are heavy-duty and typical applications of it. The need for the available strong and durable rear axles is going up on account of the increasing transportation of goods by trucks and the sales of off-road vehicles.

Manufacturer steps have been taken to deal with lightweight but strong rear axles', mainly in North America and Europe, due to the pressure of the efficiency standards on vehicles and the driving force being fuel efficiency and emission norms which lead technology forward.

The front axle has turned out to be a significant steering and shock absorber component of all kinds of vehicles, especially of passenger and light commercial ones. The increasing number of front-wheel-drive cars that are very popular in cities has driven the demand for front axles. Automobile companies aim to create aluminium alloys that are entirely new materials to achieve better energy efficiency and more effective performance.

The electrical vehicles (EVs) breakthrough has led to the development of new type of front axles, which are constructed with motors that are directly connected. Asia-Pacific is the region witnessing the largest growth, and China and India are the two main contributors of the demand for advanced front axle systems.

Passenger cars are the asset of this market segment, namely, automotive axle and propeller shaft, thanks to their large production volume and the globally increasing number of car owners. The growing interest in SUV and electric vehicles has pushed forward the development of axle and propeller shaft technology which mainly focuses on low weight materials and high efficiency.

Consumers' desire for the most fuel-efficient and the least needed service drivetrains has reassured the manufacturers to put more money into the new axle technologies that use features such as an independent rear suspension. Asia-Pacific is the major region making a very big impact with China and India who are seeing a fast pace of urbanization and a booming middle class which is reflected in the sales of vehicles thus increasing the demand for car axles.

The E-commerce and logistical sectors have moved in the right direction with the introduction of light commercial vehicles (LCVs) which now need durable and efficient axle and propeller shaft systems consequently. LCVs have to include axles that are optimized for a high load-bearing capacity and fuel consumption, means that they should be made of lightweight and high strength materials.

Government grants for electric and hybrid LCVs have mobilized the evolution of sustainable axle-systems. North America and Europe are the main markets where strict emission rules are gradually introducing new lightweight axle designs promising better fuel economy without compromising durability for commercial applications.

Automotive Axle and Propeller Shaft Market was responsible for sluggish growth across the globe owing to maintenance and the rise of alternative powertrains. The market at this present time largely rests on the electric vehicle (EV) boom, high emission standards compliance and the route to reliability brought about by innovation in lightweight parts.

The major players focus on the strategic partnership, joint ventures and high-end technologies which helps to enhance their market circulation. Some of the leading global players in this market include ZF Friedrichshafen AG, Dana Incorporated, American Axle & Manufacturing, GKN Automotive, Meritor Inc. and Hyundai WIA Corporation. In addition, the market is dominated by regional players in the Asia-Pacific industry such as Tata Auto Comp Systems and JTEKT Corporation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ZF Friedrichshafen AG | 15-20% |

| Dana Incorporated | 12-16% |

| American Axle & Manufacturing (AAM) | 10-14% |

| GKN Automotive | 8-12% |

| Meritor Inc. | 5-9% |

| Hyundai WIA Corporation | 4-7% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| ZF Friedrichshafen AG | Manufactures high-performance axles and drivetrains for both ICE and EVs. Strong focus on e-mobility solutions. |

| Dana Incorporated | Supplies advanced axle and propeller shaft solutions with a strong emphasis on electrification and lightweight materials. |

| American Axle & Manufacturing (AAM) | Specializes in driveline and drivetrain components, offering fuel-efficient and high-durability solutions. |

| GKN Automotive | Develops electric drive systems, axle solutions, and propeller shafts for hybrid and electric vehicles. |

| Meritor Inc. | Focuses on commercial vehicle axles and drivetrain solutions, with increasing investments in electrification. |

| Hyundai WIA Corporation | Provides a comprehensive range of axles and propeller shafts, with growing penetration in EV applications. |

Key Company Insights

ZF Friedrichshafen AG

ZF Friedrichshafen AG is a frontrunner in driveline and chassis technology on a global scale, with a specialty in innovative solutions for electric and conventional vehicles.

The firm has been significantly contributing money toward electric mobility, the manufacture of advanced e-axles and integrated drivetrain solutions. ZF’s unique partnerships with high-profile automakers not only boost its market placement but also its lightweight axle designs, which help to improve fuel efficiency and sustainability.

