The automotive active safety system market is expanding rapidly, driven by increasing regulatory pressures for vehicle safety and rising consumer expectations for advanced driver assistance technologies. Global road safety initiatives and regional mandates for crash avoidance technologies have accelerated the integration of active safety features across vehicle platforms. Industry publications and OEM announcements have spotlighted significant investments in sensor fusion, AI-based decision-making, and real-time data processing technologies.

Automakers are enhancing in-vehicle safety by incorporating systems such as adaptive cruise control, lane departure warning, and emergency braking across both premium and mid-range models. Furthermore, strategic collaborations between automakers and technology suppliers have fueled innovation in hardware integration and software development.

The proliferation of electric and autonomous vehicles has further emphasized the importance of robust active safety systems. Looking forward, growth is expected to be sustained by the adoption of hardware-intensive safety architectures, dominance of passenger car volumes, and the growing penetration of adaptive cruise control as a foundational feature in intelligent mobility.

| Metric | Value |

|---|---|

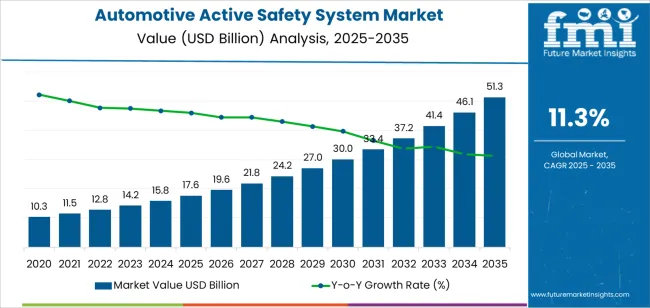

| Automotive Active Safety System Market Estimated Value in (2025 E) | USD 17.6 billion |

| Automotive Active Safety System Market Forecast Value in (2035 F) | USD 51.3 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

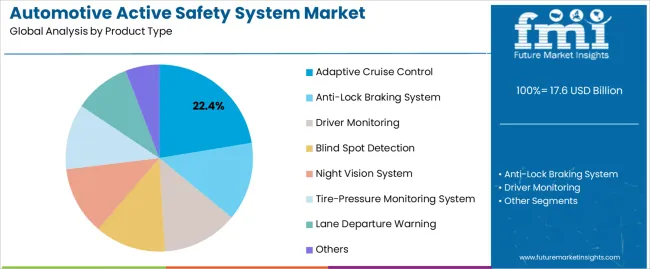

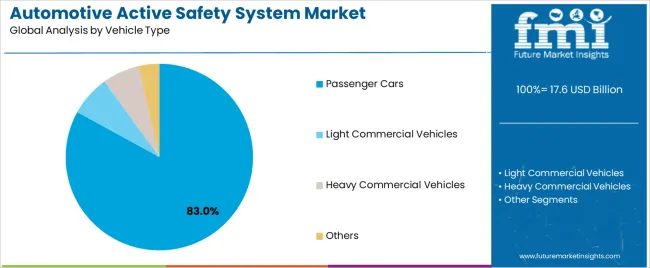

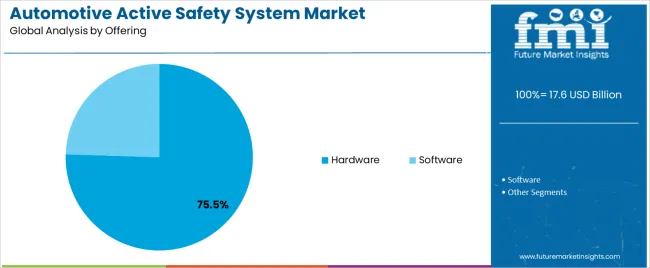

The market is segmented by Product Type, Vehicle Type, and Offering and region. By Product Type, the market is divided into Adaptive Cruise Control, Anti-Lock Braking System, Driver Monitoring, Blind Spot Detection, Night Vision System, Tire-Pressure Monitoring System, Lane Departure Warning, and Others. In terms of Vehicle Type, the market is classified into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others. Based on Offering, the market is segmented into Hardware and Software. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Adaptive Cruise Control segment is projected to hold 22.4% of the automotive active safety system market revenue in 2025, reflecting its widespread integration into modern vehicle safety architectures. Growth in this segment has been driven by increasing emphasis on driver convenience and real-time traffic adaptation features.

