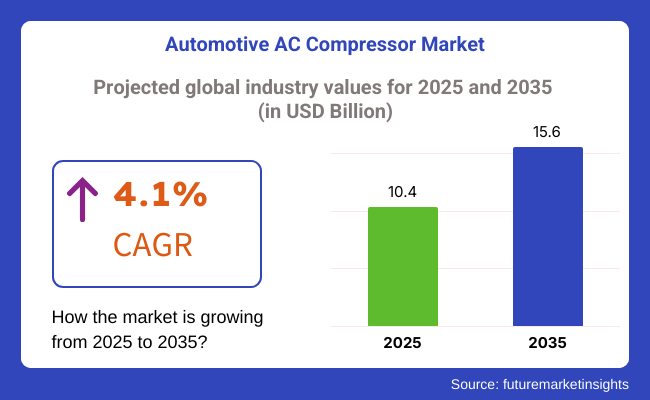

The Automotive AC Compressor Market is projected to experience steady growth over the forecast period, driven by increasing vehicle production, rising demand for enhanced in-cabin comfort, and advancements in energy-efficient air conditioning systems. The market is expected to grow from USD 10.4 billion in 2025 to USD 15.6 billion by 2035, registering a CAGR of 4.1%. The shift toward electric vehicles (EVs), along with innovations in compressor technology, will play a crucial role in shaping the market landscape.

The automotive ac compressor industry is listening to new technologies, growing with trends related to vehicle comfort, and energy efficiency. Providing top-class climate control technologies are among the most important features for car manufacturers to enhance the comfort of passengers in vehicles as international regulations on vehicle emission encourage the adoption of greener refrigerants.

However, the growing production of electric vehicles can be directly linked to the growing demand for electric driven compressors that are expected to replace the traditional belt-driven compressors. Compressor technology is also witnessing new developments such as variable displacement and oil-free compressors, which not only boost fuel economy and reduce emissions, but also global moves towards automotive greener solutions.

The market is witnessing notable advancements, as, invention of electric-driven compressors which are assigned solely for the hybrid and electric vehicle's function. For the time being, the traditional belt-driven compressors that operate on internal combustion engines (ICE) vehicles still lead the market, however, the culture of the eco-friendly refrigerants and the varying displacement compressor is making a flip to the sector.

The major forces involve the expanding vehicle population in undeveloped countries, the occurred rise of the climate changes that directly lead to the hotter temperatures and the tightest emission laws that pushed the automakers to install the more energy-efficient parts. Moreover, the quest for smaller and lighter compressors which would lead to the improvement of the fuel economy and also the battery range in electric cars is bound to increase.

Explore FMI!

Book a free demo

North America Automotive AC Compressor Market is driven by the rising demand for SUVs, pickup trucks, and luxury vehicles that emphasize sophisticated climate control systems. Manufacturers have since been forced to produce compressors as stricter fuel efficiency regulations have been introduced by such organizations as the EPA (Environmental Protection Agency). Energy-efficient compressors are productive machines that help minimize greenhouse gases.

The electric-driven AC compressors introduced in various combinations of vehicles, such as electric cars and plug-in hybrid electric vehicles, have also been a great part of this project. Additionally, the presence of major automakers and Tier 1 suppliers in the United States, Canada, and Mexico is ensuring the steady market growth through continuous innovations and advancements in compressor technology.

Europe’s Automotive AC Compressor Market is not only the result of the region’s push towards the electrification of motor vehicles and the environmental policies that have tightened up, but it can also stand the other way around. Thanks to the EU’s carbon neutrality objective, electric vehicles (EV) production has increased leading to a corresponding increase in the demand for electric AC compressors.

Germany, France, and the UK are the leading locations where the top automakers are investing in energy-efficient climate control systems. In addition, the use of eco-friendly refrigerants instead of F-Gas could meet this requirement and become one of the drivers in the market. The luxury and premium vehicles mainly in Europe are another source for the new compressors that should include features such as variable displacement and smart climate control.

The Asia-Pacific Automotive AC Compressor Market is the fastest-growing, driven by high vehicle production in China, India, Japan, and South Korea. Rising disposable incomes and rapid urbanization are increasing the demand for passenger vehicles with enhanced comfort features.

The promotion of electric vehicles (EVs) throughout the governments, most notably in China, is related to a great increase in the demand for electric AC compressors. Furthermore, the leading compressor manufacturers are building up production plants in Asia since the costs for manufacturing are lower, and the automotive suppliers are strong.

As a result of ride-sharing and mobility services expand in Southeast Asia, the fleet vehicles related to this will need trustworthy and durable AC compressors with proper setting.

Latin America, Middle East and Africa Automotive AC Compressor Market has been growing initially at a sluggish rate on account of lack of required vehicle infrastructure and the allied growth of automobile sector. The weather in the Middle East is hot, and so, good AC compressors are in high demand to handle unprecedented heat. Compressor production in both Brazil and Mexico benefitting from increasing the local automotive production in Latin America.

Africa is slowly developing with the establishment of new businesses and markets, which are contributing to the rise in demand for affordable commercial and passenger vehicles along with the need for better AC systems. Moreover, the promotion of eco-friendly practices and the introduction of new regulations concerning refrigerants profoundly affect the course of development in several areas across the world.

Challenges

Fluctuations in Raw Material Prices

The Automotive AC Compressor Market is the most affected by the volatility of raw material prices, especially the aluminium, steel, and copper used in the process of manufacture. The root causes of the price change are mostly global supply chain disruptions, geopolitical tensions, and persistent inflation. If raw material costs increase, that will lead to increased production costs, and decreased manufacturer profits, consequently vehicle prices for the end-users will become costlier.

Apart from that, the shortage of semiconductors and electronic components which are very crucial for the new line of electric compressors aggravates the supply constraints more. The auto-manufacturers and suppliers will have to apply proper sourcing strategies and seek alternate materials to defuse the situation.

Stringent Environmental Regulations on Refrigerants

Environmental concerns and government legislation on refrigeration are some of the key challenges currently affecting Automotive AC Compressor Market. Many of the traditional refrigerants on the market, such as R-134A, have been outlawed in parts of the world because of their high GWP, resulting in much of the industry moving towards low-GWP alternatives such as R-134yf.

Furthermore, using eco-friendly refrigerants requires additional investments as it requires the redesigning of the entire compressor and producing new technologies. Moreover, the use of eco-friendly refrigerants entails more investments since it includes the redesigning of the whole compressor and the manufacturing of new technologies.

Moreover, the adherence to the strict regulations like the F-Gas Regulation within the EU and the guidelines of the USA EPA make it thus uncommon. Companies are put under pressure to get the right mix of environment and social governance that is cost-efficient yet at the same time beneficial for their business like producing next-generation sustainable AC compressors.

Opportunities

Growth in Electric and Hybrid Vehicle Adoption

The presence of electric and hybrid vehicles in the automotive market forces the automotive AC compressor market to evolve, therefore, this is a big opportunity. Instead of the traditional belt-driven compressors found in ICE vehicles, hybrid and EVs need electric-driven compressors that, for a part, are operated separately from the engine. Electric vehicles have high demand among the consumers, and this is a reason why local manufacturers are producing smaller energy-saving AC compressors.

The companies that deal with the manufacturing of high-voltage electric compressors and intelligent climate controls are likely to achieve considerable profits from the project. In the course of time, as the production of EVs increases, the suppliers, who will be applying the compressor technologies in innovative ways, will gain the competitive gain in the market

Advancements in Smart and Energy-Efficient Climate Control Systems

The advent of intelligent and energy-efficient climate control systems, namely the Automotive AC Compressor Market has initiated radical changes. Car manufacturers are acquiescent to the will of technologies that include variable displacement compressors, heat pump technology, and AI-managed climate control systems, thereby enhancing passenger comfort and diverting from the mainstream energy consumption. These changes mean a lot for the electric cars, where heat management is the major factor affecting battery longevity and the overall performance of the vehicle.

The introduction of IoT and connected car technologies makes it possible to monitor in real-time and adapt the climate effectively thus improving the energy efficiency. The firms where the compressor designs will be next-generation with predictive climate control algorithms set are the ones that will take advantage of the movement to the smart automotive HVAC systems.

