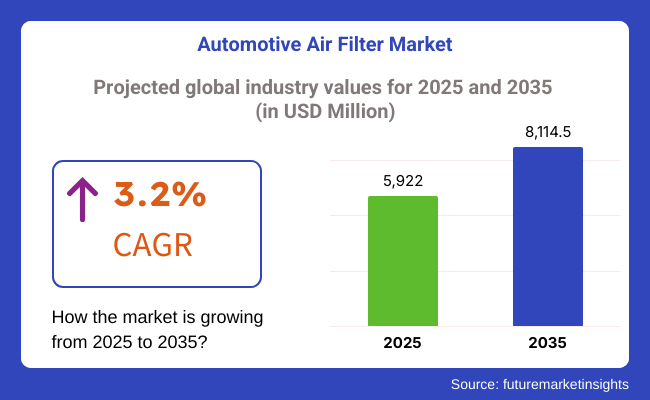

The automotive air filter market is poised for steady growth over the next decade, driven by increasing vehicle production, heightened consumer awareness regarding vehicle maintenance, and stricter emissions regulations. The market, valued at USD 5,922.0 million in 2025, is expected to reach USD 8,114.5 million by 2035, expanding at a CAGR of 3.2% during the forecast period.

The two ways of the expansion of the automotive industry and the factors like rising urbanization and increased disposable incomes are leading to a rise in global vehicle ownership. On the other hand, the increasing environmental troubles and the measures taken by the government to bring down vehicular emissions are pushing the development of advanced filtration technologies.

The snout manufacturers have started putting more of their resources into research and development in order to solvent bigger problems like the filter efficiency, durability, and sustainability, the sale of which will lead this benefitting market to grow. In addition, the coming of electric vehicles, which rely on a high-performance cabin air filter, bring fresh opportunities and because of this dynamic evolution, the automotive air filter market is being ensured to survive.

There are a lot of the reasons that promote the growth of the automotive air filter market. The key factor is the increasing demand for the cars with low emissions and fuel economy, since it is these air filters that affect the performance of the engine and emissions the most.

Furthermore, the cutting-edge filter materials and technology, like the napkin-based and high-efficiency particulate air (HEPA) filters, are not only reaping the good harvest in product performance but also ensuring the lifespan of the devices.

What's more, the surge in the electric car (EV) adoption is the success driving of technology market renovation. Although EV cars do not need engine air filters, the cabin air filters still are being relied on to keep the indoor air clean. This change is the reason for the new ideas in filters for the cabin air.

Explore FMI!

Book a free demo

The market growth is attributed to the implementation of strict emission norms and the establishment of a well-established automotive sector. The United States emerges as the leader of this region, exhibiting the most solid demand for high-grade air filters, mostly for luxurious and high-performance vehicles. The increasing number of electric cars has created a demand for the best cabin air filters thus increasing the passengers' comfort.

Moreover, the initiatives implemented by the authorities, such as the guidelines laid down by the Environmental Protection Agency (EPA) have effectively forced the automobile manufacturers to use more advanced solutions for filtration.

The aftermarket segment is also seeing growth, as more and more car owners focus on regular maintenance and filter changes to ensure good performance of the vehicle and a better air quality.

The demand for air filters with high performance is ever increasing as a result of global environmental challenges and restrictive law regulations such as the Euro6. Germany is a pivotal actor in this play because of its strategic importance as a car manufacturing hub. The automotive industry in Europe is affected by the replacement of fuel-consuming cars with electricity and hybrids which gives birth to new kinds of cabin air filters.

Additionally, the idea of sustainability, that is more than just a trend, also has a new outlet, thanks to the manufacturing of eco-friendly and recyclable air filter materials. The air filter market in this region is buoyed by the presence of top car manufacturers as well as a vibrant aftermarket segment.

The market is on an upward trajectory, propelled by car sales and production increases in China and India. State-arranged movements which not only clean the air but also promote electric cars are the driving force behind the growth of newer technologies for filtration.

The region's wealthier middle class and increased disposable incomes have led to higher rates of motor vehicle ownership which in turn has driven the market even further.

Additionally, automotive manufacturers have started to fund R&D through which they create air filters that are both cost-effective and highly efficient. The auto plants of Japan and South Korea, among other places, are the ones that invented this progress.