The company has also picked interest in autonomous vehicle technologies and AI-driven driveline systems. By utilizing digitalization and Industry 4.0 practices, ZF is capable of driving the development of driveline efficiency and ensuring its advantage in the very dynamic automotive field.

Dana Builders

Dana Incorporated is one of the automaker's most well-known manufacturers of driveline components and is renowned for its focus on electrification and sustainability.

It innovates axle and propeller shaft solutions for passenger vehicles, commercial vehicles, and off-highway applications. Dana’s involvement in e-mobility, such as production of e-axels with high-efficiency ratings and thermal management systems, is fuelled by emerging needs for electric vehicles.

Dana helps auto companies’ lower emissions and increase vehicle performance with a focus on the lightest materials coupled with modular driveline construction plans. Because of this worldwide footprint and strong commitment to research-first, it is a leader in the transition to more environmentally friendly automotive propulsion technologies.

American Axle & Manufacturing (AAM)

American Axle & Manufacturing (AAM) is an essential and leading supplier of driving units, driveshaft, and differential assemblies as well as high-performance axles. In a bid to durability and efficiency, AAM has turned its focus on both combustion engine vehicles and the growing electric vehicle segment. The manufacturer of integrated electrical drive units has AAM design to boost performance and energy efficiency in EVs.

AAM works together with world car manufacturers to produce systems for vehicles that are lighter and consume less fuel. Through its manufacturing of advanced techniques and equipment, AAM has been able to extend its reach in the global automotive market and strengthen its role in the industry.

GKN Automotive

GKN Automotive is a company that embodies the creativity of driveline technology, with specialization in all-wheel drive (AWD) systems, electric drive units, and propeller shafts. This company belongs to electrification's forefront sector by offering cutting-edge drive solutions, some of which power the leading electric and hybrid vehicles globally. GKN's proprietary torque vectoring and intelligent all-wheel-drive systems not only enhance vehicle performance but also add safety features.

Building on the company's idea of modularity, automakers are enabled to rationalize production processes by adopting scaled driveline designs. GKN is also firmly committed to sustainability, constantly pushing the development of lighter weight and energy-efficient components that are crucial for the mobility shift toward clean options.

Meritor Inc.

Meritor Inc. is a key player in commercial vehicles driveline systems, producing axles and drivetrain components for trucks, buses, and off-highway applications. The firm is quickly building up its arsenal by adding electrified axle solutions thus becoming part of the trend on zero-emission transportation. The expertise of Meritor in heavy-duty drivetrain systems is the secret behind high performance and durability of the systems under extremely difficult conditions.

Meritor is kicking off the next wave of commercial vehicle powertrain innovation by making ongoing investments in electrification, automation and connectivity. By acquiring strategically and forming global partnerships, the company enhances its presence in the automotive supply chain, thus providing stiff competition as a supplier.

Hyundai WIA Corporation

Hyundai WIA Corporation is a major force in the automotive parts industry, producing premium axles and propeller shafts for cars, lightboxes, and trucks. It is also entering the electric vehicle market by manufacturing particular driveline components for hybrid and battery-electric vehicles.

Hyundai WIA will continue to at the core of its agenda, high-quality materials and precise engineering to enhance the product efficiency and lifecycle. The new vehicle is the first electric SUV the automaker has produced in the field of research investments, production and supply chain integration is being leveraged from its larger corporate mates, thanks to its position as a subsidiary of Hyundai Motor Group.

Hyundai WIA's consistent focus on innovation and manufacturing strategies not only makes it a key player in the global market but also in the future of autonomous machines.

The global Automotive Axle and Propeller Shaft market is projected to reach USD 32.6 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 3.7% over the forecast period.

By 2035, the Automotive Axle and Propeller Shaft market is expected to reach USD 46.8 billion.

The rear axle segment is expected to dominate the market, driven by its widespread use in heavy-duty, commercial, and high-performance vehicles, ensuring superior load-bearing capacity, stability, and torque transmission.

Key players in the Automotive Axle and Propeller Shaft market include ZF Friedrichshafen AG, Dana Incorporated, American Axle & Manufacturing (AAM), GKN Automotive, Meritor Inc.

In terms of axle orientation, the industry is divided into Front Axle, Rear axle.

In terms of vehicle type, the industry is divided into Passenger Vehicles, Light Commercial Vehicle, Heavy Commercial Vehicle.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Germany Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United Kingdom Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United States Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.