The automotive AC compressor market has seen a steady increase over the period of 2020 to 2024. The reasons for this are raised vehicle production, the need for climate control in passenger vehicles and commercial ones, and technology advancements. These advancements are particularly crucial in EVs, whereby the manufacturers were pushing for the development of energy efficient compressors. These two government acts on vehicle emissions and fuel efficiency significantly also have had a dominating effect on the industry.

The expected changes in the market regarding the prediction of the future for the period from 2025 to 2035 are indeed several and most of them are basically rooted in the electrification of the vehicles, the sustainability of mandates, as well as the continued advancements in the HVAC systems.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emission control regulations encouraged the adoption of eco-friendly refrigerants and energy-efficient compressors. |

| Technological Advancements | Transition from conventional belt-driven compressors to electric-driven models for EVs and hybrids. |

| Industry-Specific Demand | Strong demand from passenger vehicles and light commercial vehicles, with a growing market in developing regions. |

| Sustainability & Circular Economy | Introduction of low-GWP refrigerants and focus on reducing compressor energy consumption. |

| Market Growth Drivers | Growth in automotive sales, climate control demands, and regulatory pressures for energy efficiency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates will drive the use of low-GWP (Global Warming Potential) refrigerants and enhanced efficiency standards. |

| Technological Advancements | Integration of AI-driven climate control, variable-speed compressors, and smart thermal management for optimized energy use. |

| Industry-Specific Demand | Rising demand from EV manufacturers, expansion into emerging markets, and development of modular compressors for various applications. |

| Sustainability & Circular Economy | Full-scale adoption of eco-friendly refrigerants, recyclable components, and closed-loop manufacturing practices. |

| Market Growth Drivers | Expansion of electric mobility, sustainability policies, and technological innovations enhancing compressor efficiency. |

The USA automotive AC compressor scene is on the path to reach a notable market capitalization and is speculated to grow at a compound annual growth rate of 3.8% (2025 to 2035). The factors which are initiating this skyrocket rise are strong automotive production, increasing demand for electric & hybrid vehicles alongside consumer choices for sophisticated climate controls. The presence of major automakers and HVAC component manufacturers, in turn, is solid evidence of the strong performance of this market.

In addition, the changes in the compressor design that are caused by the shift in the refrigerant to eco-friendly ones like R-1234yf are also a factor. The electric compressors for EVs changing from the standard to the green paradigm is a hallmark trend. Aftermarket sales are coming in too eye-catching numbers due to factors like total vehicle longevity and the new requirement for replacements.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The UK platform is projected to rise at a compound of 3.5% annually and reach a considerable market size between 2025 and 2035 if we consider the primary factor that is the soaring penetration of electric vehicles along with the government’s support for carbon neutrality by 2035. Cars manufacturers have to some extent changed to the adoption of lightweight and compressing energy-efficient machines to realize their plans for better car efficiency.

The move towards electric AC compressors in hybrid and electric vehicles, together with the need for complex climate controls, is spurring innovation. Apart from that, the very strict emission laws and consumers’ preferences for the thermal comfort have played an important role in the market expansion. Furthermore, the post-Brexit auto policies probably will have an impact on the component imports and manufacturing trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| United kingdom | 3.5% |

The EU automotive AC compressor market is unequivocally set to witness a phenomenal CAGR of 3.9% (2025 to 2035) as a result of new regulations regarding CO₂ emissions, the growing demand for EVs, and the massive presence of an automotive industry in Europe.

Manufacturers leading the charge in this field like Bosch and Valeo are turning their attention to the engineering of energy-efficient and sustainable HVAC technology. The move to the use of refrigerants and the development of electric compressors fits right into the mandates of the EU's Green Deal.

The major markets for Germany, France, and Italy are massively in demand for luxury cars having implemented the climate of conflict with high-tech solutions. The government's promotion of the purchase of hybrid and electric cars is expected to result in a turnaround in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.9% |

Japan's market has been proven to be the site of the next stage of development of math-entertainment robots which was predicted to grow at a CAGR of 4.2% (2025 to 2035).

The reason for it is investor funds to R&D, the joint effort of researchers & engineers, and the expertise of local and foreign companies in these subjects. Local Industry Leaders such as Denso and Mitsubishi Heavy Industries drive the results of innovation in the innovation of portable AC compressors betting on better efficiency.