The automotive air filter market is on an upward trend in the Rest of the World area due to higher car production regarding demand and thus improving overall economic development.

Latin America witnessed the greatest surge in the market as the car sales, especially in Brazil and Mexico have spiked leading to the quest for high-performance air filters. The Middle East is an area with adversarial weather, where filtration products are a must to alleviate dust and pollutant effects.

Africa has presented a new market opportunity for the auto industry due to urbanization and infrastructure development. However, the ongoing inconsistencies in regulations and strata-wise challenges in these regions may plant seeds of doubt in the minds of stakeholders looking for a long haul in these parts.

Challenges

The High Costs of Advanced Filter Materials

Creation and utilization of highly-efficient air filters need advanced materials such as nanofibers and HEPA filters that are way beyond the budgets of most consumers. These materials are the only means of achieved unique filter characteristics and durability, while at the same time, arising the question of accessibility in cost-constrained markets.

Besides, the assembly of these filters typically consists of specifics like necessary processing which is exclusive and accompanied by strong quality assurance that ultimately lead to higher costs.

Compliance with new instructions and profitable governance is a must and the difficult part comes in when the two clash. Companies that manage to innovate and come up with high-quality yet affordable filters will prosper, while the ones that don’t have good cost-reduction will face the downsizing of profit in this highly competitive sector.

The Impact of the Advent of Electric Vehicles on Engine Air Filters

The transition to electric cars (EVs) worldwide puts a serious dent in the traditional engine air filter sector. EVs, which are run by electricity, are different from the Internal Combustion Engine (ICE) cars which don’t need air filters for the engine, which lessens the demand for this product section. The government everywhere is considering environmental issues and demanding a change, which in turn is speeding up the process of replacement of ICE vehicles.

This pivot forces the manufacturers of air filters to evaluate their existing products and put resources into alternatives, for instance, modern cabin air filters that have beneficial effects on passengers' health. Organizations that choose not to fit in this new automotive environment will be prone to suffering forever lasting losses in terms of market share and the growth that comes with it.

Opportunities

The Growth of Eco-Friendly and Sustainable Air Filters

As the global environmental situation worsens, there is an increase in the demand for sustainable and biodegradable air filters. Manufacturers are in contention, investing in the making of filters fashioned from recyclable and eco-friendly materials, thus, helping in reducing their carbon footprints. Governments all over the world are backing the Green projects with policies that are pro-green thus creating a conducive environment for the sustainable air filter sector.

Industries that involve the inclusion of recycled and green materials will lead in the marketplace, as people, on the whole, are inclined towards environmental choices. So, the move to sustainability should be a big chance for air filter manufacturers to find new and unique ways of doing things.

Aftermarket Segment Expands

The automotive aftermarket industry has been on an upward trajectory and it has brought about manifold opportunities for air filter manufacturers. With the increase in the number of vehicles, drivers have started to realize the significance of performing regular maintenance and replacements for the best performance and air quality. The development of the e-commerce industry has enabled the consumer to buy a variety of aftermarket air filters easily.

Making the move to easy features and high performance, the cost-effective replacement filters can be the main thing that gives companies a leg up on this trend. Joint work with garage operatives and sellers can also add to the sales, turning aftermarket into a credible income stream for air filter manufacturers.

The automotive air filter market has perceived big changes from the period of 2020 to 2024, significantly driven by the increased vehicle production, the threat of environment changes and new regulations aimed at cutting down emissions.

The demand for fuel-efficient cars which is going hand in hand with the demand for high-performance cars is, therefore, the driver for this advanced air filtration market. It was in this time frame that the producers that succeeded the most were those that raised the filter efficiency, switched to long life cycles and made eco-friendly materials.

When looking toward the future between 2025 and 2035, it is expected that the market will undergo more rapid progression due to the technological leaps by the electric automobiles (EVs), the modifying emissions laws, and the innovation of filtering media.

