Growth opportunities are anticipated in the Automotive AI Chipset Market during 2025 to 2035, due to the growing deployment of autonomous and semi-autonomous vehicles, the development of AI-powered driver assistance systems, and the rising demand for real-time data processing in connected cars. Advanced Driver Assistance Systems (ADAS), autonomous driving, predictive maintenance, and in-vehicle infotainment are some of the areas where AI chipsets are becoming increasingly vital to make a vehicle smarter and safer.

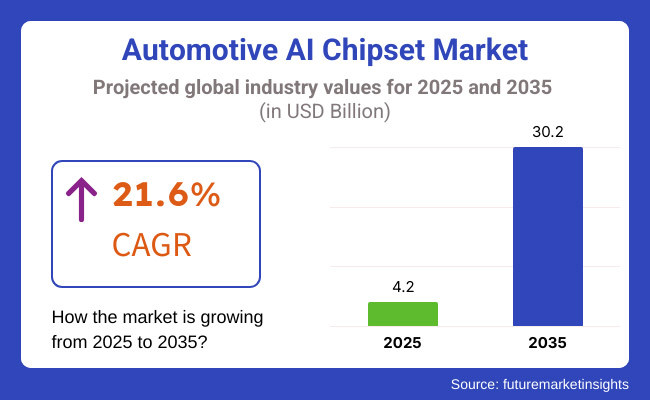

The entire market will rise very closely there It was predicted to USD 4.2 Billion by 2025 to USD 30.2 Billion by 2035, expanding at a CAGR of 21.6% during the forecast time. Electric vehicle (EV) manufacturers are now integrating AI chipsets into their vehicles to improve their autonomation abilities, committing themselves to utilize AI-based sensor fusion systems for improved navigation, and seeking out more AI-based Automotive Software solutions as they work to deploy AI more broadly. Also, new approaches like AI-on-chip, neuromorphic computing, and energy-efficient AI accelerators will lead to more innovations in automotive AI hardware.

Explore FMI!

Book a free demo

The largest chunk of the Automotive AI Chipset Market belongs to North America due to substantial investments in self-driven technologies, strong presence of the semiconductor industry and supportive government initiatives for AI-based mobility. The US and Canadian countries are ahead in the region by virtue of major auto and technology companies including Tesla, NVIDIA, Intel, and Qualcomm developing AI chipsets for next-gen cars.

The NHTSA and the USA Department of Transportation are actively pushing for AI-based vehicle safety regulations, which is further driving the demand for automotive AI chipsets for applications running autonomous driving and predictive safety. Moreover, the growing adoption of 5G networks, V2X communication, and AI-based fleet management solutions which contributing to solidify deepening North America market.

The Automotive AI Chipset Market is dominated by Europe, this is due to countries like Germany, the UK, and France leading the race for innovation in AI-powered automotive, trials of autonomous vehicles, and establishment of regulatory frameworks for AI in mobility. Once again, stringent vehicle safety mandates from the European Union such as ADAS requirements and Euro NCAP safety rating drive the integration of AI in ADAS, driver monitoring systems, and for real time hazard detection.

Major European automakers such as BMW, Mercedes-Benz, and Volkswagen are pouring funds into AI-derived semiconductors for driverless vehicles, energy-efficient AI processing, and neural network decision systems. Moreover, the emergence of AI-based mobility-as-a-service (MaaS) platforms and smart transportation programs are advanced factors anticipated to drive market growth in Europe.

The Automotive AI Chipset Market in the Asia-Pacific region is estimated to register the highest CAGR owing to increased automotive production, growing adoption of AI in EVs and government-backed smart mobility initiatives. China, Japan, South Korea, and India dominate this combined-market opportunity of AI-driven automotive innovation, semiconductor manufacturing, and autonomous vehicle research.

China's biggest automotive and semiconductor market in the world driving up the speed of AI adoption on EVs and AVs, with tech mega companies like Huawei, Baidu, and Alibaba, all making strong investments in developing AI chipset for their self-driving vehicles, AI-enhanced infotainment systems, and predicting real-time traffic. On the other end of the spectrum, Japan and South Korea, which is home to the likes of Toyota, Honda, Hyundai, and Kia; are incorporating AI-based perception systems, AI-based battery management solutions, and deep-learning-based driver aids for their next-gen cars.

The demand for cost-effective AI chipsets in connected vehicles is propelled by the automotive electronics market's growth in India and the increasing emphasis on AI-integrated mobility solutions. Increasing adoption of AI-driven manufacturing, LiDAR-based AI perception, and smart cities are also propelling the growth of the market in this region.

Challenges

High Costs and AI Hardware Complexity

High-cost AI semiconductor manufacturing is one of the major reasons that advanced AI chipsets, when integrated into mass-market vehicles, prove to be cost-prohibitive in the Automotive AI Chipset Market. Moreover, AI processing needs a high computing power and an effective energy management, introducing thermal and energy efficiency challenges in the vehicles.

Integration of AI hardware into existing automotive architectures is challenging and long development cycles and the need to meet regulatory constraints can stifle market uptake. In addition, world supply chain disruptions, shortage of semiconductor chips, and geopolitical trade restrains may influence availability of automotive AI chipsets and production schedule delays.

Opportunities

Edge AI Computing and AI-Powered Automotive Personalization

The Automotive AI Chipset Market report, however, acknowledges the challenges faced by the Automotive AI Chipset Market, but emphasizes that the opportunities in this industry are still very significant in the upcoming years. Edge AI computing, which allows the processing of AI algorithms in real time within the vehicle is minimizing latency and maximizing ADAS capabilities, predictive analytics and AI-enabled user experiences.

With data learned until October 2023, AI-enabled automotive personalization techniques such as voice assistance systems, emotion detection AI, and technique sense-oriented AI are enhancing the journey of drivers and passengers. Also emerging new revenue streams for automakers and AI chipset manufacturers include the development of AI-powered safety analytics, predictive vehicle diagnostics, and AI-assisted navigation solutions.

Rising deployment of AI based cybersecurity solution for connected vehicles further benefits the growing demand for AI based fleet management, smart traffic control and autonomous logistics, further boosting the market outlook. Industry transformation is anticipated to surge with quicker adoption of AI chipsets in vehicle-to-everything (V2X) communication and a cloud-connected automotive ecosystem.

The Automotive AI Chipset Market witnessed significant growth from 2020 to 2024 due to the rising adoption of autonomous driving technologies, advanced driver assistance systems, and connected vehicle ecosystems. AI-powered chipsets were integrated into the vision processing, sensor fusion, real-time decision-making, and in-vehicle infotainment systems of automakers and technology firms to enhance safety, navigation, and user experience. The emergence of Level 2+ and Level 3 autonomous cars and regulations around AI-enabled safety features drove demand for high-performance, low-latency AI processors for automotive applications.

The Automotive AI Chipset Market will be revolutionized between 2025 to 2035 with quantum AI computing, 3D-stacked neuromorphic processors & AI powered automotive edge networks. Level 4 and Level 5 autonomous driving with next-gen AI chipsets, offering self-learning AI algorithms, ultra-low latency processing of real-time data, and AI-powered energy efficiency.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adoption of AI-powered safety mandates, ADAS integration laws, and NHTSA & EU AI compliance standards. |

| Technological Advancements | Introduction of edge AI, deep learning-powered NPUs, and AI-accelerated vision processing. |

| Industry Applications | Used in ADAS, in-vehicle AI assistants, real-time sensor fusion, and vision-based perception models. |

| Adoption of Smart Equipment | AI-powered sensor fusion, intelligent traffic monitoring, and automated safety decision-making. |

| Sustainability & Cost Efficiency | High-power AI chipsets increased vehicle energy consumption and costs. |

| Data Analytics & Predictive Modeling | Use of AI for predictive maintenance, ADAS optimization, and route planning. |

| Production & Supply Chain Dynamics | Supply chain disruptions affected semiconductor availability and AI processor integration in vehicles. |

| Market Growth Drivers | Growth driven by ADAS expansion, real-time AI navigation demand, and connected vehicle intelligence. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-secured AI decision compliance, quantum-safe AI encryption, and global AI chip standardization for autonomous mobility. |

| Technological Advancements | Quantum AI chipsets, bio-inspired neuromorphic processors, and 3D-integrated AI-SoCs for ultra-low latency inferencing. |