The need for electric AC compressors has increased as Japan is stepping up EV manufacturing due to the aims of reaching carbon neutrality by 2050. Also, Japan's harsh seasonal weather conditions require sophisticated climate control systems thereby benefitting sales even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The CNC machine tool market in South Korea is predicted to have the highest growth rate in the PALs area with a projected CAGR of 4.5% (2025 to 2035). The latest two segments of the fast-growing automaker industry: Hyundai and Kia are rapidly expanding their electric and hybrid vehicle line-ups, thus, increasing the demand for high-efficiency AC compressors.

Further, the fight against climate change is accompanied by grants for the manufacturing of EVs and further progress in green automotive technology which is the initiative from the government.

In order to generate significant interest in their products, the Korean manufacturers are including AI in smart climate control technology. The automotive component exports to other countries such as the USA and the EU which is expected to fuel the growth process are marketing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

The Scroll Type Compressor is the leading market player owing to its extraordinary operating efficiency, noiseless functionality, and long lifespan. Its predominant application is in passenger cars and electric vehicles as it provides lower friction losses and superior thermal performance compared to other types.

The sales of electric and hybrid vehicles are the primary factor driving the proliferation of scroll compressors, as they contribute to the overall energy efficiency. In parts of Europe and North America where tough fuel economy regulations are in force, OEMs consider scroll-type compressors first because of their capacity to cut emissions and give better mileage to vehicles.

Rotary Type Compressors are conquering a major share, particularly in small passenger cars and economy vehicles, owing to their compact design and cost efficiency. These compressors are most preferred in Asian markets like China and India where considerable manufacturing of affordable passenger cars is the trend. They provide uninterrupted airflow, greater reliability, and lower weight, so they are perfect for vehicles running in hot and humid environments.

However, rotary compressors are rapidly overtaking scroll compressors in some premium vehicles despite their higher noise and minor efficiency. On the other hand, advancement in variable-speed rotary compressors should be beneficial for maintaining their market place.

Passenger cars are the leading vehicle segment in the automotive AC compressor market, driven by rising consumer demand for increased comfort, luxury, and energy-efficient climate control systems. Introduction of electric cars and hybrid cars especially in developed markets was further fueling demand for high-performance compressors that meet sustainability agendas.

Automakers are opting for eco-friendly refrigerants and novel compressor technologies in regions such as North America, Europe, and China to enhance vehicle efficacy. Moreover, FAQs The growth in implementation of automatic climate control systems in premium and mid-range segment passenger cars is boosting the innovation & adoption of compressor technology.

The light commercial vehicle (LCV) segment shows a strong upward trend in deploying AC systems, and justifies this by the demand for last-mile delivery, urban logistics, and fleet expansion. Countries like India, Brazil, and ASEAN represent potential markets for LCVs and further push demand for efficient AC units.

Furthermore, statutory laws aligning with driver comfort and safety have encouraged manufacturers to incorporate sophisticated cooling systems in LCVs. The growth of demand for electric commercial vans is another contributing factor to the development of electric AC compressors that add battery performance on the condition of maintaining cooling efficiency.

The Automotive AC Compressor Market is a key element in vehicle climate control systems by the cooling process these units achieve. Markets are driven by rising car production, the growing use of electric vehicles (EVs), and the latest development in energy-efficient compressor technology.

The main factors present are replacing the use of electric compressors in EVs, switching to lightweight and compact compressor models, and the increase in the lifespan of the components used in extreme weather conditions.