Automotive safety reports have highlighted adaptive cruise control as a foundational element of semi-autonomous driving, enabling vehicles to maintain safe following distances and reduce driver fatigue during long commutes. Its growing implementation across mid-range and entry-level vehicles has broadened its adoption beyond the luxury segment.

Regulatory encouragement for collision avoidance technologies and advancements in radar and lidar systems have further supported its deployment. As more OEMs move toward offering comprehensive driver assistance packages, the Adaptive Cruise Control segment is expected to remain a key contributor to the active safety landscape.

The Passenger Cars segment is expected to account for 83.0% of the automotive active safety system market revenue in 2025, maintaining its dominant share across vehicle categories. This growth has been reinforced by the sheer volume of passenger car production globally and heightened consumer demand for in-vehicle safety enhancements.

OEM safety disclosures and regional policy frameworks have increasingly mandated the inclusion of active safety features in passenger vehicles, particularly in urban markets where traffic density and accident risks are higher.

Passenger vehicles have served as the primary platform for testing and deploying advanced active safety technologies due to their broader consumer base and higher refresh rates. Additionally, automakers have leveraged competitive differentiation by offering advanced safety packages in compact and mid-size segments. As safety awareness grows and affordability improves, the Passenger Cars segment is expected to remain the cornerstone of active safety system implementation.

The Hardware segment is projected to contribute 75.5% of the automotive active safety system market revenue in 2025, positioning it as the leading offering category. Segment growth has been propelled by the increasing demand for physical components such as sensors, cameras, radar units, and control modules that form the backbone of active safety systems.

Industry updates have emphasized continuous innovation in hardware technologies, including solid-state lidar, high-definition radar, and AI-optimized chipsets, which enhance system performance and responsiveness.

Automakers and Tier 1 suppliers have invested heavily in scaling up production of safety-critical hardware to meet growing OEM requirements. Hardware’s essential role in real-time environment monitoring and decision-making has ensured its prominence in active safety deployments. With ongoing developments in sensor miniaturization and cost reduction, the Hardware segment is expected to retain its leadership, supporting the broader integration of safety systems across all vehicle classes.

Integration of Artificial Intelligence and Machine Learning to Fuel Demand

A specific driver in the global market for automotive active safety systems is the integration of artificial intelligence (AI) and machine learning (ML) technologies. The adoption of AI and ML is revolutionizing vehicle safety by enhancing predictive capabilities, enabling real-time decision making and allowing for personalized safety features.

The technologies process vast amounts of data from various sensors, such as cameras, radar, and Lidar, to predict potential hazards more accurately than traditional systems. By identifying patterns and predicting the behavior of other road users, AI and ML significantly improve the effectiveness of safety interventions.

AI-driven systems also excel in making split-second decisions, important for features like automatic emergency braking, collision avoidance, and adaptive cruise control. The continuous learning capabilities of these systems mean these become more accurate and reliable over time, adapting to new data and scenarios. This real-time decision-making capacity not only enhances safety but also builds trust in the technology among consumers and regulators.

Adoption of Vehicle-to-everything (V2X) Communication Technologies Spurs Demand

One of the latest market trends in automotive active safety systems is the increasing integration of vehicle-to-everything (V2X) communication technologies. V2X encompasses vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), vehicle-to-pedestrian (V2P), and vehicle-to-network (V2N) communications.