| Industry Applications | Expanded into fully autonomous driving (Level 4 & 5), AI-enhanced vehicle-to-cloud (V2C) networks, and software-defined mobility AI architectures. |

| Adoption of Smart Equipment | Self-learning vehicular AI, AI-driven V2X coordination, and real-time AI inferencing with decentralized edge processing. |

| Sustainability & Cost Efficiency | AI-powered energy harvesting, bio-neural AI circuits, and ultra-efficient quantum AI processing. |

| Data Analytics & Predictive Modeling | Quantum-AI-based predictive hazard assessment, real-time AI-enhanced traffic fluidity modeling, and decentralized AI inference for autonomous fleets. |

| Production & Supply Chain Dynamics | AI-driven semiconductor fabrication, blockchain-backed AI chip traceability, and global decentralized AI chip production hubs. |

| Market Growth Drivers | Future expansion fueled by quantum AI chip integration, software-defined vehicle ecosystems, and AI-powered full autonomy. |

The United States Automotive AI Chipset Market is fast growing on account of growing investments in autonomous driving technology, rising adoption of AI-powered infotainment systems and increasing government support for AI innovation. American regulators at the DOT and NHTSA promote AI-based vehicle safety systems such as advanced driver monitoring and autonomous emergency braking and their usage in vehicles.

Top semiconductor companies including NVIDIA, Intel and Qualcomm are focused on next-generation AI chipsets for autonomous driving, sensor fusion, and predictive maintenance applications. Moreover, the development of 5G and edge AI computing has also accelerated the real-time data processing capabilities of connected vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 22.1% |

Growing focus on autonomous vehicle development, AI-driven mobility solutions, and government-backed funding for smart transportation projects is expected to boost growth in the Automotive AI Chipset Market in United Kingdom. CCAV is the UK’s Centre for Connected and Autonomous Vehicles and is funding sensor analytics algorithms (AI-Algorithm-Based Perception of Vehicles), contribute to vehicle perception and processing, sensor data and AI-Edge Computing for Real-Time Navigation.

Automakers like Jaguar Land Rover are funding AI-powered driver-assistance systems, predictive specialists and next-gen AI processors to add in semi-autonomous automobiles. Demand for smart cities and connected infrastructure in the UK is also giving a boost to the take up of AI chipsets for vehicle-to-everything (V2X) communication.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 21.2% |

The growing European Union penetration of AI in automotive systems, stringent vehicle safety standards, and a high level of investment in semiconductor R&D are driving the growth of the European Union Automotive AI Chipset Market. Ongoing AI development for autonomous vehicles, ADAS, and intelligent traffic management systems, driven by The Horizon Europe program of the European Commission.

Countries such as Germany, France, and the Netherlands are ahead of the curve for chipset adoption, where the likes of BMW, Mercedes-Benz, and Volkswagen are adopting high-performance AI processors in applications like autonomous driving and connected car technologies. Moreover, rising push for energy-efficient AI chipsets in electric and hybrid vehicles (EVs) is aiding market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 21.6% |

Japan Automotive AI Chipset Market is growing because of government support for AI research, investment in semiconductor technology and a push for AI-enhanced solutions for mobility, driving the market for Automotive AI Chipsets. Japan's METI agrees, funding investments AI-enhanced vehicle safety systems, autonomous driving, and sophisticated sensors and processing.

With AI chipsets, Japan's Toyota, Honda and Nissain qualify for real-time decision making, object recognition and improved autonomous driving capabilities. AI-enabled robotics for automotive manufacturing are advancing too, driving demand for high-performance automotive AI processors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 21.8% |

The Automotive AI Chipset Market in South Korea is set to expand rapidly, given government-funded AI innovation initiatives, increasing demand for AI-powered mobility solutions, and growth of the semiconductor manufacturing sector. The South Korean Ministry of Trade, Industry, and Energy (MOTIE) is facilitating the development of Semiconductor chips for AI-based areas such as Electric, Connected, and Autonomous Vehicles.

Global leaders in the car industry and semiconductor market like Hyundai, Samsung, and SK Hynix are also pouring millions of research dollars into AI chips for sensor fusion in real time, deep learning algorithms, and V2X communication. Also, the joint capabilities of 5G-enabled AI processors are ushering in next-generation autonomous and smart mobility solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 22.3% |

Accelerated growth of the Automotive AI Chipset Market is becoming apparent due to the growing implementation of artificial intelligence (AI) in areas such as autonomous driving, infotainment, and advanced driver assistance systems (ADAS). Out of all available chipset types in market, Graphics Processing Unit (GPU) and Application-Specific Integrated Circuit (ASIC) comprise most production share of a given device due to their ability to perform a lot of calculations, ability to process data in real time, and lower energy consumption level.

Graphics Processing Units (GPUs) are the most adopted AI chipsets across the board including, ADAS, autonomous driving and in-car infotainment systems, offering massive parallel processing means required for real-time image processing, sensor fusion and AI-driven decision-making. Hence, AI-enabled automotive applications prefer GPUs for training and deploying deep learning models used in computer vision, object recognition, and sensor data analysis.

As autonomous driving progresses rapidly, automotive manufacturers are adopting high-performance GPUs for self-driving vehicles, AI-aided navigation, and predictive control of vehicles. Then there are companies like NVIDIA and Intel Mobileye providing the market with automotive-grade GPUs that suit AI workloads, accelerate deep learning and analyze traffic in real-time.

However, despite their huge computational power demand, the rise of GPUs has been limited to energy consumption and heat dissipation, which will greatly affect the vehicle battery and thermal management system. The good news however is new innovations such as AI-optimised GPUs, low power chip architectures and AI Edge computing solutions are aimed at ensuring these concerns will soon be addressed, in turn empowering AI-powered vehicles operate smoother, smarter and greener than ever before.

The automotive AI chipset market is also witnessing the increasing adoption of Application-Specific Integrated Circuits (ASICs) owing to their highly optimized performance, lower power consumption, and customizability for specific AI tasks. ASICs, unlike general-purpose processors such as GPUs or CPUs, are highly specialized designs for implementing AI-based functionalities like sensor fusion, real-time vehicle perception and automated driving planning methodologies.

To improve processing, reduce latency, and optimize vehicle safety systems, both automakers and AI chipset manufacturers are developing AI-dedicated ASICs. Companies including Tesla, Qualcomm and Alphabet’s Waymo have put money into automotive-specific AI chipsets designed for the speedy processing of data to make possible autonomous navigation, AI-powered braking and road hazard detection.

While they are more energy-efficient and optimized for specific tasks, ASIC chipsets are less flexible than GPUs, as they cannot easily be repurposed to perform other AI-related tasks. Still, the boom of AI demand of autonomous as well as connected vehicles will likely be a push-force of new tech innovations for ASIC-based automotive AI processors.

The usage of AI chipsets in automobiles largely comes from autonomous driving and advanced driver assistance systems (ADAS), as both segments depend on high-speed AI processing and the ability to fuse real-time data and make predictive decisions.

The biggest consumer of AI chipsets is in the autonomous driving segment, where automakers and technology companies are racing to create fully autonomous vehicles. AI chipsets facilitate perception, object detection, sensor fusion, and automated route planning in self-driving vehicles, guaranteeing real-time navigation, obstacle avoidance, and analysis of traffic patterns.

Autonomous driving systems powered by AI rely on a combination of AI accelerators and deep learning algorithms and neural network processors to interpret raw data sourced from LiDAR, radar, cameras, and ultrasonic sensors, so high-performance GPUs and ASICs are necessary for achieving real-time decision-making and ultra-low-latency response times.

Nevertheless, there are still technological and regulatory hurdles including validation for AI safety and emissions testing, that prevent mass adoption. With these problems addressed, AI chipset manufacturers are working on warping their AI chipsets to train on a whole range of AI models, utilize advanced neural processing units (NPUs), and implement quantum AI computing solutions, addressing self-driving vehicle safety and overall reliability.

Another common AI chipset application comes in the form of Advanced Driver Assistance Systems (ADAS); lane departure warning, collision detection, adaptive cruise control and blind-spot monitoring all use some combination of real-time AI analytics. The AI algorithm of advanced driver assistance systems (ADAS) processes the heavy volume data of numerous sensors in milliseconds to enhance driving safety, lower human error, and assist in semi-autonomous driving.