The most important companies dominating the market include Denso Corporation, Hanon Systems, Valeo, Sanden Corporation, and MAHLE GmbH, among others. The landscape is defined by strong competition, technological advancement, and strategic alliances to improve measures of energy efficiency and sustainability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Denso Corporation | 20-25% |

| Hanon Systems | 15-20% |

| Valeo | 10-15% |

| Sanden Corporation | 8-12% |

| MAHLE GmbH | 5-10% |

| Other Companies | 35-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Denso Corporation | Manufactures high-efficiency compressors for internal combustion engine (ICE) and electric vehicles. Focuses on energy-saving designs and sustainability. |

| Hanon Systems | Develops electric compressors tailored for hybrid and battery electric vehicles (BEVs). Invests in lightweight materials and smart control technology. |

| Valeo | Produces compact and high-performance compressors, emphasizing CO2 refrigerant systems for reduced environmental impact. |

| Sanden Corporation | Specializes in variable displacement and fixed displacement compressors for passenger and commercial vehicles. Expanding in the EV sector. |

| MAHLE GmbH | Provides advanced thermal management solutions with a focus on reducing emissions and enhancing fuel efficiency. |

Key Company Insights

Denso Corporation

Denso Corporation is a global major in automotive air conditioning systems and their solution includes supplying high efficiency, energy-saving vehicle climate control compressors. In a bid to improve energy usage and reduce the ecological footprint, the group engages in significant R&D efforts. With sustainable development in mind Denso produces CO2-based refrigerants and electric compressors for hybrid and electric vehicles.

With a great number of manufacturing plants across the globe and holds partnerships with various popular automakers, Denso expands a plant in the North American region as well as in Asia. It focuses on providing technologies and regulatory frameworks to keep up with the latest market trends.

Hanon Systems

Hanon Systems has established itself as a principal player in the automotive thermal management industry with a special focus on electric compressors for hybrid and battery electric vehicles. The business uses a lightweight content and smart control technology to improve energy efficiency and return of the car. Hanon is forming sustainable solutions by bringing forth eco-friendly refrigerants and lowered emission components.

As its footprint grows in the Asia-Pacific and European markets, the company is restructuring its relationship with car manufacturers worldwide. The continuous STAGE research & development, and innovative thermal solutions that keep Hanon Systems at the forefront of the rapidly evolving automotive industry.

Valeo

Valeo is one of the leading manufacturers of compact and energy-efficient automotive compressors, which are also designed for sustainability and efficiency. They have been a leader in developing refrigerants based on CO2, which contribute significantly to reducing the environmental footprint. Valeo's lightweight and energy-efficient compressors reflect the growing popularity of electric and hybrid vehicles.

The firm is rapidly raising its stakes within Europe as well as opening itself up to the world. Valeo's research into high-tech cooling is a sign of its ambitions to comply with ever-defining regulations. It is precisely these collaborations with the automobile industry, as well as its R&D funding, that position Valeo as a friend to the biggest names in the automotive climate control market.

Sanden Corporation

Sanden Corporation is a well-known supplier of variable and fixed displacement compressors. The company has developed a product range that caters to both passenger and commercial vehicles. Sanden has set its sights on the electric vehicle segment of the market by developing new technologies that will increase electric compressor's efficiency.

The company also encourages product durability and performance as it ensures their products can withstand extreme climate conditions. Sanden is a global company and a lot of its suppliers are based in North America and Asia. The shift towards EV sector along with the introduction of new technologies has made Sanden a strong industry player in the automotive AC compressor market.

MAHLE GmbH

MAHLE GmbH is a company pioneering the thermal management technology of tomorrow, by emphasizing reducing emissions and achieving better fuel economy. The firm is actively developing next-generation compressors that lose the least amount of energy in cooling systems in vehicles. MAHLE's innovative cooling technologies are designed for the ever-growing market of electrified powertrains in hybrid and battery electric vehicles.

By investing in eco-friendly refrigerants and lightweight components, the company has placed a strong emphasis on the sustainability drive. MAHLE has, through the expansion of its R&D division, rightfully appointed itself as a future market leader in automotive climate control technology.

The global Automotive AC Compressor market is projected to reach USD 10.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.1% over the forecast period.

By 2035, the Automotive AC Compressor market is expected to reach USD 15.6 billion.

The Scroll Type Compressor segment is expected to dominate the market, due to their high efficiency, compact design, low noise, durability, and smooth operation, making them ideal for modern vehicles requiring reliable and energy-efficient cooling solutions.

Key players in the Automotive AC Compressor market include Denso Corporation, Hanon Systems, Valeo, Sanden Corporation, MAHLE GmbH.

In terms of Configuration, the industry is divided into Scroll Type Compressor, Rotary Type Compressor.

In terms of Vehicle type, the industry is divided into Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.