The adoption of re-usable and biodegradable filter resources is presumed to be on the rise. Furthermore, a more than one-faceted growth in urbanization and industrialization will be the engine of demand for high-performance air filters.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emission norms such as Euro 6 and BS-VI enforced stricter air filtration requirements. |

| Technological Advancements | Development of synthetic and cellulose-based filters with improved efficiency. |

| Industry-Specific Demand | High demand from ICE vehicles and hybrid models. |

| Sustainability & Circular Economy | Introduction of eco-friendly filter materials with longer service life. |

| Market Growth Drivers | Rising vehicle ownership, stringent air quality regulations, and consumer preference for high-performance vehicles. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Future policies will focus on reducing particulate matter emissions, driving the adoption of advanced nanofiber and HEPA filters. |

| Technological Advancements | Integration of smart filtration systems with IoT connectivity for real-time monitoring and maintenance. |

| Industry-Specific Demand | Rising adoption of EVs will reshape the air filter market, with an increased focus on cabin air filtration over engine air filtration. |

| Sustainability & Circular Economy | Growth in biodegradable and recyclable air filters to reduce environmental impact. |

| Market Growth Drivers | Increased awareness of in-cabin air quality, expansion of the EV market, and technological innovations in filtration materials. |

The automotive air filter sector in the USA is expected to experience a growth rate of 2.8% per annum, compound over the period of 10 years from 2025 to 2035. The primary drivers of this change will be the increased number of car owners, the laws concerning emissions imposed by the EPA as well as the consumer's growing awareness of air quality. On the other hand, the demand for high-efficiency particulate air (HEPA) and nanofiber filters has been growing, especially in electric and hybrid vehicles.

The sale of the original part of the vehicles as well as of the aftermarket service providers is boosted due to the manufacturers of the automotive industry and the service providers. But the epidemic of frequently worn filters due to long-lasting ones replacing those in need, lessening the sales of the aftermarket segment, is the minor factor hindering their growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.8% |

The UK automotive air filter market is projected to develop at a CAGR of 3.0% from 2025 to 2035. This increase is primarily sustained by the strict environmental regulations such as Euro 6 emission standards and the transition to hybrid and electric vehicles.

The climb of consumer preference for high-performance and environmentally friendly filters is accentuating the innovation. Besides, the automobile aftermarket industry which is growing is the major driving force for the demand of premium and reusable filters. However, the economic downturn and consequences from Brexit may be challenges to the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.0% |

The automotive air filter market in EU is expected to experience a growth rate of 3.3% per year from 2025 to 2035, which is higher than the global average. The main driving forces for the growth are the Eur-7 air emission norms, the steadily increasing share of electric vehicles and the ever more important focus on cabin air quality.

Automotive manufacturers' presence in Germany, France, and Italy eases and reinforces the demand. The transition towards the filter materials, which are sustainable and biodegradable, has a crucial impact on the innovation.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.3% |

Automotive air filter market in Japan is expected to grow within a growth range of 2.9% CAGR during 2025 to 2035. As a major manufacturing hub for cars that lead the air filtration technologies market through giants like Toyota Motor Corporation and Honda Motor Corporation, demand for high-performance air filtration systems is on the rise.

Concerns over urban air quality and the rise of electric vehicles are driving adoption of higher-performance filters. Moreover, Japan research has been directed towards smart air filters, the type that allows for real-time monitoring, thereby opening up new market possibilities; However, the slowdown in domestic car production could have a small impact on overall market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.9% |

The South Korean automotive air filter market is projected to grow at a CAGR of 3.1% over the next ten years, between 2025 and 2035. The market is largely driven by its strong domestic automotive industry led by Hyundai and Kia, along with the rising exports. The stricter emission rules the government has put in place along with the customers' rising issues concerning high-quality indoor air make the market grow.

The new model of cars which is being produced is with integrated air filtration specifically designed for electric and hydrogen vehicles. Despite the robust demand, the market growth could be affected by the fluctuations in raw material prices and the import-export trade policy inconsistencies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

Cabin air filters command a leading space within the auto air filter sector amid the rising customer inclination of clean air and its health implications. These filters play a significant part in the elimination of dust, pollen, allergens, and the pollutants, thereby ensuring the interior of the vehicle is not only clean but also safe for the cabin. The increasing levels of air pollution and the tightening of emission rules further complement the cause.

Car manufacturers are adopting HEPA (high-efficiency particulate air) and activated carbon cabin filters as a means to improve the air purification system in cars. The Asia-Pacific region, specifically China and India, has the most noticeable progress due to its high speed of urbanization and the rise in the number of vehicles sold which in turn causes the dissemination of advanced filtration technologies.