Governments are now making these features compulsory for modern vehicles, and automotive manufacturers are embedding high-efficiency AI chipsets to not only process the sensor inputs but also detect road hazards while assisting drivers with complex traffic conditions. Then, AI is revolutionizing vehicle safety by proactively managing potential risks and contributing to accident prevention, creating an even greater demand for custom AI chipsets designed for real-time vehicle diagnostics and adaptive control.

However, the rise of ADAS has introduced obstacles of cost limitations, AI misinterpretation risks, and potential threats to cybersecurity in connected vehicles. Nonetheless, recent developments in edge AI computing, high-speed automotive AI chips, and AI-enabled vehicle-to-everything (V2X) communication will usher in enhancements of ADAS functionalities, accuracy, and protection.

The global automotive AI chipset market is anticipated to grow at a significant CAGR during the forecast period owing to rising adoption of AI-based autonomous driving and ADAS & connected vehicle technologies. The demand for enhanced performance computing in vehicles, improvements in deep learning algorithms, and the growth of electric and self-driving cars are driving the market. Businesses target super-fast AI processors, energy-efficient neural processing units (NPUs), and real-time edge computing to groom these developments in autonomous navigation, predictive maintenance, and in-car infotainment systems. These trends eventually shape the AI in Automotive market, which consists of leading semiconductor manufacturers, automotive AI technology companies, and SoC developers working to bring about such innovations in AI-driven perception, sensor fusion, and real-time decision-making for smart mobility.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| NVIDIA Corporation | 20-25% |

| Qualcomm Technologies, Inc. | 15-20% |

| Intel Corporation (Mobileye) | 12-16% |

| NXP Semiconductors | 8-12% |

| Tesla, Inc. | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| NVIDIA Corporation | Develops high-performance AI processors (NVIDIA DRIVE) for autonomous vehicles and deep learning applications. |

| Qualcomm Technologies, Inc. | Specializes in automotive AI chipsets (Snapdragon Ride) with integrated machine learning for ADAS and in-vehicle computing. |

| Intel Corporation (Mobileye) | Manufactures AI vision processing chipsets for ADAS and fully autonomous driving solutions. |

| NXP Semiconductors | Provides AI-powered SoCs for real-time edge computing, vehicle connectivity, and automotive safety applications. |

| Tesla, Inc. | Develops custom AI chipsets for self-driving vehicles, optimizing neural network processing and autonomous decision-making. |

NVIDIA Corporation (20-25%)

NVIDIA leads the automotive AI chipset market, providing NVIDIA DRIVE AI processors that power autonomous driving, sensor fusion, and real-time AI computing for self-driving vehicles.

Qualcomm Technologies, Inc. (15-20%)

Qualcomm specializes in automotive AI SoCs (Snapdragon Ride), delivering high-speed AI processing for ADAS, in-vehicle infotainment, and connected mobility.

Intel Corporation (Mobileye) (12-16%)

Intel’s Mobileye division develops AI-based vision processing chips, supporting advanced driver-assistance, autonomous navigation, and real-time object detection.

NXP Semiconductors (8-12%)

NXP provides high-efficiency AI chipsets for vehicle connectivity, predictive maintenance, and safety-critical applications in autonomous and electric vehicles.

Tesla, Inc. (6-10%)

Tesla manufactures in-house AI processors, enhancing neural network inference and real-time decision-making for its Full Self-Driving (FSD) system.

Other Key Players (25-35% Combined)

Several automotive AI chipset manufacturers and semiconductor firms contribute to high-performance computing, neural network acceleration, and AI-driven vehicle intelligence. These include:

The overall market size for the Automotive AI Chipset Market was USD 4.2 Billion in 2025.

The Automotive AI Chipset Market is expected to reach USD 30.2 Billion in 2035.

Rising adoption of autonomous vehicles, increasing integration of AI-powered ADAS, and advancements in in-vehicle computing and connectivity will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

Graphics Processing Units (GPUs) are expected to lead in the Automotive AI Chipset Market.

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Mobile Wallet Market Insights – Demand & Growth Forecast 2025 to 2035

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Push-to-Talk Market Trends - Demand & Growth Forecast 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.