The technology allows vehicles to communicate with each other, as well as with traffic signals, road signs, pedestrians, and even the broad network infrastructure. The primary goal of V2X communication is to enhance safety and efficiency on the roads by enabling real-time data exchange, which helps in predicting and preventing potential hazards.

Adoption of V2X technology is being pushed by advancements in 5G connectivity, which offers the low latency and high data transfer rates necessary for real-time communication. With 5G, vehicles can share complex information almost instantaneously, such as sudden braking, road conditions, or the presence of emergency vehicles.

The rapid exchange of information allows for more coordinated and timely responses, significantly reducing the likelihood of accidents. For instance, if a vehicle detects icy road conditions, it can immediately broadcast this information to nearby vehicles, allowing them to take precautionary measures.

Analysis of Sensor Technologies and Algorithms in Automotive Active Safety Systems

Ongoing development and integration of advanced sensor fusion technologies is set to create new market opportunities for autonomous and semi-autonomous vehicle safety systems. Sensor fusion technology significantly enhances the accuracy and reliability of active safety systems by leveraging the strengths of different sensor types to overcome individual limitations. As the demand for high levels of vehicle automation and safety increases, the ability to provide robust sensor fusion solutions presents a lucrative opportunity for market players.

Advancements of sensor fusion technology are set to be propelled by the growing complexity of driving environments and the need for precise object detection and classification. Each type of sensor has its strengths. For instance, cameras offer high-resolution imaging and object recognition, radar provides excellent range and velocity measurements, and Lidar excels in depth perception and 3D mapping.

By integrating data from these diverse sources, sensor fusion systems can deliver a more accurate and reliable representation of the driving environment. This is significant for the effectiveness of active safety features such as adaptive cruise control, lane-keeping assist, and automatic emergency braking.

Need for Expensive Components and Complexity of Integration to Hamper Sales

Despite the significant advancements and opportunities in the active safety system market, there are several restraints that could hinder growth. One key challenge is the high cost associated with the development and integration of advanced safety technologies.

Active safety systems often rely on a combination of expensive components such as radar, Lidar, high-resolution cameras, and advanced computing platforms. The cost of these technologies can be prohibitive, particularly for budget and mid-range vehicle segments.

The high cost limits the widespread adoption of these systems, as manufacturers must balance the price of these technologies with the affordability of the vehicle. Consequently, the penetration of active safety systems remains low in cost-sensitive markets.

Another significant restraint is the complexity of integrating active safety systems with existing vehicle architectures. Modern vehicles are already equipped with a myriad of electronic systems and control units.

Integrating advanced safety systems requires seamless compatibility with these existing components to ensure optimal performance and reliability. The integration process can be technically challenging and time-consuming, often requiring extensive testing and validation. Any incompatibility or technical glitches can lead to system malfunctions, which not only affect the safety performance but also erode consumer trust in these technologies.

As per the automotive safety system market growth analysis, government regulations have been a significant driver in the United States. Agencies like the National Highway Traffic Safety Administration (NHTSA) are pushing for strict safety standards.

Recent mandates require new vehicles to include certain active safety features, such as automatic emergency braking and lane departure warnings, as standard equipment. These regulations aim to reduce traffic fatalities and injuries, creating a regulatory environment that encourages the adoption of advanced safety technologies by automakers.

Consumer awareness and rising demand for safe vehicles have played a key role in the growing popularity of active safety systems across China. Automotive active safety system market analysis shows with the proliferation of information on vehicle safety ratings and the impact of safety features on accident prevention, consumers are becoming more educated about the benefits of these systems.

Growing awareness is reflected in purchasing decisions, with several buyers prioritizing vehicles equipped with the latest safety technologies. As a result, automakers are increasingly incorporating advanced safety features into new models to meet consumer expectations and maintain competitiveness in the country.

Technological advancements have significantly contributed to the high demand for active safety systems in Germany. Rapid development and integration of artificial intelligence, machine learning, and advanced sensor technologies have made these systems more effective and reliable. Consumer preferences for reliability and functionality in automotive active safety features is anticipated to aid demand.