The intake air filters are the main barrier between the engine and contaminants like dirt, debris, and micro-particles that can damage the combustion process. This permits the engine to attain the best possible air-fuel mix for improved engine performance, fuel economy, and reduced carbon emissions thanks to these filters. The massive need for high-efficiency inhalation filters is primarily driven by the development of turbocharged engines and the tightening emission limits globally.

Increasing adoption of multi-layered, synthetic material-based composite filtration media as these offers tear resistance & pocket strength along with filtration performance. Technological advancements are more tip of the spear in the North American and European markets, but consumer preferences and production capacities in developing economies are on the rise; in particular, the demand for fuel-efficient vehicles.

The synthetic air filters are such a big seller in the market because they are characterized by the highest level of filtration efficiency, a longer life cycle, and added durability compared to cellulose filters, the standard ones. These are the special filters designed for cleaning up the airflow by capturing smaller particulates while ensuring optimal use of the filters, thus making them suitable for cabin air filter and intake filter simultaneously.

Additionally, the automotive sector is still in the green phase as the demand for premium and electric vehicles fosters the use of synthetic filters, especially in places with a high degree of pollution. Also, the synthetic filters are superior in moisture resistance, hence they do not clog easily and this leads to longer maintenance intervals. The synthesis of nanofiber-based synthetic filters for ecological stewardship and performance is expected to witness growing R&D activities.

Activated carbon filters are finding their place quite fast in the automotive air filter market, with a large portion of them dedicated to the cabin air filtering. The filters have great properties, such as removing harmful gases, VOCs´ (volatile organic compounds), and bad smell and improving quality of air inside the cabin, besides, the filters are good at absorbing the gases.

The preference of consumer’s vis-a-vis driving in a clean car with the latest technology falls in line with the laws to the effect of a less polluting environment which in turn increases the consumption of said filters.

Car manufacturers are implementing these filters in cars at premium and mid-ranges to the customers who are conscious about the negative impact on human health. The Asia-Pacific region is the place of opportunity for activated carbon-based air filtration where major air pollutions are increasing, and vehicle ownership is going up.

Air filters are an essential component of automotive engineering, serving as the lifeblood of operating engine and cabin filtration. Environmental concerns, emissions compliance requirements, and the growth of car production are driving the demand for high-performance air filters. This foreshadows that core players in the market are eyeing technology leadership, sustainability, and uniqueness of products to take them head-on.

Key Players in the Global Automotive Air Filter Market The key players in the global automotive air filter market are: MANN+HUMMEL Donaldson Company Parker Hannifin Mahle GmbH Ahlstrom-Munksjö K&N Engineering Fram Group Regional players too are contributing massively, especially in emerging economies such as China and India.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| MANN+HUMMEL | 18-22% |

| Donaldson Company | 12-16% |

| Parker Hannifin | 10-14% |

| Mahle GmbH | 8-12% |

| Ahlstrom-Munksjö | 5-9% |

| K&N Engineering | 3-7% |

| Fram Group | 2-6% |

| Other Companies | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| MANN+HUMMEL | Manufactures high-efficiency air filters for engines & cabins. Focuses on sustainability and smart filtration solutions. |

| Donaldson Company | Provides advanced filtration technology for heavy-duty & passenger vehicles. Invests in nanofiber filtration innovation. |

| Parker Hannifin | Specializes in high-performance air filters for commercial & off-road vehicles. Prioritizes energy efficiency & emissions reduction. |

| Mahle GmbH | Produces premium automotive air filters with a focus on fuel efficiency and emissions control. Expands in electric vehicle filtration. |

| Ahlstrom-Munksjö | Develops fiber-based filtration materials for automotive air filters. Focuses on eco-friendly and sustainable solutions. |

| K&N Engineering | Leading provider of performance air filters with washable and reusable designs. Targets motorsports and aftermarket segments. |

| Fram Group | Offers cost-effective and reliable air filtration solutions for passenger vehicles. Expanding reach in emerging markets. |

Key Company Insights

MANN+HUMMEL

MANN+HUMMEL has become the seize in the automotive filtration solutions sector as it is the world’s top provider and is notably recognized for its high-efficiency air filters for engines and cabins. To achieve its sustainability objective, the company has made substantial steps by inventing/modifying filter media that is bio-based and reusable.

Streaming IoT into both the hardware and the software of the filtration system has allowed for automated/remote monitoring resulting in smart maintenance scheduling (predictive). MANN+HUMMEL has taken more global strides through the stringent investment in innovation and the strategic purchasing of companies, thus enhancing its hold on vital markets.

Donaldson Company

Donaldson Company is the leader in constructing top-flight filtration devices, especially for the heavy-duty and commercial truck market. Their ability to use nanofiber filtration technology, which is proven to be more efficient, is detrimental to the overall health of the engine.

The organization is in the process of growing its overall production lines that are in different parts of the world, such as Asia and North America. Moreover, Donaldson is devoted to creating environmentally friendly filtration devices, which not only meet strict emissions rules but also help the company dominate new automotive industry trends.

Parker Hannifin

Parker Hannifin is famous for its specialized and high-performance air filtration solutions for the majority of the commercial, off-road, and industrial applications. The company was the first to create energy-efficient air filtration systems that not only cut down on emissions but also optimize vehicle performance.

Focused on R&D, Parker Hannifin is building air filters for the future which are specifically suited to electric and hybrid vehicles. The worldwide supply chain, together with the ceaseless pursuit of newer and better solutions, underpins Parker Hannifin's competitive advantage in the market.

Mahle GmbH

Mahle GmbH is a household name when it comes to premium quality air filtration systems for OEMs as well as the aftermarket. The company is a solid player in the fields of internal combustion engine (ICE) and also electric vehicle (EV). Mahle is heavily investing in filtration solutions that enhance fuel efficiency and emissions control. The company has taken up electric vehicle air purification systems as one of its newly expanded areas.

Ahlstrom-Munksjö

Ahlstrom-Munksjö is the global leader in fiber-based filtration material production and in addition, it has been specializing in the manufacture of the most sustainable and eco-friendly automotive air filters. One of the routes that the company has taken is cooperation with the OEMs that develop the next-generation filter media which is to follow the new environmental standards/legislation.

Ahlstrom-Munksjö stands out as both an innovative company in the area of filtration technology and as an automotive air filter provider that attaches great importance to environmental issues. The company has gained strength thanks to the conducive/discussion environment surrounding international regulation and the consequent increase in demand.

K&N Engineering

K&N Engineering is the exclusive leader and high-performance air filter manufacturer, featuring a line of filters that can be reused and washed to allow for added vehicle performance. It is widely known and present in both motorsports as well as the aftermarket sector.

Among the numerous new products that K&N Engineering announces throughout the year, the high-flow air filters that boost engine horsepower, and efficiency ranks at the top of the list. The company is also developing a wider distribution network throughout the globe in order to access new customer segments.

Fram Group

Fram Group is a versatile and distinctive name in the field of affordable and durable air filtration systems, predominantly for passenger car solutions. The company emphasizes affordability; along with this aspect, it has kept its filtration efficiency at a high level.

Fram's plan of penetration for the future would likely be the success factor due to the provision of high-quality yet low-cost items to emerging markets. The group heals the situation through investing in environmentally friendly materials that are the latest in high-tech filtration equipment in order to satisfy the curve-ball industry standards and also the customer needs.

The global Automotive Air Filter market is projected to reach USD 5,922.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.2% over the forecast period.

By 2035, the Automotive Air Filter market is expected to reach USD 8,114.5 million.

The cabin segment is expected to dominate the market, due to increasing demand for superior in-cabin air quality, rising pollution levels, growing health concerns, and advancements in filtration technologies enhancing passenger comfort and safety.

Key players in the Automotive Air Filter market include MANN+HUMMEL, Donaldson Company, Parker Hannifin, Mahle GmbH, Ahlstrom-Munksjö.

In terms of Type, the industry is divided into Cabin, Intake.

In terms of Filtering Media, the industry is divided into Synthetic, Cellulose, Activated Carbon Particle

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Automotive Brake Shims Market Growth - Trends & Forecast 2025 to 2035

Portable Wheel Jack Market Growth - Trends & Forecast 2025 to 2035

Marine Suspension Seat Bases Market Growth - Trends & Forecast 2035 to 2035

Off Highway Tires Market Growth - Trends & Forecast 2025 to 2035

Maritime Patrol Naval Vessels Market Growth - Trends & Forecast 2025 to 2035

Gasoline Direct Injection Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.