Improved accuracy and performance of safety features such as adaptive cruise control, collision avoidance, and pedestrian detection have made these more attractive to consumers and manufacturers alike. Additionally, the cost of these technologies has been decreasing, making these more accessible to a broad range of vehicles beyond the luxury segment.

Demand for adaptive cruise control (ACC) is rising globally due to several factors that address both safety and convenience concerns among drivers. Growing emphasis on road safety is set to spur demand. Analysis of automotive active safety system market share predicts the segment to lead through 2035.

With road traffic accidents remaining a significant global concern, there is a heightened awareness of the importance of technologies that can help prevent collisions and mitigate severity. ACC's ability to regulate speed based on traffic conditions reduces the likelihood of rear-end collisions caused by driver inattention or misjudgment, making it an attractive feature for safety-conscious consumers.

Rising consumer demand for safe vehicles is driving the adoption of active safety systems in passenger cars. With growing awareness of the importance of vehicle safety and the availability of advanced technologies, consumers are increasingly prioritizing safety features when purchasing a new car.

Active safety systems offer added peace of mind to consumers, knowing that their vehicle is equipped with features that can help protect them and their passengers in the event of a collision or emergency situation. As a result, automakers are responding to this demand by incorporating active safety systems into vehicle lineup, making these more accessible to a broad range of consumers. The aforementioned factors are projected to push the segment, thereby augmenting the market size of automotive active safety systems.

To stay competitive, key players in the automotive active safety system industry are forming strategic alliances, partnerships, and joint ventures. These collaborations would help in sharing technology, reducing development costs, and accelerating time-to-market. Ongoing partnerships between traditional automotive companies and tech firms to integrate advanced safety solutions would create new opportunities.

Government regulations and safety standards are becoming more stringent globally, pushing the adoption of active safety systems. Companies that can quickly adapt to new regulations and standards have a competitive advantage. Regulations such as the European Union's General Safety Regulation, which mandates the inclusion of several ADAS features in new vehicles, significantly impact the market.

In addition to established companies, numerous start-ups and emerging companies are entering the market, often focusing on niche technologies or innovative solutions. These new entrants can disrupt the market with breakthrough technologies and flexible business models.

Industry Updates

By product type, the automotive active safety system market segmentation includes anti-lock braking system, driver monitoring, blind spot detection, night vision system, adaptive cruise control, tire-pressure monitoring system, and lane departure warning.

A few types of vehicles in the industry include passenger cars, light commercial vehicles, and heavy commercial vehicles.

Hardware and software are two key offerings available in the global market.

Information of key countries across North America, Latin America, Europe, East Asia, South Asia and Pacific, and the Middle East and Africa is provided.

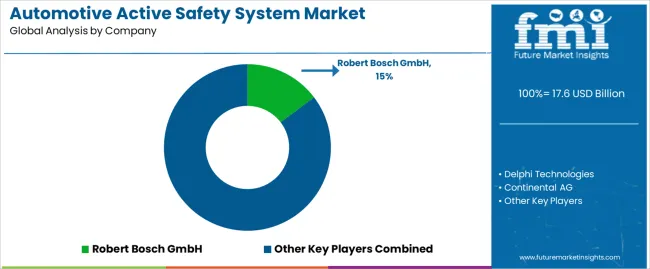

The global automotive active safety system market is estimated to be valued at USD 17.6 billion in 2025.

The market size for the automotive active safety system market is projected to reach USD 51.3 billion by 2035.

The automotive active safety system market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in automotive active safety system market are adaptive cruise control, anti-lock braking system, driver monitoring, blind spot detection, night vision system, tire-pressure monitoring system, lane departure warning and others.

In terms of vehicle type, passenger cars segment to command 83.0% share in the automotive active safety system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA